Rocket Liquid Propulsion Market Synopsis

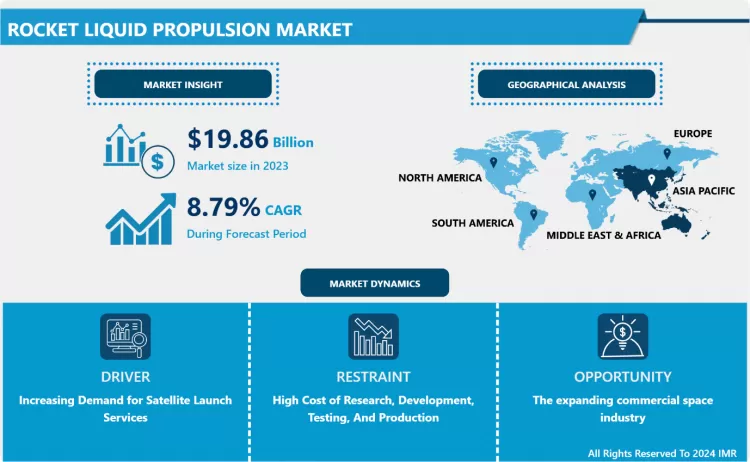

Rocket Liquid Propulsion Market was worth USD 19.86 billion in 2023, As such, the forecast is that the market is expected to reach USD 42.39 Billion by 2032 with a CAGR of 8.79% over the period from 2024 to 2032

Rocket liquid propulsion refers to a propulsion system used in rockets where liquid propellants are used to generate thrust. In this type of propulsion system, two separate liquids, typically a fuel and an oxidizer, are stored in tanks aboard the rocket. These liquids are pumped into a combustion chamber, where they are mixed and ignited.

- The pressure, pump, and gas generator cycles are among the different types of liquid rocket propulsion systems. Pressure injection systems use tank pressure to force propellants into the combustion chamber. In pump-driven systems, turbopumps are used to pressurize and transport propellants. Gas generator cycles are run with a small amount of propellant to drive turbines that power the pumps. Additionally, sequential combustion cycles can enhance efficiency by burning propellants in separate stages.

- The market leaders have been actively developing and utilizing liquid fuel technology for various space missions, including satellite launches, cargo maintenance on the International Space Station (ISS), and piloted flights to the Moon and Mars. Also, advancements in propulsion technology, such as the creation of reusable rocket stages and the adoption of methane as a propellant, have spurred market growth by decreasing launch costs and increasing flight endurance. The market is expected to continue to rise in the coming years due to increasing investments in space exploration, growing demand for satellite-based services and the emergence of new players in the commercial space industry.

Global Rocket Liquid Propulsion Market Trend Analysis

Increasing Demand for Satellite Launch Services

- Growing demand for satellite launch services fueled the growth of the liquid rocket propulsion market during the forecast period.The space industry's fast growth, driven by the need for satellite-based communications, navigation, earth observation, and research missions, has led to a surge in demand for efficient rocket propulsion systems.

- Fluid propulsion systems offer several advantages, such as higher specific impulse, greater flexibility in thrust control, and the ability to carry a wide variety of payloads to different orbits. As satellite technology advances and the miniaturization of satellites across constellations and mega-constellations, the demand for cost-effective, reliable, and repeatable satellite launches has increased.

- The government initiatives, private sector investments, and commercial interests in space exploration and the use of satellites have increased the demand for liquid rocket propulsion systems. Companies in the space launch industry are constantly innovating to develop more efficient propulsion technologies to meet growing demand while lowering costs and improving reusability.

The expanding commercial space industry Creates an Opportunity for the Global Rocket Liquid Propulsion Market

- The expanding commercial space industry provides significant opportunities for the liquid rocket propulsion market. Private space firms such as SpaceX, Blue Origin, and Rocket Lab are increasingly relying on high-efficiency propulsion systems to support various missions like satellite installations/launches, space tourism operations, cargo transportation, etc. across the globe. Station (ISS) and research beyond Earth orbit.

- This demand is the increasing number of satellites launches for communication, Earth observation, and scientific purposes. The need for advanced fluid propulsion systems to transport payloads into low Earth orbit and beyond will be amplified by the emergence of new markets like space exploration and lunar exploration.

- As competition in the commercial space sector intensifies, companies are looking for innovative propulsion solutions to achieve a competitive advantage in terms of cost efficiency, reliability, and performance. Manufacturers and suppliers of rocket propulsion systems can now develop innovative technology to capture a larger portion of the growing market.

Global Rocket Liquid Propulsion Market Segment Analysis:

Global Rocket Liquid Propulsion Market is Segmented into the Type, Orbit, Component, Vehicle Type, and End User.

By Type, Rocket Engine Segment Is Expected to Dominate the Market During the Forecast Period.

- Liquid propellants offer higher specific impulse compared to solid propellants, resulting in more efficient thrust generation. This efficiency is crucial for achieving the desired velocity and payload capacity in space missions.

- Additionally, liquid propulsion systems provide greater flexibility and controllability during flight, enabling precise trajectory adjustments and maneuverability. This feature is indispensable for complex missions like orbital insertions, rendezvous, and docking procedures.

- Liquid rocket engine expels hot gas at high velocity, creating an equal and opposite force (thrust) propelling the rocket forward. Measures the engine's ability to convert propellant mass into thrust. Higher specific impulse means more thrust per unit of propellant, leading to longer mission durations or higher payloads. Higher pressure allows for more complete combustion, maximizing energy release and potentially raising specific impulse. Balancing efficiency gains with challenges like material strength and complexity necessitates trade-offs in chamber pressure selection. Advanced technologies for higher performance often drive up costs

|

Feature |

Units |

Engines (Low)

|

Engines (High) |

|

Thrust |

kN |

29 kN (RS-27) |

5,125 kN (F-1) |

|

Specific Impulse |

|

316 s (Merlin 1D) |

458 s (VASIMR) |

|

Chamber Pressure |

MPa |

3.4 MPa (RD-170) |

22.5 MPa (BE-3) |

|

Mixture Ratio |

- |

2.17 (RD-180) |

6.7 (J-2) |

|

Propellants |

- |

LOX/LH2, N2O4/UDMH |

NTO/Aerozine 50 |

|

Mass |

kg |

175 kg (RD-107A) |

3,300 kg (RS-68A) |

|

Burn Time |

s |

110 s (Merlin 1D) |

860 s (RD-170) |

|

Cost per Engine |

USD |

~$1 million |

~$500 million |

By Component, Propellant Segment Held the Largest Share Of 54.8% In 2022.

- Within the propellant segment, various types exist, including liquid oxygen, liquid hydrogen, and hypergolic fuels, each offering distinct advantages depending on the mission requirements. Liquid propellants are favoured for their high energy density and efficiency, making them indispensable for a wide range of space missions, from satellite launches to interplanetary exploration.

- Ongoing advancements in propellant technology, such as the development of more efficient formulations and novel propulsion concepts, continue to drive growth in this segment. Additionally, the increasing demand for reliable and cost-effective propulsion systems for both government and commercial space endeavors further solidifies the dominance of the propellant segment in the rocket liquid propulsion market.

Global Rocket Liquid Propulsion Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia Pacific region is poised to dominate the rocket liquid propulsion market due to several key factors. Countries like China, India, and Japan have been investing heavily in their space programs, leading to significant advancements in rocket technology. These nations have ambitious plans for space exploration, satellite launches, and even manned missions, driving the demand for liquid propulsion systems.

- The Asia Pacific region boasts a robust manufacturing sector, with many companies specializing in aerospace engineering and rocket propulsion technology. This enables the development and production of high-quality liquid propulsion systems within the region, reducing reliance on imports and driving down costs. The strategic location of the Asia Pacific region offers advantages for satellite launches and space missions, with access to a wide range of orbital inclinations and launch trajectories.

Global Rocket Liquid Propulsion Market Top Key Players:

Rocket Liquid Propulsion Market

Base Year:

2023

Forecast Period:

2024-2032

Historical Data:

2017 to 2023

Market Size in 2023:

USD 19.86 Bn.

Forecast Period 2024-32 CAGR:

8.79 %

Market Size in 2032:

USD 42.39 Bn.

Segments Covered:

By Type

- Rocket Motor

- Rocket Engine

By Orbit

- Low Earth Orbit (LEO)

- Medium Earth Orbit (MEO)

- Geostationary Earth Orbit (GEO)

- Beyond Geosynchronous Orbit (BGEO)

By Component

- Motor Casing

- Nozzle

- Igniter Hardware

- Turbo Pump

- Propellant

By Vehicle Type

- Manned

- Unmanned

By End User

- Military Government

- Commercial

- Research and Development

By Region

- North America (U.S., Canada, Mexico)

- Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

- Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

- Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC)

- Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

- South America (Brazil, Argentina, Rest of SA)

Key Market Drivers:

- Increasing Demand for Satellite Launch Services

Key Market Restraints:

- High Cost of Research, Development, Testing, And Production

Key Opportunities:

- The expanding commercial space industry

Companies Covered in the report:

- Aerojet Rocketdyne (United States), SpaceX (United States), Blue Origin (United States), Northrop Grumman Innovation Systems (United States), Mitsubishi Heavy Industries (Japan), and Other Major Players.

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Rocket Liquid Propulsion Market by By Type (2018-2032)

4.1 Rocket Liquid Propulsion Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Rocket Motor

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Rocket Engine

Chapter 5: Rocket Liquid Propulsion Market by By Orbit (2018-2032)

5.1 Rocket Liquid Propulsion Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Low Earth Orbit (LEO)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Medium Earth Orbit (MEO)

5.5 Geostationary Earth Orbit (GEO)

5.6 Beyond Geosynchronous Orbit (BGEO)

Chapter 6: Rocket Liquid Propulsion Market by By Component (2018-2032)

6.1 Rocket Liquid Propulsion Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Motor Casing

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Nozzle

6.5 Igniter Hardware

6.6 Turbo Pump

6.7 Propellant

Chapter 7: Rocket Liquid Propulsion Market by By Vehicle Type (2018-2032)

7.1 Rocket Liquid Propulsion Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Manned

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Unmanned

Chapter 8: Rocket Liquid Propulsion Market by By End User (2018-2032)

8.1 Rocket Liquid Propulsion Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Military Government

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Commercial

8.5 Research and Development

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Rocket Liquid Propulsion Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 RESILINC (UNITED STATES)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 AVETTA (UNITED STATES)

9.4 RISKEX (UNITED KINGDOM)

9.5 DHL RESILIENCE360 (GERMANY)

9.6 ORACLE CORPORATION (UNITED STATES)

9.7 SAP SE (GERMANY)

9.8 SAS INSTITUTE INC. (UNITED STATES)

9.9 KINAXIS INC. (CANADA)

9.10 EVERSTREAM ANALYTICS (CANADA)

9.11 CLOUDLEAF (UNITED STATES)

9.12 QUANTZIG (UNITED STATES)

9.13 LOGICMANAGER (UNITED STATES)

9.14 ANAPLAN INC. (UNITED STATES)

9.15 INFOR (UNITED STATES)

9.16 COUPA SOFTWARE INC. (UNITED STATES)

9.17 IBM CORPORATION (UNITED STATES)

9.18 QAD INC. (UNITED STATES)

9.19 SAVI TECHNOLOGY (UNITED STATES)

9.20 E2OPEN (UNITED STATES)

9.21 AMBER ROAD (UNITED STATES)

9.22 FOURKITES (UNITED STATES)

9.23 JDA SOFTWARE (UNITED STATES)

Chapter 10: Global Rocket Liquid Propulsion Market By Region

10.1 Overview

10.2. North America Rocket Liquid Propulsion Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By By Type

10.2.4.1 Rocket Motor

10.2.4.2 Rocket Engine

10.2.5 Historic and Forecasted Market Size By By Orbit

10.2.5.1 Low Earth Orbit (LEO)

10.2.5.2 Medium Earth Orbit (MEO)

10.2.5.3 Geostationary Earth Orbit (GEO)

10.2.5.4 Beyond Geosynchronous Orbit (BGEO)

10.2.6 Historic and Forecasted Market Size By By Component

10.2.6.1 Motor Casing

10.2.6.2 Nozzle

10.2.6.3 Igniter Hardware

10.2.6.4 Turbo Pump

10.2.6.5 Propellant

10.2.7 Historic and Forecasted Market Size By By Vehicle Type

10.2.7.1 Manned

10.2.7.2 Unmanned

10.2.8 Historic and Forecasted Market Size By By End User

10.2.8.1 Military Government

10.2.8.2 Commercial

10.2.8.3 Research and Development

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Rocket Liquid Propulsion Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By By Type

10.3.4.1 Rocket Motor

10.3.4.2 Rocket Engine

10.3.5 Historic and Forecasted Market Size By By Orbit

10.3.5.1 Low Earth Orbit (LEO)

10.3.5.2 Medium Earth Orbit (MEO)

10.3.5.3 Geostationary Earth Orbit (GEO)

10.3.5.4 Beyond Geosynchronous Orbit (BGEO)

10.3.6 Historic and Forecasted Market Size By By Component

10.3.6.1 Motor Casing

10.3.6.2 Nozzle

10.3.6.3 Igniter Hardware

10.3.6.4 Turbo Pump

10.3.6.5 Propellant

10.3.7 Historic and Forecasted Market Size By By Vehicle Type

10.3.7.1 Manned

10.3.7.2 Unmanned

10.3.8 Historic and Forecasted Market Size By By End User

10.3.8.1 Military Government

10.3.8.2 Commercial

10.3.8.3 Research and Development

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Rocket Liquid Propulsion Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By By Type

10.4.4.1 Rocket Motor

10.4.4.2 Rocket Engine

10.4.5 Historic and Forecasted Market Size By By Orbit

10.4.5.1 Low Earth Orbit (LEO)

10.4.5.2 Medium Earth Orbit (MEO)

10.4.5.3 Geostationary Earth Orbit (GEO)

10.4.5.4 Beyond Geosynchronous Orbit (BGEO)

10.4.6 Historic and Forecasted Market Size By By Component

10.4.6.1 Motor Casing

10.4.6.2 Nozzle

10.4.6.3 Igniter Hardware

10.4.6.4 Turbo Pump

10.4.6.5 Propellant

10.4.7 Historic and Forecasted Market Size By By Vehicle Type

10.4.7.1 Manned

10.4.7.2 Unmanned

10.4.8 Historic and Forecasted Market Size By By End User

10.4.8.1 Military Government

10.4.8.2 Commercial

10.4.8.3 Research and Development

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Rocket Liquid Propulsion Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By By Type

10.5.4.1 Rocket Motor

10.5.4.2 Rocket Engine

10.5.5 Historic and Forecasted Market Size By By Orbit

10.5.5.1 Low Earth Orbit (LEO)

10.5.5.2 Medium Earth Orbit (MEO)

10.5.5.3 Geostationary Earth Orbit (GEO)

10.5.5.4 Beyond Geosynchronous Orbit (BGEO)

10.5.6 Historic and Forecasted Market Size By By Component

10.5.6.1 Motor Casing

10.5.6.2 Nozzle

10.5.6.3 Igniter Hardware

10.5.6.4 Turbo Pump

10.5.6.5 Propellant

10.5.7 Historic and Forecasted Market Size By By Vehicle Type

10.5.7.1 Manned

10.5.7.2 Unmanned

10.5.8 Historic and Forecasted Market Size By By End User

10.5.8.1 Military Government

10.5.8.2 Commercial

10.5.8.3 Research and Development

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Rocket Liquid Propulsion Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By By Type

10.6.4.1 Rocket Motor

10.6.4.2 Rocket Engine

10.6.5 Historic and Forecasted Market Size By By Orbit

10.6.5.1 Low Earth Orbit (LEO)

10.6.5.2 Medium Earth Orbit (MEO)

10.6.5.3 Geostationary Earth Orbit (GEO)

10.6.5.4 Beyond Geosynchronous Orbit (BGEO)

10.6.6 Historic and Forecasted Market Size By By Component

10.6.6.1 Motor Casing

10.6.6.2 Nozzle

10.6.6.3 Igniter Hardware

10.6.6.4 Turbo Pump

10.6.6.5 Propellant

10.6.7 Historic and Forecasted Market Size By By Vehicle Type

10.6.7.1 Manned

10.6.7.2 Unmanned

10.6.8 Historic and Forecasted Market Size By By End User

10.6.8.1 Military Government

10.6.8.2 Commercial

10.6.8.3 Research and Development

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Rocket Liquid Propulsion Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By By Type

10.7.4.1 Rocket Motor

10.7.4.2 Rocket Engine

10.7.5 Historic and Forecasted Market Size By By Orbit

10.7.5.1 Low Earth Orbit (LEO)

10.7.5.2 Medium Earth Orbit (MEO)

10.7.5.3 Geostationary Earth Orbit (GEO)

10.7.5.4 Beyond Geosynchronous Orbit (BGEO)

10.7.6 Historic and Forecasted Market Size By By Component

10.7.6.1 Motor Casing

10.7.6.2 Nozzle

10.7.6.3 Igniter Hardware

10.7.6.4 Turbo Pump

10.7.6.5 Propellant

10.7.7 Historic and Forecasted Market Size By By Vehicle Type

10.7.7.1 Manned

10.7.7.2 Unmanned

10.7.8 Historic and Forecasted Market Size By By End User

10.7.8.1 Military Government

10.7.8.2 Commercial

10.7.8.3 Research and Development

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Rocket Liquid Propulsion Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 19.86 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.79 % |

Market Size in 2032: |

USD 42.39 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Orbit |

|

||

|

By Component |

|

||

|

By Vehicle Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Global Rocket Liquid Propulsion Market research report is 2024-2032.

Aerojet Rocketdyne (United States), SpaceX (United States), Blue Origin (United States), Northrop Grumman Innovation Systems (United States), Mitsubishi Heavy Industries (Japan), IHI Corporation (Japan), Safran S.A. (France), Ariane Group (France), Rocket Lab (New Zealand), Yuzhnoye Design Office (Ukraine), KBKhA (Russia), NPO Energomash (Russia), Europropulsion (Italy/France), Avio S.p.A (Italy), ISRO (India), China Aerospace Science and Technology Corporation (China), China Academy of Launch Vehicle Technology (China), CASIC (China), Iran Aviation Industries Organization (Iran), RKK Energia (Russia), SpaceX (United States), Rocket Crafters Inc. (United States), Firefly Aerospace (United States), Relativity Space (United States) and Other Major Players.

The Global Rocket Liquid Propulsion Market is segmented into Service, Application, and region. By Type, the market is categorized into Rocket Motor and Rocket Engine. By Orbit, the market is categorized into Low Earth Orbit (LEO), Medium Earth Orbit (MEO), Geostationary Earth Orbit (GEO), and Beyond Geosynchronous Orbit (BGEO). By Component, the market is categorized into Motor Casing, Nozzle, Igniter Hardware, Turbo Pump, and Propellant. By Vehicle Type, the market is categorized into Manned and unmanned. By End User the market is categorized into Military Government, Commercial, Research, and Development, By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Rocket liquid propulsion refers to a propulsion system used in rockets where liquid propellants are used to generate thrust. In this type of propulsion system, two separate liquids, typically a fuel and an oxidizer, are stored in tanks aboard the rocket. These liquids are pumped into a combustion chamber, where they are mixed and ignited.

Rocket Liquid Propulsion Market was worth USD 19.86 billion in 2023, As such, the forecast is that the market is expected to reach USD 42.39 Billion by 2032 with a CAGR of 8.79% over the period from 2024 to 2032