Outdoor TV Market Synopsis

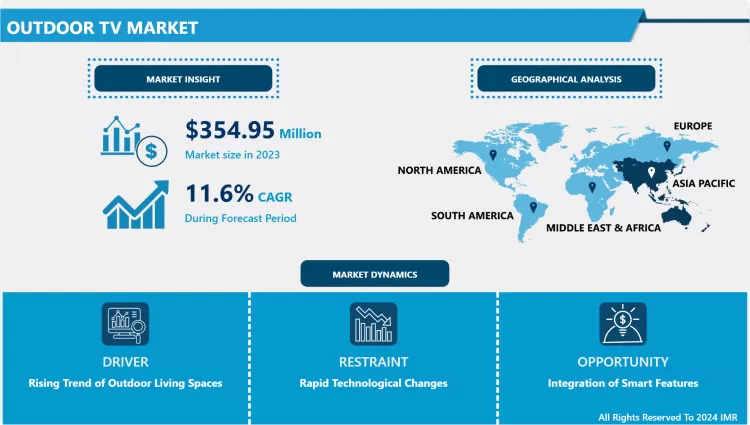

Outdoor TV Market Size Was Valued at USD 354.95 Million In 2023 And Is Projected to Reach USD 953.11 Million By 2032, Growing at A CAGR of 11.6% From 2024-2032.

An outdoor TV is a television specifically designed for use in outdoor environments, providing durability and weather resistance to withstand various outdoor conditions. These TVs are engineered to operate in a range of temperatures, resist moisture, and combat elements like rain, snow, and dust. The design typically includes robust casings, anti-glare screens for better visibility in sunlight, and sometimes built-in heating or cooling systems to maintain optimal performance in extreme weather.

- The applications of outdoor TVs extend across residential and commercial settings. In residential spaces, outdoor TVs are often installed in patios, decks, or outdoor entertainment areas, allowing homeowners to enjoy television programming and content while spending time outdoors. In commercial environments, outdoor TVs find use in sports bars, restaurants, hotels, and public spaces where patrons can gather for outdoor events or entertainment.

- Current trends in the outdoor TV market include the integration of smart TV features, such as internet connectivity and streaming capabilities, providing users with access to a variety of online content. Additionally, advancements in display technology, like 4K resolution and HDR (High Dynamic Range), enhance the viewing experience outdoors. There is also a growing demand for sleek and aesthetically pleasing designs to seamlessly blend with outdoor decor. As outdoor living spaces become more popular, the market for outdoor TVs continues to expand, with manufacturers focusing on innovation to meet the evolving demands of consumers seeking high-quality outdoor entertainment solutions.

Outdoor TV Market Trend Analysis

Rising Trend of Outdoor Living Spaces

- In recent years, there has been a significant shift in consumer preferences toward creating functional and stylish outdoor environments, such as patios, decks, and backyard entertainment areas. As outdoor spaces become extensions of the home, the demand for outdoor TVs has surged, driven by the desire to bring the comforts of indoor entertainment to the outdoors.

- This trend is fueled by a cultural shift towards embracing outdoor lifestyles, where individuals and families seek to maximize their time spent in nature and create multifunctional spaces for relaxation and entertainment. Outdoor living spaces are increasingly viewed as integral parts of homes, and outdoor TVs play a pivotal role in transforming these areas into fully immersive entertainment hubs.

- As homeowners invest in outdoor furniture, landscaping, and recreational amenities, the integration of outdoor TVs becomes a natural progression to enhance the overall outdoor experience. Manufacturers respond by developing weather-resistant, durable, and aesthetically pleasing outdoor TVs, aligning with the demand generated by the rising trend of outdoor living spaces. This trend is expected to continue driving innovation and growth in the outdoor TV market as consumers prioritize creating seamless and enjoyable connections between their indoor and outdoor living spaces.

Integration of Smart Features

- With the global surge in demand for smart home technologies, consumers increasingly seek seamless connectivity and interactive functionalities in their outdoor entertainment spaces. This presents a prime opportunity for manufacturers to enhance outdoor TVs with intelligent features, creating a more immersive and convenient user experience.

- Smart features can include voice recognition for hands-free control, compatibility with virtual assistants, and the integration of artificial intelligence for personalized content recommendations. The ability to connect outdoor TVs to smart home ecosystems allows users to control and monitor their outdoor entertainment setups remotely. This connectivity aligns with the broader trend of creating integrated and interconnected living spaces, where outdoor TVs become integral components of smart home networks.

- Furthermore, the integration of streaming services, apps, and internet connectivity directly into outdoor TVs offers users access to a plethora of digital content. This not only expands the entertainment options available but also caters to the evolving preferences of consumers accustomed to on-demand and personalized content experiences. As the demand for smart homes continues to rise, the integration of intelligent features in outdoor TVs represents a strategic opportunity for manufacturers to meet the expectations of tech-savvy consumers and drive the market's growth.

Outdoor TV Market Segment Analysis:

Outdoor TV Market Segmented based on screen size, resolution, and end-users.

By Screen Size, 50 inches to 70 inches segment is expected to dominate the market during the forecast period

- In the outdoor TV market, the 50 inches to 70 inches segment is anticipated to emerge as the most dominant screen size category. This range caters to a diverse consumer base seeking larger, immersive displays for their outdoor entertainment spaces. The 50-70 inches segment strikes a balance between providing a sizable viewing area and ensuring practicality for various outdoor settings, making it a popular choice among homeowners and commercial establishments alike. This screen size range offers an optimal viewing experience for gatherings, events, and outdoor leisure activities, contributing to its expected dominance in the market. Manufacturers are likely to focus on innovations and technological enhancements within this size category to meet the evolving preferences of consumers seeking a compelling and visually engaging outdoor TV experience.

By End User, Commercial segment held the largest market share of 58.1% in 2022

- The commercial outdoor TV segment is anticipated to assert dominance in the market, reflecting a growing demand for outdoor entertainment solutions in commercial spaces. This trend is particularly evident in hospitality venues, restaurants, bars, and event spaces where outdoor TVs enhance the overall customer experience. Commercial establishments seek to create engaging and versatile outdoor environments for patrons, and outdoor TVs play a key role in providing entertainment for outdoor events, sports viewing, and social gatherings.

- The durability and performance features of outdoor TVs make them essential for businesses looking to attract and retain customers in outdoor settings. With an increasing emphasis on outdoor dining and entertainment, the commercial segment is expected to drive significant growth in the market, leading manufacturers to tailor products that meet the specific needs and demands of the commercial outdoor TV landscape.

Outdoor TV Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- Asia Pacific is poised to dominate the outdoor TV market over the forecast period. The region's ascendancy is propelled by factors such as rapid urbanization, a burgeoning middle class, and the increasing adoption of outdoor entertainment trends. As lifestyles evolve, there is a growing demand for sophisticated outdoor entertainment solutions in residential and commercial spaces.

- Additionally, favorable economic conditions and a surge in disposable income contribute to the increased investment in outdoor leisure and entertainment setups. Manufacturers are likely to focus on catering to the diverse preferences and climatic conditions within the Asia Pacific region, further driving the market's growth. With a dynamic blend of technological advancements and changing consumer behaviors, Asia Pacific is anticipated to be a key hub for the outdoor TV market, solidifying its dominant position in the industry.

Outdoor TV Market Top Key Players:

- Sunbritetv (U.S.)

- Seura (U.S.)

- Skyvue (U.S.)

- Peerless-Av (U.S.)

- The Tv Shield (U.S.)

- Miragevision (U.S.)

- Apollo Enclosures (U.S.)

- Aqualite Outdoor (U.K.)

- Cinios (South Korea)

- Luxurite (U.K.)

- Nec Display Solutions (Japan)

- Samsung Electronics (South Korea)

- Lg Electronics (South Korea)

- Tcl Corporation (China)

- Sony Corporation (Japan)

- Vizio Inc. (U.S.)

- Hisense Group (China)

- Koninklijke Philips N.V. (Philips) (Netherlands)

- Panasonic Corporation (Japan)

- Sharp Corporation (Japan) And Other Major Players

|

Outdoor TV Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 354.95 Mn. |

|

Forecast Period 2024-32 CAGR: |

11.6 % |

Market Size in 2032: |

USD 953.11 Mn. |

|

Segments Covered: |

By Screen Size |

|

|

|

By Resolution |

|

||

|

By Display Type |

|

||

|

By End-Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Outdoor TV Market by By Screen Size (2018-2032)

4.1 Outdoor TV Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Less than 30 inches

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 30 inches to 50 inches

4.5 50 inches to 70 inches

4.6 More than 70 inches

Chapter 5: Outdoor TV Market by By Resolution (2018-2032)

5.1 Outdoor TV Market Snapshot and Growth Engine

5.2 Market Overview

5.3 4K

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 1080p

5.5 720p

Chapter 6: Outdoor TV Market by By Display Type (2018-2032)

6.1 Outdoor TV Market Snapshot and Growth Engine

6.2 Market Overview

6.3 LCD

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 LED

Chapter 7: Outdoor TV Market by By End-Users (2018-2032)

7.1 Outdoor TV Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Residential

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Commercial

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Outdoor TV Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 RECKITT BENCKISER GROUP PLC (U.K.)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 THE CLOROX COMPANY (U.S.)

8.4 PROCTER & GAMBLE CO. (U.S.)

8.5 KIMBERLY-CLARK CORPORATION (U.S.)

8.6 3M COMPANY (U.S.)

8.7 ECOLAB INC. (U.S.)

8.8 SC JOHNSON & SON INC. (U.S.)

8.9 NICE-PAK PRODUCTS INC. (U.S.)

8.10 PDI INC. (PDI HEALTHCARE) (U.S.)

8.11 CARDINAL HEALTH INC. (U.S.)

8.12 PAL INTERNATIONAL (U.K.)

8.13 DIAMOND WIPES INTERNATIONAL INC. (U.S.)

8.14 EDGEWELL PERSONAL CARE (U.S.)

8.15 GAMA HEALTHCARE LTD. (U.K.)

8.16 HANGZHOU LINAN JINLONG CHEMICAL FIBER COLTD. (CHINA)

8.17 CLARUS (U.S.)

8.18 LA FRESH GROUP (U.S.)

8.19 UNILEVER (U.K.)

8.20 MÖLNLYCKE HEALTH CARE (SWEDEN)

8.21 DUPONT DE NEMOURS INC. (U.S.)

Chapter 9: Global Outdoor TV Market By Region

9.1 Overview

9.2. North America Outdoor TV Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By By Screen Size

9.2.4.1 Less than 30 inches

9.2.4.2 30 inches to 50 inches

9.2.4.3 50 inches to 70 inches

9.2.4.4 More than 70 inches

9.2.5 Historic and Forecasted Market Size By By Resolution

9.2.5.1 4K

9.2.5.2 1080p

9.2.5.3 720p

9.2.6 Historic and Forecasted Market Size By By Display Type

9.2.6.1 LCD

9.2.6.2 LED

9.2.7 Historic and Forecasted Market Size By By End-Users

9.2.7.1 Residential

9.2.7.2 Commercial

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Outdoor TV Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By By Screen Size

9.3.4.1 Less than 30 inches

9.3.4.2 30 inches to 50 inches

9.3.4.3 50 inches to 70 inches

9.3.4.4 More than 70 inches

9.3.5 Historic and Forecasted Market Size By By Resolution

9.3.5.1 4K

9.3.5.2 1080p

9.3.5.3 720p

9.3.6 Historic and Forecasted Market Size By By Display Type

9.3.6.1 LCD

9.3.6.2 LED

9.3.7 Historic and Forecasted Market Size By By End-Users

9.3.7.1 Residential

9.3.7.2 Commercial

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Outdoor TV Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By By Screen Size

9.4.4.1 Less than 30 inches

9.4.4.2 30 inches to 50 inches

9.4.4.3 50 inches to 70 inches

9.4.4.4 More than 70 inches

9.4.5 Historic and Forecasted Market Size By By Resolution

9.4.5.1 4K

9.4.5.2 1080p

9.4.5.3 720p

9.4.6 Historic and Forecasted Market Size By By Display Type

9.4.6.1 LCD

9.4.6.2 LED

9.4.7 Historic and Forecasted Market Size By By End-Users

9.4.7.1 Residential

9.4.7.2 Commercial

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Outdoor TV Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By By Screen Size

9.5.4.1 Less than 30 inches

9.5.4.2 30 inches to 50 inches

9.5.4.3 50 inches to 70 inches

9.5.4.4 More than 70 inches

9.5.5 Historic and Forecasted Market Size By By Resolution

9.5.5.1 4K

9.5.5.2 1080p

9.5.5.3 720p

9.5.6 Historic and Forecasted Market Size By By Display Type

9.5.6.1 LCD

9.5.6.2 LED

9.5.7 Historic and Forecasted Market Size By By End-Users

9.5.7.1 Residential

9.5.7.2 Commercial

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Outdoor TV Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By By Screen Size

9.6.4.1 Less than 30 inches

9.6.4.2 30 inches to 50 inches

9.6.4.3 50 inches to 70 inches

9.6.4.4 More than 70 inches

9.6.5 Historic and Forecasted Market Size By By Resolution

9.6.5.1 4K

9.6.5.2 1080p

9.6.5.3 720p

9.6.6 Historic and Forecasted Market Size By By Display Type

9.6.6.1 LCD

9.6.6.2 LED

9.6.7 Historic and Forecasted Market Size By By End-Users

9.6.7.1 Residential

9.6.7.2 Commercial

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Outdoor TV Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By By Screen Size

9.7.4.1 Less than 30 inches

9.7.4.2 30 inches to 50 inches

9.7.4.3 50 inches to 70 inches

9.7.4.4 More than 70 inches

9.7.5 Historic and Forecasted Market Size By By Resolution

9.7.5.1 4K

9.7.5.2 1080p

9.7.5.3 720p

9.7.6 Historic and Forecasted Market Size By By Display Type

9.7.6.1 LCD

9.7.6.2 LED

9.7.7 Historic and Forecasted Market Size By By End-Users

9.7.7.1 Residential

9.7.7.2 Commercial

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Outdoor TV Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 354.95 Mn. |

|

Forecast Period 2024-32 CAGR: |

11.6 % |

Market Size in 2032: |

USD 953.11 Mn. |

|

Segments Covered: |

By Screen Size |

|

|

|

By Resolution |

|

||

|

By Display Type |

|

||

|

By End-Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Outdoor TV Market research report is 2024-2032.

SunBriteTV (U.S.), Seura (U.S.), SkyVue (U.S.), Peerless-AV (U.S.), The TV Shield (U.S.), MirageVision (U.S.), Apollo Enclosures (U.S.), Aqualite Outdoor (U.K.), Cinios (South Korea), Luxurite (U.K.), NEC Display Solutions (Japan), Samsung Electronics (South Korea), LG Electronics (South Korea), TCL Corporation (China), Sony Corporation (Japan), Vizio Inc. (U.S.), Hisense Group (China), Koninklijke Philips N.V. (Philips) (Netherlands), Panasonic Corporation (Japan), Sharp Corporation (Japan) and Other Major Players.

The Outdoor TV Market is segmented into Screen Size, Resolution, Display Type, End-Users, and region. By Screen Size, the market is categorized into Less than 30 inches, 30 inches to 50 inches, 50 inches to 70 inches, and More than 70 inches. By Resolution, the market is categorized into 4K, 1080p, and 720p. By Display Type, the market is categorized into LCD, LED, and Others. By End-Users, the market is categorized into Residential, and Commercial. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

An outdoor TV is a television specifically designed for use in outdoor environments, providing durability and weather resistance to withstand various outdoor conditions. These TVs are engineered to operate in a range of temperatures, resist moisture, and combat elements like rain, snow, and dust. The design typically includes robust casings, anti-glare screens for better visibility in sunlight, and sometimes built-in heating or cooling systems to maintain optimal performance in extreme weather.

Outdoor TV Market Size Was Valued at USD 354.95 Million In 2023 And Is Projected to Reach USD 953.11 Million By 2032, Growing at A CAGR of 11.6% From 2024-2032.