Non-Invasive Blood Glucose Monitoring Device Market Synopsis

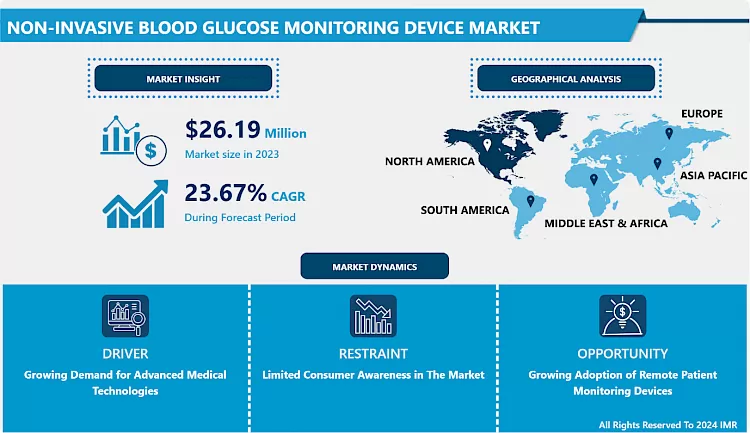

Non-Invasive Blood Glucose Monitoring Device Market Size was valued at USD 26.19 Million in 2023, and is Projected to Reach USD 177.22 Million by 2032, Growing at a CAGR of 23.67% From 2024-2032.

The global Non-Invasive Blood Glucose Monitoring Device Market refers to the industry focused on developing, manufacturing, and distributing advanced medical devices designed to measure blood glucose levels without the need for invasive techniques like traditional fingerpricking. These devices utilize innovative technologies such as optical sensors, microneedles, electrochemical sensors, and spectroscopy-based methods to provide real-time glucose monitoring with minimal discomfort.

- The non-invasive blood glucose monitoring device market is experiencing rapid growth, driven by the increasing global prevalence of diabetes and the demand for convenient, pain-free glucose monitoring solutions. With over 557 million individuals affected by diabetes worldwide in 2023, the need for frequent blood glucose monitoring has become a cornerstone of effective disease management. Traditional invasive methods, which rely on finger-prick tests, are often associated with pain, risk of infection, and patient discomfort.

- These challenges have spurred the development and adoption of non-invasive technologies, which offer a promising alternative by measuring glucose levels without the need to draw blood. Utilizing advanced techniques such as optical sensors, electromagnetic technologies, and transdermal biosensors, these devices provide accurate, continuous monitoring in real-time, enhancing both patient adherence and overall diabetes management. Technological advancements play a pivotal role in the growth of this market, with wearable devices emerging as a transformative solution.

- The non-invasive blood glucose monitoring device market is poised for sustained growth, driven by technological innovation, regulatory support, and rising consumer demand for pain-free, efficient glucose monitoring solutions. These devices address the limitations of invasive methods and also redefine diabetes management by enhancing patient comfort, improving health outcomes, and reducing healthcare burdens. With continuous advancements in sensor technology, data processing, and device integration, the non- invasive blood glucose monitoring device market is set to play a transformative role in the global fight against diabetes.

Non-Invasive Blood Glucose Monitoring Device Market Trend Analysis

Rising Geriatric Population with Diabetes and Related Disorders

- The global increase in the geriatric population is driving demand for Non-Invasive Blood Glucose Monitoring Devices. In 2023, the U.S. had 231,361 individuals under 55 years, representing 70% of the population, while those aged 55-59 and 60-64 accounted for 6.2% and 6.4%. China's elderly population is also rising, with 216.8 million people aged 65 and older, making up 15.4% of its total. This demographic shift highlights the urgent need for healthcare solutions for older adults, particularly those managing chronic conditions like diabetes.

- Diabetes poses a major issue for the aging global population, especially the elderly. With 21.3% of EU individuals being 65 or older in 2023, there is an increasing need for effective diabetes care. User-friendly, non-invasive blood glucose monitoring devices are crucial for seniors averse to traditional methods. The growing global geriatric population, especially in China, the EU, and the US, is driving the expansion of non-invasive blood glucose monitoring devices. As the elderly population in Germany is projected to reach nearly one-third by 2050, there will be an increased demand for user-friendly diabetes management solutions. This trend presents significant growth opportunities for the market as healthcare aims to enhance the quality of life for older adults.

- Germany's aging population aged 65 and above has shown a steady increase from 2019 to 2023. In 2019, this demographic accounted for 21.73% of the population, rising to 21.96% in 2020, 22.17% in 2021, 22.41% in 2022, and reaching 22.74% in 2023. This upward trend reflects a growing need for healthcare solutions tailored to older individuals.

- The aging population correlates with an increased prevalence of chronic conditions, including diabetes, which disproportionately affects older adults. As such, the market for non-invasive blood glucose monitoring devices is poised for significant growth in Germany. These devices offer a pain-free, convenient solution for monitoring blood sugar levels, seek user-friendly and less intrusive healthcare technologies. The consistent rise in the aging population highlights the expanding demand for such innovations, making Germany a key market for non-invasive blood glucose monitoring solutions in the coming years.

Integration of Data Analytics and Artificial Intelligence for Personalized Care

- Data analytics and AI are transforming the non-invasive blood glucose monitoring market, creating opportunities for innovation. As demand for personalized healthcare grows, AI devices like Actxa's BGEM leverage cloud algorithms for continuous glucose monitoring through non- invasive sensors. These technologies offer real-time insights for early detection of abnormalities, enabling timely interventions. By analyzing vast health data and recognizing glucose patterns, they enhance preventive care and proactive health management.

- AI's capacity to analyze extensive health data is enhancing glucose monitoring by making it more accurate and personalized. AI-powered devices, particularly those utilizing photoplethysmography (PPG) sensors, surpass traditional finger-stick tests in accuracy and convenience. Continuous data analysis identifies subtle glucose fluctuations, aiding healthcare providers in delivering tailored care. As AI evolves, it promises to improve early prediction and prevention of health risks, advancing non-invasive glucose monitoring's effectiveness. The noninvasive glucose monitoring market will benefit from the increasing use of AI and data analytics, improving convenience, cost-effectiveness and scalability. As diabetes increases globally, noninvasive and user-friendly solutions are urgently needed. Devices such as SugarBEAT and UBand enable continuous monitoring, empowering individuals.

Non-Invasive Blood Glucose Monitoring Device Market Segment Analysis:

Non-Invasive Blood Glucose Monitoring Device Market is segmented on the basis of Type, Technology, Application, End-User, Distribution Channel, and Region

By Technology, Optical Technologies segment is expected to dominate the market during the forecast period

- The Optical Technologies segment is anticipated to lead the Non-Invasive Blood Glucose Monitoring Device market during the forecast period due to its ability to provide accurate and pain-free glucose monitoring. Optical technologies, such as near-infrared spectroscopy and Raman spectroscopy, allow for non-invasive measurement by analyzing light interactions with tissues, eliminating the need for blood samples. This method enhances patient comfort and convenience, a key factor driving adoption, especially among diabetic patients who require frequent monitoring.

- Advancements in optical sensor technologies have improved accuracy, making them increasingly reliable for glucose measurement. As these devices become more affordable and portable, they are gaining popularity among both consumers and healthcare providers. The potential to reduce healthcare costs associated with traditional invasive methods further propels the growth of this segment. Thus, the benefits of accuracy, ease of use, and cost-effectiveness are expected to make optical technologies a dominant force in the market.

By Type, Wearable Devices segment held the largest share of 39.03% in 2023

- The Wearable Devices segment dominated the Glucose Monitoring Device Market in 2023, capturing the largest share of 39.03%. This growth is primarily attributed to the increasing demand for continuous glucose monitoring (CGM) systems, which offer real-time tracking and ease of use. These devices, often integrated with mobile applications, enable patients to monitor glucose levels efficiently, reducing the need for frequent finger-prick tests. The rise in diabetes prevalence, coupled with technological advancements, has spurred the adoption of these devices, particularly among younger, tech-savvy individuals and those requiring proactive diabetes management.

- Wearable glucose monitors align with the broader trend of personalized healthcare, providing actionable insights and better glycemic control. Their integration with other health-monitoring devices, such as fitness trackers and smartwatches, enhances convenience and usability. These factors, along with increased awareness and government initiatives promoting advanced diabetes care, are expected to sustain the dominance of this segment throughout the forecast period.

Non-Invasive Blood Glucose Monitoring Device Market Regional Insights:

- North America is Expected to Dominate the Market Over the Forecast period North America, mainly comprising Canada, the U.S., and Mexico, is a diverse and economically vital region. As of December 12, 2024, its population is about 615 million, with the U.S. being the largest in population and economy, representing nearly 57%. It is bordered by the Arctic Ocean, Atlantic Ocean, Pacific Ocean, and South America to the southeast. North America saw notable population growth, rising from 565 million in 2016 to over 613 million in 2024, projected to reach 713.7 million by 2083. Major urban centers like New York and Mexico City play key roles economically, as the region is among the wealthiest globally.

- The United States leads in technology and finance, while Canada and Mexico add value through resources and trade. North America's diverse landscapes include Arctic tundra and deserts. The region faces health challenges, notably a 14% diabetes prevalence, with a projected 24% increase by 2045, resulting in substantial costs and mortality. Despite these issues, North America remains crucial globally for population, economy, and health.

Non-Invasive Blood Glucose Monitoring Device Market Top Key Players:

- Aerbetic (U.S.)

- Afon Technology (United Kingdom)

- Bobang Fangzhou Medical Technology (Beijing) Co., Ltd. (China)

- Cnoga (Israel)

- Diamontech Ag (Germany)

- Eyva (India)

- Glucorx Limited (United Kingdom)

- Hagar (Gwave) (Israel)

- Know Labs, Inc. (U.S.)

- Lifeplus (U.S.)

- Liom (Switzerland)

- Mimos Berhad (Malaysia)

- Nemaura Medical (U.S)

- Noviosense Bv (Netherland)

- Occuity (United Kingdom)

- Pkvitality (France)

- Quantum Operation Inc. (Japan)

- Rsp System (Denmark)

- Shinsei Corporation (Japan)

- Sibionics (China), Other Active Players

Key Industry Developments in the Non-Invasive Blood Glucose Monitoring Device Market:

- In December 2024, Liom, formerly Spiden, announced significant progress in non-invasive glucose monitoring, achieving accurate glucose measurements without invasive calibration. In 2024, the company demonstrated a MARD of 14.5%, with potential for further improvement. Liom raised over USD 55m in funding and secured over USD 25m in its Series A. The company plans to develop a wrist-worn prototype for testing by 2025 and aims for a product launch by mid-2027. Liom’s technology aims to revolutionize health monitoring with light- and AI-driven wearables.

- In April 2023, MIMOS, Malaysia's applied research agency, launched GlucoSenz, a non-invasive blood glucose monitor, after seven years of development. The device used chemometric methods and photonics technology to analyze near-infrared absorbances from a user’s thumb, eliminating the need for finger-pricking. Expected to reach the public by year-end 2024, GlucoSenz promises improved safety for healthcare workers.

|

Non-Invasive Blood Glucose Monitoring Device Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 26.19 Mn. |

|

Forecast Period 2024-32 CAGR: |

23.67% |

Market Size in 2032: |

USD 177.22 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Non-Invasive Blood Glucose Monitoring Device Market by By Type (2018-2032)

4.1 Non-Invasive Blood Glucose Monitoring Device Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Wearable Devices

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Portable Devices

4.5 Stationary Devices

4.6 Breath Analysis Devices

4.7 Transdermal Devices

Chapter 5: Non-Invasive Blood Glucose Monitoring Device Market by By Technology (2018-2032)

5.1 Non-Invasive Blood Glucose Monitoring Device Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Optical Technologies

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Electromagnetic & Electric Techniques

Chapter 6: Non-Invasive Blood Glucose Monitoring Device Market by By Application (2018-2032)

6.1 Non-Invasive Blood Glucose Monitoring Device Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Diabetes Monitoring

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Pre-Diabetes Monitoring

6.5 Gestational Diabetes Monitoring

6.6 Others

Chapter 7: Non-Invasive Blood Glucose Monitoring Device Market by By End-User (2018-2032)

7.1 Non-Invasive Blood Glucose Monitoring Device Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Hospitals & Clinics

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Home Care Settings

7.5 Clinical Research Organizations

7.6 Fitness Centers & Gyms

Chapter 8: Non-Invasive Blood Glucose Monitoring Device Market by By Distribution Channel (2018-2032)

8.1 Non-Invasive Blood Glucose Monitoring Device Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Direct Sales

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Healthcare Facilities

8.5 Pharmacies

8.6 Online Sales

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Non-Invasive Blood Glucose Monitoring Device Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 AERBETIC (U.S.)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 AFON TECHNOLOGY (UNITED KINGDOM)

9.4 BOBANG FANGZHOU MEDICAL TECHNOLOGY (BEIJING) COLTD. (CHINA)

9.5 CNOGA (ISRAEL)

9.6 DIAMONTECH AG (GERMANY)

9.7 EYVA (INDIA)

9.8 GLUCORX LIMITED (UNITED KINGDOM)

9.9 HAGAR (GWAVE) (ISRAEL)

9.10 KNOW LABS INC. (U.S.)

9.11 LIFEPLUS (U.S.)

9.12 LIOM (SWITZERLAND)

9.13 MIMOS BERHAD (MALAYSIA)

9.14 NEMAURA MEDICAL (U.S)

9.15 NOVIOSENSE BV (NETHERLAND)

9.16 OCCUITY (UNITED KINGDOM)

9.17 PKVITALITY (FRANCE)

9.18 QUANTUM OPERATION INC. (JAPAN)

9.19 RSP SYSTEM (DENMARK)

9.20 SHINSEI CORPORATION (JAPAN)

9.21 SIBIONICS (CHINA)

9.22

Chapter 10: Global Non-Invasive Blood Glucose Monitoring Device Market By Region

10.1 Overview

10.2. North America Non-Invasive Blood Glucose Monitoring Device Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By By Type

10.2.4.1 Wearable Devices

10.2.4.2 Portable Devices

10.2.4.3 Stationary Devices

10.2.4.4 Breath Analysis Devices

10.2.4.5 Transdermal Devices

10.2.5 Historic and Forecasted Market Size By By Technology

10.2.5.1 Optical Technologies

10.2.5.2 Electromagnetic & Electric Techniques

10.2.6 Historic and Forecasted Market Size By By Application

10.2.6.1 Diabetes Monitoring

10.2.6.2 Pre-Diabetes Monitoring

10.2.6.3 Gestational Diabetes Monitoring

10.2.6.4 Others

10.2.7 Historic and Forecasted Market Size By By End-User

10.2.7.1 Hospitals & Clinics

10.2.7.2 Home Care Settings

10.2.7.3 Clinical Research Organizations

10.2.7.4 Fitness Centers & Gyms

10.2.8 Historic and Forecasted Market Size By By Distribution Channel

10.2.8.1 Direct Sales

10.2.8.2 Healthcare Facilities

10.2.8.3 Pharmacies

10.2.8.4 Online Sales

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Non-Invasive Blood Glucose Monitoring Device Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By By Type

10.3.4.1 Wearable Devices

10.3.4.2 Portable Devices

10.3.4.3 Stationary Devices

10.3.4.4 Breath Analysis Devices

10.3.4.5 Transdermal Devices

10.3.5 Historic and Forecasted Market Size By By Technology

10.3.5.1 Optical Technologies

10.3.5.2 Electromagnetic & Electric Techniques

10.3.6 Historic and Forecasted Market Size By By Application

10.3.6.1 Diabetes Monitoring

10.3.6.2 Pre-Diabetes Monitoring

10.3.6.3 Gestational Diabetes Monitoring

10.3.6.4 Others

10.3.7 Historic and Forecasted Market Size By By End-User

10.3.7.1 Hospitals & Clinics

10.3.7.2 Home Care Settings

10.3.7.3 Clinical Research Organizations

10.3.7.4 Fitness Centers & Gyms

10.3.8 Historic and Forecasted Market Size By By Distribution Channel

10.3.8.1 Direct Sales

10.3.8.2 Healthcare Facilities

10.3.8.3 Pharmacies

10.3.8.4 Online Sales

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Non-Invasive Blood Glucose Monitoring Device Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By By Type

10.4.4.1 Wearable Devices

10.4.4.2 Portable Devices

10.4.4.3 Stationary Devices

10.4.4.4 Breath Analysis Devices

10.4.4.5 Transdermal Devices

10.4.5 Historic and Forecasted Market Size By By Technology

10.4.5.1 Optical Technologies

10.4.5.2 Electromagnetic & Electric Techniques

10.4.6 Historic and Forecasted Market Size By By Application

10.4.6.1 Diabetes Monitoring

10.4.6.2 Pre-Diabetes Monitoring

10.4.6.3 Gestational Diabetes Monitoring

10.4.6.4 Others

10.4.7 Historic and Forecasted Market Size By By End-User

10.4.7.1 Hospitals & Clinics

10.4.7.2 Home Care Settings

10.4.7.3 Clinical Research Organizations

10.4.7.4 Fitness Centers & Gyms

10.4.8 Historic and Forecasted Market Size By By Distribution Channel

10.4.8.1 Direct Sales

10.4.8.2 Healthcare Facilities

10.4.8.3 Pharmacies

10.4.8.4 Online Sales

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Non-Invasive Blood Glucose Monitoring Device Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By By Type

10.5.4.1 Wearable Devices

10.5.4.2 Portable Devices

10.5.4.3 Stationary Devices

10.5.4.4 Breath Analysis Devices

10.5.4.5 Transdermal Devices

10.5.5 Historic and Forecasted Market Size By By Technology

10.5.5.1 Optical Technologies

10.5.5.2 Electromagnetic & Electric Techniques

10.5.6 Historic and Forecasted Market Size By By Application

10.5.6.1 Diabetes Monitoring

10.5.6.2 Pre-Diabetes Monitoring

10.5.6.3 Gestational Diabetes Monitoring

10.5.6.4 Others

10.5.7 Historic and Forecasted Market Size By By End-User

10.5.7.1 Hospitals & Clinics

10.5.7.2 Home Care Settings

10.5.7.3 Clinical Research Organizations

10.5.7.4 Fitness Centers & Gyms

10.5.8 Historic and Forecasted Market Size By By Distribution Channel

10.5.8.1 Direct Sales

10.5.8.2 Healthcare Facilities

10.5.8.3 Pharmacies

10.5.8.4 Online Sales

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Non-Invasive Blood Glucose Monitoring Device Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By By Type

10.6.4.1 Wearable Devices

10.6.4.2 Portable Devices

10.6.4.3 Stationary Devices

10.6.4.4 Breath Analysis Devices

10.6.4.5 Transdermal Devices

10.6.5 Historic and Forecasted Market Size By By Technology

10.6.5.1 Optical Technologies

10.6.5.2 Electromagnetic & Electric Techniques

10.6.6 Historic and Forecasted Market Size By By Application

10.6.6.1 Diabetes Monitoring

10.6.6.2 Pre-Diabetes Monitoring

10.6.6.3 Gestational Diabetes Monitoring

10.6.6.4 Others

10.6.7 Historic and Forecasted Market Size By By End-User

10.6.7.1 Hospitals & Clinics

10.6.7.2 Home Care Settings

10.6.7.3 Clinical Research Organizations

10.6.7.4 Fitness Centers & Gyms

10.6.8 Historic and Forecasted Market Size By By Distribution Channel

10.6.8.1 Direct Sales

10.6.8.2 Healthcare Facilities

10.6.8.3 Pharmacies

10.6.8.4 Online Sales

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Non-Invasive Blood Glucose Monitoring Device Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By By Type

10.7.4.1 Wearable Devices

10.7.4.2 Portable Devices

10.7.4.3 Stationary Devices

10.7.4.4 Breath Analysis Devices

10.7.4.5 Transdermal Devices

10.7.5 Historic and Forecasted Market Size By By Technology

10.7.5.1 Optical Technologies

10.7.5.2 Electromagnetic & Electric Techniques

10.7.6 Historic and Forecasted Market Size By By Application

10.7.6.1 Diabetes Monitoring

10.7.6.2 Pre-Diabetes Monitoring

10.7.6.3 Gestational Diabetes Monitoring

10.7.6.4 Others

10.7.7 Historic and Forecasted Market Size By By End-User

10.7.7.1 Hospitals & Clinics

10.7.7.2 Home Care Settings

10.7.7.3 Clinical Research Organizations

10.7.7.4 Fitness Centers & Gyms

10.7.8 Historic and Forecasted Market Size By By Distribution Channel

10.7.8.1 Direct Sales

10.7.8.2 Healthcare Facilities

10.7.8.3 Pharmacies

10.7.8.4 Online Sales

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Non-Invasive Blood Glucose Monitoring Device Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 26.19 Mn. |

|

Forecast Period 2024-32 CAGR: |

23.67% |

Market Size in 2032: |

USD 177.22 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Non-Invasive Blood Glucose Monitoring Device Market research report is 2024-2032.

Aerbetic (U.S.), Afon Technology (United Kingdom), Bobang Fangzhou Medical Technology (Beijing) Co., Ltd. (China), Cnoga (Israel), Diamontech AG (Germany),Eyva (India),Glucorx Limited (United Kingdom),Hagar (Gwave) (Israel),Know Labs, Inc. (U.S.), Lifeplus (U.S.), Liom (Switzerland), Mimos Berhad (Malaysia), Nemaura Medical (U.S),Noviosense Bv (Netherland), Occuity (United Kingdom), Pkvitality (France), Quantum Operation Inc. (Japan), Rsp System (Denmark), Shinsei Corporation (Japan), Sibionics (China), Other Active Players.

The Non-Invasive Blood Glucose Monitoring Device Market is segmented into Type, Technology, Application, End-User, Distribution Channel, and Region. By Type, the market is categorized into Wearable Devices, Portable Devices, Stationary Devices, Breath Analysis Devices, and Transdermal Devices. By Technology, the market is categorized into Optical Technologies and Electromagnetic & Electric Techniques. By Application, the market is categorized into Diabetes Monitoring, Pre-Diabetes Monitoring, Gestational Diabetes Monitoring, and Others. By End-User, the market is categorized into Hospitals & Clinics, Home Care Settings, Clinical Research Organizations, and Fitness Centers & Gyms. By Application, the market is categorized into Direct Sales, Healthcare Facilities, Pharmacies, and Online Sales. By Region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The global Non-Invasive Blood Glucose Monitoring Device Market refers to the industry focused on developing, manufacturing, and distributing advanced medical devices designed to measure blood glucose levels without the need for invasive techniques like traditional finger pricking. These devices utilize innovative technologies such as optical sensors, microneedles, electrochemical sensors, and spectroscopy-based methods to provide real-time glucose monitoring with minimal discomfort.

Non-Invasive Blood Glucose Monitoring Device Market Size Was Valued at USD 26.19 Million in 2023, and is Projected to Reach USD 177.22 Million by 2032, Growing at a CAGR of 23.67% From 2024-2032.