Plant Activators Market Synopsis

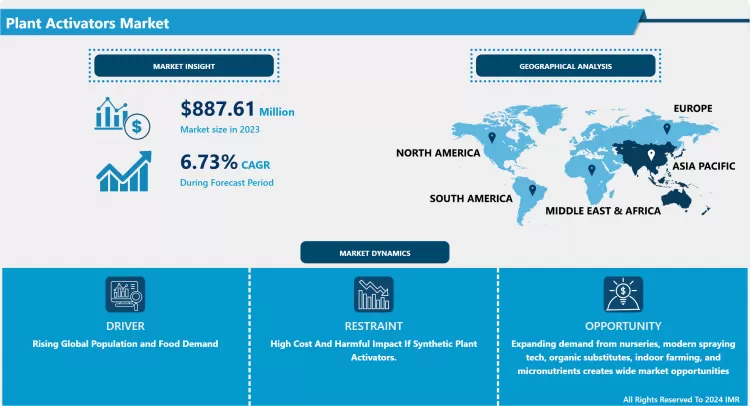

Plant Activators Market Size Was Valued at USD 887.61 Million in 2023 and is Projected to Reach USD 1595.15 Million by 2032, Growing at a CAGR of 6.73% From 2024-2032.

Plant activators are natural or synthetic chemical compounds that protect plants from various pathogens by activating the defense priming. Plant activators provide durable effects to enhance plant resistance, unlike traditional fungicides or pesticides since they do not exert a direct detrimental effect on the pathogens.

- The application of plant activators in crops is on the rise to control currently emerging plant disease however, most of the molecular mechanisms underlying immune induction by these activators remain unclear. It has been widely recognized that primary metabolites play an important role not only in plant growth and reproduction but also in plant defense. For example, sugars no longer only served as substrates for energy provision but also acted as real signaling entities with hormone-like actions.

- Plant activators are chemicals that activate the defense genes in plants by providing signals via the signal transduction pathway mediated by salicylic acid. A chemical will be considered as a ‘plant activator’ only if, neither the agent nor its metabolites have direct antifungal/antibacterial activity in vitro or planta. The agent should modify the plant–pathogen interaction so that it resembles phenotypically an incompatible interaction, which includes defense-related mechanisms before or after challenge, and the agent should protect a plant against a broad spectrum of pathogens. Plant activators render plants resistance to a wide spectrum of pathogens by activating systemic acquired resistance (SAR). Since plant activators do not have pesticidal or antibiotic activity, their adverse effects on human health and environment are minimal. In addition, since they do not interact directly with the pathogens, it is unlikely that plant pathogens will develop resistance to these chemicals.

Plant Activators Market Trend Analysis

Growing demand for eco-friendly plant activators fueled by biotechnology advancements reflects market trends.

- The increasing need for environmentally friendly plant activators is fueling the market trend. Producers creating environmentally friendly products sourced from natural ingredients. Biodegradable and non-toxic choices adhere to sustainable farming principles and fulfill the requirements of environmentally aware consumers. The use of technology is increasing in the plant activator sector, leading to better quality products and increased efficiency. Biotechnology, nanotechnology, and precision agriculture are employed to create advanced plant activators for enhanced efficiency and effectiveness.

- Plant activators available in stores imitate the natural defense mechanisms such as SAR and induced systemic resistance, thereby boosting plant immunity. Harnessing the natural defense mechanisms is essential for ensuring long-term crop protection and enhancing the overall health and yield of plants. The plant activator market is moving towards bio-based and natural ingredients to fulfill increasing demand for sustainable products, providing advantages such as biodegradability and compatibility with organic farming methods.

- The plant activator market is observing new trends in formulations and delivery systems, which are improving effectiveness and ease of use, leading to increased adoption. Increasing need for organic food leads to use of plant activators in sustainable farming, which helps the environment. The plant activator market is expanding into new regions because of increased awareness of the advantages, sustainable input demand, and government backing.

Expanding demand from nurseries, modern spraying tech, organic substitutes, indoor farming, and micronutrients creates wide market opportunities.

- The growth of nurseries and planting is boosting the thriving plant activators market. The growing need for plant activators, which enhance immune responses and growth, is fueled by the rising demand for disease-resistant and healthy plants. Developments in horticultural methods and a growing enthusiasm for gardening are driving this trend, resulting in a profitable market for companies catering to both commercial nurseries and individual gardeners.

- Modern spraying techniques in the plant activators industry provide accurate application and improved efficiency. Innovations such as drones and automated sprayers help cut labor expenses and waste, while boosting crop yields and plant well-being. As plant activators become more affordable and accessible, their adoption is projected to increase, leading to market growth and expansion. Consumers and farmers are opting more and more for organic plant activators due to their environmental advantages and support for sustainable agriculture. Taken from natural origins, they improve the overall health of the soil and promote the growth of plants. Increasing recognition of the negative effects of synthetic chemicals is fueling the desire for organic substitutes, creating possibilities for businesses.

- The increasing popularity of indoor farming is driving the need for plant activators to grow. Controlled environments profit from natural activators, enhancing plant health and increasing yield. Businesses can take advantage of this trend by creating specialized products for indoor agriculture. Increased use of fertilizers, particularly micronutrients, boosts the need for plant activators. Micronutrients are essential for the well-being of plants, frequently found to be deficient in soil. Plant activators enhance the uptake of nutrients. Combining fertilizers with activators increases crop production. The demand for activators is on the rise. Increasing world population and greater demand for food are fueling the growth of the plant activators market by enhancing crop productivity and sustainability.

Plant Activators Market Segment Analysis:

Plant Activators Market is Segmented on the basis of Type, Application, Formulation, Crop Type, Function, And Distribution Channels.

By Type, Chemical Plant Activators Segment Is Expected to Dominate the Market During the Forecast Period

- Chemical plant activators provide consistent and expected results, giving farmers advantages such as disease resistance and stress tolerance. Thorough studies have refined these blends for top-notch results in different environments, resulting in higher crop yields and better-quality produce, establishing trust and broad acceptance in the market. Chemical plant activators are flexible and efficient in safeguarding cereals, fruits, vegetables, and ornamentals from pests, diseases, and environmental stresses. Their wide-reaching effectiveness makes farming easier, lowers expenses, and boosts output for farmers cultivating various crops.

- Chemical plant activators are quickly absorbed and used by plants to enhance growth, health, and stress resistance, delivering fast and noticeable outcomes. Farmers depend on how quickly they can control pests or diseases, which builds trust and encourages ongoing use in critical agricultural scenarios. Chemical plant activators are subjected to extensive testing and regulatory approval to guarantee their safety and effectiveness. Farmers can trust in the credibility provided by scientific evidence due to the strict quality control and standardization protocols.

- Advanced formulation technologies enhance the efficiency and user-friendliness of chemical plant activators. Improved delivery systems guarantee accurate deployment, effectiveness, reduced waste, and minimal environmental footprint. Current studies are focused on improving safety, minimizing toxicity, and enhancing biodegradability to maintain a strong position in the market.

- Chemical plant activators are affordable because of their efficient manufacturing methods. Farmers save money through efficient plant protection methods. Storing and transporting chemical formulations is simple. Chemical plant activators can be easily obtained from different distribution channels such as agricultural retail stores, cooperatives, and direct sales, guaranteeing continuous availability for farmers of any scale.

By Crop Type, Fruits & Vegetables Segment Held the Largest Share In 2023

- Fruits and vegetables have great economic importance in agriculture, demanding higher prices compared to grains. Farmers purchase plant activators to enhance crop productivity, immunity to diseases, and the overall quality of their harvests. Chemical plant activators provide dependable protection and promote growth, resulting in increased profits in the profitable fruits and vegetables industry. Diseases and pests pose a significant threat to the yield and quality of fruits and vegetables. Chemical plant activators enhance plant defense, providing rapid protection and reducing reliance on pesticides, making them essential in the marketplace.

- Quality and appearance, including color, size, and lack of blemishes, influence consumers' decisions when selecting fruits and vegetables. Plant activators support crops in achieving these criteria by stimulating growth, improving color, and boosting resistance, making them highly sought after in the market. Growing fruits and vegetables requires higher levels of input, including more fertilizers, pesticides, and growth enhancers. This is in line with chemical compounds in plants that improve plant health, growth, and ability to withstand stress. Farmers within this industry are putting money into high-tech agricultural resources in order to increase output, which is stimulating the demand for plant activators.

- Plant activators help farmers in growing high-quality fruits and vegetables for export by improving plant health, decreasing the need for pesticides, and meeting quality and safety requirements in the market.

- Growing fruits and vegetables all year in controlled environments increases the occurrence of pests and diseases, which results in the need for chemical plant activators to ensure consistent production. Purchasing plant activators for fruits and vegetables results in significant profits because of the quality of the crops. Increased yield, quality, and marketability offset the expenses of chemicals.

Plant Activators Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The varied agricultural industry in the Asia Pacific area, involving nations such as China, India, and Japan, needs flexible techniques such as plant activators to meet the needs of different types of crops and climates. This wide variety of crops provides a large market for plant activators, leading to a dominant position in the market. The increasing populations in China and India are fueling a need for greater food production. Increased consumption of a variety of foods is being driven by rising incomes and a expanding middle class. Farmers are using plant activators to enhance crop yields and quality in order to meet the increasing demand.

- Governments in the Asia Pacific region are supporting agricultural development and encouraging sustainable farming practices by offering subsidies, educating the public, and implementing favorable regulations to improve crop productivity. In the Asia Pacific region, there have been important technological developments in agriculture, such as new spraying technologies for chemicals and activators, which improve efficiency and accessibility for farmers. Combining precision agriculture with automated systems guarantees the best application and industry leadership. Multinational and local suppliers meet the Asia Pacific region's demand for cost-effective plant activators due to high chemical product demand, ensuring a consistent supply for farmers and widespread usage.

- There is a growing interest in sustainable agriculture and plant activators among the public in Asia Pacific. Farmers are being educated on how to improve crop resilience and productivity while also reducing their environmental impact, thanks to educational initiatives, training programs, and market expansion efforts. The increase of plant nurseries in Asia Pacific focuses on excellence and expertise in plant growing. Nurseries play a crucial role in the initial development of plants by utilizing enhancers to ensure strong and healthy growth, leading to increased agricultural output.

Plant Activators Market Active Players

- Syngenta AG (Switzerland)

- Bayer CropScience (Germany)

- BASF SE (Germany)

- Isagro S.p.A. (Italy)

- Plant Health Care plc (United States)

- Arysta LifeScience Corporation (United States)

- Nihon Nohyaku Co., Ltd. (Japan)

- Certis USA LLC (United States)

- Koppert Biological Systems (Netherlands)

- Marrone Bio Innovations, Inc. (United States)

- Valent BioSciences Corporation (United States)

- Andermatt Biocontrol AG (Switzerland)

- Sumitomo Chemical Co., Ltd. (Japan)

- Monsanto Company (United States)

- ADAMA Agricultural Solutions Ltd. (Israel)

- UPL Limited (India)

- Dow AgroSciences LLC (United States)

- FMC Corporation (United States)

- SDS Biotech K.K. (Japan)

- BioWorks, Inc. (United States)

-

Plant Activators Market

Base Year:

2023

Forecast Period:

2024-2032

Historical Data:

2017 to 2023

Market Size in 2023:

USD 887.61 Mn.

Forecast Period 2024-32 CAGR:

6.73 %

Market Size in 2032:

USD 1595.15 Mn.

Segments Covered:

By Type

- Biological Plant Activators

- Chemical Plant Activators

By Application

- Foliar Spray

- Soil Treatment

- Seed Treatment

By Formulation

- Water-dispersible Granules

- Wettable Powders

- Liquid Solutions

- Emulsifiable Concentrates

By Crop Type

- Cereals & Grains

- Fruits & Vegetables

- Oilseeds & Pulses

- Other Crops { ornamentals, turf, spices, condiments,}

By Function

- Growth Promotion

- Stress Tolerance

- Disease Resistance

- Nutrient Utilization

By Distribution Channels

- Agricultural Retail Stores

- Nurseries and Garden Centers

- Farmers’ Cooperatives

- E-commerce

By Region

- North America (U.S., Canada, Mexico)

- Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

- Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

- Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

- Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

- South America (Brazil, Argentina, Rest of SA)

Key Market Drivers:

- Rising Global Population and Food Demand

Key Market Restraints:

- High Cost And Harmful Impact If Synthetic Plant Activators.

Key Opportunities:

- Expanding demand from nurseries, modern spraying tech, organic substitutes, indoor farming, and micronutrients creates wide market opportunities

Companies Covered in the report:

Syngenta AG (Switzerland), Bayer CropScience (Germany), BASF SE (Germany), Isagro S.p.A. (Italy), Plant Health Care plc (United States), Arysta LifeScience Corporation (United States), Nihon Nohyaku Co., Ltd. (Japan), and Other Active Players.

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Plant Activators Market by By Type (2018-2032)

4.1 Plant Activators Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Biological Plant Activators

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Chemical Plant Activators

Chapter 5: Plant Activators Market by By Application (2018-2032)

5.1 Plant Activators Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Foliar Spray

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Soil Treatment

5.5 Seed Treatment

Chapter 6: Plant Activators Market by By Formulation (2018-2032)

6.1 Plant Activators Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Water-dispersible Granules

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Wettable Powders

6.5 Liquid Solutions

6.6 Emulsifiable Concentrates

Chapter 7: Plant Activators Market by By Crop Type (2018-2032)

7.1 Plant Activators Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Cereals & Grains

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Fruits & Vegetables

7.5 Oilseeds & Pulses

7.6 Other Crops { ornamentals

7.7 turf

7.8 spices

7.9 condiments

7.10 }

Chapter 8: Plant Activators Market by By Function (2018-2032)

8.1 Plant Activators Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Growth Promotion

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Stress Tolerance

8.5 Disease Resistance

8.6 Nutrient Utilization

Chapter 9: Plant Activators Market by By Distribution Channels (2018-2032)

9.1 Plant Activators Market Snapshot and Growth Engine

9.2 Market Overview

9.3 Agricultural Retail Stores

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

9.3.3 Key Market Trends, Growth Factors, and Opportunities

9.3.4 Geographic Segmentation Analysis

9.4 Nurseries and Garden Centers

9.5 Farmers’ Cooperatives

9.6 E-commerce

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 Plant Activators Market Share by Manufacturer (2024)

10.1.3 Industry BCG Matrix

10.1.4 Heat Map Analysis

10.1.5 Mergers and Acquisitions

10.2 SYNGENTA AG (SWITZERLAND)

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Key Strategic Moves and Recent Developments

10.2.10 SWOT Analysis

10.3 BAYER CROPSCIENCE (GERMANY)

10.4 BASF SE (GERMANY)

10.5 ISAGRO S.P.A. (ITALY)

10.6 PLANT HEALTH CARE PLC (UNITED STATES)

10.7 ARYSTA LIFESCIENCE CORPORATION (UNITED STATES)

10.8 NIHON NOHYAKU COLTD. (JAPAN)

10.9 CERTIS USA LLC (UNITED STATES)

10.10 KOPPERT BIOLOGICAL SYSTEMS (NETHERLANDS)

10.11 MARRONE BIO INNOVATIONS INC. (UNITED STATES)

10.12 VALENT BIOSCIENCES CORPORATION (UNITED STATES)

10.13 ANDERMATT BIOCONTROL AG (SWITZERLAND)

10.14 SUMITOMO CHEMICAL COLTD. (JAPAN)

10.15 MONSANTO COMPANY (UNITED STATES)

10.16 ADAMA AGRICULTURAL SOLUTIONS LTD. (ISRAEL)

10.17 UPL LIMITED (INDIA)

10.18 DOW AGROSCIENCES LLC (UNITED STATES)

10.19 FMC CORPORATION (UNITED STATES)

10.20 SDS BIOTECH K.K. (JAPAN)

10.21 BIOWORKS INC. (UNITED STATES)

10.22 EVOGENE LTD. (ISRAEL)

10.23 BIOLCHIM S.P.A. (ITALY)

10.24 LALLEMAND PLANT CARE (CANADA)

10.25 STOLLER GROUP (UNITED STATES)

10.26 ITALPOLLINA S.P.A. (ITALY)

10.27 ACADIAN SEAPLANTS LIMITED (CANADA)

10.28 SYMBORG (SPAIN)

10.29 TAMINCO (AN EASTMAN COMPANY) (UNITED STATES)

10.30 HUMOFERT S.A. (GREECE)

10.31 SIPCAM AGRO USA INC. (UNITED STATES)

Chapter 11: Global Plant Activators Market By Region

11.1 Overview

11.2. North America Plant Activators Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecasted Market Size By By Type

11.2.4.1 Biological Plant Activators

11.2.4.2 Chemical Plant Activators

11.2.5 Historic and Forecasted Market Size By By Application

11.2.5.1 Foliar Spray

11.2.5.2 Soil Treatment

11.2.5.3 Seed Treatment

11.2.6 Historic and Forecasted Market Size By By Formulation

11.2.6.1 Water-dispersible Granules

11.2.6.2 Wettable Powders

11.2.6.3 Liquid Solutions

11.2.6.4 Emulsifiable Concentrates

11.2.7 Historic and Forecasted Market Size By By Crop Type

11.2.7.1 Cereals & Grains

11.2.7.2 Fruits & Vegetables

11.2.7.3 Oilseeds & Pulses

11.2.7.4 Other Crops { ornamentals

11.2.7.5 turf

11.2.7.6 spices

11.2.7.7 condiments

11.2.7.8 }

11.2.8 Historic and Forecasted Market Size By By Function

11.2.8.1 Growth Promotion

11.2.8.2 Stress Tolerance

11.2.8.3 Disease Resistance

11.2.8.4 Nutrient Utilization

11.2.9 Historic and Forecasted Market Size By By Distribution Channels

11.2.9.1 Agricultural Retail Stores

11.2.9.2 Nurseries and Garden Centers

11.2.9.3 Farmers’ Cooperatives

11.2.9.4 E-commerce

11.2.10 Historic and Forecast Market Size by Country

11.2.10.1 US

11.2.10.2 Canada

11.2.10.3 Mexico

11.3. Eastern Europe Plant Activators Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecasted Market Size By By Type

11.3.4.1 Biological Plant Activators

11.3.4.2 Chemical Plant Activators

11.3.5 Historic and Forecasted Market Size By By Application

11.3.5.1 Foliar Spray

11.3.5.2 Soil Treatment

11.3.5.3 Seed Treatment

11.3.6 Historic and Forecasted Market Size By By Formulation

11.3.6.1 Water-dispersible Granules

11.3.6.2 Wettable Powders

11.3.6.3 Liquid Solutions

11.3.6.4 Emulsifiable Concentrates

11.3.7 Historic and Forecasted Market Size By By Crop Type

11.3.7.1 Cereals & Grains

11.3.7.2 Fruits & Vegetables

11.3.7.3 Oilseeds & Pulses

11.3.7.4 Other Crops { ornamentals

11.3.7.5 turf

11.3.7.6 spices

11.3.7.7 condiments

11.3.7.8 }

11.3.8 Historic and Forecasted Market Size By By Function

11.3.8.1 Growth Promotion

11.3.8.2 Stress Tolerance

11.3.8.3 Disease Resistance

11.3.8.4 Nutrient Utilization

11.3.9 Historic and Forecasted Market Size By By Distribution Channels

11.3.9.1 Agricultural Retail Stores

11.3.9.2 Nurseries and Garden Centers

11.3.9.3 Farmers’ Cooperatives

11.3.9.4 E-commerce

11.3.10 Historic and Forecast Market Size by Country

11.3.10.1 Russia

11.3.10.2 Bulgaria

11.3.10.3 The Czech Republic

11.3.10.4 Hungary

11.3.10.5 Poland

11.3.10.6 Romania

11.3.10.7 Rest of Eastern Europe

11.4. Western Europe Plant Activators Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecasted Market Size By By Type

11.4.4.1 Biological Plant Activators

11.4.4.2 Chemical Plant Activators

11.4.5 Historic and Forecasted Market Size By By Application

11.4.5.1 Foliar Spray

11.4.5.2 Soil Treatment

11.4.5.3 Seed Treatment

11.4.6 Historic and Forecasted Market Size By By Formulation

11.4.6.1 Water-dispersible Granules

11.4.6.2 Wettable Powders

11.4.6.3 Liquid Solutions

11.4.6.4 Emulsifiable Concentrates

11.4.7 Historic and Forecasted Market Size By By Crop Type

11.4.7.1 Cereals & Grains

11.4.7.2 Fruits & Vegetables

11.4.7.3 Oilseeds & Pulses

11.4.7.4 Other Crops { ornamentals

11.4.7.5 turf

11.4.7.6 spices

11.4.7.7 condiments

11.4.7.8 }

11.4.8 Historic and Forecasted Market Size By By Function

11.4.8.1 Growth Promotion

11.4.8.2 Stress Tolerance

11.4.8.3 Disease Resistance

11.4.8.4 Nutrient Utilization

11.4.9 Historic and Forecasted Market Size By By Distribution Channels

11.4.9.1 Agricultural Retail Stores

11.4.9.2 Nurseries and Garden Centers

11.4.9.3 Farmers’ Cooperatives

11.4.9.4 E-commerce

11.4.10 Historic and Forecast Market Size by Country

11.4.10.1 Germany

11.4.10.2 UK

11.4.10.3 France

11.4.10.4 The Netherlands

11.4.10.5 Italy

11.4.10.6 Spain

11.4.10.7 Rest of Western Europe

11.5. Asia Pacific Plant Activators Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecasted Market Size By By Type

11.5.4.1 Biological Plant Activators

11.5.4.2 Chemical Plant Activators

11.5.5 Historic and Forecasted Market Size By By Application

11.5.5.1 Foliar Spray

11.5.5.2 Soil Treatment

11.5.5.3 Seed Treatment

11.5.6 Historic and Forecasted Market Size By By Formulation

11.5.6.1 Water-dispersible Granules

11.5.6.2 Wettable Powders

11.5.6.3 Liquid Solutions

11.5.6.4 Emulsifiable Concentrates

11.5.7 Historic and Forecasted Market Size By By Crop Type

11.5.7.1 Cereals & Grains

11.5.7.2 Fruits & Vegetables

11.5.7.3 Oilseeds & Pulses

11.5.7.4 Other Crops { ornamentals

11.5.7.5 turf

11.5.7.6 spices

11.5.7.7 condiments

11.5.7.8 }

11.5.8 Historic and Forecasted Market Size By By Function

11.5.8.1 Growth Promotion

11.5.8.2 Stress Tolerance

11.5.8.3 Disease Resistance

11.5.8.4 Nutrient Utilization

11.5.9 Historic and Forecasted Market Size By By Distribution Channels

11.5.9.1 Agricultural Retail Stores

11.5.9.2 Nurseries and Garden Centers

11.5.9.3 Farmers’ Cooperatives

11.5.9.4 E-commerce

11.5.10 Historic and Forecast Market Size by Country

11.5.10.1 China

11.5.10.2 India

11.5.10.3 Japan

11.5.10.4 South Korea

11.5.10.5 Malaysia

11.5.10.6 Thailand

11.5.10.7 Vietnam

11.5.10.8 The Philippines

11.5.10.9 Australia

11.5.10.10 New Zealand

11.5.10.11 Rest of APAC

11.6. Middle East & Africa Plant Activators Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecasted Market Size By By Type

11.6.4.1 Biological Plant Activators

11.6.4.2 Chemical Plant Activators

11.6.5 Historic and Forecasted Market Size By By Application

11.6.5.1 Foliar Spray

11.6.5.2 Soil Treatment

11.6.5.3 Seed Treatment

11.6.6 Historic and Forecasted Market Size By By Formulation

11.6.6.1 Water-dispersible Granules

11.6.6.2 Wettable Powders

11.6.6.3 Liquid Solutions

11.6.6.4 Emulsifiable Concentrates

11.6.7 Historic and Forecasted Market Size By By Crop Type

11.6.7.1 Cereals & Grains

11.6.7.2 Fruits & Vegetables

11.6.7.3 Oilseeds & Pulses

11.6.7.4 Other Crops { ornamentals

11.6.7.5 turf

11.6.7.6 spices

11.6.7.7 condiments

11.6.7.8 }

11.6.8 Historic and Forecasted Market Size By By Function

11.6.8.1 Growth Promotion

11.6.8.2 Stress Tolerance

11.6.8.3 Disease Resistance

11.6.8.4 Nutrient Utilization

11.6.9 Historic and Forecasted Market Size By By Distribution Channels

11.6.9.1 Agricultural Retail Stores

11.6.9.2 Nurseries and Garden Centers

11.6.9.3 Farmers’ Cooperatives

11.6.9.4 E-commerce

11.6.10 Historic and Forecast Market Size by Country

11.6.10.1 Turkiye

11.6.10.2 Bahrain

11.6.10.3 Kuwait

11.6.10.4 Saudi Arabia

11.6.10.5 Qatar

11.6.10.6 UAE

11.6.10.7 Israel

11.6.10.8 South Africa

11.7. South America Plant Activators Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecasted Market Size By By Type

11.7.4.1 Biological Plant Activators

11.7.4.2 Chemical Plant Activators

11.7.5 Historic and Forecasted Market Size By By Application

11.7.5.1 Foliar Spray

11.7.5.2 Soil Treatment

11.7.5.3 Seed Treatment

11.7.6 Historic and Forecasted Market Size By By Formulation

11.7.6.1 Water-dispersible Granules

11.7.6.2 Wettable Powders

11.7.6.3 Liquid Solutions

11.7.6.4 Emulsifiable Concentrates

11.7.7 Historic and Forecasted Market Size By By Crop Type

11.7.7.1 Cereals & Grains

11.7.7.2 Fruits & Vegetables

11.7.7.3 Oilseeds & Pulses

11.7.7.4 Other Crops { ornamentals

11.7.7.5 turf

11.7.7.6 spices

11.7.7.7 condiments

11.7.7.8 }

11.7.8 Historic and Forecasted Market Size By By Function

11.7.8.1 Growth Promotion

11.7.8.2 Stress Tolerance

11.7.8.3 Disease Resistance

11.7.8.4 Nutrient Utilization

11.7.9 Historic and Forecasted Market Size By By Distribution Channels

11.7.9.1 Agricultural Retail Stores

11.7.9.2 Nurseries and Garden Centers

11.7.9.3 Farmers’ Cooperatives

11.7.9.4 E-commerce

11.7.10 Historic and Forecast Market Size by Country

11.7.10.1 Brazil

11.7.10.2 Argentina

11.7.10.3 Rest of SA

Chapter 12 Analyst Viewpoint and Conclusion

12.1 Recommendations and Concluding Analysis

12.2 Potential Market Strategies

Chapter 13 Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

|

Plant Activators Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 887.61 Mn. |

|

Forecast Period 2024-32 CAGR: |

6.73 % |

Market Size in 2032: |

USD 1595.15 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Formulation |

|

||

|

By Crop Type |

|

||

|

By Function |

|

||

|

By Distribution Channels |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Syngenta AG (Switzerland), Bayer CropScience (Germany), BASF SE (Germany), Isagro S.p.A. (Italy), Plant Health Care plc (United States), Arysta LifeScience Corporation (United States), Nihon Nohyaku Co., Ltd. (Japan), and Other Active Players. |

||

Frequently Asked Questions :

The forecast period in the Plant Activators Market research report is 2024-2032.

Syngenta AG (Switzerland), Bayer CropScience (Germany), BASF SE (Germany), Isagro S.p.A. (Italy), Plant Health Care plc (United States), Arysta LifeScience Corporation (United States), Nihon Nohyaku Co., Ltd. (Japan), Certis USA LLC (United States), Koppert Biological Systems (Netherlands), Marrone Bio Innovations, Inc. (United States), Valent BioSciences Corporation (United States), Andermatt Biocontrol AG (Switzerland), Sumitomo Chemical Co., Ltd. (Japan), Monsanto Company (United States), ADAMA Agricultural Solutions Ltd. (Israel), UPL Limited (India), Dow AgroSciences LLC (United States), FMC Corporation (United States), SDS Biotech K.K. (Japan), BioWorks, Inc. (United States), Evogene Ltd. (Israel), Biolchim S.p.A. (Italy), Lallemand Plant Care (Canada), Stoller Group (United States), Italpollina S.p.A. (Italy), Acadian Seaplants Limited (Canada), Symborg (Spain), Taminco (an Eastman Company) (United States), Humofert S.A. (Greece), Sipcam Agro USA, Inc. (United States) and Other Active Players.

The Plant Activators Market is segmented into Type, Application, Formulation, Crop Type, Function, Distribution Channels, and region. By Type, the market is categorized into Biological Plant Activators, Chemical Plant Activators. By Application, the market is categorized into Foliar Spray, Soil Treatment, and Seed Treatment. By Formulation, the market is categorized into Water-dispersible Granules, wetable powders, Liquid Solutions, and Emulsifiable Concentrates. By Crop Type, the market is categorized into Cereals & Grains, Fruits & Vegetables, Oilseeds & Pulses, Other Crops {ornamentals, turf, spices, condiments,}. By Function, The Market Is Categorized Into Growth Promotion, Stress Tolerance, Disease Resistance, Nutrient Utilization. By Distribution Channels, the market is categorized into Agricultural Retail Stores, Nurseries and Garden Centers, Farmers’ Cooperatives, E-commerce. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Plant activators are natural or synthetic chemical compounds that protect plants from various pathogens by activating the defense priming. Plant activators provide durable effects to enhance plant resistance, unlike traditional fungicides or pesticides since they do not exert a direct detrimental effect on the pathogens.

Plant Activators Market Size Was Valued at USD 887.61 Million in 2023 and is Projected to Reach USD 1595.15 Million by 2032, Growing at a CAGR of 6.73% From 2024-2032.