Pressure Sensitive Tapes & Labels Market Synopsis:

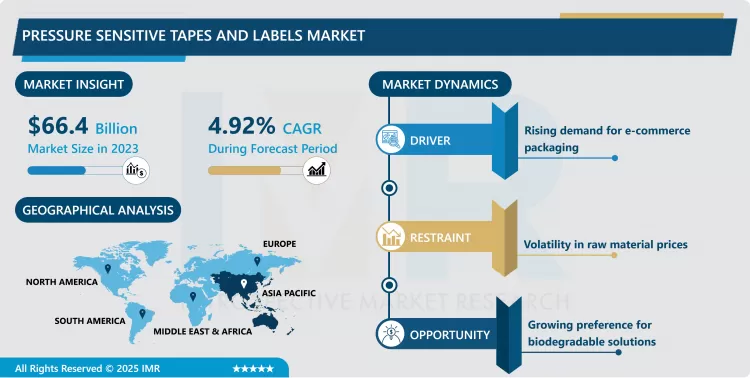

Pressure Sensitive Tapes & Labels Market Size Was Valued at USD 66.4 Billion in 2023, and is Projected to Reach USD 102.30 Billion by 2032, Growing at a CAGR of 4.92% From 2024-2032.

Pressure-sensitive tapes and labels or the Pressure Sensitive Tapes and Labels Market is a market involving the manufacturing and selling of adhesive backed goods that bond to surfaces on application of light pressure and do not require heating, water or solvent activators. Such products include for example the adhesive tapes and labels manufactured and applied in the different industries for uses like bonding, labeling, sealing and insulating, among others. Some of the peculiarities highlighted include ease of application, the product’s and substrate nature, and the high durability possessed by pressure-sensitive adhesive. As newer and better adhesives are developed and old ones are disposed of, the market has thus continued to grow to meet the changing industrial and Customer’s expectations.

The Pressure Sensitive Tapes and Labels Market has shown remarkable growth in the last few years due to the increasing industries such as electronic business, automotive, and healthcare. With the increasing popularity of obtaining goods through the internet, focus on effective and tamper-proof protective packaging, where labels and tapes produced on the basis of pressure-sensitive adhesives are fully relevant. This has made them to act as vital tools in the packaging industry, used for everything from guarding cartons to serving as source of information on products. In the same way, automotive manufacturers use pressure-sensitive tapes in assembly processes to substitute mechanically fasteners to improve efficiency and minimize the automotive’s weight.

In healthcare segment, hygiene and safety consciousness has accelerated the use of adhesive labels for medical device and pharmaceutical industries, PPE etc. Also, there is improved information on sustainability for packaging that has led to advances in pressure-sensitive recycle and bio-based solutions. The industry is also concentrating on such factors as ecological compatibility of adhesives as well as substrates in line with ecological rules as well as customer trends. It is for this reason that this shift towards sustainability is believed to have a profound impact on the future profile of the market.

Pressure Sensitive Tapes & Labels Market Trend Analysis:

The Rise of Smart Labels

- The Pressure Sensitive Tapes and Labels Market also has certain trends, which are tremendously influencing its growth; one of these trends involves smart labeling technologies. RFID or QR code enabled smart labels are becoming increasingly popular across industries is because such labels offer information visibility in real time, track inventory, and Consumer engagement. Such labels are especially widespread in the food and beverage industry and the pharmaceutical industry as they guarantee product origin and origin. Given that digital transformation is gradually extending to supply chains, smart labels are more than a novelties – they are opportunities for market players.

Growing Demand for Biodegradable and Sustainable Solutions

- As more emphasis is placed on reducing the effects of environmental degradation and proper disposal of wastes, there is increasing market need for bio-degradable pressure-sensitive tapes and labels. This need for eco-friendly packaging has led consumers and hence the businesses to look for products from packaging manufacturers who use environment friendly adhesives, recyclable substrates and non-solvent systems. It has high potential for growth for the simple reason that any organization that is able can push out solutions based on sustainability and environmentalism would have a competitive edge by doing so. Governments around the world are supporting this shift through the provision of incentives for green activities hence boosting the demand for sustainable pressure-sensitive products.

Pressure Sensitive Tapes & Labels Market Segment Analysis:

Pressure Sensitive Tapes & Labels Market Segmented based on Product, Technology, Backing Material and Region.

By Product, Specialty Tapes Segment is Expected to Dominate the Market During the Forecast Period

- Specialty Tapes have the fundamentals to dominate the Pressure Sensitive Tapes and Labels Market throughout the forecast period due to the multiple usability and better performance compared to the others. There are particular varieties of tapes which are meant for specific application areas such as construction, aerospace and electronics application which may have requirements such as high temperature stability, electrical insulation and water proofing. For example in electronics, specialty tapes are employed in bonding and in shielding different components in products such as mobile devices or wears.

- Also, development in adhesive technology has improved the use of specialty tapes to perform its role in areas where reliability and accuracy are important. That they have been used to replace conventional methods of fastening have boosted their demand even further especially in fields that are rapidly expanding including renewable energy and health.

By Technology, Hot Melt Segment Expected to held the Largest Share

- The Pressure Sensitive Tapes and Labels Market is forecasted to have its major focus on the Hot Melt technology segment due to its enhanced performance and adaptability. There is a diverse range of hot melt adhesives industries prefer due to high bond strength and fast dry time, and they are compatible with a lot of substrates. They are especially used in packaging because high production line requires fast setting agents with no compromise to performance. Beyond packaging, hot melt adhesive has other uses; auto industry, sanitary products, and the construction business. This style’s lack of solvents appeals to consumers as it follows the industry-wide trend of going green to increase effectiveness. Given that the number of applications demanding high-performance adhesives is continually expanding across various industries, it is not surprising that hot melt technology dominates the adhesive market.

Pressure Sensitive Tapes & Labels Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Pressure Sensitive Tapes and Labels market regional outlook was led by Asia Pacific in 2023. Leadership of this region can be explained under increased manufacture centres, industrialization and expanding buying nations such as China, India and Japan. Claims such as packaging industry has steadily grown at an exponential rate due to the increase in e-commerce and retail industries in Asia Pacific region proven it. Also, demands for unique pressure sensitive products are triggered by automotive and electronics industries which are well developed in the region. The increase in demand for infrastructure projects across the world, together with a strong emphasis on green components, contributes to Asia Pacific taking the lead.

Active Key Players in the Pressure Sensitive Tapes & Labels Market:

- 3M (USA)

- Avery Dennison Corporation (USA)

- Berry Global Inc. (USA)

- CCL Industries Inc. (Canada)

- Intertape Polymer Group (Canada)

- Lintec Corporation (Japan)

- Lohmann GmbH & Co. KG (Germany)

- Nitto Denko Corporation (Japan)

- Scapa Group Plc (UK)

- Shurtape Technologies, LLC (USA)

- Tesa SE (Germany)

- UPM Raflatac (Finland)

- VHB Tapes (USA)

- Wacker Chemie AG (Germany)

- Zhejiang Yonghe Adhesive Products Co., Ltd. (China), and other active Players

Key Industry Developments of Pressure Sensitive Tapes & Labels:

-

In June 2024, Avery Dennison introduced new pressure-sensitive adhesive tape solutions designed for electric vehicle (EV) battery cell wrapping applications. These innovative products aim to improve efficiency, durability, and performance in the growing EV industry. The new tapes offer advanced adhesion properties, contributing to the overall safety and effectiveness of EV battery cells. This development highlights Avery Dennison's commitment to providing cutting-edge solutions for the automotive sector.

|

Global Pressure Sensitive Tapes & Labels Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 66.4 Billion |

|

Forecast Period 2024-32 CAGR: |

4.92% |

Market Size in 2032: |

USD 102.30 Billion |

|

Segments Covered: |

By Product |

|

|

|

By Technology |

|

||

|

By Backing Material |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Pressure Sensitive Tapes & Labels Market by By Product (2018-2032)

4.1 Pressure Sensitive Tapes & Labels Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Specialty Tapes

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Packaging Tapes

4.5 Consumer Tapes

Chapter 5: Pressure Sensitive Tapes & Labels Market by By Technology (2018-2032)

5.1 Pressure Sensitive Tapes & Labels Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Hot Melt

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Water-based

5.5 Solvent-based

5.6 Radiation-cured

Chapter 6: Pressure Sensitive Tapes & Labels Market by By Backing Material (2018-2032)

6.1 Pressure Sensitive Tapes & Labels Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Woven/Nonwoven

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Polyvinylchloride (PVC)

6.5 Polypropylene (pp)

6.6 Polyethylene Terephthalate (pet)

6.7 Foam

6.8 Metal

6.9 Other Backing Materials

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Pressure Sensitive Tapes & Labels Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 3M (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 AVERY DENNISON CORPORATION (USA)

7.4 BERRY GLOBAL INC. (USA)

7.5 CCL INDUSTRIES INC. (CANADA)

7.6 INTERTAPE POLYMER GROUP (CANADA)

7.7 LINTEC CORPORATION (JAPAN)

7.8 LOHMANN GMBH & CO. KG (GERMANY)

7.9 NITTO DENKO CORPORATION (JAPAN)

7.10 SCAPA GROUP PLC (UK)

7.11 SHURTAPE TECHNOLOGIES LLC (USA)

7.12 TESA SE (GERMANY)

7.13 UPM RAFLATAC (FINLAND)

7.14 VHB TAPES (USA)

7.15 WACKER CHEMIE AG (GERMANY)

7.16 ZHEJIANG YONGHE ADHESIVE PRODUCTS CO. LTD. (CHINA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Pressure Sensitive Tapes & Labels Market By Region

8.1 Overview

8.2. North America Pressure Sensitive Tapes & Labels Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Product

8.2.4.1 Specialty Tapes

8.2.4.2 Packaging Tapes

8.2.4.3 Consumer Tapes

8.2.5 Historic and Forecasted Market Size By By Technology

8.2.5.1 Hot Melt

8.2.5.2 Water-based

8.2.5.3 Solvent-based

8.2.5.4 Radiation-cured

8.2.6 Historic and Forecasted Market Size By By Backing Material

8.2.6.1 Woven/Nonwoven

8.2.6.2 Polyvinylchloride (PVC)

8.2.6.3 Polypropylene (pp)

8.2.6.4 Polyethylene Terephthalate (pet)

8.2.6.5 Foam

8.2.6.6 Metal

8.2.6.7 Other Backing Materials

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Pressure Sensitive Tapes & Labels Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Product

8.3.4.1 Specialty Tapes

8.3.4.2 Packaging Tapes

8.3.4.3 Consumer Tapes

8.3.5 Historic and Forecasted Market Size By By Technology

8.3.5.1 Hot Melt

8.3.5.2 Water-based

8.3.5.3 Solvent-based

8.3.5.4 Radiation-cured

8.3.6 Historic and Forecasted Market Size By By Backing Material

8.3.6.1 Woven/Nonwoven

8.3.6.2 Polyvinylchloride (PVC)

8.3.6.3 Polypropylene (pp)

8.3.6.4 Polyethylene Terephthalate (pet)

8.3.6.5 Foam

8.3.6.6 Metal

8.3.6.7 Other Backing Materials

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Pressure Sensitive Tapes & Labels Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Product

8.4.4.1 Specialty Tapes

8.4.4.2 Packaging Tapes

8.4.4.3 Consumer Tapes

8.4.5 Historic and Forecasted Market Size By By Technology

8.4.5.1 Hot Melt

8.4.5.2 Water-based

8.4.5.3 Solvent-based

8.4.5.4 Radiation-cured

8.4.6 Historic and Forecasted Market Size By By Backing Material

8.4.6.1 Woven/Nonwoven

8.4.6.2 Polyvinylchloride (PVC)

8.4.6.3 Polypropylene (pp)

8.4.6.4 Polyethylene Terephthalate (pet)

8.4.6.5 Foam

8.4.6.6 Metal

8.4.6.7 Other Backing Materials

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Pressure Sensitive Tapes & Labels Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Product

8.5.4.1 Specialty Tapes

8.5.4.2 Packaging Tapes

8.5.4.3 Consumer Tapes

8.5.5 Historic and Forecasted Market Size By By Technology

8.5.5.1 Hot Melt

8.5.5.2 Water-based

8.5.5.3 Solvent-based

8.5.5.4 Radiation-cured

8.5.6 Historic and Forecasted Market Size By By Backing Material

8.5.6.1 Woven/Nonwoven

8.5.6.2 Polyvinylchloride (PVC)

8.5.6.3 Polypropylene (pp)

8.5.6.4 Polyethylene Terephthalate (pet)

8.5.6.5 Foam

8.5.6.6 Metal

8.5.6.7 Other Backing Materials

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Pressure Sensitive Tapes & Labels Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Product

8.6.4.1 Specialty Tapes

8.6.4.2 Packaging Tapes

8.6.4.3 Consumer Tapes

8.6.5 Historic and Forecasted Market Size By By Technology

8.6.5.1 Hot Melt

8.6.5.2 Water-based

8.6.5.3 Solvent-based

8.6.5.4 Radiation-cured

8.6.6 Historic and Forecasted Market Size By By Backing Material

8.6.6.1 Woven/Nonwoven

8.6.6.2 Polyvinylchloride (PVC)

8.6.6.3 Polypropylene (pp)

8.6.6.4 Polyethylene Terephthalate (pet)

8.6.6.5 Foam

8.6.6.6 Metal

8.6.6.7 Other Backing Materials

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Pressure Sensitive Tapes & Labels Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Product

8.7.4.1 Specialty Tapes

8.7.4.2 Packaging Tapes

8.7.4.3 Consumer Tapes

8.7.5 Historic and Forecasted Market Size By By Technology

8.7.5.1 Hot Melt

8.7.5.2 Water-based

8.7.5.3 Solvent-based

8.7.5.4 Radiation-cured

8.7.6 Historic and Forecasted Market Size By By Backing Material

8.7.6.1 Woven/Nonwoven

8.7.6.2 Polyvinylchloride (PVC)

8.7.6.3 Polypropylene (pp)

8.7.6.4 Polyethylene Terephthalate (pet)

8.7.6.5 Foam

8.7.6.6 Metal

8.7.6.7 Other Backing Materials

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Pressure Sensitive Tapes & Labels Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 66.4 Billion |

|

Forecast Period 2024-32 CAGR: |

4.92% |

Market Size in 2032: |

USD 102.30 Billion |

|

Segments Covered: |

By Product |

|

|

|

By Technology |

|

||

|

By Backing Material |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Pressure Sensitive Tapes & Labels Market research report is 2024-2032.

3M (USA), Avery Dennison Corporation (USA), Berry Global Inc. (USA), CCL Industries Inc. (Canada), Intertape Polymer Group (Canada), Lintec Corporation (Japan), Lohmann GmbH & Co. KG (Germany), Nitto Denko Corporation (Japan), Scapa Group Plc (UK), Shurtape Technologies, LLC (USA), Tesa SE (Germany), UPM Raflatac (Finland), VHB Tapes (USA), Wacker Chemie AG (Germany), Zhejiang Yonghe Adhesive Products Co., Ltd. (China), and other active Players

The Pressure Sensitive Tapes & Labels Market is segmented into Product, Technology, Backing Material and region. By Product, the market is categorized into Specialty Tapes, Packaging Tapes, Consumer Tapes. By Technology, the market is categorized into Hot Melt, Water-based, Solvent-based, Radiation-cured. By Backing Material, the market is categorized into Woven/Nonwoven, Polyvinylchloride (PVC), Polypropylene (pp), Polyethylene Terephthalate (pet), Foam, Metal, Other Backing Materials. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Pressure-sensitive tapes and labels or the Pressure Sensitive Tapes and Labels Market is a market involving the manufacturing and selling of adhesive backed goods that bond to surfaces on application of light pressure and do not require heating, water or solvent activators. Such products include for example the adhesive tapes and labels manufactured and applied in the different industries for uses like bonding, labeling, sealing and insulating, among others. Some of the peculiarities highlighted include ease of application, the product’s and substrate nature, and the high durability possessed by pressure-sensitive adhesive. As newer and better adhesives are developed and old ones are disposed of, the market has thus continued to grow to meet the changing industrial and Customer’s expectations.

Pressure Sensitive Tapes & Labels Market Size Was Valued at USD 66.4 Billion in 2023, and is Projected to Reach USD 102.30 Billion by 2032, Growing at a CAGR of 4.92% From 2024-2032.