Oleate Esters Market Synopsis

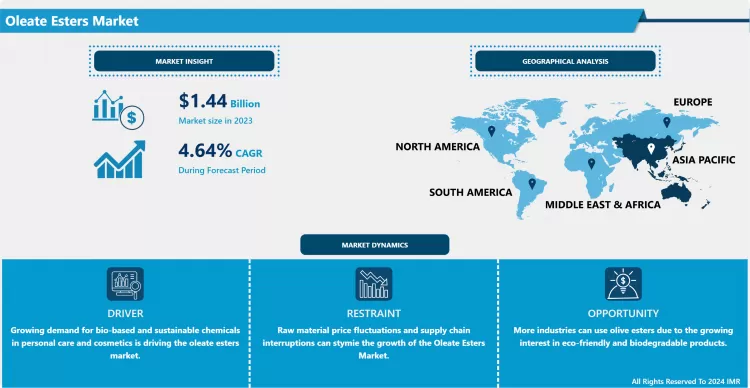

Oleate Esters Market Size is Valued at USD 1.44 Billion in 2024, and is Projected to Reach USD 2.07 Billion by 2032, Growing at a CAGR of 4.64% From 2024-2032.

Currently, the Oleate Esters Market can be considered as a promising niche within the chemical industry that is being stimulated by the constantly increasing demand across numerous industries such as personal care, cosmetics, pharmaceuticals and other industries. Oleate esters are synthesized from oleic acid – a commonly occurring fatty acid in vegetable oils – and these are appreciated for their solvent, emulsifying and lubricating properties. These esters are widely used in the preparation of skin care products owing to their moisturizing and non-greasylsilky feel. In addition, due to their biodegradability as well as the environmentally friendly nature of these catalysts, the green chemical industry is quickly embracing them.

- The increasing demand for oleate esters as bio-based chemicals over synthetic chemicals is expected to boost the Market. This is due to a recent shift of society’s conscience regarding synthetic chemicals and the move toward green substitutes. Especially in the application of the personal care products where the customers are shifting more towards natural products and pure labeling, oleate esters are most suitable for this turnover because they are derived from plant sources. The use of oleate esters to work as emulsifiers and emollients in lotions, creams, and hair care products is being boosted by the growth in the cosmetics personal care industry.

- Another important factor that is fueling the growth of the oleate esters market is application in the pharmaceutical sector is another important factor . Oleate esters are therefore being widely used as excipients and in drug delivery systems due to the natural biodegradability and non toxicity. They are the best carriers in various formulations because of their incredibly good dissolving action on active substances. Also they are the best suited for preparation of plethora of creams and ointments because they are compatible with natural and organic components. This is therefore helping to drive the sector’s growth, specifically in the pharmaceutical sector together with tremendously growing economies.

Oleate Esters Market Trend Analysis

Cosmetics and personal care products employ more oleate esters due to demand for bio-based and sustainable chemicals.

- Another essential trend worth observing in the Oleate Esters Market is the expansion of uses for oleate esters in cosmetics and personal care appliances, stimulated primarily by the interest in bio and environmentally friendly chemicals. Natural and organic products are receiving a lot of preference all over as people become conscious about what they apply on their face and body. Natural oleate esters which can be extracted from natural sources like vegetable oils, are quite popular for their skin conditioning, skin moisture restoring, and skin softening abilities. Therefore, they are widely used by manufacturers who aim at fulfilling the customers’ need for green and unadulterated products. Of equal importance in the cosmetics’ industry there is the growing focus on sustainability contributing to which these products are biodegradable.

- Furthermore, use of renewable bio-based chemicals like oleate esters is on the rise as the regulatory agencies have begun to ban the use of synthetic chemicals in formation of personal care products. Offering things like minimizing roughness and cohesiveness while also serving to hydrate, these esters offer both practical considerations and safety in terms of environmental impact. Oleate esters has been substantiated as an ideal component in the creams, lotions, hair products, make-up, due to the shift towards natural and biodegradable products have opened up tremendous growth prospects. As a result, the personal care segment continues to play an important role in the development of the Oleate Esters Market.

Environmental laws are encouraging the industry to use eco-friendly oleate esters in lubricants and metalworking fluids.

- The proliferation of environmental regulations is driving a notable trend in the oleate esters market: the switch to acquiring sustainable products. During its recent years, governments and regulatory bodies throughout the world have stepped up their effort to reduce the permissible emission of dangerous synthetic chemicals especially in areas, including metalworking fluids and lubricants. In the above identified sectors, they are gradually replacing other types of esters because of the biodegradable and non-toxic nature of oleate esters. They offer a durable product which can help industries meet present environmental standards successfully and simultaneously cater to the growing market for eco-friendly product solutions.

- This form of regulatory push is helping the development of new forms of oleate esters and conditioning the industrial landscape. Due to bio based markets interest to replace petroleum derived chemicals, companies are exploring ways to enhance the performance and utilization of these esters in various systems. Huge growth potential is expected for oleate esters because of the growing need for eco-friendly lubricants and fluids. The increase in market sustainability in the tyre industry and its ability to meet the environmental standards laws are the major influences to this growth.

Oleate Esters Market Segment Analysis:

Oleate Esters Market Segmented on the basis of By Product, By Source, and By Application

By Product Type, Methyl Oleate segment is expected to dominate the market during the forecast period

- This report categorizes the oleate esters market by product type into methyl oleate, ethyl oleate, butyl oleate and trimethylolpropane trichlorate (TMPTO). Methyl oleate is widely used in many sectors as a solvent, lubricant and coalescing agent because of its pronounced biodegradability and acute toxicity. Ethyl oleate is used in many pharmaceuticals as a solvent and a drug vehicle It has emollient properties with regard to skin softening and moisturizing effect and is now being used in the cosmetic industry as well. There are some innovations for these bio based esters and it is due to high demand for green products from industries.

- Likewise, butyl oleate and TPMO, motivated by their specialty uses in industrial lubricants, metal working fluids, and coatings, are also gaining favor.. This is particularly true because butyl oleate has a high biodegradability rate; it is thereby the best lubricant in metalworking fluids. Synthetic lubricants especially those to be used in high temperatures use TMPTO because of its stability and abilities. The global market share occupied by these oleate esters and the general enlargement of this market can be attributed to their versatility in application across the pharmaceuticals and cosmetics industries as well as in industrial usage.

By Application, Lubricant segment held the largest share in 2024

- Some of the major applications of oleate esters include as agrochemicals, cosmetics, lubricants, plasticizers and absorbents, as well as in other industries. Usually, oleate esters are used in the agrochemical industry as emulsifiers and solvents of pesticide formulations because they are biodegradable compounds that are compatible with the most organic materials. In cosmetics, they also used as emollient and emulsifier in skin products as well as hair and make up products which enhance moisturizing effect of a formulation and provides a good texture. A demand for natural and environmentally friendly materials in AP personal care products is the major factor that influences the oleate esters market in this industry.

- Oleate esters commonly acts as bio-degradable lubricants in industrial and auto mobile lubricants particularly where environmental impacts are of considerable concern. However, they also act as plasticizers in the production of flexible plastics; and thereby provide natural and sustainable solution to synthetic plasticizers. In addition, the high chemical inactivity and high level of aqueous absorbency make oleate esters suitable for use as absorbents in chemical products and cleaning compounds. This product is entering many different markets across a broad range of industries as more customers seek out green options and the applications of the oleate esters in these markets.

Oleate Esters Market Regional Insights:

Asia Pacific is expected to dominate the Oleate Esters Market

- Industry insiders believe that the market for oleate esters is likely to be most concentrated in Asia Pacific due to the booming growth of various industries including pharmaceuticals, cosmetics and personal care. By people’s population growth and growth of the customer’s disposable income, there appears a need to use personal care products. Oleate esters are used often in these products because of their ability to emulsify as well as to moisten the skin. In addition, it is expected that this market will continue to grow because oleate esters are used as the excipients in the formulation of drugs in the developing pharmacological industry in the region including China and India.

- Also, Asia Pacific region shows significant shift toward green and bio-part products conforming to the global demotic move to ameliorate the environmental impact. This is supported by government encouragement of green chemical products, and strong legislation against toxic synthetic chemicals in cosmetic products. There is, therefore, anticipated to be a shift in the usage of oleate esters as manufacturers in the Asia Pacific region evolves to meet these changes hence consolidating the region’s position as the world’s dominant producer of oleate esters. Oleate esters are widely used in Asia Pacific owing to the growth in industry and consumers and also adoption of sustainability.

Active Key Players in the Oleate Esters Market

- Croda International Plc (U.K.)

- acme synthetic chemicals (India)

- Victorian Chemical Company Pty Ltd.(Australia)

- PT. Ecogreen Oleochemicals (Malaysia)

- Procter & Gamble (U.S.)

- KLK OLEO (Malaysia)

- Cayman Chemical (U.S.)

- Wilmar International Ltd (Singapore)

- Kao Corporation (Japan)

- Italmatch Chemical S.p.A. (Italy)

- Others

|

Global Oleate Esters Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 1.44 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.64% |

Market Size in 2032: |

USD 2.07 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Source |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Oleate Esters Market by By Product (2018-2032)

4.1 Oleate Esters Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Methyl Oleate

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Ethyl Oleate

4.5 Butyl Oleate

4.6 Tri-methylolpropane Trioleate (TMPTO)

4.7 Others

Chapter 5: Oleate Esters Market by By Source (2018-2032)

5.1 Oleate Esters Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Corn

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Granules

5.5 Soy

5.6 Urea

Chapter 6: Oleate Esters Market by By Application (2018-2032)

6.1 Oleate Esters Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Agrochemical

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Cosmetics

6.5 Lubricant

6.6 Plasticizer

6.7 Absorbent

6.8 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Oleate Esters Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 CRODA INTERNATIONAL PLC (U.K.)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ACME SYNTHETIC CHEMICALS (INDIA)

7.4 VICTORIAN CHEMICAL COMPANY PTY LTD.(AUSTRALIA)

7.5 PT. ECOGREEN OLEOCHEMICALS (MALAYSIA)

7.6 PROCTER & GAMBLE (U.S.)

7.7 KLK OLEO (MALAYSIA)

7.8 CAYMAN CHEMICAL (U.S.)

7.9 WILMAR INTERNATIONAL LTD (SINGAPORE)

7.10 KAO CORPORATION (JAPAN)

7.11 ITALMATCH CHEMICAL S.P.A. (ITALY)

7.12 OTHERS

7.13

Chapter 8: Global Oleate Esters Market By Region

8.1 Overview

8.2. North America Oleate Esters Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Product

8.2.4.1 Methyl Oleate

8.2.4.2 Ethyl Oleate

8.2.4.3 Butyl Oleate

8.2.4.4 Tri-methylolpropane Trioleate (TMPTO)

8.2.4.5 Others

8.2.5 Historic and Forecasted Market Size By By Source

8.2.5.1 Corn

8.2.5.2 Granules

8.2.5.3 Soy

8.2.5.4 Urea

8.2.6 Historic and Forecasted Market Size By By Application

8.2.6.1 Agrochemical

8.2.6.2 Cosmetics

8.2.6.3 Lubricant

8.2.6.4 Plasticizer

8.2.6.5 Absorbent

8.2.6.6 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Oleate Esters Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Product

8.3.4.1 Methyl Oleate

8.3.4.2 Ethyl Oleate

8.3.4.3 Butyl Oleate

8.3.4.4 Tri-methylolpropane Trioleate (TMPTO)

8.3.4.5 Others

8.3.5 Historic and Forecasted Market Size By By Source

8.3.5.1 Corn

8.3.5.2 Granules

8.3.5.3 Soy

8.3.5.4 Urea

8.3.6 Historic and Forecasted Market Size By By Application

8.3.6.1 Agrochemical

8.3.6.2 Cosmetics

8.3.6.3 Lubricant

8.3.6.4 Plasticizer

8.3.6.5 Absorbent

8.3.6.6 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Oleate Esters Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Product

8.4.4.1 Methyl Oleate

8.4.4.2 Ethyl Oleate

8.4.4.3 Butyl Oleate

8.4.4.4 Tri-methylolpropane Trioleate (TMPTO)

8.4.4.5 Others

8.4.5 Historic and Forecasted Market Size By By Source

8.4.5.1 Corn

8.4.5.2 Granules

8.4.5.3 Soy

8.4.5.4 Urea

8.4.6 Historic and Forecasted Market Size By By Application

8.4.6.1 Agrochemical

8.4.6.2 Cosmetics

8.4.6.3 Lubricant

8.4.6.4 Plasticizer

8.4.6.5 Absorbent

8.4.6.6 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Oleate Esters Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Product

8.5.4.1 Methyl Oleate

8.5.4.2 Ethyl Oleate

8.5.4.3 Butyl Oleate

8.5.4.4 Tri-methylolpropane Trioleate (TMPTO)

8.5.4.5 Others

8.5.5 Historic and Forecasted Market Size By By Source

8.5.5.1 Corn

8.5.5.2 Granules

8.5.5.3 Soy

8.5.5.4 Urea

8.5.6 Historic and Forecasted Market Size By By Application

8.5.6.1 Agrochemical

8.5.6.2 Cosmetics

8.5.6.3 Lubricant

8.5.6.4 Plasticizer

8.5.6.5 Absorbent

8.5.6.6 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Oleate Esters Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Product

8.6.4.1 Methyl Oleate

8.6.4.2 Ethyl Oleate

8.6.4.3 Butyl Oleate

8.6.4.4 Tri-methylolpropane Trioleate (TMPTO)

8.6.4.5 Others

8.6.5 Historic and Forecasted Market Size By By Source

8.6.5.1 Corn

8.6.5.2 Granules

8.6.5.3 Soy

8.6.5.4 Urea

8.6.6 Historic and Forecasted Market Size By By Application

8.6.6.1 Agrochemical

8.6.6.2 Cosmetics

8.6.6.3 Lubricant

8.6.6.4 Plasticizer

8.6.6.5 Absorbent

8.6.6.6 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Oleate Esters Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Product

8.7.4.1 Methyl Oleate

8.7.4.2 Ethyl Oleate

8.7.4.3 Butyl Oleate

8.7.4.4 Tri-methylolpropane Trioleate (TMPTO)

8.7.4.5 Others

8.7.5 Historic and Forecasted Market Size By By Source

8.7.5.1 Corn

8.7.5.2 Granules

8.7.5.3 Soy

8.7.5.4 Urea

8.7.6 Historic and Forecasted Market Size By By Application

8.7.6.1 Agrochemical

8.7.6.2 Cosmetics

8.7.6.3 Lubricant

8.7.6.4 Plasticizer

8.7.6.5 Absorbent

8.7.6.6 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Oleate Esters Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 1.44 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.64% |

Market Size in 2032: |

USD 2.07 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Source |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Oleate Esters Market research report is 2024-2032.

Croda International Plc (U.K.) , acme synthetic chemicals (India) , Victorian Chemical Company Pty Ltd. (Australia) , PT. Ecogreen Oleochemicals (Malaysia) , Procter & Gamble (U.S.) , KLK OLEO (Malaysia) , Cayman Chemical (U.S.) , Wilmar International Ltd (Singapore) , Kao Corporation (Japan) , Italmatch Chemical S.p.A. (Italy) , Others

The Oleate Esters Market is segmented into By Product (Methyl Oleate, Ethyl Oleate, Butyl Oleate, Tri-methylolpropane Trioleate (TMPTO) and Others), Source (Corn, Granules, Soy, Urea), Application (Agrochemical, Cosmetics, Lubricant, Plasticizer, Absorbent and Others). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Chemical compounds known as oleate esters are produced by the esterification of oleic acid, a monounsaturated fatty acid that is frequently derived from a variety of vegetable oils, with alcohols. The lubricating, emulsifying, and moisturizing properties of these esters render them valuable in a diverse range of applications, such as personal care products, cosmetics, pharmaceuticals, and industrial formulations. Oleate esters are preferred due to their capacity to improve product texture and stability, while also being biodegradable and environmentally benign. This is consistent with the increasing demand for sustainable ingredients in the current market. Their prevalence across various sectors is further bolstered by their compatibility with a diverse array of ingredients and their versatility.

Oleate Esters Market Size is Valued at USD 1.44 Billion in 2024, and is Projected to Reach USD 2.07 Billion by 2032, Growing at a CAGR of 4.64% From 2024-2032.