North America Automotive Fuel Injection Systems Market Synopsis:

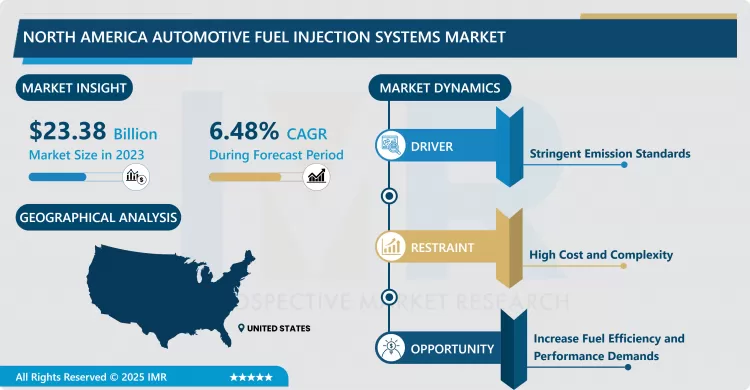

North America Automotive Fuel Injection Systems Market Size Was Valued at USD 23.38 Billion in 2023, and is Projected to Reach USD 41.14 Billion by 2032, Growing at a CAGR of 6.48% From 2024-2032.

Automotive fuel injection systems are essential parts of internal combustion engines, accurately supplying fuel to the engine cylinders. These systems improve combustion efficiency, boosting vehicle performance and fuel economy. They are made up of fuel injectors, a fuel pump, a pressure regulator, and an Electronic Control Unit (ECU) that oversees the injection procedure. Fuel may be introduced directly into the combustion chamber (Direct Fuel Injection) or into the intake port (Port Fuel Injection). These systems serve both gasoline and diesel engines, playing an active role in contemporary vehicles by ensuring accurate fuel delivery, minimizing emissions, and meeting strict environmental regulations.

The market for Automotive Fuel Injection Systems is witnessing considerable expansion because of their various advantages. These systems enhance engine efficiency by managing the fuel-air mix, optimizing combustion, and boosting vehicle performance. This results in lower emissions and environmental issues. Fuel injection systems provide improved throttle response, smoother engine performance, and increased reliability in comparison to conventional carburetors. The market is evolving advanced fuel injection technologies such as Gasoline Direct Injection (GDI) and Common Rail Diesel Injection (CRDI), which provide better fuel atomization and combustion, resulting in increased power and fuel efficiency in gasoline engines. Producers are motivated by the need for fuel-efficient and eco-friendly cars, as the incorporation of electronic parts and sensors continues to rise. The Automotive Fuel Injection Systems market is anticipated to expand owing to the rising automotive sector. The growing consciousness about environmental sustainability and stringent emission regulations is prompting automakers to invest in cutting-edge fuel injection technologies, leading to ongoing demand and technological progress.

North America Automotive Fuel Injection Systems Market Trend Analysis:

Stringent Emission Standards

- Strict emission regulations are essential in the Automotive Fuel Injection Systems sector. With the rise of environmental issues worldwide, governments and regulatory agencies are enforcing stricter emission regulations to reduce the effects of vehicle pollution. Fuel injection systems are crucial in this regard as they enhance the combustion process, leading to a more efficient and cleaner fuel burn. Conventional carburetors and fuel injection systems provide precise regulation of the air-fuel mixture, reducing unburned hydrocarbons and carbon monoxide emissions.

- Car manufacturers are compelled to implement advanced fuel injection technologies to comply with these strict standards, since fuel injection systems play a crucial role in diminishing harmful exhaust emissions. This pattern is especially evident in areas with strong environmental regulations, fostering an expanding market for Automotive Fuel Injection Systems. Producers are pouring resources into research and development to improve the performance of fuel injection systems, which is crucial for attaining reduced emission rates and supporting a more sustainable automotive sector.

Increase Fuel Efficiency and Performance Demands

- The growing significance of fuel efficiency and performance in the automotive sector presents a substantial opportunity for the Automotive Fuel Injection Systems market. As worldwide attention on environmental sustainability and fuel conservation grows, consumers are increasingly valuing vehicles that provide exceptional fuel efficiency. Sophisticated fuel injection systems are essential in fulfilling these requirements by accurately managing the fuel supply to the engine, enhancing combustion efficiency, and boosting overall fuel efficiency.

- The implementation of fuel injection technologies is enhancing vehicle performance, as automotive enthusiasts and consumers alike demand increased power, precise response, and smoother engine functionality. Sophisticated fuel injection systems, such as GPI and CRDI, enhance engine performance, fulfilling consumer demands for fuel efficiency and driving experience. This creates a considerable chance for manufacturers in the Automotive Fuel Injection Systems sector to create and provide cutting-edge solutions.

North America Automotive Fuel Injection Systems Market Segment Analysis:

North America Automotive Fuel Injection Systems Market is segmented based on Fuel Type, Injection System, Components, Vehicle Type, Technology, and Distribution Channel.

By Fuel Type, Gasoline segment is expected to dominate the market during the forecast period

- Gasoline engines, commonly found in passenger cars and smaller vehicles, are anticipated to continue being the preferred option for consumers because of their perceived performance and efficiency benefits. The growing strictness of emissions rules motivates car manufacturers to implement sophisticated gasoline fuel injection systems to comply with environmental requirements.

- The progress in Gasoline Direct Injection (GDI) technology, which provides better combustion efficiency and fuel economy, increases the attractiveness of gasoline engines. The industry's emphasis on creating cleaner and more fuel-efficient gasoline vehicles reinforces the supremacy of the gasoline segment in the Automotive Fuel Injection Systems market. As the automotive industry shifts towards greener alternatives, the gasoline sector continues to hold its market dominance throughout the forecast period.

By Technology, Gasoline Port Injection (GPI) expected to dominate the market during the forecast period

- Gasoline Port Injection (GPI) expected to dominate the market during the forecast period due to its various properties. Gasoline Port Injection (GPI) is recognized for its dependability, affordability, and ease of use, which makes it a favored option for a range of gasoline-operated vehicles. The existing manufacturing framework and the experience of automakers play a role in its ongoing supremacy. Cutting-edge innovations such as Gasoline Direct Injection (GDI) provide specific benefits, while GPI balances performance and cost, positioning it as a sensible option for various uses.

- The anticipated prevalence of GPI signifies the sector's acknowledgment of its history and the pragmatic factors affecting both producers and buyers. With the evolution of the automotive industry, GPI is anticipated to continue being a fundamental technology, fulfilling the requirements for effectiveness, dependability, and affordability in fuel injection systems.

Active Key Players in the North America Automotive Fuel Injection Systems Market:

- Carter Fuel Systems, Llc (U.S.)

- Edekbrock, Llc (U.S.)

- Federal-Mogul Corporation (U.S.)

- Kinsler Fuel Injection (U.S.)

- Stanadyne (U.S.)

- Ucal Fuel Systems Ltd. (Canada)

- Aptiv Plc (Ireland)

- Bosch, Robert (Germany)

- Continental Ag (Germany)

- Magneti Marelli (Italy)

- Magneti Marelli S.P.A. (Italy)

- Denso Corporation (Japan)

- Hitachi Limited (Japan)

- Keihin Corporation (Japan)

- Mikuni Corporation (Japan), and Other Active Players

Key Industry Development in the North America Automotive Fuel Injection Systems Market:

- In December 2023, Stanadyne, a leading provider of fuel and air management systems, launched an innovative enhancement kit for high-pressure port fuel injection (HPFI) at the 2023 PRI Show in Indianapolis. This cutting-edge kit boosts fuel delivery pressures by up to 100 bar, making it ideal for high-performance and racing gasoline engines. Designed to meet the demands of professional racers and enthusiasts, the aftermarket port injection technology promises enhanced engine performance and efficiency. With this launch, Stanadyne continues to solidify its position at the forefront of fuel management innovation for the automotive industry.

- In September 2023, Continental and Google Cloud have announced a strategic collaboration to transform the automotive industry. By combining Continental's expertise in automotive technology with Google Cloud’s advanced data and AI capabilities, the partnership aims to create innovative in-vehicle experiences and enhance automotive-grade software. The collaboration focuses on advancing safety, efficiency, and user-centric solutions, driving the future of connected mobility.

|

North America Automotive Fuel Injection Systems Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 23.38 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.48% |

Market Size in 2032: |

USD 41.14 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Injection System |

|

||

|

By Components |

|

||

|

By Vehicle Type |

|

||

|

By Technology |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: North America Automotive Fuel Injection Systems Market by By Type (2018-2032)

4.1 North America Automotive Fuel Injection Systems Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Gasoline

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Diesel

Chapter 5: North America Automotive Fuel Injection Systems Market by By Injection System (2018-2032)

5.1 North America Automotive Fuel Injection Systems Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Single-point Injection (SPI)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Multi-point Injection (MPI)

Chapter 6: North America Automotive Fuel Injection Systems Market by By Components (2018-2032)

6.1 North America Automotive Fuel Injection Systems Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Fuel injectors

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Fuel Pressure Regulator (FPR)

6.5 Fuel Pump

6.6 Electronic Control Unit (ECU)

Chapter 7: North America Automotive Fuel Injection Systems Market by By Vehicle Type (2018-2032)

7.1 North America Automotive Fuel Injection Systems Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Passenger Cars

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Light Commercial Vehicles (LCVs)

7.5 Heavy Commercial Vehicles (HCVs)

Chapter 8: North America Automotive Fuel Injection Systems Market by By Technology (2018-2032)

8.1 North America Automotive Fuel Injection Systems Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Diesel Direct Injection

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Gasoline Port Injection

8.5 Gasoline Direct Injection

Chapter 9: North America Automotive Fuel Injection Systems Market by By Distribution Channel (2018-2032)

9.1 North America Automotive Fuel Injection Systems Market Snapshot and Growth Engine

9.2 Market Overview

9.3 Original Equipment Manufacturer (OEM)

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

9.3.3 Key Market Trends, Growth Factors, and Opportunities

9.3.4 Geographic Segmentation Analysis

9.4 Aftermarket

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 North America Automotive Fuel Injection Systems Market Share by Manufacturer (2024)

10.1.3 Industry BCG Matrix

10.1.4 Heat Map Analysis

10.1.5 Mergers and Acquisitions

10.2 CARTER FUEL SYSTEMS

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Operating Business Segments

10.2.5 Product Portfolio

10.2.6 Business Performance

10.2.7 Recent News & Development

10.2.8 SWOT Analysis

10.3 LLC (U.S.)

10.4 EDEKBROCK

10.5 LLC (U.S.)

10.6 FEDERAL-MOGUL CORPORATION (U.S.)

10.7 KINSLER FUEL INJECTION (U.S.)

10.8 STANADYNE (U.S.)

10.9 UCAL FUEL SYSTEMS LTD. (CANADA)

10.10 APTIV PLC (IRELAND)

10.11 BOSCH

10.12 ROBERT (GERMANY)

10.13 CONTINENTAL AG (GERMANY)

10.14 MAGNETI MARELLI (ITALY)

10.15 MAGNETI MARELLI S.P.A. (ITALY)

10.16 DENSO CORPORATION (JAPAN)

10.17 HITACHI LIMITED (JAPAN)

10.18 KEIHIN CORPORATION (JAPAN)

10.19 MIKUNI CORPORATION (JAPAN)

10.20 AND

Chapter 11:North America Automotive Fuel Injection Systems Market Analysis, Insights and Forecast, 2016-2028

11.1 Market Overview

11.2 Key Market Trends, Growth Factors and Opportunities

11.3 Key Players

11.4 Historic and Forecasted Market Size By By Type

11.4.1 Gasoline

11.4.2 Diesel

11.5 Historic and Forecasted Market Size By By Injection System

11.5.1 Single-point Injection (SPI)

11.5.2 Multi-point Injection (MPI)

11.6 Historic and Forecasted Market Size By By Components

11.6.1 Fuel injectors

11.6.2 Fuel Pressure Regulator (FPR)

11.6.3 Fuel Pump

11.6.4 Electronic Control Unit (ECU)

11.7 Historic and Forecasted Market Size By By Vehicle Type

11.7.1 Passenger Cars

11.7.2 Light Commercial Vehicles (LCVs)

11.7.3 Heavy Commercial Vehicles (HCVs)

11.8 Historic and Forecasted Market Size By By Technology

11.8.1 Diesel Direct Injection

11.8.2 Gasoline Port Injection

11.8.3 Gasoline Direct Injection

11.9 Historic and Forecasted Market Size By By Distribution Channel

11.9.1 Original Equipment Manufacturer (OEM)

11.9.2 Aftermarket

11.10 Historic and Forecast Market Size by Country

11.10.1 U.S.

11.10.2 Canada

11.10.3 Mexico

Chapter 12 Analyst Viewpoint and Conclusion

12.1 Recommendations and Conclusion

Chapter 13 Our Thematic Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

|

North America Automotive Fuel Injection Systems Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 23.38 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.48% |

Market Size in 2032: |

USD 41.14 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Injection System |

|

||

|

By Components |

|

||

|

By Vehicle Type |

|

||

|

By Technology |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the North America Automotive Fuel Injection Systems Market research report is 2024-2032.

Carter Fuel Systems, Llc (U.S.), Edekbrock, Llc (U.S.), Federal-Mogul Corporation (U.S.), Kinsler Fuel Injection (U.S.), Stanadyne (U.S.), Ucal Fuel Systems Ltd. (Canada), Aptiv Plc (Ireland), Bosch, Robert (Germany), Continental Ag (Germany), Magneti Marelli (Italy), Magneti Marelli S.P.A. (Italy), Denso Corporation (Japan), Hitachi Limited (Japan), Keihin Corporation (Japan), Mikuni Corporation (Japan), and Other Active Players.

The North America Automotive Fuel Injection Systems Market is segmented into Fuel Type, Injection System, Components, Vehicle Type, Technology, Distribution Channel, and region. By Fuel Type, the market is categorized into Gasoline and Diesel. By Injection System, the market is categorized into Single-point Injection (SPI) and multi-point Injection (MPI). By Components, the market is categorized into Fuel injectors, Fuel Pressure Regulator (FPR), Fuel pumps, and Electronic Control Units (ECU). By Vehicle Type, the market is categorized into Passenger Cars, Light Commercial Vehicles (LCVs), and Heavy Commercial Vehicles (HCVs). By Technology, the market is categorized into Diesel Direct Injection, Gasoline Port Injection, and Gasoline Direct Injection. By Distribution Channel, the market is categorized into Original Equipment Manufacturer (OEM), and Aftermarket. By region, it is analyzed across North America (U.S.; Canada; Mexico)

Automotive fuel injection systems are essential parts of internal combustion engines, accurately supplying fuel to the engine cylinders. These systems improve combustion efficiency, boosting vehicle performance and fuel economy. They are made up of fuel injectors, a fuel pump, a pressure regulator, and an Electronic Control Unit (ECU) that oversees the injection procedure.

North America Automotive Fuel Injection Systems Market Size Was Valued at USD 23.38 Billion in 2023, and is Projected to Reach USD 41.14 Billion by 2032, Growing at a CAGR of 6.48% From 2024-2032.