Oil and Gas Pipeline Market Synopsis:

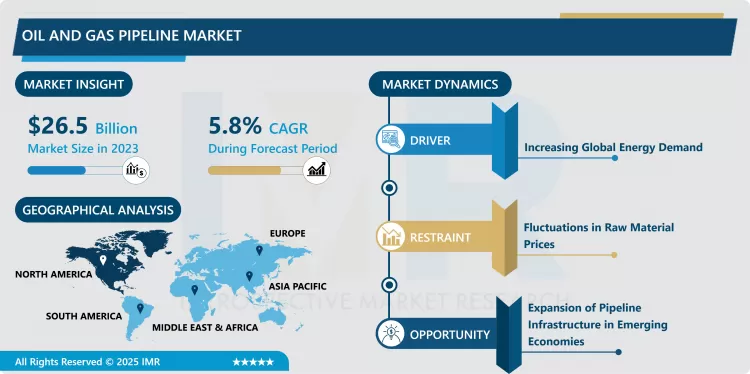

Oil and Gas Pipeline Market Size Was Valued at USD 26.5 Billion in 2023, and is Projected to Reach USD 44.01 Billion by 2032, Growing at a CAGR of 5.8% From 2024-2032.

The oil and gas pipeline industry include global pipeline infrastructure for conveying crude oil, natural gas and petroleum product pipelines from production source to demand points. This infrastructure is essential for the timely, safe and cost-effective transportation of energy resources in order to meet the global energy needs and stabilize the ever-volatile economies.

The overall market for oil and gas pipeline has been experienced a very high growth rate majorly fuelled by increased energy consumption around the world, rise in the development of urban areas, and industrialization. A continued market growth is driven by the increase in demand and in pipeline inspection technology to optimize and optimize the operation as well as safety. Further, the new regulation policies of exploration brought up opportunities of pipeline infrastructure growth to meet the rising demand of oil &Natural gas in different sectors all over the world.

The market is divided into two types namely crude oil pipelines and natural gas pipelines; however, natural gas pipeline dominates the market due to increasing demand for natural gas as a source of energy all over the world due to the fact that it is cheaper as compared to other sources of energy. Applications are classified into onshore and offshore pipelines, of which offshore parts contribute significantly in terms of revenue in transporting resources from subsea wells to production facilities. Locally, North America and Asia-Pacific regions have been on the rise due to robust pipeline infrastructure invested in and rising energy requirements.

Oil and Gas Pipeline Market Trend Analysis:

Digitalization and Technological Advancements in Pipeline Operations

- As we know, the current oil and gas pipeline industry is just at the cusp of moving towards the more digitalized and efficient industry with the help of adopting advanced technologies. Due to advancement in technology, polymers and IoT devices, smart sensors, and machine learning algorithms are used in real-time monitoring and predicting pipeline infrastructure.

- These developments contribute to improving operation efficacy and safety; minimum stoppages and maintenance expenses. This direction to digitalization proves its readiness to deliver appropriate technological solutions for novel demands and new requirements.

Expansion of Pipeline Infrastructure in Emerging Economies

- New opportunities for the growth of pipelines for oil and gas appear mainly in emergent economies, especially in the Asia-Pacific region. The recent trends of industrialization and urbanization and escalating energy demand in the states like China and India also put pressure on the need to create specialized pipeline facilities for energy delivery.

- Opportunities for the industry in these regions include capital on new pipeline projects and the upgrading of old infrastructure in these areas to power market growth.

Oil and Gas Pipeline Market Segment Analysis:

Oil and Gas Pipeline Market is Segmented on the basis of type, application, sector, and region

By Type, Crude Oil Pipeline segment is expected to dominate the market during the forecast period

- Transportation crude oil pipelines constitute another important category of the oil and gas pipeline market that enables the carriage of petroleum crude in its natural state from production stations to MSRs. It is through these pipelines that the long distance, safe, efficient and cost-effective transportation of crude oil into the international energy systems takes place. It is common to use them for high capacities, they are vital in meeting energy power demands by the industrial, transport and commercial sectors. Expenditures incurred on upgrading as well as the construction of crude oil pipelines have been progressively increasing mainly in zones considered to be endowed with petroleum deposits including North America and Middle East.

- The market is overwhelmingly dominated by the natural gas pipelines as the demand for natural gas as an energy source is rising across the globe. These pipelines can transport natural gas from production fields, processing plants and distribution centers and to the final customer. As global energies turn their attention to minimizing carbon emissions, the use of natural gas pipelines has rapidly increased owing to increased consumer and commercial utilization. The segment is also seeing the positive influence of improving technology, including smart pipelines that make the monitoring and management of the networks better, making natural gas a key player in the transition to a resource-scarce future.

By Application, Onshore segment expected to held the largest share

- onshore pipelines are also one of the segments of the oil and gas pipeline market, which is aimed at delivering energy products through the territory from the extraction points to factories and consumers. These pipelines are very essential in the link between inland oil and gas fields and processing centers as well as consumption centers. In addition, onshore pipelines are relatively easy to access for construction and maintenance which costs significantly less than the offshore pipelines. North America, APAC, and Europe have many onshore pipelines that enable the increasing energy needs of industrial and residential sectors. Third, the current pipeline technologies have improved the operations, chiefly within the onshore locations, making this segment more appealing.

- Subsea pipelines are used frequently in order to transfer oil and gas production from subsea reservoirs to onshore platforms. These pipelines are essential for accessing the resources present beneath the sea surface mainly in the Gulf of Mexico, North sea and offshore Asia. Despite the hurdles associated with offshore pipeline construction like high cost, requirement of materials that are resistant to marine environment etc offshore pipelines are still very vital in the process of development of the offshore resources. Recent development in pipeline engineering including new coatings and sometimes corrosion resistant materials has improved their durability. Offshore pipeline markets are thus projected to achieve steady growth given growing interest in operating in deep water and ultra-deep water zones.

Oil and Gas Pipeline Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Hence dissecting geographically, the North America oil and gas pipeline market size is significant value of overall oil and pipeline market values around the year 2023. This dominance is because of availability of extensive pipeline infrastructure, large number of pipeline projects being developed, and existence of major industry participants.

- The USA for instance has extensive pipeline infrastructure in the transport of oil and natural gas, for its own consumption, and exportation.

Active Key Players in the Oil and Gas Pipeline Market:

- Baker Hughes Co. (United States)

- ChelPipe (Russia)

- China National Petroleum Corporation (China)

- ConocoPhillips (United States)

- Eni S.p.A (Italy)

- EVRAZ North America (United States)

- Gazprom (Russia)

- General Electric (United States)

- Mott Macdonald Group Ltd. (United Kingdom)

- National Oilwell Varco (United States)

- Nippon Steel Corporation (Japan)

- Royal Dutch Shell p.l.c. (Netherlands)

- Saipem S.p.A (Italy)

- TechnipFMC (United Kingdom)

- Tenaris S.A. (Luxembourg)

- Other Active Players

Key Industry Development in the Oil and Gas Pipeline Market:

- In September 2024, Mott MacDonald, a prominent global consultancy in engineering, management, and development, finalized its acquisition of Neo Engineering Consultancy (Neo), which specializes in electrical engineering and strategic advisory services in utilities.

- In June 2023, Eni S.p.A. is happy to report that together with Vår Energi ASA it has finalized an agreement to purchase Neptune Energy Group Limited Neptune stands as a premier independent exploration and production firm with a top-tier collection of gas-focused assets and operations across Western Europe, North Africa, Indonesia, and Australia. The portfolio is cost-effective and has minimal operational emissions.

|

Global Oil and Gas Pipeline Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 26.5 Billion |

|

Forecast Period 2024-32 CAGR: |

5.8% |

Market Size in 2032: |

USD 44.01 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Sector |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Oil and Gas Pipeline Market by By Type (2018-2032)

4.1 Oil and Gas Pipeline Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Crude Oil Pipeline

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Natural Gas Pipeline

Chapter 5: Oil and Gas Pipeline Market by By Application (2018-2032)

5.1 Oil and Gas Pipeline Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Onshore

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Offshore

Chapter 6: Oil and Gas Pipeline Market by By Sector (2018-2032)

6.1 Oil and Gas Pipeline Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Upstream

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Midstream

6.5 Downstream

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Oil and Gas Pipeline Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BAKER HUGHES CO. (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CHELPIPE (RUSSIA)

7.4 CHINA NATIONAL PETROLEUM CORPORATION (CHINA)

7.5 CONOCOPHILLIPS (UNITED STATES)

7.6 ENI S.P.A (ITALY)

7.7 EVRAZ NORTH AMERICA (UNITED STATES)

7.8 GAZPROM (RUSSIA)

7.9 GENERAL ELECTRIC (UNITED STATES)

7.10 MOTT MACDONALD GROUP LTD. (UNITED KINGDOM)

7.11 NATIONAL OILWELL VARCO (UNITED STATES)

7.12 NIPPON STEEL CORPORATION (JAPAN)

7.13 ROYAL DUTCH SHELL P.L.C. (NETHERLANDS)

7.14 SAIPEM S.P.A (ITALY)

7.15 TECHNIPFMC (UNITED KINGDOM)

7.16 TENARIS S.A. (LUXEMBOURG)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Oil and Gas Pipeline Market By Region

8.1 Overview

8.2. North America Oil and Gas Pipeline Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Type

8.2.4.1 Crude Oil Pipeline

8.2.4.2 Natural Gas Pipeline

8.2.5 Historic and Forecasted Market Size By By Application

8.2.5.1 Onshore

8.2.5.2 Offshore

8.2.6 Historic and Forecasted Market Size By By Sector

8.2.6.1 Upstream

8.2.6.2 Midstream

8.2.6.3 Downstream

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Oil and Gas Pipeline Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Type

8.3.4.1 Crude Oil Pipeline

8.3.4.2 Natural Gas Pipeline

8.3.5 Historic and Forecasted Market Size By By Application

8.3.5.1 Onshore

8.3.5.2 Offshore

8.3.6 Historic and Forecasted Market Size By By Sector

8.3.6.1 Upstream

8.3.6.2 Midstream

8.3.6.3 Downstream

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Oil and Gas Pipeline Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Type

8.4.4.1 Crude Oil Pipeline

8.4.4.2 Natural Gas Pipeline

8.4.5 Historic and Forecasted Market Size By By Application

8.4.5.1 Onshore

8.4.5.2 Offshore

8.4.6 Historic and Forecasted Market Size By By Sector

8.4.6.1 Upstream

8.4.6.2 Midstream

8.4.6.3 Downstream

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Oil and Gas Pipeline Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Type

8.5.4.1 Crude Oil Pipeline

8.5.4.2 Natural Gas Pipeline

8.5.5 Historic and Forecasted Market Size By By Application

8.5.5.1 Onshore

8.5.5.2 Offshore

8.5.6 Historic and Forecasted Market Size By By Sector

8.5.6.1 Upstream

8.5.6.2 Midstream

8.5.6.3 Downstream

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Oil and Gas Pipeline Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Type

8.6.4.1 Crude Oil Pipeline

8.6.4.2 Natural Gas Pipeline

8.6.5 Historic and Forecasted Market Size By By Application

8.6.5.1 Onshore

8.6.5.2 Offshore

8.6.6 Historic and Forecasted Market Size By By Sector

8.6.6.1 Upstream

8.6.6.2 Midstream

8.6.6.3 Downstream

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Oil and Gas Pipeline Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Type

8.7.4.1 Crude Oil Pipeline

8.7.4.2 Natural Gas Pipeline

8.7.5 Historic and Forecasted Market Size By By Application

8.7.5.1 Onshore

8.7.5.2 Offshore

8.7.6 Historic and Forecasted Market Size By By Sector

8.7.6.1 Upstream

8.7.6.2 Midstream

8.7.6.3 Downstream

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Oil and Gas Pipeline Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 26.5 Billion |

|

Forecast Period 2024-32 CAGR: |

5.8% |

Market Size in 2032: |

USD 44.01 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Sector |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Oil and Gas Pipeline Market research report is 2024-2032.

Baker Hughes Co. (United States), ChelPipe (Russia), China National Petroleum Corporation (China), ConocoPhillips (United States), Eni S.p.A (Italy), EVRAZ North America (United States), Gazprom (Russia), General Electric (United States), Mott Macdonald Group Ltd. (United Kingdom), National Oilwell Varco (United States), Nippon Steel Corporation (Japan), Royal Dutch Shell p.l.c. (Netherlands), Saipem S.p.A (Italy), TechnipFMC (United Kingdom), Tenaris S.A. (Luxembourg), and Other Active Players.

The Oil and Gas Pipeline Market is segmented into Type, Application, By Sector and region. By Type, the market is categorized into Crude Oil Pipeline, Natural Gas Pipeline), Application, the market is categorized into (Onshore, Offshore), By Sector, the market is categorized into (Upstream, Midstream, Downstream. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The oil and gas pipeline industry include global pipeline infrastructure for conveying crude oil, natural gas and petroleum product pipelines from production source to demand points. This infrastructure is essential for the timely, safe and cost-effective transportation of energy resources in order to meet the global energy needs and stabilize the ever-volatile economies.

Oil and Gas Pipeline Market Size Was Valued at USD 26.5 Billion in 2023, and is Projected to Reach USD 44.01 Billion by 2032, Growing at a CAGR of 5.8% From 2024-2032.