Poultry Vaccine Market Synopsis:

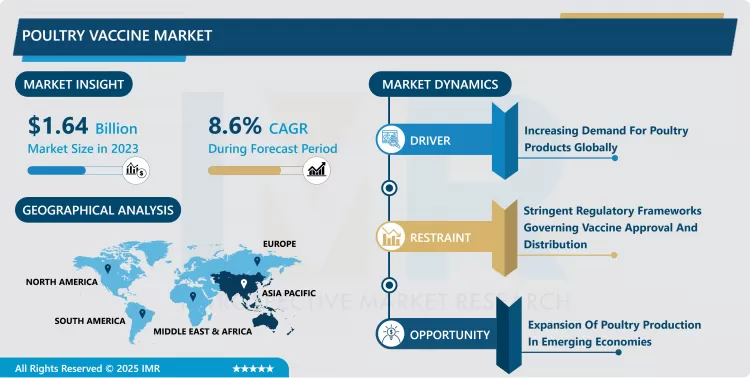

Poultry Vaccine Market Size Was Valued at USD 1.64 Billion in 2023, and is Projected to Reach USD 4.8 Billion by 2032, Growing at a CAGR of 8.6% From 2024-2032.

The poultry vaccine market concerns vaccines aimed at controlling diseases in various poultry birds including chicken, turkey, duck and goose. These vaccines are crucial in poultry health and production mainly because they help eradicate infectious diseases within flocks hence foods security.

Poultry vaccines market has gained much attention in the recent past due to the growing population of poultry and the consequent need to curb diseases that are lethal to poultry birds. As mentioned above, factors such as improving technology in the creation of vaccines including recombinant vaccines, and vector vaccines has boosted the poultry vaccines markets, in terms of effectiveness and safety. Furthermore, more poultry farmers today are aware of such advantages such as increased level of survival rates in their stock, improved feed conversion ratios among others are encouraging global high uptake of vaccination.

The market is full of many types of vaccines for various diseases such as Newcastle disease, avian influenza, infectious bronchitis, and Marek’s diseases. Producers are bringing new vaccines every now and then through research and innovation in an effort to provide improved coverage and easier to administer. In addition, the support accorded to animal health and food safety policies and programs by various governments have created market friendly environment. However, challenges such as stringent regulatory frameworks, high development costs, need for cold chain in vaccines etc form some of the constraints to the market prospective.

Poultry Vaccine Market Trend Analysis:

Emergence of Recombinant Vaccines Revolutionizes Poultry Health Management

- One of the most emerging trends of the global poultry vaccine market is a rise in recombinant vaccine. In contrast to conventional vaccines, recombinant vaccines use genetic engineering to create specific antigens which create immunity without compromising live organism. This approach increases the immunogenicity of the vaccine and makes it possible to produce vaccines against a number of diseases at once. Such aspects have seen vaccine development enabled by recombinant technology with enhanced efficacy coupled with decreased adverse effects.

- However, recombinant vaccines can be produced quickly in response to disease threats compared to traditional methods giving the needed advantage in case of an outbreak. Taking into consideration the constant search by the poultry industry for effective and effective disease control solutions, the use of recombinant vaccines will increase in the future of poultry health management.

Expanding Poultry Production in Emerging Economies Presents Lucrative Market Opportunities

- The growth of poultry sector in the developing countries remains a major growth factor of the poultry vaccine market. The Asia-Pacific and the Latin American region especially are experiencing rapid progress in keeping up with the demand for cheap sources of protein through increased production of poultry. This expansion therefore calls for proper disease control measures which will mean a healthy and productive flock.

- This has in turn led to the require for efficient immunisation campaigns that cutting across the disease profile prevalent within these areas. This is an opportunity that manufacturers with a focus on cost and regional strategies to deliver a vaccine can fully exploit. Such collaborations will extend market permeation and sustain growth among these new markets through offering vaccination education and support to local governments and poultry associations.

Poultry Vaccine Market Segment Analysis:

Poultry Vaccine Market is Segmented on the basis of Type, Application, Disease Type, and Region.

By Type, Inactivated Vaccines segment is expected to dominate the market during the forecast period

- The market for poultry vaccines presents a number of different vaccines designed to target particular diseases for poultry. In the list of regularly used vaccines, there are Attenuated/Live Vaccines which effectively provoke a very powerful and prolonged immune response due to the use of rather weakened viruses or bacteria. These vaccines are especially useful for managing ailments such Marek’s Disease and Newcastle Disease. However, the storage and handling of these products present a number of constraints; for instance, they need to be stored at low temperatures. Inactivated Vaccines have live pathogens that have been destroyed to offer the same immunity. These vaccines are safer to use especially in special populations such as pregnant women but usually need to be boosted to give long-lasting protection.

- The Recombinant Vaccines is a technological breakthrough in the poultry vaccine market. These vaccines are made through genetic engineering that design different antigens in order to cause immunity to various diseases, in most cases, within one application. They are gradually being adopted because they are safe for use and they are effective. Subunit vaccines which contain only components of the pathogen are intended to provide the immune response without side effects. Some of these are in the pipeline as the future of the market, namely the DNA based and vector vaccines. Combined, these categories capture the industry’s interest in increasing the efficiency of combating avian diseases and continuing to develop new methods and products that address the market’s needs.

By Application, Inactivated Vaccines segment expected to held the largest share

- In poultry vaccines used, the breeders are the most important application segment. As the producers of the fertile eggs and the genetic keepers of the poultry flocks, breeders’ overall health and their ability to fight diseases is non-negligible. Vaccination for breeders is laid down to meet immunity of diseases that can be vertically transmitted to their offspring like the hens. Confined to respiratory diseases like infectious bronchitis and avian influenza which is very competitive scientifically, socially M have severe impact on the flock productivity and quality of progeny. Vaccination of the breeder stocks serves the dual purpose of enhancing the health of the birds as well as producing better stocks of quality, healthy and disease-free chicks that act as a basic input into the poultry value chain.

- Specifically, for layers and broilers the vaccines are developed in a manner that suits them due to their importance in poultry production. Layers for which the hatching floor is created mainly for egg laying need vaccines against diseases that partially affect the quality of eggs and hatching, including New Castle Disease and Salmonella. While there are broilers that are vaccinated against certain diseases that have a different growth pattern or cause mortality and these include; coccidiosis and infectious bursal disease. For these categories, appropriate immunization helps maintain productivity and reduce losses for consumer-flocks while preserving poultry product quality, rendering high revenues throughout the poultry business.

Poultry Vaccine Market Regional Insights:

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- Asia-Pacific region contributed to a significant share of the poultry vaccine market governing the global market share in 2023. This domination is attributed to large population of poultry, growing demand for poultry products and measures towards controlling diseases affecting birds. China, and India, in particularly, have been the key shapers of this market share, owing to its large poultry farming market and increasing focus on infrastructure development of animal healthcare.

- Although, the exact market share forecasts for the 2023 configuration are hard to come by, the Asia-Pacific geography’s dominance in poultry production rates and vaccination programs makes it an influential market in the poultry vaccine market.

Active Key Players in the Poultry Vaccine Market:

- Boehringer Ingelheim International GmbH (Germany)

- Ceva Santé Animale (France)

- Elanco Animal Health (United States)

- Hester Biosciences Limited (India)

- Hipra (Spain)

- KM Biologics (Meiji Animal Health) (Japan)

- Merck & Co., Inc. (United States)

- Phibro Animal Health Corporation (United States)

- Vaxxinova International BV (Netherlands)

- Virbac (France)

- Vetoquinol (France)

- Zoetis Services LLC (United States), and Other Active Players.

Key Industry Development in the Poultry Vaccine Market:

- In December 2024, The U.S. Department of Agriculture (USDA) has announced the approval of a live avian metapneumovirus (aMPV) vaccine for import into the United States. Developed by Vaxxinova Italy, the vaccine targets Swollen Head Syndrome, an illness caused by aMPV, and aims to bolster poultry health. This live vaccine represents a significant step forward in disease prevention for the poultry industry. It is expected to be available in the U.S. by early 2025, providing producers with a critical tool to protect against this disease. The USDA’s approval underscores its commitment to advancing animal health solutions.

- In November 2024, Boehringer Ingelheim has launched an advanced vaccine for Marek’s disease in India, leveraging an innovative controlled attenuation process to enhance protection. This next-generation serotype-1 construct vaccine offers a breakthrough balance of safety and efficacy, addressing ongoing challenges posed by virulent strains in Indian poultry. The launch reinforces the company’s commitment to improving poultry health and productivity in the region.

|

Poultry Vaccine Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.64 Billion |

|

Forecast Period 2024-32 CAGR: |

8.6 % |

Market Size in 2032: |

USD 4.8 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Disease Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Poultry Vaccine Market by By Type (2018-2032)

4.1 Poultry Vaccine Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Attenuated/Live Vaccines

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Inactivated Vaccines

4.5 Recombinant Vaccines

4.6 Subunit Vaccines

4.7 Others

Chapter 5: Poultry Vaccine Market by By Application (2018-2032)

5.1 Poultry Vaccine Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Breeder

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Layer

5.5 Broiler

Chapter 6: Poultry Vaccine Market by By Disease Type (2018-2032)

6.1 Poultry Vaccine Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Newcastle Disease

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Infectious Bronchitis

6.5 Avian Influenza

6.6 Marek's Disease

6.7 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Poultry Vaccine Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BOEHRINGER INGELHEIM INTERNATIONAL GMBH (GERMANY)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CEVA SANTÉ ANIMALE (FRANCE)

7.4 ELANCO ANIMAL HEALTH (UNITED STATES)

7.5 HESTER BIOSCIENCES LIMITED (INDIA)

7.6 HIPRA (SPAIN)

7.7 KM BIOLOGICS (MEIJI ANIMAL HEALTH) (JAPAN)

7.8 MERCK & CO. INC. (UNITED STATES)

7.9 PHIBRO ANIMAL HEALTH CORPORATION (UNITED STATES)

7.10 VAXXINOVA INTERNATIONAL BV (NETHERLANDS)

7.11 VIRBAC (FRANCE)

7.12 VETOQUINOL (FRANCE)

7.13 ZOETIS SERVICES LLC (UNITED STATES)

7.14 OTHER ACTIVE PLAYERS

Chapter 8: Global Poultry Vaccine Market By Region

8.1 Overview

8.2. North America Poultry Vaccine Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Type

8.2.4.1 Attenuated/Live Vaccines

8.2.4.2 Inactivated Vaccines

8.2.4.3 Recombinant Vaccines

8.2.4.4 Subunit Vaccines

8.2.4.5 Others

8.2.5 Historic and Forecasted Market Size By By Application

8.2.5.1 Breeder

8.2.5.2 Layer

8.2.5.3 Broiler

8.2.6 Historic and Forecasted Market Size By By Disease Type

8.2.6.1 Newcastle Disease

8.2.6.2 Infectious Bronchitis

8.2.6.3 Avian Influenza

8.2.6.4 Marek's Disease

8.2.6.5 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Poultry Vaccine Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Type

8.3.4.1 Attenuated/Live Vaccines

8.3.4.2 Inactivated Vaccines

8.3.4.3 Recombinant Vaccines

8.3.4.4 Subunit Vaccines

8.3.4.5 Others

8.3.5 Historic and Forecasted Market Size By By Application

8.3.5.1 Breeder

8.3.5.2 Layer

8.3.5.3 Broiler

8.3.6 Historic and Forecasted Market Size By By Disease Type

8.3.6.1 Newcastle Disease

8.3.6.2 Infectious Bronchitis

8.3.6.3 Avian Influenza

8.3.6.4 Marek's Disease

8.3.6.5 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Poultry Vaccine Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Type

8.4.4.1 Attenuated/Live Vaccines

8.4.4.2 Inactivated Vaccines

8.4.4.3 Recombinant Vaccines

8.4.4.4 Subunit Vaccines

8.4.4.5 Others

8.4.5 Historic and Forecasted Market Size By By Application

8.4.5.1 Breeder

8.4.5.2 Layer

8.4.5.3 Broiler

8.4.6 Historic and Forecasted Market Size By By Disease Type

8.4.6.1 Newcastle Disease

8.4.6.2 Infectious Bronchitis

8.4.6.3 Avian Influenza

8.4.6.4 Marek's Disease

8.4.6.5 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Poultry Vaccine Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Type

8.5.4.1 Attenuated/Live Vaccines

8.5.4.2 Inactivated Vaccines

8.5.4.3 Recombinant Vaccines

8.5.4.4 Subunit Vaccines

8.5.4.5 Others

8.5.5 Historic and Forecasted Market Size By By Application

8.5.5.1 Breeder

8.5.5.2 Layer

8.5.5.3 Broiler

8.5.6 Historic and Forecasted Market Size By By Disease Type

8.5.6.1 Newcastle Disease

8.5.6.2 Infectious Bronchitis

8.5.6.3 Avian Influenza

8.5.6.4 Marek's Disease

8.5.6.5 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Poultry Vaccine Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Type

8.6.4.1 Attenuated/Live Vaccines

8.6.4.2 Inactivated Vaccines

8.6.4.3 Recombinant Vaccines

8.6.4.4 Subunit Vaccines

8.6.4.5 Others

8.6.5 Historic and Forecasted Market Size By By Application

8.6.5.1 Breeder

8.6.5.2 Layer

8.6.5.3 Broiler

8.6.6 Historic and Forecasted Market Size By By Disease Type

8.6.6.1 Newcastle Disease

8.6.6.2 Infectious Bronchitis

8.6.6.3 Avian Influenza

8.6.6.4 Marek's Disease

8.6.6.5 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Poultry Vaccine Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Type

8.7.4.1 Attenuated/Live Vaccines

8.7.4.2 Inactivated Vaccines

8.7.4.3 Recombinant Vaccines

8.7.4.4 Subunit Vaccines

8.7.4.5 Others

8.7.5 Historic and Forecasted Market Size By By Application

8.7.5.1 Breeder

8.7.5.2 Layer

8.7.5.3 Broiler

8.7.6 Historic and Forecasted Market Size By By Disease Type

8.7.6.1 Newcastle Disease

8.7.6.2 Infectious Bronchitis

8.7.6.3 Avian Influenza

8.7.6.4 Marek's Disease

8.7.6.5 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Poultry Vaccine Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.64 Billion |

|

Forecast Period 2024-32 CAGR: |

8.6 % |

Market Size in 2032: |

USD 4.8 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Disease Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Poultry Vaccine Market research report is 2024-2032.

Boehringer Ingelheim International GmbH (Germany), Ceva Santé Animale (France), Elanco Animal Health (United States), Hester Biosciences Limited (India), Hipra (Spain), KM Biologics (Meiji Animal Health) (Japan), Merck & Co., Inc. (United States), Phibro Animal Health Corporation (United States), Vaxxinova International BV (Netherlands), Virbac (France), Vetoquinol (France), Zoetis Services LLC (United States), and Other Active Players.

The Poultry Vaccine Market is segmented into Vaccine Type, Application, By Disease Type and region. By Vaccine Type, the market is categorized into Attenuated/Live Vaccines, Inactivated Vaccines, Recombinant Vaccines, Subunit Vaccines, Others), Application, the market is categorized into (Breeder, Layer, Broiler), By Disease Type, the market is categorized into (Newcastle Disease, Infectious Bronchitis, Avian Influenza, Marek's Disease, Others. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

The poultry vaccine market concerns vaccines aimed at controlling diseases in various poultry birds including chicken, turkey, duck and goose. These vaccines are crucial in poultry health and production mainly because they help eradicate infectious diseases within flocks hence foods security.

Poultry Vaccine Market Size Was Valued at USD 1.64 Billion in 2023, and is Projected to Reach USD 4.8 Billion by 2032, Growing at a CAGR of 8.6% From 2024-2032.