L-Amino Acid Market Synopsis

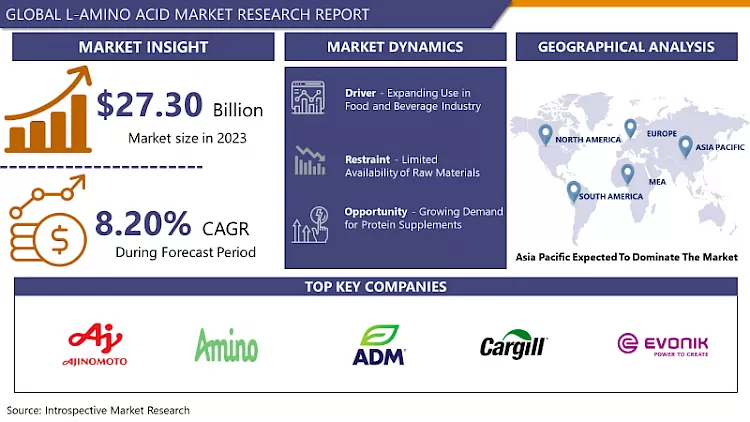

L-Amino Acid Market Size Was Valued at USD 27.30 Billion in 2023, and is Projected to Reach USD 55.49 Billion by 2032, Growing at a CAGR of 8.20% From 2024-2032.

L-amino acids are the foundational molecules for proteins and crucial participants in various biologic processes. They are usually referred as compounds having the amine (-NH2) and the carboxyl (-COOH) groups both bonded to the same carbon atom at the ? -position. Moreover, the backbone of each amino acid carries its own characteristic side-chain (R-groups) that define individual side-chains. These molecules are the building blocks that fill these crucial roles by providing structural support, performing catalytic function, regulating hormones, and conducting neurotransmission within living things. While all amino acids excluding glycine have their chirality, which creates an opportunity for various stereochemical properties, thus influencing their participation and the performance of the biological systems.

- The L-amino acid market has observed the exceptional growth and has undergone massive departure due to the multiplicity of factors that include the rising demand from customer-end industries such as pharmaceuticals, food and beverages, animals feed, cosmetics, just to name but a few. L-amino acids are the components of proteins, which are the building blocks of various life processes. Therefore, they are critical for using them in different applications, which includes but is not limited to food supplements.

- L-Amino acids market has been continuously flourishing because of the increasing consciousness about health and nutrition. Hence, health-conscious consumers are eagerly looking for products rich in L-amino acids to enhance their bodily functions and this has resulted in increased use of these amino acids in dietary supplements, foods, and nutraceuticals. One of the main industries toward L-amino acids supply is the pharmaceutical industry that integrates these biomolecules in their active agents because of their therapeutic properties thus providing market dashboard for it.

- Growing populations that are also composed of members with rising incomes are consuming more processed foods and animal protein products. This has boosted the demand for L-amino acids in the areas of food and feed applications. A-amino acids are employed as a taste enhancers, preservatives, and further these nutritional supplements in food ingredients and additives as well as livestock feed to support animal growth and production are also integrated.

- Biotechnology, genetics and technological development in fermentation have revolutionized l-amino acid production, through which the rate of production have significantly improved, which has led to lower costs and increased the market penetration for l-amino acid production. In the light of microbial fermentation methodologies about L-amino acid production, attention has been drawn to the sustainable and environmental social responsibilities, as the market tends to grow.

- Overcoming obstacles in the l-amino acid products market may involve conformity to strict manufacturing quality and safety regulations as well as fluctuations of raw material prices. Regulated Authorities grave (strict) regulations for L-amino acid manufacturing and its application limits competition performance in the industry and production development due to compliance and product validation. Uncertainty surrounding the cost of feedstocks, a material generally used in the fermentation processes, has an impact on the financial return of some L-amino acid manufacturing companies.

L-Amino Acid Market Trend Analysis

Growing Demand for Plant-Based L-Amino Acids

- L-amino acid is a global market that has hit the peak, in which the plant-based source used to be as a mainstream, as the demands for guide by a series of aspects are on the rise in the world. One of the most important factors that contribute to the market growth is the increasing attention shown by consumers to their health and fitness, while the great demand for natural-based ingredients being in trend. More and more people begin to pay closer attention to their dietary habits and are looking for alternatives to animal-based productions, and thus plant-based L-amino acids have increasingly become highly regarded as desirable options, which are similar to nutritional benefits of animal-based products without the ethical or environmental concerns.

- Creating, for instance, a clear explanation of what amino acids are and how important they are to human body. Amino acids are not just some random elements in the periodic table but they rather quite literally form the building blocks of proteins. Protein synthesis, enzyme production and neurotransmitter regulation are thus dependent on amino acids, making them quite useful when considering balanced diets. Consequently, the companies concerned with L-amino acids that are used by industries in the food, pharmaceutical, and health care products are using more of plant-based L-amino acids to serve the people existing now.

- There have been sophisticated technological innovations and betterment of fermentation procedure in plant genetics for the production of L-amino acids, this has made them economically more viable for commercial use than their alternatives. It has therefore given rise to the market expansion by offering alternative solutions to obstacles of intensification and pricing competitiveness like those faced by animal-based sources.

- The activity of the research and developments which is focused on enhancing the functionality and bioavailability of plant available L-amino acids has hence opened up a greater array of opportunities so that their use can also be found in areas like sport nutrition, dietary supplements, pharmaceutical formulations and cosmetic products. So the evolvements of these technologies are expected to keep stimulating the markets’ growth by helping companies to improve and innovate their product offerings to satisfy consumers with higher and diversified expectations.

Growing Demand for Protein Supplements

- Demand for protein supplements have for a long time heavily powered the growth of the L- amino acid Market to greater heights. The perception entering the minds of individuals regarding the advantage of supplementing protein for building skeletal muscles, weight management and general health, consumers nowadays buy protein supplements for their convenience. L-amino acids, just like proteins, are the very basic ingredients of this realm and can impact it greatly. They are the basic requirements for many of the physiological functions in the body, among others boosting muscle health, protecting the immune system and controlling hormones levels. While the increase in the popularity of the overall general fitness trend as well as the ubiquitous focus on health and wellness motivates the demand for supplementary protein products and consequently L-amino acids, the trend will continue its upward trajectory.

- Furthermore, facets incorporating urbanization, hectic lives, and rise in income levels that allow for the purchase of nimble solutions all contribute to this market just because consumers seek convenient and quick in order to fill their dietary obligations. technical and manufacturing breakthroughs have given rise to the implication of amino L products, which not only fulfil various consumer’s taste and dietary demands, but also stimulate growth of the market. Nevertheless, it is necessary that the congnizience in the L-amino acid market reconsider and address the fact that product quality, safety and comformity with regulations are the issue to build and sustain the consumer trust and the growth the of the sector over long-term period.

L-Amino Acid Market Segment Analysis:

L-Amino Acid Market is segmented based on Type and Application.

By Type, Food Grade segment is expected to dominate the market during the forecast period

- Food Grade: L-amino acids (which are reckoned as food grade) are the best demonstration of the strictest standards of purity and safety of them making them appropriate for use as food and beverage ingredients. The sole function of these amino acids is as a taste-improver, nutritional supplement, or functional ingredient which are common in a variety of products.

- Pharmaceutical Grade: Pharmaceutical L-amino acid that is produced in the grade of pharmacy pass quality evaluation and safety test conducted by the national quality standards so that they can be available to users as formulation. The nutritionists basically emphasized on the use of these amino acids in production of medication, supplements, and pharmaceutical preparations.

- Feed Grade: Among L-amino acids that are generally used with animal feed and nutritional solutions are the feed grade. They have special compositions and are designed to provide for the dietary needs of livestock and poultry, thereby leading to strong growth, good health and elevated productivity. In a similar vein, feed grade L-amino acids can be added to animals feeds to supplement essential amino acids that may be lacking in animal feed ingredients.

By Application, Food Industry segment held the largest share in 2023

- Food Industry:L- Amino acids are, a lot of time, applied as food additives in food processing for flavor improvement, texture enhancement and nutrition value boosting in different food produce. The accept them as functional foods ingredients and additives in the production of processed foods, beverages, dietary supplements and functional foods. In a similar manner, L-amino acids also fill in the flavour enhancer’s role, mainly for savory products like soups, sauces, and snacks.

- Pharmaceutical Industry:L-Amino acids are they building blocks for pharmaceutical drugs and medicines and therefore they are essential to be in the chain of production. They function as the basis for the synthesis of peptides and proteins, which are of the utmost significance in the formulation and creation of drugs. Pharmaceutical-grade L-Amino acids forms a basis for the synthesis of medicines, including antibiotics, vaccines, and hormone therapies, among other pharmaceutical products.

- Feed Industry:L-Amino acids are exploited as a support in the livestock nutrition system to enhance feed quality, and nutritional status of the livestock. They are ingredients of feed that are used for poultry and livestock in the protein synthesis process, enhance growth, and generally, achieve optimal health. L-amino acids contribute to the physiological supply of amino acids, which are necessary for the formation of the essential amino acids and this in turn helps in improving feed to meat conversion, thereby improving quality of performance.

L-Amino Acid Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- To keep with that, the Asia Pacific countries will be competing in this market. Some key elements for such a convincing prediction can be explained as follows. Primarily, the region's bulging population coalesces with the growing disposable incomes is fuelling a momentous cumulation in the demand for protein-rich, as well as functional foods, where L-amino acids are crucially important entities build of proteins. In addition, high speed urbanization and lifestyle improvements in places similar to China, India, and Japan are causing consumers to understand the benefits of different health or wellness products and thus the demand for L-amino acids from different industries such as pharmaceuticals, animal feeds and cosmetics is sure to escalate.

- Besides that, Asia Pacific also offers a well-developed industrial infrastructure and well-known businesses which are present in the manufacturing and L-amino acids distribution. This not only maintains the staple provision of L-amino acids, but also creates reasonable grounds for technology revolution and new products, thus creating a pathway to market growth. Moreover, government initiatives supporting the progress of the pharmaceutical and food industries, along with investment in the field of research and development, is believed to have impact on to market growth expansion in the country.

- The Asia-Pacific region enjoys a wealth source base, in particular, of the key materials required to produce L-amino acids such as soybean and corn. This provides for the manufacturers to sustain their cost priority and helps to develop a continuous supply chain that inseparably connects all players in the sector and thus improves the attractiveness of the region for market users. heightened concentration on ecological behaviour and conservation boosts manufacturers in Asia Pacific to substitute traditional production processes with environment friendly methods and increase investment on renewable energy resources. This enhances their competitive advantage in global market.

Active Key Players in the L-Amino Acid Market

- Ajinomoto(Japan)

- Amino(US)

- Archer-Daniels-Midland (US)

- Cargill(US)

- Evonik Industries(Germany)

- Sumitomo Chemical(Japan)

- Adisseo(China)

- Daesang(South Korea)

- Fufeng Group(China)

- Glanbia Nutritionals(Ireland)

- Other Key Players

|

Global L-Amino Acid Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 27.30 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.20% |

Market Size in 2032: |

USD 55.49 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: L-Amino Acid Market by By Type (2018-2032)

4.1 L-Amino Acid Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Food Grade

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Pharmaceutical Grade

4.5 Feed Grade

Chapter 5: L-Amino Acid Market by By Application (2018-2032)

5.1 L-Amino Acid Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Food

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Pharmaceutical

5.5 Feed

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 L-Amino Acid Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 GELEST INC. (U.S)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 STERLING CHEMICALS (U.S)

6.4 W. R. GRACE & CO.-CONN (U.S)

6.5 BEDOUKIAN RESEARCH (U.S)

6.6 AMS APPLIED MATERIAL SOLUTIONS (U.S)

6.7 ECOLAB INC. (U.S)

6.8 CABOT CORPORATION (U.S)

6.9 MAXIM GROUP (U.S)

6.10 BOC SCIENCES (U.S)

6.11 EVONIK INDUSTRIES AG (GERMANY)

6.12 MERCK KGAA (GERMANY)

6.13 NANOCO TECHNOLOGIES (UNITED KINGDOM)

6.14 EM INDUSTRIES (SWITZERLAND)

6.15 ADEKA CORPORATION (JAPAN)

6.16 NISSAN CHEMICAL CORPORATION (JAPAN)

6.17 ZEON CORP (JAPAN)

6.18 NIPPON ZEON (JAPAN)

6.19 FINETECH INDUSTRY LIMITED (CHINA)

6.20 ANGENE INTERNATIONAL LIMITED (CHINA)

6.21 HANGZHOU PEAK CHEMICAL (CHINA)

6.22 ZHANGJIAGANG XINYI CHEMICAL (CHINA)

6.23 STRUCHEM (CHINA)

6.24 JINAN HAOHUA INDUSTRY (CHINA)

6.25 ATOMAX CHEMICALS (CHINA)

6.26 WACKER SILICONES KOREA COLTD. (SOUTH KOREA)

6.27

Chapter 7: Global L-Amino Acid Market By Region

7.1 Overview

7.2. North America L-Amino Acid Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By By Type

7.2.4.1 Food Grade

7.2.4.2 Pharmaceutical Grade

7.2.4.3 Feed Grade

7.2.5 Historic and Forecasted Market Size By By Application

7.2.5.1 Food

7.2.5.2 Pharmaceutical

7.2.5.3 Feed

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe L-Amino Acid Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By By Type

7.3.4.1 Food Grade

7.3.4.2 Pharmaceutical Grade

7.3.4.3 Feed Grade

7.3.5 Historic and Forecasted Market Size By By Application

7.3.5.1 Food

7.3.5.2 Pharmaceutical

7.3.5.3 Feed

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe L-Amino Acid Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By By Type

7.4.4.1 Food Grade

7.4.4.2 Pharmaceutical Grade

7.4.4.3 Feed Grade

7.4.5 Historic and Forecasted Market Size By By Application

7.4.5.1 Food

7.4.5.2 Pharmaceutical

7.4.5.3 Feed

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific L-Amino Acid Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By By Type

7.5.4.1 Food Grade

7.5.4.2 Pharmaceutical Grade

7.5.4.3 Feed Grade

7.5.5 Historic and Forecasted Market Size By By Application

7.5.5.1 Food

7.5.5.2 Pharmaceutical

7.5.5.3 Feed

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa L-Amino Acid Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By By Type

7.6.4.1 Food Grade

7.6.4.2 Pharmaceutical Grade

7.6.4.3 Feed Grade

7.6.5 Historic and Forecasted Market Size By By Application

7.6.5.1 Food

7.6.5.2 Pharmaceutical

7.6.5.3 Feed

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America L-Amino Acid Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By By Type

7.7.4.1 Food Grade

7.7.4.2 Pharmaceutical Grade

7.7.4.3 Feed Grade

7.7.5 Historic and Forecasted Market Size By By Application

7.7.5.1 Food

7.7.5.2 Pharmaceutical

7.7.5.3 Feed

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global L-Amino Acid Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 27.30 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.20% |

Market Size in 2032: |

USD 55.49 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the L-Amino Acid Market research report is 2024-2032.

Ajinomoto(Japan), Amino(US), Archer-Daniels-Midland (US), Cargill(US), Evonik Industries(Germany), Sumitomo Chemical(Japan), and Other Major Players.

The L-Amino Acid Market is segmented into Type, Application and Region. By Type, the market is categorized into Food Grade, Pharmaceutical Grade, Feed Grade. By Application, the market is categorized into Food, Pharmaceutical, Feed. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

L-Amino acids are the building blocks of proteins and essential molecules in biological processes. They are characterized by having the amino group (-NH2) and carboxyl group (-COOH) bonded to the same carbon atom, known as the ?-carbon. Additionally, each amino acid has a unique side chain (R-group) that determines its specific properties. These molecules play crucial roles in structural support, enzyme function, hormone regulation, and neurotransmission within living organisms. Their chirality, with exception of glycine, gives them unique spatial arrangements, influencing their interactions and functions within biological systems.

L-Amino Acid Market Size Was Valued at USD 27.30 Billion in 2023, and is Projected to Reach USD 55.49 Billion by 2032, Growing at a CAGR of 8.20% From 2024-2032.