Poultry Pharmaceuticals Market Synopsis:

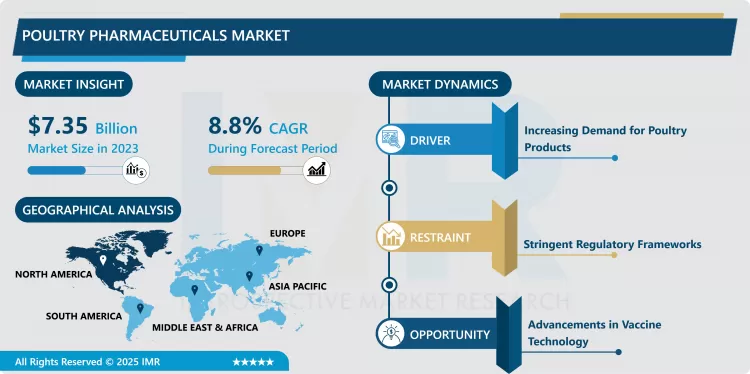

Poultry Pharmaceuticals Market Size Was Valued at USD 7.35 Billion in 2023, and is Projected to Reach USD 15.70 Billion by 2032, Growing at a CAGR of 8.8% From 2024-2032.

As defined by the scope of this work, the poultry pharmaceuticals market belongs to the industry that deals with the production and distribution of drugs and vaccines as well as other medicinal products for poultry. These products are used for controlling, treating and preventing diseases in chickens, turkeys, ducks, and other poultry species enhancing productivity in the commercial poultry farming. Poultry products include antibiotics, anti-viruses, anti-fungal, vaccines among other drugs that are very important in poultry health, their immunity and productivity of poultry farms. The trends in the market include demand for animal protein, awareness on health of poultry, and the trends to control the outbreak of diseases affecting poultry.

Market analysis has indicated that the market of poultry pharmaceuticals has been growing for the recent past decades as the consumption of poultry products such as eggs and poultry meat continues to rise. Such increase has moreover seen the need to enhance food safety, disease prevention thus encouraging the use of poultry pharmaceuticals. Diseases amongst poultry include avian influenza, Newcastle disease, salmonella amongst others, These, diseases constitute major threats to poultry farming practices and control or prevention measures require effective Pharmaceuticals. Therefore, the governments, agricultural organizations and private companies have been keen to invest on the improved form of poultry drugs and vaccines. Also, the global regulatory bodies such as; FDA are now paying their attention in the safety of these pharmaceutical products to both animals and humans, provoking an increased innovation and stringent regulations in the market.

The market is also shifted towards the farm’s use of sustainability and no antibiotic used in raising the poultry. The consumer is moving away from products containing antibiotics and chemicals hence the advances of other solutions such as probiotics and prebiotics alongside herbal products. Secondly, improvements in biotechnology and nanotechnology have provided means for developing better vaccines and therapeutic products which can overcome new poultry diseases. It is for this reason they expect the market to grow as advancement in poultry healthcare will enable better living standard for poultry and productivity of poultry business around the world.

Poultry Pharmaceuticals Market Trend Analysis:

The Rise of Antibiotic-Free Poultry Farming

- Another aspect that defines the current and future development of the segment is the customers’ focus on products that are free from antibiotics. The latter has developed in response to the consumers idea about the possible dangers connected with the use of antibiotics in poultry farming. Intake of antibiotics in poultry farming is gradually becoming a concern among many countries to prevent further development of antibiotic resistance which has both the potential in affecting the health of animals and human beings. Thus, there is a trend towards the application of the bio-designs like vaccines, prebiotics, probiotics, plant extracts, etc., to improve chicken’s resistance to diseases and sicknesses.

- This trend has made poultry pharmaceutical manufacturers to invest much time and resources in new poultry pharmaceutical products that are not antibiotics This has been one of the biggest changes in the poultry industry in the recent past. These antibiotic-free solutions have become applicable in companies’ operations due to increasing consumer awareness on the health benefits of antibiotics-free poultry products and form the regulation on the use of antibiotics.

Technological Advancements in Vaccine Development

- Thus, the opportunities of the poultry pharmaceuticals market are rather great due to the progressive increase in the application of the biotechnology and vaccines production. As new and more dangerous infectious diseases keep appearing globally affecting the poultry industry, there is a great potential when it comes to inventing more improved, efficient and cheap vaccines. High technology innovations in vaccines including genetic engineered, recombinant DNA technology, and mRNA vaccines also in enhancing the management and prevention of poultry diseases. It, therefore, goes without question that these technological progressions have made it now possible to invent higher efficacy vaccines that could also be produced and deployed much faster.

- Also, with focus on measures to contain diseases in poultry farms, there is likely to be expanded portfolios that the pharmaceutical firms can sell to farmers to control diseases. The current launch of poultry pharmaceuticals is being supported by governments and the industry which shall fund these innovations hence the continuous growth of the poultry pharmaceuticals in the future years.

Poultry Pharmaceuticals Market Segment Analysis:

Poultry Pharmaceuticals Market Segmented on the basis of product Type, Application, Disease Type, and Region.

By Product Type, Antibiotics segment is expected to dominate the market during the forecast period

- The poultry pharmaceuticals market has cut across by product type whereby antibiotics and vaccines are some of the most well-known segments. Antibiotics are commonly used for controlling bacterial diseases in poultry for maintaining high performance of poultry flocks. Diagnosis based on clinical samples has been an important pillar in disease control particularly in areas with concentrated poultry production. However current usage of antibiotics is subject to controversy because of possibilities of fate antimicrobial resistance leading to the use of other products. On the same note, vaccines are increasing its market popularity as a preventive measure to curb infectious diseases such as avian, new castle and infectious bronchitis. Higher concerns for biosecurity and a movement towards a decreased reliance on antibiotics is increasing the need for new and better vaccines to support strengthening of immunity in poultry and curbing of diseases.

- The other product includes parasiticides in diseases affecting the health of poultry, and anti-inflammatory agents. Parasiticides play a big role in eradicating parasitic disorders which have indirect effects on the standards of productivity and animal health. The use of drugs to control and prevent inflammation in cases of such diseases guarantees optimal growth rates and health of poultry. Probiotics are expanding their uses as a means to enhancing the intestinal health and general production immunity of birds especially when reared under antibiotic-free production regimes. This segment is experiencing growth because consumers continue to demand natural, and eco-friendly poultry products. Other products include nutritional supplements and herbal products, which more and more people turn to solve the issues of the poultry industry. Altogether, these product types create a product type category that is very active and constantly developing thanks to advancements in technology and shifts in popular demand.

By Application, eggs segment expected to held the largest share

- Poultry pharmaceuticals market has been classified on the basis of application as poultry meat and eggs, which have different needs and trends. The product with the largest participation in the market is poultry meat because this is one of the most consumed animal proteins in the world today. Holding of the health and productivity of the broiler chickens is important especially with increasing demand for poultry meat. Antibiotics, vaccines, and growth promoting supplements are the other chemicals used in the industry to treat diseases, to stop its transmission, and increase the bird’s growth rate respectively. Growing concern over food hygiene and implementing of antibiotic-free poultry rearing are also responsible for the management of pharmaceuticals in poultry meat.

- The eggs segment also forms another significant market offering of poultry pharmaceuticals especially for layer hens. It is therefore important to keep layers healthy to allow them continue laying healthy eggs. Immunisations are used in combating viral illnesses which prevent the flock from laying eggs. Also, other feed additives such as probiotics and nutritional supplements are frequently used to improve the health as well as production efficiency of layers. As customers continue to demand better tasting, less risky eggs, the chicken farmers add pharma to the mix to promote flock health and longevity. The increase in demand for organic and free-range eggs has triggered the use of natural and sustainable health systems in this segment as well.

Poultry Pharmaceuticals Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The market scale of poultry pharmaceuticals in North America significantly accounted for the overall market share of the global market in 2023 due to large scale poultry farming industry in America particularly in United states of America and Canada. The markets of North America and Europe represented more than 70% of the world’s total market. It has existing production structures for poultry farming, a good knowledge in health status of poultry, standards on use of pharmaceutical products that have been instituted and maintained. The necessity for poultry pharmaceuticals in North America rises from high consumption of poultry products in the region besides demand for disease control products by commercial poultry farmers. Also, there is the improved health care and biotechnology which has enhanced fast progression and utilization of improved poultry drugs in the region.

- Europe and Asia-Pacific also have a good market share because Europe emphasizes on a sustainable and antibiotic-free poultry farming industry, while Asia-Pacific is a rapidly growing market due to higher intake of poultry and growth of poultry farming industry in the developing countries such as china, India and Southeast Asian countries.

Active Key Players in the Poultry Pharmaceuticals Market:

- Adisseo (France)

- Alltech Inc. (USA)

- Bayer Animal Health (Germany)

- Boehringer Ingelheim (Germany)

- Ceva Santé Animal (France)

- Eli Lilly and Company (USA)

- Elanco Animal Health (USA)

- Hester Biosciences (India)

- Huvepharma (Bulgaria)

- Merck & Co. Inc. (USA)

- MSD Animal Health (USA)

- Novartis Animal Health (Switzerland)

- Zoetis Inc. (USA)

- Virbac (France)

- Vetoquinol (France), and Other Active Players.

Key Industry Development in the Poultry Pharmaceuticals Market:

- In February 2023, Boehringer Ingelheim Animal Health USA Inc. has entered into a strategic collaboration with Alizent, a subsidiary of Air Liquide, to enhance poultry vaccine supply chain management. The collaboration focuses on implementing an innovative cold chain tracking solution using Alizent’s SmartDewar IoT platform. This technology will monitor Dewars filled with liquid nitrogen to maintain the ultra-cold temperatures required for preserving the efficacy of frozen poultry vaccines. By leveraging the growing capabilities of the Internet of Things (IoT), this collaboration aims to improve the efficiency and reliability of vaccine distribution, ensuring optimal conditions during transit.

|

Global Poultry Pharmaceuticals Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.35 Billion |

|

Forecast Period 2024-32 CAGR: |

8.8% |

Market Size in 2032: |

USD 15.70 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Disease Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Poultry Pharmaceuticals Market by By Product Type (2018-2032)

4.1 Poultry Pharmaceuticals Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Antibiotics

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Vaccines

4.5 Parasiticides

4.6 Anti-inflammatory drugs

4.7 Probiotics

4.8 Others

Chapter 5: Poultry Pharmaceuticals Market by By Application (2018-2032)

5.1 Poultry Pharmaceuticals Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Poultry Meat

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Eggs

Chapter 6: Poultry Pharmaceuticals Market by By Disease Type (2018-2032)

6.1 Poultry Pharmaceuticals Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Respiratory Diseases

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Digestive Diseases

6.5 Metabolic Diseases

6.6 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Poultry Pharmaceuticals Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ADISSEO (FRANCE)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ALLTECH INC. (USA)

7.4 BAYER ANIMAL HEALTH (GERMANY)

7.5 BOEHRINGER INGELHEIM (GERMANY)

7.6 CEVA SANTÉ ANIMAL (FRANCE)

7.7 ELI LILLY AND COMPANY (USA)

7.8 ELANCO ANIMAL HEALTH (USA)

7.9 HESTER BIOSCIENCES (INDIA)

7.10 HUVEPHARMA (BULGARIA)

7.11 MERCK & CO. INC. (USA)

7.12 MSD ANIMAL HEALTH (USA)

7.13 NOVARTIS ANIMAL HEALTH (SWITZERLAND)

7.14 ZOETIS INC. (USA)

7.15 VIRBAC (FRANCE)

7.16 VETOQUINOL (FRANCE)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Poultry Pharmaceuticals Market By Region

8.1 Overview

8.2. North America Poultry Pharmaceuticals Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Product Type

8.2.4.1 Antibiotics

8.2.4.2 Vaccines

8.2.4.3 Parasiticides

8.2.4.4 Anti-inflammatory drugs

8.2.4.5 Probiotics

8.2.4.6 Others

8.2.5 Historic and Forecasted Market Size By By Application

8.2.5.1 Poultry Meat

8.2.5.2 Eggs

8.2.6 Historic and Forecasted Market Size By By Disease Type

8.2.6.1 Respiratory Diseases

8.2.6.2 Digestive Diseases

8.2.6.3 Metabolic Diseases

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Poultry Pharmaceuticals Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Product Type

8.3.4.1 Antibiotics

8.3.4.2 Vaccines

8.3.4.3 Parasiticides

8.3.4.4 Anti-inflammatory drugs

8.3.4.5 Probiotics

8.3.4.6 Others

8.3.5 Historic and Forecasted Market Size By By Application

8.3.5.1 Poultry Meat

8.3.5.2 Eggs

8.3.6 Historic and Forecasted Market Size By By Disease Type

8.3.6.1 Respiratory Diseases

8.3.6.2 Digestive Diseases

8.3.6.3 Metabolic Diseases

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Poultry Pharmaceuticals Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Product Type

8.4.4.1 Antibiotics

8.4.4.2 Vaccines

8.4.4.3 Parasiticides

8.4.4.4 Anti-inflammatory drugs

8.4.4.5 Probiotics

8.4.4.6 Others

8.4.5 Historic and Forecasted Market Size By By Application

8.4.5.1 Poultry Meat

8.4.5.2 Eggs

8.4.6 Historic and Forecasted Market Size By By Disease Type

8.4.6.1 Respiratory Diseases

8.4.6.2 Digestive Diseases

8.4.6.3 Metabolic Diseases

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Poultry Pharmaceuticals Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Product Type

8.5.4.1 Antibiotics

8.5.4.2 Vaccines

8.5.4.3 Parasiticides

8.5.4.4 Anti-inflammatory drugs

8.5.4.5 Probiotics

8.5.4.6 Others

8.5.5 Historic and Forecasted Market Size By By Application

8.5.5.1 Poultry Meat

8.5.5.2 Eggs

8.5.6 Historic and Forecasted Market Size By By Disease Type

8.5.6.1 Respiratory Diseases

8.5.6.2 Digestive Diseases

8.5.6.3 Metabolic Diseases

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Poultry Pharmaceuticals Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Product Type

8.6.4.1 Antibiotics

8.6.4.2 Vaccines

8.6.4.3 Parasiticides

8.6.4.4 Anti-inflammatory drugs

8.6.4.5 Probiotics

8.6.4.6 Others

8.6.5 Historic and Forecasted Market Size By By Application

8.6.5.1 Poultry Meat

8.6.5.2 Eggs

8.6.6 Historic and Forecasted Market Size By By Disease Type

8.6.6.1 Respiratory Diseases

8.6.6.2 Digestive Diseases

8.6.6.3 Metabolic Diseases

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Poultry Pharmaceuticals Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Product Type

8.7.4.1 Antibiotics

8.7.4.2 Vaccines

8.7.4.3 Parasiticides

8.7.4.4 Anti-inflammatory drugs

8.7.4.5 Probiotics

8.7.4.6 Others

8.7.5 Historic and Forecasted Market Size By By Application

8.7.5.1 Poultry Meat

8.7.5.2 Eggs

8.7.6 Historic and Forecasted Market Size By By Disease Type

8.7.6.1 Respiratory Diseases

8.7.6.2 Digestive Diseases

8.7.6.3 Metabolic Diseases

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Poultry Pharmaceuticals Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.35 Billion |

|

Forecast Period 2024-32 CAGR: |

8.8% |

Market Size in 2032: |

USD 15.70 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Disease Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Poultry Pharmaceuticals Market research report is 2024-2032.

Adisseo (France), Alltech Inc. (USA), Bayer Animal Health (Germany), Boehringer Ingelheim (Germany), Ceva Santé Animal (France), Eli Lilly and Company (USA), Elanco Animal Health (USA), Hester Biosciences (India), Huvepharma (Bulgaria), Merck & Co. Inc. (USA), MSD Animal Health (USA), Novartis Animal Health (Switzerland), Zoetis Inc. (USA), Virbac (France), Vetoquinol (France), and Other Active Players.

The Poultry Pharmaceuticals Market is segmented into Product Type, Application, By Disease Type and region. By Product Type, the market is categorized into Antibiotics, Vaccines, Parasiticides, Anti-inflammatory drugs, Probiotics, Others), Application, the market is categorized into (Poultry Meat, Eggs), By Disease Type, the market is categorized into North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

As defined by the scope of this work, the poultry pharmaceuticals market belongs to the industry that deals with the production and distribution of drugs and vaccines as well as other medicinal products for poultry. These products are used for controlling, treating and preventing diseases in chickens, turkeys, ducks, and other poultry species enhancing productivity in the commercial poultry farming. Poultry products include antibiotics, anti-viruses, anti-fungal, vaccines among other drugs that are very important in poultry health, their immunity and productivity of poultry farms. The trends in the market include demand for animal protein, awareness on health of poultry, and the trends to control the outbreak of diseases affecting poultry.

Poultry Pharmaceuticals Market Size Was Valued at USD 7.35 Billion in 2023, and is Projected to Reach USD 15.70 Billion by 2032, Growing at a CAGR of 8.8% From 2024-2032.