Pet Food Market Synopsis

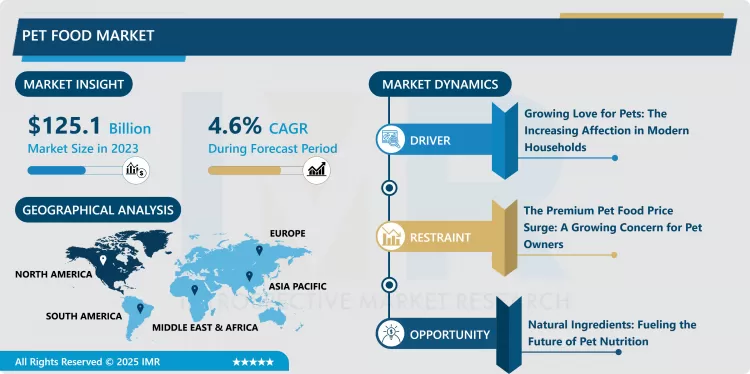

Pet Food Market Size Was Valued at USD 125.1 Billion in 2023 and is Projected to Reach USD 187.5 Billion by 2032, Growing at a CAGR of 4.6% From 2024-2032.

Pet food is another type of food consumed by domesticated animals and is designed to supply all the necessities of the foodstuff for instance meat, grains, cereals, meat by-products, vitamins as well as minerals. It can be purchased in supermarkets & hypermarkets and pet shops and more especially according to specific animals like cats, dogs, fish & other pets.

- The demand for the products is expected to be led by the inclination to accept pets and the increasing consciousness regarding their health. Other factors such as enhancement in the general functioning and digestion in the stomach of pet animals due to the intake of a healthy diet will probably enhance the growth of the market over the forecast period. Most of the pet food products that are featured in the global market are quite similar. For this reason, similarity bias has pushed manufacturers to incorporate multi-functional and innovative constituents into their products. It may be convenient to note that this industry could be driven mainly by convenience taking into account the increase in the sales of prepared pet food. The other segment that falls under Deluxe and Premium products is organic pet food which is relatively new in the market and gaining ground.

- The enhancement of the supply of organic products in general flavors and types, and implementation of basic products like probiotics and anti-oxidants are some key factors that are going to enhance the positive global market trends. On the other hand, low product penetration due to high price is slightly high, which may limit the position of the company’s organic segment growth in the coming years as every family cannot afford the higher price of the products.

- The market value chain has suppliers of raw materials, the production line, companies that distribute the products, and users of the products. Some of them are Meat, meat by products, cereals, grains, and special proteins the animal origin, palatants, flavors & sweeteners vitamins, minerals enzymes amongst others.

- Manufacturers develop these products through the recommended nutritional value for the domesticated animals. Meat products are seasoned, mechanically deboned or separated through enzymatic or acidic treatments to obtain proteins, water and oils sections. Another process in manufacturing is grinding, cooking and mixing of the mentioned raw materials and other related ingredients.

Pet Food Market Trend Analysis

Increasing Pet Ownership

- Growing customer preferences for superior quality pet foods and the growing trend of pet adoption in emerging markets will create more growth in the Pet Food Market. Customers’ improved health consciousness and their inclination towards natural and organic products are also factors that have an impact on the Pet Food Market growth.

- This situation gives rise to the global pet food market, which is significantly influenced by the new culture that pets are members of the family. This has greatly transformed the situation and dramatically increased the number of individuals owning pets across the globe. In the global front, dogs are the most popular type of pet among the pet parents.

- And as per the report, in 2022 the dry pet food sector dominate the pet food market by owning the highest market value of US$ 80. 03 Billion in 2022. Going by these figures the market is expected to get to a market size of US$ 156. 60 Billion in 2029. This is due to increase in adoption of commercial food by pet owners from homemade food, dogs require many nutrients than the other pets, there are many dogs than other pets. The population of pet owners has woken up to the need of providing for the health needs of their pets and in turn this has been addressing the need to feed pets well through quality pet foods.

Expanding Retail and E-Commerce Channels

- The increasing availability of the pet food through internet retail stores and other retailing formats for easy accessing is another factor fuelling the market growth. A number of important firms are planning to increase the number outlets that are available offline so as to penetrate the marked wider.

- For instance, Durkha Dog Chew, stated that it will welcome its first ever industrial scale plant for yak cheese chews in Nepal shortly. It is anticipated that the facility will be commissioned in the next year, April 2024, and the first six months of production, the company is anticipated to produce fifty tons of the Yak cheese chews.

- It is expected to increase the production capacity to 100 tons per month within the following one year of the store’s opening. Not only this, the growth and development of online retail stores favoring the pet food business is also adding to the market growth. For instance, pet care such as food was purchased online and in the United States showed a rise from 32 % in the year ending January 2020 to 40% in the year ending January 2022.

Pet Food Market Segment Analysis:

Pet Food Market Segmented based on Pet Type, Product Type, Pricing Type, Ingredient Type, and Distribution Channel.

By Pet Type, dog food segment is expected to dominate the market during the forecast period

- The dog food segment shall continue to lead the market for the duration of the given forecast period and shall hold the maximum market share of the total pet food market due to the high requirements of dog population in the international market. Dogs engaged a higher percentage of the expenditure for pets they constituted the majority of share in the year 2022, and they used a lot of pet food than the cats particularly the premium kinds of pet food. Consumers are sensitive to the health needs of their pet dogs hence the buy a variety of foods meant to meet the needs of their dogs.

By Product Type, dry pet food segment held the largest share in 2023

- Among product types, dry pet food remains the most dominant product in the market. These include relatively cheaper prices, convenience in handling and preservation and usually tend to have a longer shelf life. For instance, dry dog food that falls in the economy range had the biggest market share and its value reached more than USD 238 Million in 2021 in India. This translated into a share of almost 40 percent on the total market capitalization of the dry dog foods across India in the considered period. Dry pet food is popular among the pet owners whose main concern is to feed their pets a well-balanced diet at an affordable price.

Pet Food Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America dominates the global pet food market with maximum hosiery of the market share. This can be blamed on a vibrant pet culture together with a high degree of pet anthropomorphization. The newest survey demonstrates that North America was the biggest market for pet food around the world in 2022. The pet food market size by country shows that United States and Mexico have the largest contribution to the North American pet food market because the both the countries have huge pet owner base. Consumers in the region remain conscious of their pet’s health and welfare hence this increasing trend for quality and natural products for their pets’ meals.

- The factors most influential to the said regional demand are the intensifying consciousness of consumers to the beneficial impact of pet nutrition on pet health, and the ongoing pet humanisation. It is also expected that with the increasing trend of the millennial generation adopting pets, the market will also grow. According to APPA, approximately 38 percent of Americans own cats, and most of them keep two cats on average.

Active Key Players in the Pet Food Market

- The J.M. Smucker Company

- Nestle Purina

- Mars, Incorporated

- LUPUS Alimentos

- Total Alimentos

- Hill’s Pet Nutrition, Inc.

- General Mills Inc.

- WellPet LLC

- The Hartz Mountain Corporation Other Key Players

|

Global Pet Food Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 125.1 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.6 % |

Market Size in 2032: |

USD 187.5 Bn. |

|

Segments Covered: |

By Pet Type |

|

|

|

By Pricing Type |

|

||

|

By Product Type |

|

||

|

By Ingredient Type |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Pet Food Market by By Pet Type (2018-2032)

4.1 Pet Food Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Dog Food

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Cat Food

4.5 Others

Chapter 5: Pet Food Market by By Pricing Type (2018-2032)

5.1 Pet Food Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Mass Products

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Premium Products

Chapter 6: Pet Food Market by By Product Type (2018-2032)

6.1 Pet Food Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Dry Pet Food

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Wet and Canned Pet Food

6.5 Snacks and Treats

Chapter 7: Pet Food Market by By Ingredient Type (2018-2032)

7.1 Pet Food Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Animal Derived

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Plant Derived

Chapter 8: Pet Food Market by By Distribution Channel (2018-2032)

8.1 Pet Food Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Supermarkets and Hypermarkets

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Specialty Stores

8.5 Online Stores

8.6 Others

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Pet Food Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 ALFA AESAR (UNITED STATES)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 BASF SE (GERMANY)

9.4 CHONGQING HUAFENG CHEMICAL COLTD. (CHINA)

9.5 DAICEL CORPORATION (JAPAN)

9.6 DONGYING CITY LONGXING CHEMICAL COLTD. (CHINA)

9.7 HAIHANG INDUSTRY COLTD. (CHINA)

9.8 JIANGSU SIGMA CHEMICAL COLTD. (CHINA)

9.9 JINAN DAIKI NEW MATERIAL COLTD. (CHINA)

9.10 LG CHEM (SOUTH KOREA)

9.11 MEILAN GROUP (CHINA)

9.12 NANJING LANYA CHEMICAL COLTD. (CHINA)

9.13 PERSTORP (SWEDEN)

9.14 POLYCAPROLACTONE CORPORATION (UNITED STATES)

9.15 RUIJIE CHEMICAL COLTD. (CHINA)

9.16 SHENZHEN ESUN INDUSTRIAL COLTD. (CHINA)

9.17 SHENZHEN KEHONGDA TECHNOLOGY COLTD. (CHINA)

9.18 SIGMA-ALDRICH CO. LLC (UNITED STATES)

9.19 SUZHOU XIANGYUAN SPECIAL FINE CHEMICAL COLTD. (CHINA)

9.20 ZHANGJIAGANG FORTUNE CHEMICAL COLTD. (CHINA)

9.21 ZHEJIANG JINHUA CHEMICAL COLTD. (CHINA)

9.22 OTHER KEY PLAYERS

Chapter 10: Global Pet Food Market By Region

10.1 Overview

10.2. North America Pet Food Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By By Pet Type

10.2.4.1 Dog Food

10.2.4.2 Cat Food

10.2.4.3 Others

10.2.5 Historic and Forecasted Market Size By By Pricing Type

10.2.5.1 Mass Products

10.2.5.2 Premium Products

10.2.6 Historic and Forecasted Market Size By By Product Type

10.2.6.1 Dry Pet Food

10.2.6.2 Wet and Canned Pet Food

10.2.6.3 Snacks and Treats

10.2.7 Historic and Forecasted Market Size By By Ingredient Type

10.2.7.1 Animal Derived

10.2.7.2 Plant Derived

10.2.8 Historic and Forecasted Market Size By By Distribution Channel

10.2.8.1 Supermarkets and Hypermarkets

10.2.8.2 Specialty Stores

10.2.8.3 Online Stores

10.2.8.4 Others

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Pet Food Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By By Pet Type

10.3.4.1 Dog Food

10.3.4.2 Cat Food

10.3.4.3 Others

10.3.5 Historic and Forecasted Market Size By By Pricing Type

10.3.5.1 Mass Products

10.3.5.2 Premium Products

10.3.6 Historic and Forecasted Market Size By By Product Type

10.3.6.1 Dry Pet Food

10.3.6.2 Wet and Canned Pet Food

10.3.6.3 Snacks and Treats

10.3.7 Historic and Forecasted Market Size By By Ingredient Type

10.3.7.1 Animal Derived

10.3.7.2 Plant Derived

10.3.8 Historic and Forecasted Market Size By By Distribution Channel

10.3.8.1 Supermarkets and Hypermarkets

10.3.8.2 Specialty Stores

10.3.8.3 Online Stores

10.3.8.4 Others

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Pet Food Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By By Pet Type

10.4.4.1 Dog Food

10.4.4.2 Cat Food

10.4.4.3 Others

10.4.5 Historic and Forecasted Market Size By By Pricing Type

10.4.5.1 Mass Products

10.4.5.2 Premium Products

10.4.6 Historic and Forecasted Market Size By By Product Type

10.4.6.1 Dry Pet Food

10.4.6.2 Wet and Canned Pet Food

10.4.6.3 Snacks and Treats

10.4.7 Historic and Forecasted Market Size By By Ingredient Type

10.4.7.1 Animal Derived

10.4.7.2 Plant Derived

10.4.8 Historic and Forecasted Market Size By By Distribution Channel

10.4.8.1 Supermarkets and Hypermarkets

10.4.8.2 Specialty Stores

10.4.8.3 Online Stores

10.4.8.4 Others

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Pet Food Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By By Pet Type

10.5.4.1 Dog Food

10.5.4.2 Cat Food

10.5.4.3 Others

10.5.5 Historic and Forecasted Market Size By By Pricing Type

10.5.5.1 Mass Products

10.5.5.2 Premium Products

10.5.6 Historic and Forecasted Market Size By By Product Type

10.5.6.1 Dry Pet Food

10.5.6.2 Wet and Canned Pet Food

10.5.6.3 Snacks and Treats

10.5.7 Historic and Forecasted Market Size By By Ingredient Type

10.5.7.1 Animal Derived

10.5.7.2 Plant Derived

10.5.8 Historic and Forecasted Market Size By By Distribution Channel

10.5.8.1 Supermarkets and Hypermarkets

10.5.8.2 Specialty Stores

10.5.8.3 Online Stores

10.5.8.4 Others

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Pet Food Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By By Pet Type

10.6.4.1 Dog Food

10.6.4.2 Cat Food

10.6.4.3 Others

10.6.5 Historic and Forecasted Market Size By By Pricing Type

10.6.5.1 Mass Products

10.6.5.2 Premium Products

10.6.6 Historic and Forecasted Market Size By By Product Type

10.6.6.1 Dry Pet Food

10.6.6.2 Wet and Canned Pet Food

10.6.6.3 Snacks and Treats

10.6.7 Historic and Forecasted Market Size By By Ingredient Type

10.6.7.1 Animal Derived

10.6.7.2 Plant Derived

10.6.8 Historic and Forecasted Market Size By By Distribution Channel

10.6.8.1 Supermarkets and Hypermarkets

10.6.8.2 Specialty Stores

10.6.8.3 Online Stores

10.6.8.4 Others

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Pet Food Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By By Pet Type

10.7.4.1 Dog Food

10.7.4.2 Cat Food

10.7.4.3 Others

10.7.5 Historic and Forecasted Market Size By By Pricing Type

10.7.5.1 Mass Products

10.7.5.2 Premium Products

10.7.6 Historic and Forecasted Market Size By By Product Type

10.7.6.1 Dry Pet Food

10.7.6.2 Wet and Canned Pet Food

10.7.6.3 Snacks and Treats

10.7.7 Historic and Forecasted Market Size By By Ingredient Type

10.7.7.1 Animal Derived

10.7.7.2 Plant Derived

10.7.8 Historic and Forecasted Market Size By By Distribution Channel

10.7.8.1 Supermarkets and Hypermarkets

10.7.8.2 Specialty Stores

10.7.8.3 Online Stores

10.7.8.4 Others

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Pet Food Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 125.1 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.6 % |

Market Size in 2032: |

USD 187.5 Bn. |

|

Segments Covered: |

By Pet Type |

|

|

|

By Pricing Type |

|

||

|

By Product Type |

|

||

|

By Ingredient Type |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Pet Food Market research report is 2024-2032.

Mars, Hill's Pet Nutrition, Nestle Purina, The J.M. Smucker Company (Big Heart Pet Brands, Inc.), Colgate and Other Major Players.

Pet Food Market is segmented into Pet Type, Food Type, Distribution Channel and region. By Pet Type, the market is categorized into Dogs, Cats, Others. By Food Type, the market is categorized into Dry Food, Wet Food, Snacks, Treats, Nutritious Food. By Distribution Channels, the market is categorized into Specialized Pet Stores, Supermarkets, Online, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Pet food is an animal food in the form of whole food, snacks, dry food and wet food for consumption by pets. The pet food market includes sales of goods and services by entities associated with manufacturing cat and dog food and other animal food from ingredients such as grains, oilseed, mill products and meat products.

Pet Food Market Size Was Valued at USD 125.1 Billion in 2023, and is Projected to Reach USD 187.5 Billion by 2032, Growing at a CAGR of 4.6% From 2024-2032.