PP Capacitor Films Market Synopsis

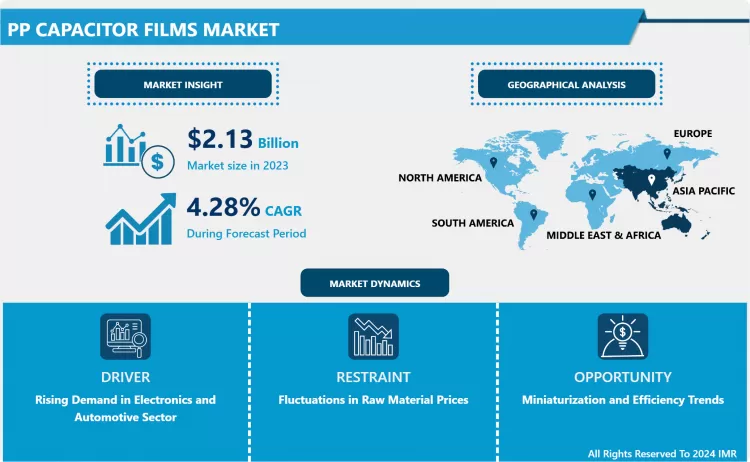

PP Capacitor Films Market Size Was Valued at USD 2.13 Billion in 2023 and is Projected to Reach USD 3.11 Billion by 2032, Growing at a CAGR of 4.28% From 2024-2032.

Polypropylene (PP) film capacitors are a type of passive electrical component used widely in electronic circuits to store energy, stabilize voltage fluctuations, and reduce noise, thereby enhancing device performance and reliability. These capacitors utilize a dielectric made from polypropylene, a polymer that offers high dielectric strength and low dielectric losses, making them ideal for various applications where performance stability is crucial.

- Capacitors, in general, consist of two conductive plates separated by an insulating material, known as a dielectric, which stores electrical energy. When a voltage is applied, charge accumulates on the plates, creating an electric field between them. The polypropylene film used in PP capacitors has superior insulating properties, making it an excellent choice for applications that require high precision and efficiency, such as power supplies and audio systems. The polymer’s inherent qualities ensure that the capacitor can handle high voltages and provide reliable performance in circuits requiring minimal energy dissipation.

- PP film capacitors are favoured for their stability, low self-heating, and long lifespan, as the dielectric material is resistant to degradation over time. In audio systems, they are particularly useful for filtering and smoothing out power supply fluctuations, which reduces unwanted noise and improves sound quality. These capacitors are also used in power electronics for voltage regulation, motor run applications, and RF circuits due to their ability to withstand high-frequency switching and provide consistent performance.

- For DIY electronics enthusiasts, understanding the different types of capacitors, including PP film capacitors, is essential for choosing the correct components based on the specific requirements of a circuit. Their versatility, coupled with their superior performance, makes PP film capacitors a staple in modern electronic devices.

PP Capacitor Films Market Trend Analysis

Rising Demand in Electronics and Automotive Sector

- PP films are ideal for miniaturizing and portability in electronics like smartphones and wearables. They offer high capacitance density and are used in data centers, medical devices, industrial automation, and the Internet of Things (IoT). Capacitors provide features of biocompatibility. reliable, and cost-effective, ideal for power conversion, energy storage, and communication in devices like pacemakers, defibrillators, and implantable devices.

- The electric vehicle (EV) led to a demand for high-performance capacitors for various applications, including powertrain management systems, battery management systems, onboard electronics, charging infrastructure, and inverters and converters. ADAS features, such as automatic emergency braking and lane departure warning systems, require smaller, lighter capacitors in automotive electronics. PP films offer advantages such as cost-effectiveness, high dielectric strength, wide operating temperature range, and high ripple current handling. PP Capacitor Films has the potential for miniaturization while maintaining high capacitance density, towards smaller electronics and automotive components. The rising demand in electronics and the automotive sector is the growing use of PP Capacitor Films in Various Applications.

Miniaturization and Efficiency Trends

- There is a high demand for smaller, lighter capacitors due to the increasing compactness of modern electronic devices. PP capacitor films, particularly metalized and biaxially oriented (BO) versions, offer high capacitance density, for smaller capacitors with the same level of energy storage or filtering capability. PP films boast low ESR and good thermal stability which is ideal for applications like AC filtering, power conversion, and DC-DC converters in smaller, more efficient devices.

- Miniaturization trends are opening up new application areas for PP films, such as wearable electronics, IoT devices, and implantable medical devices. PP films offer comparable performance at a lower cost compared to alternative materials like ceramic or metalized polyester. The demand for PP capacitor films is expected to grow steadily as miniaturization and efficiency trends continue to dominate the electronics sector.

PP Capacitor Films Market Segment Analysis:

PP Capacitor Films Market Segmented based on Product Type and End-User.

By Product Type, Metallized PP Capacitor Films segment is expected to dominate the market during the forecast period

- Metalized PP Capacitor Films offer enhanced performance compared to their non-metalized counterparts. Metalized layer enhances the overall efficiency and reliability of capacitors, and is used for a wide range of applications. Metallization in MPPCFs increases capacitance per unit area, which enables smaller capacitors with the same energy storage capacity.

- Metalized PP Capacitor Films provide superior self-healing properties. As industries increasingly demand for capacitors with higher performance standards will also increase. The Metallized PP Capacitor Films segment will dominate the market, with advanced solutions evolving technological requirements and contributing to the overall efficiency of electronic systems.

By Application, the Automotive segment held the largest share of 24.7% in 2022

- The automotive industry is shifting towards electrification and advanced electronics. There is rising adoption of electric vehicles (EVs) and the integration of electronic components in conventional vehicles. PP Capacitor Films play a critical role in the automotive sector by ensuring the efficiency and reliability of capacitors used in energy storage systems, power electronics, and various electronic control units within vehicles.

- PP Capacitor Films, offers excellent dielectric properties, thermal stability, and the ability to withstand harsh automotive environments, emerging as the material of choice for capacitors in these applications. PP Capacitor Films play a crucial role in supporting the technological advancements driving the future of the automotive industry towards electrification and the increasingly advanced electronic systems in modern vehicles.

PP Capacitor Films Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia Pacific region is experiencing explosive electronics growth due to major manufacturing hubs like China, India, and South Korea producing smartphones, computers, and consumer electronics. This has led to a massive demand for capacitors, including PP films, for various applications within these devices.

- PP films, especially in metalized versions have excelled in miniaturization due to their high capacitance density and small size. The diverse and growing consumer base in Asia Pacific is contributing to the demand for electronic appliances and gadgets. This trend has created a sustained need for capacitors, supporting the market for PP Capacitor Films.

- The region is also witnessing huge demand for electric vehicles (EVs) and hybrid/plug-in hybrid vehicles (HEVs/PHEVs), which heavily rely on PP films for power electronics and control systems. Government support and tax breaks for manufacturers have increased the production of PP Capacitor Films applications. These factors make PP films an attractive choice for manufacturers in the region, as they offer cost-effectiveness, competitiveness, and the potential for bio-based alternatives.

PP Capacitor Films Market Top Key Players:

- AVX Corporation (United States)

- KEMET Electronics Corporation (United States)

- Vishay Intertechnology, Inc. (United States)

- Illinois Capacitor (United States)

- Terichem Tervakoski, a.s. (Czech Republic)

- Polinas (Turkey)

- Borealis AG (Austria)

- The Bollor Group (France)

- TDK Corporation (Japan)

- Panasonic Corporation (Japan)

- Nichicon Corporation (Japan)

- Rubycon Corporation (Japan)

- Shin-Etsu Chemical Co., Ltd. (Japan)

- Toray Industries, Inc. (Japan)

- Nichicon Corporation (Japan)

- Nuintek Co Ltd (South Korea)

- Anhui Eastern Communication Group (China), and Other Major Players.

Key Industry Developments in the PP Capacitor Films Market:

- In July 2022, Nichicon Corporation developed and launched the GYF series of high-capacitance conductive polymer hybrid aluminum electrolytic capacitors with high ripple current and low ESR performance, which are increasingly demanded in automotive and telecommunications applications.

|

Global PP Capacitor Films Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 2.13 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.28 % |

Market Size in 2032: |

USD 3.11 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: PP Capacitor Films Market by By Type (2018-2032)

4.1 PP Capacitor Films Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Metalized PP Capacitor Films

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Plain PP Capacitor Films

Chapter 5: PP Capacitor Films Market by By End-User (2018-2032)

5.1 PP Capacitor Films Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Automotive

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Energy and Power

5.5 Medical Devices

5.6 Locomotive

5.7 Consumer Goods

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 PP Capacitor Films Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 THE HALLSTAR COMPANY (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 TEXAS NATURAL SUPPLY (USA)

6.4 SUNAROMA (USA)

6.5 CAMDEN-GREY ESSENTIAL OILS INC (USA)

6.6 MADINA INDUSTRIAL CORP. (USA)

6.7 PREMIER SPECIALTIES INC (USA)

6.8 ORGANIC CREATIONS (USA)

6.9 AOS PRODUCTS PRIVATE LIMITED (INDIA)

6.10

Chapter 7: Global PP Capacitor Films Market By Region

7.1 Overview

7.2. North America PP Capacitor Films Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By By Type

7.2.4.1 Metalized PP Capacitor Films

7.2.4.2 Plain PP Capacitor Films

7.2.5 Historic and Forecasted Market Size By By End-User

7.2.5.1 Automotive

7.2.5.2 Energy and Power

7.2.5.3 Medical Devices

7.2.5.4 Locomotive

7.2.5.5 Consumer Goods

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe PP Capacitor Films Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By By Type

7.3.4.1 Metalized PP Capacitor Films

7.3.4.2 Plain PP Capacitor Films

7.3.5 Historic and Forecasted Market Size By By End-User

7.3.5.1 Automotive

7.3.5.2 Energy and Power

7.3.5.3 Medical Devices

7.3.5.4 Locomotive

7.3.5.5 Consumer Goods

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe PP Capacitor Films Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By By Type

7.4.4.1 Metalized PP Capacitor Films

7.4.4.2 Plain PP Capacitor Films

7.4.5 Historic and Forecasted Market Size By By End-User

7.4.5.1 Automotive

7.4.5.2 Energy and Power

7.4.5.3 Medical Devices

7.4.5.4 Locomotive

7.4.5.5 Consumer Goods

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific PP Capacitor Films Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By By Type

7.5.4.1 Metalized PP Capacitor Films

7.5.4.2 Plain PP Capacitor Films

7.5.5 Historic and Forecasted Market Size By By End-User

7.5.5.1 Automotive

7.5.5.2 Energy and Power

7.5.5.3 Medical Devices

7.5.5.4 Locomotive

7.5.5.5 Consumer Goods

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa PP Capacitor Films Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By By Type

7.6.4.1 Metalized PP Capacitor Films

7.6.4.2 Plain PP Capacitor Films

7.6.5 Historic and Forecasted Market Size By By End-User

7.6.5.1 Automotive

7.6.5.2 Energy and Power

7.6.5.3 Medical Devices

7.6.5.4 Locomotive

7.6.5.5 Consumer Goods

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America PP Capacitor Films Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By By Type

7.7.4.1 Metalized PP Capacitor Films

7.7.4.2 Plain PP Capacitor Films

7.7.5 Historic and Forecasted Market Size By By End-User

7.7.5.1 Automotive

7.7.5.2 Energy and Power

7.7.5.3 Medical Devices

7.7.5.4 Locomotive

7.7.5.5 Consumer Goods

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global PP Capacitor Films Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 2.13 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.28 % |

Market Size in 2032: |

USD 3.11 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the PP Capacitor Films Market research report is 2024-2032.

AVX Corporation (United States), KEMET Electronics Corporation (United States), Vishay Intertechnology, Inc. (United States), Illinois Capacitor (United States), Terichem Tervakoski, a.s. (Czech Republic), Polinas (Turkey), Borealis AG (Austria), The Bollor Group (France), TDK Corporation (Japan), Panasonic Corporation (Japan), Nichicon Corporation (Japan), Rubycon Corporation (Japan), Shin-Etsu Chemical Co., Ltd. (Japan), Toray Industries, Inc. (Japan), Nichicon Corporation (Japan), Nuintek Co Ltd (South Korea), Anhui Eastern Communication Group (China), and Other Major Players.

The PP Capacitor Films Market is segmented into Product Type, End-User, and region. By Product Type, the market is categorized into Metalized PP Capacitor Films and Plain PP Capacitor Films. By End-User, the market is categorized into Automotive, Infrastructure, Energy and Power, Medical Devices, Locomotive, and Consumer Goods. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

PP capacitor films are dielectric materials made of polypropylene, characterized by high electrical insulation properties. These films find extensive use in capacitor construction, specifically in applications requiring efficient energy storage and release. They are available in single or double layers, they differ in thickness to meet diverse capacitance and voltage requirements.

PP Capacitor Films Market Size Was Valued at USD 2.13 Billion in 2023 and is Projected to Reach USD 3.11 Billion by 2032, Growing at a CAGR of 4.28% From 2024-2032.