Military Exoskeleton Market Synopsis:

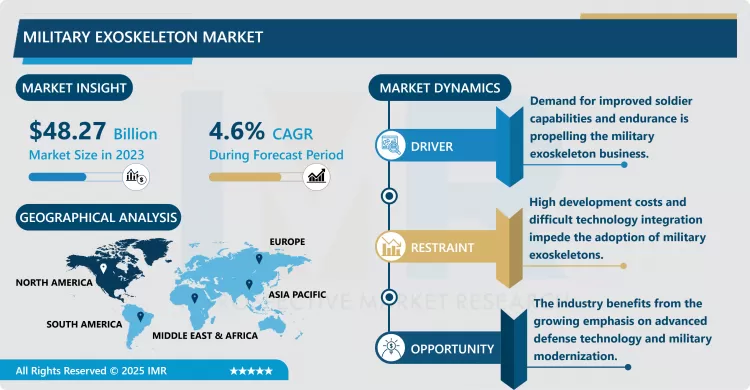

Military Exoskeleton Market Size Was Valued at USD 48.27 Billion in 2023, and is Projected to Reach USD 66.29 Billion by 2032, Growing at a CAGR of 4.6 % from 2024-2032.

Military exoskeleton industry can be defined as the emerging business area related to the development and utilization of the apparel-like robotic equipment intended to support and boost the soldier’s strength, stamina and agility. These exoskeletons are primarily designed to prevent fatigue and enhance a soldier, performance by supplementing augmenting a soldier’s strength and helping add extra carrying capacity without adding extra load. As the global trend towards higher technology content equipment grows, military exoskeletons are perceived as indispensable aid to enhancing soldier productivity, survivability and overall mission accomplishment in difficult terrains and topping the demands of modern warfare.

The market for military exoskeletons is growing as a result of increasing demand for increased technology in the defense and military arena. Bitter experiences from Iraq and Afghanistan wars have had governments and defence agencies across the world keenly seeking ways that would enhance physical performance of soldiers and how develop coping mechanisms for the constraints that come with employing manual tasks in the bonks. These suits are currently incorporated with quite a number of sensors, AI systems, and light weight materials to enhance mobility, quick maneuver and some tactical benefits in military combat. However, this is good news for exoskeletons as their purpose is expanding not only within the military, but in helping rebuild soldiers who have been injured in the line of duty.

Nevertheless, the military exoskeleton market has many problems: high product development costs, difficulties in integration with other military equipment, and approval from authorities. Nonetheless, the report attributed major future growth on materials science, robotics and batteries to power electric autos. With adverse effects such as injuries and fatigue possibly eliminated by these systems and more advanced systems becoming cheaper, more efficient and easy to use the military exoskeleton is expected to be a key component of modern warfare strategy by helping the military forces improve on their operations while at the same time preventing physical injuries in combat.

Military Exoskeleton Market Trend Analysis:

Integration of Advanced Materials and Lightweight Design

- The use of advanced materials in the construction of upgrades to soldiers, or in this case, exoskeletons is on the rise. Advanced high strength materials including carbon fiber, titanium and nether polymers are being employed to build the exoskeleton that will ease strength whilst not necessarily adding extra mass. These materials make the soldiers more mobile and less restricted in movement, which is important in today’s more fluid and instability filled environments on the battle field. Since material technologies enhance, exoskeletons are becoming feasible for common use in military applications in which strength is required without causing encumbrance on mobility.

Enhanced Mobility and Flexibility Through AI and Robotics

- The third important factor that shapes the Military Exoskeleton Market is use artificial intelligence and robotics to improve mobility and efficacy. Today, element of Artificial intelligence is added to exoskeletons so that it can self-adjust to different terrains and motion types. Such an artificial intelligence makes it possible for soldiers to do tricky tasks like climbing stairs, crouching, or even carrying loads of different weights. Robotic application with soldiers wearing exoskeletons enhances the flexibility experience of military personnel in various mission-critical environments.

Military Exoskeleton Market Segment Analysis:

Military Exoskeleton Market is Segmented on the basis of type, application, payload, and region

By Type, Fixed Wing segment is expected to dominate the market during the forecast period

The military exoskeleton market is broadly categorized into two main types depending on the application of fixed-wing and rotary blade platforms. The rigid structure of the powered exoskeleton suits can be applied to soldier applications where steady stamina and power output is required over long ranges or in hauling missions for an extensive period. These exoskeleton systems are developed for increased mobility although they are usually coupled with number of sensors for adjusting the soldier’s gait and posture. At the same time, rotary blade exoskeletons are designed for operations with helicopters and other types of aircraft, where the speed and stability of movements are important. These wearable exoskeletons can help to support the soldiers and do functions like assisting in airborne operations ,tactical extraction. Both are being produced to enhance functionality, protect soldiers, and minimize fatigue in prescribed use and working conditions.

By Application, Combat segment expected to held the largest share

- Military exoskeleton market segmentation is done on the basis of application area into combat, military transport, airborne early warning and control, and reconnaissance and surveillance. In combat use, exoskeleton technology is aimed at increasing the strength and stamina of soldiers and their ability to lift heavy equipment and move across rough terrains and perform physically taxing operations with comparative ease and for long periods of time. In military mobility, people with exoskeletons help in moving equipment by offering support and absorbing stress during transportation. In airborne early warning and control, there are on suit exoskeletons to enhance movement and energy endurance of military personnel that operate radar and communication equipment in extreme conditions. Finally, in reconnaissance and surveillance, plates allow military men to move around in an adequate and proper manner, and to perform long sustained surveillance accompanied with endurance tasking in extreme terrains without fatigue accounting to their performance.

Military Exoskeleton Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North American region is anticipated to lead the market for military exoskeleton through the given timeframe because of the presence of a number of original equipment manufacturers, drastically high defense spending, and continuous innovation in technology in this region. The U.S. military particularly is heavily endowing capital in exoskeleton technologies to boost performance of soldiers, durability during operations. This continuously growing demand for expanded soldier capabilities along with increasing research and development activities in North America make the region, the leader in use and development of military exoskeleton system. In addition, as we see the continual broadening of the use and expansion of these lethal technologies, the synergistic working of military agencies and firms is also putting onto the fast track the commercialization and utilization of such technologies.

Active Key Players in the Military Exoskeleton Market

- BAE Systems (UK)

- General Atomics (US)

- Lockheed Martin Corporation (US)

- Raytheon Company (US)

- Safran (France)

- Bionic Power Inc. (Canada)

- Ekso Bionics (US)

- Revision Military (US)

- SpringActive (US)

- SRI International (US)

- Others Active Players

Key Industry Developments in Interferon Military Exoskeleton Market

In January 2024, Mehler Protection, a leading brand under Mehler Systems, unveils the ExoM Up-Armoured Exoskeleton, developed in collaboration with Mawashi Science & Technology and France’s elite GIGN. This groundbreaking solution sets new standards in weight management and ballistic protection for military and law enforcement. The ExoM redistributes up to 70% of equipment weight from shoulders to the ground, reducing physical strain and injuries. It also provides advanced full-body ballistic protection, enhancing operator safety and performance.

|

Military Exoskeleton Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 48.27 Billion |

|

Forecast Period 2024-32 CAGR: |

4.6% |

Market Size in 2032: |

USD 66.29 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Payload |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Military Exoskeleton Market by By Type (2018-2032)

4.1 Military Exoskeleton Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Fixed Wing

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Rotary Blade

Chapter 5: Military Exoskeleton Market by By Application (2018-2032)

5.1 Military Exoskeleton Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Combat

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Military Transport

5.5 Airborne Early Warning & Control

5.6 Reconnaissance & Surveillance

Chapter 6: Military Exoskeleton Market by By Payload (2018-2032)

6.1 Military Exoskeleton Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Below 50 tons

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 51 to 100 Tons

6.5 101 tons and Above

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Military Exoskeleton Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AIRBUS SAS (FRANCE)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 DASSAULT AVIATION (FRANCE)

7.4 LOCKHEED MARTIN CORPORATION (USA)

7.5 TEXTRON INC. (USA)

7.6 BOEING (USA)

7.7 LEONARDO S.P.A (ITALY)

7.8 NORTHROP GRUMMAN (USA)

7.9 PILATUS AIRCRAFT LTD (SWITZERLAND)

7.10 RUSSIAN HELICOPTERS (RUSSIA)

7.11 SAAB AB (SWEDEN)

7.12 HINDUSTAN AERONAUTICS LIMITED (INDIA)

7.13 GENERAL ELECTRIC (USA)

7.14 FACC AG (AUSTRIA)

7.15 OTHER ACTIVE PLAYERS.

Chapter 8: Global Military Exoskeleton Market By Region

8.1 Overview

8.2. North America Military Exoskeleton Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Type

8.2.4.1 Fixed Wing

8.2.4.2 Rotary Blade

8.2.5 Historic and Forecasted Market Size By By Application

8.2.5.1 Combat

8.2.5.2 Military Transport

8.2.5.3 Airborne Early Warning & Control

8.2.5.4 Reconnaissance & Surveillance

8.2.6 Historic and Forecasted Market Size By By Payload

8.2.6.1 Below 50 tons

8.2.6.2 51 to 100 Tons

8.2.6.3 101 tons and Above

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Military Exoskeleton Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Type

8.3.4.1 Fixed Wing

8.3.4.2 Rotary Blade

8.3.5 Historic and Forecasted Market Size By By Application

8.3.5.1 Combat

8.3.5.2 Military Transport

8.3.5.3 Airborne Early Warning & Control

8.3.5.4 Reconnaissance & Surveillance

8.3.6 Historic and Forecasted Market Size By By Payload

8.3.6.1 Below 50 tons

8.3.6.2 51 to 100 Tons

8.3.6.3 101 tons and Above

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Military Exoskeleton Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Type

8.4.4.1 Fixed Wing

8.4.4.2 Rotary Blade

8.4.5 Historic and Forecasted Market Size By By Application

8.4.5.1 Combat

8.4.5.2 Military Transport

8.4.5.3 Airborne Early Warning & Control

8.4.5.4 Reconnaissance & Surveillance

8.4.6 Historic and Forecasted Market Size By By Payload

8.4.6.1 Below 50 tons

8.4.6.2 51 to 100 Tons

8.4.6.3 101 tons and Above

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Military Exoskeleton Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Type

8.5.4.1 Fixed Wing

8.5.4.2 Rotary Blade

8.5.5 Historic and Forecasted Market Size By By Application

8.5.5.1 Combat

8.5.5.2 Military Transport

8.5.5.3 Airborne Early Warning & Control

8.5.5.4 Reconnaissance & Surveillance

8.5.6 Historic and Forecasted Market Size By By Payload

8.5.6.1 Below 50 tons

8.5.6.2 51 to 100 Tons

8.5.6.3 101 tons and Above

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Military Exoskeleton Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Type

8.6.4.1 Fixed Wing

8.6.4.2 Rotary Blade

8.6.5 Historic and Forecasted Market Size By By Application

8.6.5.1 Combat

8.6.5.2 Military Transport

8.6.5.3 Airborne Early Warning & Control

8.6.5.4 Reconnaissance & Surveillance

8.6.6 Historic and Forecasted Market Size By By Payload

8.6.6.1 Below 50 tons

8.6.6.2 51 to 100 Tons

8.6.6.3 101 tons and Above

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Military Exoskeleton Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Type

8.7.4.1 Fixed Wing

8.7.4.2 Rotary Blade

8.7.5 Historic and Forecasted Market Size By By Application

8.7.5.1 Combat

8.7.5.2 Military Transport

8.7.5.3 Airborne Early Warning & Control

8.7.5.4 Reconnaissance & Surveillance

8.7.6 Historic and Forecasted Market Size By By Payload

8.7.6.1 Below 50 tons

8.7.6.2 51 to 100 Tons

8.7.6.3 101 tons and Above

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Military Exoskeleton Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 48.27 Billion |

|

Forecast Period 2024-32 CAGR: |

4.6% |

Market Size in 2032: |

USD 66.29 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Payload |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Military Exoskeleton Market research report is 2024-2032.

BAE Systems (UK), General Atomics (US), Lockheed Martin Corporation (US), Raytheon Company (US), Safran (France), Bionic Power Inc. (Canada), Ekso Bionics (US), Revision Military (US), SpringActive (US), SRI International (US), Others Active Players.

The Military Exoskeleton Market is segmented into Type, Application, By Payload and region. By Type (Fixed Wing and Rotary Blade), Application (Combat, Military Transport, Airborne Early Warning & Control, Reconnaissance & Surveillance), Payload (Below 50 tons, 51 to 100 Tons, 101 tons and Above). region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; The Netherlands; Italy; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A military exoskeleton is a wearable robotic device designed to augment the physical abilities of soldiers by enhancing their strength, endurance, and mobility. These exoskeletons are typically made of lightweight, durable materials and use actuators, sensors, and advanced computing to assist with heavy lifting, walking, running, and reducing fatigue. They can help improve operational efficiency in challenging environments, allowing soldiers to carry more equipment over longer distances and perform tasks with greater precision. Military exoskeletons aim to reduce the physical strain on soldiers while increasing their effectiveness and safety in combat situations.

Military Exoskeleton Market Size Was Valued at USD 48.27 Billion in 2023, and is Projected to Reach USD 66.29 Billion by 2032, Growing at a CAGR of 4.6 % from 2024-2032.