Retail Coffee Chains Market Synopsis

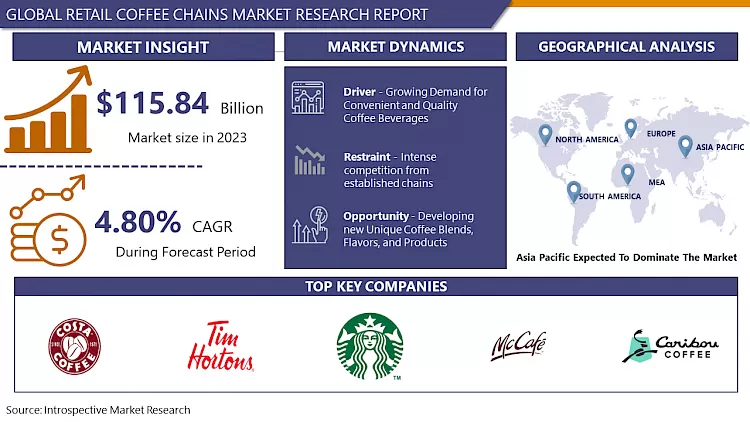

Retail Coffee Chains Market Size Was Valued at USD 115.84 Billion in 2023 and is Projected to Reach USD 176.65 Billion by 2032, Growing at a CAGR of 4.80 % From 2024-2032.

Retail coffee chains are businesses that specialize in selling coffee and related products through multiple locations, often following a standardized model. These chains typically offer a variety of coffee beverages, pastries, and merchandise conveniently and consistently. They provide customers with a familiar experience across different locations, often emphasizing speed, convenience, and quality.

The retail coffee chain market is a dynamic and competitive sector within the global coffee industry. Characterized by well-known brands like Starbucks, Costa Coffee, and Dunkin', among others, this market caters to the growing demand for premium coffee experiences and convenient access to caffeine fixes.

- The market is driven by the increasing popularity of specialty coffee beverages, urbanization, and changing consumer lifestyles. Retail coffee chains offer a variety of products, including espresso, brewed coffee, teas, snacks, and pastries.

- The market spans across various regions, with a strong presence in urban centers and commercial hubs. Expansion strategies often involve franchising, partnerships, and strategic location selection to maximize foot traffic and brand visibility.

- Technology also plays a significant role, with mobile ordering, loyalty programs, and digital marketing being crucial components of many chains' business models. Moreover, sustainability and ethical sourcing practices are increasingly becoming focal points for consumers, prompting coffee chains to emphasize transparency and environmental stewardship in their operations.

- The retail coffee chain market continues to grow, driven by innovation, evolving consumer preferences, and the enduring allure of the coffee culture. As the market evolves, adaptation and differentiation will remain essential for companies looking to flourish in this competitive landscape.

Retail Coffee Chains Market Trend Analysis

Growing Demand for Convenient and Quality Coffee Beverages

- There is growing demand for a fast-paced lifestyle, consumers increasingly pursue convenience in their daily routines. Retail coffee chains offer a quick and accessible solution for individuals looking to satisfy their coffee cravings without the hassle of brewing at home or waiting in long lines at traditional cafes.

- Moreover, there is a growing emphasis on the quality of coffee among consumers. As coffee culture continues to evolve, people are becoming more discerning about the taste and authenticity of their coffee. Retail coffee chains capitalize on this demand by offering a wide range of high-quality coffee options, often with customizable features to cater to individual preferences.

- The explosion of retail coffee chains is also driven by the rise of socialization spaces. These establishments serve as gathering points for friends, colleagues, and communities, fostering social interactions and providing a relaxed ambiance for meetings or casual hangouts. The combination of convenience, quality, and social appeal makes retail coffee chains a preferred choice for many consumers, driving the market's growth trajectory.

Developing new Unique Coffee Blends, Flavors, and Products

- Consumers are increasingly adventurous in their taste preferences and seek out new and exciting flavor experiences. By continuously innovating and introducing new blends and flavors, coffee chains can attract and retain customers who are looking for something different and distinctive. The unique coffee offerings provide a competitive edge in a crowded market. With numerous coffee chains vying for consumer attention, differentiation is crucial for success. By developing proprietary blends and exclusive flavors, coffee chains can carve out a niche for themselves and stand out from the competition.

- Moreover, creating new coffee products allows chains to capitalize on emerging trends and cater to changing consumer preferences. Whether it's incorporating exotic ingredients, offering seasonal specialties, or tapping into health-conscious trends, innovative coffee products enable chains to stay relevant and appeal to a broad customer base.

- Furthermore, introducing new products can drive foot traffic and encourage repeat visits as customers seek out the latest offerings. This can lead to increased sales and revenue opportunities for coffee chains, ultimately contributing to their growth and expansion strategies. The development of new and unique coffee blends, flavors, and products represents a strategic opportunity for retail coffee chains to satisfy evolving consumer demands, differentiate themselves in the market, and drive business growth.

Retail Coffee Chains Market Segment Analysis:

Retail Coffee Chains Market Segmented based on type, application, and end-users.

By Type, the Dine-In segment is expected to dominate the market during the forecast period

- The dine-in segment offers customers a unique experience beyond just coffee consumption. Dine-in establishments provide an ambiance conducive to socializing, working, or relaxing, enhancing the overall coffee-drinking experience.

- The Dine-In outlets often offer a broader menu range, including snacks, pastries, and light meals, catering to a diverse customer base with varying preferences and dietary requirements. This expanded menu can attract customers beyond traditional coffee drinkers, thereby increasing foot traffic and revenue. Dine-in locations serve as convenient meeting spots for business meetings, casual gatherings, or study sessions, further boosting their appeal. With the rise of remote work and flexible schedules, these spaces provide an alternative to traditional office environments.

Retail Coffee Chains Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The region's large and diverse population provides a vast consumer base, with a growing middle class and urbanization driving increased demand for convenient coffee options. The rapid economic growth in countries like China, India, and Southeast Asian nations has encouraged disposable incomes, leading to greater spending on premium coffee experiences.

- The region's embrace of Western lifestyles and trends has fueled the popularity of coffee culture, making it a social and leisure activity among younger demographics. This cultural shift has facilitated the expansion of international coffee chains like Starbucks, Costa Coffee, and Coffee Bean & Tea Leaf, which have capitalized on the demand for branded coffee experiences.

- The Asia Pacific's technological advancement and digitalization have facilitated the penetration of coffee chains through online ordering, delivery services, and mobile payment options, catering to convenience-oriented consumer preferences.

- The increasing investments in infrastructure and the establishment of free trade agreements have created a conducive environment for foreign investments and the expansion of multinational coffee chains in the region. Combined, these factors have propelled the Asia Pacific to the forefront of the retail coffee chain market, showcasing its dominance in the global coffee industry.

Retail Coffee Chains Market Top Key Players:

- Starbucks (United States)

- Caribou Coffee (United States)

- It's a Grind Coffee House (United States)

- McCafé (United States)

- The Coffee Bean & Tea Leaf (United States)

- Dunkin' (United States)

- Tim Hortons (Canada)

- Second Cup (Canada)

- Pret A Manger (United Kingdom)

- Tim Wendelboe (Norway)

- Caffè Nero (United Kingdom)

- Costa Coffee (United Kingdom)

- Tully's Coffee (Japan)

- Gloria Jean's Coffees (Australia), and Other Major Players

Key Industry Developments in the Retail Coffee Chains Market:

- In January 2024, Caribou Coffee's announcement of a significant agreement with JDE Peet's. Valued at $260M, the deal involves licensing Caribou Coffee's brand in consumer packaged goods and foodservice channels. It encompasses the transfer of Caribou Coffee's roasting operations in Minnesota and its office coffee and foodservice contracts. The move, slated to finalize in the first quarter of 2024 pending customary closing conditions, allows Caribou Coffee to concentrate on its core retail coffeehouse business, while JDE Peet's gains a robust platform for expanding its premium coffee offerings in North America.

|

Global Retail Coffee Chains Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023 : |

USD 115.84 Bn. |

|

Forecast Period 2023-30 CAGR: |

4.80 % |

Market Size in 2032: |

USD 175.65 Bn. |

|

Segments Covered: |

By Service Type |

|

|

|

By Product Offering |

|

||

|

By Chain Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Retail Coffee Chains Market by By Product Offering (2018-2032)

4.1 Retail Coffee Chains Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Specialty Coffee Chains

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Fast Food Chains with Coffee

Chapter 5: Retail Coffee Chains Market by By Chain Type (2018-2032)

5.1 Retail Coffee Chains Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Franchise Chains

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Independent Chains

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Retail Coffee Chains Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ILLUMINA INC. (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 THERMO FISHER SCIENTIFIC INC. (USA)

6.4 PACIFIC BIOSCIENCES OF CALIFORNIA INC. (USA)

6.5 BGI (CHINA)

6.6 QIAGEN (NETHERLANDS)

6.7 AGILENT TECHNOLOGIES (USA)

6.8 PSOMAGEN (USA)

6.9 AZENTA US INC. (GENEWIZ) (USA)

6.10 PERKINELMER INC. (USA)

6.11 PROPHASE LABS INC. (NEBULA GENOMICS) (USA)

6.12 OTHERS KEY PLAYER

6.13

Chapter 7: Global Retail Coffee Chains Market By Region

7.1 Overview

7.2. North America Retail Coffee Chains Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By By Product Offering

7.2.4.1 Specialty Coffee Chains

7.2.4.2 Fast Food Chains with Coffee

7.2.5 Historic and Forecasted Market Size By By Chain Type

7.2.5.1 Franchise Chains

7.2.5.2 Independent Chains

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Retail Coffee Chains Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By By Product Offering

7.3.4.1 Specialty Coffee Chains

7.3.4.2 Fast Food Chains with Coffee

7.3.5 Historic and Forecasted Market Size By By Chain Type

7.3.5.1 Franchise Chains

7.3.5.2 Independent Chains

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Retail Coffee Chains Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By By Product Offering

7.4.4.1 Specialty Coffee Chains

7.4.4.2 Fast Food Chains with Coffee

7.4.5 Historic and Forecasted Market Size By By Chain Type

7.4.5.1 Franchise Chains

7.4.5.2 Independent Chains

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Retail Coffee Chains Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By By Product Offering

7.5.4.1 Specialty Coffee Chains

7.5.4.2 Fast Food Chains with Coffee

7.5.5 Historic and Forecasted Market Size By By Chain Type

7.5.5.1 Franchise Chains

7.5.5.2 Independent Chains

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Retail Coffee Chains Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By By Product Offering

7.6.4.1 Specialty Coffee Chains

7.6.4.2 Fast Food Chains with Coffee

7.6.5 Historic and Forecasted Market Size By By Chain Type

7.6.5.1 Franchise Chains

7.6.5.2 Independent Chains

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Retail Coffee Chains Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By By Product Offering

7.7.4.1 Specialty Coffee Chains

7.7.4.2 Fast Food Chains with Coffee

7.7.5 Historic and Forecasted Market Size By By Chain Type

7.7.5.1 Franchise Chains

7.7.5.2 Independent Chains

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Retail Coffee Chains Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023 : |

USD 115.84 Bn. |

|

Forecast Period 2023-30 CAGR: |

4.80 % |

Market Size in 2032: |

USD 175.65 Bn. |

|

Segments Covered: |

By Service Type |

|

|

|

By Product Offering |

|

||

|

By Chain Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Retail Coffee Chains Market research report is 2024-2032.

Starbucks (United States), Caribou Coffee (United States), It's a Grind Coffee House (United States), McCafé (United States), The Coffee Bean & Tea Leaf (United States), Dunkin' (United States), Tim Hortons (Canada), Second Cup (Canada), Pret A Manger (United Kingdom), Tim Wendelboe (Norway), Caffè Nero (United Kingdom), Costa Coffee (United Kingdom), Tully's Coffee (Japan), Gloria Jean's Coffees (Australia), and Other Major Players.

The Retail Coffee Chains Market is segmented into Service Type, Product Offering, Chain Type, and region. By Service Type, the market is categorized into Dine-In, Takeaway, and Drive-Thru. By Product Offering, the market is categorized into Specialty Coffee Chains and fast Food Chains with Coffee. By Chain Type, the market is categorized into Franchise Chains and Independent Chains. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Retail coffee chains are businesses that specialize in selling coffee and related products through multiple locations, often following a standardized model. These chains typically offer a variety of coffee beverages, pastries, and merchandise conveniently and consistently. They provide customers with a familiar experience across different locations, often emphasizing speed, convenience, and quality.

Retail Coffee Chains Market Size Was Valued at USD 115.84 Billion in 2023 and is Projected to Reach USD 176.65 Billion by 2032, Growing at a CAGR of 4.80 % From 2024-2032.