Probiotic Yogurt Market Synopsis

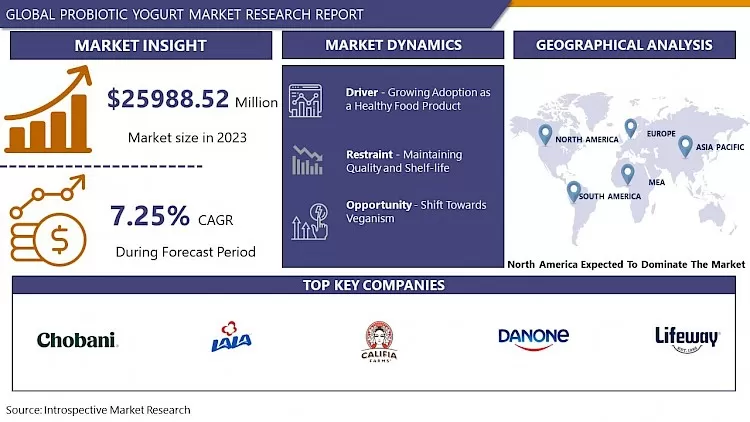

Probiotic Yogurt Market Size Was Valued at USD 25988.52 Million in 2023 and is Projected to Reach USD 48792.97 Million by 2032, Growing at a CAGR of 7.25% From 2024-2032.

Probiotic yogurt contains live beneficial bacteria called probiotics that help maintain the health of the digestive system. It aids in supporting a balanced gut microbiome for overall health.

- Probiotic Yogurt promotes digestive health by maintaining a healthy balance of micro-organisms in the gut, reducing the risk of diarrhea, and assisting with lactose breakdown.

- These helpful bacteria can improve the immune system by increasing immune response and decreasing inflammation. Probiotics may help in improving mental well-being by possibly reducing anxiety and depression symptoms and aiding in stress control.

- Probiotic Yogurt aids in weight control by increasing metabolism, improving feelings of fullness, and assisting in absorbing nutrients. Probiotics found in yogurt can lower the chances of kids' allergies and protect against inflammatory bowel disease and cancer.

- Additionally, they enhance skin well-being by enhancing conditions such as acne and eczema via the gut-skin axis. Adding probiotic yogurt to your daily meals can offer various health advantages.

Source: Company Database

Source: Company Database

- This statistic depicts the market share of probiotic products worldwide 2023, by selected category. In that year, probiotic yogurt held about 71 percent of the category market share.

Probiotic Yogurt Market Trend Analysis

Growing Adoption as a Healthy Food Product

- Consumers are prioritizing health and wellness, mainly by promoting a balanced gut microbiome through probiotics. The rise in popularity of natural and functional food items like probiotic yogurt and supplements can be attributed to the increased emphasis on preventive healthcare.

- Scientific studies have validated the benefits of probiotics, including improved digestion, boosted immunity, and enhanced mental health, leading to increased trust from consumers in these products.

- The popularity of probiotics has grown because of their link to controlling conditions such as irritable bowel syndrome (IBS), inflammatory bowel disease (IBD), and allergies.

- The market has met consumer demand by providing a range of probiotic items in various styles, accommodating different dietary choices and lifestyles, and simplifying the process of integrating them into daily habits for consumers.

Opportunity

Shift Towards Veganism

- Plant-based yogurts with probiotics are becoming increasingly popular in the market, providing a variety of options such as almond, soy, coconut, and oat milk to meet different consumer needs.

- Businesses are concentrating on customizing particular probiotic strains for plant-based settings in order to provide similar health advantages as dairy-based choices.

- These items target the improvement of digestive health and enhancement of the immune system, attracting consumers who prioritize their health. Moreover, vegan probiotic yogurts follow ethical principles by steering clear of animal exploitation and boasting a reduced environmental footprint, attracting consumers interested in sustainability.

- Marketing strategies highlight the advantages of plant-based diets in promoting overall health and lifestyle choices. Consumer demand is the primary factor fueling growth in the market for vegan probiotic yogurts, prompting higher levels of investment in research, production, and marketing.

Probiotic Yogurt Market Segment Analysis:

The Probiotic Yogurt market is segmented on the basis of Product Type, Source, Flavour, Fat Content, and Distribution Channel.

By Flavour, Flavoured Segment Is Expected to Dominate the Market During the Forecast Period

There are two segments by flavour such as flavoured and unflavoured. Among these, the flavored segment is expected to dominate the market during the forecast period.

- Consumer demand for a combination of different flavors and appealing tastes contributes to the success of flavored probiotic yogurts, providing a broad selection of flavors to cater to a variety of consumers.

- The taste of these yogurts improves pleasure and contentment, finding a harmony between wellness advantages and indulgence. Promoting these items as a nutritious snacking choice appeals to health-conscious consumers who prioritize taste.

- In a crowded market, brands can stand out and grow their market share by introducing new flavors and innovating their products. Flavored yogurts are especially well-liked by kids, families, young adults, and city dwellers who value both taste and convenience. Emotional bonds and personal preferences also influence the attraction of these items.

- In-store visibility, along with creative packaging and promotions, also boost sales. In light of consumer preferences for low sugar and natural components, companies can tailor flavored yogurt options to suit specific regions, broadening their global popularity.

By Distribution Channel, Hypermarkets/Supermarkets Segment Held the Largest Share In 2023

There are six segments by distribution channel such as hypermarkets/supermarkets, convenience stores, grocery stores, specialty stores, wholesalers, and online retailers. Among these, the hypermarkets/supermarkets segment held the largest share in 2023.

- Hypermarkets and supermarkets offer a wide variety of probiotic yogurt products, catering to diverse consumer preferences and increasing customer satisfaction.

- With high footfall and visibility, these stores make purchasing probiotic yogurt convenient and offer effective promotional strategies to boost sales. Well-known for quality and safety, they have efficient distribution networks and negotiate better prices with suppliers due to high volumes, potentially leading to lower prices for consumers.

- Strategic product placement and informative displays help customers make informed decisions, while sampling and excellent customer service enhance the overall shopping experience.

- By adapting to health trends and expanding their health-focused product selection, hypermarkets and supermarkets attract health-conscious consumers looking for probiotic yogurt products.

Probiotic Yogurt Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North American consumers are very focused on their health and understand the advantages of probiotics for the digestive and immune systems, which is increasing the need for probiotic products.

- Hectic schedules result in a desire for health supplements that can be easily incorporated. The advanced healthcare systems in the area facilitate the use of probiotics for both preventing and treating illnesses.

- Top research institutions play a key role in driving progress in the probiotics industry. Increased levels of discretionary income enable customers to invest further in health-related products, facilitating the expansion of market reach.

- The clearly established regulatory framework ensures the quality and safety of probiotic products, enhancing consumer trust. North America is where major probiotics manufacturers are based, leading to innovation and market expansion.

Probiotic Yogurt Market Active Players

- Chobani, LLC (United States)

- Danone (France)

- Grupo Lala (Mexico)

- Califia Farms (United States)

- Lifeway Foods, Inc. (United States)

- Bio-K+ (Canada)

- Harmless Harvest (United States)

- GoodBelly Probiotics (United States)

- KeVita (United States)

- Arla Foods, Inc. (Denmark)

- BioGaia AB (Sweden)

- Chr. Hansen Holding A/S (Denmark)

- Danisco A/S (Denmark)

- General Mills Inc. (United States)

- i-Health Inc. (United States)

- Lallemand Inc. (Canada)

- Mother Dairy Fruit & Vegetable Pvt. Ltd. (India)

- Kerry (Ireland)

- Nestle S.A. (Switzerland)

- Probi (Sweden)

- Yakult Honsha Co., Ltd. (Japan)

- Wallaby Organic (United States)

- WhiteWave Foods (United States)

- Fage International (Greece)

- Chiltern Farm Cheese Company (United Kingdom), and Other Active Players.

Key Industry Developments in the Probiotic Yogurt Market:

- In March 2024, Nounós Creamery, a Greek yogurt maker, has chosen Greiner Packaging's sustainable K3® cup for its new probiotic strained yogurt, as part of its efforts to operate in an environmentally friendly manner. They initially used sustainable glass pots for their yogurt and have now opted for the K3 cardboard-plastic packaging for their new 16 oz variant.

- In September 2023, Packaging Solutions provider SIG and AnaBio Technologies, a global name in micro encapsulation technologies

|

Global Probiotic Yogurt Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 25988.52 Mn. |

|

Forecast Period 2024-32 CAGR: |

7.25 % |

Market Size in 2032: |

USD 48792.97 Mn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Source |

|

||

|

By Flavour |

|

||

|

By Fat Content |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Probiotic Yogurt Market by By Product Type (2018-2032)

4.1 Probiotic Yogurt Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Drinkable

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Spoonable

Chapter 5: Probiotic Yogurt Market by By Source (2018-2032)

5.1 Probiotic Yogurt Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Animal Based

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Plant-Based

Chapter 6: Probiotic Yogurt Market by By Flavour (2018-2032)

6.1 Probiotic Yogurt Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Flavoured

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Unflavoured

Chapter 7: Probiotic Yogurt Market by By Fat Content (2018-2032)

7.1 Probiotic Yogurt Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Regular

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Low Fat

7.5 Fat Free

Chapter 8: Probiotic Yogurt Market by By Distribution Channel (2018-2032)

8.1 Probiotic Yogurt Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Hypermarkets/Supermarkets

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Convenience Stores

8.5 Grocery Stores

8.6 Specialty Stores

8.7 Wholesalers

8.8 Online Retailers

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Probiotic Yogurt Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 ADIDAS (GERMANY)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 EVERLAST (UNITED STATES)

9.4 VENUM (FRANCE)

9.5 TOP KING (THAILAND)

9.6 FAIEX (UNKNOWN)

9.7 ZOOBOO (CHINA)

9.8 KANGRUI (CHINA)

9.9 TWINS (THAILAND)

9.10 MAIZO (CHINA)

9.11 BRUCE LEE (UNITED STATES)

9.12 OTHERS

9.13

Chapter 10: Global Probiotic Yogurt Market By Region

10.1 Overview

10.2. North America Probiotic Yogurt Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By By Product Type

10.2.4.1 Drinkable

10.2.4.2 Spoonable

10.2.5 Historic and Forecasted Market Size By By Source

10.2.5.1 Animal Based

10.2.5.2 Plant-Based

10.2.6 Historic and Forecasted Market Size By By Flavour

10.2.6.1 Flavoured

10.2.6.2 Unflavoured

10.2.7 Historic and Forecasted Market Size By By Fat Content

10.2.7.1 Regular

10.2.7.2 Low Fat

10.2.7.3 Fat Free

10.2.8 Historic and Forecasted Market Size By By Distribution Channel

10.2.8.1 Hypermarkets/Supermarkets

10.2.8.2 Convenience Stores

10.2.8.3 Grocery Stores

10.2.8.4 Specialty Stores

10.2.8.5 Wholesalers

10.2.8.6 Online Retailers

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Probiotic Yogurt Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By By Product Type

10.3.4.1 Drinkable

10.3.4.2 Spoonable

10.3.5 Historic and Forecasted Market Size By By Source

10.3.5.1 Animal Based

10.3.5.2 Plant-Based

10.3.6 Historic and Forecasted Market Size By By Flavour

10.3.6.1 Flavoured

10.3.6.2 Unflavoured

10.3.7 Historic and Forecasted Market Size By By Fat Content

10.3.7.1 Regular

10.3.7.2 Low Fat

10.3.7.3 Fat Free

10.3.8 Historic and Forecasted Market Size By By Distribution Channel

10.3.8.1 Hypermarkets/Supermarkets

10.3.8.2 Convenience Stores

10.3.8.3 Grocery Stores

10.3.8.4 Specialty Stores

10.3.8.5 Wholesalers

10.3.8.6 Online Retailers

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Probiotic Yogurt Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By By Product Type

10.4.4.1 Drinkable

10.4.4.2 Spoonable

10.4.5 Historic and Forecasted Market Size By By Source

10.4.5.1 Animal Based

10.4.5.2 Plant-Based

10.4.6 Historic and Forecasted Market Size By By Flavour

10.4.6.1 Flavoured

10.4.6.2 Unflavoured

10.4.7 Historic and Forecasted Market Size By By Fat Content

10.4.7.1 Regular

10.4.7.2 Low Fat

10.4.7.3 Fat Free

10.4.8 Historic and Forecasted Market Size By By Distribution Channel

10.4.8.1 Hypermarkets/Supermarkets

10.4.8.2 Convenience Stores

10.4.8.3 Grocery Stores

10.4.8.4 Specialty Stores

10.4.8.5 Wholesalers

10.4.8.6 Online Retailers

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Probiotic Yogurt Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By By Product Type

10.5.4.1 Drinkable

10.5.4.2 Spoonable

10.5.5 Historic and Forecasted Market Size By By Source

10.5.5.1 Animal Based

10.5.5.2 Plant-Based

10.5.6 Historic and Forecasted Market Size By By Flavour

10.5.6.1 Flavoured

10.5.6.2 Unflavoured

10.5.7 Historic and Forecasted Market Size By By Fat Content

10.5.7.1 Regular

10.5.7.2 Low Fat

10.5.7.3 Fat Free

10.5.8 Historic and Forecasted Market Size By By Distribution Channel

10.5.8.1 Hypermarkets/Supermarkets

10.5.8.2 Convenience Stores

10.5.8.3 Grocery Stores

10.5.8.4 Specialty Stores

10.5.8.5 Wholesalers

10.5.8.6 Online Retailers

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Probiotic Yogurt Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By By Product Type

10.6.4.1 Drinkable

10.6.4.2 Spoonable

10.6.5 Historic and Forecasted Market Size By By Source

10.6.5.1 Animal Based

10.6.5.2 Plant-Based

10.6.6 Historic and Forecasted Market Size By By Flavour

10.6.6.1 Flavoured

10.6.6.2 Unflavoured

10.6.7 Historic and Forecasted Market Size By By Fat Content

10.6.7.1 Regular

10.6.7.2 Low Fat

10.6.7.3 Fat Free

10.6.8 Historic and Forecasted Market Size By By Distribution Channel

10.6.8.1 Hypermarkets/Supermarkets

10.6.8.2 Convenience Stores

10.6.8.3 Grocery Stores

10.6.8.4 Specialty Stores

10.6.8.5 Wholesalers

10.6.8.6 Online Retailers

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Probiotic Yogurt Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By By Product Type

10.7.4.1 Drinkable

10.7.4.2 Spoonable

10.7.5 Historic and Forecasted Market Size By By Source

10.7.5.1 Animal Based

10.7.5.2 Plant-Based

10.7.6 Historic and Forecasted Market Size By By Flavour

10.7.6.1 Flavoured

10.7.6.2 Unflavoured

10.7.7 Historic and Forecasted Market Size By By Fat Content

10.7.7.1 Regular

10.7.7.2 Low Fat

10.7.7.3 Fat Free

10.7.8 Historic and Forecasted Market Size By By Distribution Channel

10.7.8.1 Hypermarkets/Supermarkets

10.7.8.2 Convenience Stores

10.7.8.3 Grocery Stores

10.7.8.4 Specialty Stores

10.7.8.5 Wholesalers

10.7.8.6 Online Retailers

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Probiotic Yogurt Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 25988.52 Mn. |

|

Forecast Period 2024-32 CAGR: |

7.25 % |

Market Size in 2032: |

USD 48792.97 Mn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Source |

|

||

|

By Flavour |

|

||

|

By Fat Content |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Probiotic Yogurt Market research report is 2024-2032.

Chobani, LLC (United States), Danone (France), Grupo Lala (Mexico), Califia Farms (United States), Lifeway Foods, Inc. (United States), Bio-K+ (Canada), Harmless Harvest (United States), GoodBelly Probiotics (United States), KeVita (United States), Arla Foods, Inc. (Denmark), BioGaia AB (Sweden), Chr. Hansen Holding A/S (Denmark), Danisco A/S (Denmark), General Mills Inc. (United States), i-Health Inc. (United States), Lallemand Inc. (Canada), Mother Dairy Fruit & Vegetable Pvt. Ltd. (India), Kerry (Ireland), Nestle S.A. (Switzerland), Probi (Sweden), Yakult Honsha Co., Ltd. (Japan), Wallaby Organic (United States), WhiteWave Foods (United States), Fage International (Greece), Chiltern Farm Cheese Company (United Kingdom), and Other Active Players.

The Probiotic Yogurt Market is segmented into Product Type, Source, Flavour, Fat Content, Distribution Channel, and region. By Product Type, the market is categorized into Drinkable and Spoonable. By Source, the market is categorized into Animal Based, Plant-Based. By Flavour, the market is categorized into Flavoured, Unflavoured. By Fat Content, the market is categorized into Regular, Low Fat, Fat-Free. By Distribution Channel, The Market Is Categorized into Hypermarkets/Supermarkets, Convenience Stores, Grocery Stores, Specialty Stores, Wholesalers, And Online Retailers. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Probiotic yogurt contains live beneficial bacteria called probiotics that help maintain the health of the digestive system. It aids in supporting a balanced gut microbiome for overall health.

Probiotic Yogurt Market Size Was Valued at USD 25988.52 Million in 2023, and is Projected to Reach USD 48792.97 Million by 2032, Growing at a CAGR of 7.25% From 2024-2032.