Road Marking Removal Machines Market Synopsis

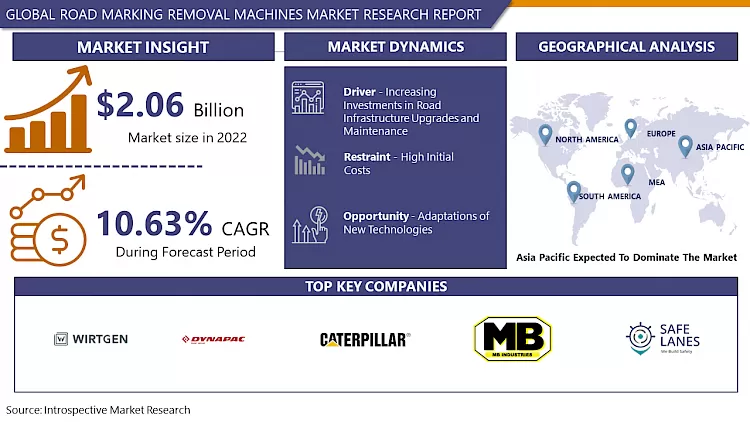

Road Marking Removal Machines Market Size Was Valued at USD 2.06 Billion in 2022 and is Projected to Reach USD 4.62 Billion by 2030, Growing at a CAGR of 10.63% From 2023-2030.

Road Marking Removal Machines are specialized equipment designed to eliminate painted or thermoplastic road markings. Utilizing various methods such as shot blasting, grinding, water blasting, scarifying, or chemical processes, these machines efficiently strip away old markings from surfaces like roads, highways, airport runways, parking lots, and industrial areas.

- Road Marking Removal Machines play a crucial role in infrastructure maintenance and renovation projects, ensuring safe and clean transportation routes. These machines come in different types to suit specific applications and are essential tools for government agencies, contractors, and facility managers involved in road maintenance and traffic management.

- Road Marking Removal Machines are gaining popularity due to their efficiency in road maintenance, saving time and labor costs. They are versatile and can be used on various surfaces, including roads, highways, airport runways, and parking lots. Advanced technologies minimize damage to underlying surfaces, preserving road and pavement integrity.

- The market trend for these machines is growing due to infrastructure development and urbanization, with governments and municipalities investing in upgrading and maintaining transportation networks. Environmental considerations are also driving the adoption of water-based or chemical removal machines. As road networks expand and age, regular maintenance, and re-marking are required.

- Governments and private entities are investing in road maintenance equipment to improve road safety, reduce accidents, and ensure clear traffic signage. The market is dynamic, influenced by factors like urbanization, technological advancements, and sustainability initiatives. As demand for efficient and precise road marking removal increases, manufacturers are likely to see sustained demand for these specialized machines.

Road Marking Removal Machines Market Trend Analysis

Increasing Investments in Road Infrastructure Upgrades and Maintenance

- The Road Marking Removal Machines market is growing focus on road infrastructure upgrades and maintenance by governments and municipal authorities worldwide. As aging roads and outdated markings pose safety concerns, comprehensive road maintenance programs are being prioritized. Road Marking Removal Machines play a crucial role in removing old markings and ensuring a clean slate for new signage.

- These investments align with broader goals of improving traffic management, enhancing road safety, and accommodating the increasing volume of vehicles on roadways. As governments prioritize these initiatives, the demand for advanced Road Marking Removal Machines is expected to grow. Manufacturers in the market are expected to provide innovative solutions that contribute to the effectiveness of road maintenance programs, supporting the safe and efficient movement of people and goods.

Adaptations of New Technologies

- The Road Marking Removal Machines Market is assured of significant growth due to the integration of new technologies. Artificial Intelligence (AI) and automation are key advancements that can optimize removal processes, reduce damage risk, and improve operational efficiency. Automation reduces reliance on manual labor, addressing workforce availability and cost concerns.

- Smart technologies, such as sensors and connectivity features, can provide real-time monitoring and data analysis, enabling predictive maintenance strategies. This aligns with the trend of creating smart cities and intelligent transportation systems. Manufacturers in the Road Marking Removal Machines Market can position themselves as leaders in innovation, meeting industry needs, and contributing to safer and more sustainable road maintenance practices. By embracing these advancements, manufacturers can position themselves as leaders in the industry.

Road Marking Removal Machines Market Segment Analysis:

Road Marking Removal Machines Market Segmented based on Operation Type, Technology, Machine Capacity, Application, and End-User

By Technology, Mechanical Removal segment is expected to dominate the market during the forecast period

- The Mechanical Removal segment is efficient, versatile, and cost-effective. Techniques, like shot blasting and grinding, are reliable for removing road markings, offering quick and thorough solutions. These machines handle various road surfaces, including asphalt and concrete, making them versatile for various applications. The segment aligns with industry preferences for robust and straightforward technologies, as they require less maintenance than alternative technologies. As road maintenance projects demand efficient, reliable, and cost-effective solutions, the Mechanical Removal segment will maintain its dominance in the Road Marking Removal Machines market.

By Machine Capacity, 251 liters -750 liters segment held the largest share of xx% in 2022

- The 251-liter to 750-liter segment machines can handle various surface types and marking materials, making them suitable for various road maintenance projects. The demand for machines in this capacity range is particularly high in medium to large-scale operations, catering to government agencies and private contractors in road infrastructure projects.

- The 251-liter to 750-liter segment is expected to be the dominant force in the market, meeting the demands of most road marking removal projects during the forecast period.

Road Marking Removal Machines Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia Pacific region is expected to dominate the Road Marking Removal Machines market due to rapid urbanization, infrastructure development, stringent government regulations, and increasing awareness of environmental sustainability. Countries like China and India are investing in transportation infrastructure, leading to a higher demand for road marking removal machines. Governments in the region are also emphasizing the need for clear, visible road markings to enhance traffic safety.

- The growing awareness of green and sustainable practices is driving the adoption of eco-friendly road marking removal methods. The region's economic growth and numerous construction projects further fuel the demand for road marking removal machines. As a result, the Asia Pacific region is expected to be a key player in the Road Marking Removal Machines market, showcasing sustained growth and dominance over the forecast period.

Road Marking Removal Machines Market Top Key Players:

- Caterpillar Inc. (US)

- Roadtec Inc. (US)

- Ingersoll Rand (US)

- Vacu-Sweep International LLC (US)

- Diamond Tool International Inc. (US)

- Hydro-Tech International (US)

- Safe-Lane Industries Inc. (US)

- Crafco Inc. (US)

- M-B Industries Inc. (US)

- Striatech Inc. (Canada)

- Wirtgen Group (Germany)

- Bomag (Germany)

- Dynapac (Germany)

- Weber Maschinentechnik GmbH (Germany)

- Hamm AG (Germany)

- Atlas Copco (Sweden)

- Ecolines (France)

- Sany Heavy Industry Group (China)

- Wirtgen India (India)

- Cemenco (Turkey)

Key Industry Developments in the Road Marking Removal Machines Market:

- In November 2023, Atlas Copco Group acquired Hamamc?o?lu Makina (HAMAK), a Turkish company specializing in air compressor sales and service. HAMAK offers compressors, parts, and services to the Turkish market.

- In August 2023, Bomag (Germany) collaborated with a waste management company to investigate pilot projects that used milling machines to remove road markings and recycle the asphalt material for sustainable pavement resurfacing.

|

Global Road Marking Removal Machines Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 2.06 Bn. |

|

Forecast Period 2023-30 CAGR: |

10.63 % |

Market Size in 2030: |

USD 4.62 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Machine Capacity |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Road Marking Removal Machines Market by By Type (2018-2032)

4.1 Road Marking Removal Machines Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Processed Road Marking Removal Machines

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Unprocessed Road Marking Removal Machines

Chapter 5: Road Marking Removal Machines Market by By Technology (2018-2032)

5.1 Road Marking Removal Machines Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Mechanical Removal

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Thermal Removal

5.5 Chemical Removal

5.6 Water Removal

Chapter 6: Road Marking Removal Machines Market by By Machine Capacity (2018-2032)

6.1 Road Marking Removal Machines Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Less than 100 Litre

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 100 Litre - 250 Litre

6.5 251 Litre - 750 Litre

6.6 More than 750 Litre

Chapter 7: Road Marking Removal Machines Market by By Application (2018-2032)

7.1 Road Marking Removal Machines Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Highways

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Urban Roads

7.5 Parking Lots

Chapter 8: Road Marking Removal Machines Market by By End-User (2018-2032)

8.1 Road Marking Removal Machines Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Government and Municipalities

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Airport Authorities

8.5 Parking Lot

8.6 Industrial Facility

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Road Marking Removal Machines Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 BIOMIN (AUSTRIA)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 BENTOLI (US)

9.4 ANGELYEAST CO.LTD. (CHINA)

9.5 CARGILL (US)

9.6 BASF SE (GERMANY)

9.7 ARCHER DANIELS MIDLAND (US)

9.8 BAYER AG (GERMANY)

9.9 PERSTORP (SWEDEN)

9.10 CHR. HANSEN HOLDING A/S (DENMARK)

9.11 ANFOTAL NUTRITION'S PRIVATE LIMITED (INDIA)

9.12 VLVIPRO (UK)

9.13 VIRBAC (INDIA)

9.14 NOVUS INTERNATIONAL (US)

9.15 SELKO (NETHERLANDS)OTHERMAJOR KEY PLAYERS.COVID-19 IMPACT ON FEED MYCOTOXIN BINDERS MARKET THE OUTBREAK OF COVID-19 ADVERSELY AFFECTED THE OPERATIONAL ACTIVITIES OF SEVERAL INDUSTRY VERTICALS. TO CURB THE SPREAD OF THE VIRUS VARIOUS RESTRICTIONS WERE IMPOSED ON THE MOVEMENTS OF PEOPLE. GOVERNMENT WORLDWIDE FORCED THE NON-ESSENTIAL INDUSTRIES TO SHUT DOWN. THE LOCKDOWNS RESULTED IN A SHORTAGE OF RAW MATERIALS REQUIRED FOR THE PRODUCTION OF FEED MYCOTOXIN BINDERS. MOREOVER

9.16 THE DEMAND FOR MEAT PRODUCTS AMID THE PANDEMIC FELL SHARPLY HENCE

9.17 PRODUCTION AND PRICES OF MEAT PRODUCTS FELL SIMULTANEOUSLY. WITHIN THE U.STHE SHUTDOWN BEGAN ON MARCH 27TH

9.18 2020

9.19 WITH A FOSTER FARMS POULTRY PROCESSING PLANT AT FARMERVILLE

9.20 LOUISIANA. IN ADDITION

9.21 A CASCADE OF CLOSURES STARTED ACROSS CATTLE

9.22 POULTRY

9.23 AND PIG SECTORS WHILE SOME CLOSURES WERE ONLY FOR A FEW DAYS FOR DEEP CLEANING AND OTHERS WERE LONGER. THESE CLOSURES RESULTED IN THE DECLINE OF SLAUGHTER AND PROCESSING CAPACITY. FURTHERMORE

9.24 PIG SLAUGHTER CAPACITY IN THE U.S. WAS OPERATING AT ONLY ABOUT 55% OF NORMAL

9.25 MEANING THAT ABOUT 250

9.26 000 PIGS A DAY WERE AT SLAUGHTER WEIGHT

9.27 BUT HAD NOWHERE TO GO FOR SLAUGHTER. THE IMPACT WAS SIMILAR ON OTHER LIVESTOCK INDUSTRIES.

Chapter 10: Global Road Marking Removal Machines Market By Region

10.1 Overview

10.2. North America Road Marking Removal Machines Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By By Type

10.2.4.1 Processed Road Marking Removal Machines

10.2.4.2 Unprocessed Road Marking Removal Machines

10.2.5 Historic and Forecasted Market Size By By Technology

10.2.5.1 Mechanical Removal

10.2.5.2 Thermal Removal

10.2.5.3 Chemical Removal

10.2.5.4 Water Removal

10.2.6 Historic and Forecasted Market Size By By Machine Capacity

10.2.6.1 Less than 100 Litre

10.2.6.2 100 Litre - 250 Litre

10.2.6.3 251 Litre - 750 Litre

10.2.6.4 More than 750 Litre

10.2.7 Historic and Forecasted Market Size By By Application

10.2.7.1 Highways

10.2.7.2 Urban Roads

10.2.7.3 Parking Lots

10.2.8 Historic and Forecasted Market Size By By End-User

10.2.8.1 Government and Municipalities

10.2.8.2 Airport Authorities

10.2.8.3 Parking Lot

10.2.8.4 Industrial Facility

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Road Marking Removal Machines Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By By Type

10.3.4.1 Processed Road Marking Removal Machines

10.3.4.2 Unprocessed Road Marking Removal Machines

10.3.5 Historic and Forecasted Market Size By By Technology

10.3.5.1 Mechanical Removal

10.3.5.2 Thermal Removal

10.3.5.3 Chemical Removal

10.3.5.4 Water Removal

10.3.6 Historic and Forecasted Market Size By By Machine Capacity

10.3.6.1 Less than 100 Litre

10.3.6.2 100 Litre - 250 Litre

10.3.6.3 251 Litre - 750 Litre

10.3.6.4 More than 750 Litre

10.3.7 Historic and Forecasted Market Size By By Application

10.3.7.1 Highways

10.3.7.2 Urban Roads

10.3.7.3 Parking Lots

10.3.8 Historic and Forecasted Market Size By By End-User

10.3.8.1 Government and Municipalities

10.3.8.2 Airport Authorities

10.3.8.3 Parking Lot

10.3.8.4 Industrial Facility

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Road Marking Removal Machines Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By By Type

10.4.4.1 Processed Road Marking Removal Machines

10.4.4.2 Unprocessed Road Marking Removal Machines

10.4.5 Historic and Forecasted Market Size By By Technology

10.4.5.1 Mechanical Removal

10.4.5.2 Thermal Removal

10.4.5.3 Chemical Removal

10.4.5.4 Water Removal

10.4.6 Historic and Forecasted Market Size By By Machine Capacity

10.4.6.1 Less than 100 Litre

10.4.6.2 100 Litre - 250 Litre

10.4.6.3 251 Litre - 750 Litre

10.4.6.4 More than 750 Litre

10.4.7 Historic and Forecasted Market Size By By Application

10.4.7.1 Highways

10.4.7.2 Urban Roads

10.4.7.3 Parking Lots

10.4.8 Historic and Forecasted Market Size By By End-User

10.4.8.1 Government and Municipalities

10.4.8.2 Airport Authorities

10.4.8.3 Parking Lot

10.4.8.4 Industrial Facility

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Road Marking Removal Machines Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By By Type

10.5.4.1 Processed Road Marking Removal Machines

10.5.4.2 Unprocessed Road Marking Removal Machines

10.5.5 Historic and Forecasted Market Size By By Technology

10.5.5.1 Mechanical Removal

10.5.5.2 Thermal Removal

10.5.5.3 Chemical Removal

10.5.5.4 Water Removal

10.5.6 Historic and Forecasted Market Size By By Machine Capacity

10.5.6.1 Less than 100 Litre

10.5.6.2 100 Litre - 250 Litre

10.5.6.3 251 Litre - 750 Litre

10.5.6.4 More than 750 Litre

10.5.7 Historic and Forecasted Market Size By By Application

10.5.7.1 Highways

10.5.7.2 Urban Roads

10.5.7.3 Parking Lots

10.5.8 Historic and Forecasted Market Size By By End-User

10.5.8.1 Government and Municipalities

10.5.8.2 Airport Authorities

10.5.8.3 Parking Lot

10.5.8.4 Industrial Facility

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Road Marking Removal Machines Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By By Type

10.6.4.1 Processed Road Marking Removal Machines

10.6.4.2 Unprocessed Road Marking Removal Machines

10.6.5 Historic and Forecasted Market Size By By Technology

10.6.5.1 Mechanical Removal

10.6.5.2 Thermal Removal

10.6.5.3 Chemical Removal

10.6.5.4 Water Removal

10.6.6 Historic and Forecasted Market Size By By Machine Capacity

10.6.6.1 Less than 100 Litre

10.6.6.2 100 Litre - 250 Litre

10.6.6.3 251 Litre - 750 Litre

10.6.6.4 More than 750 Litre

10.6.7 Historic and Forecasted Market Size By By Application

10.6.7.1 Highways

10.6.7.2 Urban Roads

10.6.7.3 Parking Lots

10.6.8 Historic and Forecasted Market Size By By End-User

10.6.8.1 Government and Municipalities

10.6.8.2 Airport Authorities

10.6.8.3 Parking Lot

10.6.8.4 Industrial Facility

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Road Marking Removal Machines Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By By Type

10.7.4.1 Processed Road Marking Removal Machines

10.7.4.2 Unprocessed Road Marking Removal Machines

10.7.5 Historic and Forecasted Market Size By By Technology

10.7.5.1 Mechanical Removal

10.7.5.2 Thermal Removal

10.7.5.3 Chemical Removal

10.7.5.4 Water Removal

10.7.6 Historic and Forecasted Market Size By By Machine Capacity

10.7.6.1 Less than 100 Litre

10.7.6.2 100 Litre - 250 Litre

10.7.6.3 251 Litre - 750 Litre

10.7.6.4 More than 750 Litre

10.7.7 Historic and Forecasted Market Size By By Application

10.7.7.1 Highways

10.7.7.2 Urban Roads

10.7.7.3 Parking Lots

10.7.8 Historic and Forecasted Market Size By By End-User

10.7.8.1 Government and Municipalities

10.7.8.2 Airport Authorities

10.7.8.3 Parking Lot

10.7.8.4 Industrial Facility

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Road Marking Removal Machines Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 2.06 Bn. |

|

Forecast Period 2023-30 CAGR: |

10.63 % |

Market Size in 2030: |

USD 4.62 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Machine Capacity |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Road Marking Removal Machines Market research report is 2023-2030.

Caterpillar Inc. (US), Roadtec Inc. (US), Ingersoll Rand (US), Vacu-Sweep International LLC (US), Diamond Tool International Inc. (US), Hydro-Tech International (US), Safe-Lane Industries Inc. (US), Crafco Inc. (US), M-B Industries Inc. (US), Striatech Inc. (Canada), Wirtgen Group (Germany), Bomag (Germany), Dynapac (Germany), Weber Maschinentechnik GmbH (Germany), Hamm AG (Germany), Atlas Copco (Sweden), Ecolines (France), Sany Heavy Industry Group (China), Wirtgen India (India), Cemenco (Turkey) and Other Major Players.

The Road Marking Removal Machines Market is segmented into Operation Type, Technology, Machine Capacity, Application, End-User, and Region. By Operation Type, the market is categorized into Manual, Semi-Automatic, and Fully Automatic. By Technology, the market is categorized into Mechanical Removal, Thermal Removal, Chemical Removal, and Water Removal. By Machine Capacity, the market is categorized into Less than 100 Litre, 100 Litre - 250 Litre, 251 Litre - 750 Litre, and More than 750 Litre. By Application, the market is categorized into Highways, Urban Roads, and Parking Lots. By End-User, the market is categorized into Government and Municipalities, Airport Authorities, Parking Lot and Industrial Facility. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Road Marking Removal Machines are specialized equipment designed to eliminate painted or thermoplastic road markings. Utilizing various methods such as shot blasting, grinding, water blasting, scarifying, or chemical processes, these machines efficiently strip away old markings from surfaces like roads, highways, airport runways, parking lots, and industrial areas.

Road Marking Removal Machines Market Size Was Valued at USD 2.06 Billion in 2022 and is Projected to Reach USD 4.62 Billion by 2030, Growing at a CAGR of 10.63% From 2023-2030.