Military Robots Market Synopsis:

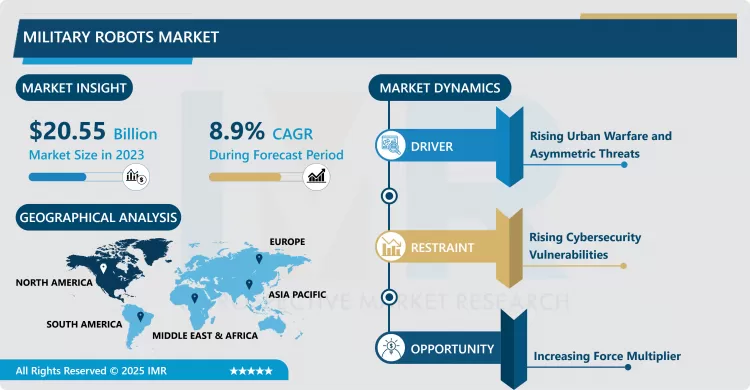

Military Robots Market Size Was Valued at USD 20.55 Billion in 2023, and is Projected to Reach USD 40.65 Billion by 2032, Growing at a CAGR of 8.9% from 2024-2032.

Military robots market is showing good growth rate because of innovation in auto system and growing defense budget across the world. Unmanned aerial vehicles (UAVs), ground robots, and underwater drones are steadily being inserted into military tactical concepts in order to improve mission effectiveness, decrease friendly losses and perform activities in dangerous conditions.

Popular utilization of military robots include combat, reconnaissance, surveillance, target acquisition, mine clearing, and recognition of explosive objects. The use of AI and machine learning as sub-systems of LAVs is increasing the independence and decisions making abilities of these robots so that they can also fight better in the complex and ever changing combat environments. Further, the increasing versatility of military robots that are designed for both military and civil purposes is growing their market opportunities and encouraging development.

However, the market is not devoid of challenges; which entails, it has some barriers including high cost of development and operation, ethical issues, and regulatory factors. Solving these issues is important if there has to be broader implementation and incorporation of military robots in military operations. Future work implies the continuation of R&D in this area as well as the international cooperation, as these factors will be able to eliminate above mentioned challenges, which in its turn will lead to higher automation level in military operations.

Military Robots Market Trend Analysis:

Integration of Artificial Intelligence (AI) and Machine Learning

- Since the operational functionality of various types of military robots demand advanced decision-making mechanisms and improved working capacities, the market for military robots is currently adopting AI and machine learning technologies. Such developments make robots more efficient in surveillance, and reconnaissance, and in engaging the enemy with little or no human intercession. Despite the AI mechanics facilitate real-time data analysis and adaptive response to changing situations this proves the assumptions that Military Robots experience great improvements.

Expansion of Unmanned Underwater Vehicles (UUVs)

- Currently, there are visible tendencies towards creation and usage of unmanned underwater vehicles (UUVs) as characteristic military platforms. These UUVs are used in functions like mine hunting, monitoring and observation of water bodies among others. Their operations without putting the lives of humans in danger makes them vital tools of naval forces. Future of UUVs is anticipated to be bright primarily owing to technological improvements in underwater robotic systems and defense spending.

Military Robots Market Segment Analysis:

Military Robots Market is Segmented on the basis of type, platform, propulsion, range, system, deployment method, application, payout, mode of operation, end user and region

By Type, Land segment is expected to dominate the market during the forecast period

- The military robots market is categorized into three primary types: land, marine, and airborne. These are self- powered robots for ground use; used in surveillance, reconnaissance tasks and Bomb Disposal. Marine robots consist of unmanned underwater vehicles, that is, UUVs that perform duties like mine reconnaissance and underwater reconnaissance. Aerial robots or commonly referred to as unmanned aerial vehicles are used for spying, reconnaissance, and guided bombing. Of all the types, the airborne segment is the largest market share holder and has a CAGR of 4.95% through the forecast period.

By Application, Intelligence segment expected to held the largest share

- Military robots are even used in manifold more or less related activities to improve military functions and effectiveness in operations. In ISR Unmanned Aerial Systems (UASs) or Unmanned Air Vehicles (UAVs) and ground robotic systems are used for securing the information, observation of hostile activities, and being up-to-date on current situation. In Search and Rescue, sensor and camera mounted robots are employed to search and find injured or stuck employees in dangerous environment without putting human lifearisks involved in such scenario. In Combat Support, endoskeletons transfer bulky loads, supply fire support and conduct scouting works which support the ground forces. In Transportation, Self-driving Car is employed to deliver materials and staff, it improves the function of supply chain and eliminated manned convoy in the hazardous region. In the EOD, robots are used in identifying, neutralizing and destroying bombs, thus avoiding losses on side of bomb disposal squad. For Mine Clearance, illustrated robots which integrated with detectors and disarming tools are used in order to discover the mines and dispose them without causing harm to soldier’s lives or endangering the lives other people. In Firefighting, they are used where human access is impossible due to the effects of chemicals or due to the kind of fire in enclosed spaces. These applications also define the capacity and indispensability of military robots in contemporary warfare scenarios.

Military Robots Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is assumed to have the largest shares of the military robots market for the forecast period due to high defense budgets and increasing development of innovative military systems. For instance, the U.S. military department spends considerably on several kinds of military robots based on UAVs, the land robots, and under water drones so that to elevate operation effectiveness and decrease human losses. This commitment towards innovation and modernisation makes North America as centre for development and procurement of military robotic systems.

Active Key Players in the Military Robots Market:

- Northrop Grumman (U.S.)

- Lockheed Martin Corporation (U.S.)

- QinetiQ (U.K.)

- Cobham Limited (U.K.)

- General Dynamics Corporation (U.S.)

- Elbit Systems Ltd. (Israel)

- IAI (Israel Aerospace Industries) (Israel)

- AeroVironment, Inc. (U.S.)

- Thales (France)

- BAE Systems (U.K.)

- SAAB (Sweden)

- Boston Dynamics (U.S.)

- Textron Systems (U.S.)

- RTX (U.S.)

- Others Active Players

Key Industry Developments in the Military Robots Market

- In June 2024, KNDS unveils its innovative range of military robots, including the new CENTURIO combat robots and modular UGV solutions developed with MILREM Robotics. Highlighting operational achievements, KNDS demonstrated the NERVA patrol robot, securing the Eurosatory 2024 exhibition, and showcased advanced unmanned solutions like remote-operated bridge-laying systems and AI-driven ULTRO robots. With secured communication technologies extending up to 80km, KNDS strengthens its role as a pioneer in modular, life-saving robotic solutions for modern warfare.

|

Military Robots Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 20.55 Billion |

|

Forecast Period 2024-32 CAGR: |

8.9% |

Market Size in 2032: |

USD 40.65 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Platform |

|

||

|

Propulsion |

|

||

|

Range |

|

||

|

System |

|

||

|

Deployment Method |

|

||

|

Application |

|

||

|

Payout |

|

||

|

Mode of Operation |

|

||

|

End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Military Robots Market by By Type (2018-2032)

4.1 Military Robots Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Land

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Marine

4.5 Airborne

Chapter 5: Military Robots Market by By Platform (2018-2032)

5.1 Military Robots Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Land Robots

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Marine Robots

5.5 Airborne Robots

5.6 Propulsion

5.7 Electric

5.8 Mechanical

5.9 Hybrid

5.10 Range

5.11 Land Range

5.12 Marine Range

5.13 Airborne Range

5.14 System

5.15 Land System

5.16 Marine System

5.17 Airborne System

5.18 Deployment Method

5.19 Land Deployment

5.20 Marine Deployment

5.21 Airborne Deployment

5.22 Application

5.23 Intelligence

5.24 Surveillance and Reconnaissance (ISR)

5.25 Search and Rescue

5.26 Combat Support

5.27 Transportation

5.28 Explosive Ordnance Disposal (EOD)

5.29 Mine Clearance

5.30 Firefighting

5.31 Others

5.32 Payout

5.33 Sensor

5.34 Radar

5.35 Weapon

5.36 Others

5.37 Mode of Operation

5.38 Human Operated

5.39 Autonomous

5.40 End User

5.41 Defense

5.42 Homeland Security

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Military Robots Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 NORTHROP GRUMMAN (FALLS CHURCH

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 VIRGINIA

6.4 USA)

6.5 LOCKHEED MARTIN CORPORATION (BETHESDA

6.6 MARYLAND

6.7 USA)

6.8 QINETIQ (LONDON

6.9 UNITED KINGDOM)

6.10 COBHAM LIMITED (DORSET

6.11 UNITED KINGDOM)

6.12 GENERAL DYNAMICS CORPORATION (RESTON

6.13 VIRGINIA

6.14 USA)

6.15 ELBIT SYSTEMS LTD. (HAIFA

6.16 ISRAEL)

6.17 IAI (ISRAEL AEROSPACE INDUSTRIES) (LOD

6.18 ISRAEL)

6.19 AEROVIRONMENT INC. (ARLINGTON

6.20 VIRGINIA

6.21 USA)

6.22 THALES (PARIS

6.23 FRANCE)

6.24 BAE SYSTEMS (LONDON

6.25 UNITED KINGDOM)

6.26 SAAB (LINKÖPING

6.27 SWEDEN)

6.28 BOSTON DYNAMICS (WALTHAM

6.29 MASSACHUSETTS

6.30 USA)

6.31 TEXTRON SYSTEMS (HUNT VALLEY

6.32 MARYLAND

6.33 USA)

6.34 RTX (WALTHAM

6.35 MASSACHUSETTS

6.36 USA)

6.37 OTHER ACTIVE PLAYERS.

Chapter 7: Global Military Robots Market By Region

7.1 Overview

7.2. North America Military Robots Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By By Type

7.2.4.1 Land

7.2.4.2 Marine

7.2.4.3 Airborne

7.2.5 Historic and Forecasted Market Size By By Platform

7.2.5.1 Land Robots

7.2.5.2 Marine Robots

7.2.5.3 Airborne Robots

7.2.5.4 Propulsion

7.2.5.5 Electric

7.2.5.6 Mechanical

7.2.5.7 Hybrid

7.2.5.8 Range

7.2.5.9 Land Range

7.2.5.10 Marine Range

7.2.5.11 Airborne Range

7.2.5.12 System

7.2.5.13 Land System

7.2.5.14 Marine System

7.2.5.15 Airborne System

7.2.5.16 Deployment Method

7.2.5.17 Land Deployment

7.2.5.18 Marine Deployment

7.2.5.19 Airborne Deployment

7.2.5.20 Application

7.2.5.21 Intelligence

7.2.5.22 Surveillance and Reconnaissance (ISR)

7.2.5.23 Search and Rescue

7.2.5.24 Combat Support

7.2.5.25 Transportation

7.2.5.26 Explosive Ordnance Disposal (EOD)

7.2.5.27 Mine Clearance

7.2.5.28 Firefighting

7.2.5.29 Others

7.2.5.30 Payout

7.2.5.31 Sensor

7.2.5.32 Radar

7.2.5.33 Weapon

7.2.5.34 Others

7.2.5.35 Mode of Operation

7.2.5.36 Human Operated

7.2.5.37 Autonomous

7.2.5.38 End User

7.2.5.39 Defense

7.2.5.40 Homeland Security

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Military Robots Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By By Type

7.3.4.1 Land

7.3.4.2 Marine

7.3.4.3 Airborne

7.3.5 Historic and Forecasted Market Size By By Platform

7.3.5.1 Land Robots

7.3.5.2 Marine Robots

7.3.5.3 Airborne Robots

7.3.5.4 Propulsion

7.3.5.5 Electric

7.3.5.6 Mechanical

7.3.5.7 Hybrid

7.3.5.8 Range

7.3.5.9 Land Range

7.3.5.10 Marine Range

7.3.5.11 Airborne Range

7.3.5.12 System

7.3.5.13 Land System

7.3.5.14 Marine System

7.3.5.15 Airborne System

7.3.5.16 Deployment Method

7.3.5.17 Land Deployment

7.3.5.18 Marine Deployment

7.3.5.19 Airborne Deployment

7.3.5.20 Application

7.3.5.21 Intelligence

7.3.5.22 Surveillance and Reconnaissance (ISR)

7.3.5.23 Search and Rescue

7.3.5.24 Combat Support

7.3.5.25 Transportation

7.3.5.26 Explosive Ordnance Disposal (EOD)

7.3.5.27 Mine Clearance

7.3.5.28 Firefighting

7.3.5.29 Others

7.3.5.30 Payout

7.3.5.31 Sensor

7.3.5.32 Radar

7.3.5.33 Weapon

7.3.5.34 Others

7.3.5.35 Mode of Operation

7.3.5.36 Human Operated

7.3.5.37 Autonomous

7.3.5.38 End User

7.3.5.39 Defense

7.3.5.40 Homeland Security

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Military Robots Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By By Type

7.4.4.1 Land

7.4.4.2 Marine

7.4.4.3 Airborne

7.4.5 Historic and Forecasted Market Size By By Platform

7.4.5.1 Land Robots

7.4.5.2 Marine Robots

7.4.5.3 Airborne Robots

7.4.5.4 Propulsion

7.4.5.5 Electric

7.4.5.6 Mechanical

7.4.5.7 Hybrid

7.4.5.8 Range

7.4.5.9 Land Range

7.4.5.10 Marine Range

7.4.5.11 Airborne Range

7.4.5.12 System

7.4.5.13 Land System

7.4.5.14 Marine System

7.4.5.15 Airborne System

7.4.5.16 Deployment Method

7.4.5.17 Land Deployment

7.4.5.18 Marine Deployment

7.4.5.19 Airborne Deployment

7.4.5.20 Application

7.4.5.21 Intelligence

7.4.5.22 Surveillance and Reconnaissance (ISR)

7.4.5.23 Search and Rescue

7.4.5.24 Combat Support

7.4.5.25 Transportation

7.4.5.26 Explosive Ordnance Disposal (EOD)

7.4.5.27 Mine Clearance

7.4.5.28 Firefighting

7.4.5.29 Others

7.4.5.30 Payout

7.4.5.31 Sensor

7.4.5.32 Radar

7.4.5.33 Weapon

7.4.5.34 Others

7.4.5.35 Mode of Operation

7.4.5.36 Human Operated

7.4.5.37 Autonomous

7.4.5.38 End User

7.4.5.39 Defense

7.4.5.40 Homeland Security

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Military Robots Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By By Type

7.5.4.1 Land

7.5.4.2 Marine

7.5.4.3 Airborne

7.5.5 Historic and Forecasted Market Size By By Platform

7.5.5.1 Land Robots

7.5.5.2 Marine Robots

7.5.5.3 Airborne Robots

7.5.5.4 Propulsion

7.5.5.5 Electric

7.5.5.6 Mechanical

7.5.5.7 Hybrid

7.5.5.8 Range

7.5.5.9 Land Range

7.5.5.10 Marine Range

7.5.5.11 Airborne Range

7.5.5.12 System

7.5.5.13 Land System

7.5.5.14 Marine System

7.5.5.15 Airborne System

7.5.5.16 Deployment Method

7.5.5.17 Land Deployment

7.5.5.18 Marine Deployment

7.5.5.19 Airborne Deployment

7.5.5.20 Application

7.5.5.21 Intelligence

7.5.5.22 Surveillance and Reconnaissance (ISR)

7.5.5.23 Search and Rescue

7.5.5.24 Combat Support

7.5.5.25 Transportation

7.5.5.26 Explosive Ordnance Disposal (EOD)

7.5.5.27 Mine Clearance

7.5.5.28 Firefighting

7.5.5.29 Others

7.5.5.30 Payout

7.5.5.31 Sensor

7.5.5.32 Radar

7.5.5.33 Weapon

7.5.5.34 Others

7.5.5.35 Mode of Operation

7.5.5.36 Human Operated

7.5.5.37 Autonomous

7.5.5.38 End User

7.5.5.39 Defense

7.5.5.40 Homeland Security

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Military Robots Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By By Type

7.6.4.1 Land

7.6.4.2 Marine

7.6.4.3 Airborne

7.6.5 Historic and Forecasted Market Size By By Platform

7.6.5.1 Land Robots

7.6.5.2 Marine Robots

7.6.5.3 Airborne Robots

7.6.5.4 Propulsion

7.6.5.5 Electric

7.6.5.6 Mechanical

7.6.5.7 Hybrid

7.6.5.8 Range

7.6.5.9 Land Range

7.6.5.10 Marine Range

7.6.5.11 Airborne Range

7.6.5.12 System

7.6.5.13 Land System

7.6.5.14 Marine System

7.6.5.15 Airborne System

7.6.5.16 Deployment Method

7.6.5.17 Land Deployment

7.6.5.18 Marine Deployment

7.6.5.19 Airborne Deployment

7.6.5.20 Application

7.6.5.21 Intelligence

7.6.5.22 Surveillance and Reconnaissance (ISR)

7.6.5.23 Search and Rescue

7.6.5.24 Combat Support

7.6.5.25 Transportation

7.6.5.26 Explosive Ordnance Disposal (EOD)

7.6.5.27 Mine Clearance

7.6.5.28 Firefighting

7.6.5.29 Others

7.6.5.30 Payout

7.6.5.31 Sensor

7.6.5.32 Radar

7.6.5.33 Weapon

7.6.5.34 Others

7.6.5.35 Mode of Operation

7.6.5.36 Human Operated

7.6.5.37 Autonomous

7.6.5.38 End User

7.6.5.39 Defense

7.6.5.40 Homeland Security

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Military Robots Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By By Type

7.7.4.1 Land

7.7.4.2 Marine

7.7.4.3 Airborne

7.7.5 Historic and Forecasted Market Size By By Platform

7.7.5.1 Land Robots

7.7.5.2 Marine Robots

7.7.5.3 Airborne Robots

7.7.5.4 Propulsion

7.7.5.5 Electric

7.7.5.6 Mechanical

7.7.5.7 Hybrid

7.7.5.8 Range

7.7.5.9 Land Range

7.7.5.10 Marine Range

7.7.5.11 Airborne Range

7.7.5.12 System

7.7.5.13 Land System

7.7.5.14 Marine System

7.7.5.15 Airborne System

7.7.5.16 Deployment Method

7.7.5.17 Land Deployment

7.7.5.18 Marine Deployment

7.7.5.19 Airborne Deployment

7.7.5.20 Application

7.7.5.21 Intelligence

7.7.5.22 Surveillance and Reconnaissance (ISR)

7.7.5.23 Search and Rescue

7.7.5.24 Combat Support

7.7.5.25 Transportation

7.7.5.26 Explosive Ordnance Disposal (EOD)

7.7.5.27 Mine Clearance

7.7.5.28 Firefighting

7.7.5.29 Others

7.7.5.30 Payout

7.7.5.31 Sensor

7.7.5.32 Radar

7.7.5.33 Weapon

7.7.5.34 Others

7.7.5.35 Mode of Operation

7.7.5.36 Human Operated

7.7.5.37 Autonomous

7.7.5.38 End User

7.7.5.39 Defense

7.7.5.40 Homeland Security

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Military Robots Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 20.55 Billion |

|

Forecast Period 2024-32 CAGR: |

8.9% |

Market Size in 2032: |

USD 40.65 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Platform |

|

||

|

Propulsion |

|

||

|

Range |

|

||

|

System |

|

||

|

Deployment Method |

|

||

|

Application |

|

||

|

Payout |

|

||

|

Mode of Operation |

|

||

|

End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Military Robots Market research report is 2024-2032.

Northrop Grumman (Falls Church, Virginia, USA), Lockheed Martin Corporation (Bethesda, Maryland, USA), QinetiQ (London, United Kingdom), Cobham Limited (Dorset, United Kingdom), General Dynamics Corporation (Reston, Virginia, USA), Elbit Systems Ltd. (Haifa, Israel), IAI (Israel Aerospace Industries) (Lod, Israel), AeroVironment, Inc. (Arlington, Virginia, USA), Thales (Paris, France), BAE Systems (London, United Kingdom), SAAB (Linköping, Sweden), Boston Dynamics (Waltham, Massachusetts, USA), Textron Systems (Hunt Valley, Maryland, USA), RTX (Waltham, Massachusetts, USA), Others Active Players.

The Military Robots Market is segmented into By Type, Platform, Propulsion, Range, System, Deployment Method , Payout, Mode of Operation , End User and region. By Type (Land, Marine, and Airborne), Platform (Land Robots, Marine Robots, and Airborne Robots), Propulsion (Electric, Mechanical, and Hybrid), Range (Land Range, Marine Range, and Airborne Range), System (Land System, Marine System, and Airborne System), Deployment Method (Land Deployment, Marine Deployment, and Airborne Deployment), Application (Intelligence, Surveillance and Reconnaissance (ISR), Search and Rescue, Combat Support, Transportation, Explosive Ordnance Disposal (EOD), Mine Clearance, Firefighting, and Others), Payout (Sensor, Radar, Weapon, and Others), Mode of Operation (Human Operated and Autonomous), End User (Defense and Homeland Security). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; The Netherlands; Italy; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Military robots are autonomous or remotely operated machines designed for defense applications, including surveillance, reconnaissance, combat, and logistics support. They encompass unmanned aerial vehicles (UAVs), unmanned ground vehicles (UGVs), and unmanned underwater vehicles (UUVs), each tailored for specific military tasks. These robots enhance operational efficiency, reduce human risk in hazardous environments, and perform complex missions with precision. Their integration into modern warfare represents a significant advancement in military technology, offering capabilities that were previously unattainable.

Military Robots Market Size Was Valued at USD 20.55 Billion in 2023, and is Projected to Reach USD 40.65 Billion by 2032, Growing at a CAGR of 8.9% from 2024-2032.