Micro-Mobility Charging Infrastructure Market Synopsis:

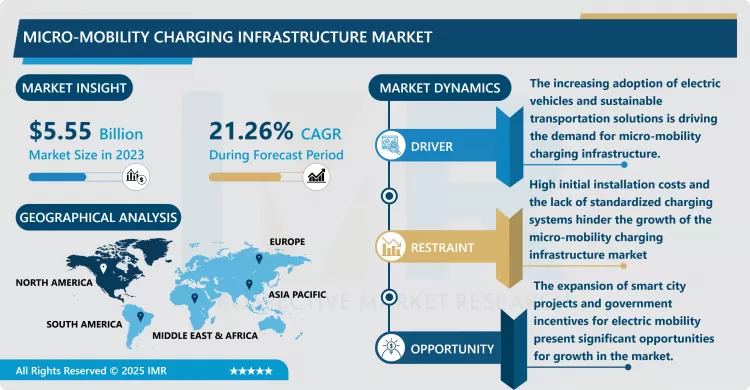

Micro-mobility Charging Infrastructure Market Size Was Valued at USD 5.55 Billion in 2023, and is Projected to Reach USD 31.48 Billion by 2032, Growing at a CAGR of 21.26% from 2024-2032.

The micro-mobility charging infrastructure market has and continued to grow in the recent past because of the growth in the use of electric scooters, bikes, and any small electric vehicle in the urban society. Due to increased need for reducing traffic congestion, air pollution and Greenhouse gas emissions in cities around the world, there has been a strong demand for sustainable transport solutions. The change towards using electrical micro-mobility solutions has therefore birthed the need to provide effective charging technologies for these automobiles. Micro-mobility charging stations remain ideal, easily accessible, and can easily be deployed across cities for effective consumer experience and support of electric bicycle and scooter usage in towns.

The market continues to evolve in technologies, with recent innovations including wireless charging systems and high power rapid charging stations to meet demands current fast charging systems. Also, IoT integration into charging stations is improving on station performance through remote monitoring, and management, and improved energy management. High-growth business opportunities, supported by governments and favorable regulation to boost the utilization of EVs and micro-mobility solutions are also increasing market growth.

Micro-mobility charging infrastructure market is expected to grow further in the future as more private businesses and public institutions pay attention to development of communications and operations within urban areas. Increasing adoption of shared micro-mobility services, most especially in world’s rapidly developing urban centers is also influential to the development of the market. With the constant increasing need for greener and convenient transportation, it is key to understand the micro mobility charging infrastructure market that will determine the shift towards sustainable transportation systems across the world.

Micro-Mobility Charging Infrastructure Market Trend Analysis:

Integration of Wireless Charging Technologies

- The market trend that has been identified as concerning in the micro-mobility charging infrastructure market variable is the adoption of wireless charging solutions. This innovation helps to avoid the need of cables, which has a higher level of ergonomics for the users of electric scooters and bikes. Inductive charging pads and the other wireless charging systems make it possible for vehicles to charge while resting on a charging platform. This is not only a development in terms of charging comfort, but also a relief for the physical contacts between car and charging station since both will benefit of longer lifetimes. So, the wireless technology seems to be the key driving force of the future advancement of micro-mobility charging facilities with focusing on the most loaded urban areas.

Smart Charging Stations with IoT Integration

- The combined charging modules and dispersion of plug-in points different from purely technical solutions also works into another emergent trend of establishing depulsed charging stations, IOT controlled. These intelligent stations include sensing capability, monitoring of the charging points in real-time and remote control of the energy storage and usage by operators. Further, with IoT characteristics, the stations could include options such as dynamic charging that allows for modification of the charging costs to match the demand, or send a reminder of, for instance, necessary maintenance, thus avoiding long downtimes. Not only is IoT integration improving self-employment infrastructure more efficiently but it also helps to develop a more sustainable and durable charging system. Thus, the popularity of connected charging stations remains high in several cities that actively use smart technology for managing the population’s needs, which will increase demand for such novelties and stimulate the development of the market.

Micro-Mobility Charging Infrastructure Market Segment Analysis:

Micro-mobility Charging Infrastructure Market is Segmented based on vehicle type, type, source, end use, and region.

By Vehicle Type, Electric Scooters/ Motorcycles segment is expected to dominate the market during the forecast period

- The micro-mobility charging infrastructure market is characterized by vehicle types namely electric scooter/ motorcycle, e-bike, e-skateboard and e-unicycle. These categories are already clearly defined, most importantly the electric scooter and electric motorcycles segment since these products are specific to the urban short-range mobility that is more and more covered by shared mobility services. Another segment refers to E-bikes, as buyer’s interest in energy efficient means of transport has increased and with the growing adoption of bike sharing services. Other related mobile products such as e-skateboards and e-unicycles, even though considerably smaller, are also beginning to gain popularity among enthusiasts and special niches seeking compact and effective means of transport. Since each car type consumes power in a different manner, and charging also takes different time, the entire charging system needs to be flexible enough so as to accommodate as many users as possible; for all types of micro mobility devices.

By End Use, Residential segment expected to held the largest share

- In the case of micro-mobility charging infrastructure, it is common to categorize the end use between the residential and the commercial segments. Residential is mainly influenced by self-usage of consumers with electric scooters, bikes and other micro-mobility vehicles. Portable charging options are on the rise since they make home-based charging convenient and cheaper to everyone who charges their cars at night. On the other hand, the commercial segment is growing rapidly due to increased demand for shared micro-mobility services required in bike-sharing and scooter-sharing within city centers. These services demand a vast network of charging stations for as many cars on fleets as to guarantee constant availability. Another type of installation is public charging stations in places where there is a high human and/or vehicle traffic, which play a significant role in expanding the use of micro mobility products.

Micro-Mobility Charging Infrastructure Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The regional segment analysis also reveals that North America would continue to hold the largest market share for micro-mobility charging infrastructure during the forecast period owing to the growing use of electron scooters, bikes, and other micro-mobility solutions in cities. The ever increasing need to conserve the environment and minimize emission of carbon dioxide among other factors, promotion and grant support by various governments to green infrastructure and the rising demand for efficient and widespread charging solutions. Moreover, micro-mobility is a rapidly growing trend making large cities, including San Francisco, New York, and Los Angeles the pioneers and key drivers behind the development of sophisticated charging infrastructure and integrated micro-mobility systems. Hence, North America is expected to retain a large market share as there is still much development going on in the technological as well as the infrastructure fronts.

Active Key Players in the Micro-Mobility Charging Infrastructure Market:

- Ather Energy (India)

- bike-energy (Germany)

- Bikeep (Estonia)

- Flower Turbines (Netherlands)

- Get Charged, Inc. (USA)

- Giulio Barbieri SRL (Italy)

- Ground Control Systems (USA)

- Magment GmbH (Germany)

- Perch Mobility (USA)

- Robert Bosch GmbH (Germany)

- Solum PV (Sweden)

- SWIFTMILE (USA)

- The Mobility House GmbH (Germany), and Others Active players

|

Micro-Mobility Charging Infrastructure Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 32.91 Billion |

|

Forecast Period 2024-32 CAGR: |

5.8% |

Market Size in 2032: |

USD 48.73 Billion |

|

Segments Covered: |

By Vehicle Type |

|

|

|

By Type |

|

||

|

By Source |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Micro-mobility Charging Infrastructure Market by By Vehicle Type (2018-2032)

4.1 Micro-mobility Charging Infrastructure Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Electric Scooters/ Motorcycles

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 E-bike

4.5 E-Skateboards

4.6 E-Unicycles

Chapter 5: Micro-mobility Charging Infrastructure Market by By Type (2018-2032)

5.1 Micro-mobility Charging Infrastructure Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Wired

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Wireless

Chapter 6: Micro-mobility Charging Infrastructure Market by By Source (2018-2032)

6.1 Micro-mobility Charging Infrastructure Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Solar Powered

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Battery Powered

Chapter 7: Micro-mobility Charging Infrastructure Market by By End Use (2018-2032)

7.1 Micro-mobility Charging Infrastructure Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Residential

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Commercial

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Micro-mobility Charging Infrastructure Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 ATHER ENERGY (INDIA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 BIKE-ENERGY (GERMANY)

8.4 BIKEEP (ESTONIA)

8.5 FLOWER TURBINES (NETHERLANDS)

8.6 GET CHARGED INC. (USA)

8.7 GIULIO BARBIERI SRL (ITALY)

8.8 GROUND CONTROL SYSTEMS (USA)

8.9 MAGMENT GMBH (GERMANY)

8.10 PERCH MOBILITY (USA)

8.11 ROBERT BOSCH GMBH (GERMANY)

8.12 SOLUM PV (SWEDEN)

8.13 SWIFTMILE (USA)

8.14 THE MOBILITY HOUSE GMBH (GERMANY)

8.15 OTHER ACTIVE PLAYERS.

Chapter 9: Global Micro-mobility Charging Infrastructure Market By Region

9.1 Overview

9.2. North America Micro-mobility Charging Infrastructure Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By By Vehicle Type

9.2.4.1 Electric Scooters/ Motorcycles

9.2.4.2 E-bike

9.2.4.3 E-Skateboards

9.2.4.4 E-Unicycles

9.2.5 Historic and Forecasted Market Size By By Type

9.2.5.1 Wired

9.2.5.2 Wireless

9.2.6 Historic and Forecasted Market Size By By Source

9.2.6.1 Solar Powered

9.2.6.2 Battery Powered

9.2.7 Historic and Forecasted Market Size By By End Use

9.2.7.1 Residential

9.2.7.2 Commercial

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Micro-mobility Charging Infrastructure Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By By Vehicle Type

9.3.4.1 Electric Scooters/ Motorcycles

9.3.4.2 E-bike

9.3.4.3 E-Skateboards

9.3.4.4 E-Unicycles

9.3.5 Historic and Forecasted Market Size By By Type

9.3.5.1 Wired

9.3.5.2 Wireless

9.3.6 Historic and Forecasted Market Size By By Source

9.3.6.1 Solar Powered

9.3.6.2 Battery Powered

9.3.7 Historic and Forecasted Market Size By By End Use

9.3.7.1 Residential

9.3.7.2 Commercial

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Micro-mobility Charging Infrastructure Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By By Vehicle Type

9.4.4.1 Electric Scooters/ Motorcycles

9.4.4.2 E-bike

9.4.4.3 E-Skateboards

9.4.4.4 E-Unicycles

9.4.5 Historic and Forecasted Market Size By By Type

9.4.5.1 Wired

9.4.5.2 Wireless

9.4.6 Historic and Forecasted Market Size By By Source

9.4.6.1 Solar Powered

9.4.6.2 Battery Powered

9.4.7 Historic and Forecasted Market Size By By End Use

9.4.7.1 Residential

9.4.7.2 Commercial

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Micro-mobility Charging Infrastructure Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By By Vehicle Type

9.5.4.1 Electric Scooters/ Motorcycles

9.5.4.2 E-bike

9.5.4.3 E-Skateboards

9.5.4.4 E-Unicycles

9.5.5 Historic and Forecasted Market Size By By Type

9.5.5.1 Wired

9.5.5.2 Wireless

9.5.6 Historic and Forecasted Market Size By By Source

9.5.6.1 Solar Powered

9.5.6.2 Battery Powered

9.5.7 Historic and Forecasted Market Size By By End Use

9.5.7.1 Residential

9.5.7.2 Commercial

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Micro-mobility Charging Infrastructure Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By By Vehicle Type

9.6.4.1 Electric Scooters/ Motorcycles

9.6.4.2 E-bike

9.6.4.3 E-Skateboards

9.6.4.4 E-Unicycles

9.6.5 Historic and Forecasted Market Size By By Type

9.6.5.1 Wired

9.6.5.2 Wireless

9.6.6 Historic and Forecasted Market Size By By Source

9.6.6.1 Solar Powered

9.6.6.2 Battery Powered

9.6.7 Historic and Forecasted Market Size By By End Use

9.6.7.1 Residential

9.6.7.2 Commercial

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Micro-mobility Charging Infrastructure Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By By Vehicle Type

9.7.4.1 Electric Scooters/ Motorcycles

9.7.4.2 E-bike

9.7.4.3 E-Skateboards

9.7.4.4 E-Unicycles

9.7.5 Historic and Forecasted Market Size By By Type

9.7.5.1 Wired

9.7.5.2 Wireless

9.7.6 Historic and Forecasted Market Size By By Source

9.7.6.1 Solar Powered

9.7.6.2 Battery Powered

9.7.7 Historic and Forecasted Market Size By By End Use

9.7.7.1 Residential

9.7.7.2 Commercial

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Micro-Mobility Charging Infrastructure Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 32.91 Billion |

|

Forecast Period 2024-32 CAGR: |

5.8% |

Market Size in 2032: |

USD 48.73 Billion |

|

Segments Covered: |

By Vehicle Type |

|

|

|

By Type |

|

||

|

By Source |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Micro-mobility Charging Infrastructure Market research report is 2024-2032.

Ather Energy (India), bike-energy (Germany), Bikeep (Estonia), Flower Turbines (Netherlands), Get Charged, Inc. (USA), Giulio Barbieri SRL (Italy), Ground Control Systems (USA), Magment GmbH (Germany), Perch Mobility (USA), Robert Bosch GmbH (Germany), Solum PV (Sweden), SWIFTMILE (USA), The Mobility House GmbH (Germany), and others Active Players.

The Micro-mobility Charging Infrastructure Market is segmented into Type, Application and region. By Type (Metal fencing (Non-Wire fencing, Barbed & Twisted steel wire fencing, and Other metal fencing), Wood fencing, Plastic & Composite fencing, and Concrete fencing), By Application (Residential, Agricultural, and Industrial). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; The Netherlands; Italy; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Micro-mobility charging infrastructure refers to the network of charging stations and systems designed to support the efficient and reliable charging of small electric vehicles such as e-scooters, e-bikes, and other personal electric transport modes. These charging solutions are critical for ensuring the availability and operational efficiency of micro-mobility fleets, particularly in urban areas. The infrastructure can include both stationary charging stations and mobile charging units, integrated with advanced technologies for monitoring, payment systems, and optimized energy management. This infrastructure is a key enabler for the growth of sustainable urban transportation.

Micro-mobility Charging Infrastructure Market Size Was Valued at USD 5.55 Billion in 2023, and is Projected to Reach USD 31.48 Billion by 2032, Growing at a CAGR of 21.26% from 2024-2032.