Matcha Market Synopsis

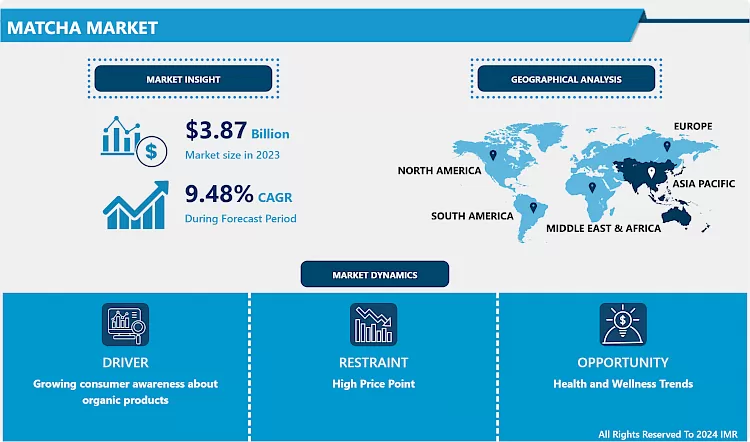

Matcha Market Size Was Valued at USD 3.87 Billion in 2023, and is Projected to Reach USD 8.74 Billion by 2032, Growing at a CAGR of 9.48% From 2024-2032.

- Matcha is a ground powder extracted from specially grown and processed green tea leaves. The tea leaves used in the production of matcha are specially grown in darkness for three weeks before being harvested, to accelerate the higher levels of chlorophyll. The veins and stems of these leaves are then removed during the production, while shelf life of matcha up to 20 days. In addition, matcha involves a slow grinding process, with focus to keep the entire aroma. It takes around one hour to yield 30 grams of matcha.

- The flavor of matcha leaves depends upon its amino acid levels, the highest grades of which are perceived by enormous sweetness and aroma. Matcha is especially produced in the countries such as Japan and China. Moreover, with the raw material matcha there are various products are products from matcha such as matcha tea, matcha ice cream, matcha beverages and also utilized in preparation of personal products.

- Moreover, matcha tea is rich in antioxidants and protects from serious diseases such as cancer and heart diseases. Experts recommend taking matcha tea as medicine for the Wight management. According the researchers of Kumamoto University of Japan, matcha tea contain certain ingredients that activate the hormone receptors dopamine and serotonin which reduces the stress.

- High-quality green tea in the form of powder is called matcha. It has more caffeine and antioxidants than conventional green tea since it is grown and brewed differently. Matcha is rich in antioxidants and has many health advantages, including the ability to lower heart disease risk and promote weight loss, relaxation, and alertness. Additionally, matcha is a great component for the skin. Additionally, antioxidants are believed to lessen acne and improve skin suppleness

Matcha Market Trend Analysis

Growing consumer awareness about organic products

- In recent years, there has been a notable shift in consumer behavior towards healthier and sustainably sourced alternatives, and matcha perfectly aligns with these evolving preferences. As individuals become more conscious of their well-being, the intrinsic health benefits associated with matcha, coupled with its organic nature, have catapulted it into the spotlight. Matcha, derived from shade-grown tea leaves, is renowned for its rich antioxidant content, vitamins, and minerals, making it a favorable choice among health-conscious consumers.

- The surge in awareness about the potential adverse effects of pesticides and synthetic additives has fueled a demand for organic products, and matcha's organic credentials resonate strongly with this discerning consumer base. Organic matcha is cultivated without the use of harmful chemicals, ensuring a pure and natural product that appeals to those seeking a cleaner and more environmentally friendly lifestyle.

- This increased awareness has not only bolstered the popularity of matcha as a standalone beverage but has also spurred innovation in the incorporation of matcha into various food and beverage applications.

- Moreover, the organic trend extends beyond the product itself to encompass sustainable and ethical sourcing practices. Consumers are not only looking for organic certifications but also for transparency in the supply chain, ensuring that their chosen products align with their values. As the matcha market continues to thrive, businesses that emphasize the organic and sustainable aspects of their offerings are likely to capitalize on this growing consumer awareness, establishing a robust foothold in this burgeoning market segment.

Health and Wellness Trends

- Matcha is often associated with health benefits, including high levels of antioxidants and potential metabolism-boosting properties. As consumers become more health-conscious, the demand for products like Matcha might increase. The use of Matcha in various culinary applications, such as in beverages, desserts, and savory dishes, can drive market growth. Creative recipes and innovative uses of Matcha can attract new consumers.

- Growing working population, busy lifestyle, and stress has increased universality of chronic diseases such as diabetes, obesity, and cancer. In addition, increasing awareness among consumers about various health benefits of matcha, such as its high content of anti-oxidants, vitamins, minerals, and amino acids, that are beneficial to overcome risk of such chronic diseases is a key factor expected to boost growth of the global matcha market in projected period. Easy availability of matcha in retail stores, online stores, and hypermarkets is helps to accelerate growth of market.

- Matcha green tea is an excellent detoxifier, its consumption increases metabolism, helps to burn fat, reduce cholesterol, improves brain activity, and overcome stress. Matcha is also widely recognized for its cancer-fighting characteristics, which are other key factors expected to stimulate growth of the global matcha market.

Matcha Market Segment Analysis:

Matcha Market Segmented on the basis of Product, Form, Grade and Distribution Channel.

By Product, Matcha Tea segment is expected to dominate the market during the forecast period

- Matcha tea, a finely ground powder of specially grown and processed green tea leaves, holds deep roots in Japanese tradition and has gained widespread popularity globally.

- Matcha tea is cherished for its cultural heritage and ritualistic preparation in traditional Japanese tea ceremonies. This cultural association adds a unique and authentic appeal to matcha, attracting consumers who appreciate the historical and ceremonial aspects of the beverage. The perceived authenticity enhances the overall market positioning of matcha tea.

- The health and wellness trend have been a significant driver for the dominance of matcha tea. Consumers are increasingly seeking beverages that offer not only flavor but also health benefits. Matcha tea, being rich in antioxidants, vitamins, and minerals, is positioned as a healthier alternative to other beverages. Its potential to boost metabolism, improve mental alertness, and provide a calming effect further contributes to its popularity among health-conscious consumers.

- Furthermore, the versatility of matcha tea in culinary applications has expanded its market reach. Beyond traditional brewing, matcha is used in various recipes, including smoothies, lattes, desserts, and even savory dishes. This adaptability makes matcha tea a versatile ingredient for both beverage companies and food manufacturers, contributing to its dominance in the overall product type segment.

By Grade, Classic segment held the largest share of 40.23% in 2022

- The Classic grade represents a balanced and versatile option that appeals to a broad consumer base. It strikes a middle ground in terms of flavor, color, and aroma, making it suitable for various culinary applications and traditional tea ceremonies. The well-rounded characteristics of Classic grade matcha make it an accessible choice for both connoisseurs who appreciate the authentic taste of matcha and for those who are new to this green tea variant.

- The Classic grade is often considered a more affordable option compared to higher grades like Ceremonial or Premium. This affordability makes it attractive to a wider audience, including budget-conscious consumers who still seek a quality matcha experience without a significant price premium. The accessibility of Classic grade matcha contributes to its dominance in terms of market share.

- Classic grade's versatility extends to its use in both culinary and beverage applications. Its balanced flavor profile allows it to blend seamlessly into various recipes, ranging from lattes and smoothies to baked goods and savory dishes. This adaptability enhances its market appeal and contributes to its dominance, especially as consumers increasingly seek innovative and diverse ways to incorporate matcha into their diets.

Matcha Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Matcha has deep roots in Asian cultures, particularly in Japan, where it is an integral part of traditional tea ceremonies. This cultural connection establishes a strong foundation for matcha consumption in the region, fostering a natural demand among consumers.

- In Asia, the consumption of green tea, including matcha, has been a longstanding tradition. The familiarity and acceptance of matcha in daily life contribute to its continued popularity. In countries like Japan, China, and South Korea, where tea culture is deeply ingrained, matcha has a natural and enduring presence.

- The Asia-Pacific region has been at the forefront of the global health and wellness movement. Matcha, known for its antioxidant properties and potential health benefits, aligns well with the preferences of health-conscious consumers. The region's emphasis on holistic well-being has further fueled the demand for matcha-based products.

- Asia-Pacific countries have a rich culinary tradition, and matcha's versatility has allowed it to be seamlessly integrated into a wide range of dishes. The incorporation of matcha into both traditional and modern recipes, including desserts, beverages, and savory dishes, has expanded its appeal beyond traditional tea consumption.

Matcha Market Top Key Players:

- Matcha Brewing Co. (US)

- Jade Leaf Matcha (US)

- Kyoto Dew Matcha (US)

- Vivid Vitality Ltd. (UK)

- Tenzo Tea (US)

- Enzo’s Private Selection (US)

- Naoki Matcha (US)

- Jade Leaf Matcha (US)

- Matchaful (US)

- My Matcha Life (Canada)

- D?Matcha (Canada)

- Eisai Co. Ltd. (Japan)

- Mitsubishi Corporation (Japan)

- Marusan Ai Co. Ltd. (Japan)

- Kibun Foods Co., Ltd. (Japan)

- Fukujuen Co. Ltd. (Japan)

- Ippodo Tea Co., Ltd. (Japan)

- Yamamotoyama Honpo Seicha Co., Ltd. (Japan)

- En Tea Co. Ltd. (Japan)

- Hayashiya Shoten (Japan)

- Oimatsucha Co., Ltd. (Japan)

- Tenren Matcha Co., Ltd. (Japan)

- Cha Cha Matcha Company (Japan)

- Epic Matcha (US)

- The Republic of Tea (US), and Other Major Player.

Key Industry Developments in the Matcha Market:

In February 2022, the Brooklyn-based green tea company and innovators of healthy beverages introduced a plant-based functional energy drink, "LOVE ENERGY +," under their brand. They claimed that the new matcha LOVE ENERGY + line is a green tea and matcha blend made with 100% Japanese matcha with functional ingredients that benefit the body and mind.

In January 2022, the producer of premium Matcha green tea, AIYA matcha, launched its newest collection, the Matcha Infused Tea Line. The collection includesthree excellent Japanese green teas, Organic Matcha Infused Gyokuro, Organic Matcha Infused Sencha, and Organic Matcha Infused Genmaicha.

|

Matcha Market |

|

||||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

|

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.87 Bn. |

|

|

|

CAGR (2024-2032): |

9.48% |

Market Size in 2032: |

USD 8.74 Bn. |

|

|

|

Segments Covered: |

By Product |

|

|

|

|

|

By Form |

|

|

|

||

|

By Grade |

|

|

|

||

|

By Distribution Channel |

|

|

|

||

|

By Region |

|

|

|||

|

Key Market Drivers: |

|

|

|||

|

Key Market Restraints: |

|

|

|||

|

Key Opportunities: |

|

|

|||

|

Companies Covered in the Report: |

|

|

|||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Matcha Market by By Product (2018-2032)

4.1 Matcha Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Matcha Tea

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Match Ice-Cream

4.5 Matcha Cake

4.6 Cha-Soba Sushi Roll

4.7 Food

Chapter 5: Matcha Market by By Form (2018-2032)

5.1 Matcha Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Powder

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Liquid

Chapter 6: Matcha Market by By Grade (2018-2032)

6.1 Matcha Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Ceremonial

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Classic

6.5 Culinary

Chapter 7: Matcha Market by By Distribution Channel (2018-2032)

7.1 Matcha Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Hypermarket/Supermarket

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Specialty Stores

7.5 Online

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Matcha Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 CARGILL INCORPORATED (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 DUPONT DE NEMOURS INC. (US)

8.4 ARCHER DANIELS MIDLAND COMPANY (ADM) (US)

8.5 INGREDION INCORPORATED (US)

8.6 GRAIN PROCESSING CORPORATION (GPC) (US)

8.7 FIBERSTAR INC. (US)

8.8 GRAIN MILLERS INC. (US)

8.9 NOW HEALTH GROUP INC. (US)

8.10 CP KELCO (US)

8.11 NUTRI-PEA LIMITED (CANADA)

8.12 SUNOPTA INC. (CANADA)

8.13 BENEO GMBH (GERMANY)

8.14 J. RETTENMAIER & SÖHNE GMBH (JRS) (GERMANY)

8.15 KONINKLIJKE DSM N.V. (DSM) (NETHERLANDS)

8.16 SENSUS BV (NETHERLANDS)

8.17 ROQUETTE FRÈRES (FRANCE)

8.18 NEXIRA SAS (FRANCE)

8.19 TATE & LYLE PLC (UK)

8.20 KERRY GROUP PLC (IRELAND)

8.21 LONZA GROUP LTD. (SWITZERLAND)

8.22 COSUCRA GROUPE WARCOING SA (BELGIUM)

8.23 TAIYO INTERNATIONAL INC. (JAPAN)

8.24 SHANDONG BAOLINGBAO BIOLOGY COLTD. (CHINA)

8.25 GELYMAR S.A. (CHILE)

8.26

Chapter 9: Global Matcha Market By Region

9.1 Overview

9.2. North America Matcha Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By By Product

9.2.4.1 Matcha Tea

9.2.4.2 Match Ice-Cream

9.2.4.3 Matcha Cake

9.2.4.4 Cha-Soba Sushi Roll

9.2.4.5 Food

9.2.5 Historic and Forecasted Market Size By By Form

9.2.5.1 Powder

9.2.5.2 Liquid

9.2.6 Historic and Forecasted Market Size By By Grade

9.2.6.1 Ceremonial

9.2.6.2 Classic

9.2.6.3 Culinary

9.2.7 Historic and Forecasted Market Size By By Distribution Channel

9.2.7.1 Hypermarket/Supermarket

9.2.7.2 Specialty Stores

9.2.7.3 Online

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Matcha Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By By Product

9.3.4.1 Matcha Tea

9.3.4.2 Match Ice-Cream

9.3.4.3 Matcha Cake

9.3.4.4 Cha-Soba Sushi Roll

9.3.4.5 Food

9.3.5 Historic and Forecasted Market Size By By Form

9.3.5.1 Powder

9.3.5.2 Liquid

9.3.6 Historic and Forecasted Market Size By By Grade

9.3.6.1 Ceremonial

9.3.6.2 Classic

9.3.6.3 Culinary

9.3.7 Historic and Forecasted Market Size By By Distribution Channel

9.3.7.1 Hypermarket/Supermarket

9.3.7.2 Specialty Stores

9.3.7.3 Online

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Matcha Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By By Product

9.4.4.1 Matcha Tea

9.4.4.2 Match Ice-Cream

9.4.4.3 Matcha Cake

9.4.4.4 Cha-Soba Sushi Roll

9.4.4.5 Food

9.4.5 Historic and Forecasted Market Size By By Form

9.4.5.1 Powder

9.4.5.2 Liquid

9.4.6 Historic and Forecasted Market Size By By Grade

9.4.6.1 Ceremonial

9.4.6.2 Classic

9.4.6.3 Culinary

9.4.7 Historic and Forecasted Market Size By By Distribution Channel

9.4.7.1 Hypermarket/Supermarket

9.4.7.2 Specialty Stores

9.4.7.3 Online

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Matcha Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By By Product

9.5.4.1 Matcha Tea

9.5.4.2 Match Ice-Cream

9.5.4.3 Matcha Cake

9.5.4.4 Cha-Soba Sushi Roll

9.5.4.5 Food

9.5.5 Historic and Forecasted Market Size By By Form

9.5.5.1 Powder

9.5.5.2 Liquid

9.5.6 Historic and Forecasted Market Size By By Grade

9.5.6.1 Ceremonial

9.5.6.2 Classic

9.5.6.3 Culinary

9.5.7 Historic and Forecasted Market Size By By Distribution Channel

9.5.7.1 Hypermarket/Supermarket

9.5.7.2 Specialty Stores

9.5.7.3 Online

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Matcha Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By By Product

9.6.4.1 Matcha Tea

9.6.4.2 Match Ice-Cream

9.6.4.3 Matcha Cake

9.6.4.4 Cha-Soba Sushi Roll

9.6.4.5 Food

9.6.5 Historic and Forecasted Market Size By By Form

9.6.5.1 Powder

9.6.5.2 Liquid

9.6.6 Historic and Forecasted Market Size By By Grade

9.6.6.1 Ceremonial

9.6.6.2 Classic

9.6.6.3 Culinary

9.6.7 Historic and Forecasted Market Size By By Distribution Channel

9.6.7.1 Hypermarket/Supermarket

9.6.7.2 Specialty Stores

9.6.7.3 Online

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Matcha Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By By Product

9.7.4.1 Matcha Tea

9.7.4.2 Match Ice-Cream

9.7.4.3 Matcha Cake

9.7.4.4 Cha-Soba Sushi Roll

9.7.4.5 Food

9.7.5 Historic and Forecasted Market Size By By Form

9.7.5.1 Powder

9.7.5.2 Liquid

9.7.6 Historic and Forecasted Market Size By By Grade

9.7.6.1 Ceremonial

9.7.6.2 Classic

9.7.6.3 Culinary

9.7.7 Historic and Forecasted Market Size By By Distribution Channel

9.7.7.1 Hypermarket/Supermarket

9.7.7.2 Specialty Stores

9.7.7.3 Online

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Matcha Market |

|

||||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

|

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.87 Bn. |

|

|

|

CAGR (2024-2032): |

9.48% |

Market Size in 2032: |

USD 8.74 Bn. |

|

|

|

Segments Covered: |

By Product |

|

|

|

|

|

By Form |

|

|

|

||

|

By Grade |

|

|

|

||

|

By Distribution Channel |

|

|

|

||

|

By Region |

|

|

|||

|

Key Market Drivers: |

|

|

|||

|

Key Market Restraints: |

|

|

|||

|

Key Opportunities: |

|

|

|||

|

Companies Covered in the Report: |

|

|

|||

Frequently Asked Questions :

The forecast period in the Matcha Market research report is 2024-2032.

Matcha Brewing Co., Jade Leaf Matcha, Kyoto Dew Matcha, Vivid Vitality Ltd., Tenzo Tea, Enzo’s Private Selection, Naoki Matcha, Jade Leaf Matcha, Matchaful, My Matcha Life, D?Matcha, Eisai Co. Ltd., Mitsubishi Corporation, Marusan Ai Co. Ltd., Kibun Foods Co., Ltd., Fukujuen Co. Ltd., Ippodo Tea Co., Ltd., Yamamotoyama Honpo Seicha Co., Ltd., En Tea Co. Ltd., Hayashiya Shoten, Oimatsucha Co., Ltd., Tenren Matcha Co., Ltd., Cha Cha Matcha Company, Epic Matcha, The Republic of Tea, and Other Major Players.

The Matcha Market is segmented into Product, Form, Grade, Distribution Channel, and region. By Product, the market is categorized into Matcha Tea, Match Ice-Cream, Matcha Cake, Cha-Soba Sushi Roll, Food. By Form, the market is categorized into Powder and Liquid. By Grade, the market is categorized into Ceremonial, Classic, Culinary. By Distribution Channel, the market is categorized into Hypermarket/Supermarket, Specialty Stores, Online. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Matcha is a ground powder extracted from specially grown and processed green tea leaves. The tea leaves used in the production of matcha are specially grown in darkness for three weeks before being harvested, to accelerate the higher levels of chlorophyll.

Matcha Market Size Was Valued at USD 3.87 Billion in 2023, and is Projected to Reach USD 8.74 Billion by 2032, Growing at a CAGR of 9.48% From 2024-2032.