North America Hydrogen Market Synopsis:

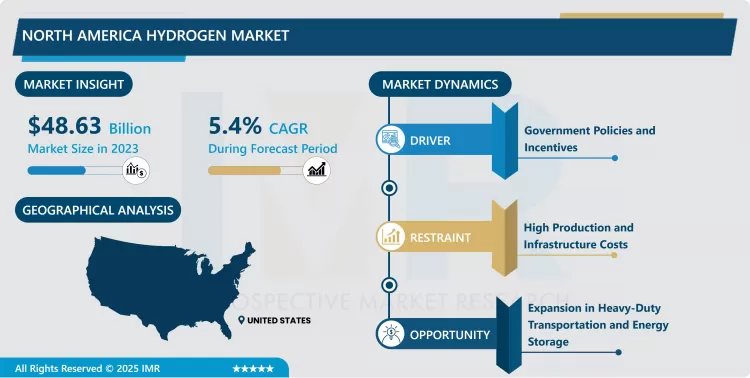

North America Hydrogen Market Size Was Valued at USD 48.63 Billion in 2023, and is Projected to Reach USD 78.07 Billion by 2032, Growing at a CAGR of 5.4% From 2024-2032.

The North American hydrogen market is a dynamic and rapidly evolving sector, driven by the region's commitment to reducing carbon emissions and transitioning to a low-carbon economy. The United States is at the forefront of this transformation, leveraging its advanced technological capabilities and extensive energy infrastructure to develop hydrogen production, storage, and distribution systems.

Canada is also emerging as a key player, particularly in the production of green hydrogen, thanks to its abundant renewable energy resources such as hydropower and wind. Together, these countries are positioning North America as a significant hub for hydrogen innovation and deployment.

The market is characterized by a diverse mix of hydrogen production methods, including gray, blue, and green hydrogen. Gray hydrogen, produced from natural gas through steam methane reforming (SMR), currently dominates due to its cost-effectiveness and established infrastructure.

However, blue hydrogen, which incorporates carbon capture and storage (CCS) to mitigate emissions, is gaining traction as a transitional solution. Green hydrogen, produced via electrolysis using renewable energy, is experiencing rapid growth, driven by declining costs of renewable energy and advancements in electrolyzer technologies. Initiatives like the U.S. Department of Energy’s Hydrogen Energy Earthshot are accelerating innovation and investment in clean hydrogen production.

Industrial applications are the primary drivers of hydrogen demand in North America, with key sectors including oil refining, ammonia production, and methanol synthesis. The refining industry, particularly in the U.S., is a major consumer of hydrogen, using it for processes such as desulfurization and hydrocracking. The chemical industry also relies heavily on hydrogen for ammonia and fertilizer production.

North America Hydrogen Market Growth and Trend Analysis:

Government Policies and Incentives

- Government policies and incentives are a major driver of the North American hydrogen market. Initiatives like the U.S. Inflation Reduction Act (IRA) and Canada’s Hydrogen Strategy provide substantial financial support, including tax credits and grants, for clean hydrogen production and infrastructure development. These policies aim to reduce the cost of green and blue hydrogen, making them more competitive with traditional fossil fuels. Additionally, federal and state-level mandates for decarbonization and renewable energy adoption are pushing industries to integrate hydrogen into their operations, further accelerating market growth.

- The focus on achieving net-zero emissions by 2050 is also driving investment in hydrogen technologies. Governments are partnering with private companies to fund research, development, and deployment of hydrogen infrastructure, such as electrolyzers, fuel cells, and hydrogen refueling stations. These efforts are creating a favorable environment for innovation and scaling up hydrogen production, positioning North America as a leader in the global hydrogen economy.

High Production and Infrastructure Costs

- The primary restraints in the North American hydrogen market is the high cost of production, particularly for green hydrogen. Electrolyzers and renewable energy systems required for green hydrogen production are capital-intensive, and the technology is still in the early stages of commercialization. Additionally, the lack of widespread hydrogen infrastructure, such as pipelines, storage facilities, and refueling stations, poses a significant challenge to market expansion.

- The transition from gray to green hydrogen also requires substantial investment in carbon capture and storage (CCS) technologies for blue hydrogen, which further increases costs. These financial barriers can slow down adoption, especially for small and medium-sized enterprises. Until economies of scale are achieved and infrastructure is more developed, cost remains a critical restraint for the hydrogen market.

Expansion in Heavy-Duty Transportation and Energy Storage

- The hydrogen market in North America presents significant opportunities in heavy-duty transportation and energy storage. Hydrogen fuel cells are increasingly being adopted for trucks, buses, trains, and even maritime applications, offering a zero-emission alternative to diesel engines. This is particularly relevant for long-haul transportation, where battery-electric solutions face limitations in range and charging time.

- Hydrogen also holds immense potential for energy storage and grid balancing, especially as renewable energy adoption grows. Excess renewable energy can be used to produce hydrogen, which can then be stored and converted back to electricity when needed. This capability addresses the intermittency of renewables and enhances grid stability, making hydrogen a key component of the future energy system. Companies investing in these applications are well-positioned to capitalize on this emerging opportunity.

North America Hydrogen Market Segment Analysis:

North America Hydrogen Market is segmented based on Type, Production Source, Application, and Country

By Type, Grey hydrogen currently dominates the North American hydrogen market

- Grey hydrogen currently dominates the North American hydrogen market, accounting for the largest share of production. This is primarily due to its cost-effectiveness and well-established production infrastructure. Grey hydrogen is produced through steam methane reforming (SMR), a process that uses natural gas as a feedstock. The widespread availability of natural gas in North America, particularly in the U.S., makes grey hydrogen the most economically viable option for industries requiring large volumes of hydrogen, such as oil refining and ammonia production.

- However, grey hydrogen production is associated with significant carbon emissions, as the process releases CO? into the atmosphere. This environmental drawback has led to increasing scrutiny and a push for cleaner alternatives like blue and green hydrogen. Despite this, grey hydrogen remains the dominant segment due to its low production costs and the slow transition to more sustainable methods.

By Production Source, Natural Gas segment held the largest share of 57.88% in 2023

- Natural gas is the dominant production source for hydrogen in North America, accounting for the largest share of the market. This is primarily because steam methane reforming (SMR), which uses natural gas as a feedstock, is the most cost-effective and widely adopted method for hydrogen production. The abundance of natural gas resources in the region, particularly in the U.S., has made it the preferred choice for industries requiring large volumes of hydrogen, such as oil refining, ammonia production, and methanol synthesis.

- The dominance of natural gas in hydrogen production is further reinforced by the existing infrastructure and technological maturity of SMR. However, this method is associated with significant carbon emissions, which has led to growing interest in cleaner alternatives like electrolysis powered by renewable energy. Despite this shift, natural gas-based hydrogen production continues to lead the market due to its economic advantages and established supply chains.

North America Hydrogen Market Regional Insights:

U.S. is projected to lead the market over the forecast period

- The United States is expected to dominate the North American hydrogen market over the forecast period, driven by its robust energy infrastructure, technological advancements, and strong policy support. The U.S. is a global leader in hydrogen innovation, with significant investments in both blue and green hydrogen production. Initiatives like the U.S. Department of Energy’s Hydrogen Energy Earthshot and the Inflation Reduction Act (IRA) are providing substantial financial incentives, making clean hydrogen more economically viable and accelerating its adoption across industries.

- The U.S. benefits from abundant natural gas resources, which support cost-effective grey and blue hydrogen production, and a growing renewable energy sector, which is essential for green hydrogen. The country’s focus on decarbonizing heavy industries, transportation, and power generation further positions it as a key player in the global hydrogen economy. With strong government backing, private sector investment, and a commitment to achieving net-zero emissions, the U.S. is poised to lead the hydrogen market in North America and beyond.

Active Players in the North America Hydrogen Market:

- Air Products and Chemicals, Inc. (U.S.)

- Linde plc (U.K.)

- Plug Power Inc. (U.S.)

- Bloom Energy Corporation (U.S.)

- Cummins Inc. (U.S.)

- Shell plc (Netherlands)

- BP plc (U.K.)

- Chevron Corporation (U.S.)

- ExxonMobil Corporation (U.S.)

- Ballard Power Systems Inc. (Canada)

- Nel ASA (Norway)

- Mitsubishi Power Americas, Inc. (Japan)

- ITM Power plc (U.K.)

- FirstElement Fuel Inc. (U.S.)

- McPhy Energy S.A. (France), and Other Active Players.

Key Industry Developments in the North America Hydrogen Market:

In November 2024, 2023: GE Vernova’s Power Conversion business and Next Hydrogen Solutions Inc. signed a memorandum of understanding to integrate Next Hydrogen’s electrolysis technology with GE Vernova’s power systems, aiming to produce green hydrogen and advance decarbonization efforts through renewable energy-powered electrolysis.

In May 2024, Toyota Motor North America (TMNA) established its North American Hydrogen Headquarters (H2HQ) in Gardena, California, by renaming its TMNA R&D office, reaffirming its commitment to hydrogen technology; the renovated facility now supports hydrogen-related R&D, commercialization, and sales, with future plans for a microgrid, customer education center, and more.

In March 2024, US Capital Global announced its engagement as a strategic financial advisor for Charbone Hydrogen Corporation to support a potential multi-million-dollar financing initiative, aiding Charbone’s efforts in developing modular green hydrogen plants across North America to accelerate the transition to clean energy.

|

North America Hydrogen Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 48.63 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.4% |

Market Size in 2032: |

USD 78.07 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Production Source |

|

||

|

By Application |

|

||

|

By Country |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: North America Hydrogen Market by By Type (2018-2032)

4.1 North America Hydrogen Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Grey

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Blue

4.5 Green

Chapter 5: North America Hydrogen Market by By Production Source (2018-2032)

5.1 North America Hydrogen Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Natural gas

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Coal

5.5 Hydrocarbons

5.6 Electrolysis

5.7 Other sources

Chapter 6: North America Hydrogen Market by By Application (2018-2032)

6.1 North America Hydrogen Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Refineries

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Ammonia

6.5 Methanol & Other Chemicals

6.6 Metals & Fabrication

6.7 Electronic Food & Beverage

6.8 Glass & Ceramics

6.9 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 North America Hydrogen Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AIR PRODUCTS AND CHEMICALS

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Recent News & Development

7.2.8 SWOT Analysis

7.3 INC. (U.S.)

7.4 LINDE PLC (U.K.)

7.5 PLUG POWER INC. (U.S.)

7.6 BLOOM ENERGY CORPORATION (U.S.)

7.7 CUMMINS INC. (U.S.)

7.8 SHELL PLC (NETHERLANDS)

7.9 BP PLC (U.K.)

7.10 CHEVRON CORPORATION (U.S.)

7.11 EXXONMOBIL CORPORATION (U.S.)

7.12 BALLARD POWER SYSTEMS INC. (CANADA)

7.13 NEL ASA (NORWAY)

7.14 MITSUBISHI POWER AMERICAS

7.15 INC. (JAPAN)

7.16 ITM POWER PLC (U.K.)

7.17 FIRSTELEMENT FUEL INC. (U.S.)

7.18 MCPHY ENERGY S.A. (FRANCE)

7.19 AND

Chapter 8:North America Hydrogen Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Key Market Trends, Growth Factors and Opportunities

8.3 Key Players

8.4 Historic and Forecasted Market Size By By Type

8.4.1 Grey

8.4.2 Blue

8.4.3 Green

8.5 Historic and Forecasted Market Size By By Production Source

8.5.1 Natural gas

8.5.2 Coal

8.5.3 Hydrocarbons

8.5.4 Electrolysis

8.5.5 Other sources

8.6 Historic and Forecasted Market Size By By Application

8.6.1 Refineries

8.6.2 Ammonia

8.6.3 Methanol & Other Chemicals

8.6.4 Metals & Fabrication

8.6.5 Electronic Food & Beverage

8.6.6 Glass & Ceramics

8.6.7 Others

8.7 Historic and Forecast Market Size by Country

8.7.1 U.S.

8.7.2 Canada

8.7.3 Mexico

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Conclusion

Chapter 10 Our Thematic Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

North America Hydrogen Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 48.63 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.4% |

Market Size in 2032: |

USD 78.07 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Production Source |

|

||

|

By Application |

|

||

|

By Country |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the North America Hydrogen Market research report is 2024-2032.

Air Products and Chemicals, Inc. (U.S.), Linde plc (U.K.), Plug Power Inc. (U.S.), Bloom Energy Corporation (U.S.), Cummins Inc. (U.S.), Shell plc (Netherlands), BP plc (U.K.), Chevron Corporation (U.S.), ExxonMobil Corporation (U.S.), Ballard Power Systems Inc. (Canada), Nel ASA (Norway), Mitsubishi Power Americas, Inc. (Japan), ITM Power plc (U.K.), FirstElement Fuel Inc. (U.S.), McPhy Energy S.A. (France), Other Active Players.

The North America Hydrogen Market is segmented into Type, Production Source, Application, and Region. By Type, the market is categorized into Grey, Blue, Green. By Production Source, the market is categorized into Natural gas, Coal, hydrocarbons, Electrolysis, other sources. By Application, the market is categorized into Refineries, Ammonia, Methanol & Other Chemicals, Metals & Fabrication, Electronic Food & Beverage, Glass & Ceramics, Others. By Region, it is analyzed across North America (U.S.; Canada; Mexico).

The North American hydrogen market is a dynamic and rapidly evolving sector, driven by the region's commitment to reducing carbon emissions and transitioning to a low-carbon economy. The United States is at the forefront of this transformation, leveraging its advanced technological capabilities and extensive energy infrastructure to develop hydrogen production, storage, and distribution systems.

North America Hydrogen Market Size Was Valued at USD 48.63 Billion in 2023, and is Projected to Reach USD 78.07 Billion by 2032, Growing at a CAGR of 5.4% From 2024-2032.