Reusable Launch Vehicle Market Synopsis:

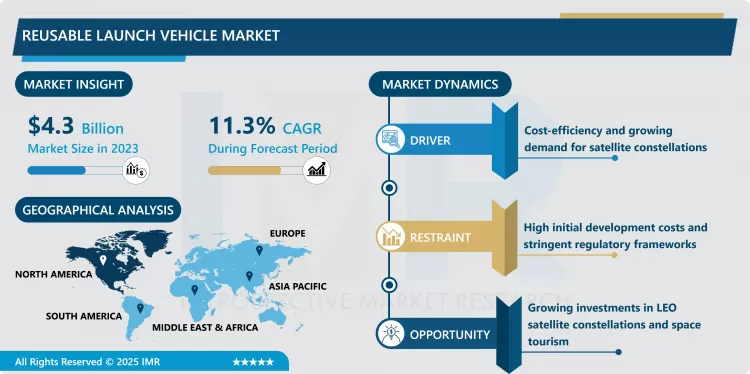

Reusable Launch Vehicle Market Size Was Valued at USD 4.3 Billion in 2023, and is Projected to Reach USD 11.2 Billion by 2032, Growing at a CAGR of 11.3% From 2024-2032.

The RLV market can be described as pertaining to space suitable transportation systems which are Reusable Launch Vehicle, have potential for multiple missions and launches, primarily intended to decrease the cost of space supporting operations. Compared to expendable rockets, which are used only once and burned up in the process, RLVs are built to withstand the forces of re-entry and reuse providing substantial impalements in mission efficiency, environmental concerns, and cost-effectiveness. These vehicles are more or less important in such applications as satellites deployment, supply of ISS, space tourism and planetary exploration among others. The factors that drive the market include; New satellite constellations, privatization of space and enhancement of government funding to spur innovation in the aerospace market. RLVs stand as the epitome of engineering effort in making space more viable and cost effective.

There has been massive growth in reusable launch vehicle market which has been brought about by high commercialization of space business and advances in the field of air and space engineering. With increasing needs for satellite deployment and expansion around the world especially in telecommunications, defense, and scientific research activities, RLVs are proving to be as effective and efficient as classic launch systems but more cost efficient and friendly to the environment. Relatively, governments worldwide, private firms, and space agencies are increasing their spending on RLV Development Programs to achieve technology dominance and address soaring demands of industries depending on satellites. In addition, advancements in space tourism, lunar and interplanetary missions would increase utilization of RLVs, adding them as vital tools of contemporary spaceflight plans.

Due to advancement of private participant’s competition and novelty are pushing the market forward, which is another advantage for the market’s progress. Today, SpaceX, Blue Origin, Rocket Lab or other firms are effectively extending what it means to have reusable launch system to mean cost effective and efficient. For the same, while Asian Pacific and European firms are stepping in the race to develop reusable technologies they are increasing the. However, some challenges like high initial cost of development, increased regulatory requirement, and requisite need for technological improvement retains as major obstacles.

Reusable Launch Vehicle Market Trend Analysis:

Technological Advancements Leading to Market Transformation

- The LOR market is slowly being revolutionized by ongoing technological developments that seek to enhance the lifetimes, performance capacities, and dependability of launch vehicles. Some of the important trends that has been noticed is the use of light weight high technology thermal protection system, development of On-board intelligence for precision landing and high altitude specifications, and propulsion systems for improvement of reusability. For example, composite material and ablative heat shield guarantee these vehicles for a number of launches and re entries without getting eroded. Further improvements in artificial intelligence and machine learning also make it possible for the RLVs to also perform salvage missions, with lowered incidences of mission failure and reduced reliance on ground command. These improvements are not only changing the functionalities of RLVs, but they are also creating possibilities in space tourism or in colonization.

Emerging Opportunities in Low-Earth Orbit (LEO) Deployment

- The very fact of plans to utilize reusable launch vehicles that will supply LEO satellite constellations market is promising. Space manufacturing is already being pursued by aspiring ventures such as Boston-based Space Tango, and huge projects to launch thousands of satellites are being undertaken by SpaceX and Amazon to provide global internet coverage, which is likely to dramatically change telecommunication, remote sensing and data transmission. As such, RLVs are uniquely positioned to serve this purpose, as they are designed to execute launches of a frequency that entails lowered costs, thus constituting an enabler for such grandiose plans. Besides, as more countries launch development programs of space infrastructure to boost their military and economic potential, RLVs fit well into the framework of future needs regarding affordable satellites launching. It is a huge opportunity for manufacturers of RLVs to form partner with the governments, private entity and research institutions that may drive the formation of more economical vehicle system strengthening its standing in global space industry.

Reusable Launch Vehicle Market Segment Analysis:

Reusable Launch Vehicle Market is Segmented on the basis of Reusability Level, Payload Capacity, Application, and Region

By Reusability Level, Partially Reusable Vehicles segment is expected to dominate the market during the forecast period

- When considering reusability level, partially reusable vehicle segment holds the largest reusable launch vehicle market share in the given time line. Some Launch vehicles are partially reusable to capture and reuse major parts, for instance, SpaceX’s Falcon 9 has recoverable first-stage booster, which costs quite a deal. This makes it a popular approach among commercial and governmental organizations due to a balance is struck between operations functioning and technology applicability. These systems are already showing the capability to transform the cost structure of space launches by achieving 30-40% cost savings in relation to classic booster expendable systems.

- This is additional incentive why partially reusable vehicles are more popular: many of them are tested to perform launches and landings, O’Leary said. The model is gradually being adopted more widely and many companies are introducing innovations in the case of partially reusable systems. Moreover, continuous investments in enhanced reusability and performance of such vehicles seemed to bolster their market in the future years.

By Payload Capacity, Medium-Lift Vehicles (5,000 - 20,000 kg) segment expected to held the largest share

- Based on payload, the growing demand is identified to the medium-lift vehicle segment which has a payload of 5,000 to 20,000, kilograms. These vehicles specifically target applications for commercial satellite, science, and cargo delivery to space and space stations across a wide range of missions. First, their usefulness in both governmental and commercial applications can help interest a wide variety of stakeholders in the space industry.

- The demand of medium-lift vehicles is further increase along with the increase in demand of Large Satellite Constellations in LEO (Low Earth Orbit) and MEO (Medium Earth Orbit). Such vehicles are the most cost-effective and effective means of delivering multiple satellites at once due to its combination of cost and payload capabilities.

Reusable Launch Vehicle Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America will lead the reusable launch vehicle market in the year 2023 That is because important stakeholders like SpaceX, Blue Origin out of the United States as well as United Launch Alliance are leading the development of reusable technologies in the region. Government backing in the form of finance from such bodies as NASA and Department of Defense takes the overall advancement and usage of RLVs to other stringer territory in the region. Furthermore, the high rate of launching satellites and increasing demand of space tourism and deep space travel also explain the large market share of North America.

Active Key Players in the Reusable Launch Vehicle Market:

- Arianespace (France)

- Blue Origin (United States)

- Boeing (United States)

- Dynetics (United States)

- Firefly Aerospace (United States)

- ISRO (India)

- Lockheed Martin (United States)

- Mitsubishi Heavy Industries (Japan)

- Northrop Grumman (United States)

- Rocket Lab (New Zealand)

- Sierra Nevada Corporation (United States)

- SpaceX (United States)

- Virgin Galactic (United States)

- Virgin Orbit (United States)

- XCOR Aerospace (United States)

- Other Active Players

|

Reusable Launch Vehicle Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.3 Billion |

|

Forecast Period 2024-32 CAGR: |

11.3% |

Market Size in 2032: |

USD 11.2 Billion |

|

Segments Covered: |

By Reusability Level |

|

|

|

By Payload Capacity |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Reusable Launch Vehicle Market by By Reusability Level (2018-2032)

4.1 Reusable Launch Vehicle Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Partially Reusable Vehicles

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Fully Reusable Vehicles

4.5 Single-Stage-to-Orbit Vehicles

Chapter 5: Reusable Launch Vehicle Market by By Payload Capacity (2018-2032)

5.1 Reusable Launch Vehicle Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Medium-Lift Vehicles (5

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 000 - 20

5.5 000 kg)

5.6 Small-Lift Vehicles (< 5

5.7 000 kg)

5.8 Heavy-Lift Vehicles (>20

5.9 000 kg)

Chapter 6: Reusable Launch Vehicle Market by By Application (2018-2032)

6.1 Reusable Launch Vehicle Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Commercial Satellite Launch

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Government/Military Missions

6.5 Space Tourism and Research

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Reusable Launch Vehicle Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ARIANESPACE (FRANCE)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BLUE ORIGIN (UNITED STATES)

7.4 BOEING (UNITED STATES)

7.5 DYNETICS (UNITED STATES)

7.6 FIREFLY AEROSPACE (UNITED STATES)

7.7 ISRO (INDIA)

7.8 LOCKHEED MARTIN (UNITED STATES)

7.9 MITSUBISHI HEAVY INDUSTRIES (JAPAN)

7.10 NORTHROP GRUMMAN (UNITED STATES)

7.11 ROCKET LAB (NEW ZEALAND)

7.12 SIERRA NEVADA CORPORATION (UNITED STATES)

7.13 SPACEX (UNITED STATES)

7.14 VIRGIN GALACTIC (UNITED STATES)

7.15 VIRGIN ORBIT (UNITED STATES)

7.16 XCOR AEROSPACE (UNITED STATES)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Reusable Launch Vehicle Market By Region

8.1 Overview

8.2. North America Reusable Launch Vehicle Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Reusability Level

8.2.4.1 Partially Reusable Vehicles

8.2.4.2 Fully Reusable Vehicles

8.2.4.3 Single-Stage-to-Orbit Vehicles

8.2.5 Historic and Forecasted Market Size By By Payload Capacity

8.2.5.1 Medium-Lift Vehicles (5

8.2.5.2 000 - 20

8.2.5.3 000 kg)

8.2.5.4 Small-Lift Vehicles (< 5

8.2.5.5 000 kg)

8.2.5.6 Heavy-Lift Vehicles (>20

8.2.5.7 000 kg)

8.2.6 Historic and Forecasted Market Size By By Application

8.2.6.1 Commercial Satellite Launch

8.2.6.2 Government/Military Missions

8.2.6.3 Space Tourism and Research

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Reusable Launch Vehicle Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Reusability Level

8.3.4.1 Partially Reusable Vehicles

8.3.4.2 Fully Reusable Vehicles

8.3.4.3 Single-Stage-to-Orbit Vehicles

8.3.5 Historic and Forecasted Market Size By By Payload Capacity

8.3.5.1 Medium-Lift Vehicles (5

8.3.5.2 000 - 20

8.3.5.3 000 kg)

8.3.5.4 Small-Lift Vehicles (< 5

8.3.5.5 000 kg)

8.3.5.6 Heavy-Lift Vehicles (>20

8.3.5.7 000 kg)

8.3.6 Historic and Forecasted Market Size By By Application

8.3.6.1 Commercial Satellite Launch

8.3.6.2 Government/Military Missions

8.3.6.3 Space Tourism and Research

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Reusable Launch Vehicle Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Reusability Level

8.4.4.1 Partially Reusable Vehicles

8.4.4.2 Fully Reusable Vehicles

8.4.4.3 Single-Stage-to-Orbit Vehicles

8.4.5 Historic and Forecasted Market Size By By Payload Capacity

8.4.5.1 Medium-Lift Vehicles (5

8.4.5.2 000 - 20

8.4.5.3 000 kg)

8.4.5.4 Small-Lift Vehicles (< 5

8.4.5.5 000 kg)

8.4.5.6 Heavy-Lift Vehicles (>20

8.4.5.7 000 kg)

8.4.6 Historic and Forecasted Market Size By By Application

8.4.6.1 Commercial Satellite Launch

8.4.6.2 Government/Military Missions

8.4.6.3 Space Tourism and Research

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Reusable Launch Vehicle Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Reusability Level

8.5.4.1 Partially Reusable Vehicles

8.5.4.2 Fully Reusable Vehicles

8.5.4.3 Single-Stage-to-Orbit Vehicles

8.5.5 Historic and Forecasted Market Size By By Payload Capacity

8.5.5.1 Medium-Lift Vehicles (5

8.5.5.2 000 - 20

8.5.5.3 000 kg)

8.5.5.4 Small-Lift Vehicles (< 5

8.5.5.5 000 kg)

8.5.5.6 Heavy-Lift Vehicles (>20

8.5.5.7 000 kg)

8.5.6 Historic and Forecasted Market Size By By Application

8.5.6.1 Commercial Satellite Launch

8.5.6.2 Government/Military Missions

8.5.6.3 Space Tourism and Research

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Reusable Launch Vehicle Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Reusability Level

8.6.4.1 Partially Reusable Vehicles

8.6.4.2 Fully Reusable Vehicles

8.6.4.3 Single-Stage-to-Orbit Vehicles

8.6.5 Historic and Forecasted Market Size By By Payload Capacity

8.6.5.1 Medium-Lift Vehicles (5

8.6.5.2 000 - 20

8.6.5.3 000 kg)

8.6.5.4 Small-Lift Vehicles (< 5

8.6.5.5 000 kg)

8.6.5.6 Heavy-Lift Vehicles (>20

8.6.5.7 000 kg)

8.6.6 Historic and Forecasted Market Size By By Application

8.6.6.1 Commercial Satellite Launch

8.6.6.2 Government/Military Missions

8.6.6.3 Space Tourism and Research

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Reusable Launch Vehicle Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Reusability Level

8.7.4.1 Partially Reusable Vehicles

8.7.4.2 Fully Reusable Vehicles

8.7.4.3 Single-Stage-to-Orbit Vehicles

8.7.5 Historic and Forecasted Market Size By By Payload Capacity

8.7.5.1 Medium-Lift Vehicles (5

8.7.5.2 000 - 20

8.7.5.3 000 kg)

8.7.5.4 Small-Lift Vehicles (< 5

8.7.5.5 000 kg)

8.7.5.6 Heavy-Lift Vehicles (>20

8.7.5.7 000 kg)

8.7.6 Historic and Forecasted Market Size By By Application

8.7.6.1 Commercial Satellite Launch

8.7.6.2 Government/Military Missions

8.7.6.3 Space Tourism and Research

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Reusable Launch Vehicle Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.3 Billion |

|

Forecast Period 2024-32 CAGR: |

11.3% |

Market Size in 2032: |

USD 11.2 Billion |

|

Segments Covered: |

By Reusability Level |

|

|

|

By Payload Capacity |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Reusable Launch Vehicle Market research report is 2024-2032.

Arianespace (France), Blue Origin (United States), Boeing (United States), Dynetics (United States), Firefly Aerospace (United States), ISRO (India), Lockheed Martin (United States), Mitsubishi Heavy Industries (Japan), Northrop Grumman (United States), Rocket Lab (New Zealand), Sierra Nevada Corporation (United States), SpaceX (United States), Virgin Galactic (United States), Virgin Orbit (United States), XCOR Aerospace (United States), and Other Active Players.

The Reusable Launch Vehicle Market is segmented into Reusability Level, Payload Capacity, Application and region. By Reusability Level, the market is categorized into Partially Reusable Vehicles, Fully Reusable Vehicles, Single-Stage-to-Orbit Vehicles. By Payload Capacity, the market is categorized into Medium-Lift Vehicles (5,000 - 20,000 kg), Small-Lift Vehicles (< 5,000 kg), Heavy-Lift Vehicles (>20,000 kg). By Application, the market is categorized into Commercial Satellite Launch, Government/Military Missions, Space Tourism and Research. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

The RLV market can be described as on space suitable transportation systems which are Reusable Launch Vehicle, have potential for multiple missions and launches, primarily intended to decrease the cost of space supporting operations. Compared to expendable rockets, which are used only once and burned up in the process, RLVs are built to withstand the forces of re-entry and reuse providing substantial impalements in mission efficiency, environmental concerns, and cost-effectiveness. These vehicles are more or less important in such applications as satellites deployment, supply of ISS, space tourism and planetary exploration among others. The factors that drive the market include; New satellite constellations, privatization of space and enhancement of government funding to spur innovation in the aerospace market. RLVs stand as the epitome of engineering effort in making space more viable and cost effective.

Reusable Launch Vehicle Market Size Was Valued at USD 4.3 Billion in 2023, and is Projected to Reach USD 11.2 Billion by 2032, Growing at a CAGR of 11.3% From 2024-2032.