Septic Solutions Market Synopsis:

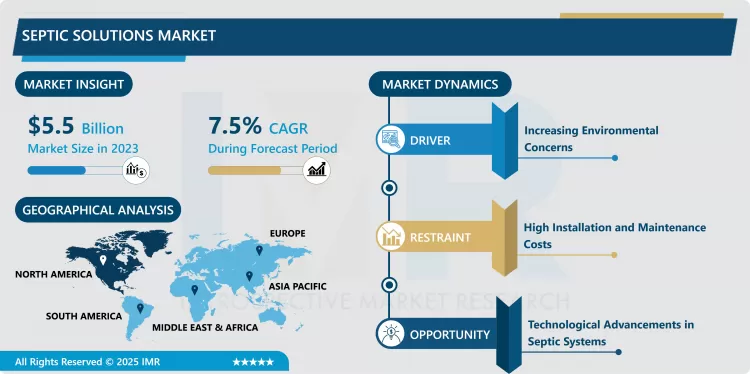

Septic Solutions Market Size Was Valued at USD 5.5 Billion in 2023, and is Projected to Reach USD 9.8 Billion by 2032, Growing at a CAGR of 7.5% From 2024-2032.

The Septic Solutions Market can be defined as the array of products, technologies and services directed to wastewater treatment and disposal, where there is no centralized sewerage system. This involves septic tank constructing, installation, servicing, and repair of effluent filters, disposal systems, pumps, lift stations as well as aerobic treatment units. All these solutions are vital in on-site wastewater management for environmental conservation and health of people who use the water in their homes constructed, commerce, cities, industries, and agriculture.

- Over the last few decades, the Septic Solutions Market has increased at a high pace owing to the growth of sophisticated urban infrastructure and the increases in the development of rural regions without proper sewerage covering. According to the market analysis, the global market for Get is poised to reach USD 5.6 billion in the year 2023 and will likely touch USD 9.4 billion by 2030 with a CAGR of 7.5% between 2023 and 2030.

- This growth can be attributed to increased environmental consciousness, legislative actions addressing the discharge of wastewaters and technologies that have enhanced development of cost effective, environment friendly septic systems. The market with regards to the systems and applications is divided based on systems type, applications type, components type, type of services and geographically; septic tanks took slightly over 40% of market share in 2023. Finally, the usage of smart septic system is emerging as one of the trends in the market. These systems involve the use of sensors as well as monitoring technologies to improve performance, facilitate easy monitoring and to minimize on the impacts of the environment. Integration of Internet of Things (IOT) enable instant evaluation of how the system is functioning, and clues given to irregular functioning of the system in compliance with the rapidly advancing smart waste management systems.

Septic Solutions Market Trend Analysis:

Transforming Wastewater Management

- One of the major factors that are transforming the Septic Solutions Market is the increasing use of smart septic systems that include monitoring and automations of the system. These systems integrate IoT to monitor WWT real-time with data as wastewater levels, flow, and general performance. Many parts of a septic system are fitted with sensors and so cases like blocked drainages, leakages, or low efficiency can be easily assessed and prevented, hence, cutting on expenses of maintenance and the adverse effects of polluting the environment. Smart systems also enable central control and monitoring, so the users can efficiently monitor their wastewater systems through application on their mobile phones or personal computers.

- This trend is characteristic of the overall trend toward a digital economy and the rational use of waste. They serve the customers who are residential users who want ease in their usage and customers who are commercial users who want efficiency realizing they have to meet set environmental standards. Whereas, with progress of smart technologies septic systems are expected to offer increased precision, durability, and sustainability.

Expansion in Emerging Markets

- Novel markets especially in the Asia Pacific are likely to generate considerable growth for the Septic Solution Market. Huge investment in urbanization, new sanitation technology adoption in rural areas, and large construction projects across emerging economies such as China and India are stimulating the need for efficiency wastewater treatment solutions. Additional efforts by governments in the development of better sanitation facilities also make a great contribution to the growth of the market in these regions.

- According to the market research done in 2023, Asia Pacific was the largest consumer of Septic Solutions and took more than 38% of the global Market share. This is much due to fast-growing urbanization, major investments in rural sanitation and construction sector (MSG,SG,kGS),primarily in China and India. North America came next with over 32 % staking its position on the growth of the infrastructure expenditure, redevelopment initiatives and stabilization of modern decentralized sewage treatment systems.

Septic Solutions Market Segment Analysis:

Septic Solutions Market Segmented on the basis of by system, application and component.

By System, Effluent Filters segment is expected to dominate the market during the forecast period

- The Septic Solutions Market is a classification of several systems that are used to properly treat wastewater since the market does not have centralized sewage systems. This segment is dominated by septic tanks due to high demand across various industries including residential and commercial domains. These tanks are efficient, affordable to construct and manage and are common in many rural and semi urban households. Another important ad-on is effluent filters which helps direct only already treated water to the drainage field and increase the lifetime and efficiency of the drainage field.

- Disposal systems, pumps, and lift stations are important elements in conveying as well as managing wastewater especially in topographical areas of elevated and complicated services. Aerobic treatment units are also on the rise in the market because they afford better treatment performance than anaerobic treatment units, especially in environmentally sensitive areas. Other systems available in the market incorporate special functions, such as advanced filtration systems and bio-degradation; they serve specific essential functions that expand the horizons and opportunities of septic solutions across different parts of the world.

By Application, industrial segment expected to held the largest share

- The Global Septic Solutions Market main growth drivers are its versatility for use in residential, commercial, municipal, industrial, and agricultural industries. The primary segment contributes the most to the market as there is a need for efficient waste disposal from buildings in rural and suburban regions where the necessary sewage system is not well developed. Septic system is used because they are cheap, effective and easy to maintain by most homeowners. As people progress to fully urbanistic lifestyle, and as more housing solutions are constructed in distant areas, residential sector remains to be the largest market segment.

- These are also sharing a good market proportion; this is due to the increasing demand of reliable wastewater management systems in commercial and municipal building and projects. Businesses, most especially those located in rural areas or companies/industries that require highly particular effluent treatment, see septic systems as their investment priority. Further, there is a hint of the use of septic solutions in agriculture where the management of animal wastes together with wastes from the farming processes is a necessary factor for compliance with environmental conservation objectives and standards.

Septic Solutions Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The septic solutions market was dominated geographically by the Asia Pacific region in 2023 with a market share of 38%. This leadership is mainly attributed to the increased urbanization and growth of large population countries such as China, India, Indonesia and many other countries that require effective and large scale wastewater treatment solutions.

- There has been amplified use of on-site sewage solutions in many of the presented rural and peri-urban regions of the region due to lack of centralized sewage systems. China is the largest contributor within the region benefiting from large scale construction activities and ‘Green’ environmental policies that seek to encourage and promote the use of advanced ways of wastewater treatment. pertaining to sustainable awareness and the use of smart technologies in the septic systems, the Asia Pacific is rapidly setting the record as the most dominant region globally.

Active Key Players in the Septic Solutions Market:

- AquaKlear, Inc. (USA)

- BioMicrobics, Inc. (USA)

- EcoSafe (Country not specified)

- Infiltrator Water Technologies (USA)

- Klargester Environmental (UK)

- Orenco Systems, Inc. (USA)

- Premier Tech Aqua (Canada)

- Rewatec (Germany)

- Saint Dizier Environment (France)

- Septic Solutions, Inc. (USA)

- Simop (France)

- Techneau (France)

- Tricel (Ireland)

- WPL Ltd (UK)

- Zoeller (USA)

- Other Active Players

Septic Solutions Market Scope:

|

Septic Solutions Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.5 Billion |

|

Forecast Period 2024-32 CAGR: |

7.5% |

Market Size in 2032: |

USD 9.8 Billion |

|

Segments Covered: |

By System |

|

|

|

By Application |

|

||

|

By Component |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Septic Solutions Market by By System (2018-2032)

4.1 Septic Solutions Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Septic Tanks

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Effluent Filters

4.5 Disposal Systems

4.6 Pumps and Lift Stations

4.7 Aerobic Treatment Units

4.8 Others

Chapter 5: Septic Solutions Market by By Application (2018-2032)

5.1 Septic Solutions Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Residential

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Commercial

5.5 Municipal

5.6 Industrial

5.7 Others (Agriculture)

Chapter 6: Septic Solutions Market by By Component (2018-2032)

6.1 Septic Solutions Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Distribution Boxes

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Pipe and Fittings

6.5 Alarms

6.6 Pumps

6.7 Aeration Equipment

6.8 Filters

6.9 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Septic Solutions Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AQUAKLEAR INC. (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BIOMICROBICS INC. (USA)

7.4 ECOSAFE (COUNTRY NOT SPECIFIED)

7.5 INFILTRATOR WATER TECHNOLOGIES (USA)

7.6 KLARGESTER ENVIRONMENTAL (UK)

7.7 ORENCO SYSTEMS INC. (USA)

7.8 PREMIER TECH AQUA (CANADA)

7.9 REWATEC (GERMANY)

7.10 SAINT DIZIER ENVIRONMENT (FRANCE)

7.11 SEPTIC SOLUTIONS INC. (USA)

7.12 SIMOP (FRANCE)

7.13 TECHNEAU (FRANCE)

7.14 TRICEL (IRELAND)

7.15 WPL LTD (UK)

7.16 ZOELLER (USA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Septic Solutions Market By Region

8.1 Overview

8.2. North America Septic Solutions Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By System

8.2.4.1 Septic Tanks

8.2.4.2 Effluent Filters

8.2.4.3 Disposal Systems

8.2.4.4 Pumps and Lift Stations

8.2.4.5 Aerobic Treatment Units

8.2.4.6 Others

8.2.5 Historic and Forecasted Market Size By By Application

8.2.5.1 Residential

8.2.5.2 Commercial

8.2.5.3 Municipal

8.2.5.4 Industrial

8.2.5.5 Others (Agriculture)

8.2.6 Historic and Forecasted Market Size By By Component

8.2.6.1 Distribution Boxes

8.2.6.2 Pipe and Fittings

8.2.6.3 Alarms

8.2.6.4 Pumps

8.2.6.5 Aeration Equipment

8.2.6.6 Filters

8.2.6.7 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Septic Solutions Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By System

8.3.4.1 Septic Tanks

8.3.4.2 Effluent Filters

8.3.4.3 Disposal Systems

8.3.4.4 Pumps and Lift Stations

8.3.4.5 Aerobic Treatment Units

8.3.4.6 Others

8.3.5 Historic and Forecasted Market Size By By Application

8.3.5.1 Residential

8.3.5.2 Commercial

8.3.5.3 Municipal

8.3.5.4 Industrial

8.3.5.5 Others (Agriculture)

8.3.6 Historic and Forecasted Market Size By By Component

8.3.6.1 Distribution Boxes

8.3.6.2 Pipe and Fittings

8.3.6.3 Alarms

8.3.6.4 Pumps

8.3.6.5 Aeration Equipment

8.3.6.6 Filters

8.3.6.7 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Septic Solutions Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By System

8.4.4.1 Septic Tanks

8.4.4.2 Effluent Filters

8.4.4.3 Disposal Systems

8.4.4.4 Pumps and Lift Stations

8.4.4.5 Aerobic Treatment Units

8.4.4.6 Others

8.4.5 Historic and Forecasted Market Size By By Application

8.4.5.1 Residential

8.4.5.2 Commercial

8.4.5.3 Municipal

8.4.5.4 Industrial

8.4.5.5 Others (Agriculture)

8.4.6 Historic and Forecasted Market Size By By Component

8.4.6.1 Distribution Boxes

8.4.6.2 Pipe and Fittings

8.4.6.3 Alarms

8.4.6.4 Pumps

8.4.6.5 Aeration Equipment

8.4.6.6 Filters

8.4.6.7 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Septic Solutions Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By System

8.5.4.1 Septic Tanks

8.5.4.2 Effluent Filters

8.5.4.3 Disposal Systems

8.5.4.4 Pumps and Lift Stations

8.5.4.5 Aerobic Treatment Units

8.5.4.6 Others

8.5.5 Historic and Forecasted Market Size By By Application

8.5.5.1 Residential

8.5.5.2 Commercial

8.5.5.3 Municipal

8.5.5.4 Industrial

8.5.5.5 Others (Agriculture)

8.5.6 Historic and Forecasted Market Size By By Component

8.5.6.1 Distribution Boxes

8.5.6.2 Pipe and Fittings

8.5.6.3 Alarms

8.5.6.4 Pumps

8.5.6.5 Aeration Equipment

8.5.6.6 Filters

8.5.6.7 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Septic Solutions Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By System

8.6.4.1 Septic Tanks

8.6.4.2 Effluent Filters

8.6.4.3 Disposal Systems

8.6.4.4 Pumps and Lift Stations

8.6.4.5 Aerobic Treatment Units

8.6.4.6 Others

8.6.5 Historic and Forecasted Market Size By By Application

8.6.5.1 Residential

8.6.5.2 Commercial

8.6.5.3 Municipal

8.6.5.4 Industrial

8.6.5.5 Others (Agriculture)

8.6.6 Historic and Forecasted Market Size By By Component

8.6.6.1 Distribution Boxes

8.6.6.2 Pipe and Fittings

8.6.6.3 Alarms

8.6.6.4 Pumps

8.6.6.5 Aeration Equipment

8.6.6.6 Filters

8.6.6.7 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Septic Solutions Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By System

8.7.4.1 Septic Tanks

8.7.4.2 Effluent Filters

8.7.4.3 Disposal Systems

8.7.4.4 Pumps and Lift Stations

8.7.4.5 Aerobic Treatment Units

8.7.4.6 Others

8.7.5 Historic and Forecasted Market Size By By Application

8.7.5.1 Residential

8.7.5.2 Commercial

8.7.5.3 Municipal

8.7.5.4 Industrial

8.7.5.5 Others (Agriculture)

8.7.6 Historic and Forecasted Market Size By By Component

8.7.6.1 Distribution Boxes

8.7.6.2 Pipe and Fittings

8.7.6.3 Alarms

8.7.6.4 Pumps

8.7.6.5 Aeration Equipment

8.7.6.6 Filters

8.7.6.7 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Septic Solutions Market Scope:

|

Septic Solutions Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.5 Billion |

|

Forecast Period 2024-32 CAGR: |

7.5% |

Market Size in 2032: |

USD 9.8 Billion |

|

Segments Covered: |

By System |

|

|

|

By Application |

|

||

|

By Component |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Septic Solutions Market research report is 2024-2032.

AquaKlear, Inc. (USA), BioMicrobics, Inc. (USA), EcoSafe (Country not specified), Infiltrator Water Technologies (USA), Klargester Environmental (UK), Orenco Systems, Inc. (USA), Premier Tech Aqua (Canada), Rewatec (Germany), Saint Dizier Environment (France), Septic Solutions, Inc. (USA), Simop (France), Techneau (France), Tricel (Ireland), WPL Ltd (UK), Zoeller (USA) and Other Active Players.

The Septic Solutions Market is segmented into by system, Application, by component and region. By System, the market is categorized into Septic Tanks, Effluent Filters, Disposal Systems, Pumps and Lift Stations, Aerobic Treatment Units, Others), Application, the market is categorized into (Residential, Commercial, Municipal, Industrial, Others (Agriculture)), By Component, the market is categorized into (Distribution Boxes, Pipe and Fittings, Alarms, Pumps, Aeration Equipment, Filters, Others. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

The Septic Solutions Market can be defined as the array of products, technologies and services directed to wastewater treatment and disposal, where there is no centralized sewerage system. This involves septic tank constructing, installation, servicing, and repair of effluent filters, disposal systems, pumps, lift stations as well as aerobic treatment units. All these solutions are vital in on-site wastewater management for environmental conservation and health of people who use the water in their homes constructed, commerce, cities, industries, and agriculture.

Septic Solutions Market Size Was Valued at USD 5.5 Billion in 2023, and is Projected to Reach USD 9.8 Billion by 2032, Growing at a CAGR of 7.5% From 2024-2032.