Laboratory Freezers Market Synopsis:

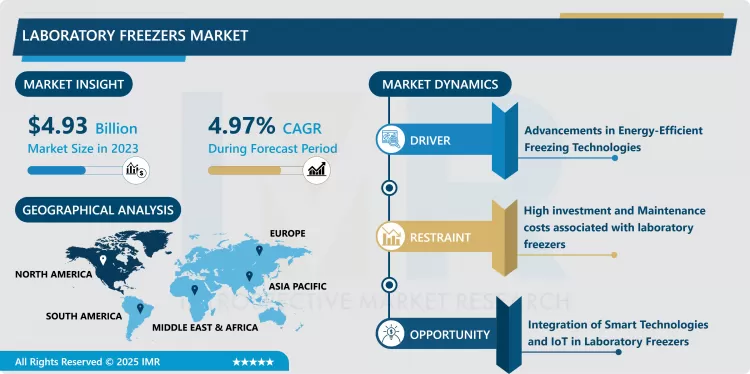

Laboratory Freezers Market Size Was Valued at USD 4.93 Billion in 2023, and is Projected to Reach USD 7.58 Billion by 2032, Growing at a CAGR of 4.97% from 2024-2032.

The laboratory freezers market has been experiencing a high growth over the few years owing to rising need for efficient and proficient solutions for the range of applications in the fields of research and medical. Laboratory freezers are used to store various and particular laboratory samples and reagents and solvents under condition control temperature. There are various kinds of such freezers such as ultra-low temperature (ULT) freezers, -20°C freezers as well as cryogenic freezers for research uses, clinical laboratories, the biotechnology sector, and pharmaceutical companies. As the need for keeping sample integrity becomes increased and the need to achieve accurate, reliable storage means, there is increasing need for laboratory freezers.

Some of the important drivers of this market include the increasing progress in the biotechnology and pharmaceutical industries coupled with increased investment in research in the healthcare segment. Specialties such as Vaccine research laboratories, genetics laboratories, and clinical trial laboratories need extra dependable freezing systems to avoid loss of the samples that they contain. Moreover, more extensive use of customizable medicines and precision healthcare leads to the growth in the demand of advanced laboratory storage, which would also boost the market’s growth.

Technological advancement like energy efficient laboratory freezers, fit and proper temperature control systems, advanced insulation and so on have also impacted the laboratory freezers market. Such players are always innovating as far as the delivery of environmentally friendly and affordable solutions that meet the various end user needs. Due to the increasing demand for a precise sample preservation across sectors, the market for laboratory freezers will remain buoyant in the future years in North America, Europe, and APAC specifically.

Laboratory Freezers Market Trend Analysis:

Advancements in Energy-Efficient Freezing Technologies

- The global trends seen in the laboratory freezers market include the greater popularity of energy efficient models. Since laboratories and research facilities are constantly in the process of cutting down expenses of operation and also attempting on giving less impact on the environment, manufacturers have shifted their attention on designing new freezers that are more energy efficient but also carry the best performance. The prior techniques certain as improved insulation materials, variable speed compressor, and energy-saving mode are becoming popular in new Laboratory Freezer models. These developments not only assist in savings on energy but also the recurrent expenditures which other laboratories that frequently depend on freezing apparatus need to make.

Integration of Smart Technologies and IoT in Laboratory Freezers

- The other key market trend that is being observed in the laboratory freezers market is the smart technologies with IoT connections. Currently, the modern laboratory freezers are fitted with elaborate temperature-monitoring systems that afford real-time visibility on the temperatures, remote monitoring, and even notification of fluctuation from standard storage conditions. This integration improves the practicability of the sample storage process, protects the sample from temperature variations caused by mishaps, and offers the users more concerted control of the preservation process. Such advanced features are always desirable especially in the research facilities where sample integrity plays a major role, thus a rise in the use of such freezers.

Laboratory Freezers Market Segment Analysis:

Laboratory Freezers Market is Segmented based on product type, end-user, target audience, and region

By Product Type, Freezers segment is expected to dominate the market during the forecast period

- The laboratory freezers market is classified according to product type which include freezers, refrigerators and cryopreservation systems that serve different functions in research and preservation. Apart from storing Freeze-Dried Biological samples for long terms very low temperatures freezers are used to store chemicals, pharmaceuticals, and other very sensitive varieties which may require ultra-low temperatures subtypes such as ultra-low freezer (ULT). Refrigerators are utilized mostly on short- and medium-term storage of comparatively non-sensitive samples and reagents and are generally colder than freezers. Cryopreservation systems are refrigerators used for storage of cells, tissues, and related biological materials at cryogenic temperature which is helpful in medical research stores stem cell and Biobanking. The usage of specialised products increases with the advancement in the fields of biotechnology, healthcare and pharmaceutical, and each product category tends to have its own merits to suit the particular temperature control needs.

Target Audience, Laboratory Equipment Manufacturers segment expected to held the largest share

- The target consumers for laboratory freezers include laboratories equipment makers, laboratories freezers makers, and original equipment makers who provide the proper equipment to support superior freezing technologies. Hospitals, diagnostic centres, medical institutes, health care service providers and others who rely on laboratory freezers are benefited by suppliers and distributors of these products. Also, blood banks, laboratories, and research consultancy are some of the stakeholders as they need efficient storage and preservation of blood samples and chemicals, and vaccines respectively. These audiences sustain the need for enhanced freezing technology that is energy efficient and highly secure for various perishable material utilized in clinical research and healthcare units.

Laboratory Freezers Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Due to the good healthcare infrastructure and highly developed research & development sector in North America, the North American sector is expected to lead the overall laboratory freezers market in the coming period. The existence of twelfth-ranking United States, twenty-second-ranking Canada, and fourth-ranking world’s scientific rivals in the role of biotechnology, pharmaceutical and research institutions is driving the need for accurate and precise laboratory freezers particularly for drug development, clinical trials and vaccines. Increased investment and efficient technologies: In particular, new products, smart technologies, improved energy-saving freezer models, and other stringent legislative requirements that directly and positively influence the growth of the market in the region are also the factors that would help the CAVD market grow. Because of the continued advancement in the healthcare industry particularly in North America. The laboratory freezers market is also predicted to have a good growth rate in the coming years.

Active Key Players in the Laboratory Freezers Market

- Thermo Fisher Scientific Inc. (US)

- LabWare (US),

- LabVantage Solutions Inc. (US)

- Abbott (US),

- Waters Corporation. (US)

- Agilent Technologies, Inc (US)

- IDBS (US)

- PerkinElmer, Inc. (US)

- Autoscribe Informatics. (UK)

- Arxspan a Bruker Company (US)

- Dassault Systèmes (France)

- RURO Inc. (US)

- Kinematik (Ireland)

- LabLynx LIMS (US)

- Labworks (US)

- Cerner Corporation (US)

- McKesson Corporation (US)

- Scientific Equipment Repair (US)

- Other Active Players

Key Industry Developments in the Laboratory Freezers Market:

- In December 2024, LabVantage Solutions, Inc., a leading provider of laboratory informatics solutions and services, and The Netherlands Forensic Institute (NFI) announced that they had formed a partnership to digitalize forensic laboratory workflows as part of NFI’s IT renewal initiative. A key aspect of this collaboration was the implementation of LabVantage Solutions’ Laboratory Information Management System (LIMS), which aimed to streamline NFI’s forensic operations by replacing fragmented processes and incorporating advanced capabilities.

- In July 2024, Thermo Fisher Scientific Inc., a global leader in serving science, announced that it had completed the acquisition of Olink Holding AB, a leading provider of next-generation proteomics solutions. The transaction, which valued Olink at approximately $3.1 billion, net of $96 million in acquired cash, resulted in Olink becoming part of Thermo Fisher's Life Sciences Solutions segment.

|

Laboratory Freezers Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.93 Billion |

|

Forecast Period 2024-32 CAGR: |

4.97% |

Market Size in 2032: |

USD 7.58 Billion |

|

Segments Covered: |

Product Type |

|

|

|

End User |

|

||

|

Target Audience |

|

||

|

Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Laboratory Freezers Market by By Product Type (2018-2032)

4.1 Laboratory Freezers Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Freezers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Refrigerators

4.5 Cryopreservation Systems

Chapter 5: Laboratory Freezers Market by End User (2018-2032)

5.1 Laboratory Freezers Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Blood Banks

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Pharmaceutical and Biotechnology Companies

5.5 Academic and Research Institutes

5.6 Medical Laboratories

5.7 Hospitals

5.8 Pharmacies

Chapter 6: Laboratory Freezers Market by Target Audience (2018-2032)

6.1 Laboratory Freezers Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Laboratory Equipment Manufacturers

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Laboratory Freezer Manufacturers

6.5 Original Equipment Manufacturers

6.6 Suppliers and Distributors of Laboratory Freezers

6.7 Hospitals

6.8 Healthcare Service Providers

6.9 Diagnostic Centers

6.10 Laboratories

6.11 Medical Institutes

6.12 Blood Banks

6.13 Research and Consulting Firms

6.14 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Laboratory Freezers Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 THERMO FISHER SCIENTIFIC INC.(US) LABWARE (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 LABVANTAGE SOLUTIONS INC. (US)

7.4 ABBOTT (US)

7.5 WATERS CORPORATION. (US)

7.6 AGILENT TECHNOLOGIES INC (US)

7.7 IDBS (US)

7.8 PERKINELMER INC. (US)

7.9 AUTOSCRIBE INFORMATICS. (UK)

7.10 ARXSPAN A BRUKER COMPANY (US)

7.11 DASSAULT SYSTÈMES (FRANCE)

7.12 RURO INC.

7.13 KINEMATIK (IRELAND)

7.14 LABLYNX LIMS (US)

7.15 LABWORKS (US)

7.16 CERNER CORPORATION (US)

7.17 MCKESSON CORPORATION (US) SCIENTIFIC EQUIPMENT REPAIR (US)

7.18 OTHER ACTIVE PLAYERS

Chapter 8: Global Laboratory Freezers Market By Region

8.1 Overview

8.2. North America Laboratory Freezers Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Product Type

8.2.4.1 Freezers

8.2.4.2 Refrigerators

8.2.4.3 Cryopreservation Systems

8.2.5 Historic and Forecasted Market Size By End User

8.2.5.1 Blood Banks

8.2.5.2 Pharmaceutical and Biotechnology Companies

8.2.5.3 Academic and Research Institutes

8.2.5.4 Medical Laboratories

8.2.5.5 Hospitals

8.2.5.6 Pharmacies

8.2.6 Historic and Forecasted Market Size By Target Audience

8.2.6.1 Laboratory Equipment Manufacturers

8.2.6.2 Laboratory Freezer Manufacturers

8.2.6.3 Original Equipment Manufacturers

8.2.6.4 Suppliers and Distributors of Laboratory Freezers

8.2.6.5 Hospitals

8.2.6.6 Healthcare Service Providers

8.2.6.7 Diagnostic Centers

8.2.6.8 Laboratories

8.2.6.9 Medical Institutes

8.2.6.10 Blood Banks

8.2.6.11 Research and Consulting Firms

8.2.6.12 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Laboratory Freezers Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Product Type

8.3.4.1 Freezers

8.3.4.2 Refrigerators

8.3.4.3 Cryopreservation Systems

8.3.5 Historic and Forecasted Market Size By End User

8.3.5.1 Blood Banks

8.3.5.2 Pharmaceutical and Biotechnology Companies

8.3.5.3 Academic and Research Institutes

8.3.5.4 Medical Laboratories

8.3.5.5 Hospitals

8.3.5.6 Pharmacies

8.3.6 Historic and Forecasted Market Size By Target Audience

8.3.6.1 Laboratory Equipment Manufacturers

8.3.6.2 Laboratory Freezer Manufacturers

8.3.6.3 Original Equipment Manufacturers

8.3.6.4 Suppliers and Distributors of Laboratory Freezers

8.3.6.5 Hospitals

8.3.6.6 Healthcare Service Providers

8.3.6.7 Diagnostic Centers

8.3.6.8 Laboratories

8.3.6.9 Medical Institutes

8.3.6.10 Blood Banks

8.3.6.11 Research and Consulting Firms

8.3.6.12 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Laboratory Freezers Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Product Type

8.4.4.1 Freezers

8.4.4.2 Refrigerators

8.4.4.3 Cryopreservation Systems

8.4.5 Historic and Forecasted Market Size By End User

8.4.5.1 Blood Banks

8.4.5.2 Pharmaceutical and Biotechnology Companies

8.4.5.3 Academic and Research Institutes

8.4.5.4 Medical Laboratories

8.4.5.5 Hospitals

8.4.5.6 Pharmacies

8.4.6 Historic and Forecasted Market Size By Target Audience

8.4.6.1 Laboratory Equipment Manufacturers

8.4.6.2 Laboratory Freezer Manufacturers

8.4.6.3 Original Equipment Manufacturers

8.4.6.4 Suppliers and Distributors of Laboratory Freezers

8.4.6.5 Hospitals

8.4.6.6 Healthcare Service Providers

8.4.6.7 Diagnostic Centers

8.4.6.8 Laboratories

8.4.6.9 Medical Institutes

8.4.6.10 Blood Banks

8.4.6.11 Research and Consulting Firms

8.4.6.12 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Laboratory Freezers Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Product Type

8.5.4.1 Freezers

8.5.4.2 Refrigerators

8.5.4.3 Cryopreservation Systems

8.5.5 Historic and Forecasted Market Size By End User

8.5.5.1 Blood Banks

8.5.5.2 Pharmaceutical and Biotechnology Companies

8.5.5.3 Academic and Research Institutes

8.5.5.4 Medical Laboratories

8.5.5.5 Hospitals

8.5.5.6 Pharmacies

8.5.6 Historic and Forecasted Market Size By Target Audience

8.5.6.1 Laboratory Equipment Manufacturers

8.5.6.2 Laboratory Freezer Manufacturers

8.5.6.3 Original Equipment Manufacturers

8.5.6.4 Suppliers and Distributors of Laboratory Freezers

8.5.6.5 Hospitals

8.5.6.6 Healthcare Service Providers

8.5.6.7 Diagnostic Centers

8.5.6.8 Laboratories

8.5.6.9 Medical Institutes

8.5.6.10 Blood Banks

8.5.6.11 Research and Consulting Firms

8.5.6.12 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Laboratory Freezers Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Product Type

8.6.4.1 Freezers

8.6.4.2 Refrigerators

8.6.4.3 Cryopreservation Systems

8.6.5 Historic and Forecasted Market Size By End User

8.6.5.1 Blood Banks

8.6.5.2 Pharmaceutical and Biotechnology Companies

8.6.5.3 Academic and Research Institutes

8.6.5.4 Medical Laboratories

8.6.5.5 Hospitals

8.6.5.6 Pharmacies

8.6.6 Historic and Forecasted Market Size By Target Audience

8.6.6.1 Laboratory Equipment Manufacturers

8.6.6.2 Laboratory Freezer Manufacturers

8.6.6.3 Original Equipment Manufacturers

8.6.6.4 Suppliers and Distributors of Laboratory Freezers

8.6.6.5 Hospitals

8.6.6.6 Healthcare Service Providers

8.6.6.7 Diagnostic Centers

8.6.6.8 Laboratories

8.6.6.9 Medical Institutes

8.6.6.10 Blood Banks

8.6.6.11 Research and Consulting Firms

8.6.6.12 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Laboratory Freezers Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Product Type

8.7.4.1 Freezers

8.7.4.2 Refrigerators

8.7.4.3 Cryopreservation Systems

8.7.5 Historic and Forecasted Market Size By End User

8.7.5.1 Blood Banks

8.7.5.2 Pharmaceutical and Biotechnology Companies

8.7.5.3 Academic and Research Institutes

8.7.5.4 Medical Laboratories

8.7.5.5 Hospitals

8.7.5.6 Pharmacies

8.7.6 Historic and Forecasted Market Size By Target Audience

8.7.6.1 Laboratory Equipment Manufacturers

8.7.6.2 Laboratory Freezer Manufacturers

8.7.6.3 Original Equipment Manufacturers

8.7.6.4 Suppliers and Distributors of Laboratory Freezers

8.7.6.5 Hospitals

8.7.6.6 Healthcare Service Providers

8.7.6.7 Diagnostic Centers

8.7.6.8 Laboratories

8.7.6.9 Medical Institutes

8.7.6.10 Blood Banks

8.7.6.11 Research and Consulting Firms

8.7.6.12 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Laboratory Freezers Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.93 Billion |

|

Forecast Period 2024-32 CAGR: |

4.97% |

Market Size in 2032: |

USD 7.58 Billion |

|

Segments Covered: |

Product Type |

|

|

|

End User |

|

||

|

Target Audience |

|

||

|

Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Laboratory Freezers Market research report is 2024-2032.

Thermo Fisher Scientific Inc. (US) LabWare (US), LabVantage Solutions Inc. (US), Abbott (US), Waters Corporation. (US), Agilent Technologies, Inc (US), IDBS (US), PerkinElmer, Inc. (US), Autoscribe Informatics. (UK), Arxspan a Bruker Company (US), Dassault Systèmes (France), RURO Inc., Kinematik (Ireland), LabLynx LIMS (US), Labworks (US), Cerner Corporation (US), McKesson Corporation (US) and Scientific Equipment Repair (US), and Other Active Players.

The Laboratory Freezers Market is segmented into By Product Type, End User, Target Audience and region. By Product Type (Freezers, Refrigerators, Cryopreservation Systems), End User (Blood Banks, Pharmaceutical and Biotechnology Companies, Academic and Research Institutes, Medical Laboratories, Hospitals, Pharmacies), Target Audience (Laboratory Equipment Manufacturers, Laboratory Freezer Manufacturers, Original Equipment Manufacturers, Suppliers and Distributors of Laboratory Freezers, Hospitals, Healthcare Service Providers, Diagnostic Centers, Laboratories, Medical Institutes, Blood Banks, Research and Consulting Firms, Others). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; The Netherlands; Italy; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Laboratory freezers are specialized refrigeration units designed to store biological samples, chemicals, pharmaceuticals, and other sensitive materials at low temperatures to preserve their integrity. These freezers are critical in various scientific fields, including biotechnology, healthcare, and pharmaceuticals, where maintaining precise temperature control is essential to prevent degradation or contamination of samples. Laboratory freezers come in different types, such as ultra-low temperature (ULT) freezers, -20°C freezers, and cryogenic freezers, each tailored to meet specific storage needs. Equipped with advanced temperature regulation systems and safety features, these freezers ensure reliable and secure storage for research and clinical applications.

Laboratory Freezers Market Size Was Valued at USD 4.93 Billion in 2023, and is Projected to Reach USD 7.58 Billion by 2032, Growing at a CAGR of 4.97% from 2024-2032.