Opioid Drugs Market Synopsis:

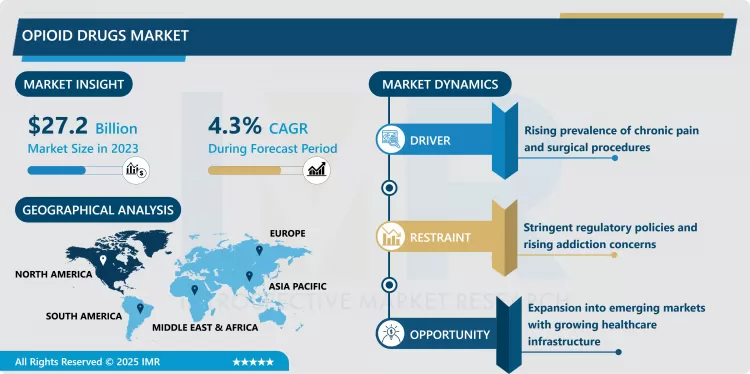

Opioid Drugs Market Size Was Valued at USD 27.2 Billion in 2023, and is Projected to Reach USD 43.2 Billion by 2032, Growing at a CAGR of 4.3% From 2024-2032.

The opioids drugs market is the branch of the market of pharmaceuticals comprising the drugs that originate from opioids that are natural, synthetic, or semi-synthetic opioids. These drugs mainly exert their action on the opioid receptors of the central nervous system (G CNS in order to have an analgesic impact. Opioids are used for the general management of pain, anesthesia, and the treatment of opioid dependence as well as in the care of those with terminal illnesses. However, opioids are considered to be accompanied by risks including dependency and addiction and due to this reason, there are increased regulation and pressure to develop new opioids that are safe. The market comprises buprenorphine, fentanyl, oxycodone, methadone opioids across healthcare, rehabilitation, and surgical use in multiple applications.

The opioids are a fast growing and developing market segment, therefore; it is fueled by the rising cases of chronic pain, surgeries, and cancer pains across the globe. As the world’s population age increases and the heath care requirements escalate, pain management products have emerged as a necessity. Opioids continue to play the central role in moderate and severe pain management especially in a hospital or a specific care unit. However, changes in the regulatory environment, growing awareness of opioid dependence, and the availability of non-opioid analgesia are changing the competitive environment.

Regionally, the market is also less stable, and the largest markets are Great 5 nations including the U.S and Europe due to their developed healthcare facility and frequent prescription of Opioid. On the other hand, emerging economies are experiencing growth in the use of opioids since the health care access is growing, and drug policies are liberalizing. Nevertheless, market participants remain interested in the development of new abuse-resistant forms and the expansion of the range of opioid indications.

Opioid Drugs Market Trend Analysis:

Abuse-Deterrent Formulations (ADF)

- Another major trend that is slowly defining the opioid drugs market is the inclusion of abuse-deterrent formulations (ADF). Such drugs belong to a new generation since they are intended for the effective pain relief but with a very low risk of becoming abused, misused or leading to the development of addiction. ADF opioids contain the following elements: Mechanical and chemical obstructions that prevent the drug from being injected or ingested in ways not intended; chemical and biological irritant substances that make the drug unpleasant to inject or take if it is taken in ways the manufacturers did not intend. ADF formulations are evolving favour among governments and health care providers as entities that can be developed and prescribed in the fight against the opioid crisis. This trend is a formative one for making weightage between patient’s interests and the interest of public health.

Expansion in Emerging Markets

- The emerging markets, which already show signs of building up their healthcare industry, are the key growth area for the opioid drugs market. Healthcare costs are increasing in nations of Asia-Pacific, Latin America and Middle East while management of cancer related pain is also magnificently escalating and moreover many countries have modish their stringent laws for controlled substances. Also, growing information with regard to the management of chronic pain and the opportunity to obtain cost-effective generics of opioids are other reasons. It is an opportunity that market players should embrace by adopting the following strategies: entering into partnership with local distributors, retaining region specific compliance and partnering with educational organizations to develop continuing education for health care providers.

Opioid Drugs Market Segment Analysis:

Opioid Drugs Market Segmented on the basis of Product, application and region.

By Product, Buprenorphine Segment is Expected to Dominate the Market During the Forecast Period

- It is pointed out that the segment with buprenorphine holds the largest potential in the course of the opioid drugs market in the forecast period owing to its functions as both an anesthetic agent and an essential drug for the treatment of opioid addiction. The peculiar agonist-antagonist characteristics of buprenorphine providing strong analgesia while representing lower risk of respiratory depression have helped establish buprenorphine as a popular drug among healthcare practitioners. It is even more the case with its application in medication-assisted treatment (MAT) programs for opioid addiction throughout North America and Europe, which highlights its increasing role.

- Another aspect in which buprenorphine has been appreciated is the fact that it is available in different forms: sublingual tablets, transdermal patches and injectables thus increasing its applicability to different population groups. Approval of new pregel formulations and its entry into list of recommendation for treating addiction cements its position in the target market.

By Application, Anesthesia Segment Expected to Held the Largest Share

- Out of these products and services the anesthesia segment is expected to dominate the market share of the opioid drugs. Opioids are used in anesthesia regimens becoming essential for postoperative pain treatment and intraoperative sedation. The speed of action, the relatively clear pharmacokinetics, and the improvement in the effectiveness of balanced anesthesia are the major reasons for employing these agents.

- Also, the increase of surgery cases in worldwide, orthopaedic, cardiovascular, oncology surgeries and so forth is boosting the demand of opioid-based anesthesia. Further, recent developments in anesthetic opioid formulations that largely contribute towards the postoperative complication and faster recovery times are progressing the segment. However, due to rising rates of surgeries resulting from aging population and development in surgical techniques, skills and in medical products the Anesthesia segment will be critical in the sale of the opioid drugs.

Opioid Drugs Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The global market for opioid drugs in 2023 was dominated by North America region that retained over 45 per cent market for this product. The high incidence of chronic pain in the region, well-developed healthcare systems, and high utilization of innovative pain management technologies can be credited for leadership of the region. The USA stands out given its high consumption of opioids for medical, as well as non-medical, needs. This aspect includes government measures towards opioid misuse through awareness creation and regulation actions which have formed market characteristics. However, there are some challenges linked with this story of opioids like problems connected with opioid crisis North America’s market for modified and safer opium formulation still exists and thus is asserting its market leadership.

Active Key Players in the Opioid Drugs Market

- Allergan (Ireland)

- Assertio Therapeutics (USA)

- Camurus AB (Sweden)

- Daiichi Sankyo Co. (Japan)

- Endo Pharmaceuticals (Ireland)

- Grünenthal Group (Germany)

- Hikma Pharmaceuticals (UK)

- Indivior (UK)

- Johnson & Johnson (USA)

- Mallinckrodt Pharmaceuticals (Ireland)

- Mundipharma International (UK)

- Pfizer Inc. (USA)

- Purdue Pharma (USA)

- Sanofi (France)

- Teva Pharmaceuticals (Israel), and other active Players

Key Industry Development of Opioid Drugs Market:

In April 2024, Amneal Pharmaceuticals announced U.S. FDA approval for its over-the-counter Naloxone Hydrochloride Nasal Spray, designed for emergency opioid overdose treatment. The OTC availability aims to increase access to this lifesaving medication amid the opioid crisis. This approval marks a significant milestone in improving public health, empowering individuals to act swiftly during overdose emergencies without a prescription. The product will soon be available nationwide for purchase in retail stores and online.

|

Global Opioid Drugs Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 27.2 Billion |

|

Forecast Period 2024-32 CAGR: |

4.3% |

Market Size in 2032: |

USD 43.2 Billion |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Opioid Drugs Market by By Product (2018-2032)

4.1 Opioid Drugs Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Buprenorphine

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Fentanyl

4.5 Hydrocodone

4.6 Morphine

4.7 Oxycodone

4.8 Tramadol

4.9 Other products

Chapter 5: Opioid Drugs Market by By Application (2018-2032)

5.1 Opioid Drugs Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Anesthesia

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Pain relief

5.5 Cough suppression

5.6 Diarrhea suppression

5.7 Deaddiction

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Opioid Drugs Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ALLERGAN (IRELAND)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 ASSERTIO THERAPEUTICS (USA)

6.4 CAMURUS AB (SWEDEN)

6.5 DAIICHI SANKYO CO. (JAPAN)

6.6 ENDO PHARMACEUTICALS (IRELAND)

6.7 GRÜNENTHAL GROUP (GERMANY)

6.8 HIKMA PHARMACEUTICALS (UK)

6.9 INDIVIOR (UK)

6.10 JOHNSON & JOHNSON (USA)

6.11 MALLINCKRODT PHARMACEUTICALS (IRELAND)

6.12 MUNDIPHARMA INTERNATIONAL (UK)

6.13 PFIZER INC. (USA)

6.14 PURDUE PHARMA (USA)

6.15 SANOFI (FRANCE)

6.16 TEVA PHARMACEUTICALS (ISRAEL)

6.17 OTHER ACTIVE PLAYERS

Chapter 7: Global Opioid Drugs Market By Region

7.1 Overview

7.2. North America Opioid Drugs Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By By Product

7.2.4.1 Buprenorphine

7.2.4.2 Fentanyl

7.2.4.3 Hydrocodone

7.2.4.4 Morphine

7.2.4.5 Oxycodone

7.2.4.6 Tramadol

7.2.4.7 Other products

7.2.5 Historic and Forecasted Market Size By By Application

7.2.5.1 Anesthesia

7.2.5.2 Pain relief

7.2.5.3 Cough suppression

7.2.5.4 Diarrhea suppression

7.2.5.5 Deaddiction

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Opioid Drugs Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By By Product

7.3.4.1 Buprenorphine

7.3.4.2 Fentanyl

7.3.4.3 Hydrocodone

7.3.4.4 Morphine

7.3.4.5 Oxycodone

7.3.4.6 Tramadol

7.3.4.7 Other products

7.3.5 Historic and Forecasted Market Size By By Application

7.3.5.1 Anesthesia

7.3.5.2 Pain relief

7.3.5.3 Cough suppression

7.3.5.4 Diarrhea suppression

7.3.5.5 Deaddiction

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Opioid Drugs Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By By Product

7.4.4.1 Buprenorphine

7.4.4.2 Fentanyl

7.4.4.3 Hydrocodone

7.4.4.4 Morphine

7.4.4.5 Oxycodone

7.4.4.6 Tramadol

7.4.4.7 Other products

7.4.5 Historic and Forecasted Market Size By By Application

7.4.5.1 Anesthesia

7.4.5.2 Pain relief

7.4.5.3 Cough suppression

7.4.5.4 Diarrhea suppression

7.4.5.5 Deaddiction

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Opioid Drugs Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By By Product

7.5.4.1 Buprenorphine

7.5.4.2 Fentanyl

7.5.4.3 Hydrocodone

7.5.4.4 Morphine

7.5.4.5 Oxycodone

7.5.4.6 Tramadol

7.5.4.7 Other products

7.5.5 Historic and Forecasted Market Size By By Application

7.5.5.1 Anesthesia

7.5.5.2 Pain relief

7.5.5.3 Cough suppression

7.5.5.4 Diarrhea suppression

7.5.5.5 Deaddiction

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Opioid Drugs Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By By Product

7.6.4.1 Buprenorphine

7.6.4.2 Fentanyl

7.6.4.3 Hydrocodone

7.6.4.4 Morphine

7.6.4.5 Oxycodone

7.6.4.6 Tramadol

7.6.4.7 Other products

7.6.5 Historic and Forecasted Market Size By By Application

7.6.5.1 Anesthesia

7.6.5.2 Pain relief

7.6.5.3 Cough suppression

7.6.5.4 Diarrhea suppression

7.6.5.5 Deaddiction

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Opioid Drugs Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By By Product

7.7.4.1 Buprenorphine

7.7.4.2 Fentanyl

7.7.4.3 Hydrocodone

7.7.4.4 Morphine

7.7.4.5 Oxycodone

7.7.4.6 Tramadol

7.7.4.7 Other products

7.7.5 Historic and Forecasted Market Size By By Application

7.7.5.1 Anesthesia

7.7.5.2 Pain relief

7.7.5.3 Cough suppression

7.7.5.4 Diarrhea suppression

7.7.5.5 Deaddiction

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Opioid Drugs Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 27.2 Billion |

|

Forecast Period 2024-32 CAGR: |

4.3% |

Market Size in 2032: |

USD 43.2 Billion |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Opioid Drugs Market research report is 2024-2032.

Allergan (Ireland), Assertio Therapeutics (USA), Camurus AB (Sweden), Daiichi Sankyo Co. (Japan), Endo Pharmaceuticals (Ireland), Grünenthal Group (Germany), and Other active Players.

The Opioid Drugs Market is segmented into Product, Application, and region. By Product, the market is categorized into Buprenorphine, Fentanyl, Hydrocodone, Morphine, Oxycodone, Tramadol, Other products. By Application, the market is categorized into Anesthesia, Pain relief, Cough suppression, Diarrhea suppression, Deaddiction. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

The opioids drugs market is the branch of the market of pharmaceuticals comprising the drugs that originate from opioids that are natural, synthetic, or semi-synthetic opioids. These drugs mainly exert their action on the opioid receptors of the central nervous system (G CNS in order to have an analgesic impact. Opioids are used for the general management of pain, anesthesia, and the treatment of opioid dependence as well as in the care of those with terminal illnesses.

Opioid Drugs Market Size Was Valued at USD 27.2 Billion in 2023, and is Projected to Reach USD 43.2 Billion by 2032, Growing at a CAGR of 4.3% From 2024-2032.