Power Boiler Market Synopsis

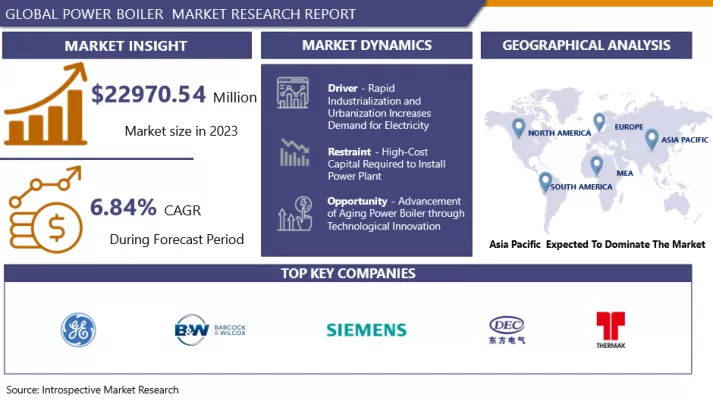

Power Boiler Market Size Was Valued at USD 22970.54 Million in 2023, and is Projected to Reach USD 41665.45 Million by 2032, Growing at a CAGR of 6.84% From 2024-2032.

A power boiler is a big, intricate piece of machinery employed to create steam for powering a turbine and generating electricity. The primary purpose of a power plant boiler is to transform water into steam by utilizing heat produced from burning fuel, commonly coal, natural gas, or oil.

- The boiler's steam is then sent to a turbine which changes the steam's thermal energy into mechanical energy in order to power an electric generator. Power plant boilers are available in different sizes and types, including multi-tube boilers, modular boilers, and once-through boilers, and are specifically made to function under high pressures and temperatures. Efficiency and reliability of power plant boilers are crucial for the economical and safe functioning of any thermal power plant.

- The increase in the power plant boiler market is fuelled by higher energy demand, advancements in power plant boiler technology and materials, greater awareness of environmental concerns, and the requirement for sustainable energy sources. The main drivers behind the growth of the power plant boiler market are these favourable factors. The need for power boilers has increased due to the emerging countries' rapid industrialization and urbanisation. Furthermore, rising worries about carbon emissions and a growing market for energy solutions that are extremely efficient have resulted in technological breakthroughs in the design and operation of boilers.

- Furthermore, as developed and developing countries become more dependent on electronic goods like air conditioners, microwave ovens, and washing machines, their energy needs have grown. The governments of several countries are making significant investments in the expansion of already-existing power plants and the building of new facilities in order to meet this constantly rising demand.

Power Boiler Market Trend Analysis

Rapid Industrialization and Urbanization Increases Demand for Electricity

- Industrialization encompasses the creation and growth of factories and facilities for manufacturing and processing, which are significant users of electricity. Factories, refineries, and production facilities need significant and dependable power for their activities. The use of automation and advanced machinery in industries leads to a rise in electricity usage. Modern industrial processes heavily depend on electrical power for machinery, robotics, and control systems. The demand for residential electricity rises as more individuals relocate to urban regions. City dwellers utilize electricity for lighting, heating, cooling, appliances, and electronics in their homes.

- Urbanization results in the development of commercial buildings, offices, shopping centres, and infrastructure projects like transportation systems. The advancements necessitate a substantial amount of electricity. The growth of the digital economy, which includes data centres, telecommunications, and IT services, results in an increased need for power. These facilities need consistent and dependable power in order to function effectively. The growing use of electric cars leads to a rise in electricity usage due to the need for charging stations, putting more strain on the power grid.

- To keep up with the higher energy demand, it is necessary to increase power generation capacity. This includes the installation of new power boilers or the enhancement of current ones to produce electricity more efficiently. Power boilers play a vital role in thermal power plants by producing steam to power turbines for electricity generation. The emphasis on energy efficiency and sustainability leads to the development of more efficient boiler systems that consume less fuel and produce fewer emissions. Retrofitting and upgrading existing boilers to improve efficiency and comply with new environmental standards is a key trend in the market.

Opportunity

Advancement of Aging Power Boiler through Technological Innovation

- Advancements in boiler technology, like sophisticated combustion systems, enhance thermal efficiency. As environmental regulations tighten, low-NOx burners and flue gas treatment systems are now necessary. The modernizations aid old power boilers in meeting emission regulations, enhancing their sustainability and appeal to customers. The incorporation of digital innovations such as IoT sensors, AI, and advanced control systems enables monitoring in real-time and predictive upkeep. Not only does this improve how well the boiler operates, but it also extends its lifespan, making older systems more competitive in the market. New boilers are created with a modular design, allowing for easy retrofitting into current infrastructure.

- The flexibility enables old power plants to integrate upgrades without extensive renovations, prolonging their lifespan and staying competitive in the market. Boilers are now being adjusted to operate alongside renewable energy systems due to the shift towards clean energy. By incorporating solar thermal or biomass into hybrid systems, old boilers can help diversify the energy mix and decrease dependence on fossil fuels. Progress in materials science has resulted in the creation of stronger and more heat-resistant materials for boiler parts. This boosts the longevity and performance of older boilers, enhancing their appeal in the market.

- Boilers are now being designed to be able to respond to grid demands, like load balancing, as power grids become more advanced. This flexibility is crucial for merging with the changing energy environment. Innovations in the power boiler sector provide aging boilers with upgrades to comply with evolving environmental regulations and maintain operation in regulated markets. Retrofit solutions offered by companies incorporate advanced technologies like better insulation, heat recovery systems, and automation to boost performance and efficiency. This technological innovation rejuvenates older infrastructure by increasing efficiency, cutting emissions, enhancing operational flexibility, and meeting environmental standards. These developments result in a different market situation.

Power Boiler Market Segment Analysis:

Power Boiler Market is Segmented on the basis of Type, Fuel Type, Technology, Application, Capacity, And Region.

By Fuel Type, Coal Segment Is Expected to Dominate the Market During the Forecast Period

- Coal is widely available on Earth as a fossil fuel, with ample reserves located in several countries like the US, China, India, Russia, and Australia. This widespread accessibility guarantees a consistent power generation supply. Nations with abundant coal reserves typically opt to utilize coal for producing electricity in order to guarantee energy independence and lessen reliance on imported fuels. Coal is generally more cost-effective than alternative fossil fuels such as oil and natural gas. Its affordability makes it a desirable choice for generating power, especially in regions where cost is a key factor. Coal has traditionally exhibited more consistent pricing compared to oil and natural gas, offering reliability in cost for generating power.

- Additionally, coal possesses a high energy density, allowing for the production of significant energy per weight unit. This allows for efficient power generation on a large scale. Many nations have developed a large network of coal-fired power plants over the years, which are able to consistently offer a steady and dependable source of electricity. The current infrastructure enables coal to be used for power generation. Switching to alternative energy sources would need a large investment in new infrastructure, making coal a cost-effective option for now.

- Technological progress has resulted in the creation of advanced coal boilers that operate at higher temperatures and pressures, boosting efficiency and decreasing emissions. Contemporary coal power plants are fitted with cutting-edge emission control technologies like flue gas desulfurization, selective catalytic reduction, and carbon capture and storage (CCS). Utilizing these technologies enables compliance with strict environmental laws while still utilizing coal. The coal industry plays a significant role in the local economy in numerous areas by providing taxes, royalties, and supporting businesses.

- The data shows fluctuations in raw coal production from 2020 to 2023. Despite a slight decrease from 2020 to 2021, there was an overall increase in production over the period. This increase could be attributed to factors such as growing demand for electricity, industrialization, and economic growth in various regions. As raw coal is a significant fuel source for power boilers, the fluctuations in its production can directly impact the power boiler market. A rising trend in coal production may indicate increased demand for power boilers, while a decline may suggest challenges or shifts in the energy landscape, such as a transition to cleaner energy sources or changes in regulatory policies affecting coal usage.

By Technology, Subcritical Segment Held the Largest Share In 2023

- Subcritical boilers have been in existence for a considerable period and are a widely recognized technology in the field of power generation. Many power plants prefer them due to their proven performance and reliability. Subcritical boilers generally demand less initial capital investment when compared to supercritical and ultra-supercritical boilers. This enhances their appeal, particularly in areas where cost is a top priority. The supply chain for subcritical boiler parts, such as materials and technology, is firmly established. This level of maturity within the supply chain makes it easier to obtain components and decreases construction lead times, leading to the dominance of the subcritical segment.

- Subcritical boilers provide variability in terms of fuel choices. They are capable of burning different fuels like coal, biomass, and certain waste types, making them adaptable to various energy markets. In certain areas, subcritical technology may be preferred due to its lower emissions compared to older, less effective boiler technologies under regulatory frameworks. Regulatory alignment in those markets can increase the demand for subcritical boilers. The extensive operational experience of many power companies with this technology also strengthens their preference for subcritical boilers.

- Having knowledge of operation and maintenance procedures can decrease the risks and expenses related to shifting to more modern technologies. Although subcritical boilers are still prevalent, there is an increasing focus on advanced technologies like supercritical and ultra-supercritical boilers due to the demand for better efficiency and reduced emissions. Nevertheless, subcritical boilers are likely to remain dominant in the power generation market in the coming years due to factors like expensive initial expenses and extended construction times.

Power Boiler Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia Pacific region is more and more embracing advanced boiler technologies like supercritical and ultra-supercritical boilers, providing better efficiency and lower emissions compared to traditional subcritical boilers. The shift is motivated by strict environmental rules and a focus on enhancing fuel efficiency. The existence of top boiler manufacturers like Harbin Electric and Dongfang Electric in China, and Bharat Heavy Electricals Limited (BHEL) and Thermax in India, boosts technological progress and lessens reliance on imports. There is a rising amalgamation of renewable energy sources in the power generation mix. However, the intermittent nature of renewables like solar and wind necessitates reliable backup power, which is often provided by modern, efficient boilers

- The region's expanding population results in higher energy usage. China and India, among other countries like Japan and South Korea, are the biggest energy users globally, necessitating constant growth in power generation capacity to satisfy the demand. The industrial sectors, specially manufacturing and processing industries, have a substantial need for energy, leading to an increased demand for dependable power sources such as power boilers. The strong economic growth in these countries further drives industrial expansion. The expansion of industries necessitates a significant increase in power production, leading to a growing need for power boilers.

- Urbanization is on the rise, causing a higher demand for dependable and efficient power supply in urban areas. There are strong regulatory frameworks promoting the adoption of advanced boiler technologies to ensure efficient and clean power generation. This includes incentives and subsidies for upgrading older power plants with more efficient boiler systems. There is a growing integration of renewable energy sources in the power generation mix. However, the intermittent nature of renewables like solar and wind necessitates reliable backup power, which is often provided by modern, efficient boilers.

Power Boiler Market Active Players

- General Electric (U.S.)

- Babcock & Wilcox Enterprises (U.S.)

- Mitsubishi Hitachi Power Systems (Japan)

- Siemens AG (Germany)

- Doosan Heavy Industries & Construction (South Korea)

- Dongfang Electric Corporation (China)

- IHI Corporation (Japan)

- John Wood Group (U.K.)

- Bharat Heavy Electricals Limited (India)

- Thermax Limited (India)

- Andritz Group (Austria)

- Sumitomo Heavy Industries (Japan)

- Valmet (Finland)

- Harbin Electric (China)

- Weil-McLain (U.S.)

- Victory Energy Operations (U.S.)

- The Fulton Companies (U.S.)

- Bradford White Corporation (U.S.)

- Bosch Industriekessel (Germany)

- Atlantic Boilers (U.K.)

- Ariston Holding (Italy)

- AERCO International (U.S.)

- ACV (Belgium)

- O.

Global Power Boiler Market Scope:

|

Global Power Boiler Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 22970.54 Million |

|

Forecast Period 2024-32 CAGR: |

6.84 % |

Market Size in 2032: |

USD 41665.45 Million |

|

Segments Covered: |

By Type |

|

|

|

By Fuel Type |

|

||

|

By Technology |

|

||

|

By Application |

|

||

|

By Capacity |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

General Electric (U.S.), Babcock & Wilcox Enterprises (U.S.), Mitsubishi Hitachi Power Systems (Japan), Siemens AG (Germany), Doosan Heavy Industries & Construction (South Korea), and Other Active Players. |

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Power Boiler Market by By Type (2018-2032)

4.1 Power Boiler Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Pulverized Coal Boilers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Fluidized Bed Boilers

4.5 Waste Heat Recovery Boilers

4.6 Gas-fired Boilers

4.7 Oil-fired Boilers

Chapter 5: Power Boiler Market by By Fuel Type (2018-2032)

5.1 Power Boiler Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Coal

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Natural Gas

5.5 Oil

5.6 Biomass

5.7 Solar

5.8 Others {Waste Heat

5.9 Geothermal}

Chapter 6: Power Boiler Market by By Technology (2018-2032)

6.1 Power Boiler Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Subcritical

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Supercritical

6.5 Ultra-Supercritical

6.6 Advanced Ultra-Supercritical

Chapter 7: Power Boiler Market by By Application (2018-2032)

7.1 Power Boiler Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Industrial

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Commercial

7.5 Residential

7.6 Utilities

Chapter 8: Power Boiler Market by By Capacity (2018-2032)

8.1 Power Boiler Market Snapshot and Growth Engine

8.2 Market Overview

8.3 <400 MW

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 400-800 MW

8.5 >800 MW

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Power Boiler Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 GENERAL ELECTRIC (U.S.)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 BABCOCK & WILCOX ENTERPRISES (U.S.)

9.4 MITSUBISHI HITACHI POWER SYSTEMS (JAPAN)

9.5 SIEMENS AG (GERMANY)

9.6 DOOSAN HEAVY INDUSTRIES & CONSTRUCTION (SOUTH KOREA)

9.7 DONGFANG ELECTRIC CORPORATION (CHINA)

9.8 IHI CORPORATION (JAPAN)

9.9 JOHN WOOD GROUP (U.K.)

9.10 BHARAT HEAVY ELECTRICALS LIMITED (INDIA)

9.11 THERMAX LIMITED (INDIA)

9.12 ANDRITZ GROUP (AUSTRIA)

9.13 SUMITOMO HEAVY INDUSTRIES (JAPAN)

9.14 VALMET (FINLAND)

9.15 HARBIN ELECTRIC (CHINA)

9.16 WEIL-MCLAIN (U.S.)

9.17 VICTORY ENERGY OPERATIONS (U.S.)

9.18 THE FULTON COMPANIES (U.S.)

9.19 BRADFORD WHITE CORPORATION (U.S.)

9.20 BOSCH INDUSTRIEKESSEL (GERMANY)

9.21 ATLANTIC BOILERS (U.K.)

9.22 ARISTON HOLDING (ITALY)

9.23 AERCO INTERNATIONAL (U.S.)

9.24 ACV (BELGIUM)

9.25 O. SMITH CORPORATION (U.S.)

9.26 FORBES MARSHALL (INDIA)

9.27 BDR THERMEA GROUP (NETHERLANDS)

9.28 DAIKIN INDUSTRIES (JAPAN)

Chapter 10: Global Power Boiler Market By Region

10.1 Overview

10.2. North America Power Boiler Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By By Type

10.2.4.1 Pulverized Coal Boilers

10.2.4.2 Fluidized Bed Boilers

10.2.4.3 Waste Heat Recovery Boilers

10.2.4.4 Gas-fired Boilers

10.2.4.5 Oil-fired Boilers

10.2.5 Historic and Forecasted Market Size By By Fuel Type

10.2.5.1 Coal

10.2.5.2 Natural Gas

10.2.5.3 Oil

10.2.5.4 Biomass

10.2.5.5 Solar

10.2.5.6 Others {Waste Heat

10.2.5.7 Geothermal}

10.2.6 Historic and Forecasted Market Size By By Technology

10.2.6.1 Subcritical

10.2.6.2 Supercritical

10.2.6.3 Ultra-Supercritical

10.2.6.4 Advanced Ultra-Supercritical

10.2.7 Historic and Forecasted Market Size By By Application

10.2.7.1 Industrial

10.2.7.2 Commercial

10.2.7.3 Residential

10.2.7.4 Utilities

10.2.8 Historic and Forecasted Market Size By By Capacity

10.2.8.1 <400 MW

10.2.8.2 400-800 MW

10.2.8.3 >800 MW

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Power Boiler Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By By Type

10.3.4.1 Pulverized Coal Boilers

10.3.4.2 Fluidized Bed Boilers

10.3.4.3 Waste Heat Recovery Boilers

10.3.4.4 Gas-fired Boilers

10.3.4.5 Oil-fired Boilers

10.3.5 Historic and Forecasted Market Size By By Fuel Type

10.3.5.1 Coal

10.3.5.2 Natural Gas

10.3.5.3 Oil

10.3.5.4 Biomass

10.3.5.5 Solar

10.3.5.6 Others {Waste Heat

10.3.5.7 Geothermal}

10.3.6 Historic and Forecasted Market Size By By Technology

10.3.6.1 Subcritical

10.3.6.2 Supercritical

10.3.6.3 Ultra-Supercritical

10.3.6.4 Advanced Ultra-Supercritical

10.3.7 Historic and Forecasted Market Size By By Application

10.3.7.1 Industrial

10.3.7.2 Commercial

10.3.7.3 Residential

10.3.7.4 Utilities

10.3.8 Historic and Forecasted Market Size By By Capacity

10.3.8.1 <400 MW

10.3.8.2 400-800 MW

10.3.8.3 >800 MW

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Power Boiler Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By By Type

10.4.4.1 Pulverized Coal Boilers

10.4.4.2 Fluidized Bed Boilers

10.4.4.3 Waste Heat Recovery Boilers

10.4.4.4 Gas-fired Boilers

10.4.4.5 Oil-fired Boilers

10.4.5 Historic and Forecasted Market Size By By Fuel Type

10.4.5.1 Coal

10.4.5.2 Natural Gas

10.4.5.3 Oil

10.4.5.4 Biomass

10.4.5.5 Solar

10.4.5.6 Others {Waste Heat

10.4.5.7 Geothermal}

10.4.6 Historic and Forecasted Market Size By By Technology

10.4.6.1 Subcritical

10.4.6.2 Supercritical

10.4.6.3 Ultra-Supercritical

10.4.6.4 Advanced Ultra-Supercritical

10.4.7 Historic and Forecasted Market Size By By Application

10.4.7.1 Industrial

10.4.7.2 Commercial

10.4.7.3 Residential

10.4.7.4 Utilities

10.4.8 Historic and Forecasted Market Size By By Capacity

10.4.8.1 <400 MW

10.4.8.2 400-800 MW

10.4.8.3 >800 MW

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Power Boiler Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By By Type

10.5.4.1 Pulverized Coal Boilers

10.5.4.2 Fluidized Bed Boilers

10.5.4.3 Waste Heat Recovery Boilers

10.5.4.4 Gas-fired Boilers

10.5.4.5 Oil-fired Boilers

10.5.5 Historic and Forecasted Market Size By By Fuel Type

10.5.5.1 Coal

10.5.5.2 Natural Gas

10.5.5.3 Oil

10.5.5.4 Biomass

10.5.5.5 Solar

10.5.5.6 Others {Waste Heat

10.5.5.7 Geothermal}

10.5.6 Historic and Forecasted Market Size By By Technology

10.5.6.1 Subcritical

10.5.6.2 Supercritical

10.5.6.3 Ultra-Supercritical

10.5.6.4 Advanced Ultra-Supercritical

10.5.7 Historic and Forecasted Market Size By By Application

10.5.7.1 Industrial

10.5.7.2 Commercial

10.5.7.3 Residential

10.5.7.4 Utilities

10.5.8 Historic and Forecasted Market Size By By Capacity

10.5.8.1 <400 MW

10.5.8.2 400-800 MW

10.5.8.3 >800 MW

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Power Boiler Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By By Type

10.6.4.1 Pulverized Coal Boilers

10.6.4.2 Fluidized Bed Boilers

10.6.4.3 Waste Heat Recovery Boilers

10.6.4.4 Gas-fired Boilers

10.6.4.5 Oil-fired Boilers

10.6.5 Historic and Forecasted Market Size By By Fuel Type

10.6.5.1 Coal

10.6.5.2 Natural Gas

10.6.5.3 Oil

10.6.5.4 Biomass

10.6.5.5 Solar

10.6.5.6 Others {Waste Heat

10.6.5.7 Geothermal}

10.6.6 Historic and Forecasted Market Size By By Technology

10.6.6.1 Subcritical

10.6.6.2 Supercritical

10.6.6.3 Ultra-Supercritical

10.6.6.4 Advanced Ultra-Supercritical

10.6.7 Historic and Forecasted Market Size By By Application

10.6.7.1 Industrial

10.6.7.2 Commercial

10.6.7.3 Residential

10.6.7.4 Utilities

10.6.8 Historic and Forecasted Market Size By By Capacity

10.6.8.1 <400 MW

10.6.8.2 400-800 MW

10.6.8.3 >800 MW

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Power Boiler Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By By Type

10.7.4.1 Pulverized Coal Boilers

10.7.4.2 Fluidized Bed Boilers

10.7.4.3 Waste Heat Recovery Boilers

10.7.4.4 Gas-fired Boilers

10.7.4.5 Oil-fired Boilers

10.7.5 Historic and Forecasted Market Size By By Fuel Type

10.7.5.1 Coal

10.7.5.2 Natural Gas

10.7.5.3 Oil

10.7.5.4 Biomass

10.7.5.5 Solar

10.7.5.6 Others {Waste Heat

10.7.5.7 Geothermal}

10.7.6 Historic and Forecasted Market Size By By Technology

10.7.6.1 Subcritical

10.7.6.2 Supercritical

10.7.6.3 Ultra-Supercritical

10.7.6.4 Advanced Ultra-Supercritical

10.7.7 Historic and Forecasted Market Size By By Application

10.7.7.1 Industrial

10.7.7.2 Commercial

10.7.7.3 Residential

10.7.7.4 Utilities

10.7.8 Historic and Forecasted Market Size By By Capacity

10.7.8.1 <400 MW

10.7.8.2 400-800 MW

10.7.8.3 >800 MW

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Global Power Boiler Market Scope:

|

Global Power Boiler Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 22970.54 Million |

|

Forecast Period 2024-32 CAGR: |

6.84 % |

Market Size in 2032: |

USD 41665.45 Million |

|

Segments Covered: |

By Type |

|

|

|

By Fuel Type |

|

||

|

By Technology |

|

||

|

By Application |

|

||

|

By Capacity |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

General Electric (U.S.), Babcock & Wilcox Enterprises (U.S.), Mitsubishi Hitachi Power Systems (Japan), Siemens AG (Germany), Doosan Heavy Industries & Construction (South Korea), and Other Active Players. |

||

Frequently Asked Questions :

The forecast period in the Power Boiler Market research report is 2024-2032.

General Electric (U.S.), Babcock & Wilcox Enterprises (U.S.), Mitsubishi Hitachi Power Systems (Japan), Siemens AG (Germany), Doosan Heavy Industries & Construction (South Korea), Dongfang Electric Corporation (China), IHI Corporation (Japan), John Wood Group (U.K.), Bharat Heavy Electricals Limited (India), Thermax Limited (India), Andritz Group (Austria), Sumitomo Heavy Industries (Japan), Valmet (Finland), Harbin Electric (China), Weil-McLain (U.S.), Victory Energy Operations (U.S.), The Fulton Companies (U.S.), Bradford White Corporation (U.S.), Bosch Industriekessel (Germany), Atlantic Boilers (U.K.), Ariston Holding (Italy), AERCO International (U.S.), ACV (Belgium), A. O. Smith Corporation (U.S.), Forbes Marshall (India), BDR Thermea Group (Netherlands), Daikin Industries (Japan).and Other Active Players.

The Power Boiler Market is segmented into Type, Fuel Type, Technology, Application, Capacity, Segment6, and region. By Type, the market is categorized into Pulverized Coal Boilers, Fluidized Bed Boilers, Waste Heat Recovery Boilers, Gas-fired Boilers, Oil-fired Boilers. By Fuel Type, the market is categorized into Coal, Natural Gas, Oil, Biomass, Solar, And Others {Waste Heat, Geothermal}. By Technology, the market is categorized into Subcritical, Supercritical, Ultra-Supercritical, Advanced Ultra-Supercritical. By Application, the market is categorized into Industrial, Commercial, Residential, Utilities. By Capacity, The Market Is Categorized Into <400 MW, 400-800 MW, >800 MW. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A power boiler is a big, intricate piece of machinery employed to create steam for powering a turbine and generating electricity. The primary purpose of a power plant boiler is to transform water into steam by utilizing heat produced from burning fuel, commonly coal, natural gas, or oil.

Power Boiler Market Size Was Valued at USD 22970.54 Million in 2023, and is Projected to Reach USD 41665.45 Million by 2032, Growing at a CAGR of 6.84% From 2024-2032.