Low Calorie Food Market Synopsis:

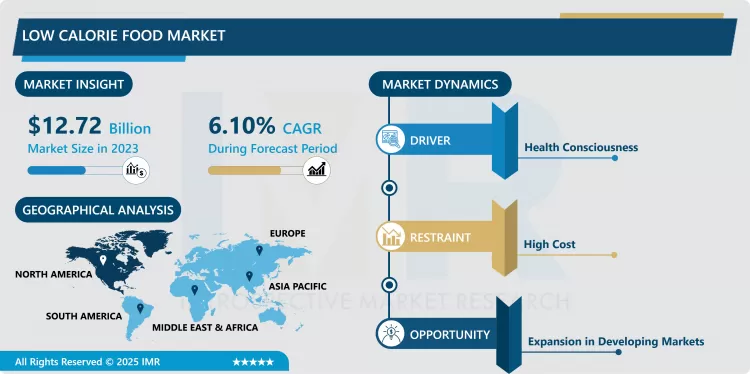

Low Calorie Food Market Size Was Valued at USD 12.72 Billion in 2023, and is Projected to Reach USD 21.67 Billion by 2032, Growing at a CAGR of 6.10% From 2024-2032.

The low-calorie food market can be defined as a niche that is associated with a production and selling of food products that have fewer total calories than does the standard food industry. These foods are generally developed for weight control, health and wellbeing, for consumers with an understanding of energy balance. The market involves products like low-fat milk, low calorie foods, low calorie and low sugar foods and other diet products. The performance drivers are such aspects as rising health consciousness, change of life, and the trend toward improved nutrition.

The low-calorie food market has expanded drastically due to growth in the importance of consumers’ personal health and well-being. This growth has been determined by changes in health conscious, obesity incidences, and shift in preference for nutritional meals. Busy and health-conscious consumers are now looking for low calorie food that do not in any way affect the taste of their preferred foods in essence, it has created a demand for low calorie foods. The products in this market are lower calorie goods including low fat dairy, sugar free snacks, zero calorie drinks and meal replacement products, for those with different tastes and requirements. Food producers & processors are always updating, relying on such ingredients as artificial sweeteners, fiber, and plant protein to produce low calorie foods that are healthy options for harried souls on the go.

The marked for low calorie food is also driven by growing knowledge of chronic diseases, including diabetes and cardiovascular diseases that are associated with poor diet. to the spread of health education more consumers are in search of healthier ways of preparing foods that are rich in calories. This has in turn coordinated this lead to increase in product and market communication concerning low calories as a part of healthy diet. Moreover, the above distribution channel has been instrumental in market coverage with the e-commerce channel facilitating acquisition of these products and the emergence of competitions among brands. Since there have been progressive developments in food processing technology as well as the development of low-calorie ingredients, the future for low calorie food products is brighter as they conform more and more to the trend of modern society that people are paying more attention to health and dietary issues.

Low Calorie Food Market Trend Analysis:

Increasing Consumer Awareness and Preference for Low-Calorie Foods

- Consumers are therefore more and more conscious of the nutritional value of food, or how they can cut on the number of calories that they take without having to forsake delicious food. This change is being further fueled by increasing rate of consciousness of the relationship between good nutrition and chronic diseases and conditions like obesity, heart diseases, and diabetes. Therefore, there is a trend in increasing demand for low-calorie food products that meet health-oriented consumers’ intentions in taste and texture sensations. Thus, the progress of food technologies has focused on the availability and demand for these choices when balancing nutritional values and palatability, their ability to develop food products with less energy density, but more beneficial and tastier. Hence, a wide variety of low-calorie products including snacks, beverages, dairy and baked have received general recognition in different categories and consumer groups.

- There are several factors that have made this segment the new normal, and these include; Flexitarianism, Think Small and Think Healthy, and Health and Wellness. There are also various social networks which gave the 'shares’ of these products, thereby increasing their popularity and availability. Secondly, fitness and wellness personalities have influenced consumers’ purchasing pattern greatly guiding consumers to go for low calories foods in their diet. In the current and future markets, there is realization of labelling to provide information on foods that lacks energy and compound of low calories. This is not a one-year trend but shows a continuous and progressive improvement in the changes towards more quality and improved life and show the emphasis of the consumers for quality improvement towards the food products which they consume.

Consumer Health Awareness and Trends

- As people become more conscious about obesity, sugar content in their diets, diabetes and the likes, they are beginning to look for products that will aid their dietary needs and fit into their health lifestyle without having to sacrifice their food’s taste. This trend is more so evident among millennial and Gen Z generations because such generation is more conscious of what they eat and are willing more willing to pay for their desired nutrition fixes. They also look for foods that can be grouped in a healthy diet that also meets their taste buds. This shift has spawned a tremendous increase in the use of low calorie foods that are healthier than the regular calorie filled foods. Since consumers remain preoccupied with establishing a healthy lifestyle, people who can relate to the brands’ healthy messages may follow accordingly by supporting those brands.

- Competitive growth in food technology has continued to drive the development of new low calorie food products. Low calorie substitutes for high calorie ingredients represent cutting edge improvements that have been made for the convenience of the consumer in particular with regard to the dieting process. These possibilities enable the food producers to come up with tasty meal products as well as meals with lowest possible calorie content – the two requirements for the health conscious consumer. Moreover, the shifting trends towards the utilization of clean label products, natural, and free from artificial additives provide new opportunities for the expansion of the low-calorie food market based on the principles of transparency and simplicity in value systems of consumers.

Low Calorie Food Market Segment Analysis:

Low Calorie Food Market is Segmented on the basis of product type, application, and region

By Product Type, Aspartame segment is expected to dominate the market during the forecast period

- Aspartame is the most consumed artificial sweetener at present, which is considered as having a very low calories than sugar but with similar taste. Some examples are aspartame which is normally used in diet sodas, chewing gum and also in dessert courses in view of the fact that it provides a good approximation of sugar. This stability makes it acceptable when foods are cooked and baked and–therefore–its use in variety of products. But, its consumption has been a subject of debate and regulatory consideration for many years. Even if aspartame has been studied and approved by numerous agencies including the FDA there are still many health issues, including links to some forms of cancer. These concerns have resulted in the formation of different policies of regulation in different area and there are debates on its safety.

- Aspartame's widespread acceptance: However, aspartame is one of the most well-tolerated artificial sweeteners because of its effectiveness and the relative safety presented whenever it is taken in moderation. Because of this, it is an excellent substitute to sugar in the attempts to cut on calorie intake, but not on flavor. Government bodies from across the world have set rules governing its use in order to cover its advantages as a low calorificaid while keeping an eye on the possible adverse effects. As such, the sweetener has continued to remain popular in result of its effectiveness and the easiness to use in calorie-nutrient meal plans and low-sugar foods.

By Application, Beverages segment expected to held the largest share

- Beverage industry is the leading user of low-calorie sweeteners due to increasing popularity of healthy products on the market. They are essential ingredients of soft drinks, flavoured water, energy drinks and juice drinks. Health concerns and the quest for foods with less calories are the main culprits for this new wave but this doesn’t mean that flavour should be compromised. This type of sweeteners include aspartame, sucralose and stevia among others since they act as good substitutes of sugar in that they provide the same taste in the production of the drink without the extra fructose. They enable manufacturers to come up with products with low calories and sweet taste, which meet the needs of the socially conscious populace.

- Sweeteners like aspartame, sucralose, and stevia: These low calorie sweeteners present a realistic solution for beverage producers who are pressured to expand on their low calorie products line. Aspartame which is heat stable is used in diet soda and energy drinks. Sucralose is able to maintain its integrity across high temperatures which allows its use in baked or cooked beverage. Stevia which is sweetener obtained from the plant Stevia rebaudiana is prized for zero-calorie content and Localization of which addresses the rising demand from health-conscious consumers. These sweeteners assist in cutting the sugar intake while maintaining taste implicating a crucial component in the formulation of low energy value beverages.

Low Calorie Food Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- In North America especially the United States and Canada, the need for low calorie foods and products is being compounded majorly by more conscious consumer health needs. High incidences of obesity and other illnesses like diabetes and cardiovascular disease have forced many people to adopt better meal plans. Consumer behaviour is therefore shifting as they are able to consume low calorie products such as snacks, drinks and meal replacement products that comes in many different types to meet consumers’ needs. So dominant players in the food industry are making conscious efforts to introduce low calorie foods and beverages into the market with the view to tapping into this segment. Similarly, an indexing role by applying modern food processing technologies is equally important in increasing the range, accessibility, and quality of low-calorie foods for health concerned consumers throughout the area.

- Also, the availability of leading food manufacturers in North America and supporting distribution channels also offers a boost to the low-calorie food market. These company are using innovation to develop products with better health profile, gaining flavours without the calories. The campaigns educating people about the available low-calorie foods and government’s measures for healthy eating also pack the trend of low-calorie diet. The appetite for clear informational labeling that is fostered by dedicated consumer groups, as well as support from the regulatory authorities, has also added to the growth prospects in North America to become a strategic region within the global low-calorie food markets.

Active Key Players in the Low-Calorie Food Market:

- PepsiCo, Inc.,

- Nestle SA,

- The Coca-Cola Company,

- Groupe Danone

- Abbott Laboratories,

- Bernard Food Industries, Inc,

- Zydus Wellness Ltd.,

- Dr. Pepper Snapple Group Inc.,

- McNeil Nutritionals LLC,

- Cargill, Incorporated,

- Ajinomoto Co., Inc, and Other Active Players

Key Industry Development in the Low-Calorie Food Market:

- In August 2023, Tate & Lyle company increased its stevia range in response to consumer demand for 'natural' sugar substitutes. Tate & Lyle's Tasteva Sol sweetener is based on stevia, as the ingredients giant attempts to capitalize on the growing demand for sugar substitutes.

- In July 2023, Ingredion announced PureCircle Clean Taste Solutions, a product line of stevia solutions suited to specific food & beverage applications. In various categories, including dairy, tea, coffee, drinks, sauces, savory, bakery, confectionery, sports nutrition, and dressings, PureCircle Clean Taste Solutions seeks to decrease sugar and deliver sweetness. For better performance, the new solutions make use of more stevia plant material.

|

Low Calorie Food Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 12.72 Billion |

|

Forecast Period 2024-32 CAGR: |

6.10% |

Market Size in 2032: |

USD 21.67 Billion |

|

|

By Product Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Low Calorie Food Market by By Product Type (2018-2032)

4.1 Low Calorie Food Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Aspartame

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Sucralose

4.5 Stevia

4.6 Saccharin

4.7 Cyclamate

4.8 Others

Chapter 5: Low Calorie Food Market by By Application (2018-2032)

5.1 Low Calorie Food Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Beverages

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Food

5.5 Healthcare

5.6 Tabletop

5.7 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Low Calorie Food Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 PEPSICO INC.

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 NESTLE SA

6.4 THE COCA-COLA COMPANY

6.5 GROUPE DANONE

6.6 ABBOTT LABORATORIES

6.7 BERNARD FOOD INDUSTRIES INC

6.8 ZYDUS WELLNESS LTD.

6.9 DR. PEPPER SNAPPLE GROUP INC.

6.10 MCNEIL NUTRITIONALS LLC

6.11 CARGILL INCORPORATED

6.12 AND AJINOMOTO CO. INC

6.13 OTHER ACTIVE PLAYERS

Chapter 7: Global Low Calorie Food Market By Region

7.1 Overview

7.2. North America Low Calorie Food Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By By Product Type

7.2.4.1 Aspartame

7.2.4.2 Sucralose

7.2.4.3 Stevia

7.2.4.4 Saccharin

7.2.4.5 Cyclamate

7.2.4.6 Others

7.2.5 Historic and Forecasted Market Size By By Application

7.2.5.1 Beverages

7.2.5.2 Food

7.2.5.3 Healthcare

7.2.5.4 Tabletop

7.2.5.5 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Low Calorie Food Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By By Product Type

7.3.4.1 Aspartame

7.3.4.2 Sucralose

7.3.4.3 Stevia

7.3.4.4 Saccharin

7.3.4.5 Cyclamate

7.3.4.6 Others

7.3.5 Historic and Forecasted Market Size By By Application

7.3.5.1 Beverages

7.3.5.2 Food

7.3.5.3 Healthcare

7.3.5.4 Tabletop

7.3.5.5 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Low Calorie Food Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By By Product Type

7.4.4.1 Aspartame

7.4.4.2 Sucralose

7.4.4.3 Stevia

7.4.4.4 Saccharin

7.4.4.5 Cyclamate

7.4.4.6 Others

7.4.5 Historic and Forecasted Market Size By By Application

7.4.5.1 Beverages

7.4.5.2 Food

7.4.5.3 Healthcare

7.4.5.4 Tabletop

7.4.5.5 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Low Calorie Food Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By By Product Type

7.5.4.1 Aspartame

7.5.4.2 Sucralose

7.5.4.3 Stevia

7.5.4.4 Saccharin

7.5.4.5 Cyclamate

7.5.4.6 Others

7.5.5 Historic and Forecasted Market Size By By Application

7.5.5.1 Beverages

7.5.5.2 Food

7.5.5.3 Healthcare

7.5.5.4 Tabletop

7.5.5.5 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Low Calorie Food Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By By Product Type

7.6.4.1 Aspartame

7.6.4.2 Sucralose

7.6.4.3 Stevia

7.6.4.4 Saccharin

7.6.4.5 Cyclamate

7.6.4.6 Others

7.6.5 Historic and Forecasted Market Size By By Application

7.6.5.1 Beverages

7.6.5.2 Food

7.6.5.3 Healthcare

7.6.5.4 Tabletop

7.6.5.5 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Low Calorie Food Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By By Product Type

7.7.4.1 Aspartame

7.7.4.2 Sucralose

7.7.4.3 Stevia

7.7.4.4 Saccharin

7.7.4.5 Cyclamate

7.7.4.6 Others

7.7.5 Historic and Forecasted Market Size By By Application

7.7.5.1 Beverages

7.7.5.2 Food

7.7.5.3 Healthcare

7.7.5.4 Tabletop

7.7.5.5 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Low Calorie Food Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 12.72 Billion |

|

Forecast Period 2024-32 CAGR: |

6.10% |

Market Size in 2032: |

USD 21.67 Billion |

|

|

By Product Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Market research report is 2024-2032.

PepsiCo, Inc., Nestle SA, The Coca-Cola Company, Groupe Danone, Abbott Laboratories, Bernard Food Industries, Inc, Zydus Wellness Ltd., Dr. Pepper Snapple Group Inc., McNeil Nutritionals LLC, Cargill, Incorporated, and Ajinomoto Co. Inc and Other Active Players.

The Low-Calorie Food Market is segmented into By Product Type, By Application and region. By Product Type, the market is categorized into Aspartame, Sucralose, Stevia, Saccharin, Cyclamate, Others. By Application, the market is categorized into Beverages, Food, Healthcare, Tabletop, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; The Netherlands; Italy; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The low-calorie food market refers to the segment of the food industry that focuses on producing and selling products that contain fewer calories compared to traditional options. These foods are typically formulated to aid in weight management, health, and wellness, catering to consumers who are conscious of their caloric intake. The market includes a wide range of products such as reduced-fat dairy, low-calorie snacks, low-sugar beverages, and diet foods. The demand for these products is driven by increasing health awareness, lifestyle changes, and a growing preference for healthier eating habits.

Low Calorie Food Market Size Was Valued at USD 12.72 Billion in 2023, and is Projected to Reach USD 21.67 Billion by 2032, Growing at a CAGR of 6.10% From 2024-2032.