Online Clothing Rental Market Synopsis:

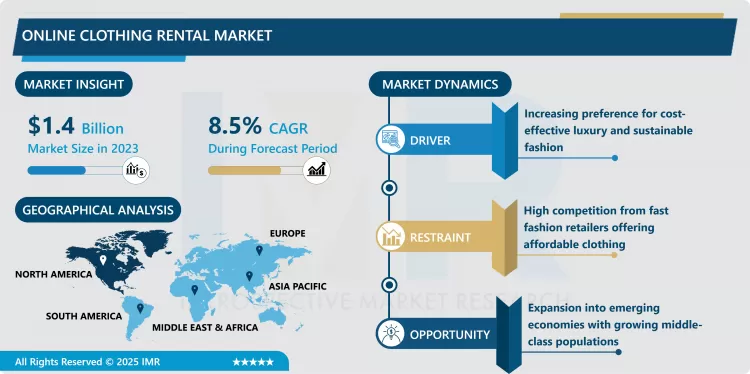

Online Clothing Rental Market Size Was Valued at USD 1.4 Billion in 2023, and is Projected to Reach USD 2.9 Billion by 2032, Growing at a CAGR of 8.5% From 2024-2032.

The online clothing rental market involves the business model of renting clothes to consumers for a specific period through digital platforms. This model is gaining immense popularity due to its affordability, convenience, and sustainability. By offering a wide variety of clothing options, such as casual wear, party dresses, formal attire, and traditional outfits, online clothing rental platforms cater to a diverse clientele, including individuals looking for cost-effective solutions for one-time events and fashion-conscious consumers wanting access to premium brands without ownership. This market thrives on the evolving consumer mindset towards shared economy practices, offering both cost-efficiency and environmental benefits by reducing textile waste and promoting sustainable consumption patterns.

The global online clothing rental market has experienced substantial growth in recent years, driven by shifting consumer preferences toward affordable luxury and sustainability. The rise of digitalization, coupled with increasing internet penetration, has made these services easily accessible, particularly in urban areas. Platforms offering rental clothing provide customers the advantage of trying out a variety of high-end designer apparel without the burden of ownership. Moreover, the growing awareness about environmental conservation and reducing fast-fashion waste further propels the adoption of online rental services as consumers seek eco-friendly alternatives.

Additionally, online clothing rental services target a wide demographic, including millennials and Gen Z, who prioritize convenience and value experiences over ownership. Technological advancements, such as AI-driven personalized recommendations and enhanced logistics for timely deliveries and returns, have further streamlined operations, enhancing customer satisfaction. With companies expanding their offerings to include maternity wear, children’s clothing, and traditional attire, the market has diversified significantly, catering to varied cultural and regional needs.

Online Clothing Rental Market Trend Analysis:

The Shift Toward Eco-Conscious Fashion

- One of the most significant trends shaping the online clothing rental market is the growing emphasis on sustainability. As environmental concerns continue to mount, consumers are becoming increasingly aware of the adverse effects of fast fashion on the planet. Renting clothing helps reduce textile waste and minimizes the carbon footprint of producing new apparel. This trend is further amplified by the integration of sustainable practices by rental platforms, including eco-friendly packaging, collaborations with sustainable fashion brands, and promoting circular fashion models. The desire to embrace environmentally friendly solutions while staying fashionable has made the rental clothing market a viable option for environmentally conscious shoppers.

Growth Potential in Emerging Economies

- The online clothing rental market presents immense opportunities for expansion into emerging economies, where middle-class populations are growing, and internet penetration is improving. Countries in Asia-Pacific, Africa, and South America have a large base of consumers who are price-sensitive yet aspire to wear branded or designer clothing for special occasions. With strategic investments in localized marketing and logistics infrastructure, rental platforms can tap into these markets effectively. Additionally, cultural events and weddings in these regions often require elaborate traditional attire, offering platforms an opportunity to cater to niche segments. By introducing subscription models and flexible rental packages, companies can create sustained customer loyalty in these high-growth markets.

Online Clothing Rental Market Segment Analysis:

Online Clothing Rental Market Segmented on the basis of Dress Code, End User and Region.

By Dress Code, Children segment is expected to dominate the market during the forecast period

- The children’s clothing segment is anticipated to dominate the online clothing rental market during the forecast period. This growth can be attributed to the rapid pace at which children outgrow their clothes, leading parents to seek cost-effective alternatives. Renting children’s clothing offers parents a practical solution to meet the constant need for new attire without overburdening their budgets. Moreover, the availability of high-quality branded and designer clothing for special occasions, such as birthdays, school events, and holidays, further boosts the segment's popularity.

- Another contributing factor is the rising awareness among parents about sustainability. Renting clothes for children ensures minimal textile waste while catering to the diverse wardrobe needs of growing kids. Many platforms also offer subscription packages tailored for children's clothing, providing ease of access and affordability. This focus on convenience, coupled with environmental benefits, has solidified the dominance of the children’s clothing segment in the market.

By End User, Traditional segment expected to held the largest share

- The traditional clothing segment is expected to hold the largest share in the online clothing rental market, owing to the high demand for traditional outfits for cultural and religious events. Traditional clothing, often expensive and worn only on specific occasions, is a popular choice for rental platforms. Consumers, particularly in regions like Asia-Pacific and the Middle East, prefer renting these garments for weddings, festivals, and ceremonies to avoid the cost of ownership.

- Moreover, the growing diaspora populations in Western countries have also contributed to the demand for renting traditional attire. Online platforms cater to these needs by offering a wide variety of ethnic wear options, allowing users to access culturally significant clothing conveniently. As rental platforms continue to expand their traditional clothing collections and improve customization options, this segment is poised to retain its leadership position in the market.

Online Clothing Rental Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America dominated the global online clothing rental market, accounting for approximately 35% of the market share. The region’s leadership is driven by high internet penetration, early adoption of digital platforms, and a well-established e-commerce infrastructure. Moreover, the growing trend of sustainable fashion and increasing preference for experiential consumption over ownership have significantly contributed to the market's expansion in the region. The United States, in particular, leads the market with numerous established rental platforms and a large customer base, including environmentally conscious millennials and Gen Z consumers. The high prevalence of events requiring formal attire, such as proms and weddings, also bolsters the market's dominance in this region.

Online Clothing Rental Market Share, by Geography, 2023 (%)

Active Key Players in the Online Clothing Rental Market:

- Armoire (USA)

- Bag Borrow or Steal (USA)

- GlamCorner (Australia)

- Glamourental (USA)

- Le Tote (USA)

- My Wardrobe HQ (UK)

- Rent the Runway (USA)

- Rotaro (UK)

- Style Lend (USA)

- Swishlist Couture (India)

- Tulerie (USA)

- Urban Outfitters' Nuuly (USA)

- Village Luxe (USA)

- Wardrobe (USA)

- YCloset (China), and Other Active Players.

Key Industry Development in the Online Clothing Rental Market:

In August 2023, Rent the Runway announced the launch of new physical locations in major cities, aiming to elevate its customer experience and simplify returns. This move reflected the brand’s commitment to a hybrid shopping model, enabling clients to try on garments before renting. By blending online convenience with in-store interactions, Rent the Runway successfully boosted customer engagement and strengthened its position in the fashion rental market. The initiative underscored the company’s dedication to innovation and accessibility, enhancing the way customers interact with their platform.

In July 2023, Le Tote recently announced a major rebranding initiative emphasizing sustainability and inclusivity. The company pledged to introduce eco-friendly rental options, aiming to reduce environmental impact while aligning with sustainable fashion practices. Additionally, Le Tote expanded its sizing range to cater to a broader customer base, reinforcing its commitment to equality and accessibility in fashion. Through these changes, the brand redefined its vision to offer diverse and environmentally conscious options, ensuring a more inclusive shopping experience for all.

|

Global Online Clothing Rental Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.4 Billion |

|

Forecast Period 2024-32 CAGR: |

8.5% |

Market Size in 2032: |

USD 2.9 Billion |

|

Segments Covered: |

By Dress Code |

|

|

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Online Clothing Rental Market by By Dress Code (2018-2032)

4.1 Online Clothing Rental Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Men

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Women

4.5 Children

Chapter 5: Online Clothing Rental Market by By End User (2018-2032)

5.1 Online Clothing Rental Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Formal

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Casual

5.5 Traditional

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Online Clothing Rental Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ARMOIRE (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 BAG BORROW OR STEAL (USA)

6.4 GLAMCORNER (AUSTRALIA)

6.5 GLAMOURENTAL (USA)

6.6 LE TOTE (USA)

6.7 MY WARDROBE HQ (UK)

6.8 RENT THE RUNWAY (USA)

6.9 ROTARO (UK)

6.10 STYLE LEND (USA)

6.11 SWISHLIST COUTURE (INDIA)

6.12 TULERIE (USA)

6.13 URBAN OUTFITTERS' NUULY (USA)

6.14 VILLAGE LUXE (USA)

6.15 WARDROBE (USA)

6.16 YCLOSET (CHINA)

6.17 OTHER ACTIVE PLAYERS

Chapter 7: Global Online Clothing Rental Market By Region

7.1 Overview

7.2. North America Online Clothing Rental Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By By Dress Code

7.2.4.1 Men

7.2.4.2 Women

7.2.4.3 Children

7.2.5 Historic and Forecasted Market Size By By End User

7.2.5.1 Formal

7.2.5.2 Casual

7.2.5.3 Traditional

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Online Clothing Rental Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By By Dress Code

7.3.4.1 Men

7.3.4.2 Women

7.3.4.3 Children

7.3.5 Historic and Forecasted Market Size By By End User

7.3.5.1 Formal

7.3.5.2 Casual

7.3.5.3 Traditional

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Online Clothing Rental Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By By Dress Code

7.4.4.1 Men

7.4.4.2 Women

7.4.4.3 Children

7.4.5 Historic and Forecasted Market Size By By End User

7.4.5.1 Formal

7.4.5.2 Casual

7.4.5.3 Traditional

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Online Clothing Rental Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By By Dress Code

7.5.4.1 Men

7.5.4.2 Women

7.5.4.3 Children

7.5.5 Historic and Forecasted Market Size By By End User

7.5.5.1 Formal

7.5.5.2 Casual

7.5.5.3 Traditional

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Online Clothing Rental Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By By Dress Code

7.6.4.1 Men

7.6.4.2 Women

7.6.4.3 Children

7.6.5 Historic and Forecasted Market Size By By End User

7.6.5.1 Formal

7.6.5.2 Casual

7.6.5.3 Traditional

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Online Clothing Rental Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By By Dress Code

7.7.4.1 Men

7.7.4.2 Women

7.7.4.3 Children

7.7.5 Historic and Forecasted Market Size By By End User

7.7.5.1 Formal

7.7.5.2 Casual

7.7.5.3 Traditional

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Online Clothing Rental Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.4 Billion |

|

Forecast Period 2024-32 CAGR: |

8.5% |

Market Size in 2032: |

USD 2.9 Billion |

|

Segments Covered: |

By Dress Code |

|

|

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Online Clothing Rental Market research report is 2024-2032.

Armoire (USA), Bag Borrow or Steal (USA), GlamCorner (Australia), Glamourental (USA), Le Tote (USA), My Wardrobe HQ (UK), Rent the Runway (USA), and Other Active Players.

The Online Clothing Rental Market is segmented into Dress Code, End User, and region. By Dress Code, the market is categorized into Men, Women, Children. By End User, the market is categorized into Formal, Casual, Traditional. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; The Netherlands; Italy; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The online clothing rental market involves the business model of renting clothes to consumers for a specific period through digital platforms. This model is gaining immense popularity due to its affordability, convenience, and sustainability. By offering a wide variety of clothing options, such as casual wear, party dresses, formal attire, and traditional outfits, online clothing rental platforms cater to a diverse clientele, including individuals looking for cost-effective solutions for one-time events and fashion-conscious consumers wanting access to premium brands without ownership. This market thrives on the evolving consumer mindset towards shared economy practices, offering both cost-efficiency and environmental benefits by reducing textile waste and promoting sustainable consumption patterns.

Online Clothing Rental Market Size Was Valued at USD 1.4 Billion in 2023, and is Projected to Reach USD 2.9 Billion by 2032, Growing at a CAGR of 8.5% From 2024-2032.