Outdoor Power Equipment Market Synopsis

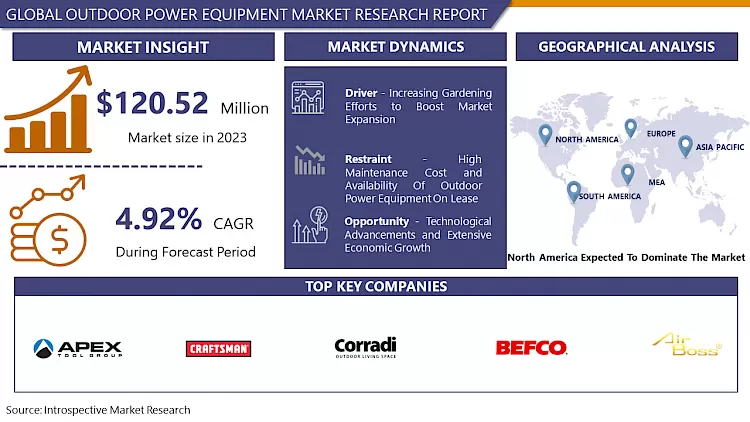

Global Outdoor Power Equipment Market Size Was Valued at USD 120.52 Million In 2023, And Is Projected to Reach USD 120.52 Million By 2032, Growing at A CAGR of 4.92% From 2024 To 2032.

Outdoor Power Equipment (OPE) refers to equipment with small motors or engines that is primarily used outdoors. Outdoor power equipment is utilized by residential and commercial users for a variety of tasks, including landscaping and maintaining lawns, gardens, and golf courses.

- The equipment is powered by a gasoline engine, an electric unit, or batteries and is robust and efficient, making it more popular. In addition, increasing urbanization has resulted in the development of smart cities and infrastructure, which has increased the demand for this construction equipment.

- The market for outdoor power equipment is shifting towards advanced and innovative products. A notable illustration is the robotic lawn mower. The demand for alternative energy sources and more efficient equipment is gradually increasing. The market is currently saturated with electric lawnmowers and robotic outdoor power equipment.

- While robotic lawnmowers are still in their infancy, electric lawnmowers have proven to be cost-effective and provide the necessary torque for landscaping tasks. Focus is being placed on developing fully and partially automatic lawn equipment for both commercial and residential clients. These factors fuel market expansion.

The Outdoor Power Equipment Market Trend Analysis

Increasing Gardening Efforts To Boost Market Expansion

- Market demand for equipment is primarily driven by the rising demand for landscaping services to enhance the aesthetic appeal of residential properties. Additionally, commercial users utilize it to improve the appearance of their properties.

- For lawn maintenance, hardscaping, lawn renovation, tree care, organic or natural lawn care, and snow removal, outdoor power equipment such as lawnmowers, blowers, hedge trimmers, and saws are used in the landscaping industry. 70% of the world's population will reside in or near urban areas, where increased landscaping and gardening activities will contribute to an increase in demand for outdoor equipment.

- Urbanization will increase the demand for smart cities and green spaces, as well as for new buildings, the maintenance of public green spaces and parks, and the purchase of equipment. In this context, numerous companies, such as Makita Corporation, develop cordless OPE systems as alternatives to gas-powered equipment in order to meet the demand for the equipment.

Technological Advancements and Extensive Economic Growth

- The introduction of a new product with evolving technology has always been a key market and industry growth driver, enabling businesses to attract more customers and meet rising demand.

- As the adoption of IoT devices and the demand for smart and connected products increases, manufacturers are emphasizing the delivery of connected equipment. Developments in technology and the adoption of wireless networking techniques result in the creation of intelligent and networked tools.

- For leading OPE manufacturers, the production of the intelligent and connected equipment is becoming increasingly important. For instance, technological advancements are anticipated to benefit the market by fostering the growth of robotic lawnmowers. In addition, the demand for battery-powered and cordless saws in the construction industry is the primary driver of the segment's expansion.

Segmentation Analysis Of The Outdoor Power Equipment Market

Outdoor Power Equipment market segments cover the Equipment Type, Power Source, Functionality, and Applications. By Equipment Type, the Lawn Mower segment is Anticipated to Dominate the Market Over the Forecast period.

- Lawnmowers dominate the global market for outdoor power equipment. A lawnmower is a machine with one or more rotating blades that even out the height of the grass. A small internal combustion engine is the most typical self-contained power source for lawnmowers. Smaller lawnmowers frequently lack any form of propulsion and must be pushed across the surface by hand.

- Lawnmowers are widely used around the world for chopping, trimming, and mowing grass patches, fields, lawns, and gardens to ensure that the grass is well-groomed and grows at the proper height. The increased development of parks and small-scale gardens in residential buildings and cities in an effort to reduce pollution has led to an increase in the demand for lawnmowers to maintain the aesthetics of these spaces.

- Individuals' increased investment in residences with gardens has contributed to the expansion of the market. The presence of the aforementioned factors is anticipated to create numerous opportunities for market growth.

Regional Analysis of The Outdoor Power Equipment Market

North America is Expected to Dominate the Market Over the Forecast period.

- The United States holds a substantial market share, followed by Canada and Mexico. According to U.S. government regulations, community garden plots are also regarded as an integral part of society; consequently, the use of gardening tools boosts the market for outdoor power equipment. The presence of snow during the winter season has led to an increase in demand for outdoor power equipment, specifically snow blowers.

- The increase in urbanization and the willingness of consumers to spend discretionary income on recreational activities such as golf and landscaping services has a positive effect on the sales of small engines for commercial and residential applications. The government's initiatives in infrastructure development are facilitating massive construction projects, primarily in the urban areas of the countries.

- The expansion of the construction industry is primarily driven by the private sector's ongoing investments in residential and commercial building projects. Additionally, individual homes in the United States with lawn or garden areas play a significant role in promoting the use of various outdoor power equipment. Due to the rise in the construction of single-family homes, the demand for lawns among Americans is rising.

- Increasing construction and the rising popularity of do-it-yourself projects are driving up the demand for outdoor equipment in North America. The aforementioned initiatives are a major factor propelling the growth of this region's market over the forecast period. The following figure shows the new residential construction in the United State which depict the growing demand for Outdoor Power Equipment.

Covid-19 Impact Analysis On the Outdoor Power Equipment Market

- COVID-19 has had a devastating impact on global trade, which has impacted households, businesses, financial institutions, industrial firms, and infrastructure companies. The novel coronavirus has impacted a number of economies and caused lockdowns in a number of nations, limiting the market's expansion.

- The cessation of industrial manufacturing led to a decrease in demand for gas-related equipment in the majority of the world's nations, which in turn led to a decrease in demand for outdoor power equipment. During the outbreak, the decrease in power consumption in industrial facilities across the globe has had a negative impact on market growth.

- With the resumption of operations in numerous industries, a surge in demand for outdoor power equipment has been observed in the post-pandemic period. The COVID-19 pandemic has had a significant impact on the value chain of the outdoor power equipment market; however, the value chain has been consistently revitalized, resulting in steady market growth.

- The United States, China, and Germany held significant market shares in 2021. In the post-pandemic period, market growth is being driven by a significant increase in demand from the commercial and residential/DIY application segments for the maintenance of public and private spaces.

Top Key Players Covered in The Outdoor Power Equipment Market

- Corradi S.P.A.

- AirBoss Air Tools Co. Ltd.

- Andreas Stihl AG & Co. KG

- American Lawn Mower Company

- Apex Tool Group LLC

- BEFCO Inc.

- Blount International Inc.

- Cub Cadet

- Draper Tools Ltd.

- Briggs & Stratton Corporation

- Craftsman

- Bigger Boyz Toyz Australia Pty Ltd

- Comifer Srl

- CAO HUNG TECHNICAL SERVICE TRADING COMPANY LIMITED

- Arboriculture Canada Training and Education Ltd. and Other Major Players

Key Industry Developments in the Outdoor Power Equipment Market

In March 2023, Briggs & Stratton Introduced the Vanguard Commercial Lithium Power 5000, a heavy-duty lithium-ion battery for commercial grounds maintenance equipment. This innovation paves the way for powerful zero-emission solutions in professional landscaping.

In April 2023, TTI (Greenworks) Unveiled a 60V battery-powered chainsaw capable of professional-grade cutting performance. This launch highlights the growing trend towards powerful cordless options, reducing noise and emissions.

In June 2023, Husqvarna Launched the Automower® 535 AWD robotic lawn mower, featuring all-wheel drive for tackling steeper slopes and rough terrain. This advancement in robotic mowers caters to increasing demand for automated yard care while maintaining a green footprint.

|

Global Outdoor Power Equipment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 120.52 Mn. |

|

Forecast Period 2023-30 CAGR: |

4.92% |

Market Size in 2032: |

USD 120.52 Mn. |

|

Segments Covered: |

By Equipment Type |

|

|

|

By Power Source |

|

||

|

By Functionality |

|

||

|

By Applications |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Outdoor Power Equipment Market by By Equipment Type (2018-2032)

4.1 Outdoor Power Equipment Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Lawn Mower

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Chainsaw

4.5 Trimmer & Edger

4.6 Others

Chapter 5: Outdoor Power Equipment Market by By Power Source (2018-2032)

5.1 Outdoor Power Equipment Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Fuel

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Electric

Chapter 6: Outdoor Power Equipment Market by By Functionality (2018-2032)

6.1 Outdoor Power Equipment Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Connected/Smart

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Conventional

Chapter 7: Outdoor Power Equipment Market by By Applications (2018-2032)

7.1 Outdoor Power Equipment Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Commercial

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Residential

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Outdoor Power Equipment Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 PROCTER & GAMBLE CO. (U.S.)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 KIMBERLY-CLARK (U.S.)

8.4 ESSITY AB (SWEDEN)

8.5 GEORGIA-PACIFIC LLC (U.S.)

8.6 HENGAN GROUP (CHINA)

8.7 SOFIDEL GROUP (ITALY)

8.8 KRUGER INC. (CANADA)

8.9 EMPRESAS CMPC S.A (CHILE)

8.10 WEPA HYGIENEPRODUKTE GMBH (GERMANY)

8.11 UNILEVER (U.K.)

8.12 ABC TISSUE (AUSTRALIA)

8.13 SUZANO (BRAZIL)

8.14 ABSORMEX CMPC TISSUE (U.S)

8.15 CAPRICE PAPER PRODUCTS PTY. LTD. (AUSTRALIA)

8.16

Chapter 9: Global Outdoor Power Equipment Market By Region

9.1 Overview

9.2. North America Outdoor Power Equipment Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By By Equipment Type

9.2.4.1 Lawn Mower

9.2.4.2 Chainsaw

9.2.4.3 Trimmer & Edger

9.2.4.4 Others

9.2.5 Historic and Forecasted Market Size By By Power Source

9.2.5.1 Fuel

9.2.5.2 Electric

9.2.6 Historic and Forecasted Market Size By By Functionality

9.2.6.1 Connected/Smart

9.2.6.2 Conventional

9.2.7 Historic and Forecasted Market Size By By Applications

9.2.7.1 Commercial

9.2.7.2 Residential

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Outdoor Power Equipment Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By By Equipment Type

9.3.4.1 Lawn Mower

9.3.4.2 Chainsaw

9.3.4.3 Trimmer & Edger

9.3.4.4 Others

9.3.5 Historic and Forecasted Market Size By By Power Source

9.3.5.1 Fuel

9.3.5.2 Electric

9.3.6 Historic and Forecasted Market Size By By Functionality

9.3.6.1 Connected/Smart

9.3.6.2 Conventional

9.3.7 Historic and Forecasted Market Size By By Applications

9.3.7.1 Commercial

9.3.7.2 Residential

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Outdoor Power Equipment Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By By Equipment Type

9.4.4.1 Lawn Mower

9.4.4.2 Chainsaw

9.4.4.3 Trimmer & Edger

9.4.4.4 Others

9.4.5 Historic and Forecasted Market Size By By Power Source

9.4.5.1 Fuel

9.4.5.2 Electric

9.4.6 Historic and Forecasted Market Size By By Functionality

9.4.6.1 Connected/Smart

9.4.6.2 Conventional

9.4.7 Historic and Forecasted Market Size By By Applications

9.4.7.1 Commercial

9.4.7.2 Residential

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Outdoor Power Equipment Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By By Equipment Type

9.5.4.1 Lawn Mower

9.5.4.2 Chainsaw

9.5.4.3 Trimmer & Edger

9.5.4.4 Others

9.5.5 Historic and Forecasted Market Size By By Power Source

9.5.5.1 Fuel

9.5.5.2 Electric

9.5.6 Historic and Forecasted Market Size By By Functionality

9.5.6.1 Connected/Smart

9.5.6.2 Conventional

9.5.7 Historic and Forecasted Market Size By By Applications

9.5.7.1 Commercial

9.5.7.2 Residential

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Outdoor Power Equipment Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By By Equipment Type

9.6.4.1 Lawn Mower

9.6.4.2 Chainsaw

9.6.4.3 Trimmer & Edger

9.6.4.4 Others

9.6.5 Historic and Forecasted Market Size By By Power Source

9.6.5.1 Fuel

9.6.5.2 Electric

9.6.6 Historic and Forecasted Market Size By By Functionality

9.6.6.1 Connected/Smart

9.6.6.2 Conventional

9.6.7 Historic and Forecasted Market Size By By Applications

9.6.7.1 Commercial

9.6.7.2 Residential

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Outdoor Power Equipment Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By By Equipment Type

9.7.4.1 Lawn Mower

9.7.4.2 Chainsaw

9.7.4.3 Trimmer & Edger

9.7.4.4 Others

9.7.5 Historic and Forecasted Market Size By By Power Source

9.7.5.1 Fuel

9.7.5.2 Electric

9.7.6 Historic and Forecasted Market Size By By Functionality

9.7.6.1 Connected/Smart

9.7.6.2 Conventional

9.7.7 Historic and Forecasted Market Size By By Applications

9.7.7.1 Commercial

9.7.7.2 Residential

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Outdoor Power Equipment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 120.52 Mn. |

|

Forecast Period 2023-30 CAGR: |

4.92% |

Market Size in 2032: |

USD 120.52 Mn. |

|

Segments Covered: |

By Equipment Type |

|

|

|

By Power Source |

|

||

|

By Functionality |

|

||

|

By Applications |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Outdoor Power Equipment Market research report is 2024-2032.

Corradi S.P.A., AirBoss Air Tools Co. Ltd., Andreas Stihl AG & Co. KG, American Lawn Mower Company, Apex Tool Group LLC, BEFCO Inc., Blount International Inc., Cub Cadet, Draper Tools Ltd., Briggs & Stratton Corporation, Craftsman, Bigger Boyz Toyz Australia Pty Ltd, Comifer Srl, CAO HUNG TECHNICAL SERVICE TRADING COMPANY LIMITED, Arboriculture Canada Training and Education Ltd., and other major players.

The Outdoor Power Equipment Market is segmented into Equipment Type, Power Source, Functionality, and region. By Equipment Type, the market is categorized into Lawn Mower, Chainsaws, Trimmers & Edger, and Others. By Power Source, the market is categorized into Fuel, Electric. By Functionality, the market is categorized into Connected/Smart, Conventional. By Applications, the market is categorized into Commercial, Residential. By region, it is analyzed across North America (US, Canada, Mexico), Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Outdoor Power Equipment (OPE) is equipment with small motors or engines primarily used for exterior service. Residential and commercial users use outdoor power equipment for various tasks such as landscaping and maintaining lawns, gardens, and golf courses.

Global Outdoor Power Equipment Market Size Was Valued at USD 120.52 Million In 2023, And Is Projected to Reach USD 120.52 Million By 2032, Growing at A CAGR of 4.92% From 2024 To 2032.