Medicinal Mushroom Market Synopsis

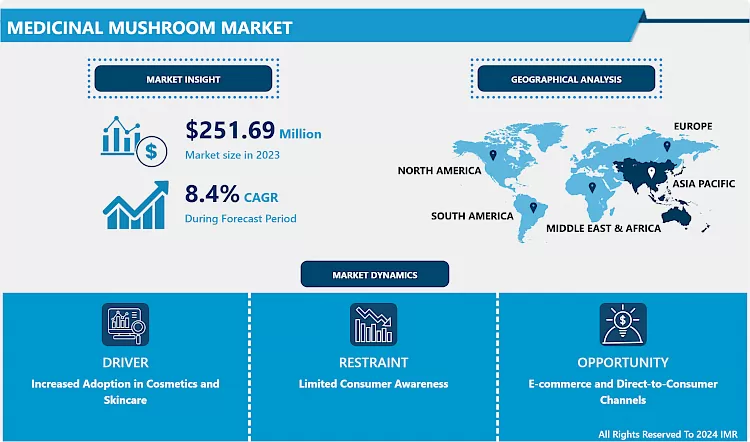

Global Medicinal Mushroom Market Size Was Valued At USD 251.69 Million In 2023 And Is Projected To Reach USD 520.15 Million By 2032, Growing At A CAGR Of 8.4% From 2024 To 2032.

- Medicinal mushrooms are a diverse group of fungi known for their therapeutic properties and extensive use in traditional medicine systems across various cultures for centuries. These mushrooms possess bioactive compounds that contribute to their medicinal benefits, making them a focal point of interest in modern health and wellness practices.

- Rich in polysaccharides, beta-glucans, triterpenes, and other bioactive compounds, medicinal mushrooms exhibit a wide range of health-promoting effects. Some of the most commonly studied and utilized medicinal mushrooms include reishi (Ganoderma lucidum), known for its immune-boosting and stress-reducing properties, and lion's mane (Hericium erinaceus), recognized for its potential in supporting cognitive function and nerve regeneration. Other popular varieties such as chaga, cordyceps, shiitake, and maitake also offer various health benefits, ranging from antioxidant and anti-inflammatory effects to potential anti-cancer properties and support for cardiovascular health.

- These mushrooms are consumed in different forms, including supplements, extracts, teas, and incorporated into ANTIOXIDANTl foods and beverages. Their versatility and adaptability in various preparations make them accessible to a broad spectrum of individuals seeking natural alternatives for enhancing overall well-being, immune system support, and specific health concerns. Ongoing scientific research continues to unveil new therapeutic potentials and applications for these remarkable fungi, contributing to the growing interest and utilization of medicinal mushrooms in modern health practices.

Medicinal Mushroom Market Trend Analysis

Increased Adoption in Cosmetics and Skincare

- Mushrooms such as reishi, chaga, and tremella have gained attention for their potential to enhance skin health, offering natural solutions for various skincare concerns. These fungi are rich in antioxidants, vitamins, and other bioactive compounds known to promote skin vitality, combat aging, and address issues such as inflammation and oxidative stress.

- The presence of polysaccharides in medicinal mushrooms contributes to their moisturizing and hydrating properties, making them valuable ingredients in skincare formulations. Additionally, their ability to support collagen production and maintain skin elasticity has positioned them as sought-after components in anti-aging products.

- Cosmetic companies are increasingly incorporating mushroom extracts or derivatives into serums, creams, masks, and other skincare products. The natural origin of these ingredients resonates with consumers seeking clean beauty solutions, contributing to the market's growth. Mushroom extracts are being utilized in formulations targeting various skin types, offering soothing effects for sensitive skin, balancing properties for oily or acne-prone skin, and rejuvenating benefits for mature skin.

- Moreover, the scientific validation of the benefits of medicinal mushrooms in skincare, coupled with the trend towards natural and plant-based skincare solutions, has bolstered consumer confidence and further propelled the integration of these fungi into the cosmetics industry. This adoption in skincare expands the market scope beyond dietary supplements, tapping into the lucrative beauty and personal care segment.

E-commerce and Direct-to-Consumer Channels

- E-commerce and direct-to-consumer (DTC) channels represent a significant opportunity for the medicinal mushroom market to expand its reach, accessibility, and consumer engagement. The digital landscape offers a powerful platform for mushroom-based product companies to directly connect with consumers, providing convenience, inFRESHtion, and a personalized shopping experience.

- Through e-commerce platforms, companies specializing in medicinal mushrooms can overcome geographical limitations and reach a global audience. They can showcase a wide range of products, from mushroom supplements to extracts and skincare, fostering consumer education and allowing for detailed product inFRESHtion, reviews, and comparisons. Moreover, these platforms enable direct feedback and interaction, nurturing a sense of trust and loyalty among consumers.

- Direct-to-consumer strategies empower brands to control their narrative, emphasizing the unique aspects of their mushroom products, their sourcing methods, and their health benefits. By bypassing intermediaries, companies can establish direct relationships with customers, gather valuable insights, and tailor marketing strategies to specific consumer preferences.

- The ease of purchase, subscription models for regular deliveries, and the ability to offer educational content about the benefits of medicinal mushrooms contribute to a more informed and engaged consumer base. As online shopping continues to grow globally, leveraging e-commerce and direct-to-consumer channels becomes a pivotal opportunity for medicinal mushroom businesses to thrive in a competitive market while fostering direct connections with their audience.

Medicinal Mushroom Market Segment Analysis:

Medicinal Mushroom Market Segmented on the basis of type, form, function, distribution channel and application.

By Type, Shiitake segment is expected to dominate the market during the forecast period

- The shiitake mushroom segment is anticipated to dominate the medicinal mushroom market during the forecast period due to several factors contributing to its popularity and widespread use. Shiitake mushrooms (Lentinula edodes) are renowned for their rich flavor in culinary applications and have gained significant attention for their diverse health benefits, propelling their prominence in the market.

- This segment's dominance can be attributed to extensive research validating the medicinal properties of shiitake mushrooms, including their immune-modulating, anti-inflammatory, and cholesterol-lowering effects. The presence of compounds like beta-glucans and polysaccharides in shiitake mushrooms has drawn attention, contributing to their recognition as a potent ANTIOXIDANTl food and supplement ingredient.

- Furthermore, the adaptability of shiitake mushrooms in various forms such as capsules, extracts, and powders for easy consumption enhances their appeal among consumers seeking natural health-enhancing products. As a result, the shiitake mushroom segment is poised to maintain its leading position in the medicinal mushroom market.

By Form, Fresh Form segment held the largest share of 70.4% in 2022

- In the medicinal mushroom market, the fresh category segment has consistently held the largest market share due to several compelling factors driving its prominence. Fresh medicinal mushrooms offer distinct advantages over processed forms, resonating with consumers seeking natural and unaltered sources of health benefits.

- The fresh category's dominance can be attributed to the perception of freshness equating to higher nutritional value and potency in mushrooms, ensuring the preservation of bioactive compounds. This segment caters to consumers who prefer incorporating fresh mushrooms directly into their diets, appreciating the versatility in culinary applications while reaping the health benefits.

- Additionally, the availability of fresh medicinal mushrooms in farmers' markets, specialty stores, and even through online platforms enhances accessibility for consumers keen on harnessing the immediate and unadulterated advantages of these fungi. The demand for fresh medicinal mushrooms aligns with the growing trend of preferring minimally processed, whole foods, contributing to its sustained leading position in the market.

Medicinal Mushroom Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is anticipated to exert significant dominance over the medicinal mushroom market throughout the forecast period owing to various contributing factors driving its growth and expansion. This region holds a rich history deeply rooted in traditional medicine systems that have long recognized the therapeutic properties of medicinal mushrooms, fostering a cultural acceptance and widespread usage of these fungi.

- Countries within the Asia Pacific, such as China, Japan, and Korea, have been pioneers in the cultivation, consumption, and utilization of medicinal mushrooms for centuries. This historical legacy, combined with increasing health consciousness and a growing preference for natural remedies, continues to fuel the demand for medicinal mushrooms in the region.

- Moreover, the abundance of diverse mushroom species indigenous to Asia, including reishi, shiitake, and cordyceps, further contributes to the region's dominance in the market. Robust production capabilities, technological advancements in cultivation methods, and the presence of key market players within the Asia Pacific reinforce its leading position in catering to both domestic consumption and global export demands, solidifying its dominance in the global medicinal mushroom market.

Medicinal Mushroom Market Top Key Players:

- Freshcap Mushrooms Ltd. (Canada)

- Banken Champignons B.V. (Netherlands)

- Far West Fungi (U.S.)

- Swadeshi Mushroom (India)

- Dxn (Malaysia)

- Nikkei Marketing Limited (Canada)

- Chaga Mountain Inc (U.S.)

- Asia Pacific Farm Enterprises (Canada)

- Nc Exotic Mushrooms (Netherlands)

- Bonduelle Sa (France)

- Nammex (Canada)

- Naturalin (China)

- Real Mushrooms (Canada)

- Mitoku (Japan)

- Hirano Mushroom Llc (Serbia)

- Gourmet Mushrooms Inc. (U.S.)

- Aloha Medicinals (U.S.)

- Bio Botanica Inc. (U.S.)

- Concord Farms (U.S.)

- Four Sigmatic Foods Inc. (U.S.)

- Nature’s Way Products Llc (U.S.)

- Oriveda Bv (Netherlands) and Other Major Players

Key Industry Developments in the Medicinal Mushroom Market:

- In September 2022, Innomy, a Spanish business focused on mushroom-based meat substitutes, revealed it has secured €1.3 million (USD 1.26 million) in a Pre-Series A fundraising round to expand, market, and sell its products throughout Europe. According to Innomy, mycelium has a high nutritional value, low cholesterol, and low saturated fat content, making it one of the most promising protein sources for the future.

- In July 2022, Ethical Naturals and Nammex collaborated to launch a new line of organic mushroom extracts called Mushroom-Plus. These extracts are specifically formulated to address specific health concerns.

- In May 2022, Grove Inc. expands into the rapidly growing medicinal mushrooms and superfoods market with their most recent product line, Cure Mushrooms. The brand delivers a US-based product line of mushroom excerpts. With cultivation in the Pacific Northwest and formulation in California, the USDA Certified Organic brand produces a full line of liquid sections and gummies.

|

Medicinal Mushroom Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 251.69 Mn. |

|

Forecast Period 2024-32 CAGR: |

8.4 % |

Market Size in 2032: |

USD 520.15 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Function |

|

||

|

By Distribution Channel |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Medicinal Mushroom Market by By Type (2018-2032)

4.1 Medicinal Mushroom Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Reishi

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Cordyceps

4.5 Lions Mane

4.6 Turkey Tail

4.7 Shiitake

4.8 Chaga

Chapter 5: Medicinal Mushroom Market by By Form (2018-2032)

5.1 Medicinal Mushroom Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Fresh

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Dried

5.5 Extracts

Chapter 6: Medicinal Mushroom Market by By Function (2018-2032)

6.1 Medicinal Mushroom Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Antioxidant

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Immune Enhancer

6.5 Anti-Cancer

6.6 Skin Care

Chapter 7: Medicinal Mushroom Market by By Distribution Channel (2018-2032)

7.1 Medicinal Mushroom Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Supermarkets/Hypermarkets

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Convenience Stores

7.5 E-Commerce

Chapter 8: Medicinal Mushroom Market by By Application (2018-2032)

8.1 Medicinal Mushroom Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Food and Beverage

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Dietary Supplements

8.5 Personal Care

8.6 Pharmaceutical

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Medicinal Mushroom Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 PROCTER & GAMBLE COMPANY (U.S.)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 REVLON INC. (U.S.)

9.4 AVEDA CORP. (U.S.)

9.5 JOHNSON & JOHNSON (U.S.)

9.6 THE ESTEE LAUDER COMPANIES (U.S.)

9.7 ALCORA CORP. (U.S.)

9.8 JOHN MASTERS ORGANIC (U.S.)

9.9 OUAI (U.S.)

9.10 BRIOGEO (U.S.)

9.11 LIVING PROOF INC. (U.S.)

9.12 BEIERSDORF GROUP (NIVEA) (GERMANY)

9.13 HENKEL AG & CO. KGAA (GERMANY)

9.14 L’OREAL S.A. (FRANCE)

9.15 UNILEVER (NETHERLANDS)

9.16 DABUR INDIA (INDIA)

9.17 MARICO LTD. (INDIA)

9.18 SHISEIDO COMPANY (JAPAN)

9.19 KAO CORP. (JAPAN)

Chapter 10: Global Medicinal Mushroom Market By Region

10.1 Overview

10.2. North America Medicinal Mushroom Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By By Type

10.2.4.1 Reishi

10.2.4.2 Cordyceps

10.2.4.3 Lions Mane

10.2.4.4 Turkey Tail

10.2.4.5 Shiitake

10.2.4.6 Chaga

10.2.5 Historic and Forecasted Market Size By By Form

10.2.5.1 Fresh

10.2.5.2 Dried

10.2.5.3 Extracts

10.2.6 Historic and Forecasted Market Size By By Function

10.2.6.1 Antioxidant

10.2.6.2 Immune Enhancer

10.2.6.3 Anti-Cancer

10.2.6.4 Skin Care

10.2.7 Historic and Forecasted Market Size By By Distribution Channel

10.2.7.1 Supermarkets/Hypermarkets

10.2.7.2 Convenience Stores

10.2.7.3 E-Commerce

10.2.8 Historic and Forecasted Market Size By By Application

10.2.8.1 Food and Beverage

10.2.8.2 Dietary Supplements

10.2.8.3 Personal Care

10.2.8.4 Pharmaceutical

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Medicinal Mushroom Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By By Type

10.3.4.1 Reishi

10.3.4.2 Cordyceps

10.3.4.3 Lions Mane

10.3.4.4 Turkey Tail

10.3.4.5 Shiitake

10.3.4.6 Chaga

10.3.5 Historic and Forecasted Market Size By By Form

10.3.5.1 Fresh

10.3.5.2 Dried

10.3.5.3 Extracts

10.3.6 Historic and Forecasted Market Size By By Function

10.3.6.1 Antioxidant

10.3.6.2 Immune Enhancer

10.3.6.3 Anti-Cancer

10.3.6.4 Skin Care

10.3.7 Historic and Forecasted Market Size By By Distribution Channel

10.3.7.1 Supermarkets/Hypermarkets

10.3.7.2 Convenience Stores

10.3.7.3 E-Commerce

10.3.8 Historic and Forecasted Market Size By By Application

10.3.8.1 Food and Beverage

10.3.8.2 Dietary Supplements

10.3.8.3 Personal Care

10.3.8.4 Pharmaceutical

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Medicinal Mushroom Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By By Type

10.4.4.1 Reishi

10.4.4.2 Cordyceps

10.4.4.3 Lions Mane

10.4.4.4 Turkey Tail

10.4.4.5 Shiitake

10.4.4.6 Chaga

10.4.5 Historic and Forecasted Market Size By By Form

10.4.5.1 Fresh

10.4.5.2 Dried

10.4.5.3 Extracts

10.4.6 Historic and Forecasted Market Size By By Function

10.4.6.1 Antioxidant

10.4.6.2 Immune Enhancer

10.4.6.3 Anti-Cancer

10.4.6.4 Skin Care

10.4.7 Historic and Forecasted Market Size By By Distribution Channel

10.4.7.1 Supermarkets/Hypermarkets

10.4.7.2 Convenience Stores

10.4.7.3 E-Commerce

10.4.8 Historic and Forecasted Market Size By By Application

10.4.8.1 Food and Beverage

10.4.8.2 Dietary Supplements

10.4.8.3 Personal Care

10.4.8.4 Pharmaceutical

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Medicinal Mushroom Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By By Type

10.5.4.1 Reishi

10.5.4.2 Cordyceps

10.5.4.3 Lions Mane

10.5.4.4 Turkey Tail

10.5.4.5 Shiitake

10.5.4.6 Chaga

10.5.5 Historic and Forecasted Market Size By By Form

10.5.5.1 Fresh

10.5.5.2 Dried

10.5.5.3 Extracts

10.5.6 Historic and Forecasted Market Size By By Function

10.5.6.1 Antioxidant

10.5.6.2 Immune Enhancer

10.5.6.3 Anti-Cancer

10.5.6.4 Skin Care

10.5.7 Historic and Forecasted Market Size By By Distribution Channel

10.5.7.1 Supermarkets/Hypermarkets

10.5.7.2 Convenience Stores

10.5.7.3 E-Commerce

10.5.8 Historic and Forecasted Market Size By By Application

10.5.8.1 Food and Beverage

10.5.8.2 Dietary Supplements

10.5.8.3 Personal Care

10.5.8.4 Pharmaceutical

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Medicinal Mushroom Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By By Type

10.6.4.1 Reishi

10.6.4.2 Cordyceps

10.6.4.3 Lions Mane

10.6.4.4 Turkey Tail

10.6.4.5 Shiitake

10.6.4.6 Chaga

10.6.5 Historic and Forecasted Market Size By By Form

10.6.5.1 Fresh

10.6.5.2 Dried

10.6.5.3 Extracts

10.6.6 Historic and Forecasted Market Size By By Function

10.6.6.1 Antioxidant

10.6.6.2 Immune Enhancer

10.6.6.3 Anti-Cancer

10.6.6.4 Skin Care

10.6.7 Historic and Forecasted Market Size By By Distribution Channel

10.6.7.1 Supermarkets/Hypermarkets

10.6.7.2 Convenience Stores

10.6.7.3 E-Commerce

10.6.8 Historic and Forecasted Market Size By By Application

10.6.8.1 Food and Beverage

10.6.8.2 Dietary Supplements

10.6.8.3 Personal Care

10.6.8.4 Pharmaceutical

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Medicinal Mushroom Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By By Type

10.7.4.1 Reishi

10.7.4.2 Cordyceps

10.7.4.3 Lions Mane

10.7.4.4 Turkey Tail

10.7.4.5 Shiitake

10.7.4.6 Chaga

10.7.5 Historic and Forecasted Market Size By By Form

10.7.5.1 Fresh

10.7.5.2 Dried

10.7.5.3 Extracts

10.7.6 Historic and Forecasted Market Size By By Function

10.7.6.1 Antioxidant

10.7.6.2 Immune Enhancer

10.7.6.3 Anti-Cancer

10.7.6.4 Skin Care

10.7.7 Historic and Forecasted Market Size By By Distribution Channel

10.7.7.1 Supermarkets/Hypermarkets

10.7.7.2 Convenience Stores

10.7.7.3 E-Commerce

10.7.8 Historic and Forecasted Market Size By By Application

10.7.8.1 Food and Beverage

10.7.8.2 Dietary Supplements

10.7.8.3 Personal Care

10.7.8.4 Pharmaceutical

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Medicinal Mushroom Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 251.69 Mn. |

|

Forecast Period 2024-32 CAGR: |

8.4 % |

Market Size in 2032: |

USD 520.15 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Function |

|

||

|

By Distribution Channel |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Medicinal Mushroom Market research report is 2024-2032

FreshCap Mushrooms LTD. (Canada), Banken Champignons B.V. (Netherlands), Far West Fungi (U.S.), Swadeshi Mushroom (India), DXN (Malaysia), Nikkei Marketing Limited (Canada), Chaga Mountain Inc (U.S.), Asia Pacific Farm Enterprises (Canada), NC Exotic Mushrooms (Netherlands), Bonduelle SA (France), Nammex (Canada), Naturalin (China), Real Mushrooms (Canada), Mitoku (Japan), Hirano Mushroom LLC (Serbia), Gourmet Mushrooms Inc. (U.S.), Aloha Medicinals (U.S.), Bio Botanica Inc. (U.S.), Concord Farms (U.S.), Four Sigmatic Foods Inc. (U.S.), Nature’s Way Products LLC (U.S.), Oriveda BV (Netherlands) and Other Major Players.

The Medicinal Mushroom Market is segmented into Type, Form, Function, Distribution Channel, Application, and region. By Type, the market is categorized into Reishi, Cordyceps, Lions Mane, Turkey Tail, Shiitake and Chaga. By Form, the market is categorized into Fresh, Dried and Extracts. By Function, the market is categorized into Antioxidant, Immune Enhancer, Anti-Cancer and Skin Care. By Distribution Channel, the market is categorized into Supermarkets/Hypermarkets, Convenience Stores and E-Commerce. By Application, the market is categorized into Food and Beverage, Dietary Supplements, Personal Care and Pharmaceutical. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Medicinal mushrooms are a diverse group of fungi known for their therapeutic properties and extensive use in traditional medicine systems across various cultures for centuries. These mushrooms possess bioactive compounds that contribute to their medicinal benefits, making them a focal point of interest in modern health and wellness practices.

Global Medicinal Mushroom Market Size Was Valued at USD 251.69 million In 2023 And Is Projected to Reach USD 520.15 million By 2032, Growing at A CAGR of 8.4% From 2024 To 2032.