Industry 4.0 Market Synopsis

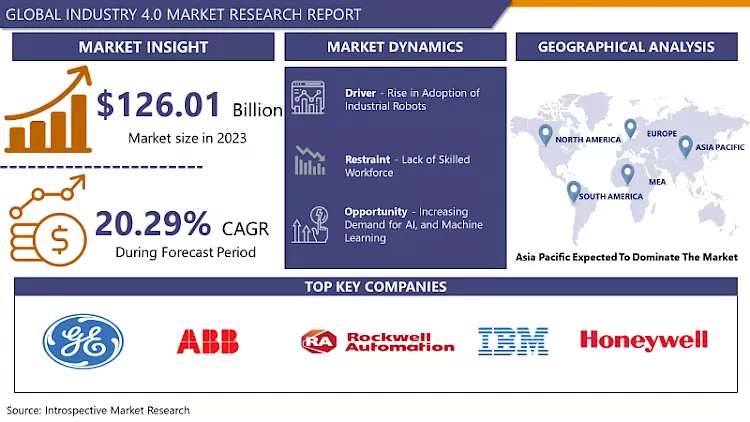

Industry 4.0 Market Size Was Valued at USD 126.01 Billion in 2023, and is Projected to Reach USD 664.46 Billion by 2032, Growing at a CAGR of 20.29% From 2024-2032

Industry 4.0 marks a transformative era in the business landscape, reshaping how products are created, refined, and distributed. This paradigm shift involves the integration of cutting-edge technologies like the Internet of Things (IoT), cloud computing, artificial intelligence (AI), and machine learning into manufacturing processes.

- As businesses embrace these innovations, they move towards establishing smart factories that leverage advanced sensors, embedded software, and robotics to collect and analyze data. The convergence of manufacturing data with information from ERP, supply chain, and customer service systems opens up new vistas of visibility and insight, breaking down silos that previously separated crucial operational information.

- Manufacturers are at the forefront of incorporating Industry 4.0 technologies into their production facilities. Smart factories, powered by IoT devices, cloud computing, and AI, enable sophisticated data collection and analysis. These digital technologies pave the way for increased automation, predictive maintenance, and self-optimization of processes. The result is a level of efficiency and responsiveness that was previously unattainable.

- A hallmark of Industry 4.0 is the synergy between manufacturing data and operational data from diverse corporate systems. The amalgamation of these datasets provides real-time visibility into production assets. Advanced analytics, fueled by massive amounts of big data from plant sensors, enables predictive maintenance strategies to reduce downtime. This data-driven approach empowers manufacturers to make informed decisions, optimize processes, and respond swiftly to consumer needs.

Industry 4.0 Market Trend Analysis

Rise in Adoption of Industrial Robots

- Industrial robots, equipped with advanced sensors and programming, can perform tasks with a level of accuracy and consistency that is often challenging for human workers. This leads to a reduction in errors and variability in production, resulting in higher-quality outputs. The automation of routine and repetitive tasks by robots also allows human workers to focus on more complex and creative aspects of their jobs, fostering a synergistic collaboration between humans and machines. ?

- Industry 4.0 envisions the creation of smart factories where interconnected devices and systems can adapt to changing demands and production requirements. Industrial robots play a crucial role in achieving this flexibility by easily adapting to different tasks and processes through reprogramming or reconfiguration. This scalability enables businesses to respond quickly to market fluctuations, customize production according to varying demands, and streamline processes for improved overall efficiency.

Increasing Demand for AI, and Machine Learning.

- AI and ML algorithms can analyze vast amounts of data generated by smart factories, identifying patterns and trends that may not be apparent through traditional analysis. This capability empowers manufacturers to make data-driven decisions in real-time, optimizing production processes, predicting equipment failures before they occur, and ultimately enhancing overall operational efficiency. As Industry 4.0 relies heavily on data integration and analytics, the demand for AI and ML technologies aligns to create intelligent, self-optimizing manufacturing systems.

- The growing popularity of AI and machine learning also opens doors to increased personalization and customization in manufacturing processes, representing a valuable opportunity within the Industry 4.0 landscape. These technologies enable manufacturers to gather and analyze customer data, preferences, and market trends, facilitating the production of highly customized products at scale. Whether it's adapting production lines to changing consumer demands or tailoring products to individual specifications, AI and ML contribute to a more flexible and responsive manufacturing environment.

Industry 4.0 Market Segment Analysis:

Industry 4.0 Market Segmented on the basis of Technologies, Applications, and Industry.

By Technologies, Industrial Robots segment is expected to dominate the market during the forecast period

- Industrial robots are poised to dominate the technology landscape within Industry 4.0 due to their unparalleled precision and efficiency in manufacturing processes. These robots can execute repetitive and complex tasks with a level of accuracy that is challenging for human workers to match. As businesses increasingly seek to optimize production and minimize errors, the integration of industrial robots becomes imperative. Their ability to operate continuously, without the need for breaks, and to handle intricate tasks with consistency positions them as a cornerstone technology for achieving higher levels of efficiency in smart factories.

- In automotive assembly lines, electronics manufacturing, or intricate tasks in aerospace, industrial robots can be programmed and configured to perform a wide range of functions. This versatility aligns with the principles of Industry 4.0, where interconnected and flexible technologies are essential. As smart factories evolve to meet changing market demands and customization requirements, industrial robots stand out for their ability to seamlessly integrate into different production environments.

By Industry, Manufacturing segment held the largest share of 38.6% in 2022

- Industry 4.0 technologies offered within manufacturing environments. Smart factories equipped with Industrial IoT, artificial intelligence, machine learning, and automation technologies allow manufacturers to streamline and enhance every stage of the production process. From predictive maintenance to real-time monitoring of equipment and inventory, Industry 4.0 solutions empower manufacturing industries to achieve unprecedented levels of efficiency and productivity. This heightened efficiency not only results in cost savings but also positions manufacturing at the forefront of realizing the transformative potential of Industry 4.0.

- Manufacturing's lead in the adoption of Industry 4.0 is also driven by the sector's inherent need for flexibility and customization. Industry 4.0 technologies enable manufacturers to pivot quickly in response to market trends and changing consumer demands. Smart manufacturing systems, facilitated by technologies like digital twins and industrial robots, allow for agile production processes that can be easily reconfigured to accommodate varying product specifications. As customization becomes a key differentiator in the competitive landscape, the manufacturing industry leverages Industry 4.0 to meet these demands effectively.

Industry 4.0 Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- China's economic prowess and a robust industrial sector drive demand for advanced technologies like the Industrial Internet of Things (IIOTs) and digital twins, supporting Industry 4.0 market growth. The expansion of the Small and Medium-sized Businesses (SMBs) sector contributes to China's economic growth, creating an increased requirement for Industry 4.0 technologies to bolster SMBs through the application of advanced technologies.

- India's industrial development thrives on a growing economy and a sizable youth population. The Government of India's emphasis on boosting manufacturing facilities aligns with employment generation goals. The adoption of Industry 4.0 in India is anticipated to surge as advanced systems and technologies enhance efficiency and productivity in the country's manufacturing sector.

- Positioned as an automated industrial economy, Japan leads in Asia-Pacific's Industry 4.0 evolution with its Industrial version 4.0 strategies. Renowned as a manufacturing hub for factory automation products, Japan plays a pivotal role in supplying these innovations to other markets in the Asia-Pacific region.

Industry 4.0 Market Top Key Players:

- General Electric (USA)

- ABB (Switzerland)

- Rockwell Automation (USA)

- IBM (USA)

- PTC (USA)

- Honeywell (USA)

- Johnson Controls International plc(USA)

- Siemens (Germany)

- Bosch Rexroth (Germany)

- Schneider Electric (France)

- Fanuc Corporation (Japan)

- Toshiba Corporation (Japan)

- Yaskawa Electric Corporation (Japan)

- Mindray Medical International Limited (China)

- Haier Group Corporation (China)

- Huawei Technologies Co., Ltd. (China)

- BYD Company Limited (China)

- Tata Consultancy Services (TCS)(India)

- Infosys (India)

- Mahindra & Mahindra (India)

- Foxconn Technology Group (Taiwan)

- Samsung Electronics (South Korea)

- Lenovo Group (Hong Kong)

- ASE Technology Holding Co., Ltd. (Taiwan)

- Hitachi, Ltd. (Japan)

- Advantech Co., Ltd. (Taiwan)

Key Industry Developments in the Industry 4.0 Market:

- In June 2023, GE HealthCare introduced Sonic DL, a state-of-the-art AI Deep Learning (DL) technology that has received FDA clearance. This cutting-edge technology excels in acquiring high-quality magnetic resonance (MR) images at a remarkable pace—up to 12 times faster than conventional methods. This accelerated imaging capability is especially notable for cardiac imaging, enabling comprehensive scans within a single heartbeat.

- In February 2023, Johnson Controls International and Willow, a digital twin solutions provider for critical infrastructure and real estate, joined forces in a global collaboration aimed at the digital transformation of buildings and facilities. This strategic partnership underscores the commitment of both Johnsons Controls and Willow to deliver cutting-edge solutions to their customers. The increasing significance of digital twins in the design, construction, and maintenance of buildings and facilities is highlighted. These digital replicas play a crucial role in handling extensive datasets and forecasting patterns and trends, contributing to the creation and upkeep of healthier built environments.

|

Global Industry 4.0 Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 126.01 Bn. |

|

Forecast Period 2024-32 CAGR: |

20.29% |

Market Size in 2032: |

USD 664.46 Bn. |

|

Segments Covered: |

By Technologies |

|

|

|

By Application |

|

||

|

By Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Industry 4.0 Market by By Technologies (2018-2032)

4.1 Industry 4.0 Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Industrial Robots

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 AI in Manufacturing

4.5 Digital Twin

4.6 Machine Vision

4.7 Industrial Sensors

4.8 Blockchain

4.9 Machine Condition Monitoring

4.10 Industrial 3D Printing

4.11 HMI (Human-Machine Interface)

4.12 AGVs (Automated Guided Vehicles)

Chapter 5: Industry 4.0 Market by By Application (2018-2032)

5.1 Industry 4.0 Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Smart Factory

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Industrial Automation

5.5 Industrial IoT (Internet of Things)

Chapter 6: Industry 4.0 Market by By Industry (2018-2032)

6.1 Industry 4.0 Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Manufacturing

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Aerospace and Defense

6.5 Automotive

6.6 Oil and Gas

6.7 Energy & Utilities

6.8 Electronics and Consumer Goods

6.9 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Industry 4.0 Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AMAZON WEB SERVICES INC

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CLOUDERA INCMICROSOFT CORPORATION

7.4 DREMIO CORPORATION

7.5 ORACLE CORPORATION

7.6 TERADATA CORPORATION

7.7 SAS INSTITUTE INCSNOWFLAKE INCINFORMATICA CORPORATION

7.8 ZALONI INC.

Chapter 8: Global Industry 4.0 Market By Region

8.1 Overview

8.2. North America Industry 4.0 Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Technologies

8.2.4.1 Industrial Robots

8.2.4.2 AI in Manufacturing

8.2.4.3 Digital Twin

8.2.4.4 Machine Vision

8.2.4.5 Industrial Sensors

8.2.4.6 Blockchain

8.2.4.7 Machine Condition Monitoring

8.2.4.8 Industrial 3D Printing

8.2.4.9 HMI (Human-Machine Interface)

8.2.4.10 AGVs (Automated Guided Vehicles)

8.2.5 Historic and Forecasted Market Size By By Application

8.2.5.1 Smart Factory

8.2.5.2 Industrial Automation

8.2.5.3 Industrial IoT (Internet of Things)

8.2.6 Historic and Forecasted Market Size By By Industry

8.2.6.1 Manufacturing

8.2.6.2 Aerospace and Defense

8.2.6.3 Automotive

8.2.6.4 Oil and Gas

8.2.6.5 Energy & Utilities

8.2.6.6 Electronics and Consumer Goods

8.2.6.7 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Industry 4.0 Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Technologies

8.3.4.1 Industrial Robots

8.3.4.2 AI in Manufacturing

8.3.4.3 Digital Twin

8.3.4.4 Machine Vision

8.3.4.5 Industrial Sensors

8.3.4.6 Blockchain

8.3.4.7 Machine Condition Monitoring

8.3.4.8 Industrial 3D Printing

8.3.4.9 HMI (Human-Machine Interface)

8.3.4.10 AGVs (Automated Guided Vehicles)

8.3.5 Historic and Forecasted Market Size By By Application

8.3.5.1 Smart Factory

8.3.5.2 Industrial Automation

8.3.5.3 Industrial IoT (Internet of Things)

8.3.6 Historic and Forecasted Market Size By By Industry

8.3.6.1 Manufacturing

8.3.6.2 Aerospace and Defense

8.3.6.3 Automotive

8.3.6.4 Oil and Gas

8.3.6.5 Energy & Utilities

8.3.6.6 Electronics and Consumer Goods

8.3.6.7 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Industry 4.0 Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Technologies

8.4.4.1 Industrial Robots

8.4.4.2 AI in Manufacturing

8.4.4.3 Digital Twin

8.4.4.4 Machine Vision

8.4.4.5 Industrial Sensors

8.4.4.6 Blockchain

8.4.4.7 Machine Condition Monitoring

8.4.4.8 Industrial 3D Printing

8.4.4.9 HMI (Human-Machine Interface)

8.4.4.10 AGVs (Automated Guided Vehicles)

8.4.5 Historic and Forecasted Market Size By By Application

8.4.5.1 Smart Factory

8.4.5.2 Industrial Automation

8.4.5.3 Industrial IoT (Internet of Things)

8.4.6 Historic and Forecasted Market Size By By Industry

8.4.6.1 Manufacturing

8.4.6.2 Aerospace and Defense

8.4.6.3 Automotive

8.4.6.4 Oil and Gas

8.4.6.5 Energy & Utilities

8.4.6.6 Electronics and Consumer Goods

8.4.6.7 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Industry 4.0 Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Technologies

8.5.4.1 Industrial Robots

8.5.4.2 AI in Manufacturing

8.5.4.3 Digital Twin

8.5.4.4 Machine Vision

8.5.4.5 Industrial Sensors

8.5.4.6 Blockchain

8.5.4.7 Machine Condition Monitoring

8.5.4.8 Industrial 3D Printing

8.5.4.9 HMI (Human-Machine Interface)

8.5.4.10 AGVs (Automated Guided Vehicles)

8.5.5 Historic and Forecasted Market Size By By Application

8.5.5.1 Smart Factory

8.5.5.2 Industrial Automation

8.5.5.3 Industrial IoT (Internet of Things)

8.5.6 Historic and Forecasted Market Size By By Industry

8.5.6.1 Manufacturing

8.5.6.2 Aerospace and Defense

8.5.6.3 Automotive

8.5.6.4 Oil and Gas

8.5.6.5 Energy & Utilities

8.5.6.6 Electronics and Consumer Goods

8.5.6.7 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Industry 4.0 Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Technologies

8.6.4.1 Industrial Robots

8.6.4.2 AI in Manufacturing

8.6.4.3 Digital Twin

8.6.4.4 Machine Vision

8.6.4.5 Industrial Sensors

8.6.4.6 Blockchain

8.6.4.7 Machine Condition Monitoring

8.6.4.8 Industrial 3D Printing

8.6.4.9 HMI (Human-Machine Interface)

8.6.4.10 AGVs (Automated Guided Vehicles)

8.6.5 Historic and Forecasted Market Size By By Application

8.6.5.1 Smart Factory

8.6.5.2 Industrial Automation

8.6.5.3 Industrial IoT (Internet of Things)

8.6.6 Historic and Forecasted Market Size By By Industry

8.6.6.1 Manufacturing

8.6.6.2 Aerospace and Defense

8.6.6.3 Automotive

8.6.6.4 Oil and Gas

8.6.6.5 Energy & Utilities

8.6.6.6 Electronics and Consumer Goods

8.6.6.7 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Industry 4.0 Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Technologies

8.7.4.1 Industrial Robots

8.7.4.2 AI in Manufacturing

8.7.4.3 Digital Twin

8.7.4.4 Machine Vision

8.7.4.5 Industrial Sensors

8.7.4.6 Blockchain

8.7.4.7 Machine Condition Monitoring

8.7.4.8 Industrial 3D Printing

8.7.4.9 HMI (Human-Machine Interface)

8.7.4.10 AGVs (Automated Guided Vehicles)

8.7.5 Historic and Forecasted Market Size By By Application

8.7.5.1 Smart Factory

8.7.5.2 Industrial Automation

8.7.5.3 Industrial IoT (Internet of Things)

8.7.6 Historic and Forecasted Market Size By By Industry

8.7.6.1 Manufacturing

8.7.6.2 Aerospace and Defense

8.7.6.3 Automotive

8.7.6.4 Oil and Gas

8.7.6.5 Energy & Utilities

8.7.6.6 Electronics and Consumer Goods

8.7.6.7 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Industry 4.0 Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 126.01 Bn. |

|

Forecast Period 2024-32 CAGR: |

20.29% |

Market Size in 2032: |

USD 664.46 Bn. |

|

Segments Covered: |

By Technologies |

|

|

|

By Application |

|

||

|

By Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Industry 4.0 Market research report is 2024-2032.

General Electric, ABB, Rockwell Automation, IBM, PTC, Honeywell, Johnson Controls International plc, Siemens, Bosch Rexroth, Schneider Electric, Fanuc Corporation, Toshiba Corporation, Yaskawa Electric Corporation, Mindray Medical International Limited, Haier Group Corporation, Huawei Technologies Co., Ltd., BYD Company Limited, Tata Consultancy Services (TCS), Infosys, Mahindra & Mahindra, Foxconn Technology Group, Samsung Electronics, Lenovo Group, ASE Technology Holding Co., Ltd., Hitachi, Ltd., Advantech Co., Ltd. and Other Major Players.

The Industry 4.0 Market is segmented into Technology, Application, Industry, and region. By Technology, the market is categorized into Industrial Robots, AI in Manufacturing, Digital Twin, Machine Vision, Industrial Sensors, Blockchain, Machine Condition Monitoring, Industrial 3D Printing, HMI, and AGVs. By Application, the market is categorized into Smart Factory, Industrial Automation, and Industrial IoT. By Industry, the market is categorized into Manufacturing, Aerospace and Defense, Automotive, Oil and Gas, Energy & Utilities, Electronics, and Consumer Goods, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Industry 4.0 marks a transformative era in the business landscape, reshaping how products are created, refined, and distributed. This paradigm shift involves the integration of cutting-edge technologies like the Internet of Things (IoT), cloud computing, artificial intelligence (AI), and machine learning into manufacturing processes.

Industry 4.0 Market Size Was Valued at USD 126.01 Billion in 2023, and is Projected to Reach USD 664.46 Billion by 2032, Growing at a CAGR of 20.29% From 2024-2032