Outdoor Apparel Market Synopsis

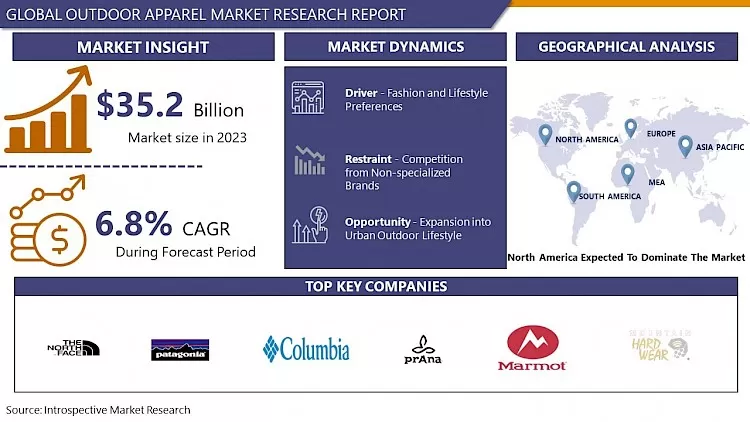

Outdoor Apparel Market Size Was Valued at USD 35.2 Billion in 2023 and is Projected to Reach USD 66.37 Billion by 2032, Growing at a CAGR of 7.3 % From 2024-2032.

Outdoor apparel refers to clothing designed specifically for outdoor activities and environments, such as hiking, camping, skiing, and climbing. This apparel is typically made from specialized materials that offer durability, weather resistance, and comfort, often including features like moisture-wicking, breathability, and insulation.

- Outdoor apparel is a versatile and versatile product that serves various purposes across various activities and environments. It protects from elements like rain, wind, snow, and sun exposure, ensuring comfort and mobility during physical activities. It also regulates body temperature with thermal insulation and moisture-wicking properties. Outdoor apparel is durable and long-lasting, with materials like abrasion-resistant fabrics and reinforced seams.

- It is versatile and adaptable, with features like zip-off legs for quick conversion, ski jackets with built-in powder skirts and helmet-compatible hoods, and fishing shirts with built-in UV protection. Specialized features, such as zip-off legs for quick conversion, are also available. Outdoor apparel has evolved to incorporate fashion and style, making it suitable for both outdoor adventures and everyday wear. Many brands prioritize sustainability, using recycled materials, organic fabrics, and ethical production methods to reduce the environmental impact of their products.

- The increasing interest in outdoor activities, health and wellness trends, fashion and lifestyle trends, and environmental sustainability are driving the demand for specialized outdoor apparel. Outdoor apparel that provides comfort, performance, and protection is essential for these activities. Fashion trends blur the lines between outdoor and everyday clothing, while technology and innovation have led to high-performance outdoor apparel with enhanced features.

- Consumers are also becoming more aware of environmental sustainability and ethical manufacturing processes. Travel and adventure tourism have fueled demand for durable, versatile clothing that can withstand diverse weather conditions and rugged terrain. Social media platforms and influencers play a significant role in promoting outdoor lifestyle trends and influencing consumer preferences. The popularity of outdoor sports like rock climbing, mountain biking, and kayaking has also contributed to the demand for specialized outdoor apparel tailored to athletes and enthusiasts.

Outdoor Apparel Market Trend Analysis

Fashion and Lifestyle Preferences

- The outdoor apparel industry is driven by a combination of style, trends, and personal preferences. Modern consumers prioritize style and aesthetics in outdoor apparel, requiring clothing that performs well in outdoor environments while looking fashionable. The athleisure trend blurs the lines between traditional athletic wear and casual clothing, leading to a greater acceptance of sporty and technical garments in everyday fashion.

- Outdoor influencers and celebrities often showcase their outdoor adventures on social media, influencing consumers' fashion choices. This leads to increased demand for trendy outdoor clothing. Customization and personalization trends encourage consumers to seek outdoor apparel that reflects their style and preferences. Outdoor brands offer customizable options such as color choices, fit adjustments, and personalized embroidery or patches, allowing consumers to create unique garments.

- The urban outdoor lifestyle emphasizes the integration of outdoor activities into urban living, leading to a growing demand for outdoor apparel that blends technical performance with urban-inspired designs. Collaborations with fashion designers, artists, and lifestyle brands inject creativity and excitement into the outdoor apparel market.

- social and environmental responsibility is a growing priority for consumers, with brands using eco-friendly materials, ethical production methods, and fair labor practices to resonate with socially conscious consumers seeking stylish and sustainable clothing options. Outdoor apparel brands capitalize on this trend by offering versatile pieces that transition seamlessly from outdoor adventures to urban settings.

Restraint

Competition from Non-specialized Brands

- The outdoor apparel industry is facing a restraint of competition from non-specialized brands due to their strong brand recognition, marketing power, diversification of product offerings, and use of existing distribution channels. Traditional fashion and sportswear brands are diversifying their offerings to cater to the growing demand for versatile, performance-driven clothing.

- Non-specialized brands also leverage existing distribution channels, such as retail partnerships, e-commerce platforms, and brick-and-mortar stores, to reach a wider consumer base. They may offer outdoor apparel at competitive price points, leveraging economies of scale and cost efficiencies. They often emphasize fashion-forward designs, blurring the distinction between traditional outdoor and fashion markets.

- Despite lacking the technical expertise of specialized brands, they invest in research and development to enhance performance and functionality. Established non-specialized brands may also benefit from consumer trust and perception, allowing them to penetrate the market with credibility and confidence.

Opportunity

Expansion into Urban Outdoor Lifestyle

- Outdoor apparel brands can capitalize on the growing trend of blending outdoor activities with urban living by expanding into the urban outdoor lifestyle. This involves developing and marketing outdoor apparel and accessories that cater to the needs and preferences of urban consumers. Targeting urban adventurers, who seek performance and functionality for activities like hiking, biking, jogging, and parkour, brands should blend technical performance with urban-inspired designs.

- Urban outdoor apparel should be versatile enough to transition between outdoor adventures and everyday urban settings, ensuring durability and comfort. Urban-friendly features, such as reflective elements, hidden pockets, and convertible designs, can differentiate products.

- Targeting urban millennials and Gen Z, who are known for their interest in outdoor activities and urban living, can help brands tailor their product offerings and marketing strategies. Creating community-building initiatives and brand experiences within urban settings can also help brands engage consumers. Additionally, addressing sustainable urban mobility, such as biking and electric scooters, can help brands offer eco-friendly and functional apparel for urban commuters and cyclists.

Challenge

Changing consumer preferences and lifestyle

- The outdoor apparel industry faces challenges due to changing consumer preferences and lifestyles. These include shifts in outdoor activities, a preference for versatility, urbanization, sustainability, and ethical considerations. Consumers are increasingly seeking clothing that can transition seamlessly between activities and environments, posing a challenge for brands to balance functionality with style. Urbanization and lifestyle changes also impact traditional outdoor pursuits, with urban dwellers prioritizing fashion and style over technical performance.

- Sustainability and ethical considerations are becoming increasingly important, with consumers preferring brands that prioritize sustainability, ethical sourcing, and transparent supply chain practices. Fashion-forward designs are also influencing outdoor apparel preferences, with consumers focusing on fashionable designs over technical features.

- The rise of digital media and influencers also influences consumer behavior, with brands needing to adapt their marketing strategies to stay relevant. Age and demographic shifts, such as the aging population and younger generations' preferences, also influence outdoor apparel demand. Finally, seamless integration into lifestyles is a growing preference, with consumers seeking products that seamlessly integrate into their daily routines and activities.

Outdoor Apparel Market Segment Analysis:

Outdoor Apparel Market is Segmented based on product type, fabric, distribution channel, and end-users.

By Product Type, Topwear segment is expected to dominate the market during the forecast period

- Topwear, including jackets, hoodies, and shirts, is a crucial component of outdoor attire, serving as a fashion statement and providing insulation, protection from the elements, and moisture-wicking properties. Manufacturers continuously innovate to improve the functionality of topwear, making it indispensable for outdoor activities.

- Topwear pieces are versatile, allowing them to be easily layered with other clothing to adapt to changing weather conditions. Brands focus on topwear products, highlighting their technical features, durability, and performance in challenging environments, contributing to their dominance in the market. Fashion trends also drive the demand for topwear in the outdoor apparel market, as fashion-conscious consumers seek stylish yet functional clothing options.

By Fabric, Polyester segment held the largest share of 45.8% in 2023

- The outdoor apparel market is dominated by fabric and polyester segments due to their excellent performance characteristics, versatility, cost-effectiveness, durability, and innovation. Polyester fabrics offer moisture-wicking, quick drying, and durability, making them ideal for outdoor activities. They can be engineered for water resistance, breathability, and UV protection, catering to various weather conditions.

- They are also more durable and long-lasting than natural fibers, making them ideal for rugged outdoor activities. Advancements in fabric technology have led to high-performance polyester blends with stretchability, abrasion resistance, and odor control. Additionally, eco-friendly production methods and recycled polyester contribute to their sustainability.

Outdoor Apparel Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America's diverse consumer base, strong outdoor culture, and innovative outdoor apparel companies like The North Face, Patagonia, Columbia Sportswear, and REI Co-op contribute to the market's growth. The region's well-established outdoor culture, coupled with its well-developed retail infrastructure, makes it easy for consumers to access a wide range of outdoor apparel options.

- The region also attracts millions of outdoor enthusiasts and tourists annually to its national parks and wilderness areas, further driving demand for appropriate clothing and gear. The region's diverse climate zones, from temperate forests to arid deserts and snowy mountains, further fuel the demand for a wide range of outdoor apparel suited to different weather and terrain conditions. North America's outdoor apparel market is a significant contributor to the industry's success.

Outdoor Apparel Market Top Key Players:

- The North Face (USA)

- Patagonia (USA)

- Columbia Sportswear Company (USA)

- Prana (USA)

- Marmot (USA)

- Mountain Hardwear (USA)

- Black Diamond Equipment (USA)

- Outdoor Research (USA)

- Eddie Bauer (USA)

- Merrell (USA)

- Timberland (USA)

- Arc'teryx (Canada)

- Canada Goose Holdings Inc. (Canada)

- Fjällräven (Sweden)

- Jack Wolfskin (Germany)

- Rab (UK)

- Berghaus (UK)

- Salomon (France)

- La Sportiva (Italy)

- Mammut Sports Group AG (Switzerland)

- Haglöfs (Sweden)

- Icebreaker (New Zealand), and other major players

Key Industry Developments in the Outdoor Apparel Market:

- In January 2024, Outdoor Research a Seattle-based outdoor apparel manufacturer unveils new materials and DWR technologies on its best-selling and now most sustainable rain collection, paired with the brand’s most significant sustainability efforts to date. The redesigned Foray and Aspire waterproof shell collections feature an all-new 3L material.

- In January 2023, Merrell the world's leading hike and outdoor footwear brand, released its second collection in collaboration with Jenny Bruso and Unlikely Hikers designed in a playful, ungendered colorway and size-inclusive in wide widths and hard-to-find sizes. Merrell exists to share the simple power of the outside with everyone inspiring its second collection with the group.

|

Global Outdoor Apparel Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

35.2 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.3% |

Market Size in 2032: |

66.37 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Fabric |

|

||

|

By Distribution Channel |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Outdoor Apparel Market by By Product Type (2018-2032)

4.1 Outdoor Apparel Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Topwear

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Bottomwear

4.5 Other Accessories

Chapter 5: Outdoor Apparel Market by By Fabric (2018-2032)

5.1 Outdoor Apparel Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Cotton

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Nylon

5.5 Polyester

Chapter 6: Outdoor Apparel Market by By Distribution Channel (2018-2032)

6.1 Outdoor Apparel Market Snapshot and Growth Engine

6.2 Market Overview

6.3 E-Commerce

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Offline

Chapter 7: Outdoor Apparel Market by By End User (2018-2032)

7.1 Outdoor Apparel Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Men

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Women

7.5 Kids

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Outdoor Apparel Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 DEERE & COMPANY (U.S.)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 IBM CORPORATION(U.S.)

8.4 CNH INDUSTRIAL (U.S.)

8.5 MICROSOFT CORPORATION (U.S.)

8.6 AGCO CORPORATION (U.S.)

8.7 RAVEN INDUSTRIES (U.S.)

8.8 COFCO INTERNATIONAL (SWITZERLAND)

8.9 AGROFY (SOUTH AFRICA)

8.10 EDEN FARM (INDONESIA)

8.11 HUMMINGBIRD TECHNOLOGIES (ENGLAND)

8.12 BAYER CROPSCIENCE (GERMANY)

8.13 MONSANTO (NOW PART OF BAYER) (U.S.)

8.14 TRIMBLE INC. (U.S.)

8.15 YARA INTERNATIONAL (NORWAY)

8.16 SST SOFTWARE (U.S.)

8.17 TARANIS (ISRAEL)

8.18 CLIMATE FIELDVIEW (U.S.)

8.19 FARMLOGS (U.S.)

8.20 AKER SOLUTIONS (NORWAY)

8.21 CRANSWICK PLC (U.K) OTHER MAJOR KEY PLAYERS.

Chapter 9: Global Outdoor Apparel Market By Region

9.1 Overview

9.2. North America Outdoor Apparel Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By By Product Type

9.2.4.1 Topwear

9.2.4.2 Bottomwear

9.2.4.3 Other Accessories

9.2.5 Historic and Forecasted Market Size By By Fabric

9.2.5.1 Cotton

9.2.5.2 Nylon

9.2.5.3 Polyester

9.2.6 Historic and Forecasted Market Size By By Distribution Channel

9.2.6.1 E-Commerce

9.2.6.2 Offline

9.2.7 Historic and Forecasted Market Size By By End User

9.2.7.1 Men

9.2.7.2 Women

9.2.7.3 Kids

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Outdoor Apparel Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By By Product Type

9.3.4.1 Topwear

9.3.4.2 Bottomwear

9.3.4.3 Other Accessories

9.3.5 Historic and Forecasted Market Size By By Fabric

9.3.5.1 Cotton

9.3.5.2 Nylon

9.3.5.3 Polyester

9.3.6 Historic and Forecasted Market Size By By Distribution Channel

9.3.6.1 E-Commerce

9.3.6.2 Offline

9.3.7 Historic and Forecasted Market Size By By End User

9.3.7.1 Men

9.3.7.2 Women

9.3.7.3 Kids

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Outdoor Apparel Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By By Product Type

9.4.4.1 Topwear

9.4.4.2 Bottomwear

9.4.4.3 Other Accessories

9.4.5 Historic and Forecasted Market Size By By Fabric

9.4.5.1 Cotton

9.4.5.2 Nylon

9.4.5.3 Polyester

9.4.6 Historic and Forecasted Market Size By By Distribution Channel

9.4.6.1 E-Commerce

9.4.6.2 Offline

9.4.7 Historic and Forecasted Market Size By By End User

9.4.7.1 Men

9.4.7.2 Women

9.4.7.3 Kids

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Outdoor Apparel Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By By Product Type

9.5.4.1 Topwear

9.5.4.2 Bottomwear

9.5.4.3 Other Accessories

9.5.5 Historic and Forecasted Market Size By By Fabric

9.5.5.1 Cotton

9.5.5.2 Nylon

9.5.5.3 Polyester

9.5.6 Historic and Forecasted Market Size By By Distribution Channel

9.5.6.1 E-Commerce

9.5.6.2 Offline

9.5.7 Historic and Forecasted Market Size By By End User

9.5.7.1 Men

9.5.7.2 Women

9.5.7.3 Kids

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Outdoor Apparel Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By By Product Type

9.6.4.1 Topwear

9.6.4.2 Bottomwear

9.6.4.3 Other Accessories

9.6.5 Historic and Forecasted Market Size By By Fabric

9.6.5.1 Cotton

9.6.5.2 Nylon

9.6.5.3 Polyester

9.6.6 Historic and Forecasted Market Size By By Distribution Channel

9.6.6.1 E-Commerce

9.6.6.2 Offline

9.6.7 Historic and Forecasted Market Size By By End User

9.6.7.1 Men

9.6.7.2 Women

9.6.7.3 Kids

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Outdoor Apparel Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By By Product Type

9.7.4.1 Topwear

9.7.4.2 Bottomwear

9.7.4.3 Other Accessories

9.7.5 Historic and Forecasted Market Size By By Fabric

9.7.5.1 Cotton

9.7.5.2 Nylon

9.7.5.3 Polyester

9.7.6 Historic and Forecasted Market Size By By Distribution Channel

9.7.6.1 E-Commerce

9.7.6.2 Offline

9.7.7 Historic and Forecasted Market Size By By End User

9.7.7.1 Men

9.7.7.2 Women

9.7.7.3 Kids

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Outdoor Apparel Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

35.2 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.3% |

Market Size in 2032: |

66.37 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Fabric |

|

||

|

By Distribution Channel |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Outdoor Apparel Market research report is 2024-2032.

The North Face (USA), Patagonia (USA), Columbia Sportswear Company (USA), Prana (USA), REI Co-op (USA), Marmot (USA), Mountain Hardwear (USA), Black Diamond Equipment (USA), Outdoor Research (USA), Eddie Bauer (USA), Merrell (USA), Timberland (USA), Arc'teryx (Canada), Canada Goose Holdings Inc. (Canada), Fjällräven (Sweden), Jack Wolfskin (Germany), Rab (UK), Berghaus (UK), Salomon (France), La Sportiva (Italy), Mammut Sports Group AG (Switzerland), Haglöfs (Sweden), Icebreaker (New Zealand), and Other Major Players.

The Outdoor Apparel Market is segmented into Product Type, Fabric, Distribution Channel, End User, and region. By Product Type, the market is categorized into Topwear, Bottomwear, and Other Accessories. By Fabric, the market is categorized into Cotton, Nylon, and Polyester. By Distribution Channel, the market is categorized into E-Commerce and offline. By End User, the market is categorized into Men, Women, and Kids. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The outdoor apparel market refers to the industry involved in designing, manufacturing, and selling clothing and accessories specifically tailored for outdoor activities and adventures. This includes a wide range of products such as jackets, pants, shirts, footwear, gloves, hats, and backpacks that are designed to provide protection, comfort, and functionality in various outdoor environments and weather conditions. The market caters to outdoor enthusiasts, athletes, hikers, campers, climbers, skiers, and other individuals who engage in outdoor recreation and sports.

Outdoor Apparel Market Size Was Valued at USD 35.2 Billion in 2023 and is Projected to Reach USD 66.37 Billion by 2032, Growing at a CAGR of 7.3 % From 2024-2032.