Seed Treatment Market Synopsis

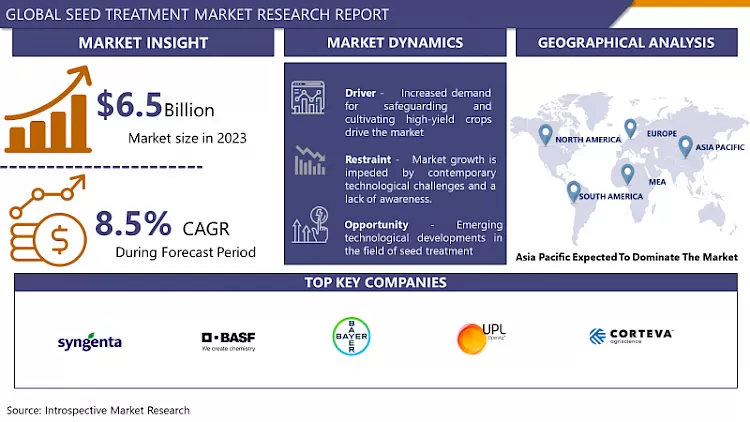

Seed Treatment Market Size Was Valued at USD 6.5 Billion in 2023, and is Projected to Reach USD 13.5 Billion by 2032, Growing at a CAGR of 8.5% From 2024-2032.

Seed treatment also known as seed coating not only as revolutionized the agricultural sector from production of single inputs to a system approach to combat a host of challenges which hinders quantity and quality of crops but has also helped to reduce post-harvest losses and green house emission. Therefore, seed treatment plays an imperatively pivotal position in the agricultural sector. In case of developed countries where the market is moving towards the direction of sustainable, systemic and adequate products, the treated seeds are sure to have a wide range of future growth for this established markets. As previously indicated, the emergence of new technologies during the coming years is presumed to account for the growth of the global market via the appropriation of methods that are both affordable and effective that also contribute to the enhancement of crop productivity sustainability.

- Indeed, seed treatments are found to be effective in managing both soil-borne and seed-borne diseases, soil-borne pathogens can, however, move past the roots of the plant and into the soil. Organic seed treatment nowadays becomes a preferable source for removing harmful chemical residue from our cereals, agricultural products. and the public is raising the awareness about significance food security and agricultural production.

- Scientists recently have been drawing researchers' attention to the fact that seed treatment use, and especially in developing countries, has been increasing in order to get higher yield of vine fruits and vegetables. This trend is set to grow world-wide given the high demand for fruits and vegetable products in the line of business. This development leads to contraction in the industrial development, resulting into fluctuations in demand and supply, which ultimately drives the price of insecticide and pesticide products high.

- Seed treatment around the world is, conversely, gradually growing greater because of the rise in the necessity to save and improve the crops with highest yields. The desired markets for agricProfile are mostly occupied by the developed economies, which include Europe and the United States. These countries, along with the rest of the leading producers of premium agricultural goods, control the market. In order to reduce the drop of post-harvest crops, keep pace with the growing of integrated pest management, generate seed treatment, meet requirements for pest resistance, and provide organic agricultural solution, bio-based seed treatment has become more common.

- An examination of this Asia-Pacific nation-region is expected to show that an increase in agricultural manufacturing and exporting of superior farm products will correspond with a need for seed treatment. Correspondingly, this result was anticipated to provide an impetus to the growth of the international sector over the course of the horizon.

Seed Treatment Market Trend Analysis

Substantial surge in agricultural output

- The world as a whole is led by the agricultural sector facing a serious increase in the output as well. The forecasted contribution of the agriculture sector to net domestic product would be 18 per cent. 8% contribution from National Income (GVA) as presented by the Government of India in recent year 2021-22. At the end of the last two years, its growth graph is illustrated in wavy manner.

- As for me, it grew around 3%. However, with GDP growth rates of 7.8% in FY 21-22 and 9% growth predicted for FY 22-23, we are well on the road to pre-pandemic levels of private sector engagement. 6% in 2020-21. The outstanding increase in agriculture production can in turn be explained by the utilization of novel technologies, hot news,and nanoprocesses within the farm industry.

- Synthetic chemicals or biological agents are being used in the coating of seedlings. This provides for excellent harvest in the long run and as a result, many sustainable and healthy crops are provided for healthy breakfast, lunch and dinner.

- No matter what approach (conventional or organic) you adapt, seed treatment has gained popularity and is seen as a pivotal part. To be honest, the majority of the seeds used in industrial farming, which are usually treated with chemicals or biotechnological processes (BFP).

- Perceiving the inefficiency of traditional agricultural practices, seeing the uncertainty of the future climate conditions, and valuing the natural resources which are non-renewable, the market is just at this point seen as appealing by the public.

Enabling a Regulatory and Policy Framework to Boost Productivity and Reduce the Disease

- Through the public sector's endeavors for the increased profitability of agriculture and by its support on agricultural policies, the world seed treatment market will keep on expanding .

- The level of support governments and regulatory bodies offer for farmers are increasing across the world, highlighting that certain agri-dependent developing markets already have profitable subsidization.

- Everyone understands the important role seed treatment plays in governments all over the world, by both developed and developing countries. Ultimately it is to ensure a good crop emergence.

- Differently from others application of other mineral inputs through drenching them, sowing them with biochemical or biological answers is a specific and effective way to avoid diseases and maximize production.

Seed Treatment Market Segment Analysis:

Seed Treatment Market is Segmented based on Type, Function, Application Technique, Stage of Seed, and Crop Type.

By Crop Type, Cereals segment is expected to dominate the market during the forecast period

- Market is segmented according to the crop category, including World’s major Crop shuffling start with cereals, oilseeds as, fruits & vegetables and others.

- The cereals sector is anticipated to maintain its leading market share in the designing countries as it has got the top priority from the government due to the great influence of the government on ensuring food security in developing nation.

- Correspondingly cereals provision is broadening as its great dimensional applications in the kitchen are experiencing a hike.

- The growing urbanization in developing countries and recent expectations of shift from conventional meals involving more processed foods are some factors responsible for increasing the demand of the vegetable oils. Among all global markets, there are strong indications that the oilseed sector has gained considerable popularity. It is expected that India’s proportion of per capita vegetable oil consumption would have a very high growth of about 2.

- Of the total food intake, I estimate 6 percent per year in the coming 10 years, coming to 14 kg per capita in 2030 as per the OECD- FAO Agricultural Outlook 2021-2030. It will follow, therefore, that imports will be the attractees in the market of that size at 3 times. 4% per year.

By Type, Synthetic chemicals segment held the largest in 2023

- The market is divided into synthetic compounds and biologicals according to type.

- The forecast of synthetic products overtakes the biological treatments in sales performance because of their limited time in summarizing diseases and insect pests. Thanks to the presence of many automated screening devices, the spaces occupied by the workers at this stage are much less, due to a labor shortage.

- While synthesized fungicides and insecticides are applied to seeds and seedlings to avert fungal and insect diseases, they may affect beneficial organisms. Large expenditure incurred on the genetically modified seed beds covers creditably for the development of chemical chemicals.

- In order to make the seeds resistant to the chemicals used to induce resistance, they are impregnated with specific reagents such as salicylic acid, jasmonic acid etc during various growth phases.

- Considering that these treatments are made up the renewable resources like widely-occurring active compounds destined to counter soil-borne pathogens, alleviate abiotic stress, and stimulate plant growth, the biological component is theorized to show the impressive development.

Seed Treatment Market Regional Insights:

Active Key Players in the Seed Treatment Market

- Syngenta AG (Switzerland)

- BASF SE (Germany)

- Bayer AG (Germany)

- UPL ltd. (India)

- Corteva Agriscience (U.S.)

- NuFarm Ltd. (Australia)

- FMC Corporation (U.S.)

- Sumitomo Chemical Co. Ltd. (Japan)

- Croda Int. PLC (U.K.)

- Germain's Seed Technology, Inc. (U.S.)

- Other Key Players

Key Industry Developments in the Seed Treatment Market:

- BASF and Poncho Votivo partnered with the movie site to promote their products by staging a marketing event at Field of Dreams Movie Site, a cornfield which is famous in the United States, in August 2022. The nematode-resist and multi-insect-control features make Poncho Votivo a performance crop yielding protector.

- Regarding the UPL Ltd. , the global company of sustainable agriculture products and solutions and the seed and plant health sector, it introduced a technology-driven and seed treatment product called Electron 3-WM three-way mix in its product line in October 2021. Economic benefits arise from tools’ applicability in reducing the costs of initial foliar applications by replacing them with seed applications, thus diminishing the production expenses.

- In March 2021 Syntegna launched Vayantis fungicide, a seed treatment for maize for which there is no other alternative. Even a fungicide Picarbatex a particular as part of the product’s technology and was purposely used to combat important blight and leaf muscular diseases. Following the introduction of this product, producers using the crop will effectively defend themselves from the root pathogen of the fungal species Pythium.

- BASF expanded its range of treatments for soybean seeds in October 2020 through the introduction of three novel products: Vault IPLP, Poncho XC and Relenya are the next quality skincare. Soybean producers are now able to manage soybean pests thereby enhancing their productivity through insect and disease safeguarding.

- In May 2020, BASF held a fungicide demonstration targeting Chinese customers, introducing them to the Melyra brand. From the mentioned product above, Kemira has designed three new products responding to the needs of the Chinese market on the basis of their existing fungicide Revysol.

|

Global Seed Treatment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 6.5 Bn. |

|

Forecast Period 2024–32 CAGR: |

8.5 % |

Market Size in 2032: |

USD 13.5 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Function |

|

||

|

By Application Technique |

|

||

|

Stage of Seed |

|

||

|

By Crop Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Seed Treatment Market by By Type (2018-2032)

4.1 Seed Treatment Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Synthetic Chemicals

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Biologicals

Chapter 5: Seed Treatment Market by By Function (2018-2032)

5.1 Seed Treatment Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Seed Protection

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Seed Enhancement

Chapter 6: Seed Treatment Market by By Application Technique (2018-2032)

6.1 Seed Treatment Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Seed Dressing

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Seed Coating

6.5 Seed Pelleting

6.6 Stage of Seed

6.7 On-farm

6.8 Off-Farm

Chapter 7: Seed Treatment Market by By Crop Type (2018-2032)

7.1 Seed Treatment Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Cereals

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Oilseeds

7.5 Fruits & Vegetables

7.6 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Seed Treatment Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 CARGILL INCORPORATED (U.S.)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 ARCHER DANIELS MIDLAND COMPANY (ADM) (U.S.)

8.4 KEMIN INDUSTRIES INC. (U.S.)

8.5 DARLING INGREDIENTS INC. (U.S.)

8.6 DUPONT DE NEMOURS INC. (U.S.)

8.7 SCOULAR (U.S.)

8.8 INGREDION INCORPORATED (U.S.)

8.9 THE GREEN LABS LLC (U.S.)

8.10 PHIBRO ANIMAL HEALTH CORPORATION (U.S.)

8.11 LALLEMAND INC. (CANADA)

8.12 BASF SE (GERMANY)

8.13 TATE & LYLE PLC (UK)

8.14 ROQUETTE FRÈRES (FRANCE)

8.15 KERRY GROUP PLC (IRELAND)

8.16 ROYAL DSM N.V. (NETHERLANDS)

8.17 NOVOZYMES A/S (DENMARK)

8.18 CHR. HANSEN HOLDING A/S (DENMARK)

8.19

Chapter 9: Global Seed Treatment Market By Region

9.1 Overview

9.2. North America Seed Treatment Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By By Type

9.2.4.1 Synthetic Chemicals

9.2.4.2 Biologicals

9.2.5 Historic and Forecasted Market Size By By Function

9.2.5.1 Seed Protection

9.2.5.2 Seed Enhancement

9.2.6 Historic and Forecasted Market Size By By Application Technique

9.2.6.1 Seed Dressing

9.2.6.2 Seed Coating

9.2.6.3 Seed Pelleting

9.2.6.4 Stage of Seed

9.2.6.5 On-farm

9.2.6.6 Off-Farm

9.2.7 Historic and Forecasted Market Size By By Crop Type

9.2.7.1 Cereals

9.2.7.2 Oilseeds

9.2.7.3 Fruits & Vegetables

9.2.7.4 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Seed Treatment Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By By Type

9.3.4.1 Synthetic Chemicals

9.3.4.2 Biologicals

9.3.5 Historic and Forecasted Market Size By By Function

9.3.5.1 Seed Protection

9.3.5.2 Seed Enhancement

9.3.6 Historic and Forecasted Market Size By By Application Technique

9.3.6.1 Seed Dressing

9.3.6.2 Seed Coating

9.3.6.3 Seed Pelleting

9.3.6.4 Stage of Seed

9.3.6.5 On-farm

9.3.6.6 Off-Farm

9.3.7 Historic and Forecasted Market Size By By Crop Type

9.3.7.1 Cereals

9.3.7.2 Oilseeds

9.3.7.3 Fruits & Vegetables

9.3.7.4 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Seed Treatment Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By By Type

9.4.4.1 Synthetic Chemicals

9.4.4.2 Biologicals

9.4.5 Historic and Forecasted Market Size By By Function

9.4.5.1 Seed Protection

9.4.5.2 Seed Enhancement

9.4.6 Historic and Forecasted Market Size By By Application Technique

9.4.6.1 Seed Dressing

9.4.6.2 Seed Coating

9.4.6.3 Seed Pelleting

9.4.6.4 Stage of Seed

9.4.6.5 On-farm

9.4.6.6 Off-Farm

9.4.7 Historic and Forecasted Market Size By By Crop Type

9.4.7.1 Cereals

9.4.7.2 Oilseeds

9.4.7.3 Fruits & Vegetables

9.4.7.4 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Seed Treatment Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By By Type

9.5.4.1 Synthetic Chemicals

9.5.4.2 Biologicals

9.5.5 Historic and Forecasted Market Size By By Function

9.5.5.1 Seed Protection

9.5.5.2 Seed Enhancement

9.5.6 Historic and Forecasted Market Size By By Application Technique

9.5.6.1 Seed Dressing

9.5.6.2 Seed Coating

9.5.6.3 Seed Pelleting

9.5.6.4 Stage of Seed

9.5.6.5 On-farm

9.5.6.6 Off-Farm

9.5.7 Historic and Forecasted Market Size By By Crop Type

9.5.7.1 Cereals

9.5.7.2 Oilseeds

9.5.7.3 Fruits & Vegetables

9.5.7.4 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Seed Treatment Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By By Type

9.6.4.1 Synthetic Chemicals

9.6.4.2 Biologicals

9.6.5 Historic and Forecasted Market Size By By Function

9.6.5.1 Seed Protection

9.6.5.2 Seed Enhancement

9.6.6 Historic and Forecasted Market Size By By Application Technique

9.6.6.1 Seed Dressing

9.6.6.2 Seed Coating

9.6.6.3 Seed Pelleting

9.6.6.4 Stage of Seed

9.6.6.5 On-farm

9.6.6.6 Off-Farm

9.6.7 Historic and Forecasted Market Size By By Crop Type

9.6.7.1 Cereals

9.6.7.2 Oilseeds

9.6.7.3 Fruits & Vegetables

9.6.7.4 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Seed Treatment Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By By Type

9.7.4.1 Synthetic Chemicals

9.7.4.2 Biologicals

9.7.5 Historic and Forecasted Market Size By By Function

9.7.5.1 Seed Protection

9.7.5.2 Seed Enhancement

9.7.6 Historic and Forecasted Market Size By By Application Technique

9.7.6.1 Seed Dressing

9.7.6.2 Seed Coating

9.7.6.3 Seed Pelleting

9.7.6.4 Stage of Seed

9.7.6.5 On-farm

9.7.6.6 Off-Farm

9.7.7 Historic and Forecasted Market Size By By Crop Type

9.7.7.1 Cereals

9.7.7.2 Oilseeds

9.7.7.3 Fruits & Vegetables

9.7.7.4 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Seed Treatment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 6.5 Bn. |

|

Forecast Period 2024–32 CAGR: |

8.5 % |

Market Size in 2032: |

USD 13.5 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Function |

|

||

|

By Application Technique |

|

||

|

Stage of Seed |

|

||

|

By Crop Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Seed Treatment Market research report is 2024–2032.

Syngenta AG (Switzerland) BASF SE (Germany) Bayer AG (Germany) UPL Ltd. . (India) Corteva Agriscience (U.S.) NuFarm Ltd. (Australia) FMC Corporation (U.S.) and Sumitomo Chemical Co. Ltd. (Japan) Croda Int. PLC (U.K.), Germain's Seed Technology, Inc. (U.S.), and Other Major Players.

The Seed Treatment Market is segmented into type, function, application technique, stage of seed, crop type, and region. By type, the market is categorized into Synthetic Chemicals, Biologicals. By function, the market is categorized into Seed Protection, and Seed Enhancement. By application technique, the market is categorized into Seed Coating, Seed Dressing, and Seed Pelleting. By stage of seed, the market is categorized into On-Farm, and Off-Farm. By crop type, the market is categorized into Cereals, Oilseeds, Fruits and Vegetables, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

In agricultural practice, seed treatment is crucial for improving the quality and efficacy of seeds prior to sowing. Seed protection entails the administration of an extensive variety of coatings and treatments to shield them from environmental stresses, pests, and diseases. In addition to fungicides and insecticides, it may also include micronutrients or growth promoters. By forming a barrier around the seed, it effectively safeguards against potential hazards that may impede germination and early plant development. Furthermore, it delivers protection precisely where it is needed, thereby reducing the environmental impact of chemical usage. Additionally, it frequently demonstrates enhanced uniformity and vitality, which may lead to more robust plants and potentially greater agricultural harvests.

Seed Treatment Market Size Was Valued at USD 6.5 Billion in 2023, and is Projected to Reach USD 13.5 Billion by 2032, Growing at a CAGR of 8.5% From 2024-2032.