Ragweed Pollen Allergy Treatment Market Synopsis:

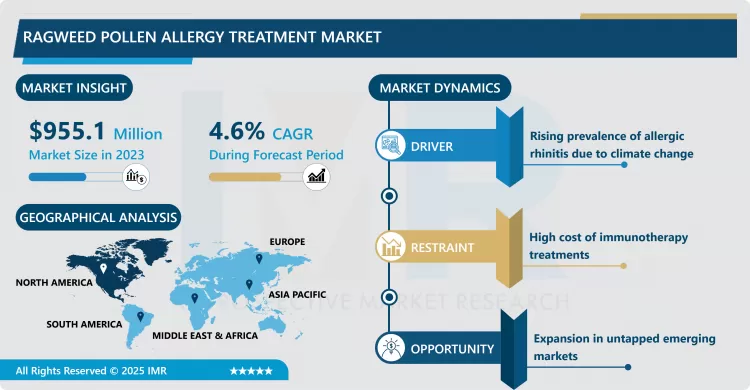

Ragweed Pollen Allergy Treatment Market Size Was Valued at USD 955.1 Million in 2023, and is Projected to Reach USD 1,431.64 Million by 2032, Growing at a CAGR of 4.6% From 2024-2032.

Ragweed Pollen Allergy Treatment Industry on the other hand is the specialized healthcare industry that deals with the diagnosis, management and treatment of ragweed pollen allergy ailments. Ragweed pollen is one of the most widespread allergens causing allergic rhinitis or hay fever and asthma in individuals during late summer and early autumn. This includes different treatments including antihistamine therapy; corticosteroid therapy; decongestant therapy as well as shot and tablet immunotherapy. These treatments are available in different outlets; hospital’s pharmacies, retail pharmacies, and even online sales. The market is stoked by a rising incidence of people suffering from general allergic conditions, enhancing the awareness of those conditions, and the occurrence of new drug active pharmaceutical ingredient developed with a purpose of treating allergic reactions efficiently. Firstly, the advancement in personalized medicine can also be said to have been a reason for growth in the market, as are the inclusion of digital health solutions for monitoring allergies.

The Ragweed Pollen Allergy Treatment Market globally has shown impressive growth in the last decade with the increase in rate of diseases related to allergies around the world. Ragweed pollen is one of the main triggers of allergic rhinitis in a given period, causing allergic reactions in millions of people, primarily in North America, where ragweed concentration is comparatively high. Due to urbanization, changing environments around the world, and longer pollen seasons caused by climate change, the health affect of allergies has grown worse. All such factors have contributed towards increasing the necessity of the availability of better treatment methods hence, contributing to the growth of the market.

Further, recent government policies and increasing consciousness for better allergy diagnostic facilities and improving treatment access along with the rising healthcare expenditure have greatly enhanced the market prospects. Pharmaceutical companies, in addition, have released sophisticated drug forms and delivery systems including the nasal sprays and inhalers have also increased the rates of use. However, the market is saturated and a pleasure to behold concerning competition as giant market players are constantly developing new products through research. However, there are certain obstacles including the high costs related to some treatments and the relatively low popularity, especially in the countries of the third world, market prospects look relatively favorable with the continuous growth of both the range of treatments and their delivery methods.

Ragweed Pollen Allergy Treatment Market Trend Analysis:

Rising Preference for Immunotherapy

- One of the most apparent tendencies on Ragweed Pollen Allergy Treatment Market is the growing popularity of immunotherapy as a chronic disease treatment. Subcutaneous immunotherapy (SCIT) and sublingual immunotherapy (SLIT) also provides powerful methods to treat ragweed pollen allergy proactively by building up unique antibody titers in the patient’s immune system. awise departure from the conventional approach to treatment that mainly consists of alleviating symptoms, immunotherapy diagnoses allergies and rids the body of it.

- Immunotherapy is now being considered as part of treatment management in allergies since its effectiveness is being recognized by patients and even doctors. Further, the development of oral tablets of SLIT has facilitated the acceptability of the treatment by eliminating systemic adverse effects and presenting an option other from the immunotherapy injections. Another factor creating the future of the market is the increasing move towards individual immunotherapy that is likely to be based on each allergic profile.

Expansion in Emerging Markets

- The global Ragweed Pollen Allergy Treatment market is estimated to offer sustainable growth prospects in the emerging regions primarily Asia-Pacific and Latin America. In these regions, due to advancing urbanization and consequent environmental changes and increased air pollution, people are more likely to be affected by seasonal allergies.

- Despite this, significant proportions of patients in these regions are either diagnosed too late or not treated adequately because of the restricted access to health care and low levels of knowledge about the potential kinds of treatment. This also opens up a marvelous chance for the pharma majors to occupy more spaces in the field by extending actual solutions that are affordable and accessible in the specific region that requires it. Cooperation in the field of diagnostics and promotion of awareness regarding allergies as well as launching campaigns for allergy management is further expected to help ADMA unlock these latent markets.

Ragweed Pollen Allergy Treatment Market Segment Analysis:

Ragweed Pollen Allergy Treatment Market is Segmented on the basis of Drug Class, Distribution Channel, and Region

By Drug Class, Antihistamines segment is expected to dominate the market during the forecast period

- The Ragweed Pollen Allergy Treatment Market size is analysed to be dominated by the segment of antihistamine during the given period of the forecast. These drugs are effective in that they inhibit histamine which causes all the symptoms related to allergy for instance; sneezing, itching and nasal congestion. The reasons for this choice are easy access to antihistamine preparations, rapid onset of their effect, and relatively low cost compared with other drugs. First generation and second generation antihistamines are the two among which second generation is popular due to low sedation. Because they are effective in relief of mild to moderate symptoms they are considered first-line medications for many patients.

- With regards to the segmented product category it is possible to observe that the segment continues to experience strong growth because of the constant emergence of new types of antihistamines that demonstrate even higher levels of efficiency while at the same time being less damaging to the human body. Accessibility of antihistamines without prescription, preference in usage of these products and wide range of patients using them have all contributed tremendously towards enhancing their position on the leading role in the market. The segment has shown consistent technological development and has also benefited from a rising trend in consumers seeking for ‘fast fix’ for allergy symptoms.

By Distribution Channel, Hospital Pharmacy Channel segment expected to held the largest share

- Among all these channels of distribution, the hospital pharmacies segment is expected to dominate the Ragweed Pollen Allergy Treatment Market due to the primary center for administration of prescription drugs and allergens treatments. Hospital pharmacies are extremely effective for patients who need professional advice and full service for their medications since such outlets supply quality drugs. This is because the cases of severe allergic reactions that warrant prescription medication like corticosteroids and immunotherapy solutions are on the rise and this has help to fuel the need for hospital pharmacy.

- Furthermore, the high number of multispecialty hospitals with new allergy clinics has also spread the reach of hospital pharmacies such that they can now serve a diverse patient population. Owing to new developments in the field of healthcare and increasing healthcare costs across the globe, hospital pharmacy segments are believed to continue their market domination. These concerns speak to their objectives of guaranteeing access to innovate treatment and efficient professional counseling services, making their allergy management proposition even stronger.

Ragweed Pollen Allergy Treatment Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America region the foremost important area acknowledged with a major market share in the Ragweed Pollen Allergy Treatment Market. This position is explained by the high illiteracy of ragweed pollen allergies, especially in the USA, where more than 15% of the population is affected by the medical manifestations of allergic reactions during the period of increased concentrations of this allergen in the air.

- That is why with conducive health care policies and practices besides having diagnostic and treatment facilities this market has been strengthened. Another factor that keeps North America ahead is the availability of large numbers of important market players, as well as continuous research of new methods and types of allergy therapies. Some sources indicate that North America held forty to forty-five percent of the entire market.

Active Key Players in the Ragweed Pollen Allergy Treatment Market:

- AbbVie Inc. (United States)

- ALK-Abelló A/S (Denmark)

- AstraZeneca PLC (United Kingdom)

- Bayer AG (Germany)

- Boehringer Ingelheim International GmbH (Germany)

- Dr. Reddy's Laboratories Ltd. (India)

- GlaxoSmithKline plc (United Kingdom)

- Johnson & Johnson (United States)

- Meda Pharmaceuticals (United States)

- Merck & Co., Inc. (United States)

- Novartis International AG (Switzerland)

- Pfizer Inc. (United States)

- Sanofi S.A. (France)

- Stallergenes Greer (United Kingdom)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Other Active Players

|

Ragweed Pollen Allergy Treatment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 955.1 Million |

|

Forecast Period 2024-32 CAGR: |

4.6% |

Market Size in 2032: |

USD 1,431.64 Million |

|

Segments Covered: |

By Drug Class |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Ragweed Pollen Allergy Treatment Market by By Drug Class (2018-2032)

4.1 Ragweed Pollen Allergy Treatment Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Antihistamines

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Decongestants

4.5 Nasal Corticosteroids

4.6 Others

Chapter 5: Ragweed Pollen Allergy Treatment Market by By Distribution Channel (2018-2032)

5.1 Ragweed Pollen Allergy Treatment Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Hospital Pharmacy

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Retail Pharmacy

5.5 Online Channel

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Ragweed Pollen Allergy Treatment Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ABBVIE INC. (UNITED STATES)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 ALK-ABELLÓ A/S (DENMARK)

6.4 ASTRAZENECA PLC (UNITED KINGDOM)

6.5 BAYER AG (GERMANY)

6.6 BOEHRINGER INGELHEIM INTERNATIONAL GMBH (GERMANY)

6.7 DR. REDDY'S LABORATORIES LTD. (INDIA)

6.8 GLAXOSMITHKLINE PLC (UNITED KINGDOM)

6.9 JOHNSON & JOHNSON (UNITED STATES)

6.10 MEDA PHARMACEUTICALS (UNITED STATES)

6.11 MERCK & CO. INC. (UNITED STATES)

6.12 NOVARTIS INTERNATIONAL AG (SWITZERLAND)

6.13 PFIZER INC. (UNITED STATES)

6.14 SANOFI S.A. (FRANCE)

6.15 STALLERGENES GREER (UNITED KINGDOM)

6.16 TEVA PHARMACEUTICAL INDUSTRIES LTD. (ISRAEL)

6.17 OTHER ACTIVE PLAYERS

Chapter 7: Global Ragweed Pollen Allergy Treatment Market By Region

7.1 Overview

7.2. North America Ragweed Pollen Allergy Treatment Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By By Drug Class

7.2.4.1 Antihistamines

7.2.4.2 Decongestants

7.2.4.3 Nasal Corticosteroids

7.2.4.4 Others

7.2.5 Historic and Forecasted Market Size By By Distribution Channel

7.2.5.1 Hospital Pharmacy

7.2.5.2 Retail Pharmacy

7.2.5.3 Online Channel

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Ragweed Pollen Allergy Treatment Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By By Drug Class

7.3.4.1 Antihistamines

7.3.4.2 Decongestants

7.3.4.3 Nasal Corticosteroids

7.3.4.4 Others

7.3.5 Historic and Forecasted Market Size By By Distribution Channel

7.3.5.1 Hospital Pharmacy

7.3.5.2 Retail Pharmacy

7.3.5.3 Online Channel

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Ragweed Pollen Allergy Treatment Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By By Drug Class

7.4.4.1 Antihistamines

7.4.4.2 Decongestants

7.4.4.3 Nasal Corticosteroids

7.4.4.4 Others

7.4.5 Historic and Forecasted Market Size By By Distribution Channel

7.4.5.1 Hospital Pharmacy

7.4.5.2 Retail Pharmacy

7.4.5.3 Online Channel

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Ragweed Pollen Allergy Treatment Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By By Drug Class

7.5.4.1 Antihistamines

7.5.4.2 Decongestants

7.5.4.3 Nasal Corticosteroids

7.5.4.4 Others

7.5.5 Historic and Forecasted Market Size By By Distribution Channel

7.5.5.1 Hospital Pharmacy

7.5.5.2 Retail Pharmacy

7.5.5.3 Online Channel

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Ragweed Pollen Allergy Treatment Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By By Drug Class

7.6.4.1 Antihistamines

7.6.4.2 Decongestants

7.6.4.3 Nasal Corticosteroids

7.6.4.4 Others

7.6.5 Historic and Forecasted Market Size By By Distribution Channel

7.6.5.1 Hospital Pharmacy

7.6.5.2 Retail Pharmacy

7.6.5.3 Online Channel

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Ragweed Pollen Allergy Treatment Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By By Drug Class

7.7.4.1 Antihistamines

7.7.4.2 Decongestants

7.7.4.3 Nasal Corticosteroids

7.7.4.4 Others

7.7.5 Historic and Forecasted Market Size By By Distribution Channel

7.7.5.1 Hospital Pharmacy

7.7.5.2 Retail Pharmacy

7.7.5.3 Online Channel

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Ragweed Pollen Allergy Treatment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 955.1 Million |

|

Forecast Period 2024-32 CAGR: |

4.6% |

Market Size in 2032: |

USD 1,431.64 Million |

|

Segments Covered: |

By Drug Class |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Ragweed Pollen Allergy Treatment Market research report is 2024-2032.

AbbVie Inc. (United States), ALK-Abelló A/S (Denmark), AstraZeneca PLC (United Kingdom), Bayer AG (Germany), Boehringer Ingelheim International GmbH (Germany), Dr. Reddy's Laboratories Ltd. (India), GlaxoSmithKline plc (United Kingdom), Johnson & Johnson (United States), Meda Pharmaceuticals (United States), Merck & Co., Inc. (United States), Novartis International AG (Switzerland), Pfizer Inc. (United States), Sanofi S.A. (France), Stallergenes Greer (United Kingdom), Teva Pharmaceutical Industries Ltd. (Israel), and Other Active Players.

The Ragweed Pollen Allergy Treatment Market is segmented into Drug Class, Distribution Channel, and Region. By Drug Class, the market is categorized into Antihistamines, Decongestants, Nasal Corticosteroids, and Others. By Distribution Channel, the market is categorized into Hospital Pharmacy, Retail Pharmacy, and Online Channel. By Region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Ragweed Pollen Allergy Treatment Industry on the other hand is the specialized healthcare industry that deals with the diagnosis, management and treatment of ragweed pollen allergy ailments. Ragweed pollen is one of the most widespread allergens causing allergic rhinitis or hay fever and asthma in individuals during late summer and early autumn. This includes different treatments including antihistamine therapy; corticosteroid therapy; decongestant therapy as well as shot and tablet immunotherapy. These treatments are available in different outlets; hospital’s pharmacies, retail pharmacies, and even online sales. The market is stoked by a rising incidence of people suffering from general allergic conditions, enhancing the awareness of those conditions, and the occurrence of new drug active pharmaceutical ingredient developed with a purpose of treating allergic reactions efficiently. Firstly, the advancement in personalized medicine can also be said to have been a reason for growth in the market, as are the inclusion of digital health solutions for monitoring allergies.

Ragweed Pollen Allergy Treatment Market Size Was Valued at USD 955.1 Million in 2023, and is Projected to Reach USD 1,431.64 Million by 2032, Growing at a CAGR of 4.6% From 2024-2032.