North America Electric Vehicle Market Synopsis

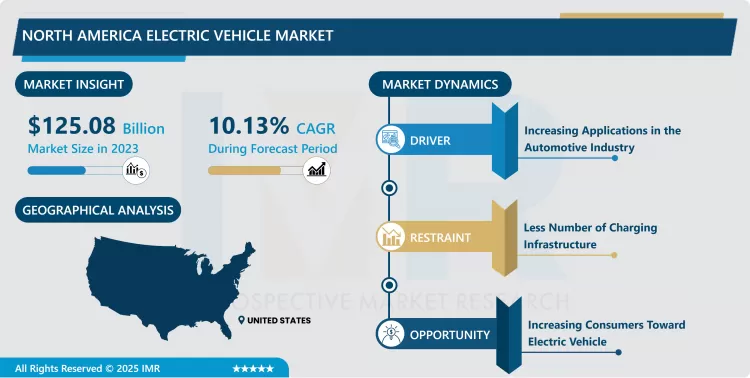

North America Electric Vehicle Market size was valued at USD 125.08 Billion in 2023 and is projected to reach USD 298.08 Billion by 2032, growing at a CAGR of 10.13%from 2024 to 2032.

An Electric Vehicle (EV) is a class of automobile driven by one or multiple electric motors, making energy from stored electricity in sources such as batteries, fuel cells, or other energy reservoirs. In variation to conventional vehicles powered by internal combustion engines that rely on fossil fuels, electric vehicles employ electricity to generate motion, leading to reduced emissions and a lessened environmental footprint, the electricity originates from renewable sources. Electric vehicles are mainly used in sustainable transportation solutions, utilizing electric motors and rechargeable battery packs for propulsion. including lower operational costs, reduced environmental impact through zero emissions, decreased noise pollution, and smoother rides.

The rapid growth of the electric vehicle industry is driven by its positive impact on the environment, including zero emissions and reduced greenhouse gases. This trend is supported by economic benefits like cost-effective operation, quiet performance, smooth acceleration, and government backing. The increasing adoption of EVs is not only advancing the automotive sector but also creating opportunities in various fields like battery supply, transportation, utilities, online shopping, delivery, and EV manufacturing. This situation is creating a favorable environment for expansion and innovation. Types of Electric Vehicles Battery Electric Vehicles (BEVs) operate solely on batteries for power, Plug-in Hybrid Electric Vehicles (PHEVs) combine electric and gasoline engines, and Fuel Cell Electric Vehicles (FCEVs) utilize hydrogen fuel cells. These varying types provide consumers with options that balance factors like range, charging times, and environmental impact.

One of the major hurdles to EV adoption has been the cost of batteries. However, advancements in battery technology and economies of scale have led to a steady decline in battery costs, making EVs more affordable. Growing awareness of environmental issues and the benefits of EVs, along with a shift in consumer preferences towards sustainable options, has also driven demand for EVs. Partnerships between automakers, energy companies, and technology firms can accelerate the development of EVs, charging solutions, and associated technologies. This will help to make EVs more affordable and accessible to a wider range of consumers.

The North America Electric Vehicle Market Trend Analysis

Increasing Applications in the Automotive Industry

- The electric vehicle market is currently dominated by the passenger car segment, and this is expected to continue in the upcoming period. The rolling demand for eco-friendly and fuel-efficient vehicles is driving this phenomenon. Commercial vehicles are gradually embracing electric propulsion as enterprises aim to curtail operational expenses. Electric-powered buses and trucks are gaining traction as governmental bodies and urban centers prioritize enhancing air quality. Even two-wheelers and off-road vehicles are experiencing a roll in electric adoption due to their increasing affordability and availability.

- Battery technology has greatly improved, solving past issues like short electric vehicle range and expensive batteries. These improvements include better energy storage, faster charging, and longer-lasting batteries. electric vehicles now have longer ranges and are more reasonably priced. As technology gets better and more batteries are made, their production costs are going down. This makes electric cars cheaper for consumers to buy electric vehicles. ?

- Governments in different countries are giving rewards and discounts to encourage people to buy electric cars. These rewards can be in the form of tax breaks, money back, cheaper fees for registering the car, and even the ability to drive in special high-occupancy vehicle lanes. These rewards make electric cars more appealing to buyers and are helping the electric car market to grow.

- Technology is getting better and more electric car batteries are being made, the cost of making these batteries is going down. This is making electric cars cheaper for consumers to buy an electric vehicle.

Increasing consumers toward electric vehicle

- Consumers are concerned about the environmental impact of gasoline-powered vehicles and are looking for more sustainable transportation options. Electric vehicles produce zero emissions and help to reduce air pollution and climate change.

- Growing awareness and concern about environmental issues, particularly related to climate change and air pollution. consumers become more conscious of their carbon footprint and the negative impacts of traditional internal combustion engine (ICE) vehicles on the environment and are considering alternatives that are more sustainable and eco-friendlier. EVs offer a clear advantage as they produce zero tailpipe emissions, leading to reduced greenhouse gas emissions and improved air quality.

- Consumers have been drawn to the cutting-edge features, seamless driving experience, and the potential for reduced maintenance costs, EVs have a small number of moving parts compared to traditional gasoline-powered vehicles.

- The electric car market has been much better recently. Electric vehicles now have longer ranges and faster charging times, making them easy for regular driving. EVs have a small number of moving parts and require less maintenance, which translates to reduced servicing costs over the vehicle's lifetime. This economic advantage aligns with the consumer’s desire to save money while making a sustainable choice for the consumer.

North America Electric Vehicle Market Segmentation Analysis:

North America Electric Vehicle Market is segmented into the Type, Application, and, vehicle type.

By Type, the Battery Electric Vehicle segment is Anticipated to Dominate the Market Over the Forecast period.

- Battery Electric vehicles produce no tailpipe emissions, making them environmentally friendly and contributing to improved air quality in urban areas. Battery Electric vehicles provide instant torque, resulting in quick acceleration and responsive performance. They are design allows for a lower centre of gravity, contributing to better handling.

- BEVs have seen significant advancements in battery technology, resulting in higher energy density, longer driving ranges, and reduced charging times. This makes them more appealing to consumers as they offer practical, real-world usability compared to other EV types.

- The expansion of charging infrastructure is a key factor supporting the dominance of BEVs. Governments and private entities are investing heavily in charging stations, making it more convenient for consumers to charge their vehicles and thus reducing range anxiety.

By Vehicle Type, the Two-Wheelers segment held the largest share in 2023

- Electric two-wheelers, such as electric scooters and motorcycles, typically have a lower purchase price compared to electric cars. This makes them more affordable, especially for first-time EV buyers or those seeking an economical and environmentally friendly alternative to traditional vehicles.

- In dense urban areas, electric two-wheelers are well-suited for short commutes and quick trips. They are more maneuverable in traffic and have the added benefit of being able to access areas with heavy congestion or limited parking. This makes them a popular choice for urban dwellers looking for an efficient, cost-effective way to get around.

- Electric two-wheelers offer significant savings on fuel costs compared to gas-powered motorcycles or scooters. They are more energy-efficient and require less maintenance, making them an attractive option for consumers looking to reduce long-term operating costs.

- With growing environmental concerns, consumers are increasingly turning to electric two-wheelers as a cleaner, zero-emission alternative to traditional petrol-powered vehicles. This aligns with the push for reduced carbon footprints and lower pollution in urban areas.

- Governments in North America, especially in states like California, offer incentives such as rebates, tax credits, and exemptions to encourage the adoption of electric vehicles, including two-wheelers. These incentives make electric two-wheelers even more affordable and attractive to consumers.

Active Players in the North America Automatic Bus Door System Market:

- Tesla, Inc. (US)

- General Motors (GM) (US)

- Ford Motor Company (US)

- Rivian Automotive (US)

- Lucid Motors (US)

- Volkswagen Group of America (US)

- BMW Group (Germany)

- Nissan North America (US)

- Hyundai Motor America (US)

- Mercedes-Benz USA (US)

- Porsche AG (Germany)

- Volvo Cars (US)

- Fisker Automotive (US)

- Lordstown Motors (US)

- Canoo Inc. (US)

- Faraday Future (US)

- BYD (Build Your Dreams) (China)

- Kia Corporation (South Korea), and Other Active Players.

Key Industry Developments in the North America Electric Vehicle Market:

- In October 2024, Tesla launched the Low-Voltage Connector Standard (LVCS) to simplify vehicle electrical connectivity, reducing the number of required connectors from over 200 to just 6. This initiative aimed to enhance manufacturing efficiency and support the widespread adoption of the 48V architecture, first introduced along with Cybertruck. Tesla sought to facilitate cost reduction and operational efficiency across the automotive industry by promoting standardization.

- In November 2024, Rivian and Volkswagen Group launched a joint venture to advance electric vehicle development. Under the partnership, the companies seek to combine their expertise to reduce costs and accelerate technology scaling. Rivian's R2 model will be introduced by 2026, and Volkswagen's models by 2027. Volkswagen will invest up to USD 5.8 billion in the venture, focusing on innovation and cost-efficiency for the electric vehicle market.

|

North America Electric Vehicle Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 125.08 Bn. |

|

Forecast Period 2024-32 CAGR: |

10.13 % |

Market Size in 2032: |

USD 298.08 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Vehicle Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: North America Electric Vehicle Market by By Type (2018-2032)

4.1 North America Electric Vehicle Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Battery Electric Vehicle

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Hybrid Electric Vehicle

4.5 Plug-in Hybrid Electric Vehicle

4.6 Fuel Cell Electric Vehicle

Chapter 5: North America Electric Vehicle Market by By Application (2018-2032)

5.1 North America Electric Vehicle Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Battery Electric Vehicle

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Plug-In Hybrid Electric Vehicle

Chapter 6: North America Electric Vehicle Market by By Vehicle Type (2018-2032)

6.1 North America Electric Vehicle Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Two-Wheelers

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Passenger Cars

6.5 Commercial Vehicles

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 North America Electric Vehicle Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 TESLA

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Recent News & Development

7.2.8 SWOT Analysis

7.3 INC. (US)

7.4 GENERAL MOTORS (GM) (US)

7.5 FORD MOTOR COMPANY (US)

7.6 RIVIAN AUTOMOTIVE (US)

7.7 LUCID MOTORS (US)

7.8 VOLKSWAGEN GROUP OF AMERICA (US)

7.9 BMW GROUP (GERMANY)

7.10 NISSAN NORTH AMERICA (US)

7.11 HYUNDAI MOTOR AMERICA (US)

7.12 MERCEDES-BENZ USA (US)

7.13 PORSCHE AG (GERMANY)

7.14 VOLVO CARS (US)

7.15 FISKER AUTOMOTIVE (US)

7.16 LORDSTOWN MOTORS (US)

7.17 CANOO INC. (US)

7.18 FARADAY FUTURE (US)

7.19 BYD (BUILD YOUR DREAMS) (CHINA)

7.20 KIA CORPORATION (SOUTH KOREA)

7.21 AND

Chapter 8:North America Electric Vehicle Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Key Market Trends, Growth Factors and Opportunities

8.3 Key Players

8.4 Historic and Forecasted Market Size By By Type

8.4.1 Battery Electric Vehicle

8.4.2 Hybrid Electric Vehicle

8.4.3 Plug-in Hybrid Electric Vehicle

8.4.4 Fuel Cell Electric Vehicle

8.5 Historic and Forecasted Market Size By By Application

8.5.1 Battery Electric Vehicle

8.5.2 Plug-In Hybrid Electric Vehicle

8.6 Historic and Forecasted Market Size By By Vehicle Type

8.6.1 Two-Wheelers

8.6.2 Passenger Cars

8.6.3 Commercial Vehicles

8.7 Historic and Forecast Market Size by Country

8.7.1 U.S.

8.7.2 Canada

8.7.3 Mexico

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Conclusion

Chapter 10 Our Thematic Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

North America Electric Vehicle Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 125.08 Bn. |

|

Forecast Period 2024-32 CAGR: |

10.13 % |

Market Size in 2032: |

USD 298.08 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Vehicle Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

Frequently Asked Questions :

The forecast period in the Electric Vehicle Market research report is 2024-2032.

Tesla, Inc. (US), General Motors (GM) (US), Ford Motor Company (US), Rivian Automotive (US), Lucid Motors (US), Volkswagen Group of America (US), BMW Group (Germany), Nissan North America (US), Hyundai Motor America (US), Mercedes-Benz USA (US), Porsche AG (Germany), Volvo Cars (US), Fisker Automotive (US), Lordstown Motors (US), Canoo Inc. (US), Faraday Future (US), BYD (Build Your Dreams) (China), Kia Corporation (South Korea), and Other Active Players.

The Electric Vehicle Market is segmented into Type, Application, Vehicle Type, and region. By Type, the market is categorized into Battery Electric Vehicle, Hybrid Electric Vehicles, Plug-in Hybrid Electric Vehicles, and Fuel Cell Electric Vehicle. By Application, the market is categorized into Battery Electric Vehicle and Plug-In Hybrid Electric Vehicle. By Vehicle Type, the market is categorized into Two-Wheelers, Passenger Cars, and Commercial Vehicles. By region, it is analyzed across North America (U.S.; Canada; Mexico).

An Electric Vehicle (EV) is a class of automobile driven by one or multiple electric motors, making energy from stored electricity in sources such as batteries, fuel cells, or other energy reservoirs. In variation to conventional vehicles powered by internal combustion engines that rely on fossil fuels, electric vehicles employ electricity to generate motion, leading to reduce emissions and a lessened environmental footprint, the electricity originates from renewable sources.

North America Electric Vehicle Market size was valued at USD 125.08 Billion in 2023 and is projected to reach USD 298.08 Billion by 2032, growing at a CAGR of 10.13%from 2024 to 2032.