North America Coal to Liquid Market Synopsis:

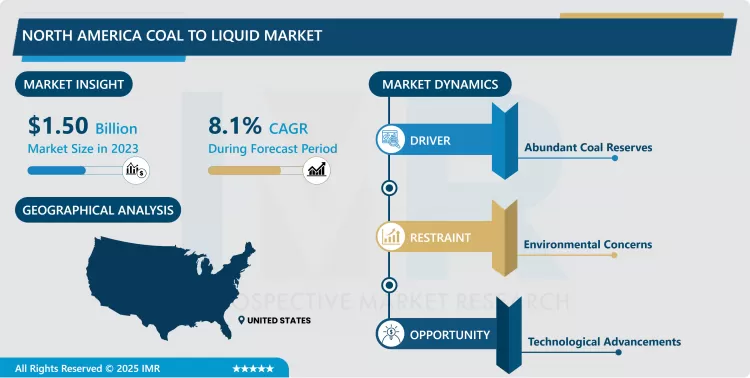

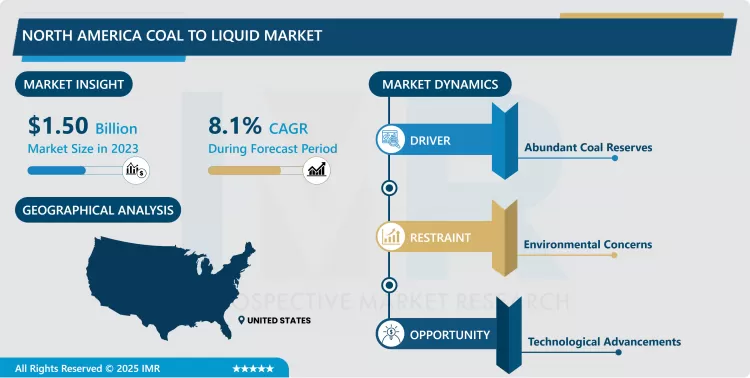

North America Coal to Liquid Market Size Was Valued at USD 1.50 Billion in 2023, and is Projected to Reach USD 3.02 Billion by 2032, Growing at a CAGR of 8.1% From 2024-2032.

The North America Coal to Liquid (CTL) market is a niche but evolving segment within the broader energy and fuel industry. CTL technology involves converting coal into liquid hydrocarbons, such as diesel, gasoline, and other petroleum products, through processes like Fischer-Tropsch synthesis or direct coal liquefaction. While the region has abundant coal reserves, particularly in the United States, the adoption of CTL technology has been limited due to economic, environmental, and regulatory challenges. High capital costs, coupled with the availability of cheaper and more established energy sources like shale oil and natural gas, have historically hindered large-scale CTL development. However, interest in CTL has persisted as a potential pathway to enhance energy security and reduce reliance on imported crude oil.

Environmental concerns are a significant factor influencing the North America CTL market. The process of converting coal to liquid fuels is carbon-intensive, leading to higher greenhouse gas emissions compared to conventional petroleum refining. This has drawn criticism from environmental groups and policymakers, particularly as the region increasingly focuses on decarbonization and transitioning to cleaner energy sources. Despite these challenges, advancements in carbon capture and storage (CCS) technologies offer a potential pathway to mitigate emissions and improve the environmental profile of CTL projects. Some proponents argue that CTL, when combined with CCS, could serve as a bridge fuel in the transition to a low-carbon economy, particularly for sectors like aviation and heavy transportation that are harder to electrify.

The future of the North America CTL market remains uncertain, with its growth heavily dependent on technological advancements, policy support, and market dynamics. While the U.S. Department of Energy and other stakeholders have explored CTL as part of a diversified energy strategy, the lack of significant commercial-scale projects highlights the barriers to widespread adoption. Nevertheless, in a scenario where oil prices rise significantly or geopolitical tensions disrupt global oil supplies, CTL could gain renewed attention as a strategic alternative. For now, the market remains in a nascent stage, with most activity focused on research, pilot projects, and feasibility studies rather than large-scale production. As the energy landscape continues to evolve, the role of CTL in North America will likely remain a topic of debate, balancing its potential benefits against environmental and economic considerations.

North America Coal to Liquid Market Growth and Trend Analysis:

The coal-to-liquid (CTL) industry refers to the processes that convert coal into liquid hydrocarbons, primarily fuels such as diesel and gasoline. This transformation can occur through two main methods: direct liquefaction, which involves breaking down coal directly into liquid fuels, and indirect liquefaction, where coal is first converted into syngas before being transformed into liquid hydrocarbons. CTL technologies are increasingly recognized as a means to enhance energy security by reducing dependence on crude oil and leveraging the abundant coal reserves in regions like North America.

In North America, the CTL industry has gained traction due to its significant coal reserves and advancements in liquefaction technologies. The U.S. has been at the forefront of this development, with various projects aimed at optimizing the conversion processes to produce synthetic fuels. For instance, the Great Plains Gasification Plant in North Dakota exemplifies a successful application of indirect liquefaction, converting coal into syngas and subsequently into synthetic natural gas. This facility has been operational since 1984 and showcases the potential for utilizing existing infrastructure to support CTL initiatives.

The government policies in North America have played a crucial role in promoting CTL technologies. Incentives for research and development, along with favorable regulations, have encouraged investment in this sector. Companies are exploring innovative methods to improve efficiency and reduce emissions associated with coal conversion processes. Notably, projects like those developed by Encoal and SASOL have demonstrated the viability of direct liquefaction techniques that can produce high-quality synthetic fuels while minimizing environmental impacts.

North America Coal to Liquid Market Growth and Trend Analysis:

Abundant Coal Reserves

- The availability of vast coal reserves is a significant driver for the coal-to-liquid (CTL) industry in North America. With the United States possessing one of the largest coal deposits globally, the region has a reliable and accessible feedstock for CTL technologies. This abundance not only ensures a consistent supply of raw materials but also lowers production costs, making CTL an economically viable alternative to traditional petroleum-based fuels. The growing interest in energy independence further amplifies this driver, as domestic production of liquid fuels can mitigate reliance on imported oil, thereby enhancing national energy security.

- Advancements in CTL technology have improved the efficiency and effectiveness of converting coal into liquid fuels. Companies are investing in innovative processes that enhance yield and reduce environmental impacts, making CTL fuels more attractive to consumers and businesses alike. As demand for cleaner energy solutions rises, the ability to utilize abundant coal resources while developing sustainable practices positions the CTL industry favorably in the evolving energy landscape.

Environmental Concerns

- Despite its potential, the CTL industry faces significant restraints due to environmental concerns associated with coal utilization. The conversion of coal to liquid fuels typically results in high greenhouse gas emissions compared to other renewable energy sources. As global awareness of climate change intensifies, regulatory pressures are mounting on fossil fuel industries, including CTL. Governments are increasingly implementing stringent environmental regulations and carbon pricing mechanisms that could hinder the growth of coal-to-liquid projects.

- The public perception of coal as a dirty fuel source poses challenges for CTL adoption. Activist groups and environmental organizations advocate for cleaner alternatives, leading to potential opposition against new CTL facilities or expansions. The industry's ability to address these environmental challenges through innovations such as carbon capture and storage (CCS) will be crucial in mitigating these restraints and gaining broader acceptance among stakeholders.

Technological Advancements

- The ongoing advancements in CTL technology present a significant opportunity for market growth. Innovations in both direct and indirect liquefaction processes are enhancing efficiency and reducing costs, making CTL production more competitive with conventional fuels. For instance, breakthroughs in catalytic processes can lead to higher conversion rates and lower energy consumption during production. As research continues to evolve, these technological improvements can facilitate the development of more sustainable and economically viable CTL solutions.

- There is a growing market for synthetic lubricants produced as by-products of CTL processes. This diversification not only provides additional revenue streams but also enhances the overall appeal of CTL operations by showcasing their versatility beyond just fuel production. As governments and industries increasingly prioritize energy security and sustainability, the integration of advanced technologies into the CTL sector can position it as a key player in the transition towards cleaner energy systems.

North America Coal to Liquid Market Segment Analysis:

North America Coal to Liquid Market is segmented based on by Liquefaction Process, Product, end-users, and Country

By Liquefaction Process, The Indirect Liquefaction Segment is Set to Be the Market Leader During the Forecast Period

- The indirect liquefaction segment is projected to dominate the coal-to-liquid market, capturing over 59.9% of the market share in 2023. This process involves gasifying coal to produce syngas, which is then converted into liquid hydrocarbons using catalytic methods.

- The flexibility of indirect liquefaction allows for the utilization of various coal types, enhancing its appeal across different applications. Additionally, it produces cleaner fuels with reduced sulfur and nitrogen content, aligning with stringent environmental regulations and addressing pollution concerns associated with traditional coal usage.

- The operational advantages of indirect liquefaction further contribute to its dominance in the market. This method can efficiently handle a diverse range of coal qualities and is capable of generating higher yields of liquid fuels per ton of coal processed compared to direct liquefaction.

By Product, the Diesel Segment accounted for the highest market share in 2023

- The diesel segment is projected to dominate the coal-to-liquid market. This dominance is driven by the widespread use of diesel in various transportation sectors, including heavy-duty vehicles, buses, and freight transport. Diesel's high energy density and efficiency make it a preferred choice for applications requiring reliable and powerful fuel sources, particularly in regions with significant coal reserves.

- The increasing number of diesel-powered vehicles and the global push for energy independence are expected to bolster the demand for synthetic diesel derived from coal.

North America Coal to Liquid Market Country Insights:

The Market is Anticipated to Be Dominated by the U.S. Over the Forecast Period

- The United States is projected to lead the coal-to-liquid (CTL) market during the forecast period, driven by its substantial coal reserves and advancements in CTL technology. With a focus on reducing reliance on imported fuels, the U.S. government has implemented favorable policies and funding initiatives that promote research and development in this sector. These efforts are expected to enhance domestic production capabilities, making CTL fuels increasingly accessible and economically viable for various applications.

- The growing demand for alternative fuels, particularly in the transportation sector, will further bolster the U.S. CTL market. As the number of vehicles continues to rise, the need for reliable fuel sources is becoming more critical. The ability of CTL processes to convert abundant domestic coal into high-quality synthetic fuels positions the U.S. to meet both current and future energy demands effectively, ensuring its dominance in the global market throughout the forecast period.

Active Players in the North America Coal to Liquid Market:

- TransGas Development Systems (USA)

- Headwaters, Inc. (USA)

- Eastman Chemical Company (USA)

- Calera Corporation (USA)

- Global Energy Inc. (USA)

- DKRW Energy (USA)

- Rentech (USA)

- Giga Watt (USA), and Other Active Players

|

North America Coal to Liquid Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.50 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.1% |

Market Size in 2032: |

USD 3.02 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Country |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: North America Coal to Liquid Market by By Type (2018-2032)

4.1 North America Coal to Liquid Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Direct Coal Liquefaction

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Indirect Coal Liquefaction

Chapter 5: North America Coal to Liquid Market by By Application (2018-2032)

5.1 North America Coal to Liquid Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Diesel

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Gasoline

5.5 Other Fuels

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 North America Coal to Liquid Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 TRANSGAS DEVELOPMENT SYSTEMS (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Operating Business Segments

6.2.5 Product Portfolio

6.2.6 Business Performance

6.2.7 Recent News & Development

6.2.8 SWOT Analysis

6.3 HEADWATERS

6.4 INC. (USA)

6.5 EASTMAN CHEMICAL COMPANY (USA)

6.6 CALERA CORPORATION (USA)

6.7 GLOBAL ENERGY INC. (USA)

6.8 DKRW ENERGY (USA)

6.9 RENTECH (USA)

6.10 GIGA WATT (USA)

6.11 AND

Chapter 7:North America Coal to Liquid Market Analysis, Insights and Forecast, 2016-2028

7.1 Market Overview

7.2 Key Market Trends, Growth Factors and Opportunities

7.3 Key Players

7.4 Historic and Forecasted Market Size By By Type

7.4.1 Direct Coal Liquefaction

7.4.2 Indirect Coal Liquefaction

7.5 Historic and Forecasted Market Size By By Application

7.5.1 Diesel

7.5.2 Gasoline

7.5.3 Other Fuels

7.6 Historic and Forecast Market Size by Country

7.6.1 U.S.

7.6.2 Canada

7.6.3 Mexico

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Conclusion

Chapter 9 Our Thematic Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

North America Coal to Liquid Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.50 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.1% |

Market Size in 2032: |

USD 3.02 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Country |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the North America Coal to Liquid Market research report is 2024-2032.

TransGas Development Systems (USA), Headwaters, Inc. (USA), Eastman Chemical Company (USA), Calera Corporation (USA), Global Energy Inc. (USA), DKRW Energy (USA), Rentech (USA), Giga Watt (USA), and Other Active Players

The North America Coal to Liquid Market is segmented into Liquefaction Process, Product, and Region. By Liquefaction Process, the market is categorized into Direct Coal Liquefaction, Indirect Coal Liquefaction. By Product, the market is categorized into Diesel, Gasoline, Other Fuels. By Region, it is analyzed across North America (U.S.; Canada; Mexico).

The coal-to-liquid (CTL) industry refers to the processes that convert coal into liquid hydrocarbons, primarily fuels such as diesel and gasoline. This transformation can occur through two main methods: direct liquefaction, which involves breaking down coal directly into liquid fuels, and indirect liquefaction, where coal is first converted into syngas before being transformed into liquid hydrocarbons.

North America Coal to Liquid Market Size Was Valued at USD 1.50 Billion in 2023, and is Projected to Reach USD 3.02 Billion by 2032, Growing at a CAGR of 8.1% From 2024-2032.