Motorcycle Antilock Braking System (ABS) Market Overview

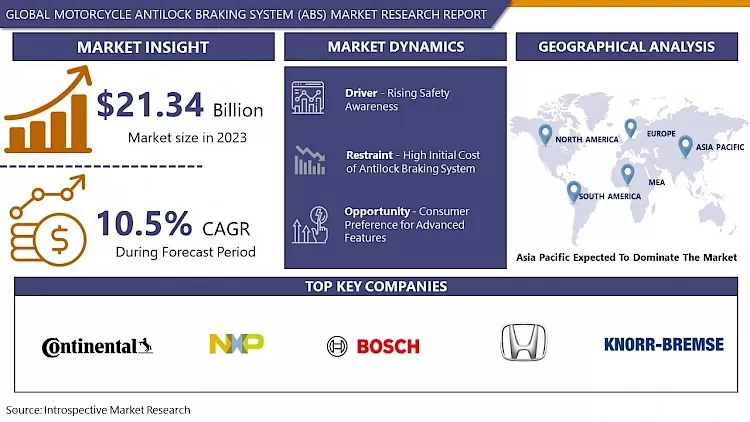

Motorcycle Antilock Braking System (ABS) Market size is expected to grow from USD 21.34 Billion in 2023 to USD 52.41 Billion by 2032, at a CAGR of 10.5% during the forecast period (2024-2032).

The Motorcycle Antilock Braking System (ABS) Market refers to the segment of the automotive industry focused on producing, implementing, and enhancing ABS technology specifically tailored for motorcycles. ABS is a safety feature designed to prevent wheels from locking up during braking, thereby maintaining traction and stability on the road.

-

This system works by modulating brake pressure to each wheel independently, ensuring that the rider can maintain control and maneuverability even in emergency braking situations or slippery road conditions. The Motorcycle ABS Market encompasses a range of manufacturers, suppliers, and innovators striving to improve rider safety through the advancement and adoption of ABS technology in motorcycles.

- Safety features become important in the motorcycle industry as riders actively seek advanced mechanisms to mitigate risks associated with abrupt braking. Global rules and regulation frameworks are influencing the market. Motorcycle manufacturers are increasing the ABS systems in their models.

- The global Motorcycle ABS market is rising along with technological innovations, with manufacturers investing in research and development to introduce advanced ABS systems featuring enhanced performance, responsiveness, and adaptability to diverse riding conditions.

- The Motorcycle ABS market is experiencing growth in focus with rider safety and regulation for safety features, and continuous technological advancements. The integration of ABS systems in motorcycles has become important due to improved rider safety and road safety standards.

Motorcycle Antilock Braking System (ABS) Market Trend Analysis:

Rising Safety Awareness

- The Motorcycle Antilock Braking System (ABS) market is growing due to increased safety awareness among riders. ABS technology prevents wheel lock-up during braking, ensuring optimal traction and stability driving the demand for advanced safety features in motorcycles. Safety Awareness has transformed ABS from a desirable feature to a fundamental component in the motorcycle industry. Motorcycle enthusiasts and safety-conscious consumers actively seek ABS-equipped bikes, prompting manufacturers to make ABS a standard feature in their models. The evolving perception of ABS as a vital safety mechanism aligns with the broader trend of prioritizing rider safety, contributing significantly to the market's growth.

Consumer Preference for Advanced Features

- Consumer preference for advanced features represents a significant opportunity factor for the Motorcycle Antilock Braking System (ABS) Market. Consumers are increasingly valuing safety and technological advancements in their vehicles, and the demand for motorcycles equipped with ABS has seen a prominent growth. Modern consumers are more conscious about their well-being on the road, and ABS has emerged as a key safety feature that enhances braking performance and overall motorcycle safety.

- The growing awareness of the benefits of ABS, such as preventing wheel lock-up during sudden braking, gives consumers confidence in their ability to handle diverse riding conditions. Motorcycle manufacturers gain a competitive advantage by aligning products with evolving consumer preferences for enhanced safety features. The changing mindset drives market growth for ABS systems, prompting manufacturers to include them as standard or optional features in a broader range of models

Motorcycle Antilock Braking System (ABS) Market Segment Analysis:

Motorcycle Antilock Braking System (ABS) Market Segmented based on Type, Motorcycle type, Component, Technology, Distribution Channel and End-user

By Type, Large Displacement segment is expected to dominate the market during the forecast Period

- Larger displacement motorcycles are associated with higher-performance machines, appealing to motorcycle enthusiasts who prioritize power and advanced features. These motorcycles are favored for long-distance touring, cruising, and sports riding, contributing to a robust market demand. The Large Displacement segment is linked to premium and luxury motorcycle categories, where riders are willing to invest in cutting-edge technology and top-notch performance. The demand for these high-end motorcycles is obsessed by a combination of the thrill-seeking desires of riders and the perception of larger displacement bikes as status symbols. Manufacturers in the Large Displacement segment goal to capitalize on consumers' willingness to pay a premium for superior performance, comfort, and innovative features.

Motorcycle Antilock Braking System (ABS) Market Regional Insights:

Asia Pacific is expected to dominate the Market over the Forecast Period

- Asia Pacific is expected to dominate the Motorcycle Antilock Braking System (ABS) market due to rising disposable incomes, urbanization, and a growing middle class, highlighting its crucial role in the global motorcycle industry. Countries like India, China, and Southeast Asian nations have witnessed a surge in motorcycle sales, fuelled by increasing urbanization and the need for affordable and efficient transportation. As the motorcycle market expands, the demand for safety features like ABS reflects a growing awareness of the importance of rider safety. Government initiatives and regulations are contributing to Asia Pacific's dominance in the ABS market. Several countries in the region have implemented or are considering regulations that mandate the inclusion of ABS in motorcycles above a certain displacement. These regulatory pushes align with a broader global trend toward enhancing road safety and contribute to the widespread adoption of ABS in the region.

- The motorcycle culture in Asia Pacific prioritizes performance and safety, leading to a growing demand for advanced safety features like ABS. Motorcycle manufacturers in the region are responding to the demand by integrating ABS into a wide range of models, from entry-level to premium bikes. The Asia Pacific dominates the Motorcycle ABS market due to its growing market, supportive government policies, and evolving safety-conscious consumer base. As the leader in motorcycle production and consumption, it can influence domestic and international market trends and determine ABS adoption.

Key Players Covered in Motorcycle Antilock Braking System (ABS) Market:

- Bosch (Germany)

- Continental (Germany)

- Knorr-Bremse (Germany)

- ZF Friedrichshafen (Germany)

- BMW (Germany)

- NXP (Netherlands)

- Honda (Japan)

- Aisin Corporation (Japan)

- Hitachi (Japan)

- Johnson Electric Group (China), and Other Major Players

Key Industry Developments in the Motorcycle Antilock Braking System (ABS) Market:

- In October 2023, Hitachi Astemo, Ltd. will participate in EICMA 2023, a major global motorcycle exhibition in Milan, Italy, from November 7–12. The company will showcase diverse technologies and products, focusing on ADAS and EVs, to innovate motorcycles for carbon neutrality and enhanced comfort.

- In August 2023 – Bosch, a global leader in technology and engineering solutions, proudly announces its groundbreaking range of modular Motorcycle Stability Control (MSC) solutions. These cutting-edge systems, tailored to diverse application needs, combine Advanced Braking Systems (ABS) with state-of-the-art Inertial Measurement Units (IMU) for unprecedented performance and safety.

|

Global Motorcycle Antilock Braking System (ABS) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 21.34 Bn |

|

Forecast Period 2024-32 CAGR: |

10.5% |

Market Size in 2032: |

USD 52.41 Bn |

|

Segments Covered: |

By Type |

|

|

|

By Motorcycle Type |

|

||

|

By Component |

|

||

|

By Technology |

|

||

|

By Distribution Channel |

|

||

|

By End-user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Motorcycle Antilock Braking System (ABS) Market by By Type (2018-2032)

4.1 Motorcycle Antilock Braking System (ABS) Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Large Displacement

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Small Displacement

Chapter 5: Motorcycle Antilock Braking System (ABS) Market by By Motorcycle Type (2018-2032)

5.1 Motorcycle Antilock Braking System (ABS) Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Sport Bikes

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Touring Bikes

5.5 Off-road Motorcycles

5.6 Cruisers

Chapter 6: Motorcycle Antilock Braking System (ABS) Market by By Component (2018-2032)

6.1 Motorcycle Antilock Braking System (ABS) Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Sensors

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Electronic Control Unit

6.5 Hydraulic Unit

Chapter 7: Motorcycle Antilock Braking System (ABS) Market by By Technology (2018-2032)

7.1 Motorcycle Antilock Braking System (ABS) Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Single Channel ABS

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Dual Channel ABS

Chapter 8: Motorcycle Antilock Braking System (ABS) Market by By Distribution Channel (2018-2032)

8.1 Motorcycle Antilock Braking System (ABS) Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Online Retail

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Offline Retail

Chapter 9: Motorcycle Antilock Braking System (ABS) Market by By End-user (2018-2032)

9.1 Motorcycle Antilock Braking System (ABS) Market Snapshot and Growth Engine

9.2 Market Overview

9.3 OEM

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

9.3.3 Key Market Trends, Growth Factors, and Opportunities

9.3.4 Geographic Segmentation Analysis

9.4 Aftermarket

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 Motorcycle Antilock Braking System (ABS) Market Share by Manufacturer (2024)

10.1.3 Industry BCG Matrix

10.1.4 Heat Map Analysis

10.1.5 Mergers and Acquisitions

10.2 AMERICAN SPIRALWELD PIPE COMPANY (U.S)

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Key Strategic Moves and Recent Developments

10.2.10 SWOT Analysis

10.3 EVRAZ (U.K)

10.4 EUROPIPE GROUP (GERMANY)

10.5 BORUSAN MANNESMANN (TURKEY)

10.6 TENARIS (LUXEMBOURG)

10.7 BAOJI PETROLEUM STEEL PIPE (CHINA)

10.8 JFE (JAPAN)

10.9 JINDAL SAW LTD (INDIA)

10.10 ESSAR STEEL (INDIA)

10.11 JIANGSU YULONG STEEL PIPE (CHINA)

10.12 ZHEJIANG KINGLAND (CHINA)

10.13 SHENGLI OIL & GAS PIPE (CHINA)

10.14 CNPC BOHAI EQUIPMENT MANUFACTURING (CHINA)

10.15 CHU KONG PIPE (CHINA)

10.16 BAOSTEEL (CHINA)

10.17

Chapter 11: Global Motorcycle Antilock Braking System (ABS) Market By Region

11.1 Overview

11.2. North America Motorcycle Antilock Braking System (ABS) Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecasted Market Size By By Type

11.2.4.1 Large Displacement

11.2.4.2 Small Displacement

11.2.5 Historic and Forecasted Market Size By By Motorcycle Type

11.2.5.1 Sport Bikes

11.2.5.2 Touring Bikes

11.2.5.3 Off-road Motorcycles

11.2.5.4 Cruisers

11.2.6 Historic and Forecasted Market Size By By Component

11.2.6.1 Sensors

11.2.6.2 Electronic Control Unit

11.2.6.3 Hydraulic Unit

11.2.7 Historic and Forecasted Market Size By By Technology

11.2.7.1 Single Channel ABS

11.2.7.2 Dual Channel ABS

11.2.8 Historic and Forecasted Market Size By By Distribution Channel

11.2.8.1 Online Retail

11.2.8.2 Offline Retail

11.2.9 Historic and Forecasted Market Size By By End-user

11.2.9.1 OEM

11.2.9.2 Aftermarket

11.2.10 Historic and Forecast Market Size by Country

11.2.10.1 US

11.2.10.2 Canada

11.2.10.3 Mexico

11.3. Eastern Europe Motorcycle Antilock Braking System (ABS) Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecasted Market Size By By Type

11.3.4.1 Large Displacement

11.3.4.2 Small Displacement

11.3.5 Historic and Forecasted Market Size By By Motorcycle Type

11.3.5.1 Sport Bikes

11.3.5.2 Touring Bikes

11.3.5.3 Off-road Motorcycles

11.3.5.4 Cruisers

11.3.6 Historic and Forecasted Market Size By By Component

11.3.6.1 Sensors

11.3.6.2 Electronic Control Unit

11.3.6.3 Hydraulic Unit

11.3.7 Historic and Forecasted Market Size By By Technology

11.3.7.1 Single Channel ABS

11.3.7.2 Dual Channel ABS

11.3.8 Historic and Forecasted Market Size By By Distribution Channel

11.3.8.1 Online Retail

11.3.8.2 Offline Retail

11.3.9 Historic and Forecasted Market Size By By End-user

11.3.9.1 OEM

11.3.9.2 Aftermarket

11.3.10 Historic and Forecast Market Size by Country

11.3.10.1 Russia

11.3.10.2 Bulgaria

11.3.10.3 The Czech Republic

11.3.10.4 Hungary

11.3.10.5 Poland

11.3.10.6 Romania

11.3.10.7 Rest of Eastern Europe

11.4. Western Europe Motorcycle Antilock Braking System (ABS) Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecasted Market Size By By Type

11.4.4.1 Large Displacement

11.4.4.2 Small Displacement

11.4.5 Historic and Forecasted Market Size By By Motorcycle Type

11.4.5.1 Sport Bikes

11.4.5.2 Touring Bikes

11.4.5.3 Off-road Motorcycles

11.4.5.4 Cruisers

11.4.6 Historic and Forecasted Market Size By By Component

11.4.6.1 Sensors

11.4.6.2 Electronic Control Unit

11.4.6.3 Hydraulic Unit

11.4.7 Historic and Forecasted Market Size By By Technology

11.4.7.1 Single Channel ABS

11.4.7.2 Dual Channel ABS

11.4.8 Historic and Forecasted Market Size By By Distribution Channel

11.4.8.1 Online Retail

11.4.8.2 Offline Retail

11.4.9 Historic and Forecasted Market Size By By End-user

11.4.9.1 OEM

11.4.9.2 Aftermarket

11.4.10 Historic and Forecast Market Size by Country

11.4.10.1 Germany

11.4.10.2 UK

11.4.10.3 France

11.4.10.4 The Netherlands

11.4.10.5 Italy

11.4.10.6 Spain

11.4.10.7 Rest of Western Europe

11.5. Asia Pacific Motorcycle Antilock Braking System (ABS) Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecasted Market Size By By Type

11.5.4.1 Large Displacement

11.5.4.2 Small Displacement

11.5.5 Historic and Forecasted Market Size By By Motorcycle Type

11.5.5.1 Sport Bikes

11.5.5.2 Touring Bikes

11.5.5.3 Off-road Motorcycles

11.5.5.4 Cruisers

11.5.6 Historic and Forecasted Market Size By By Component

11.5.6.1 Sensors

11.5.6.2 Electronic Control Unit

11.5.6.3 Hydraulic Unit

11.5.7 Historic and Forecasted Market Size By By Technology

11.5.7.1 Single Channel ABS

11.5.7.2 Dual Channel ABS

11.5.8 Historic and Forecasted Market Size By By Distribution Channel

11.5.8.1 Online Retail

11.5.8.2 Offline Retail

11.5.9 Historic and Forecasted Market Size By By End-user

11.5.9.1 OEM

11.5.9.2 Aftermarket

11.5.10 Historic and Forecast Market Size by Country

11.5.10.1 China

11.5.10.2 India

11.5.10.3 Japan

11.5.10.4 South Korea

11.5.10.5 Malaysia

11.5.10.6 Thailand

11.5.10.7 Vietnam

11.5.10.8 The Philippines

11.5.10.9 Australia

11.5.10.10 New Zealand

11.5.10.11 Rest of APAC

11.6. Middle East & Africa Motorcycle Antilock Braking System (ABS) Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecasted Market Size By By Type

11.6.4.1 Large Displacement

11.6.4.2 Small Displacement

11.6.5 Historic and Forecasted Market Size By By Motorcycle Type

11.6.5.1 Sport Bikes

11.6.5.2 Touring Bikes

11.6.5.3 Off-road Motorcycles

11.6.5.4 Cruisers

11.6.6 Historic and Forecasted Market Size By By Component

11.6.6.1 Sensors

11.6.6.2 Electronic Control Unit

11.6.6.3 Hydraulic Unit

11.6.7 Historic and Forecasted Market Size By By Technology

11.6.7.1 Single Channel ABS

11.6.7.2 Dual Channel ABS

11.6.8 Historic and Forecasted Market Size By By Distribution Channel

11.6.8.1 Online Retail

11.6.8.2 Offline Retail

11.6.9 Historic and Forecasted Market Size By By End-user

11.6.9.1 OEM

11.6.9.2 Aftermarket

11.6.10 Historic and Forecast Market Size by Country

11.6.10.1 Turkiye

11.6.10.2 Bahrain

11.6.10.3 Kuwait

11.6.10.4 Saudi Arabia

11.6.10.5 Qatar

11.6.10.6 UAE

11.6.10.7 Israel

11.6.10.8 South Africa

11.7. South America Motorcycle Antilock Braking System (ABS) Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecasted Market Size By By Type

11.7.4.1 Large Displacement

11.7.4.2 Small Displacement

11.7.5 Historic and Forecasted Market Size By By Motorcycle Type

11.7.5.1 Sport Bikes

11.7.5.2 Touring Bikes

11.7.5.3 Off-road Motorcycles

11.7.5.4 Cruisers

11.7.6 Historic and Forecasted Market Size By By Component

11.7.6.1 Sensors

11.7.6.2 Electronic Control Unit

11.7.6.3 Hydraulic Unit

11.7.7 Historic and Forecasted Market Size By By Technology

11.7.7.1 Single Channel ABS

11.7.7.2 Dual Channel ABS

11.7.8 Historic and Forecasted Market Size By By Distribution Channel

11.7.8.1 Online Retail

11.7.8.2 Offline Retail

11.7.9 Historic and Forecasted Market Size By By End-user

11.7.9.1 OEM

11.7.9.2 Aftermarket

11.7.10 Historic and Forecast Market Size by Country

11.7.10.1 Brazil

11.7.10.2 Argentina

11.7.10.3 Rest of SA

Chapter 12 Analyst Viewpoint and Conclusion

12.1 Recommendations and Concluding Analysis

12.2 Potential Market Strategies

Chapter 13 Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

|

Global Motorcycle Antilock Braking System (ABS) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 21.34 Bn |

|

Forecast Period 2024-32 CAGR: |

10.5% |

Market Size in 2032: |

USD 52.41 Bn |

|

Segments Covered: |

By Type |

|

|

|

By Motorcycle Type |

|

||

|

By Component |

|

||

|

By Technology |

|

||

|

By Distribution Channel |

|

||

|

By End-user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Motorcycle Antilock Braking System (ABS) Market research report is 2024-2032.

Bosch (Germany), Continental (Germany), Knorr-Bremse (Germany), ZF Friedrichshafen (Germany), BMW (Germany), NXP (Netherlands), Honda (Japan), Aisin Corporation (Japan), Hitachi (Japan), and Johnson Electric Group (China), and Other Major Players.

The Motorcycle Antilock Braking System (ABS) Market is segmented into Type, Motorcycle type, Component, Technology, Distribution Channel, End-user, and region. By Type, the market is categorized as Large Displacement and Small Displacement. By Motorcycle type, the market is categorized into Sport Bikes, Touring Bikes, Off-road Motorcycles and Cruisers. By Component, the market is categorized into Sensors, Electronic Control Units, and Hydraulic Units. By Technology, the market is categorized into Single Channel ABS and Dual Channel ABS. By Distribution Channel, the market is categorized into Online Retail and Offline Retail. By End-Users, the market is categorized into OEM and Aftermarket. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Motorcycle Anti-Lock Braking System (ABS) is a safety feature designed to prevent wheel lock-up during braking, enhancing rider control and reducing the risk of accidents. ABS utilizes sensors to monitor wheel speed and automatically modulates brake pressure, preventing skidding and maintaining traction on slippery surfaces. The locking system intervenes by momentarily releasing and reapplying brake pressure, allowing the rider to maintain steering control.

Motorcycle Antilock Braking System (ABS) Market size is expected to grow from USD 21.34 Billion in 2023 to USD 52.41 Billion by 2032, at a CAGR of 10.5% during the forecast period (2024-2032).