North America Tight Gas Market Synopsis:

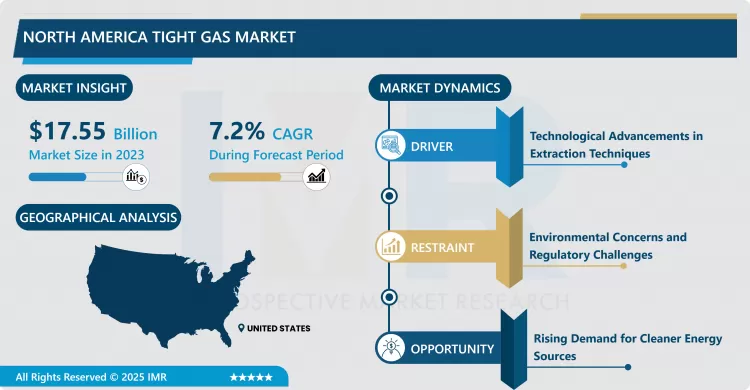

North America Tight Gas Market Size Was Valued at USD 17.55 Billion in 2023, and is Projected to Reach USD 32.81 Billion by 2032, Growing at a CAGR of 7.2% From 2024-2032.

The North America Tight Gas Market is a cornerstone of the region's energy landscape, driven by its vast reserves and advanced extraction technologies. Tight gas, a form of natural gas trapped in low-permeability rock formations, has become a critical component of the energy mix in the U.S. and Canada. The region's dominance in the global tight gas market is attributed to its early adoption of hydraulic fracturing (fracking) and horizontal drilling techniques, which have unlocked previously inaccessible resources. This has not only bolstered energy security but also positioned North America as a key player in the global natural gas market.

The United States is the largest contributor to the North America Tight Gas Market, with major shale plays such as the Marcellus, Haynesville, and Permian Basin driving production. Canada, particularly through its Montney and Duvernay formations, has also emerged as a significant producer. The region's well-established infrastructure, including pipelines and processing facilities, supports efficient extraction and distribution.

Looking ahead, the North America Tight Gas Market is poised for sustained growth, driven by increasing demand for cleaner energy sources and the region's commitment to reducing carbon emissions. Natural gas, including tight gas, is seen as a transitional fuel that complements renewable energy sources.

North America Tight Gas Market Growth and Trend Analysis:

Technological Advancements in Extraction Techniques

- Technological advancements, particularly in hydraulic fracturing (fracking) and horizontal drilling, have been the primary driver of the North America Tight Gas Market. These innovations have revolutionized the energy sector by enabling the extraction of natural gas from low-permeability rock formations that were previously considered uneconomical. The U.S. and Canada have been at the forefront of adopting these technologies, leading to a significant increase in tight gas production over the past decade. This has not only reduced dependency on conventional gas reserves but also positioned North America as a global leader in natural gas production.

- The continuous improvement in extraction technologies has also enhanced efficiency and reduced operational costs, making tight gas a more competitive energy source. For instance, advancements in multi-stage fracking and real-time data analytics have optimized well performance and minimized environmental impact. These technological breakthroughs have attracted substantial investments from both public and private sectors, further fueling the growth of the tight gas market in North America. As a result, the region has been able to meet rising energy demands while maintaining a stable supply of natural gas.

Environmental Concerns and Regulatory Challenges

- Despite its economic benefits, the North America Tight Gas Market faces significant challenges due to environmental concerns associated with fracking. The extraction process involves injecting large volumes of water, chemicals, and sand into the ground, which can lead to groundwater contamination, seismic activity, and other ecological disruptions. These issues have sparked widespread public opposition and prompted stricter regulatory measures, particularly in environmentally sensitive areas. For example, some states in the U.S. have imposed moratoriums or bans on fracking, limiting the expansion of tight gas operations.

- Regulatory uncertainty and compliance costs further constrain market growth. Companies operating in the tight gas sector must navigate a complex web of federal, state, and local regulations, which can delay project approvals and increase operational expenses. Additionally, the growing emphasis on transitioning to renewable energy sources has led to reduced support for fossil fuel projects, including tight gas.

Rising Demand for Cleaner Energy Sources

- The global shift toward cleaner energy sources presents a significant opportunity for the North America Tight Gas Market. Natural gas, including tight gas, is considered a relatively cleaner alternative to coal and oil, emitting fewer greenhouse gases and pollutants when burned. As countries worldwide strive to reduce carbon emissions and combat climate change, natural gas is increasingly being adopted as a transitional fuel to bridge the gap between traditional fossil fuels and renewable energy.

- The growing demand for liquefied natural gas (LNG) exports also offers a lucrative opportunity for the North America Tight Gas Market. The U.S. has emerged as a major LNG exporter, leveraging its abundant tight gas reserves to meet global energy needs. Expanding infrastructure, such as LNG terminals and export facilities, further enhances the region's capacity to capitalize on international markets. By aligning with the global energy transition and investing in sustainable practices, North America can solidify its position as a key player in the tight gas market while contributing to a greener energy future.

North America Tight Gas Market Segment Analysis:

North America Tight Gas Market is segmented based on type, application, and country

By Type, the Processed Tight Gas segment is anticipated to maintain its market dominance throughout the forecast period.

- In the North America Tight Gas Market, processed tight gas dominates the market due to its higher usability and compliance with industry standards. Processed tight gas undergoes treatment to remove impurities such as water, sulfur compounds, and other contaminants, making it suitable for commercial and residential use. This refined form of natural gas is in high demand across various sectors, including power generation, industrial applications, and heating, driving its dominance in the market. The extensive infrastructure for gas processing and distribution in North America further supports the prominence of this segment.

- The dominance of processed tight gas is also attributed to its alignment with environmental regulations and consumer preferences for cleaner energy. Processed gas meets stringent quality standards, reducing emissions and minimizing environmental impact compared to unprocessed gas. Additionally, the growing export of liquefied natural gas (LNG) from North America relies heavily on processed tight gas, as it must meet specific purity requirements for international markets.

By Application, the Power Generation segment accounted for the largest market share of 45% in 2023.

- In the North America Tight Gas Market, the power generation segment dominates due to the widespread use of natural gas as a primary fuel for electricity production. Tight gas, particularly processed tight gas, is a cleaner and more efficient alternative to coal, making it a preferred choice for power plants across the region. The shift toward reducing carbon emissions and transitioning to cleaner energy sources has further accelerated the adoption of natural gas in power generation, solidifying this segment's leading position in the market.

- The dominance of the power generation segment is also driven by the abundant supply of tight gas in North America, coupled with well-established infrastructure for gas distribution. Natural gas-fired power plants are highly flexible, capable of meeting both base-load and peak electricity demands, which enhances their appeal. Additionally, government policies promoting cleaner energy and the retirement of coal-fired plants have created a favorable environment for the growth of natural gas in power generation.

North America Tight Gas Market Country Insights:

- The United States is poised to dominate the North America Tight Gas Market, driven by its vast reserves, advanced extraction technologies, and well-developed infrastructure. The country is home to some of the world's largest shale plays, such as the Marcellus, Haynesville, and Permian Basin, which are major contributors to tight gas production. The widespread adoption of hydraulic fracturing (fracking) and horizontal drilling techniques has enabled the U.S. to unlock significant tight gas resources, making it a global leader in natural gas production. For instance, in 2023, the U.S. accounted for over 84.67% of North America's tight gas output, solidifying its dominant position in the market.

- U.S. benefits from a robust regulatory framework and substantial investments in energy infrastructure, including pipelines, processing facilities, and LNG export terminals. The growing demand for natural gas in power generation, industrial applications, and exports further strengthens the country's market dominance.

Active Players in the North America Tight Gas Market:

- ExxonMobil Corporation (United States)

- Chevron Corporation (United States)

- BP plc (United Kingdom)

- ConocoPhillips (United States)

- EOG Resources, Inc. (United States)

- Devon Energy Corporation (United States)

- Pioneer Natural Resources Company (United States)

- Southwestern Energy Company (United States)

- Chesapeake Energy Corporation (United States)

- Coterra Energy Inc. (United States), and Other Active Players.

|

North America Tight Gas Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 17.55 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.2% |

Market Size in 2032: |

USD 32.81 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Country |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: North America Tight Gas Market by By Type (2018-2032)

4.1 North America Tight Gas Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Processed Tight Gas

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Unprocessed Tight Gas

Chapter 5: North America Tight Gas Market by By Application (2018-2032)

5.1 North America Tight Gas Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Industrial

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Power Generation

5.5 Residential

5.6 Commercial

5.7 Transportation

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 North America Tight Gas Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 EXXONMOBIL CORPORATION (UNITED STATES)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Operating Business Segments

6.2.5 Product Portfolio

6.2.6 Business Performance

6.2.7 Recent News & Development

6.2.8 SWOT Analysis

6.3 CHEVRON CORPORATION (UNITED STATES)

6.4 BP PLC (UNITED KINGDOM)

6.5 CONOCOPHILLIPS (UNITED STATES)

6.6 EOG RESOURCES

6.7 INC. (UNITED STATES)

6.8 DEVON ENERGY CORPORATION (UNITED STATES)

6.9 PIONEER NATURAL RESOURCES COMPANY (UNITED STATES)

6.10 SOUTHWESTERN ENERGY COMPANY (UNITED STATES)

6.11 CHESAPEAKE ENERGY CORPORATION (UNITED STATES)

6.12 COTERRA ENERGY INC. (UNITED STATES)

6.13 AND

Chapter 7:North America Tight Gas Market Analysis, Insights and Forecast, 2016-2028

7.1 Market Overview

7.2 Key Market Trends, Growth Factors and Opportunities

7.3 Key Players

7.4 Historic and Forecasted Market Size By By Type

7.4.1 Processed Tight Gas

7.4.2 Unprocessed Tight Gas

7.5 Historic and Forecasted Market Size By By Application

7.5.1 Industrial

7.5.2 Power Generation

7.5.3 Residential

7.5.4 Commercial

7.5.5 Transportation

7.6 Historic and Forecast Market Size by Country

7.6.1 U.S.

7.6.2 Canada

7.6.3 Mexico

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Conclusion

Chapter 9 Our Thematic Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

North America Tight Gas Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 17.55 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.2% |

Market Size in 2032: |

USD 32.81 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Country |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the North America Tight Gas Market research report is 2024-2032.

ExxonMobil Corporation (United States), Chevron Corporation (United States), BP plc (United Kingdom), ConocoPhillips (United States), EOG Resources, Inc. (United States), Devon Energy Corporation (United States), Pioneer Natural Resources Company (United States), Southwestern Energy Company (United States), Chesapeake Energy Corporation (United States), Coterra Energy Inc. (United States), and Other Active Players.

The North America Tight Gas Market is segmented into Type, Application, and Region. By Type, the market is categorized into Processed Tight Gas, Unprocessed Tight Gas. By Application, the market is categorized into Industrial, Power Generation, Residential, Commercial, Transportation. By Region, it is analyzed across North America (U.S.; Canada; Mexico).

Tight gas is a type of natural gas trapped in low-permeability rock formations, such as sandstone or shale, making it difficult to extract using conventional methods. Specialized techniques like hydraulic fracturing (fracking) and horizontal drilling are required to access and produce this resource. Tight gas is a significant component of unconventional natural gas reserves and plays a crucial role in meeting global energy demands.

North America Tight Gas Market Size Was Valued at USD 17.55 Billion in 2023, and is Projected to Reach USD 32.81 Billion by 2032, Growing at a CAGR of 7.2% From 2024-2032.