Liquefied Petroleum Gas (LPG) Market Synopsis

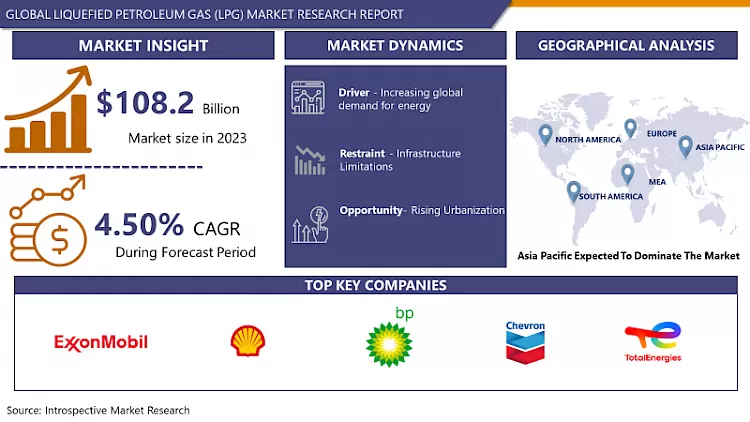

Liquefied Petroleum Gas (LPG) Market Size Was Valued at USD 108.2 Billion in 2023, and is Projected to Reach USD 160.7 Billion by 2032, Growing at a CAGR of 4.50% From 2024-2032.

- The Liquefied Petroleum Gas (LPG) market designates the worldwide commercial activity relating to production and distribution of liquefied hydrocarbon gases consisting mainly of propane and butane. Liquefied petroleum gas (LPG) is derived from natural gas processing and crude oil refining, providing a useful energy source in residential, commercial, industrial, and automobile use. Its features such as portability and clean burning, have fueled it to become widely used in place of traditional fuels like wood and coal in multiple settings. The market consists of many participants, including producers, distributors, retailers, and consummation, which is affected by issues like global energy consumption, price fluctuations, policy regulations, and innovation, which is aimed at developing efficient and environmentally friendly technologies.

- The Liquefied Petroleum Gas (LPG) market is set to witness big growth due to several growth factors. The foremost leading factor creates the growing need for the cleaner and more efficient energy resources which are needed in residential, commercial, and industrial applications. LPG is the preferred fuel for its versatility and lower environmental impact than the traditional fuels such as coal or wood.

- Government programs encouraging people to use LPG as cooking fuel, especially in the developing economies, are also contributing to the growth of the market. As a way of controlling indoor air pollution and ending up with better public health, many governments offer subsidy for LPG adoption for cooking. Additionally, a development of distribution infrastructure including storage facility and shipping networks promotes wider use of LP gas in both urban and rural areas.

- Another remarkable trend is LPG in automotive applications mainly in autogas vehicles. LPG is increasingly seen as cleaner type of the gasoline and diesel, which means a reduction in emissions as well as cost benefits. The introduction of the stricter environmental regulations and preference of the consumers towards cleaner fuel will result in an increase in the consumption of LPG in the upcoming years.

- In addition to this, the market adopts the LPG as a substitute for the traditional solid fuels in residential cooking and heating operations of places where clean energy is still a challenge to access. The impetus for this transition is to decrease deforestation, fight indoor air pollution, and achieve sustainable development goals. In general, these trends jointly lead towards a promising perspective of the global LPG market, with expected growth in consumption and trade penetration in different industries and regions.

Liquefied Petroleum Gas (LPG) Market Trend Analysis

Increasing Adoption in Residential and Commercial Sectors:

- The use of LPG has been growing rapidly in private residences for cooking and heating purposes. Being clean-burning in nature and easily accessible, it is the preferred fuel source for millions of households worldwide. LPG is a reliable and efficient source of energy for cooking since it gives an accurate temperature and fast heating.

- Furthermore, it is mobile, enabling access to remote areas where dedicated natural gas pipelines are unavailable. This factor of convenience, coupled with the reduced environmental impact compared to the traditional solid fuels such as wood or coal, has secured LPG as a major energy source in the household applications.

- Another crucial application of LPG is in commercial entities like restaurants, hotels, and industrial kitchens. Here LPG acts as the main fuel for cooking, heating and hot water supply. Its excellent combustion efficiency not only guarantees an optimum cooking environment but it also plays a part in the preservation of the environment by cutting down emissions.

- Industrial users appreciate LPG for its reliable output characteristics and environmental benefits, being in tune with the goals of sustainability that now more and more companies follow. As a multi-functional and dependable energy source, LPG is still vital in providing the multifaceted energy needs of commercial facilities while tackling the issue of environmental degradation through cleaner energy options.

Growing Demand for Cleaner Fuels

- The global transition to environment-friendly fuels is supported by the efforts of many countries working on tackling the environmental problem and lowering greenhouse gas emissions. As part of this initiative, there are many governments that are actively supporting the application of cleaner substitutes to traditional fossil fuels , LPG being a preferred choice in many places.

- LPG features superior environmental qualities to that of coal, wood, or diesel because of the low emission profile and clean combustion of this fuel. This results in the increasing demand for LPG in regions where governments are promoting cleaner fuel use as the best strategy for mitigating air pollution and improving public health.

- As the awareness of the environment continues to grow, government policies and regulations are becoming the most important factor in shaping the demand for LPG. Incentives, which include subsidies, tax breaks, and regulations, are being embraced by households, businesses and industries to switch to cleaner energy sources like LPG. This strategic move to cleaner fuels also contributes to global sustainability commitments of reducing greenhouse gases and fighting climate change.

- Consequently, LPG becomes the energy source of choice in countries that are implementing policies to accelerate the uptake of cleaner fuels thereby positioning it at the vanguard of the energy transition era.

Liquefied Petroleum Gas (LPG) Market Segment Analysis:

Liquefied Petroleum Gas (LPG) Market Segmented based on Source of Production, Application and End-User.

By Source of Production, Crude Oil segment is expected to dominate the market during the forecast period

- On a global scale crude oil is the primary energy source for the global transportation sector, playing a critical role in powering diverse forms of transportation, such as cars, trucks, ships and airplanes. The monopoly of crude oil in this sector is due to its high energy density, ease of transportation and established infrastructure for refining into gasoline, diesel and jet fuel.

- Gasoline and diesel produced from crude oil is the most widely used fuel for generating power for internal combustion engines in cars and trucks. Specifically, gasoline is the main fuel used in passenger cars, generating the energy to keep the internal combustion motor running. Also like that, diesel fuel drives the majority of heavy-duty trucks and commercial vehicles, which are responsible for transportation of goods over long distances.

- Furthermore, heavy fuel oil takes an important place in maritime shipping. Ships run with diesel fuel for propulsion and auxiliary systems powering. The major part of the large cargo ships and tankers that carry goods and resources through oceans and seas are diesel-powered. Also, the aviation industry is highly dependent on jet fuel made from crude oil to power airplanes. The jet fuel's high energy density does not only power aircraft engines profitably to make long-haul flights but also contribute to global connectivity.

- The dominance of crude oil in transportation indicates how it is integral for the movement and associated activities in the world. Nevertheless, increasing worries about environmental degradation and sustainability have resulted in the development of alternative fuels and technologies that aim at reducing the need for the use of crude oil in transportation. The objective of such programs is to enhance the application of environmentally-friendly and low-carbon technologies in transportation like electric vehicles, biofuels, and hydrogen-based vehicles, among others, to reduce greenhouse gas emissions and battle climate change.

By Application, Agriculture segment held the largest share in 2023

- In agriculture, energy sources are key for operation of farms and movement of transportation. The largest share of energy used in agriculture is mostly attributed to fossil fuels, namely to diesel and gasoline. These fuels are mostly used to run agricultural machinery and vechiles that are crucial to do tilling, planting, harvesting and transporting crops and livestock. Tractors, harvesters, and the majority of other agricultural machines heavily depend on diesel fuel for strength. Similarly, gasoline can be found in smaller farm machines like chainsaws, trimmers, and ATVs. Agriculture sector's dependence on fossil fuels underscores the sector's high energy consumption through mechanized farming systems, which are often essential to modern agricultural practices for both efficiency and productivity.

- Additionally, the transportation of agricultural products is also another significant area of energy consumption in agriculture. Non-renewable sources such as diesel fuel power trucks, trailers and the other vehicles used for transporting harvested crops, livestock, and farm supplies over long distances. The transport network ensures that the produce is delivered in time to markets, processors and consumers. An efficient use of energy is a must in the logistics of transportation of agricultural produce and it is highly desirable to minimize the costs and environmental impacts. Biofuels and other renewable energy sources are the alternatives. g. , engines) are also present in the agricultural sector, especially with the reduction in greenhouse gas emissions and dependence on traditional fossil fuels. Nevertheless, fossil fuels are widely used in the agricultural process because of their reliability and existing infrastructure for the storage and distribution of fuel.

Liquefied Petroleum Gas (LPG) Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Overall, some major countries in the Asia Pacific (APAC) region, which include China, India, Japan, South Korea, and Thailand control the global Liquefied Petroleum Gas (LPG) market. This zone holds the top spot in LPG consumption which is attributed to population growth, ample availability of resources and tremendous energy demands. The demand for LPG in Asia Pacific is largely driven by the fast paced industrialization and urbanization of the countries such as China and India.

- The main contributors to LPG demand in the region are China and India. The governments of both countries provide subsidies on LP gas cylinders which results in the availability and affordability of this fuel for households and industries. On the other hand, the growth of petrochemical manufacturing capacities in these countries strengthens the market for LPG, especially in industrial applications and as a precursor for numerous chemical products.

- India, in particular, is one of the major importers of LPG. The country's focus on the growth of LPG infrastructural facilities indicates a strong determination to increase the availability and consumption of LPG across the sectors including residential, commercial, and industrial. Programs such as the free distribution of LPG gas connections to households show India's sophisticated approach to enhancing the use of LPG and the decline of conventional fueling.

- Ultimately, the predominance of China and India within the LPG market in the Asia Pacific region is based on the supportive government policy, expanding industrial activities, and the growing population that requires the alternative cleaner and more efficient energy sources. These countries become the backbone of the global LPG market with their huge contributions and persistent efforts to increase LPG infrastructure and acceptance.

Active Key Players in the Liquefied Petroleum Gas (LPG) Market

- ExxonMobil Corporation

- Royal Dutch Shell plc

- BP plc

- Chevron Corporation

- TotalEnergies SE

- ConocoPhillips

- Phillips 66

- Sinopec

- PetroChina Company Limited

- Bharat Petroleum Corporation Limited

- Hindustan Petroleum Corporation Limited

- Saudi Aramco

- Kuwait Petroleum Corporation

- Petronas

- Gazprom

- Other Key Players

Key Industry Developments in the Liquefied Petroleum Gas (LPG) Market:

- In March 2023, ExxonMobil reported the termination of its $10-billion expansion project at Beaumont refinery located in the American Gulf Coast which will add another 250,000 barrels per day to the company's largest refinery and chemical complex in the country. The newly arrived crude production from the Permian Basin,

- In April 2023, Shell U. K. Ltd., a subsidiary of Shell plc, upgraded the Pierce oil field in the UK Central North Sea to allow future gas production, which was previously only oil from the field. In this way, field operations have now fully reopened. Pierce is a joint venture formed between subsidiaries of Shell group (92. (52% operator) and Ithaca Energy UK Limited (7%). 48 %. )

|

Global Liquefied Petroleum Gas (LPG) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 108.2 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.50% |

Market Size in 2032: |

USD 160.7 Bn. |

|

Segments Covered: |

By Source of Production |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

ExxonMobil Corporation, Royal Dutch Shell plc, BP plc, Chevron Corporation,TotalEnergies SE, ConocoPhillips , Phillips 66, Sinopec, PetroChina Company Limited, Bharat Petroleum Corporation Limited, Hindustan Petroleum Corporation Limited, Saudi Aramco, Kuwait Petroleum Corporation, Petronas, Gazprom and Other Major Players. |

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Liquefied Petroleum Gas (LPG) Market by By Source of Production (2018-2032)

4.1 Liquefied Petroleum Gas (LPG) Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Crude Oil

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Natural Gas

Chapter 5: Liquefied Petroleum Gas (LPG) Market by By Application (2018-2032)

5.1 Liquefied Petroleum Gas (LPG) Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Agriculture

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Industrial

5.5 Transportation

5.6 Others

Chapter 6: Liquefied Petroleum Gas (LPG) Market by By End-User (2018-2032)

6.1 Liquefied Petroleum Gas (LPG) Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Residential

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Commercial

6.5 Industrial

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Liquefied Petroleum Gas (LPG) Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 EBERSPACHER GROUP (GERMANY)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 TOYOTA MOTOR CORPORATION (JAPAN)

7.4 RÖCHLING-GROUP (GERMANY)

7.5 FAURECIA SA (FRANCE)

7.6 SANGO INDUSTRIAL (JAPAN)

7.7 FUTABA INDUSTRIAL (JAPAN)

7.8 TENNECO (UNITED STATES)

7.9 AMMINEX EMISSIONS TECHNOLOGY (DENMARK)

7.10 SDC MATERIALS (UNITED STATES)

7.11 MAGNETI MARELLI S.P.A. (ITALY)

7.12 BORGWARNER INC. (UNITED STATES)

7.13 JOHNSON MATTHEY PLC (UNITED KINGDOM)

7.14 BOSCH MOBILITY SOLUTIONS (GERMANY)

7.15 CONTINENTAL AG (GERMANY)

7.16 DELPHI TECHNOLOGIES (UNITED KINGDOM)

7.17 EATON CORPORATION (UNITED STATES)

7.18 DENSO CORPORATION (JAPAN)

7.19 HONEYWELL INTERNATIONAL INC. (UNITED STATES)

7.20 SCHAEFFLER AG (GERMANY)

7.21 VALEO SA (FRANCE)

Chapter 8: Global Liquefied Petroleum Gas (LPG) Market By Region

8.1 Overview

8.2. North America Liquefied Petroleum Gas (LPG) Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Source of Production

8.2.4.1 Crude Oil

8.2.4.2 Natural Gas

8.2.5 Historic and Forecasted Market Size By By Application

8.2.5.1 Agriculture

8.2.5.2 Industrial

8.2.5.3 Transportation

8.2.5.4 Others

8.2.6 Historic and Forecasted Market Size By By End-User

8.2.6.1 Residential

8.2.6.2 Commercial

8.2.6.3 Industrial

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Liquefied Petroleum Gas (LPG) Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Source of Production

8.3.4.1 Crude Oil

8.3.4.2 Natural Gas

8.3.5 Historic and Forecasted Market Size By By Application

8.3.5.1 Agriculture

8.3.5.2 Industrial

8.3.5.3 Transportation

8.3.5.4 Others

8.3.6 Historic and Forecasted Market Size By By End-User

8.3.6.1 Residential

8.3.6.2 Commercial

8.3.6.3 Industrial

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Liquefied Petroleum Gas (LPG) Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Source of Production

8.4.4.1 Crude Oil

8.4.4.2 Natural Gas

8.4.5 Historic and Forecasted Market Size By By Application

8.4.5.1 Agriculture

8.4.5.2 Industrial

8.4.5.3 Transportation

8.4.5.4 Others

8.4.6 Historic and Forecasted Market Size By By End-User

8.4.6.1 Residential

8.4.6.2 Commercial

8.4.6.3 Industrial

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Liquefied Petroleum Gas (LPG) Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Source of Production

8.5.4.1 Crude Oil

8.5.4.2 Natural Gas

8.5.5 Historic and Forecasted Market Size By By Application

8.5.5.1 Agriculture

8.5.5.2 Industrial

8.5.5.3 Transportation

8.5.5.4 Others

8.5.6 Historic and Forecasted Market Size By By End-User

8.5.6.1 Residential

8.5.6.2 Commercial

8.5.6.3 Industrial

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Liquefied Petroleum Gas (LPG) Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Source of Production

8.6.4.1 Crude Oil

8.6.4.2 Natural Gas

8.6.5 Historic and Forecasted Market Size By By Application

8.6.5.1 Agriculture

8.6.5.2 Industrial

8.6.5.3 Transportation

8.6.5.4 Others

8.6.6 Historic and Forecasted Market Size By By End-User

8.6.6.1 Residential

8.6.6.2 Commercial

8.6.6.3 Industrial

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Liquefied Petroleum Gas (LPG) Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Source of Production

8.7.4.1 Crude Oil

8.7.4.2 Natural Gas

8.7.5 Historic and Forecasted Market Size By By Application

8.7.5.1 Agriculture

8.7.5.2 Industrial

8.7.5.3 Transportation

8.7.5.4 Others

8.7.6 Historic and Forecasted Market Size By By End-User

8.7.6.1 Residential

8.7.6.2 Commercial

8.7.6.3 Industrial

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Liquefied Petroleum Gas (LPG) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 108.2 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.50% |

Market Size in 2032: |

USD 160.7 Bn. |

|

Segments Covered: |

By Source of Production |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

ExxonMobil Corporation, Royal Dutch Shell plc, BP plc, Chevron Corporation,TotalEnergies SE, ConocoPhillips , Phillips 66, Sinopec, PetroChina Company Limited, Bharat Petroleum Corporation Limited, Hindustan Petroleum Corporation Limited, Saudi Aramco, Kuwait Petroleum Corporation, Petronas, Gazprom and Other Major Players. |

||

Frequently Asked Questions :

The forecast period in the Liquefied Petroleum Gas (LPG) Market research report is 2024-2032.

ExxonMobil Corporation, Royal Dutch Shell plc, BP plc, Chevron Corporation,TotalEnergies SE, ConocoPhillips , Phillips 66, Sinopec, PetroChina Company Limited, Bharat Petroleum Corporation Limited, Hindustan Petroleum Corporation Limited, Saudi Aramco, Kuwait Petroleum Corporation, Petronas, Gazprom and Other Major Players.

The Liquefied Petroleum Gas (LPG) Market is segmented into By Source of Production,By Application, By End-User and region. By Source of Production, the market is categorized into Crude Oil and Natural Gas. By Application, the market is categorized into Agriculture, Industrial, Transportation and Others. By End-User, the market is categorized into Residential, Commercial and Industrial. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Liquefied Petroleum Gas (LPG) market refers to the global industry involved in the production, distribution, and consumption of liquefied hydrocarbon gases primarily composed of propane and butane. LPG is derived from natural gas processing and crude oil refining, serving as a versatile energy source used in residential, commercial, industrial, and automotive applications. Its properties, including easy portability and clean combustion, make it a popular alternative to traditional fuels like wood or coal in various settings. The market encompasses a wide range of stakeholders, including producers, distributors, retailers, and end-users, and is influenced by factors such as global energy demand, pricing dynamics, regulatory policies, and technological advancements aimed at improving efficiency and environmental sustainability.

Liquefied Petroleum Gas (LPG) Market Size Was Valued at USD 108.2 Billion in 2023, and is Projected to Reach USD 160.7 Billion by 2032, Growing at a CAGR of 4.50% From 2024-2032.