Security Orchestration Market Synopsis

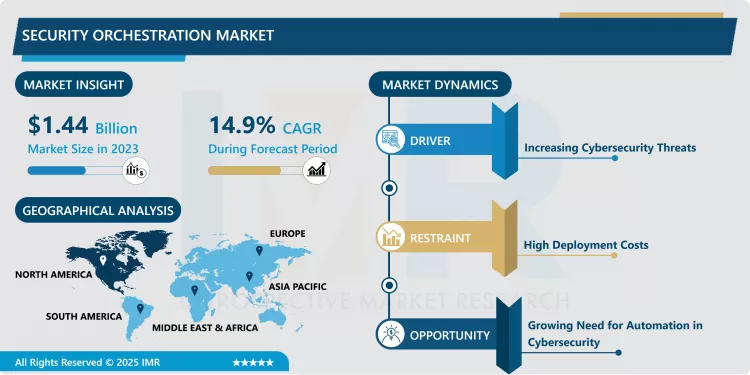

Security Orchestration Market Size Was Valued at USD 1.44 Billion in 2023, and is Projected to Reach USD 5.03 Billion by 2032, Growing at a CAGR of 14.9% From 2024-2032.

SOAR simply stands for Security Orchestration, Automation & Response market as a set of tools that makes it easier for organisations to manage their cybersecurity say. This market consolidates many security tools and systems in this market, removes tedious work, makes faster responses to security incidents, and offers improved visibility of all security aspects at the company’s security structure. Through the integration of SOAR platforms, security teams are in a position to optimise response time, efficiency and capability when confronting potential security threats both at physical on-premise facilities as well as cloud and hybrid facilities.

- The Security Orchestration market has gained a lot of traction over the last few years due to elements such as new generation cyber threats, rising automation demand in the cybersecurity domain, and incident response in real time. With organizations experiencing new and intelligent cyber threats, issues mean that conventional security solutions cannot fully address all of their needs. Security orchestration platforms enable organisations approach security in an integrated manner with security solutions like firewalls, IDS/IPS, and end point protection. They assist security teams to orchestrate their operations, analyze security data and generate proper responses to security incidents that reduce the impact.

- Another driver to the market is the growing use of cloud solutions, which require high security to cover data and applications. CSO offers the ideal solution in terms of the scale and adaptability needed, not to mention the response time problems, all of which are essential for today’s business environment. Due to the necessity of businesses adopting new work models such as remote work, protection of endpoints, information, and communication in decentralized environments remains an acute problem. Security orchestration solutions will contribute to better security by providing ‘plug and play’ means for the teams to deal with a security incident regardless of their locations.

Security Orchestration Market Trend Analysis:

Rising Demand for Cloud-Based Security Orchestration

- Need for coping with cloud security has led to the emergence of new innovations known as cloud security orchestration platforms. Solutions based in the cloud can readily scale, cost-effective and can easily interface with other cloud-based security systems. Cloud security orchestration platforms are easy to deploy hence allow organizations big or small to advance their security as required without needing many resources and hardware.

- This trend is expected to continue as all the organizations look forward to increasing cloud first strategies and hence relying heavily on cloud infrastructure. Moreover, service-based software solutions are updated and improved quicker, which means that the security of the system can always be in line with new threats.

Integration of Artificial Intelligence and Machine Learning

- Another major opportunity to be understood in Security Orchestration market is the incorporation of Artificial Intelligence (AI) and Machine Learning (ML) into security systems. AI & ML’s can benefit the SOAR platforms by making threat detection faster, recognizing upcoming dangers, and recommending the course of action. Modern SO solutions are fueled by AI and with its help, security orchestration systems can collect, analyze, and compare different types of data in order to distinctly recognize behaviours and patterns that may lead to potential threats that can be further prevented at an early stage.

- AI & ML integration helps organisations transition from firefighting mechanisms to timely security management thereby decreasing response time & improving the effectiveness of overall security framework.

Security Orchestration Market Segment Analysis:

Security Orchestration Market is Segmented on the basis of Component, Deployment Mode, End User, and Region

By Component, Solutions segment is expected to dominate the market during the forecast period

- The solutions segment of the Security Orchestration market comprises a plethora of technologies intended to automate and coordinate cybersecurity processes. It is implemented into securities solutions to offer detection of threats in a holistic way, response automation, and workflow. They are security incident and event manager (SIEM systems), security threat intelligent systems, automated response systems, and security case management systems. Security orchestration solutions assist organization in saving time as most of them is spent in manual ways, it enhances the chances of threat detection and increases response time to security threats. Since the threats are constantly evolving and becoming more sophisticated businesses are implementing these solutions to sustain the efficiency of security operations and enhance their readiness to withstand any kind of cyber-attacks.

- The solutions segment of the Security Orchestration market includes professional and managed services required for Security Orchestration software implementation, deployment, interoperability, and sustenance. Consulting services are related to assessment of organizational security needs, while implementation and integration services involve the implementation of the specific security orchestration solutions that meet organizational requirements for implementing security technologies and solutions at their individual structures. Managed services, in contrast, provide security operations of monitoring, incident, and constant management of orchestration platform services. These services are very essential to any organization that may not have the capacity or skills needed to coordinate for security services. With the rising adoption of Security Orchestration, the market for services that can help deploy, integrate and manage these systems is set to expand rapidly.

By Deployment Mode, Cloud segment expected to held the largest share

- The deployment mode for cloud in the Security Orchestration market is a growing trend due to its ability to scale, flexibility, and affordable than on premise. Software as a service security orchestration solution are completely hosted within enterprise remote servers and are available via an internet browser which makes them suitable for organizations with growing security operations teams that require extensive infrastructure investment to manage multiple tools evidenced by utilization of their extensive API capabilities. Hear, cloud deployment makes it easier to admit the latest updates and features with little to no disruption and benefits the remote workforce. Also, these solutions are characterized by brief time to value, which means that security orchestration can be smoothly implemented into an organization’s environment. This is particularly advantageous for SMEs in particular, many of which may not have the resources to adequately address managing specific on-premise solutions; and thus, is a major driving factor for the growth of the security orchestration market.

- The security orchestration solutions deployed under on-premises model encompass to host the platforms in the firms’ own environments. This deployment model enables the research to exercise full control over the business’ security systems as well as ensuring full compliance with internal business policies. The companies that select on-premise cloud deployment prefer frequently meet stringent essential demands to perform local storage for privacy and compliance purposes. Thirdly, they enable a higher level of performance control, data handling, and the ability to integrate the existing system. However, they can demand considerable initial capital investment for procuring some boards and necessary hardware and software, besides incurring regular maintenance cost, and hence, are more appropriate for large business organizations that will get best out of such systems.

Security Orchestration Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Hence in the Security Orchestration market in 2023, North America maintains its position of having the largest share with the United States in the front row. The region’s dominance can be attributed to the fact that there is a high uptake of cybersecurity solutions in most industries including; finance, healthcare and technology. Moreover, with the presence of many giant security solution vendors, including Palo Alto Networks, IBM, Splunk, etc. in this region, the technologies of security orchestration have been developed and adopted rapidly.

- The technological development in North America, strongly set cybersecurity policies and the rising trend of cyber threats have led organizations in the region to adopt integrated security solutions. In addition to this, the market of the region is further enhanced by the emerging cloud uptake and continuous Digital Transformation within the market segments.

Active Key Players in the Security Orchestration Market

- Atos (France)

- Barclays (United Kingdom)

- BMC Software (United States)

- Check Point Software Technologies (Israel)

- Cisco Systems (United States)

- FireEye (United States)

- IBM (United States)

- Microsoft (United States)

- Palo Alto Networks (United States)

- Rapid7 (United States)

- Siemens (Germany)

- Splunk (United States)

- Tenable (United States)

- Trend Micro (Japan)

- Z scaler (United States)

- Other Active Players

Security Orchestration Market Scope:

|

Security Orchestration Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.44 Billion |

|

Forecast Period 2024-32 CAGR: |

14.9% |

Market Size in 2032: |

USD 5.03 Billion |

|

Segments Covered: |

By Component |

|

|

|

By Deployment Mode |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Security Orchestration Market by By Component (2018-2032)

4.1 Security Orchestration Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Solutions

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Services

Chapter 5: Security Orchestration Market by By Deployment Mode (2018-2032)

5.1 Security Orchestration Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Cloud

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 On-premises

Chapter 6: Security Orchestration Market by By End User (2018-2032)

6.1 Security Orchestration Market Snapshot and Growth Engine

6.2 Market Overview

6.3 BFSI

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 IT and Telecom

6.5 Government

6.6 Healthcare

6.7 Retail

6.8 Manufacturing

6.9 Energy and Utilities

6.10 Others (Education

6.11 Transportation

6.12 etc.)

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Security Orchestration Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ATOS (FRANCE)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BARCLAYS (UNITED KINGDOM)

7.4 BMC SOFTWARE (UNITED STATES)

7.5 CHECK POINT SOFTWARE TECHNOLOGIES (ISRAEL)

7.6 CISCO SYSTEMS (UNITED STATES)

7.7 FIREEYE (UNITED STATES)

7.8 IBM (UNITED STATES)

7.9 MICROSOFT (UNITED STATES)

7.10 PALO ALTO NETWORKS (UNITED STATES)

7.11 RAPID7 (UNITED STATES)

7.12 SIEMENS (GERMANY)

7.13 SPLUNK (UNITED STATES)

7.14 TENABLE (UNITED STATES)

7.15 TREND MICRO (JAPAN)

7.16 Z SCALER (UNITED STATES)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Security Orchestration Market By Region

8.1 Overview

8.2. North America Security Orchestration Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Component

8.2.4.1 Solutions

8.2.4.2 Services

8.2.5 Historic and Forecasted Market Size By By Deployment Mode

8.2.5.1 Cloud

8.2.5.2 On-premises

8.2.6 Historic and Forecasted Market Size By By End User

8.2.6.1 BFSI

8.2.6.2 IT and Telecom

8.2.6.3 Government

8.2.6.4 Healthcare

8.2.6.5 Retail

8.2.6.6 Manufacturing

8.2.6.7 Energy and Utilities

8.2.6.8 Others (Education

8.2.6.9 Transportation

8.2.6.10 etc.)

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Security Orchestration Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Component

8.3.4.1 Solutions

8.3.4.2 Services

8.3.5 Historic and Forecasted Market Size By By Deployment Mode

8.3.5.1 Cloud

8.3.5.2 On-premises

8.3.6 Historic and Forecasted Market Size By By End User

8.3.6.1 BFSI

8.3.6.2 IT and Telecom

8.3.6.3 Government

8.3.6.4 Healthcare

8.3.6.5 Retail

8.3.6.6 Manufacturing

8.3.6.7 Energy and Utilities

8.3.6.8 Others (Education

8.3.6.9 Transportation

8.3.6.10 etc.)

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Security Orchestration Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Component

8.4.4.1 Solutions

8.4.4.2 Services

8.4.5 Historic and Forecasted Market Size By By Deployment Mode

8.4.5.1 Cloud

8.4.5.2 On-premises

8.4.6 Historic and Forecasted Market Size By By End User

8.4.6.1 BFSI

8.4.6.2 IT and Telecom

8.4.6.3 Government

8.4.6.4 Healthcare

8.4.6.5 Retail

8.4.6.6 Manufacturing

8.4.6.7 Energy and Utilities

8.4.6.8 Others (Education

8.4.6.9 Transportation

8.4.6.10 etc.)

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Security Orchestration Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Component

8.5.4.1 Solutions

8.5.4.2 Services

8.5.5 Historic and Forecasted Market Size By By Deployment Mode

8.5.5.1 Cloud

8.5.5.2 On-premises

8.5.6 Historic and Forecasted Market Size By By End User

8.5.6.1 BFSI

8.5.6.2 IT and Telecom

8.5.6.3 Government

8.5.6.4 Healthcare

8.5.6.5 Retail

8.5.6.6 Manufacturing

8.5.6.7 Energy and Utilities

8.5.6.8 Others (Education

8.5.6.9 Transportation

8.5.6.10 etc.)

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Security Orchestration Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Component

8.6.4.1 Solutions

8.6.4.2 Services

8.6.5 Historic and Forecasted Market Size By By Deployment Mode

8.6.5.1 Cloud

8.6.5.2 On-premises

8.6.6 Historic and Forecasted Market Size By By End User

8.6.6.1 BFSI

8.6.6.2 IT and Telecom

8.6.6.3 Government

8.6.6.4 Healthcare

8.6.6.5 Retail

8.6.6.6 Manufacturing

8.6.6.7 Energy and Utilities

8.6.6.8 Others (Education

8.6.6.9 Transportation

8.6.6.10 etc.)

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Security Orchestration Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Component

8.7.4.1 Solutions

8.7.4.2 Services

8.7.5 Historic and Forecasted Market Size By By Deployment Mode

8.7.5.1 Cloud

8.7.5.2 On-premises

8.7.6 Historic and Forecasted Market Size By By End User

8.7.6.1 BFSI

8.7.6.2 IT and Telecom

8.7.6.3 Government

8.7.6.4 Healthcare

8.7.6.5 Retail

8.7.6.6 Manufacturing

8.7.6.7 Energy and Utilities

8.7.6.8 Others (Education

8.7.6.9 Transportation

8.7.6.10 etc.)

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Security Orchestration Market Scope:

|

Security Orchestration Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.44 Billion |

|

Forecast Period 2024-32 CAGR: |

14.9% |

Market Size in 2032: |

USD 5.03 Billion |

|

Segments Covered: |

By Component |

|

|

|

By Deployment Mode |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Security Orchestration Market research report is 2024-2032.

Atos (France), Barclays (United Kingdom), BMC Software (United States), Check Point Software Technologies (Israel), Cisco Systems (United States), FireEye (United States), IBM (United States), Microsoft (United States), Palo Alto Networks (United States), Rapid7 (United States), Siemens (Germany), Splunk (United States), Tenable (United States), Trend Micro (Japan), Z scaler (United States), and Other Active Players.

The Security Orchestration Market is segmented into By Component, By Deployment Mode, End User, and Region. By Component, the market is categorized into (Solutions, Services), By Deployment Mode, the market is categorized into (Cloud, On-premises), End User, the market is categorized into (BFSI, IT and Telecom, Government, Healthcare, Retail, Manufacturing, Energy and Utilities, Others (Education, Transportation, etc.). By Region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe),Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

SOAR simply stands for Security Orchestration, Automation & Response market as a set of tools that makes it easier for organizations to manage their cybersecurity say. This market consolidates many security tools and systems in this market, removes tedious work, makes faster responses to security incidents, and offers improved visibility of all security aspects at the company’s security structure. Through the integration of SOAR platforms, security teams are in a position to optimize response time, efficiency and capability when confronting potential security threats both at physical on-premise facilities as well as cloud and hybrid facilities.

Security Orchestration Market Size Was Valued at USD 1.44 Billion in 2023, and is Projected to Reach USD 5.03 Billion by 2032, Growing at a CAGR of 14.9% From 2024-2032.