Polyurethane Market Synopsis:

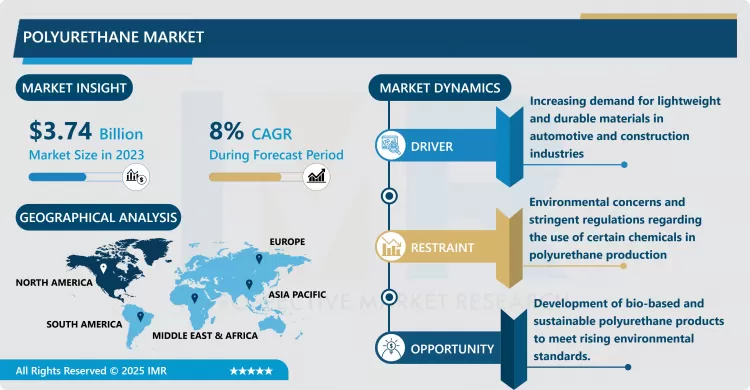

Polyurethane Market Size Was Valued at USD 3.74 Billion in 2023, and is Projected to Reach USD 7.48 Billion by 2032, Growing at a CAGR of 8% From 2024-2032.

Polyurethane is an open-chain polymer, derived from the reaction between polyols and diisocyanatos, which may produce rigid or flexible materials. That versatility makes polyurethane essential to many sectors, such as construction, automotive, furniture, electronics, and footwear, for applications considered as basic as foams, coatings, adhesives, sealants, and elastomers.

The polyurethane market has continued to grow over the years, as it has a wide-spread use in almost all industries. Polyurethane used in constructions make building energy efficient due to its good thermal insulating properties, it is durable, light and used in the automotive industry for car manufacturing where it helps reduce the weight of the vehicle thus reducing fuel consumption. Furniture industry has a use of polyurethane foams that provide comfort in bedding and seating in furniture.

Moreover, electronics uses polyurethane for varnish and encapsulation to safeguard and enhance their functionality of components in the industry. Again, this widespread use is indicative of the fact that polyurethane is an un dispensable element in most contemporary production and product designs.

Polyurethane Market Trend Analysis:

Growing Demand for Sustainable Polyurethane Solutions

- At present, there has been observed a high awareness towards environment and more focus on the green technology in production of polyurethane. This trend is informed by the increasing pollution standards and preference of customers for environment friendly products. The use of polyurethane has prompted manufacturers to try and create polyurethane from renewable sources and this is done by developing new plant based polyols.

- As well as the concern for the environment, this shift is also conducive to the development of new markets, as both the end-user and production customers increasingly look for materials with similar or superior performance characteristics but that are more sustainable solutions.

Expansion in Emerging Markets

- Current opportunities are apparent particularly in the Latin American and the Middle Eastern and the African regions. These regions are fostering rapid rates of urban and industrial development, and therefore they require construction materials, automotive parts and consumer goods all of which use polyurethane. For example, at the present Brazil and Saudi Arabia are prioritizing infrastructural expansion; which augmented the requirement of polyurethane in construction and insulating materials.

- When companies get to these growing markets they are able to reach new customers and expand their market internationally thus making the most of the potential for polyurethane markets.

Polyurethane Market Segment Analysis:

Polyurethane Market Segmented on the basis of Product Type, End User and Region.

By Product Type, Rigid Foam segment is expected to dominate the market during the forecast period

- Based on the product type, the global polyurethane market is mainly divided into rigid foam and flexible foam market. Closed cell structure rigid foams are used in insulation purposes especially in civil constructions and in refrigeration mainly because of their corresponding thermal conductivities. The other category of polyurethanes known as flexible foams also occupies a strategic position in enterprises that deals in furniture, bedding and automotive industries, since they act as comfort and support materials for seating and cushioning products.

- Other categories of polyurethanes that may be present within the market include coatings, which are utilised mainly in automotive, construction and other protective and durable applications, and adhesives and sealants which are used mainly for bonding and sealing, especially in the automotive, electronics and construction markets. Also, elastomers used in automotive and industries flexible and wear resistant applications, thermoplastic polyurethane is a general purpose plastic which has high abrasion elasticity and elastic property used in most application ranging from shoe soles to medical item.

Polyurethane Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The polyurethane market was consolidated at the global level and in 2023, the Asia-Pacific region took the largest share of revenue more than 68%.

- This dominance is due to the strong manufacturing industries of automobile, electronic and appliance industries of China, India, South Korea, and Japan respectively. The largest demand for polyurethane products is in China, thanks to large end use industries such as construction, automotive industries and others. Ongoing industrialization, urbanization, and growing consumer expenditure for polyurethane products have added to the region’s demands, making it the leading market for the polyurethane industry.

Active Key Players in the Polyurethane Market

- BASF SE (Germany)

- Covestro AG (Germany)

- Dow Inc. (United States)

- DIC Corporation (Japan)

- Eastman Chemical Company (United States)

- Huntsman International LLC (United States)

- Mitsui & Co. Plastics Ltd. (Japan)

- Mitsubishi Chemical Corporation (Japan)

- RAMPF Holding GmbH & Co. KG (Germany)

- Recitel NV/SA (Belgium)

- RTP Company (United States)

- The Lubrizol Corporation (United States)

- Tosoh Corporation (Japan)

- Wanhua Chemical Group Co., Ltd. (China)

- Woodbridge (Canada)

- Other Active Players

Key Industry Developments in the Polyurethane Market:

- In January 2025, Covestro invested a low triple-digit million Euro amount to expand its site in Hebron, Ohio, USA. The company constructed multiple new production lines and infrastructure to manufacture customized polycarbonate compounds and blends, significantly increasing its capacity in the Solutions & Specialties business for the American market.

- In June 2024, Dow announced that it had signed an agreement to acquire Circulus, a leading recycler of plastic waste into post-consumer resin (PCR). The transaction included two facilities, one in Ardmore, Oklahoma, and another in Arab, Alabama, with a combined capacity of 50,000 metric tons per year. Dow anticipated the transaction would close in the third quarter of 2024, pending customary regulatory approval.

|

Polyurethane Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.74 Billion |

|

Forecast Period 2024-32 CAGR: |

8% |

Market Size in 2032: |

USD 7.48 Billion |

|

Segments Covered: |

Product Type |

|

|

|

End User |

|

||

|

Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Polyurethane Market by by Product Type (2018-2032)

4.1 Polyurethane Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Rigid Foam

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Flexible Foam

4.5 Coatings

4.6 Adhesives & Sealants

4.7 Elastomers

4.8 Thermoplastic Polyurethane

4.9 Other Types

Chapter 5: Polyurethane Market by End User (2018-2032)

5.1 Polyurethane Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Furniture

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Building and Construction

5.5 Electronics and Appliances

5.6 Automotive

5.7 Footwear

5.8 Packaging

5.9 Other End-User Industries

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Polyurethane Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 BASF SE (GERMANY)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 COVESTRO AG (GERMANY)

6.4 DOW INC. (UNITED STATES)

6.5 DIC CORPORATION (JAPAN)

6.6 EASTMAN CHEMICAL COMPANY (UNITED STATES)

6.7 HUNTSMAN INTERNATIONAL LLC (UNITED STATES)

6.8 MITSUI & CO. PLASTICS LTD. (JAPAN)

6.9 MITSUBISHI CHEMICAL CORPORATION (JAPAN)

6.10 RAMPF HOLDING GMBH & CO. KG (GERMANY)

6.11 RECITEL NV/SA (BELGIUM)

6.12 RTP COMPANY (UNITED STATES)

6.13 THE LUBRIZOL CORPORATION (UNITED STATES)

6.14 TOSOH CORPORATION (JAPAN)

6.15 WANHUA CHEMICAL GROUP CO. LTD. (CHINA)

6.16 WOODBRIDGE (CANADA)

6.17 OTHER ACTIVE PLAYERS

Chapter 7: Global Polyurethane Market By Region

7.1 Overview

7.2. North America Polyurethane Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By by Product Type

7.2.4.1 Rigid Foam

7.2.4.2 Flexible Foam

7.2.4.3 Coatings

7.2.4.4 Adhesives & Sealants

7.2.4.5 Elastomers

7.2.4.6 Thermoplastic Polyurethane

7.2.4.7 Other Types

7.2.5 Historic and Forecasted Market Size By End User

7.2.5.1 Furniture

7.2.5.2 Building and Construction

7.2.5.3 Electronics and Appliances

7.2.5.4 Automotive

7.2.5.5 Footwear

7.2.5.6 Packaging

7.2.5.7 Other End-User Industries

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Polyurethane Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By by Product Type

7.3.4.1 Rigid Foam

7.3.4.2 Flexible Foam

7.3.4.3 Coatings

7.3.4.4 Adhesives & Sealants

7.3.4.5 Elastomers

7.3.4.6 Thermoplastic Polyurethane

7.3.4.7 Other Types

7.3.5 Historic and Forecasted Market Size By End User

7.3.5.1 Furniture

7.3.5.2 Building and Construction

7.3.5.3 Electronics and Appliances

7.3.5.4 Automotive

7.3.5.5 Footwear

7.3.5.6 Packaging

7.3.5.7 Other End-User Industries

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Polyurethane Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By by Product Type

7.4.4.1 Rigid Foam

7.4.4.2 Flexible Foam

7.4.4.3 Coatings

7.4.4.4 Adhesives & Sealants

7.4.4.5 Elastomers

7.4.4.6 Thermoplastic Polyurethane

7.4.4.7 Other Types

7.4.5 Historic and Forecasted Market Size By End User

7.4.5.1 Furniture

7.4.5.2 Building and Construction

7.4.5.3 Electronics and Appliances

7.4.5.4 Automotive

7.4.5.5 Footwear

7.4.5.6 Packaging

7.4.5.7 Other End-User Industries

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Polyurethane Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By by Product Type

7.5.4.1 Rigid Foam

7.5.4.2 Flexible Foam

7.5.4.3 Coatings

7.5.4.4 Adhesives & Sealants

7.5.4.5 Elastomers

7.5.4.6 Thermoplastic Polyurethane

7.5.4.7 Other Types

7.5.5 Historic and Forecasted Market Size By End User

7.5.5.1 Furniture

7.5.5.2 Building and Construction

7.5.5.3 Electronics and Appliances

7.5.5.4 Automotive

7.5.5.5 Footwear

7.5.5.6 Packaging

7.5.5.7 Other End-User Industries

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Polyurethane Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By by Product Type

7.6.4.1 Rigid Foam

7.6.4.2 Flexible Foam

7.6.4.3 Coatings

7.6.4.4 Adhesives & Sealants

7.6.4.5 Elastomers

7.6.4.6 Thermoplastic Polyurethane

7.6.4.7 Other Types

7.6.5 Historic and Forecasted Market Size By End User

7.6.5.1 Furniture

7.6.5.2 Building and Construction

7.6.5.3 Electronics and Appliances

7.6.5.4 Automotive

7.6.5.5 Footwear

7.6.5.6 Packaging

7.6.5.7 Other End-User Industries

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Polyurethane Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By by Product Type

7.7.4.1 Rigid Foam

7.7.4.2 Flexible Foam

7.7.4.3 Coatings

7.7.4.4 Adhesives & Sealants

7.7.4.5 Elastomers

7.7.4.6 Thermoplastic Polyurethane

7.7.4.7 Other Types

7.7.5 Historic and Forecasted Market Size By End User

7.7.5.1 Furniture

7.7.5.2 Building and Construction

7.7.5.3 Electronics and Appliances

7.7.5.4 Automotive

7.7.5.5 Footwear

7.7.5.6 Packaging

7.7.5.7 Other End-User Industries

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Polyurethane Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.74 Billion |

|

Forecast Period 2024-32 CAGR: |

8% |

Market Size in 2032: |

USD 7.48 Billion |

|

Segments Covered: |

Product Type |

|

|

|

End User |

|

||

|

Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Polyurethane Market research report is 2024-2032.

BASF SE (Germany), Covestro AG (Germany), Dow Inc. (United States), DIC Corporation (Japan), Eastman Chemical Company (United States), Huntsman International LLC (United States), Mitsui & Co. Plastics Ltd. (Japan), Mitsubishi Chemical Corporation (Japan), RAMPF Holding GmbH & Co. KG (Germany), Recitel NV/SA (Belgium), RTP Company (United States), The Lubrizol Corporation (United States), Tosoh Corporation (Japan), Wanhua Chemical Group Co., Ltd. (China), Woodbridge (Canada) and Other Active Players.

The Polyurethane Market is segmented into Product Type, End User and region. By Product Type, the market is categorized into Rigid Foam, Flexible Foam, Coatings, Adhesives & Sealants, Elastomers, Thermoplastic Polyurethane, Other Types), By End User, the market is categorized into (Furniture, Building and Construction, Electronics and Appliances, Automotive, Footwear, Packaging, Other End-User Industries. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Polyurethane is an open-chain polymer, derived from the reaction between polyols and diisocyanatos, which may produce rigid or flexible materials. That versatility makes polyurethane essential to many sectors, such as construction, automotive, furniture, electronics, and footwear, for applications considered as basic as foams, coatings, adhesives, sealants, and elastomers.

Polyurethane Market Size Was Valued at USD 3.74 Billion in 2023, and is Projected to Reach USD 7.48 Billion by 2032, Growing at a CAGR of 8% From 2024-2032.