Nuclear Moisture Separator Reheaters Market Synopsis

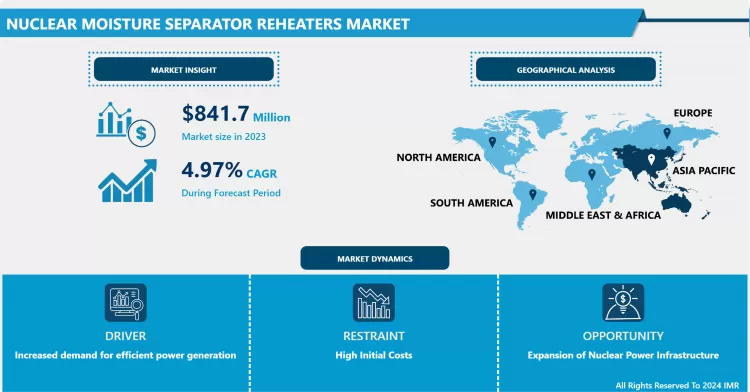

Global Nuclear Moisture Separator Reheaters Market Size Was Valued at USD 841.7 Million in 2023, and is Projected to Reach USD 1302.4 Million by 2032, Growing at a CAGR of 4.97% From 2024-2032.

Nuclear Moisture Separator Reheaters are essential components in nuclear power plants, separating moisture from steam and reheating it for improved energy efficiency. They enhance turbine performance by preventing moisture damage and increasing power output. Operating in pressurized or boiling water reactors, they ensure optimal steam quality for turbine-driven electricity production.

- Nuclear Moisture Separator Reheaters stand out for their crucial role in nuclear power generation, offering notable advantages. By efficiently eliminating moisture from steam, they elevate plant efficiency, safeguarding turbines from potential damage caused by wet steam and optimizing power output. Market trends underscore a heightened demand for advanced moisture separator reheater technologies, aligning with evolving safety and regulatory standards.

- Demand surge is propelled by the global expansion of the nuclear energy sector, emphasizing reliable and efficient power generation. A discernible trend is emerging in the industry, focusing on the advancement of Nuclear Moisture Separator Reheaters equipped with cutting-edge separation technologies to enhance moisture removal efficacy. The ongoing upgrades and modernization endeavors in existing nuclear power plants further contribute to the demand for these components.

- Increasing global emphasis on sustainable energy fosters a growing interest in nuclear power, amplifying the need for efficient and dependable components like Moisture Separator Reheaters. In essence, the confluence of technological innovation, safety compliance, and the worldwide push for cleaner energy solidifies the pivotal role of these devices in advancing nuclear power infrastructure.

Nuclear Moisture Separator Reheaters Market Trend Analysis

Increased demand for efficient power generation

- The surging demand for effective power generation stands out as a significant driver propelling the adoption of Nuclear Moisture Separator Reheaters. With an escalating global requirement for electricity, the quest for optimizing power generation processes becomes paramount. Nuclear power, acknowledged for its capacity to generate substantial electricity with minimal carbon emissions, emerges as a vital solution. In this context, Nuclear Moisture Separator Reheaters play a pivotal role by ensuring the streamlined performance of turbines within nuclear power plants.

- These reheaters are instrumental in eliminating moisture from steam, safeguarding turbines from potential damage caused by wet steam, and thereby elevating the overall efficiency of power generation. As the world increasingly prioritizes sustainability and dependability in the energy sector, the demand for power generation solutions that offer enhanced efficiency, including advanced reheating systems, experiences a notable upswing. The pursuit of heightened efficiency aligns with both economic considerations and environmental consciousness, establishing Nuclear Moisture Separator Reheaters as indispensable components in addressing the rising global demand for electricity while emphasizing reliability and environmental stewardship.

Expansion of Nuclear Power Infrastructure

- The opportunities for Nuclear Moisture Separator Reheaters are notably propelled by the expanding landscape of nuclear power infrastructure. As nations globally commit to the development and enlargement of nuclear power projects, there is a heightened demand for reliable and efficient components, specifically Moisture Separator Reheaters. These reheaters assume a crucial role in advancing power generation efficiency by guaranteeing optimal steam quality and mitigating turbine damage attributed to moisture. The prospects lie in meeting the increasing requirements of newly established nuclear facilities and those undergoing expansion.

- Countries actively diversifying their energy portfolios and emphasizing the reduction of carbon emissions, nuclear power emerges as a sustainable and pragmatic choice. This growing inclination amplifies the necessity for Nuclear Moisture Separator Reheaters, positioning them as integral to the successful operations of nuclear power plants. Manufacturers and suppliers within this sector have the opportunity to contribute significantly to the expansion of clean energy by providing advanced reheater technologies that align seamlessly with the evolving needs of the burgeoning nuclear power infrastructure, ensuring the steadfastness and effectiveness of electricity generation.

Nuclear Moisture Separator Reheaters Market Segment Analysis:

Nuclear Moisture Separator Reheaters Market Segmented on the basis of Reactor Type, Application, and Distribution Channel.

By Reactor Type, Pressurized Water Reactors (PWRs) segment is expected to dominate the market during the forecast period

- The expected dominance of the Pressurized Water Reactors (PWRs) segment in the Nuclear Moisture Separator Reheaters market throughout the forecast period is influenced by several key factors. PWRs stand as the most extensively employed nuclear reactor type globally, representing a significant share of existing and upcoming nuclear power initiatives. Given the prevalent reliance on steam for power generation in PWRs, there is an inherent and substantial demand for efficient moisture separation and reheating processes.

- Nuclear Moisture Separator Reheaters play a pivotal role within PWRs by ensuring the quality of steam remains optimal, preventing potential turbine damage caused by wet steam, and thereby elevating the overall efficiency of power plants. The widespread use of PWRs, both in established facilities and new projects, positions the associated reheater technologies as essential components meeting high market demand. Additionally, ongoing upgrades and expansions of PWR-based nuclear power infrastructure globally contribute to a sustained need for advanced and reliable Nuclear Moisture Separator Reheaters, reinforcing the prominence of the PWR segment in the market.

By Application, Moisture separation segment is expected to dominate the market during the forecast period

- The dominance anticipated for the Moisture Separation segment in the Nuclear Moisture Separator Reheaters market throughout the forecast period is rooted in its fundamental role in ensuring the efficiency and reliability of nuclear power plants. Moisture separation plays a critical function by preventing turbine damage caused by wet steam, ensuring the sustained and dependable operation of the entire power generation system. With an increasing emphasis on operational efficiency and safety in nuclear facilities, there is a heightened demand for advanced Moisture Separator Reheaters.

- This segment's prominence is further emphasized by the widespread adoption of moisture separation technologies across diverse reactor types, including Pressurized Water Reactors (PWRs) and Boiling Water Reactors (BWRs). The consistent necessity for maintaining optimal steam quality, crucial for maximizing power output, positions moisture separation as an indispensable application within the global nuclear energy landscape. As nuclear power continues to play a central role in the world's energy mix, the Moisture Separation segment is poised for dominance, driven by its fundamental contribution to the effectiveness and dependability of nuclear power generation.

Nuclear Moisture Separator Reheaters Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is poised to dominate the Nuclear Moisture Separator Reheaters market throughout the forecast period, driven by several pivotal factors. This projection is underpinned by the substantial expansion of nuclear power infrastructure in countries like China, India, and South Korea. These nations are making significant investments to meet rising energy needs while adhering to sustainable practices and reducing carbon emissions.

- The region's emphasis on nuclear energy projects, coupled with initiatives to modernize existing facilities, creates a robust demand for advanced Nuclear Moisture Separator Reheaters. These reheaters play a crucial role in ensuring the efficiency and safety of nuclear power plants. The dominance of the Asia Pacific region is further underscored by its commitment to adopting state-of-the-art technologies, aligning with global standards in nuclear power generation. Consequently, the Nuclear Moisture Separator Reheaters market is poised for substantial growth, solidifying the Asia Pacific region as a pivotal driver in shaping the evolving landscape of nuclear energy.

Nuclear Moisture Separator Reheaters Market Top Key Players:

- GE Energy (US)

- ABB (US)

- Babcock Power (US)

- Peerless (CECO) (US)

- NuCore (US)

- Nuvia Ltd. (Canada)

- Zespó? Elektromaszynowy Dolmel (Poland)

- Atomstroyexport (Russia)

- Atomenergomash (Russia)

- Energomash (Ukraine)

- Balcke-Durr (SPX) (Germany)

- Vallourec (France)

- Alstom Power (GE) (France)

- Framatome (France)

- Technip Energies (France)

- Amec Foster Wheeler (UK)

- Ansaldo Energia (Italy)

- Toshiba (Japan)

- Mitsubishi Heavy Industries (Japan)

- Harbin Boiler (China)

- Shanghai Electric (China)

- CNNC (China)

- Bharat Heavy Electricals (India)

- Thermax (India)

- Doosan Heavy Industries (South Korea), and Other Major Players.

Key Industry Developments in the Nuclear Moisture Separator Reheaters Market:

- In July 2022, GE plans to acquire Nexus Controls, a Baker Hughes business specializing in aftermarket control system upgrades and controls field services, to create a world-class full-service controls business within GE. The integrated business will develop GE's proprietary MarkTM Vle controls systems platform, design retrofit and modernization offerings, and streamline control delivery and service in power generation.

|

Global Nuclear Moisture Separator Reheaters Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 841.7 Mn. |

|

Forecast Period 2023-30 CAGR: |

4.97 % |

Market Size in 2032: |

USD 1302.4 Mn. |

|

Segments Covered: |

By Reactor Type |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Nuclear Moisture Separator Reheaters Market by By Reactor Type (2018-2032)

4.1 Nuclear Moisture Separator Reheaters Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Pressurized Water Reactors (PWRs)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Boiling Water Reactors (BWRs)

4.5 High-Temperature Gas-cooled Reactors (HTGRs)

4.6 Fast Breeder Reactors (FBRs)

Chapter 5: Nuclear Moisture Separator Reheaters Market by By Application (2018-2032)

5.1 Nuclear Moisture Separator Reheaters Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Moisture Separation

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Steam reheating

5.5 Combined cycle repowering

Chapter 6: Nuclear Moisture Separator Reheaters Market by By Distribution Channel (2018-2032)

6.1 Nuclear Moisture Separator Reheaters Market Snapshot and Growth Engine

6.2 Market Overview

6.3 OEMs (Original Equipment Manufacturers)

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Aftermarket Reheaters

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Nuclear Moisture Separator Reheaters Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ANALOG DEVICES INC. (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 SYNAPTICS (US)

7.4 THAT CORPORATION (US)

7.5 TEXAS INSTRUMENTS (US)

7.6 CIRRUS LOGIC (US)

7.7 ESS TECHNOLOGY (US)

7.8 MAXIM INTEGRATED (US)

7.9 MICROCHIP (US)

7.10 ON SEMICONDUCTOR (US)

7.11 QUALCOMM (US)

7.12 MICROSEMI CORPORATION (US)

7.13 STMICROELECTRONICS (SWITZERLAND)

7.14 DIALOG SEMICONDUCTOR (UK)

7.15 INFINEON (GERMANY)

7.16 NXP SEMICONDUCTORS (NETHERLANDS)

7.17 ASAHI KASEI MICRODEVICES (AKM) (JAPAN)

7.18 RENESAS ELECTRONICS (JAPAN)

7.19 ROHM CO. LTD. (JAPAN)

7.20 NEW JAPAN RADIO (NJR) (JAPAN)

7.21 TOSHIBA CORPORATION (JAPAN)

7.22 YAMAHA (JAPAN)

7.23 BESTECHNIC (CHINA)

7.24 AMS AG (AUSTRIA)

7.25 REALTEK (TAIWAN)

7.26

Chapter 8: Global Nuclear Moisture Separator Reheaters Market By Region

8.1 Overview

8.2. North America Nuclear Moisture Separator Reheaters Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Reactor Type

8.2.4.1 Pressurized Water Reactors (PWRs)

8.2.4.2 Boiling Water Reactors (BWRs)

8.2.4.3 High-Temperature Gas-cooled Reactors (HTGRs)

8.2.4.4 Fast Breeder Reactors (FBRs)

8.2.5 Historic and Forecasted Market Size By By Application

8.2.5.1 Moisture Separation

8.2.5.2 Steam reheating

8.2.5.3 Combined cycle repowering

8.2.6 Historic and Forecasted Market Size By By Distribution Channel

8.2.6.1 OEMs (Original Equipment Manufacturers)

8.2.6.2 Aftermarket Reheaters

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Nuclear Moisture Separator Reheaters Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Reactor Type

8.3.4.1 Pressurized Water Reactors (PWRs)

8.3.4.2 Boiling Water Reactors (BWRs)

8.3.4.3 High-Temperature Gas-cooled Reactors (HTGRs)

8.3.4.4 Fast Breeder Reactors (FBRs)

8.3.5 Historic and Forecasted Market Size By By Application

8.3.5.1 Moisture Separation

8.3.5.2 Steam reheating

8.3.5.3 Combined cycle repowering

8.3.6 Historic and Forecasted Market Size By By Distribution Channel

8.3.6.1 OEMs (Original Equipment Manufacturers)

8.3.6.2 Aftermarket Reheaters

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Nuclear Moisture Separator Reheaters Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Reactor Type

8.4.4.1 Pressurized Water Reactors (PWRs)

8.4.4.2 Boiling Water Reactors (BWRs)

8.4.4.3 High-Temperature Gas-cooled Reactors (HTGRs)

8.4.4.4 Fast Breeder Reactors (FBRs)

8.4.5 Historic and Forecasted Market Size By By Application

8.4.5.1 Moisture Separation

8.4.5.2 Steam reheating

8.4.5.3 Combined cycle repowering

8.4.6 Historic and Forecasted Market Size By By Distribution Channel

8.4.6.1 OEMs (Original Equipment Manufacturers)

8.4.6.2 Aftermarket Reheaters

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Nuclear Moisture Separator Reheaters Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Reactor Type

8.5.4.1 Pressurized Water Reactors (PWRs)

8.5.4.2 Boiling Water Reactors (BWRs)

8.5.4.3 High-Temperature Gas-cooled Reactors (HTGRs)

8.5.4.4 Fast Breeder Reactors (FBRs)

8.5.5 Historic and Forecasted Market Size By By Application

8.5.5.1 Moisture Separation

8.5.5.2 Steam reheating

8.5.5.3 Combined cycle repowering

8.5.6 Historic and Forecasted Market Size By By Distribution Channel

8.5.6.1 OEMs (Original Equipment Manufacturers)

8.5.6.2 Aftermarket Reheaters

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Nuclear Moisture Separator Reheaters Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Reactor Type

8.6.4.1 Pressurized Water Reactors (PWRs)

8.6.4.2 Boiling Water Reactors (BWRs)

8.6.4.3 High-Temperature Gas-cooled Reactors (HTGRs)

8.6.4.4 Fast Breeder Reactors (FBRs)

8.6.5 Historic and Forecasted Market Size By By Application

8.6.5.1 Moisture Separation

8.6.5.2 Steam reheating

8.6.5.3 Combined cycle repowering

8.6.6 Historic and Forecasted Market Size By By Distribution Channel

8.6.6.1 OEMs (Original Equipment Manufacturers)

8.6.6.2 Aftermarket Reheaters

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Nuclear Moisture Separator Reheaters Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Reactor Type

8.7.4.1 Pressurized Water Reactors (PWRs)

8.7.4.2 Boiling Water Reactors (BWRs)

8.7.4.3 High-Temperature Gas-cooled Reactors (HTGRs)

8.7.4.4 Fast Breeder Reactors (FBRs)

8.7.5 Historic and Forecasted Market Size By By Application

8.7.5.1 Moisture Separation

8.7.5.2 Steam reheating

8.7.5.3 Combined cycle repowering

8.7.6 Historic and Forecasted Market Size By By Distribution Channel

8.7.6.1 OEMs (Original Equipment Manufacturers)

8.7.6.2 Aftermarket Reheaters

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Nuclear Moisture Separator Reheaters Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 841.7 Mn. |

|

Forecast Period 2023-30 CAGR: |

4.97 % |

Market Size in 2032: |

USD 1302.4 Mn. |

|

Segments Covered: |

By Reactor Type |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Nuclear Moisture Separator Reheaters Market research report is 2024-2032.

GE Energy (US), ABB (US), Babcock Power (US), Peerless (CECO) (US), NuCore (US), Nuvia Ltd. (Canada), Zespó? Elektromaszynowy Dolmel (Poland), Atomstroyexport (Russia), Atomenergomash (Russia), Energomash (Ukraine), Balcke-Durr (SPX) (Germany), Vallourec (France), Alstom Power (GE) (France), Framatome (France), Technip Energies (France), Amec Foster Wheeler (UK), Ansaldo Energia (Italy), Toshiba (Japan), Mitsubishi Heavy Industries (Japan), Harbin Boiler (China), Shanghai Electric (China), CNNC (China), Bharat Heavy Electricals (India), Thermax (India), Doosan Heavy Industries (South Korea) and Other Major Players.

The Nuclear Moisture Separator Reheaters Market is segmented into Reactor Type, Application, Distribution Channel, and region. By Reactor Type, the market is categorized into Pressurized Water Reactors (PWRs), Boiling Water Reactors (BWRs), High-Temperature Gas-cooled Reactors (HTGRs), and Fast Breeder Reactors (FBRs). By Application, the market is categorized into Moisture separation, Steam reheating, and Combined cycle repowering. By Distribution Channel, the market is categorized into OEMs (Original Equipment Manufacturers) and Aftermarket Reheaters. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Nuclear Moisture Separator Reheaters are essential components in nuclear power plants, separating moisture from steam and reheating it for improved energy efficiency. They enhance turbine performance by preventing moisture damage and increasing power output. Operating in pressurized or boiling water reactors, they ensure optimal steam quality for turbine-driven electricity production.

Global Nuclear Moisture Separator Reheaters Market Size Was Valued at USD 841.7 Million in 2023, and is Projected to Reach USD 1302.4 Million by 2032, Growing at a CAGR of 4.97% From 2024-2032.