Kefir Market Synopsis

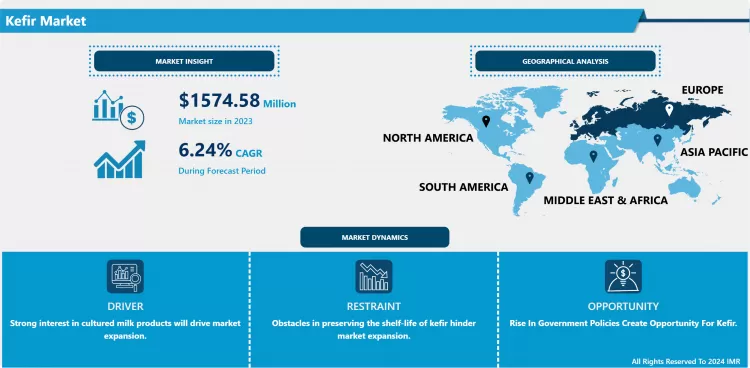

Kefir Market Size Was Valued at USD 1574.58 Million in 2023 and is Projected to Reach USD 2714.92 Million by 2032, Growing at a CAGR of 6.24% From 2024-2032.

Kefir is a fermented drink with low alcohol content, acidic and bubbly from the fermentation carbonation of kefir grains with milk or water. Its origin traces back to the Balkans, in Eastern Europe, and the Caucasus, and, over time, its consumption has expanded to other parts of the world due to its health-giving properties. Kefir varies from other fermented products because of the specific property of its starter: The kefir grains. Kefir grains range in size from 1 to 4 cm in length and look like small cauliflower florets in shape (irregular and lobed-shaped) and color (from white to light yellow). This gelatinous and slimy structure is comprised of a natural matrix of exopolysaccharides (EPS) kefiran and proteins in which lactic acid bacteria (LAB), yeasts, and acetic acid bacteria (AAB) co-exist in symbiotic connection

- Kefiran, a potential polysaccharide produced from the kefir fermentation is stated as the most preferable EPS among others due to its water-soluble and biodegradable feature. In fact, kefiran is a striking option over other EPS, including alginate, glucans, dextrin, xanthan, and levan due to its antitumor, antibacterial, antifungal, and immunomodulation activities that have been extensively studied. Kefiran was successfully incorporated into various films providing a naturally derived packaging product resistant to contamination with added health-promoting features.

- The growing popularity of kefir and kefir grains has prompted to the use of kefir starters in cheese production. Magalhães et al. demonstrated an innovative usage of kefir grains as a starter culture in the production of fermented cheese whey-based beverages. The anti-microbial action of kefir grains has offered an added incentive for use as a baker’s yeast in bread baking. Mantzourani et al. showed that the use of kefir grains as a leavening agent in sourdough bread produces a product with longer shelf life than sourdough bread prepared with wild microflora, in terms of delay in manifestation of rope spoilage caused by Bacillus spp.

Kefir Market Trend Analysis

The gut microbiota supports immunity and overall well-being, driving demand for probiotic beverages like kefir.

- Significance of Gut Microbiota in Sustaining Immunity and Overall Well-being.

The maintenance of overall health and immunity is significantly influenced by the human gut microbiota. This knowledge has had a big impact on how consumers behave and on the trends in the kefir market. Billions of microbes help with digestion, absorption of nutrients, production of vitamins, and regulation of the immune system in the digestive tract. The immune system is modulated and defended against pathogens by gut microbiota. It aids in preserving the integrity of the gut barrier to avoid inflammation and infection. - New research indicates a link between the wellness of the gut and the mind, referred to as the gut-brain axis. Kefir is a potent fermented drink containing various types of beneficial bacteria and yeast. It is backed by scientific research to ensure consumer trust and demand, supporting gut health, aiding digestion, boosting immunity, and promoting overall well-being. Consumer education is essential for understanding the advantages of kefir and gut health. Despite facing regulatory hurdles, well-defined regulations can boost consumer trust in probiotic health claims.

- The increasing awareness of the importance of gut microbiota in immunity and health is driving the growth of the kefir market. The popularity of probiotic beverages, consumer education, and interest in natural, functional foods drive demand. This pattern is likely to persist as an increasing number of individuals prioritize the health of their gut. Nowadays, consumers are showing great interest in functional foods as they become more aware of healthy eating for health and wellness. According to Guneser et al. [149] the global sales of functional foods and beverages associated with health benefits are expected to thrive by 2022. In fact, by 2020 the global sales for this market category worth were estimated to reach 377.8 billion US dollars [150]. It was recognized that functional beverages are the most active functional foods category exerting physiological effects on the body apart from providing basic nutrition [149,151]. Kefir is a nutritious alcoholic beverage that has been produced and consumed for centuries in central Asia and Eastern European countries.

Kefir's Rising Popularity

- In recent years, numerous studies on the putative health values of kefir as a natural beverage with probiotic microorganisms and functional organic substances have been reported. According to the Food and Agriculture Organization of the United Nations (FAO) and World Health Organization (WHO), probiotics refer to live microorganisms that, when applied in sufficient amounts, bestow a health benefit to the host. Additionally, evidence has shown that kefir’s exopolysaccharide, kefiran, has very significant physicochemical attributes and biological activities that certainly add value to the products. Existing reports have suggested important health benefits from kefir beverage consumption, such as anti-microbial, anti-tumor, anti-carcinogenic, hypocholesterolemic effects, anti-hypertensive, anti-diabetic, immunomodulatory activity, and also improving lactose digestion. All these health-promoting properties are linked to the kefir microorganisms, their interplays, and their metabolic products during the fermentation process.

- Kefir has recently been referred to as one of the “9 food trends to watch for in 2021” by the Institute of Food Technologist (IFT, 2021). In 2020 alone, global sales of functional foods and beverages associated with health benefits were estimated to reach US$377.8 billion (Azizi et al., 2021). The market size of kefir products is expected to increase by US$456 million from 2021 to 2025, with a compound annual growth rate of 4.37% in 2021 (Technavio.com, 2021). Despite the numerous reviews on kefir’s general health benefits, there has been no integral review regarding the antimicrobial effects of kefir microbiota and the biological mechanisms behind this probiotic property.

- The Food and Health Survey by the International Food Information Council reported in 2019 that 23% of consumers seek food and beverages for health advantages, with more than half prioritizing digestive health. Busy contemporary lifestyles are causing a rise in health problems related to lifestyle, such as obesity and diabetes. Consumers are acknowledging the significance of gut health for overall well-being, resulting in a surge in demand for probiotic beverages containing beneficial bacteria. There is an anticipation that this tendency will increase the need for these items in the upcoming years.

Kefir Market Segment Analysis:

Kefir Market Segmented based on Type, Nature, Source, Application, Packaging, Flavour, And Distribution Channel.

By Type, Milk Kefir Segment Is Expected to Dominate the Market During the Forecast Period

- Milk kefir dominates the market for several reasons, stemming from its historical roots, nutritional benefits, and broad consumer acceptance. Kefir milk, which comes from the Caucasus Mountains, has a long-standing traditional role in Eastern Europe and is embraced as a beneficial fermented dairy product in areas such as Russia and the Middle East, contributing to its ongoing popularity and high demand. Milk kefir contains probiotics that support gut health, help with digestion, and boost the immune system. Moreover, it also includes important nutrients such as calcium, protein, vitamins (B12 and K2), and minerals (magnesium and phosphorus), which appeals to those prioritizing their health. The fermentation process helps individuals with lactose intolerance digest it more easily.

- Consumers embrace milk kefir because of its tangy, creamy taste and versatile texture that is akin to drinkable yogurt. Its knowledge of dairy makes it simpler to include in current diets than plant-based options. Milk kefir can be used in various culinary ways, whether enjoyed as is, flavored, or incorporated into recipes. It attracts various types of consumers and meets the demand for functional foods that provide health benefits. Favored by individuals looking to enhance health with dietary changes.

- Different types of milk kefir products available in the market consist of plain, flavored, organic, traditional, and varying fat levels. Well-known dairy companies have built a strong level of confidence among consumers, which is advantageous for their kefir offerings. Market dynamics reflect varied consumer preferences and brand awareness. Respected dairy companies sell a range of milk kefir products, such as plain, flavored, organic, traditional, and varying fat levels, which have earned consumer confidence and boosted their products' success in the market.

By Application, Food and Beverage Segment Held the Largest Share In 2023

- The Food and Beverage segment dominates the kefir market for several reasons. This segment encompasses the direct consumption of kefir as a drink and its use as an ingredient in various culinary applications. Kefir is a nutritious drink full of probiotics that are good for gut health and boosting immunity. It provides a diverse range of flavors, catering to various preferences and tastes. Its convenience attracts busy people looking for a fast and healthy choice, making it a popular option. Kefir is a flexible ingredient that has a smooth texture and sharp taste. It is versatile in recipes such as smoothies, dressings, baking, and marinades, serving as a beneficial replacement for buttermilk, yogurt, or sour cream.

- Kefir is acknowledged for its health benefits as a functional food. It is in line with present trends by providing probiotics, vitamins, and minerals. Customers are looking for products with a clean label, such as kefir. Kefir can be readily purchased in numerous retail locations, such as grocery stores, health food stores, and on the Internet. Consumers have a variety of low-fat, full-fat, organic, and flavored choices available.

- Increased demand for probiotics and fermented foods, specifically kefir, is a result of consumers being more informed about them. Health experts suggest kefir for its advantages, with advertising emphasizing its health perks, versatility, and flavor. The global popularity of kefir has increased, resulting in its inclusion in various cultural cuisines and culinary practices around the world. Kefir is adaptable to a variety of diets such as low-carb, keto, and gluten-free, offering high protein content and minimal lactose, meeting a range of dietary requirements.

Kefir Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast Period

- Reasons for Europe's leading position in the kefir industry are the increasing need for probiotic goods, the rise in popularity of vegan eating habits, the trend of easily accessible nutrition, and the embracement of cultural preferences. The growing interest in veganism and lactose intolerance in Western Europe is driving up the need for dairy-free kefir made from almond, soy, and coconut milk. Kefir, a classic drink in Eastern Europe, has its origins in countries such as Russia and Poland. Not just drunk, but also utilized for cooking and baking, making it a fundamental aspect of European cuisine.

- Europe is at the forefront of the kefir market, with significant consumption in Russia, Poland, and Germany. Poland is the second-largest producer among these countries and is a significant exporter to other European nations, showcasing strong production and export capabilities. Health-conscious consumers in Europe are responsible for the high demand for organic products. Organic kefir's popularity is attributed to its natural probiotic content, aligning with the preference for products free of synthetic additives.

- European medical experts recommend probiotics such as kefir for issues like indigestion, heartburn, and overall gut health. Certain governments encourage the consumption of probiotic foods for public health by implementing supportive regulations. In the UK, more attention is being given to gut health, resulting in a rise in probiotic supplements and kefir intake. Digestive problems are common, boosting the sales of probiotics. In Germany, kefir and probiotics are well-liked by various demographic groups for their health advantages.

- The demand for high-quality kefir products is fueled by Europe's wealthy market, thanks to the region's high standard of living and health-conscious consumers. Europe's leading position in the kefir market is influenced by historical consumption habits, increased health consciousness, changing dietary preferences, convenience, and well-established market infrastructure.

Kefir Market Active Players

- Lifeway Foods (USA)

- Danone (France)

- Nestlé (Switzerland)

- Hain Celestial Group (USA)

- Valio Ltd. (Finland)

- The Icelandic Milk and Skyr Corporation (Iceland)

- Müller Group (Germany)

- Green Valley Creamery (USA)

- Redwood Hill Farm & Creamery (USA)

- Liberte Inc. (Canada)

- Helios Nutrition (Norway)

- Babushka Kefir (Australia)

- Nourish Kefir (UK)

- Maple Hill Creamery (USA)

- Blue Hill Farm (USA)

- Wallaby Yogurt Company (USA)

- Evolve Kefir (Australia)

- Biotiful Dairy Ltd. (UK)

- Origin Earth (New Zealand)

-

Global Kefir Market

Base Year:

2023

Forecast Period:

2024-2032

Historical Data:

2017 to 2023

Market Size in 2023:

USD 1574.58 Mn.

Forecast Period 2024-32 CAGR:

6.24 %

Market Size in 2032:

USD 2714.92 Mn.

Segments Covered:

By Type

- Milk Kefir

- Water Kefir

- Coconut Milk Kefir

- Non-Dairy Milk Kefir

By Nature,

- Organic

- Conventional

By Source

- Animal-Based

- Plant-Based

By Flavour

- Flavour

- Unflavoured

By Application

- Food and Beverage

- Dietary Supplements

- Cosmetics and Personal Care

- Pharmaceuticals

By Packaging

- Bottles

- Cartons

- Cans

- Pouches

By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- E-commerce

By Region

- North America (U.S., Canada, Mexico)

- Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

- Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

- Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

- Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

- South America (Brazil, Argentina, Rest of SA)

Key Market Drivers:

- Strong interest in cultured milk products will drive market expansion.

Key Market Restraints:

- Obstacles in preserving the shelf-life of kefir hinder market expansion.

Key Opportunities:

- Rise In Government Policies Create Opportunity For Kefir.

Companies Covered in the report:

- Lifeway Foods (USA), Danone (France), Nestlé (Switzerland), Hain Celestial Group (USA), Valio Ltd. (Finland), The Icelandic Milk and Skyr Corporation (Iceland), Müller Group (Germany), and Other Active Players.

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Kefir Market by By Type (2018-2032)

4.1 Kefir Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Milk Kefir

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Water Kefir

4.5 Coconut Milk Kefir

4.6 Non-Dairy Milk Kefir

Chapter 5: Kefir Market by By Nature, (2018-2032)

5.1 Kefir Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Organic

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Conventional

Chapter 6: Kefir Market by By Source (2018-2032)

6.1 Kefir Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Animal-Based

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Plant-Based

Chapter 7: Kefir Market by By Flavour (2018-2032)

7.1 Kefir Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Flavour

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Unflavoured

Chapter 8: Kefir Market by By Application (2018-2032)

8.1 Kefir Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Food and Beverage

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Dietary Supplements

8.5 Cosmetics and Personal Care

8.6 Pharmaceuticals

Chapter 9: Kefir Market by By Packaging (2018-2032)

9.1 Kefir Market Snapshot and Growth Engine

9.2 Market Overview

9.3 Bottles

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

9.3.3 Key Market Trends, Growth Factors, and Opportunities

9.3.4 Geographic Segmentation Analysis

9.4 Cartons

9.5 Cans

9.6 Pouches

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 Kefir Market Share by Manufacturer (2024)

10.1.3 Industry BCG Matrix

10.1.4 Heat Map Analysis

10.1.5 Mergers and Acquisitions

10.2 LIFEWAY FOODS (USA)

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Key Strategic Moves and Recent Developments

10.2.10 SWOT Analysis

10.3 DANONE (FRANCE)

10.4 NESTLÉ (SWITZERLAND)

10.5 HAIN CELESTIAL GROUP (USA)

10.6 VALIO LTD. (FINLAND)

10.7 THE ICELANDIC MILK AND SKYR CORPORATION (ICELAND)

10.8 MÜLLER GROUP (GERMANY)

10.9 GREEN VALLEY CREAMERY (USA)

10.10 REDWOOD HILL FARM & CREAMERY (USA)

10.11 LIBERTE INC. (CANADA)

10.12 HELIOS NUTRITION (NORWAY)

10.13 BABUSHKA KEFIR (AUSTRALIA)

10.14 NOURISH KEFIR (UK)

10.15 MAPLE HILL CREAMERY (USA)

10.16 BLUE HILL FARM (USA)

10.17 WALLABY YOGURT COMPANY (USA)

10.18 EVOLVE KEFIR (AUSTRALIA)

10.19 BIOTIFUL DAIRY LTD. (UK)

10.20 ORIGIN EARTH (NEW ZEALAND)

10.21 GREEN VALLEY ORGANICS (USA)

10.22 ALTIMA HEALTH PRODUCTS (USA)

10.23 MORINGA MILK KEFIR (USA)

10.24 HAPPY GUT PRO (CANADA)

10.25 YEO VALLEY (UK)

Chapter 11: Global Kefir Market By Region

11.1 Overview

11.2. North America Kefir Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecasted Market Size By By Type

11.2.4.1 Milk Kefir

11.2.4.2 Water Kefir

11.2.4.3 Coconut Milk Kefir

11.2.4.4 Non-Dairy Milk Kefir

11.2.5 Historic and Forecasted Market Size By By Nature,

11.2.5.1 Organic

11.2.5.2 Conventional

11.2.6 Historic and Forecasted Market Size By By Source

11.2.6.1 Animal-Based

11.2.6.2 Plant-Based

11.2.7 Historic and Forecasted Market Size By By Flavour

11.2.7.1 Flavour

11.2.7.2 Unflavoured

11.2.8 Historic and Forecasted Market Size By By Application

11.2.8.1 Food and Beverage

11.2.8.2 Dietary Supplements

11.2.8.3 Cosmetics and Personal Care

11.2.8.4 Pharmaceuticals

11.2.9 Historic and Forecasted Market Size By By Packaging

11.2.9.1 Bottles

11.2.9.2 Cartons

11.2.9.3 Cans

11.2.9.4 Pouches

11.2.10 Historic and Forecast Market Size by Country

11.2.10.1 US

11.2.10.2 Canada

11.2.10.3 Mexico

11.3. Eastern Europe Kefir Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecasted Market Size By By Type

11.3.4.1 Milk Kefir

11.3.4.2 Water Kefir

11.3.4.3 Coconut Milk Kefir

11.3.4.4 Non-Dairy Milk Kefir

11.3.5 Historic and Forecasted Market Size By By Nature,

11.3.5.1 Organic

11.3.5.2 Conventional

11.3.6 Historic and Forecasted Market Size By By Source

11.3.6.1 Animal-Based

11.3.6.2 Plant-Based

11.3.7 Historic and Forecasted Market Size By By Flavour

11.3.7.1 Flavour

11.3.7.2 Unflavoured

11.3.8 Historic and Forecasted Market Size By By Application

11.3.8.1 Food and Beverage

11.3.8.2 Dietary Supplements

11.3.8.3 Cosmetics and Personal Care

11.3.8.4 Pharmaceuticals

11.3.9 Historic and Forecasted Market Size By By Packaging

11.3.9.1 Bottles

11.3.9.2 Cartons

11.3.9.3 Cans

11.3.9.4 Pouches

11.3.10 Historic and Forecast Market Size by Country

11.3.10.1 Russia

11.3.10.2 Bulgaria

11.3.10.3 The Czech Republic

11.3.10.4 Hungary

11.3.10.5 Poland

11.3.10.6 Romania

11.3.10.7 Rest of Eastern Europe

11.4. Western Europe Kefir Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecasted Market Size By By Type

11.4.4.1 Milk Kefir

11.4.4.2 Water Kefir

11.4.4.3 Coconut Milk Kefir

11.4.4.4 Non-Dairy Milk Kefir

11.4.5 Historic and Forecasted Market Size By By Nature,

11.4.5.1 Organic

11.4.5.2 Conventional

11.4.6 Historic and Forecasted Market Size By By Source

11.4.6.1 Animal-Based

11.4.6.2 Plant-Based

11.4.7 Historic and Forecasted Market Size By By Flavour

11.4.7.1 Flavour

11.4.7.2 Unflavoured

11.4.8 Historic and Forecasted Market Size By By Application

11.4.8.1 Food and Beverage

11.4.8.2 Dietary Supplements

11.4.8.3 Cosmetics and Personal Care

11.4.8.4 Pharmaceuticals

11.4.9 Historic and Forecasted Market Size By By Packaging

11.4.9.1 Bottles

11.4.9.2 Cartons

11.4.9.3 Cans

11.4.9.4 Pouches

11.4.10 Historic and Forecast Market Size by Country

11.4.10.1 Germany

11.4.10.2 UK

11.4.10.3 France

11.4.10.4 The Netherlands

11.4.10.5 Italy

11.4.10.6 Spain

11.4.10.7 Rest of Western Europe

11.5. Asia Pacific Kefir Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecasted Market Size By By Type

11.5.4.1 Milk Kefir

11.5.4.2 Water Kefir

11.5.4.3 Coconut Milk Kefir

11.5.4.4 Non-Dairy Milk Kefir

11.5.5 Historic and Forecasted Market Size By By Nature,

11.5.5.1 Organic

11.5.5.2 Conventional

11.5.6 Historic and Forecasted Market Size By By Source

11.5.6.1 Animal-Based

11.5.6.2 Plant-Based

11.5.7 Historic and Forecasted Market Size By By Flavour

11.5.7.1 Flavour

11.5.7.2 Unflavoured

11.5.8 Historic and Forecasted Market Size By By Application

11.5.8.1 Food and Beverage

11.5.8.2 Dietary Supplements

11.5.8.3 Cosmetics and Personal Care

11.5.8.4 Pharmaceuticals

11.5.9 Historic and Forecasted Market Size By By Packaging

11.5.9.1 Bottles

11.5.9.2 Cartons

11.5.9.3 Cans

11.5.9.4 Pouches

11.5.10 Historic and Forecast Market Size by Country

11.5.10.1 China

11.5.10.2 India

11.5.10.3 Japan

11.5.10.4 South Korea

11.5.10.5 Malaysia

11.5.10.6 Thailand

11.5.10.7 Vietnam

11.5.10.8 The Philippines

11.5.10.9 Australia

11.5.10.10 New Zealand

11.5.10.11 Rest of APAC

11.6. Middle East & Africa Kefir Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecasted Market Size By By Type

11.6.4.1 Milk Kefir

11.6.4.2 Water Kefir

11.6.4.3 Coconut Milk Kefir

11.6.4.4 Non-Dairy Milk Kefir

11.6.5 Historic and Forecasted Market Size By By Nature,

11.6.5.1 Organic

11.6.5.2 Conventional

11.6.6 Historic and Forecasted Market Size By By Source

11.6.6.1 Animal-Based

11.6.6.2 Plant-Based

11.6.7 Historic and Forecasted Market Size By By Flavour

11.6.7.1 Flavour

11.6.7.2 Unflavoured

11.6.8 Historic and Forecasted Market Size By By Application

11.6.8.1 Food and Beverage

11.6.8.2 Dietary Supplements

11.6.8.3 Cosmetics and Personal Care

11.6.8.4 Pharmaceuticals

11.6.9 Historic and Forecasted Market Size By By Packaging

11.6.9.1 Bottles

11.6.9.2 Cartons

11.6.9.3 Cans

11.6.9.4 Pouches

11.6.10 Historic and Forecast Market Size by Country

11.6.10.1 Turkiye

11.6.10.2 Bahrain

11.6.10.3 Kuwait

11.6.10.4 Saudi Arabia

11.6.10.5 Qatar

11.6.10.6 UAE

11.6.10.7 Israel

11.6.10.8 South Africa

11.7. South America Kefir Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecasted Market Size By By Type

11.7.4.1 Milk Kefir

11.7.4.2 Water Kefir

11.7.4.3 Coconut Milk Kefir

11.7.4.4 Non-Dairy Milk Kefir

11.7.5 Historic and Forecasted Market Size By By Nature,

11.7.5.1 Organic

11.7.5.2 Conventional

11.7.6 Historic and Forecasted Market Size By By Source

11.7.6.1 Animal-Based

11.7.6.2 Plant-Based

11.7.7 Historic and Forecasted Market Size By By Flavour

11.7.7.1 Flavour

11.7.7.2 Unflavoured

11.7.8 Historic and Forecasted Market Size By By Application

11.7.8.1 Food and Beverage

11.7.8.2 Dietary Supplements

11.7.8.3 Cosmetics and Personal Care

11.7.8.4 Pharmaceuticals

11.7.9 Historic and Forecasted Market Size By By Packaging

11.7.9.1 Bottles

11.7.9.2 Cartons

11.7.9.3 Cans

11.7.9.4 Pouches

11.7.10 Historic and Forecast Market Size by Country

11.7.10.1 Brazil

11.7.10.2 Argentina

11.7.10.3 Rest of SA

Chapter 12 Analyst Viewpoint and Conclusion

12.1 Recommendations and Concluding Analysis

12.2 Potential Market Strategies

Chapter 13 Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

|

Global Kefir Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1574.58 Mn. |

|

Forecast Period 2024-32 CAGR: |

6.24 % |

Market Size in 2032: |

USD 2714.92 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Nature, |

|

||

|

By Source |

|

||

|

By Flavour |

|

||

|

By Application |

|

||

|

By Packaging |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Kefir Market research report is 2024-2032.

Lifeway Foods (USA), Danone (France), Nestlé (Switzerland), Hain Celestial Group (USA), Valio Ltd. (Finland),The Icelandic Milk and Skyr Corporation (Iceland), Müller Group (Germany), Green Valley Creamery (USA), Redwood Hill Farm & Creamery (USA), Liberte Inc. (Canada), Helios Nutrition (Norway), Babushka Kefir (Australia), Nourish Kefir (UK), Maple Hill Creamery (USA), Blue Hill Farm (USA), Wallaby Yogurt Company (USA), Evolve Kefir (Australia), Biotiful Dairy Ltd. (UK), Origin Earth (New Zealand), Green Valley Organics (USA), Altima Health Products (USA), Moringa Milk Kefir (USA), Happy Gut Pro (Canada), Yeo Valley (UK) and Other Active Players.

The Kefir Market is segmented into Type, Nature, Source, Application, Packaging, Distribution Channel, and region. By Type, the market is categorized into Milk Kefir, Water Kefir, Coconut Milk Kefir, and Non-Dairy Milk Kefir. By Nature, the market is categorized into Organic and conventional. By Source, the market is categorized into Animal-Based and plant-based. By Application, the market is categorized into Food and Beverage, Dietary Supplements, Cosmetics and Personal Care, and Pharmaceuticals. By Packaging, The Market Is Categorized Into Bottles, Cartons, Cans, Pouches. By Flavor, the market is categorized into Flavored and Unflavored. By Distribution Channel, the market is categorized into Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores, and E-commerce. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Kefiran, a potential polysaccharide produced from the kefir fermentation is stated as the most preferable EPS among others due to its water-soluble and biodegradable feature.

Kefir Market Size Was Valued at USD 1574.58 Million in 2023 and is Projected to Reach USD 2714.92 Million by 2032, Growing at a CAGR of 6.24% From 2024-2032.