Over the Counter Drugs Market Synopsis:

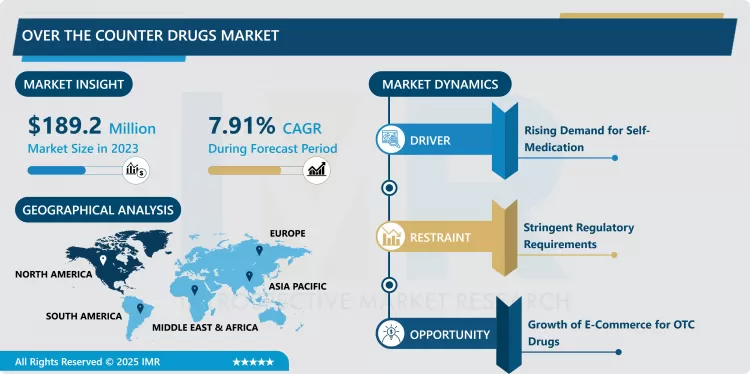

Over the Counter Drugs Market Size Was Valued at USD 189.2 Million in 2023, and is Projected to Reach USD 375.38 Million by 2032, Growing at a CAGR of 7.91% From 2024-2032.

Over the Counter (OTC) Drugs Market is a specialised area in the pharmaceutical industry that involves drugs that do not require the prescription of a doctor. These drugs are sold over the counter; they offer the consumer ways to treat themselves for everyday ailments such as headaches, colds, allergies, and digestive disorders, pain, and skin diseases. Over the counter products are available in form of tablet, liquid solution, topical or oral solutions/cream, aerosols and drops. This market has expanded in the recent past mainly due to the emerging culture of self- administration, enhanced sensitization on the general health, and the fact that these drugs do not require prescription.

The market for Over the Counter Drugs has been steadily growing over the years due to the following events; Increasing the number of people aging, growing trend of health consciousness, and growing average health care costs. A number of people are now interested in using drugs to treat their ailments personally in order to save on costs of consulting medical experts. Through innovations in formulation, the OTC products offer a variety of health conditions meaning more affected individuals get access to products that meet their health needs without the intervention of a healthcare professional. In the same time, more and more markets are being developed and growing in the global scale – both in the developed and developing countries. Direct-to-consumer channels such as online retail stores have further extended this expansion since the medication can be freely purchased from the comfort of ones home.

OTC drugs market has incorporated digital marketing, e- commerce, health apps to stay put in the strategic eye of the customer. The belief in natural and herbal products has also led to the growth in the OTC division of the company. It is pertinent to note that a large number of OTC medications are prepared synthetically with natural substances so the urban and the health-conscious individuals who have been using plant-based products are the major consumer base of these prescription medications.

Over the Counter Drugs Market Trend Analysis:

Rise of Natural and Herbal Remedies in OTC Drugs

- An emerging trend in the market is consumer trends such as the use of natural and herbal Over the Counter Drugs. As consumers become more sensitive to the effects of synthetic drugs, more people prefer natural products when it comes to personal health. This trend is therefore facilitated by the following factors; Environmentally friendly and plant-based products, Wellness and holistic living, Expansion of wellness and complimentary medicine. To this effect, OTC drug manufacturers are establishing formulations of products containing organic compounds which may include turmeric, ginger and aloe vera to solve health concerns including inflammation, digestive problems and skin conditions respectively.

Expansion of Online Sales Channels for OTC Drugs

- The Over the Counter Drugs Market means that there is considerable potential for the development of new sales formats, including internet trading. E-commerce platforms, advancing internet connection coupled with increasing, have enabled the consumer purchase the OTC drugs from the confort of their homes. This trend had been further pushed by the COVID 19 pandemic that had people order their health supplements and other health products online. Internet sources enable the cost comparison, review some other customers’ feedback and select quite a large choice of OTC drugs supplements at a lesser cost than at shops. The message in this concept for the pharmaceutical firms is the potential of reaching a wider market and client base through the possibilities of e-commerce adapted for direct-to-consumer sales.

Over the Counter Drugs Market Segment Analysis:

Over the Counter Drugs Market Segmented on the basis of product type, formulation and distribution channel and region.

By Product Type Cough, Cold, and Flu Products segment is expected to dominate the market during the forecast period

- The Cough, Cold, and Flu Products segment holds the largest share of the Over-the-Counter Drugs Market during the forecast period due to the repeated use of these products required during winter and cold flu seasons. Hence, minor ailments like cough and cold which occur all through the year have increasingly put so much reliance on OTC products to treat the symptoms. These products include cough syrups, decongestant, nasal sprays, and flu medications and are always in demand, thus are core segment that is key in the OTC drugs market. That’s why the possibility to buy products from this segment without prescription along with customers’ need to receive quick and effective relief are the major factors to drive this market.

By Formulation, OTC tablets segment expected to held the largest share

- OTC Tablets is likely to account for the largest market share in the Over-the-Counter Drugs Market because of its versatility and applicability. Tables are also quite popular among OTC preparations and are valuable because of controllable dosage and convenient carrying. They are taken for numerous conditions such as mild pain, common cold, stomach discomfort and many more conditions. Another advantage is that most tablets have a longer shelf life than the liquid products making them more popular.” The expansion of the OTC tablets segment is also propelled by the trend towards the combination of several active substances in one tablet let

Over the Counter Drugs Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America will continue to be the largest market for the Over the Counter Drugs in the coming years, mainly due to a higher per capita income, increasing health consciousness, and rampant practice of self-medication. There are OTC products accessible on racks at over the counter retail stores in most of the states in the U.S., and can also be ordered online thus offering an easy means by which consumers can self-treat minor ailment.

- The market is on a constant rise for the very same reasons in countering country Canada where citizenry is very conscious about their health and fitness. The consumer sovereignty in North America region where OTC drugs are sold has been further supported by more stringent measures put in place to protect the consumers by satisfying them with measures put in place that ensure the OTC drugs meet the required safety and efficacy standard. Consequently, North America is thought to remain the planet’s largest consumer of OTC drugs and the primary source of new products across categories that include pain, digestive and allergy treatment.

Active Key Players in the Over-the-Counter Drugs Market:

- Bayer AG (Germany)

- Boehringer Ingelheim (Germany)

- GlaxoSmithKline PLC (United Kingdom)

- Johnson & Johnson (United States)

- Kimberly-Clark Corporation (United States)

- Merck & Co., Inc. (United States)

- Novartis International AG (Switzerland)

- Pfizer Inc. (United States)

- Procter & Gamble Co. (United States)

- Reckitt Benckiser Group (United Kingdom)

- Sanofi S.A. (France)

- Takeda Pharmaceutical Company (Japan)

- Teva Pharmaceutical Industries Ltd. (Israel)

- The Himalaya Drug Company (India)

- Walgreens Boots Alliance, Inc. (United States), and Other Active Players

Key Industry Developments in the Over-the-Counter Drugs Market:

- In December 2024, India is developing a framework to regulate over-the-counter (OTC) drugs, allowing some prescription medications to be sold in general stores. A sub-committee, is reviewing international guidelines and proposing amendments to the Drugs and Cosmetics Act. The move aims to enhance accessibility while ensuring safe usage, with a report expected soon.

|

Over the Counter Drugs Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 189.2 Million |

|

Forecast Period 2024-32 CAGR: |

7.91 % |

Market Size in 2032: |

USD 375.38 Million |

|

Segments Covered: |

By Product Type |

|

|

|

By Pharmaceutical Formulation |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Over the Counter Drugs Market by By Product Type (2018-2032)

4.1 Over the Counter Drugs Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Cough

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Cold

4.5 and Flu Products

4.6 Analgesics Dermatology Products

4.7 Gastrointestinal Products

4.8 Vitamins

4.9 Mineral

4.10 and Supplements (VMS)

4.11 Weight-loss/Dietary Products

4.12 Ophthalmic Products

4.13 Sleeping Aids

4.14 Other

Chapter 5: Over the Counter Drugs Market by By Pharmaceutical Formulation (2018-2032)

5.1 Over the Counter Drugs Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Tablets

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Capsules

5.5 Injectable

5.6 Sprays

5.7 Suspensions

5.8 Powders

5.9 Other

Chapter 6: Over the Counter Drugs Market by By Distribution Channel (2018-2032)

6.1 Over the Counter Drugs Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospital Pharmacies

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Retail Pharmacies

6.5 Online Pharmacy

6.6 Other Distribution Channels

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Over the Counter Drugs Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BAYER AG (GERMANY)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BOEHRINGER INGELHEIM (GERMANY)

7.4 GLAXOSMITHKLINE PLC (UNITED KINGDOM)

7.5 JOHNSON & JOHNSON (UNITED STATES)

7.6 KIMBERLY-CLARK CORPORATION (UNITED STATES)

7.7 MERCK & CO. INC. (UNITED STATES)

7.8 NOVARTIS INTERNATIONAL AG (SWITZERLAND)

7.9 PFIZER INC. (UNITED STATES)

7.10 PROCTER & GAMBLE CO. (UNITED STATES)

7.11 RECKITT BENCKISER GROUP (UNITED KINGDOM)

7.12 SANOFI S.A. (FRANCE)

7.13 TAKEDA PHARMACEUTICAL COMPANY (JAPAN)

7.14 TEVA PHARMACEUTICAL INDUSTRIES LTD. (ISRAEL)

7.15 THE HIMALAYA DRUG COMPANY (INDIA)

7.16 WALGREENS BOOTS ALLIANCE INC. (UNITED STATES)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Over the Counter Drugs Market By Region

8.1 Overview

8.2. North America Over the Counter Drugs Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Product Type

8.2.4.1 Cough

8.2.4.2 Cold

8.2.4.3 and Flu Products

8.2.4.4 Analgesics Dermatology Products

8.2.4.5 Gastrointestinal Products

8.2.4.6 Vitamins

8.2.4.7 Mineral

8.2.4.8 and Supplements (VMS)

8.2.4.9 Weight-loss/Dietary Products

8.2.4.10 Ophthalmic Products

8.2.4.11 Sleeping Aids

8.2.4.12 Other

8.2.5 Historic and Forecasted Market Size By By Pharmaceutical Formulation

8.2.5.1 Tablets

8.2.5.2 Capsules

8.2.5.3 Injectable

8.2.5.4 Sprays

8.2.5.5 Suspensions

8.2.5.6 Powders

8.2.5.7 Other

8.2.6 Historic and Forecasted Market Size By By Distribution Channel

8.2.6.1 Hospital Pharmacies

8.2.6.2 Retail Pharmacies

8.2.6.3 Online Pharmacy

8.2.6.4 Other Distribution Channels

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Over the Counter Drugs Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Product Type

8.3.4.1 Cough

8.3.4.2 Cold

8.3.4.3 and Flu Products

8.3.4.4 Analgesics Dermatology Products

8.3.4.5 Gastrointestinal Products

8.3.4.6 Vitamins

8.3.4.7 Mineral

8.3.4.8 and Supplements (VMS)

8.3.4.9 Weight-loss/Dietary Products

8.3.4.10 Ophthalmic Products

8.3.4.11 Sleeping Aids

8.3.4.12 Other

8.3.5 Historic and Forecasted Market Size By By Pharmaceutical Formulation

8.3.5.1 Tablets

8.3.5.2 Capsules

8.3.5.3 Injectable

8.3.5.4 Sprays

8.3.5.5 Suspensions

8.3.5.6 Powders

8.3.5.7 Other

8.3.6 Historic and Forecasted Market Size By By Distribution Channel

8.3.6.1 Hospital Pharmacies

8.3.6.2 Retail Pharmacies

8.3.6.3 Online Pharmacy

8.3.6.4 Other Distribution Channels

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Over the Counter Drugs Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Product Type

8.4.4.1 Cough

8.4.4.2 Cold

8.4.4.3 and Flu Products

8.4.4.4 Analgesics Dermatology Products

8.4.4.5 Gastrointestinal Products

8.4.4.6 Vitamins

8.4.4.7 Mineral

8.4.4.8 and Supplements (VMS)

8.4.4.9 Weight-loss/Dietary Products

8.4.4.10 Ophthalmic Products

8.4.4.11 Sleeping Aids

8.4.4.12 Other

8.4.5 Historic and Forecasted Market Size By By Pharmaceutical Formulation

8.4.5.1 Tablets

8.4.5.2 Capsules

8.4.5.3 Injectable

8.4.5.4 Sprays

8.4.5.5 Suspensions

8.4.5.6 Powders

8.4.5.7 Other

8.4.6 Historic and Forecasted Market Size By By Distribution Channel

8.4.6.1 Hospital Pharmacies

8.4.6.2 Retail Pharmacies

8.4.6.3 Online Pharmacy

8.4.6.4 Other Distribution Channels

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Over the Counter Drugs Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Product Type

8.5.4.1 Cough

8.5.4.2 Cold

8.5.4.3 and Flu Products

8.5.4.4 Analgesics Dermatology Products

8.5.4.5 Gastrointestinal Products

8.5.4.6 Vitamins

8.5.4.7 Mineral

8.5.4.8 and Supplements (VMS)

8.5.4.9 Weight-loss/Dietary Products

8.5.4.10 Ophthalmic Products

8.5.4.11 Sleeping Aids

8.5.4.12 Other

8.5.5 Historic and Forecasted Market Size By By Pharmaceutical Formulation

8.5.5.1 Tablets

8.5.5.2 Capsules

8.5.5.3 Injectable

8.5.5.4 Sprays

8.5.5.5 Suspensions

8.5.5.6 Powders

8.5.5.7 Other

8.5.6 Historic and Forecasted Market Size By By Distribution Channel

8.5.6.1 Hospital Pharmacies

8.5.6.2 Retail Pharmacies

8.5.6.3 Online Pharmacy

8.5.6.4 Other Distribution Channels

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Over the Counter Drugs Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Product Type

8.6.4.1 Cough

8.6.4.2 Cold

8.6.4.3 and Flu Products

8.6.4.4 Analgesics Dermatology Products

8.6.4.5 Gastrointestinal Products

8.6.4.6 Vitamins

8.6.4.7 Mineral

8.6.4.8 and Supplements (VMS)

8.6.4.9 Weight-loss/Dietary Products

8.6.4.10 Ophthalmic Products

8.6.4.11 Sleeping Aids

8.6.4.12 Other

8.6.5 Historic and Forecasted Market Size By By Pharmaceutical Formulation

8.6.5.1 Tablets

8.6.5.2 Capsules

8.6.5.3 Injectable

8.6.5.4 Sprays

8.6.5.5 Suspensions

8.6.5.6 Powders

8.6.5.7 Other

8.6.6 Historic and Forecasted Market Size By By Distribution Channel

8.6.6.1 Hospital Pharmacies

8.6.6.2 Retail Pharmacies

8.6.6.3 Online Pharmacy

8.6.6.4 Other Distribution Channels

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Over the Counter Drugs Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Product Type

8.7.4.1 Cough

8.7.4.2 Cold

8.7.4.3 and Flu Products

8.7.4.4 Analgesics Dermatology Products

8.7.4.5 Gastrointestinal Products

8.7.4.6 Vitamins

8.7.4.7 Mineral

8.7.4.8 and Supplements (VMS)

8.7.4.9 Weight-loss/Dietary Products

8.7.4.10 Ophthalmic Products

8.7.4.11 Sleeping Aids

8.7.4.12 Other

8.7.5 Historic and Forecasted Market Size By By Pharmaceutical Formulation

8.7.5.1 Tablets

8.7.5.2 Capsules

8.7.5.3 Injectable

8.7.5.4 Sprays

8.7.5.5 Suspensions

8.7.5.6 Powders

8.7.5.7 Other

8.7.6 Historic and Forecasted Market Size By By Distribution Channel

8.7.6.1 Hospital Pharmacies

8.7.6.2 Retail Pharmacies

8.7.6.3 Online Pharmacy

8.7.6.4 Other Distribution Channels

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Over the Counter Drugs Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 189.2 Million |

|

Forecast Period 2024-32 CAGR: |

7.91 % |

Market Size in 2032: |

USD 375.38 Million |

|

Segments Covered: |

By Product Type |

|

|

|

By Pharmaceutical Formulation |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Over-the-Counter Drugs Market research report is 2024-2032.

Bayer AG, Boehringer Ingelheim, GlaxoSmithKline PLC, Johnson & Johnson, Kimberly-Clark Corporation, Merck & Co., Inc., Novartis International AG, Pfizer Inc., Procter & Gamble Co., Reckitt Benckiser Group, Sanofi S.A., Takeda Pharmaceutical Company, Teva Pharmaceutical Industries Ltd., The Himalaya Drug Company, Walgreens Boots Alliance, Inc., and Other Active Players.

The Over-the-Counter Drugs Market is segmented into Product Type, Pharmaceutical formulation, Distribution Channel and region. By Product Type, the market is categorized into Cough, Cold, and Flu Products, Analgesics Dermatology Products, Gastrointestinal Products, Vitamins, Mineral, and Supplements (VMS), Weight-loss/Dietary Products, Ophthalmic Products, Sleeping Aids, Others. By Pharmaceutical Formulation, the market is categorized into Tablets, Capsules, Injectable, Sprays, Suspensions Powders, Other. By Distribution Channel, the market is categorized into Hospital, Pharmacies, Retail Pharmacies, Online Pharmacy, Other Distribution Channels. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA)

Over the Counter (OTC) Drugs Market is a specialised area in the pharmaceutical industry that involves drugs that do not require the prescription of a doctor. These drugs are sold over the counter; they offer the consumer ways to treat themselves for everyday ailments such as headaches, colds, allergies, and digestive disorders, pain, and skin diseases. Over the counter products are available in form of tablet, liquid solution, topical or oral solutions/cream, aerosols and drops. This market has expanded in the recent past mainly due to the emerging culture of self- administration, enhanced sensitization on the general health, and the fact that these drugs do not require prescription.

Over the Counter Drugs Market Size Was Valued at USD 189.2 Million in 2023, and is Projected to Reach USD 375.38 Million by 2032, Growing at a CAGR of 7.91 % From 2024-2032.