Mining Equipment Market Synopsis

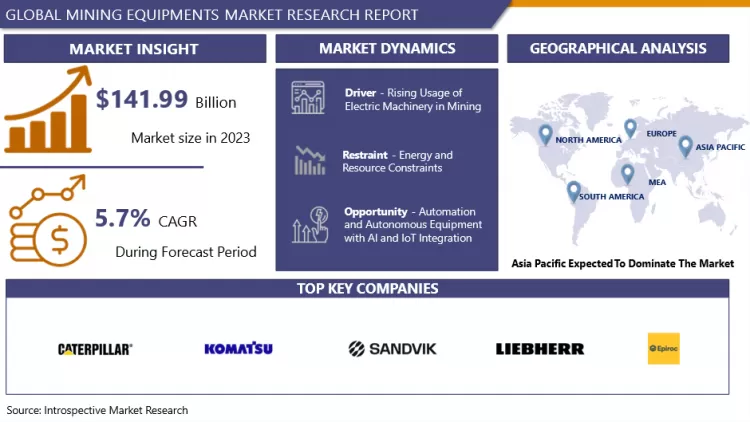

Mining Equipment Market Size Was Valued at USD 141.99 Billion in 2023, and is Projected to Reach USD 233.85 Billion by 2032, Growing at a CAGR of 5.7% From 2024-2032.

Equipment used for mining consists of machinery and tools designed to extract minerals and geological substances. It includes a range of machines for tasks in mining such as exploring, extracting, processing, and transporting. Different types of equipment consist of drilling machines, excavators, loaders, haul trucks, and crushers. These tools are necessary for obtaining mineral deposits and transporting earth and rock effectively.

- The demand for mining equipment is increasing because of the growing number of mining operations aimed at extracting metals and minerals to fulfil the higher demands. The implementation of technologies such as automation is lowering expenses and operational duration. This is leading to an increased need for creative mining machinery. Moreover, the increasing demand for resources and mineral fertilizers is driving the market forward. However, strict government regulations may hinder market expansion by focusing on environmental worries, safety criteria, emission standards, and import rules.

- Increased demand for mining activities will be propelled by the rising utilization of coal for heating and electricity in emerging nations such as India and China, as well as the heightened construction of roads and railways in mountainous areas. The use of robotic machines and drilling technology enhances safety in the workplace. However, the increase in raw material expenses could restrict the expansion of the worldwide mining equipment industry.

- The energy-intensive operations in the mining industry use various extraction and refining methods to safeguard and extract resources as mineral quality decreases, resulting in higher energy usage. Surface mining equipment remains in place and carries out different tasks such as processing and transporting. The integration of AI in mining machinery improves efficiency, productivity, and safety for miners. The mining industry worldwide is embracing smart data and AI technologies in order to boost market expansion through technological advancements.

Mining Equipment Market Trend Analysis

Rising Usage of Electric Machinery in Mining

- The mining sector faces difficulties in reducing its environmental impact, as conventional machinery leads to the release of greenhouse gases and pollution in the air. Electric equipment offers a more environmentally friendly option, decreasing both carbon emissions and noise pollution. The move towards environmentally friendly practices is pushing for the usage of electric equipment in mining activities. While electric mining equipment may be more expensive at first, it ultimately saves money in the long run due to reduced maintenance costs and stable electricity expenses.

- In contrast to conventional machinery, electric equipment is shown to be more economical and results in cost savings, making it an attractive option for mining companies looking to boost profits. Improvements in battery technology and electric powertrains have boosted the performance and feasibility of electric mining machinery. Enhancements in battery energy density, charging speed, and durability have expanded the range and capabilities of operations. Regenerative braking systems, among other innovations, also enhance efficiency.

- Electric mining equipment enhances safety and worker well-being by getting rid of harmful exhaust emissions and cutting down on noise pollution. This results in a more healthful working atmosphere for miners than with machinery that runs on diesel fuel. Mining companies have the ability to improve their energy independence by incorporating renewable energy sources such as solar and wind power in their activities. This decreases dependence on outside fuel sources, enhances energy safety, and encourages the utilization of electric equipment in mining.

Opportunity

Automation and Autonomous Equipment with AI and IoT Integration

- The usage of automation, AI, and IoT integration improves mining operations by streamlining processes, cutting downtime, and reducing human errors. AI algorithms use current data to forecast equipment malfunctions and enhance processes, leading to improved efficiency and productivity. Automation and independence in mining improve safety by decreasing the presence of human workers in dangerous zones. AI identifies potential dangers and implements proactive measures, while IoT sensors oversee surroundings and employee well-being for instant notifications.

- The integration of AI and IoT in mining equipment allows for predictive maintenance, forecasting and preventing failures by analysing sensor data. This proactive strategy decreases the amount of time equipment is not working, prolongs equipment lifespan, and reduces expenses. Automation and AI-driven optimization in mining operations cut costs by diminishing reliance on human labour, streamlining energy consumption, and adopting predictive maintenance techniques. This enhances the industry's profitability and competitiveness.

- The Internet of Things allows for remote surveillance and management of mining equipment, enhancing operational flexibility and efficiency in distant or dangerous settings. Operators have the ability to oversee performance, make adjustments to settings, and promptly deal with issues to enhance control and responsiveness. AI and IoT generate data for informed decision-making. Data analytics tools provide insights on equipment performance, operational efficiency, and resource utilization. Mining companies use these insights to optimize processes and drive improvement.

Mining Equipment Market Segment Analysis:

Mining Equipment Market is segmented on the basis of Type, Power Source, Application, and Region.

By Type, Surface Mining Equipment Segment Is Expected to Dominate the Market During the Forecast Period

- Surface mining is a commonly used technique to extract minerals and ores located close to the surface of the earth. Frequent practices consist of open-pit mining, strip mining, and quarrying, resulting in a significant need for machinery. Surface mining is usually more affordable than underground mining because of reduced equipment expenses and less labour-intensive processes, which ultimately results in higher cost-efficiency.

- Surface mining techniques enable the efficient extraction of large quantities of resources through effective and rapid material movement on a large scale. The improvement of surface mining equipment through technological advancements such as GPS tracking, automation, and real-time data analytics leads to increased precision, decreased downtime, and higher productivity, enhancing the attractiveness of operations. Surface mining is considered safer than underground mining because there are fewer risks of accidents such as cave-ins, gas leaks, and flooding, which is why it is the preferred method for operations.

- Advanced surface mining technology reduces harm to the environment, emphasizing the importance of restoration and recovery in mining operations. Technological progress decreases the environmental impact of mining operations by minimizing the ecological footprint. Surface mining equipment, like draglines, shovels, and trucks, are highly productive, handling large loads continuously for long periods, meeting global mineral demand and preferred by mining companies.

By Application, Coal Mining Segment Held the Largest Share in 2023

- Coal remains highly required after, especially in Asia, where it serves as a major energy source for powering electricity and is crucial for industries such as steel manufacturing, resulting in significant investments in coal mines. Large-scale coal mining operations necessitate substantial investments in specialized machinery. Both surface and underground mines require machinery to effectively extract, move, and process coal.

- Coal mining involves the use of a variety of machinery for different tasks like drilling, extracting, loading, transporting, and processing. This machinery consists of drills, draglines, shovels, trucks, conveyors, crushers, screens, and wash plants. The wide range of equipment requirements plays a significant role in the prevalence of coal mining in the equipment industry. The cost benefits of coal make it a strong competitor in the energy sector, resulting in increased investments in mining machinery. Economic rewards motivate the preservation and expansion of coal mining activities, supporting the need for appropriate machinery.

- Advances in technology within the coal mining sector are centred on enhancing effectiveness, security, output, and financial viability through automation, remote operation, and continuous data monitoring. Countries with abundant coal reserves rely on coal-based infrastructure for energy and industrial development. Funds are allocated towards purchasing mining tools, constructing railways, and expanding ports for coal transportation to both local and international markets.

Mining Equipment Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia Pacific area has a wealth of mineral resources such as coal, iron ore, and gold, which has resulted in numerous mining operations. Nations such as China, India, Australia, and Indonesia possess substantial reserves that fuel the need for mining machinery. The rise of industry and cities in China and India has led to a greater demand for minerals and metals in construction, manufacturing, and energy generation, leading to a higher need for mining machinery.

- Infrastructure projects in the Asia Pacific region are increasing the need for raw materials and mining equipment, leading to a surge in mining operations for materials such as steel and cement. Governments in this region have enacted beneficial policies such as China's Belt and Road Initiative and India's Make in India in order to enhance mining operations. These actions boost the need for mining equipment in the market.

- Improved mining technologies and equipment, such as automation, IoT, and AI, have increased the effectiveness, output, security, and financial success of mining activities in the area. Minerals and mining equipment are exported by countries in the Asia Pacific region. Australia sends coal and iron ore abroad, while China sends out mining equipment. Both play a significant role in producing and exporting goods in the area. Increased investments in the mining industry from both public and private sectors are fuelling market expansion, with a particular emphasis on exploration, enhancing infrastructure, and acquiring new equipment.

- In the global mining equipment market, growth trends align closely with regional mining production. The Asia Pacific region dominates both production and equipment demand, with a significant share of 60.40%. North America follows with 15.30%, while Oceania and Europe contribute equally with 6.80% each. Latin America and Africa, although smaller in production share, still hold substantial potential, contributing 5.05% and 5.20%, respectively, to the global market.

Mining Equipment Market Active Players

- Caterpillar Inc. (United States)

- Komatsu Ltd. (Japan)

- Sandvik AB (Sweden)

- Hitachi Construction Machinery Co., Ltd. (Japan)

- Liebherr Group (Switzerland)

- Epiroc AB (Sweden)

- Volvo Construction Equipment (Sweden)

- Doosan Group (South Korea)

- Terex Corporation (United States)

- Metso Outotec Corporation (Finland)

- Joy Global Inc. (United States)

- Atlas Copco AB (Sweden)

- Sany Group Co., Ltd. (China)

- Zhengzhou Coal Mining Machinery Group Co., Ltd. (China)

- XCMG Group (China)

- BEML Limited (India)

- Hyundai Heavy Industries Co., Ltd. (South Korea)

- Hitachi Construction Machinery Co., Ltd. (Japan)

- JCB (United Kingdom)

- Doosan Infracore Co., Ltd. (South Korea)

- BHP Group (Australia)

- Rio Tinto Group (United Kingdom)

- Anglo American plc (United Kingdom)

- Barrick Gold Corporation (Canada)

- Freeport-McMoRan Inc. (United States)

- China National Coal Mining Equipment Co., Ltd. (China)

- Joy Global Inc. (United States) and Other Major Players.

Global Mining Equipment Market

Base Year:

2023

Forecast Period:

2024-2032

Historical Data:

2017 to 2023

Market Size in 2023:

USD 141.99 Billion

Forecast Period 2024-32 CAGR:

5.7 %

Market Size in 2032:

USD 233.85 Billion

Segments Covered:

By Type

- Underground Mining Equipment

- Surface Mining Equipment

- Mineral Processing Machinery

- Pulverizing and Screening Equipment

- Drills & Breakers

- Others {Mineral Processing Machinery, Conveyors, Material Handling equipment’s}

By Power Source

- Diesel

- Electric

- Hybrid

- Gasoline

- Natural Gas

By Application

- Coal Mining

- Metal Mining

- Mineral Mining

- Diamond Mining

- Salt Mining

By Region

- North America (U.S., Canada, Mexico)

- Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

- Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

- Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

- Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

- South America (Brazil, Argentina, Rest of SA)

Key Market Drivers:

- Rising Usage of Electric Machinery in Mining

Key Market Restraints:

- Energy and Resource Constraints

Key Opportunities:

- Automation and Autonomous Equipment with AI and IoT Integration

Companies Covered in the report:

Caterpillar Inc. (United States), Komatsu Ltd. (Japan), Sandvik AB (Sweden), Hitachi Construction Machinery Co., Ltd. (Japan), and Other Active Players.

Global Mining Equipment Market

Base Year:

2023

Forecast Period:

2024-2032

Historical Data:

2017 to 2023

Market Size in 2023:

USD 141.99 Billion

Forecast Period 2024-32 CAGR:

5.7 %

Market Size in 2032:

USD 233.85 Billion

Segments Covered:

By Type

- Underground Mining Equipment

- Surface Mining Equipment

- Mineral Processing Machinery

- Pulverizing and Screening Equipment

- Drills & Breakers

- Others {Mineral Processing Machinery, Conveyors, Material Handling equipment’s}

By Power Source

- Diesel

- Electric

- Hybrid

- Gasoline

- Natural Gas

By Application

- Coal Mining

- Metal Mining

- Mineral Mining

- Diamond Mining

- Salt Mining

By Region

- North America (U.S., Canada, Mexico)

- Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

- Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

- Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

- Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

- South America (Brazil, Argentina, Rest of SA)

Key Market Drivers:

- Rising Usage of Electric Machinery in Mining

Key Market Restraints:

- Energy and Resource Constraints

Key Opportunities:

- Automation and Autonomous Equipment with AI and IoT Integration

Companies Covered in the report:

Caterpillar Inc. (United States), Komatsu Ltd. (Japan), Sandvik AB (Sweden), Hitachi Construction Machinery Co., Ltd. (Japan), and Other Active Players.

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Mining Equipment Market by By Type (2018-2032)

4.1 Mining Equipment Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Underground Mining Equipment

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Surface Mining Equipment

4.5 Mineral Processing Machinery

4.6 Pulverizing and Screening Equipment

4.7 Drills & Breakers

4.8 Others {Mineral Processing Machinery

4.9 Conveyors

4.10 Material Handling equipment’s}

Chapter 5: Mining Equipment Market by By Power Source (2018-2032)

5.1 Mining Equipment Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Diesel

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Electric

5.5 Hybrid

5.6 Gasoline

5.7 Natural Gas

Chapter 6: Mining Equipment Market by By Application (2018-2032)

6.1 Mining Equipment Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Coal Mining

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Metal Mining

6.5 Mineral Mining

6.6 Diamond Mining

6.7 Salt Mining

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Mining Equipment Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 CATERPILLAR INC. (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 KOMATSU LTD. (JAPAN)

7.4 SANDVIK AB (SWEDEN)

7.5 HITACHI CONSTRUCTION MACHINERY COLTD. (JAPAN)

7.6 LIEBHERR GROUP (SWITZERLAND)

7.7 EPIROC AB (SWEDEN)

7.8 VOLVO CONSTRUCTION EQUIPMENT (SWEDEN)

7.9 DOOSAN GROUP (SOUTH KOREA)

7.10 TEREX CORPORATION (UNITED STATES)

7.11 METSO OUTOTEC CORPORATION (FINLAND)

7.12 JOY GLOBAL INC. (UNITED STATES)

7.13 ATLAS COPCO AB (SWEDEN)

7.14 SANY GROUP COLTD. (CHINA)

7.15 ZHENGZHOU COAL MINING MACHINERY GROUP COLTD. (CHINA)

7.16 XCMG GROUP (CHINA)

7.17 BEML LIMITED (INDIA)

7.18 HYUNDAI HEAVY INDUSTRIES COLTD. (SOUTH KOREA)

7.19 HITACHI CONSTRUCTION MACHINERY COLTD. (JAPAN)

7.20 JCB (UNITED KINGDOM)

7.21 DOOSAN INFRACORE COLTD. (SOUTH KOREA)

7.22 BHP GROUP (AUSTRALIA)

7.23 RIO TINTO GROUP (UNITED KINGDOM)

7.24 ANGLO AMERICAN PLC (UNITED KINGDOM)

7.25 BARRICK GOLD CORPORATION (CANADA)

7.26 FREEPORT-MCMORAN INC. (UNITED STATES)

7.27 CHINA NATIONAL COAL MINING EQUIPMENT COLTD. (CHINA)

7.28 JOY GLOBAL INC. (UNITED STATES)

Chapter 8: Global Mining Equipment Market By Region

8.1 Overview

8.2. North America Mining Equipment Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Type

8.2.4.1 Underground Mining Equipment

8.2.4.2 Surface Mining Equipment

8.2.4.3 Mineral Processing Machinery

8.2.4.4 Pulverizing and Screening Equipment

8.2.4.5 Drills & Breakers

8.2.4.6 Others {Mineral Processing Machinery

8.2.4.7 Conveyors

8.2.4.8 Material Handling equipment’s}

8.2.5 Historic and Forecasted Market Size By By Power Source

8.2.5.1 Diesel

8.2.5.2 Electric

8.2.5.3 Hybrid

8.2.5.4 Gasoline

8.2.5.5 Natural Gas

8.2.6 Historic and Forecasted Market Size By By Application

8.2.6.1 Coal Mining

8.2.6.2 Metal Mining

8.2.6.3 Mineral Mining

8.2.6.4 Diamond Mining

8.2.6.5 Salt Mining

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Mining Equipment Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Type

8.3.4.1 Underground Mining Equipment

8.3.4.2 Surface Mining Equipment

8.3.4.3 Mineral Processing Machinery

8.3.4.4 Pulverizing and Screening Equipment

8.3.4.5 Drills & Breakers

8.3.4.6 Others {Mineral Processing Machinery

8.3.4.7 Conveyors

8.3.4.8 Material Handling equipment’s}

8.3.5 Historic and Forecasted Market Size By By Power Source

8.3.5.1 Diesel

8.3.5.2 Electric

8.3.5.3 Hybrid

8.3.5.4 Gasoline

8.3.5.5 Natural Gas

8.3.6 Historic and Forecasted Market Size By By Application

8.3.6.1 Coal Mining

8.3.6.2 Metal Mining

8.3.6.3 Mineral Mining

8.3.6.4 Diamond Mining

8.3.6.5 Salt Mining

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Mining Equipment Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Type

8.4.4.1 Underground Mining Equipment

8.4.4.2 Surface Mining Equipment

8.4.4.3 Mineral Processing Machinery

8.4.4.4 Pulverizing and Screening Equipment

8.4.4.5 Drills & Breakers

8.4.4.6 Others {Mineral Processing Machinery

8.4.4.7 Conveyors

8.4.4.8 Material Handling equipment’s}

8.4.5 Historic and Forecasted Market Size By By Power Source

8.4.5.1 Diesel

8.4.5.2 Electric

8.4.5.3 Hybrid

8.4.5.4 Gasoline

8.4.5.5 Natural Gas

8.4.6 Historic and Forecasted Market Size By By Application

8.4.6.1 Coal Mining

8.4.6.2 Metal Mining

8.4.6.3 Mineral Mining

8.4.6.4 Diamond Mining

8.4.6.5 Salt Mining

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Mining Equipment Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Type

8.5.4.1 Underground Mining Equipment

8.5.4.2 Surface Mining Equipment

8.5.4.3 Mineral Processing Machinery

8.5.4.4 Pulverizing and Screening Equipment

8.5.4.5 Drills & Breakers

8.5.4.6 Others {Mineral Processing Machinery

8.5.4.7 Conveyors

8.5.4.8 Material Handling equipment’s}

8.5.5 Historic and Forecasted Market Size By By Power Source

8.5.5.1 Diesel

8.5.5.2 Electric

8.5.5.3 Hybrid

8.5.5.4 Gasoline

8.5.5.5 Natural Gas

8.5.6 Historic and Forecasted Market Size By By Application

8.5.6.1 Coal Mining

8.5.6.2 Metal Mining

8.5.6.3 Mineral Mining

8.5.6.4 Diamond Mining

8.5.6.5 Salt Mining

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Mining Equipment Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Type

8.6.4.1 Underground Mining Equipment

8.6.4.2 Surface Mining Equipment

8.6.4.3 Mineral Processing Machinery

8.6.4.4 Pulverizing and Screening Equipment

8.6.4.5 Drills & Breakers

8.6.4.6 Others {Mineral Processing Machinery

8.6.4.7 Conveyors

8.6.4.8 Material Handling equipment’s}

8.6.5 Historic and Forecasted Market Size By By Power Source

8.6.5.1 Diesel

8.6.5.2 Electric

8.6.5.3 Hybrid

8.6.5.4 Gasoline

8.6.5.5 Natural Gas

8.6.6 Historic and Forecasted Market Size By By Application

8.6.6.1 Coal Mining

8.6.6.2 Metal Mining

8.6.6.3 Mineral Mining

8.6.6.4 Diamond Mining

8.6.6.5 Salt Mining

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Mining Equipment Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Type

8.7.4.1 Underground Mining Equipment

8.7.4.2 Surface Mining Equipment

8.7.4.3 Mineral Processing Machinery

8.7.4.4 Pulverizing and Screening Equipment

8.7.4.5 Drills & Breakers

8.7.4.6 Others {Mineral Processing Machinery

8.7.4.7 Conveyors

8.7.4.8 Material Handling equipment’s}

8.7.5 Historic and Forecasted Market Size By By Power Source

8.7.5.1 Diesel

8.7.5.2 Electric

8.7.5.3 Hybrid

8.7.5.4 Gasoline

8.7.5.5 Natural Gas

8.7.6 Historic and Forecasted Market Size By By Application

8.7.6.1 Coal Mining

8.7.6.2 Metal Mining

8.7.6.3 Mineral Mining

8.7.6.4 Diamond Mining

8.7.6.5 Salt Mining

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Mining Equipment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 141.99 Billion |

|

Forecast Period 2024-32 CAGR: |

5.7 % |

Market Size in 2032: |

USD 233.85 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Power Source |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Caterpillar Inc. (United States), Komatsu Ltd. (Japan), Sandvik AB (Sweden), Hitachi Construction Machinery Co., Ltd. (Japan), and Other Active Players. |

||

Frequently Asked Questions :

The forecast period in the Mining equipment’s Market research report is 2024-2032.

Caterpillar Inc. (United States), Komatsu Ltd. (Japan), Sandvik AB (Sweden), Hitachi Construction Machinery Co., Ltd. (Japan), Liebherr Group (Switzerland), Epiroc AB (Sweden), Volvo Construction Equipment (Sweden), Doosan Group (South Korea), Terex Corporation (United States), Metso Outotec Corporation (Finland), Joy Global Inc. (United States), Atlas Copco AB (Sweden), Sany Group Co., Ltd. (China), Zhengzhou Coal Mining Machinery Group Co., Ltd. (China), XCMG Group (China), BEML Limited (India), Hyundai Heavy Industries Co., Ltd. (South Korea), Hitachi Construction Machinery Co., Ltd. (Japan), JCB (United Kingdom), Doosan Infracore Co., Ltd. (South Korea), BHP Group (Australia), Rio Tinto Group (United Kingdom), Anglo American plc (United Kingdom), Barrick Gold Corporation (Canada), Freeport-McMoRan Inc. (United States), China National Coal Mining Equipment Co., Ltd. (China), Joy Global Inc. (United States) and Other Active Players.

The Mining Equipment Market is segmented into Type, Power Source, Application, and region. By Type, the market is categorized into Underground Mining Equipment, Surface Mining Equipment, Mineral Processing Machinery, Pulverizing and Screening Equipment, Drills & Breakers, And Others {Mineral Processing Machinery, Conveyors, Material Handling Equipment}. By Power Source, the market is categorized into Diesel, Electric, Hybrid, Gasoline, Natural Gas, And Power Source. By Application, the market is categorized into Coal Mining, Metal Mining, Mineral Mining, Diamond Mining, Salt Mining. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Equipment used for mining consists of machinery and tools designed to extract minerals and geological substances. It includes a range of machines for tasks in mining such as exploring, extracting, processing, and transporting. Different types of equipment consist of drilling machines, excavators, loaders, haul trucks, and crushers. These tools are necessary for obtaining mineral deposits and transporting earth and rock effectively.

Mining equipment’s Market Size Was Valued at USD 141.99 Billion in 2023, and is Projected to Reach USD 233.85 Billion by 2032, Growing at a CAGR of 5.7% From 2024-2032.