Mild Hybrid Vehicle Market Synopsis:

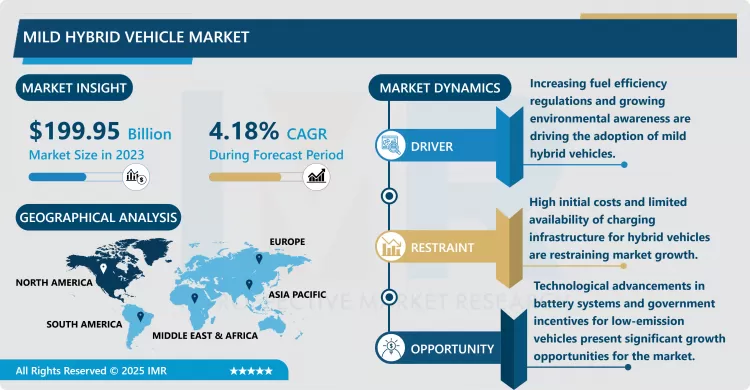

Mild Hybrid Vehicle Market Size Was Valued at USD 199.95 Billion in 2023, and is Projected to Reach USD 290.95 Billion by 2032, Growing at a CAGR of 4.18% from 2024-2032.

MHV market is caused by the recent years concern for energy efficient and sustainable motor vehicles. Hybrid electric vehicles; Integration of both the full hybrids and ICE are cheaper compared to pure electric vehicles currently found in the market. MHVs can never be solely electrically powered like full hybrids, however, the electric motor helps the mechanical engine to run, lowering fuel consumption and emissions. With Governments around the globe upping the ante on emissions standards and control, the deployment of MHVs has become popular with original equipment manufacturers as they look to provide quality with mechanical solutions while also satisfying the consumers.

The main driving forces include customer shift towards usage of electric cars and increasing availability and emergence of mild hybrid powertrain systems. Furthermore, there is a trend of government policies and incentives as well as subsidies for cleaner vehicles have stimulated the mild hybrid vehicle market. Some of the key players in the sector like Ford, Audi, BMW are exploiting the mild hybrid system in vehicle manufacturing and this has expanded the market. And as the structures for the operation of electric vehicles continues to develop and as the conservative demand for fuel and energy continues to grow, MHVs are now considered for purchase.

Regionally, Europe and North America dominate the demand for mild hybrid vehicles due to the enforcement of strict emissions standards and growing peoples’ consciousness of the older generation cars’ negative influence. Another region that is experiencing high growth in MHV market is the Asia-Pacific area mainly due to countries such as Japan and China embracing the use of hybrid technologies by producers. The core prospects considered for the growth of MHVs are hybrid powertrain technology and air battery efficiency, which are believed to be critical factors in the formation of future market demands. Incorporation of green concepts and the emphasis on a decreased level of emissions should ensure further development of the mild hybrid vehicle during the forecast period.

Mild Hybrid Vehicle Market Trend Analysis:

Rising Adoption of Mild Hybrid Technology in Mainstream Vehicles

- The fact that mild hybrid technology has been adopted by vehicle manufacturers as a feature for popular cars and models is one of the factors that define the future development of the mild hybrid vehicle market. Current car makers such as Ford, Audi and BMW are beginning to incorporate light hybrid technologies in their most selling car models and therefore the systems are becoming popular among the customers. These vehicles provide better get better fuel economy, and less emissions than fully electric or hybrid vehicles at a lower cost, making it especially suitable for frugal buyers who are also environmentally conscious. Due to growth in sales in mild hybrid automobile manufacturing, automakers are likely to step up manufacturing of these automobiles over in the forecasting period.

Stringent Emission Regulations and Government Incentives

- The other major trend closely associated with the development of mild hybrid vehicle is the tendencies towards the increase of the requirements towards emissions standards and the initiatives connected with subsidies for environmentally friendly vehicles. In recent years, governments of various countries have escalated the regulatory standards of emissions in attempts to fight climate change and diminish air pollution and as a result, many automotive manufacturers have incorporated mild hybrid technologies. Going by the current trends, especially in Europe and North America, manufactures compact hybrids to meet these regulations. Moreover, governments’ policies such as subsidies and tax exemptions for the consumption of hybrid automobiles, combined with the general increase in demand for such automobiles, is spurring the development of the mild hybrid vehicle market. All these regulatory pressure and incentives are expected to further propel the market growth.

Mild Hybrid Vehicle Market Segment Analysis:

Mild Hybrid Vehicle Market is Segmented on the basis of capacity, vehicle type, battery type, and region

By Capacity, Up To 12V segment is expected to dominate the market during the forecast period

- In the mild hybrid vehicle market, capacity is one of those parameters that have significant effects on the performance of the vehicle as well as the fuel economy. The market has been divided by voltage ranges such as up to 12V/12-24V, and more than 24V. Generally, cars and smaller light duty vehicles with up to 12V systems are employed, to give a modest improvement in fuel efficiency as overall powertrain redesign is not required. The most used level of voltage is the 12V to 24V range in the mid-range vehicles, for better fuel economy and engine performances, while the more than 24V is gently used in the mild hybrid vehicles, occasional luxury models and high levels of efficiency and control, ideal for large engines and hybrid systems. Such a segmentation makes it easy for the manufactures to market their products to the required power types of vehicles depending on the market demand on fuel efficiency and clean energy production.

By Battery Type, Lithium Ion segment expected to held the largest share

- In the mild hybrid vehicles, a critical factor that defines the ability and effectiveness of the vehicle is the battery type. Lithium-Ion (Li-ion) and Lead Acid batteries are the most popular types of batteries in use at the moment and Li-ion batteries have taken majority market share because of their high energy density, long cycle life, and lightweight relative to Lead Acid batteries. Lithium-Ion batteries provide better fuel economy and quicker recharging than commonplace batteries and have therefore gained popularity among car makers who want to improve the performance of their cars and at the same time, cut back on emission. Nevertheless, Lead Acid batteries are used in some hybrid vehicles that are moderately rated because they cost less than both Nickel Metal Hydride and Lithium Ion batteries with less power density and a shorter lifespan. NiMH batteries are also being researched, however Li-ion batteries remain the most widely used type in PHEVs because of the benefits related to the performance. With an increasing consumer demand for improved elevated efficiency and reduced emissions compared to conventional mild hybrids, lithium-ion technology will also remain a trend in the future.

Mild Hybrid Vehicle Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is anticipated to increase across within the forecast period because people show a growing interest environmentally friendly cars and fuel efficiency. Now that stringently emission rules are being imposed in the region, car makers are actively exploring mild hybrid technologies to pass through emission regulations and enhance fuel efficiency.

- This will be due to availability of government subsidies, tax credits, and authorities of both United States and Canada focusing toward environment friendly mobility solutions. Moreover, most of the prominent automotive giants across the North American region are focusing intensely on the manufacture and integration of mild hybrid automotives, which help to propel the growth of the market further in the continent.

Active Key Players in the Mild Hybrid Vehicle Market:

- Toyota Motor Corporation (Japan)

- Nissan Motor Co. Ltd (Japan)

- Honda Motor Company Ltd (Japan)

- Hyundai Motor Company (South Korea)

- Kia Motors Corporation (South Korea)

- Suzuki Motor Corporation (Japan)

- Daimler AG (Germany)

- Volvo Group (Sweden)

- Volkswagen Group (Germany)

- BMW AG (Germany)

- Ford Motor Company (USA)

- Audi AG (Germany)

- Mitsubishi Motors Corporation (Japan)

- BYD Co. Ltd. (China) and Other Active Players

Key Industry Developments in the Mild Hybrid Vehicle Market:

- In October 2024, Hyundai Motor India Limited (HMIL) confirmed its plans to launch hybrid vehicles in the Indian market soon. Although the exact timeline was not specified, the country’s second-largest carmaker expressed confidence in catering to customer preferences with a diverse range of powertrain options. Speaking at the company’s share listing ceremony on the National Stock Exchange, Unsoo Kim, Managing Director of HMIL, noted that Hyundai Motor Company provided access to various technologies, including hybrid and plug-in hybrid systems, which HMIL intended to bring to India.

- In September 2024, Skoda Auto had outlined plans to offer a comprehensive range of vehicles, from mild hybrids to electric vehicles, in India, according to Chairman & CEO Klaus Zellmer. The company had identified an entry-level EV for a global launch in 2026, positioning it as an option for the Indian market, to be followed by the SUV Enyaq and a compact SUV Elroq. Zellmer shared that a concrete plan had been devised, covering a full portfolio of mild hybrids, plug-in hybrids, and battery electric vehicles.

|

Mild Hybrid Vehicle Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 199.95 Billion |

|

Forecast Period 2024-32 CAGR: |

4.18% |

Market Size in 2032: |

USD 290.95 Billion |

|

Segments Covered: |

By Capacity |

|

|

|

By Vehicle Type |

|

||

|

By Battery Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Mild Hybrid Vehicle Market by By Capacity (2018-2032)

4.1 Mild Hybrid Vehicle Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Up To 12V

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 12V To 24V

4.5 More Than 24 V

Chapter 5: Mild Hybrid Vehicle Market by By Vehicle Type (2018-2032)

5.1 Mild Hybrid Vehicle Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Passenger Cars

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Commercial Vehicles

Chapter 6: Mild Hybrid Vehicle Market by By Battery Type (2018-2032)

6.1 Mild Hybrid Vehicle Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Lithium Ion

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Lead Acid

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Mild Hybrid Vehicle Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 TOYOTA MOTOR CORPORATION (JAPAN)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 NISSAN MOTOR CO. LTD (JAPAN)

7.4 HONDA MOTOR COMPANY LTD (JAPAN)

7.5 HYUNDAI MOTOR COMPANY (SOUTH KOREA)

7.6 KIA MOTORS CORPORATION (SOUTH KOREA)

7.7 SUZUKI MOTOR CORPORATION (JAPAN)

7.8 DAIMLER AG (GERMANY)

7.9 VOLVO GROUP (SWEDEN)

7.10 VOLKSWAGEN GROUP (GERMANY)

7.11 BMW AG (GERMANY)

7.12 FORD MOTOR COMPANY (USA)

7.13 AUDI AG (GERMANY)

7.14 MITSUBISHI MOTORS CORPORATION (JAPAN)

7.15 BYD CO. LTD. (CHINA)

7.16 OTHER ACTIVE PLAYERS

Chapter 8: Global Mild Hybrid Vehicle Market By Region

8.1 Overview

8.2. North America Mild Hybrid Vehicle Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Capacity

8.2.4.1 Up To 12V

8.2.4.2 12V To 24V

8.2.4.3 More Than 24 V

8.2.5 Historic and Forecasted Market Size By By Vehicle Type

8.2.5.1 Passenger Cars

8.2.5.2 Commercial Vehicles

8.2.6 Historic and Forecasted Market Size By By Battery Type

8.2.6.1 Lithium Ion

8.2.6.2 Lead Acid

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Mild Hybrid Vehicle Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Capacity

8.3.4.1 Up To 12V

8.3.4.2 12V To 24V

8.3.4.3 More Than 24 V

8.3.5 Historic and Forecasted Market Size By By Vehicle Type

8.3.5.1 Passenger Cars

8.3.5.2 Commercial Vehicles

8.3.6 Historic and Forecasted Market Size By By Battery Type

8.3.6.1 Lithium Ion

8.3.6.2 Lead Acid

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Mild Hybrid Vehicle Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Capacity

8.4.4.1 Up To 12V

8.4.4.2 12V To 24V

8.4.4.3 More Than 24 V

8.4.5 Historic and Forecasted Market Size By By Vehicle Type

8.4.5.1 Passenger Cars

8.4.5.2 Commercial Vehicles

8.4.6 Historic and Forecasted Market Size By By Battery Type

8.4.6.1 Lithium Ion

8.4.6.2 Lead Acid

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Mild Hybrid Vehicle Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Capacity

8.5.4.1 Up To 12V

8.5.4.2 12V To 24V

8.5.4.3 More Than 24 V

8.5.5 Historic and Forecasted Market Size By By Vehicle Type

8.5.5.1 Passenger Cars

8.5.5.2 Commercial Vehicles

8.5.6 Historic and Forecasted Market Size By By Battery Type

8.5.6.1 Lithium Ion

8.5.6.2 Lead Acid

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Mild Hybrid Vehicle Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Capacity

8.6.4.1 Up To 12V

8.6.4.2 12V To 24V

8.6.4.3 More Than 24 V

8.6.5 Historic and Forecasted Market Size By By Vehicle Type

8.6.5.1 Passenger Cars

8.6.5.2 Commercial Vehicles

8.6.6 Historic and Forecasted Market Size By By Battery Type

8.6.6.1 Lithium Ion

8.6.6.2 Lead Acid

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Mild Hybrid Vehicle Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Capacity

8.7.4.1 Up To 12V

8.7.4.2 12V To 24V

8.7.4.3 More Than 24 V

8.7.5 Historic and Forecasted Market Size By By Vehicle Type

8.7.5.1 Passenger Cars

8.7.5.2 Commercial Vehicles

8.7.6 Historic and Forecasted Market Size By By Battery Type

8.7.6.1 Lithium Ion

8.7.6.2 Lead Acid

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Mild Hybrid Vehicle Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 199.95 Billion |

|

Forecast Period 2024-32 CAGR: |

4.18% |

Market Size in 2032: |

USD 290.95 Billion |

|

Segments Covered: |

By Capacity |

|

|

|

By Vehicle Type |

|

||

|

By Battery Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Mild Hybrid Vehicle Market research report is 2024-2032.

Toyota Motor Corporation (Japan), Nissan Motor Co. Ltd (Japan), Honda Motor Company Ltd (Japan), Hyundai Motor Company (South Korea), Kia Motors Corporation (South Korea), Suzuki Motor Corporation (Japan), Daimler AG (Germany), Volvo Group (Sweden), Volkswagen Group (Germany), BMW AG (Germany), Ford Motor Company (USA), Audi AG (Germany), Mitsubishi Motors Corporation (Japan), BYD Co. Ltd. (China), and Other Active Players

The Mild Hybrid Vehicle Market is segmented into By Capacity, By Vehicle Type, By Battery Type and region. By Capacity (Up To 12V, 12V To 24V, and More Than 24 V), By Vehicle Type (Passenger Cars and Commercial Vehicles), By Battery Type (Lithium Ion and Lead Acid). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; The Netherlands; Italy; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A mild hybrid vehicle is a type of hybrid car that uses a combination of a traditional internal combustion engine (ICE) and an electric motor, but unlike full hybrid vehicles, it cannot operate solely on electric power. The electric motor assists the engine in improving fuel efficiency, providing extra power during acceleration, and enabling features like regenerative braking. Mild hybrids typically use smaller, less powerful batteries compared to full hybrids, and they rely on the combustion engine for most of their operation. This technology helps reduce fuel consumption and emissions without the higher costs associated with fully electric or hybrid vehicles.

Mild Hybrid Vehicle Market Size Was Valued at USD 199.95 Billion in 2023, and is Projected to Reach USD 290.95 Billion by 2032, Growing at a CAGR of 4.18% from 2024-2032.