Laser Cladding Market Synopsis

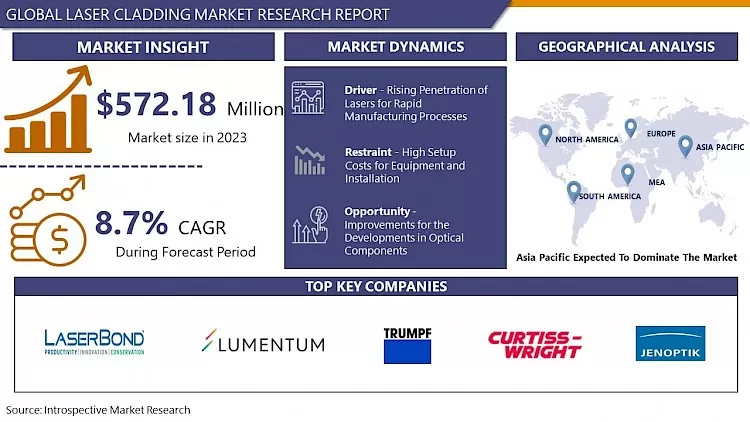

Global Laser Cladding Market Size Was Valued at USD 572.18 Million in 2023 and is Projected to Reach USD 1128.25 Million by 2032, Growing at a CAGR of 8.7 % From 2024-2032.

Laser cladding is referred to as a process that is utilized to fuse with a laser beam another material that has several metallurgical properties on a substrate, whereby only a very thin layer of the substrate has to be melted to achieve blueprinting bonding with the least dilution of added material and substrate to keep the original properties of the coating material.

- Laser cladding, an advanced surface modification technique, involves precisely depositing a layer of material onto a substrate using a laser as the heat source. Widely applied across various industries, this process serves purposes such as surface hardening, repair, and enhancing component properties. In aerospace and automotive sectors, laser cladding reinforces critical components, extending their service life and optimizing performance. The technology is also utilized in the oil and gas industry for restoring worn-out components, thereby reducing downtime and maintenance costs.

- The advantages of laser cladding are manifold. It allows for precise control of deposited material, minimizing waste and ensuring accurate coating thickness. The process accommodates various materials, including alloys, ceramics, and dissimilar metals, offering flexibility to meet specific engineering requirements. Laser cladding contributes to increased wear resistance, corrosion protection, and improved thermal conductivity, augmenting the overall durability and functionality of treated components. The localized and controlled heating inherent in laser cladding minimizes the risk of thermal distortion, making it a preferred choice for intricate and delicate parts. Moreover, the technology aligns with modern industrial practices focused on efficiency and environmental responsibility by reducing material consumption and waste. In essence, laser cladding emerges as a versatile and efficient method for enhancing material properties and extending the lifespan of critical components across diverse industrial applications.

Laser Cladding Market Trend Analysis:

Rising Penetration of Lasers for Rapid Manufacturing Processes

- The industrial area is currently the higher market for fiber lasers; a significant part of the activity right currently is at the kilowatt-class power level. Particularly entrancing is their application in car works. The car business is shifting to high-strength steel to deliver vehicles that accomplish solidness requirements yet are moderately light for better efficiency; the issue is how to cut the high-strength steel. This is where they go to fiber lasers. It is undeniably challenging, for instance, for regular machine devices to poke holes in this sort of steel; in any case, fiber lasers can undoubtedly cut these openings.

- Lasers required for changing cycles, frameworks, and applications are in the scope of two or three hundred to thousands of watts. High-power lasers are applied in enormous-scale laser shows, clinical, laser-actuated nuclear fusion, military, research, and materials preparing (welding, cutting, drilling, binding, checking, cladding, and surface adjustment) applications. Even though laser cladding declines labor force and related costs in the car and building industries, its sending includes enormous speculation. Lasers are upheld by different programming, plan documents, tough aspects, and laser sources. Moreover, these accompany administration packages and guarantees to secure against costly fixes if there should be an occurrence of a glitch.

Improvements for the Developments in Optical Components

- The National Research Council of Canada has successfully tested laser cladding technology for its application in the manufacturing of space-related structures, such as the main parts of a robotic arm. These tests emerged in the production of robotic arm components with outstanding mechanical properties, which is a simple indication of the capacity of laser cladding technology for in-space manufacturing facilities which is expected to create further lucrative opportunities for the laser cladding market. In addition, researchers have started studies on strategies for emerging a reliable in-space transportation infrastructure, which may eventually incorporate permanent refueling stations and maintenance platforms in space, as well as cargo vehicles that haul supplies over the shipping lanes of space.

- Moreover, impressive improvements can be made through developments in optical components. Lenses capable of focusing the low-quality beam from diode lasers offer various opportunities for processing. Lightweight, compact lasers are ideal tools for autonomous, flexible, robotic systems for material processing, which allows small groups of tailored components to be rapidly fabricated. Robot-mounted lasers are well suited for this purpose and can anticipate finding them in a growing number of engineering sites in the future.

Laser Cladding Market Segment Analysis:

Laser Cladding Market Segmented on the basis of Type, Material, Revenue, and End-User.

By Type, Diode laser segment is expected to dominate the market during the forecast period

- The diode lasers segment is expected to register the maximum Laser Cladding market share during the forecast period. In recent years, high-power direct diode lasers (DDL) have become progressively popular and are mostly utilized for heat processing applications. The energy-saving provided by high-power DDLs is high compared with conventional types such as carbon dioxide (CO2) lasers and yttrium aluminum garnet (YAG) lasers. Therefore, the diode lasers segment is anticipated to record the highest Laser Cladding market share.

By End-User, Oil & Gas segment held the largest share of 47.12% in 2022

- The oil & gas end-use industry is anticipated to dominate the laser cladding market during the forecast period. As per the World Corrosion Organization, corrosion costs USD 2.5 trillion to the global economy. Approximately 45% of the cost of corrosion, about USD 1 trillion annually, is accountable to the oil, gas, and petrochemical industries. As operating environments in these sectors become increasingly challenging owing to maximum temperatures, higher corrosion, higher pressures, and higher wear, the demand for materials that can better withstand these environments is increasing. Hence, it has become essential for oil and gas producers to use corrosion-resistant clad pipes in such environments to allow more efficient and, most importantly, safer operations.

Laser Cladding Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The laser cladding market is anticipated to be dominated by the regional segment of Asia Pacific. The growth of the regional segment can be primarily attributed to the growing demand for pharmaceutical, material science applications, and life science utilizations in economies such as India, Japan, China, and South Korea. Additionally, the presence of several sciences and materials sciences companies and contract manufacturers organizations are also anticipated to support in turning the growth of the Laser cladding market in the Asia Pacific region during the forecast period. Moreover, enhancing healthcare infrastructure, increase in the GDP of emerging markets, rapid urbanization, and support offered by governments and several companies to expand the pharmaceuticals and life sciences industries in emerging economies in the region.

Laser Cladding Market Top Key Players:

- Curtiss-Wright Corporation (US)

- IPG Photonics Corporation (US)

- Lumentum Operations LLC (US)

- Coherent Inc (US)

- Hayden Corporation (US)

- Alabama Specialty Products Inc. (US)

- Efesto (US)

- Fraunhofer USA's Center Midwest (US)

- Kondex Corporation (US)

- LaserStar (US)

- Preco (US)

- Lincoln Laser Solutions (Canada)

- Jenoptik (Germany)

- Laserline (Germany)

- TRUMPF (Germany)

- Lumibird (France)

- Gravotech (France)

- Technogenia (France)

- OC Oerlikon Management AG (Switzerland)

- Hoganas AB (Sweden)

- Optomec (Mexico)

- TLM Laser (UK)

- Laser Cladding Technologies (Singapore)

- LaserBond (Australia)

- Han's Laser Technology Industry Group Co.Ltd. (China), and Other Major Players

Key Industry Developments in the Laser Cladding Market:

- In January 2021, Lumibird declared a global agreement with GWU-LASERTECHNIK for the commercialization of GWU's optical parametric oscillator (OP) with Lumibird's solid-state lasers. This agreement expanded Lumibird's provision for pulsed Nd: YAG lasers to include tunable OPO systems.

- In June 2021, II-VI Incorporated and Coherent declared that II-VI's shareholders and Coherent's stockholders have each voted vigorously to adopt and approve the collaboration agreement for II-VI to acquire Coherently.

|

Global Laser Cladding Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2013 to 2023 |

Market Size in 2023: |

USD 572.18 Mn. |

|

Forecast Period 2023-30 CAGR: |

8.7 % |

Market Size in 2032: |

USD 1128.25Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Revenue |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Laser Cladding Market by By Type (2018-2032)

4.1 Laser Cladding Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Diode laser

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Fiber laser

4.5 CO2 laser

4.6 Acoustic laser

Chapter 5: Laser Cladding Market by By Material (2018-2032)

5.1 Laser Cladding Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Carbides & Carbide Blends

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Cobalt-Based Alloys

5.5 Iron-Based Alloys

5.6 Nickel-Based Alloys

Chapter 6: Laser Cladding Market by By Revenue (2018-2032)

6.1 Laser Cladding Market Snapshot and Growth Engine

6.2 Market Overview

6.3 System Revenue

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Laser Revenue

Chapter 7: Laser Cladding Market by By End-User (2018-2032)

7.1 Laser Cladding Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Oil & Gas

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Aerospace & Defense

7.5 Automotive

7.6 Agriculture

7.7 Power Generation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Laser Cladding Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 CAISLEY INTERNATIONAL (GERMANY)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 KUPSAN TAG COMPANY (TURKEY)

8.4 AFIMILK (ISRAEL)

8.5 LIVESTOCK IMPROVEMENT CORPORATION (NEW ZEALAND)

8.6 ALLFLEX (PART OF MERCK) (US)

8.7 ZOETIS (US)

8.8 LEADER PRODUCTS (AUSTRALIA)

8.9 NEDAP (NETHERLANDS)

8.10 CAINTHUS (IRELAND)

8.11 CONNECTERRA (NETHERLANDS)

8.12 DELAVAL (SWEDEN)

8.13 MOOCALL (IRELAND)

8.14 COWLAR (US)

8.15 DATAMARS (SWITZERLAND)

8.16 OTHERS MAJOR PLAYERS.

Chapter 9: Global Laser Cladding Market By Region

9.1 Overview

9.2. North America Laser Cladding Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By By Type

9.2.4.1 Diode laser

9.2.4.2 Fiber laser

9.2.4.3 CO2 laser

9.2.4.4 Acoustic laser

9.2.5 Historic and Forecasted Market Size By By Material

9.2.5.1 Carbides & Carbide Blends

9.2.5.2 Cobalt-Based Alloys

9.2.5.3 Iron-Based Alloys

9.2.5.4 Nickel-Based Alloys

9.2.6 Historic and Forecasted Market Size By By Revenue

9.2.6.1 System Revenue

9.2.6.2 Laser Revenue

9.2.7 Historic and Forecasted Market Size By By End-User

9.2.7.1 Oil & Gas

9.2.7.2 Aerospace & Defense

9.2.7.3 Automotive

9.2.7.4 Agriculture

9.2.7.5 Power Generation

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Laser Cladding Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By By Type

9.3.4.1 Diode laser

9.3.4.2 Fiber laser

9.3.4.3 CO2 laser

9.3.4.4 Acoustic laser

9.3.5 Historic and Forecasted Market Size By By Material

9.3.5.1 Carbides & Carbide Blends

9.3.5.2 Cobalt-Based Alloys

9.3.5.3 Iron-Based Alloys

9.3.5.4 Nickel-Based Alloys

9.3.6 Historic and Forecasted Market Size By By Revenue

9.3.6.1 System Revenue

9.3.6.2 Laser Revenue

9.3.7 Historic and Forecasted Market Size By By End-User

9.3.7.1 Oil & Gas

9.3.7.2 Aerospace & Defense

9.3.7.3 Automotive

9.3.7.4 Agriculture

9.3.7.5 Power Generation

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Laser Cladding Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By By Type

9.4.4.1 Diode laser

9.4.4.2 Fiber laser

9.4.4.3 CO2 laser

9.4.4.4 Acoustic laser

9.4.5 Historic and Forecasted Market Size By By Material

9.4.5.1 Carbides & Carbide Blends

9.4.5.2 Cobalt-Based Alloys

9.4.5.3 Iron-Based Alloys

9.4.5.4 Nickel-Based Alloys

9.4.6 Historic and Forecasted Market Size By By Revenue

9.4.6.1 System Revenue

9.4.6.2 Laser Revenue

9.4.7 Historic and Forecasted Market Size By By End-User

9.4.7.1 Oil & Gas

9.4.7.2 Aerospace & Defense

9.4.7.3 Automotive

9.4.7.4 Agriculture

9.4.7.5 Power Generation

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Laser Cladding Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By By Type

9.5.4.1 Diode laser

9.5.4.2 Fiber laser

9.5.4.3 CO2 laser

9.5.4.4 Acoustic laser

9.5.5 Historic and Forecasted Market Size By By Material

9.5.5.1 Carbides & Carbide Blends

9.5.5.2 Cobalt-Based Alloys

9.5.5.3 Iron-Based Alloys

9.5.5.4 Nickel-Based Alloys

9.5.6 Historic and Forecasted Market Size By By Revenue

9.5.6.1 System Revenue

9.5.6.2 Laser Revenue

9.5.7 Historic and Forecasted Market Size By By End-User

9.5.7.1 Oil & Gas

9.5.7.2 Aerospace & Defense

9.5.7.3 Automotive

9.5.7.4 Agriculture

9.5.7.5 Power Generation

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Laser Cladding Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By By Type

9.6.4.1 Diode laser

9.6.4.2 Fiber laser

9.6.4.3 CO2 laser

9.6.4.4 Acoustic laser

9.6.5 Historic and Forecasted Market Size By By Material

9.6.5.1 Carbides & Carbide Blends

9.6.5.2 Cobalt-Based Alloys

9.6.5.3 Iron-Based Alloys

9.6.5.4 Nickel-Based Alloys

9.6.6 Historic and Forecasted Market Size By By Revenue

9.6.6.1 System Revenue

9.6.6.2 Laser Revenue

9.6.7 Historic and Forecasted Market Size By By End-User

9.6.7.1 Oil & Gas

9.6.7.2 Aerospace & Defense

9.6.7.3 Automotive

9.6.7.4 Agriculture

9.6.7.5 Power Generation

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Laser Cladding Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By By Type

9.7.4.1 Diode laser

9.7.4.2 Fiber laser

9.7.4.3 CO2 laser

9.7.4.4 Acoustic laser

9.7.5 Historic and Forecasted Market Size By By Material

9.7.5.1 Carbides & Carbide Blends

9.7.5.2 Cobalt-Based Alloys

9.7.5.3 Iron-Based Alloys

9.7.5.4 Nickel-Based Alloys

9.7.6 Historic and Forecasted Market Size By By Revenue

9.7.6.1 System Revenue

9.7.6.2 Laser Revenue

9.7.7 Historic and Forecasted Market Size By By End-User

9.7.7.1 Oil & Gas

9.7.7.2 Aerospace & Defense

9.7.7.3 Automotive

9.7.7.4 Agriculture

9.7.7.5 Power Generation

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Laser Cladding Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2013 to 2023 |

Market Size in 2023: |

USD 572.18 Mn. |

|

Forecast Period 2023-30 CAGR: |

8.7 % |

Market Size in 2032: |

USD 1128.25Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Revenue |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Laser Cladding Market research report is 2024-2032.

Curtiss-Wright Corporation (US), IPG Photonics Corporation (US), Lumentum Operations LLC (US), Coherent Inc (US), Hayden Corporation (US), Alabama Specialty Products Inc. (US), Efesto (US), Fraunhofer USA's Center Midwest (US), Kondex Corporation (US), LaserStar (US), Preco (US), Lincoln Laser Solutions (Canada), Jenoptik (Germany), Laserline (Germany), TRUMPF (Germany), Lumibird (France), Gravotech (France), Technogenia (France), OC Oerlikon Management AG (Switzerland), Hoganas AB (Sweden), Optomec (Mexico), TLM Laser (UK), Laser Cladding Technologies (Singapore), LaserBond (Australia), Han's Laser Technology Industry Group Co.Ltd. (China), and Other Major Players

The Laser Cladding Market is segmented into type, material, revenue, End-User, and region. By Type, the market is categorized into Diode laser, Fiber laser, CO2 laser, Acoustic laser, and Others. Material, the market is categorized into Carbides & Carbide Blends, Cobalt-Based Alloys, Iron-Based Alloys, and Nickel-Based Alloys. By Revenue, the market is categorized into System revenue and Laser Revenue. By End-User, the market is categorized into Oil & Gas, Aerospace & Defense, Automotive, Agriculture, Power Generation, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Laser cladding is refereed as a process that is utilized to fuse with a laser beam another material that has several metallurgical properties on a substrate, whereby only a very thin layer of the substrate has to be melted to achieve blueprinting bonding with the least dilution of added material and substrate to keep the original properties of the coating material.

Global Laser Cladding Market Size Was Valued at USD 572.18 Million in 2023 and is Projected to Reach USD 1128.25 Million by 2032, Growing at a CAGR of 8.7 % From 2024-2032.