Global Renewable Energy Market Synopsis

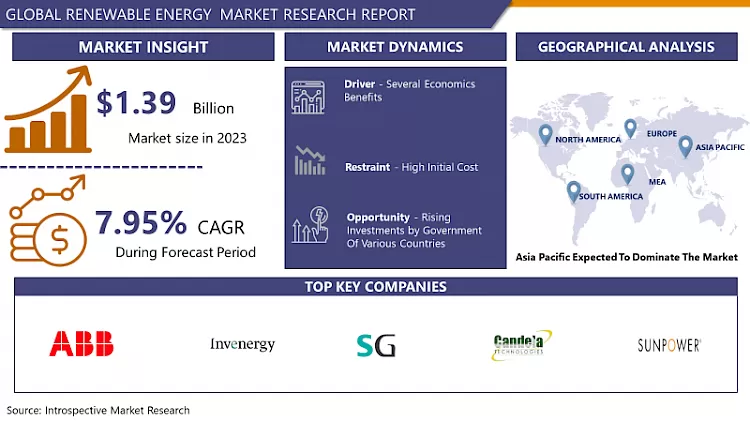

Renewable Energy Market Size Was Valued at USD 1.39 Billion in 2023 and is Projected to Reach USD 2.77 Billion by 2032, Growing at a CAGR of 7.95% From 2024-2032.

Renewable energy is derived from sources such as the wind and the sun. Solar, geothermal, wind, bioenergy, hydropower, and ocean energy are among the most important renewable energy sources.

- Renewable energy is currently utilized in the heating, electricity, cooling, and transportation sectors. Renewable energy provides approximately 7 percent of the world's energy demand. Renewable energy is costlier than fossil fuels. Global warming caused by carbon dioxide (CO2) emissions from the combustion of fossil fuels is the most important factor driving the adoption of renewable energy sources.

- Concerns regarding the reduction of greenhouse gas emissions, an increase in the search for energy security, aversion to traditional nuclear power, and a lack of advancement in the application of nuclear power are anticipated to drive the geothermal power market over the forecast period.

- Various governments in developing and developed nations have prioritized the promotion of renewable energy sources due to their increased output efficiency, lower pollution levels, and low maintenance costs. All of these factors increase the demand for renewable energy, thereby fostering the expansion of the global renewable energy market.

Global Renewable Energy Market Trend Analysis

Several Economics Benefits

- Renewable energy offers several economic benefits such as Landowner Income, Reduced Energy Costs, Increased Property Value, Avoidance of Climate Impacts, and many others

- Renewable energy provides rural landowners and farmers with an additional source of income. According to the American Wind Energy Association (AWEA), rural landowners who host wind farms in the United States receive approximately $222 million annually. Farmers can also earn money by cultivating crops used as biofuels. Currently, corn ethanol is the primary way for farmers to participate in the energy industry, but other biofuels are beginning to gain traction.

- In addition, Residential, commercial, and industrial energy consumers can save money by switching to renewable energy. Theoretically, installing solar panels on someone’s property enables users to generate their own electricity, allowing them to eliminate their energy bill entirely. The precise amount users save depends on numerous variables, including their location. According to Energy Sage, the average savings range between $10,483 and $30,523 in Washington and Massachusetts, respectively. These types of benefits propel the growth of the renewable energy market.

Rising Investments by Government of Various Countries

- Increasing investments in renewable energy sources and favorable government policies are anticipated to drive market growth over the forecast period. For Instance, The British government established a $1.2 billion package for public and private investment in India's green initiatives and renewable energy sources in September 2021.

- They have established a Climate Finance Leadership Initiative (CFLI) India partnership with the intent of mobilizing private funding for sustainable infrastructure in India. These investments would assist India in reaching its 450 Gw renewable energy target by 2030.

- Thus, the government's investment in renewable energy sources is driving market growth over the forecast period.

Global Renewable Energy Market Segment Analysis:

Global Renewable Energy Market Segmented on the basis of type, application, and end-users.

By Product, the Hydropower segment is expected to dominate the market during the forecast period

- In the past few years, the increased investment in the generation of off-grid energy and electrification of rural areas in developing economies such as China, India, Brazil, Colombia, and Vietnam has increased the demand for small-scale hydropower plants.

- Increasing government initiatives to promote the generation and use of hydropower is also driving the growth of the hydropower segment of the global renewable energy market.

- For instance, the Government of India adopted the Rajiv Gandhi Grameen Videutikaran Yojana to electrify rural areas in India. Therefore, the demand for hydroelectric power is greater, resulting in the hydropower segment's dominance.

By Application, Industrial sector segment held the largest share of 62.40% in 2022

- The industrial sector stands as the primary dominator and the fastest-growing segment for several compelling reasons. Industries have been actively embracing renewable energy sources, driven by a blend of economic, environmental, and regulatory factors. This sector's dominance is propelled by its substantial energy demands, pushing for scalable and sustainable solutions to meet these needs while reducing reliance on traditional fossil fuels.

- Industries, with their substantial energy consumption, recognize the cost-efficiency and long-term savings inherent in renewable sources. The implementation of solar, wind, hydroelectric, and increasingly, advanced technologies like biomass and geothermal, caters to their substantial power needs. These solutions not only offer a cleaner energy footprint but also promise stable energy costs, mitigating the vulnerability to volatile fossil fuel prices.

Global Renewable Energy Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- In recent years, the Asia-Pacific region has dominated the renewable energy market. It is likely to maintain its dominance throughout the period of forecast.

- China will be the global leader in the deployment of renewable energy sources by 2021. In 2021, the nation's total renewable energy capacity reached 1,020.2 GW, an increase of approximately 13.4% from the previous year. Wind, solar, and hydropower are the primary renewable energy sources in the country.

- In conjunction with the country's expanding economy and growing population, India's energy demand has increased significantly. In 2021, the nation produced 150,3 TWh of electricity from hydropower, compared to 114.3 TWh in 2011.

- India has also become the world's third-largest consumer of electricity, behind China and the United States. Moreover, India's net power generation capacity increased significantly over the past decade, with the majority of the increase attributable to large hydro and other renewable energy sources.

- The Indian government has set a goal of installing 175 GW of renewable energy capacity by 2022, including 100 GW of solar, 60 GW of wind, 10 GW of biopower, and 5 GW of small hydropower. In addition, the Indian Ministry of New and Renewable Energy expects 15 billion dollars to be invested in renewable energy, electric vehicles, solar equipment manufacturing, and green hydrogen in 2022.

- In addition, SJVN (Satluj Jal Vidyut Nigam Ltd) won a 125 MW solar project in Uttar Pradesh through a bidding process held by the Uttar Pradesh New and Renewable Energy Development Agency in January 2022. (UPNEDA). It consists of a 75 MW grid-connected solar project in the Jalaun district and a 50 MW solar project in the Kanpur Dehat district. Consequently, these developments are likely to make Asia-Pacific the market leader in renewable energy during the forecast period.

Global Renewable Energy Market Top Key Players:

- General Electric (US)

- Invenergy (US)

- Tesla (USA)

- First Solar (USA)

- SunPower (USA)

- Candela Technologies (USA)

- Xcel Energy Inc. (US)

- Siemens Gamesa Renewable Energy (Spain)

- ABB (Switzerland)

- Meyer Burger Technology AG (Switzerland)

- Vestas Wind Systems (Denmark)

- Acconia (Europe)

- Enel Spa (Italy)

- Innergex (Canada)

- Schneider Electric (France)

- Enercon GmbH (Germany)

- Suzlon Energy Ltd. (India)

- Tata Power (India)

- Longi Green Energy Technology (China)

- JA Solar Technology Co., Ltd. (China)

- Trina Solar Limited (China)

- Sungrow Power Supply Co., Ltd. (China)

- BYD Company Ltd. (China)

- Hanwha Q CELLS (South Korea)

- SolarEdge Technologies (Israel)

Key Industry Developments in the Global Renewable Energy Market:

In November 2023, Siemens Gamesa Renewable Energy (Spain): Launched its SG 14.0-222 DD offshore wind turbine, the most powerful turbine on the market with a capacity of 14 MW, significantly increasing potential energy output from offshore wind farms.

In December 2023, Vestas Wind Systems (Denmark): Introduced its V255-15 MW onshore wind turbine, boasting the largest rotor diameter in the industry, capable of generating enough power to supply over 20,000 households.

|

Global Renewable Energy Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.39 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.95% |

Market Size in 2032: |

USD 2.77 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Renewable Energy Market by By Product (2018-2032)

4.1 Renewable Energy Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Hydro Power

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Wind Power

4.5 Solar Power

4.6 Bioenergy

4.7 Others

Chapter 5: Renewable Energy Market by By Application (2018-2032)

5.1 Renewable Energy Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Industrial

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Residential

5.5 Commercial

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Renewable Energy Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 CREE LIGHTING (UNITED STATES)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 EATON CORPORATION (UNITED STATES)

6.4 GAMASONIC (UNITED STATES)

6.5 HUBBELL OUTDOOR (UNITED STATES)

6.6 GREENSHINE NEW ENERGY (UNITED STATES)

6.7 SOLAR STREET LIGHTS USA (UNITED STATES)

6.8 OKSOLAR (UNITED STATES)

6.9 SBM-SOLARTECH (UNITED STATES)

6.10 SEPCO SOLAR ELECTRIC POWER COMPANY (UNITED STATES)

6.11 CARMANAH TECHNOLOGIES (CANADA)

6.12 SIGNIFY HOLDING (NETHERLANDS)

6.13 HOLLANDIA POWER (NETHERLANDS)

6.14 OSRAM LICHT AG (GERMANY)

6.15 SUNNA DESIGN SA (FRANCE)

6.16 FLEXSOL SOLUTIONS (UNITED KINGDOM)

6.17 LIGMAN (THAILAND)

6.18 JIAWEI (CHINA)

6.19 LEADSUN (CHINA)

6.20 SOKOYO SOLAR LIGHTING CO. LTD (CHINA)

6.21 SHENZHEN SPARK (CHINA)

Chapter 7: Global Renewable Energy Market By Region

7.1 Overview

7.2. North America Renewable Energy Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By By Product

7.2.4.1 Hydro Power

7.2.4.2 Wind Power

7.2.4.3 Solar Power

7.2.4.4 Bioenergy

7.2.4.5 Others

7.2.5 Historic and Forecasted Market Size By By Application

7.2.5.1 Industrial

7.2.5.2 Residential

7.2.5.3 Commercial

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Renewable Energy Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By By Product

7.3.4.1 Hydro Power

7.3.4.2 Wind Power

7.3.4.3 Solar Power

7.3.4.4 Bioenergy

7.3.4.5 Others

7.3.5 Historic and Forecasted Market Size By By Application

7.3.5.1 Industrial

7.3.5.2 Residential

7.3.5.3 Commercial

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Renewable Energy Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By By Product

7.4.4.1 Hydro Power

7.4.4.2 Wind Power

7.4.4.3 Solar Power

7.4.4.4 Bioenergy

7.4.4.5 Others

7.4.5 Historic and Forecasted Market Size By By Application

7.4.5.1 Industrial

7.4.5.2 Residential

7.4.5.3 Commercial

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Renewable Energy Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By By Product

7.5.4.1 Hydro Power

7.5.4.2 Wind Power

7.5.4.3 Solar Power

7.5.4.4 Bioenergy

7.5.4.5 Others

7.5.5 Historic and Forecasted Market Size By By Application

7.5.5.1 Industrial

7.5.5.2 Residential

7.5.5.3 Commercial

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Renewable Energy Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By By Product

7.6.4.1 Hydro Power

7.6.4.2 Wind Power

7.6.4.3 Solar Power

7.6.4.4 Bioenergy

7.6.4.5 Others

7.6.5 Historic and Forecasted Market Size By By Application

7.6.5.1 Industrial

7.6.5.2 Residential

7.6.5.3 Commercial

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Renewable Energy Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By By Product

7.7.4.1 Hydro Power

7.7.4.2 Wind Power

7.7.4.3 Solar Power

7.7.4.4 Bioenergy

7.7.4.5 Others

7.7.5 Historic and Forecasted Market Size By By Application

7.7.5.1 Industrial

7.7.5.2 Residential

7.7.5.3 Commercial

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Renewable Energy Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.39 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.95% |

Market Size in 2032: |

USD 2.77 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Global Renewable Energy Market research report is 2024-2032.

Invenergy, Tesla, First Solar, SunPower, Candela Technologies, Xcel Energy Inc., Siemens Gamesa Renewable Energy, ABB, Meyer Burger Technology AG, Vestas Wind Systems, Acconia, Enel Spa, Innergex, Schneider Electric, Enercon GmbH, Suzlon Energy Ltd., Tata Power, Longi Green Energy Technology, JA Solar Technology Co., Ltd., Trina Solar Limited, Sungrow Power Supply Co., Ltd., BYD Company Ltd., Hanwha Q CELLS, SolarEdge Technologies and Other Major Players.

The Renewable Energy Market is segmented into Products, Applications, and regions. By Product, the market is categorized into Hydro Power, Wind Power, Solar Power, Bioenergy, and Others. By Application, the market is categorized into Industrial, Residential, and Commercial. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Renewable energy is derived from sources such as the wind and the sun. Solar, geothermal, wind, bioenergy, hydropower, and ocean energy are among the most important renewable energy sources.

Renewable Energy Market Size Was Valued at USD 1.39 Billion in 2023 and is Projected to Reach USD 2.77 Billion by 2032, Growing at a CAGR of 7.95% From 2024-2032.