Server Software Market Synopsis:

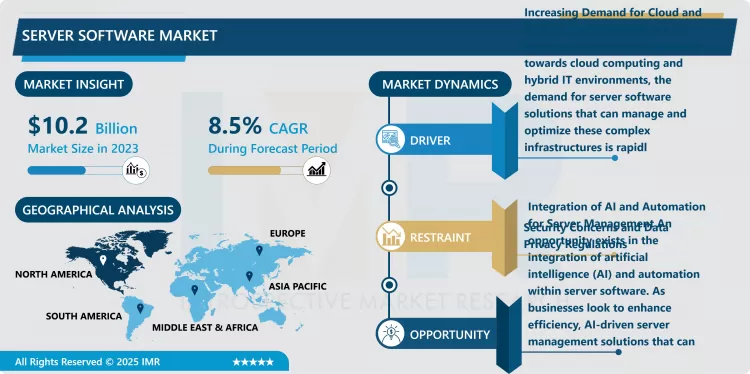

Server Software Market Size Was Valued at USD 10.2 Billion in 2023, and is Projected to Reach USD 21.3 Billion by 2032, Growing at a CAGR of 8.5% From 2024-2032.

The range of software designed to perform command, coordination and control of the server, working in different computing systems. This involves software that is employed in the development as well as management of server platforms for example operating systems and databases, virtualization tooling as well as server management programs. These tools are critically valuable for the fine-tuning of server performance, protection against potential threats, and enhancing data functionality, storage, and transfer for companies, organizations, and data fatalities.

The market for server software is thus an important sub-segment of the overall information technology industry as it offers a platform for technologies that form the backbone of enterprises, websites, cloud and numerous other online services. As the cloud computing industry grows and more and more businesses shift their operations to the online world, there is a clear need for powerful, massively scalable server software. Server software refers to program like operating systems Linux, Windows server; database MySQL, SQL server; virtualization tools like VMware etc. These solutions enable organizational cost-cutting as well as optimization of IT processes while fulfilling data demands, security, and capacity.

This market is mainly driven by the requirements for data center power and cloud structure. With the increase in the integration of multi-cloud and hybrid systems, the usage of server software to manage certain systems, virtual machines, and networks has increased greatly. Moreover, server software solutions enable corporate organizations to deal with the new emerging challenges of data management and security demands. Currently, the market is rapidly growing due to the transformation of enterprises, where server software is being used to facilitate various applications from conventional e-commerce or media streaming and to data analytical systems with AI. As IoT and edge computing are still rapidly developing, the server software market will experience steady growth in the next years.

Server Software Market Trend Analysis:

Emergence of Cloud-Native Server Software Solutions

- One of the most notable trends on the server software market is the increasing demand for cloud-native server software. Due to the prevalence of cloud solutions and hybrid clouds in more and more organizations, Cloud Native technologies such as Kubernetes or containers and microservice architectures are in demand. These cloud-based server software solutions are more flexible, scalable and economical than that of traditional server management software.

- A need to deliver applications in a containerized form, manage them across distributed environments, or scale automatically based on usage has tipped organizations to adopt cloud-native server software. This trend is being further driven by the adoption of DevOps practices and Continuous integration and continuous delivery (CI/CD) for quicker building of software in cloud platforms. Cloud-native server also enhance application performance, uptime or resilience and security, which can be seen as key parameters in cloud applications to meet the requirements of modern-day business.

Expansion of Artificial Intelligence (AI) and Machine Learning (ML) in Server Software

- One promising market in server software is in the blending of AI and ML in server software applications. In the modern world, and with the continued development and adoption of artificial intelligence and machine learning applications, server software has gradually continued to receive improvements designed to meet the demanding computation and data management needs of AI and ML apps. With the increased usage of server software that has incorporated AI and ML operations, businesses can achieve better server infrastructure, identify server failure possibilities, as well as integrate repetitive operations.

- The same goes for more intelligent resource usage, that optimizes the overall performance and efficiency of server solutions. This opportunity is especially true for finance and healthcare businesses and manufacturing businesses where AI and ML are being applied to promote anything from fraud detection to industrial maintenance. These technologies are still being adopted by server software providers who use them to provide solutions that do more than just handle servers while allowing enterprises to incorporate AI and advanced ML capabilities into their IT processes.

Server Software Market Segment Analysis:

Server Software Market is Segmented on the basis of Type, Industry Vertical, End User, and Region

By Type, Server Operating System segment is expected to dominate the market during the forecast period

- Server OS act as the foundation of any server administration; it offers the basic platform for organizing the physical and virtual resources of servers. These, like Linux, Windows server and UNIX, facilitate application run on servers, control networking resources, and enable effective communication with clients and other systems. Server operating systems are developed to solve area-specific and more comprehensive and difficult tasks than those utilized in desktop OS such as support to multiple users, heightened security and networking among others. With organizations adopting digital and hybrid models of work, there is now the need to have optimized server operating systems that boast of optimum performance, up-time and reliability.

- Database Management Software is another important segment in the server software industry including products designed for managing, storing, and retrieving data over the networks. Some common Logical DBMS systems are Oracle, Microsoft SQL Server, and MySQL that provide businesses with facilities to manage structured bulk data. These systems foster the functioning of enterprise applications, business intelligence tools as well as data analysis by enabling user to seek, filter, arrange and also manage data in a secure manner. As various companies are focusing on deploying big data and other AI technologies, DBMS becomes vital to making sure servers can accommodate the growth and complexity of the businesses, as well as providing powerful security measures to protect consumers data and meet the legal requirements governing data protection.

By Industry Vertical, Healthcare segment expected to held the largest share

- Enterprises of various forms are also a massive consumer base for server software. As enterprises press on with growth and automation, the need for dependable and scalable server software increases. Organization depend on server software to coordinate the internal network, application execution, data storage, and security protocols. Whether locally based or cloud hosted, server software guarantees efficient handling of data in organizational operations and communication. Lastly, data center hosting facility containing a large number of servers are very important to support the enterprise IT environment. Several server management software are mandatory for data centers due to massive data, uptime, resource utilization and fail over capabilities in case of system failure. Such entities gain from having reliable software that addresses issues to do with server management, load balancing and virtualisation to enhance on aspects of availability and reliability.

- Cloud service providers (CSPs) are one of the most rapidly expanding classes of end-users of server software. In an era where companies move to adapt flexible, scalable, low-cost cloud alternatives for IT management, CSPs such as Amazon Web Services (AWS), Microsoft Azure and Google Cloud rely on sever software to navigate through their massive infrastructures. Such providers require reliable server management, cloud management and virtualization solutions to meet numerous and diverse client needs, as those encompass multi-cloud, hybrid IT and more efficient management of various resources. Another important customer base includes government and defense organisms as a segment of server software market. It is why these organizations need highly secure, reliable, and scalable servers to handle the data, run the essential applications and ensure regulatory compliance. Because they are security and data e business entities security conscious, they need a server software that supports on premise and cloud environments as well as come equipped with good encryption, access control and audit trail functionalities. Health care, retail and educational organizations also add to the rising server software demand to meet their particular business requirements.

Server Software Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The global server software market in 2023 shows that North America has the largest market share in the world. This area was also found to contain some of the leading IT and server software industries consisting of software developing firms, cloud service companies and technology consulting firms. The region of North America is leading due to the speedy growth in cloud computing AI along with big data which have enhanced the need for server management software.

- Further, a trend among many organizations is the operation of large scale data centers and the overall requirement of strong and secured structure for supporting its enterprise applications has boosted the market of this region. Analysing the current markets it was estimated that in 2023 the North American market accounts for approximately 40% the global market for server software kept only for the US due to its investments in cloud structure and Information technology advancement.

Active Key Players in the Server Software Market:

- Amazon Web Services (AWS) (USA)

- Cisco Systems (USA)

- Citrix Systems (USA)

- Dell Technologies (USA)

- Ericsson (Sweden)

- Fujitsu (Japan)

- Google LLC (USA)

- Hewlett Packard Enterprise (HPE) (USA)

- IBM (USA)

- Intel Corporation (USA)

- Microsoft Corporation (USA)

- Oracle Corporation (USA)

- Rack space Technology (USA)

- Red Hat (USA)

- VMware Inc. (USA), and Other Active Players.

|

Global Server Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.2 Billion |

|

Forecast Period 2024-32 CAGR: |

8.5% |

Market Size in 2032: |

USD 21.3 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Industry Vertical |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Server Software Market by By Type (2018-2032)

4.1 Server Software Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Server Operating System

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Database Management Software

4.5 Virtualization Software

4.6 Cloud Management Software

4.7 Server Management Software

Chapter 5: Server Software Market by By Industry Vertical (2018-2032)

5.1 Server Software Market Snapshot and Growth Engine

5.2 Market Overview

5.3 IT and Telecom

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Healthcare

5.5 Manufacturing

5.6 Retail and E-Commerce

5.7 BFSI

5.8 Government and Public Sector

5.9 Others

Chapter 6: Server Software Market by By End User (2018-2032)

6.1 Server Software Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Enterprises

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Data Centers

6.5 Cloud Service Providers

6.6 Government and Defense Organizations

6.7 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Server Software Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AMAZON WEB SERVICES (AWS) (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CISCO SYSTEMS (USA)

7.4 CITRIX SYSTEMS (USA)

7.5 DELL TECHNOLOGIES (USA)

7.6 ERICSSON (SWEDEN)

7.7 FUJITSU (JAPAN)

7.8 GOOGLE LLC (USA)

7.9 HEWLETT PACKARD ENTERPRISE (HPE) (USA)

7.10 IBM (USA)

7.11 INTEL CORPORATION (USA)

7.12 MICROSOFT CORPORATION (USA)

7.13 ORACLE CORPORATION (USA)

7.14 RACK SPACE TECHNOLOGY (USA)

7.15 RED HAT (USA)

7.16 VMWARE INC. (USA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Server Software Market By Region

8.1 Overview

8.2. North America Server Software Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Type

8.2.4.1 Server Operating System

8.2.4.2 Database Management Software

8.2.4.3 Virtualization Software

8.2.4.4 Cloud Management Software

8.2.4.5 Server Management Software

8.2.5 Historic and Forecasted Market Size By By Industry Vertical

8.2.5.1 IT and Telecom

8.2.5.2 Healthcare

8.2.5.3 Manufacturing

8.2.5.4 Retail and E-Commerce

8.2.5.5 BFSI

8.2.5.6 Government and Public Sector

8.2.5.7 Others

8.2.6 Historic and Forecasted Market Size By By End User

8.2.6.1 Enterprises

8.2.6.2 Data Centers

8.2.6.3 Cloud Service Providers

8.2.6.4 Government and Defense Organizations

8.2.6.5 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Server Software Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Type

8.3.4.1 Server Operating System

8.3.4.2 Database Management Software

8.3.4.3 Virtualization Software

8.3.4.4 Cloud Management Software

8.3.4.5 Server Management Software

8.3.5 Historic and Forecasted Market Size By By Industry Vertical

8.3.5.1 IT and Telecom

8.3.5.2 Healthcare

8.3.5.3 Manufacturing

8.3.5.4 Retail and E-Commerce

8.3.5.5 BFSI

8.3.5.6 Government and Public Sector

8.3.5.7 Others

8.3.6 Historic and Forecasted Market Size By By End User

8.3.6.1 Enterprises

8.3.6.2 Data Centers

8.3.6.3 Cloud Service Providers

8.3.6.4 Government and Defense Organizations

8.3.6.5 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Server Software Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Type

8.4.4.1 Server Operating System

8.4.4.2 Database Management Software

8.4.4.3 Virtualization Software

8.4.4.4 Cloud Management Software

8.4.4.5 Server Management Software

8.4.5 Historic and Forecasted Market Size By By Industry Vertical

8.4.5.1 IT and Telecom

8.4.5.2 Healthcare

8.4.5.3 Manufacturing

8.4.5.4 Retail and E-Commerce

8.4.5.5 BFSI

8.4.5.6 Government and Public Sector

8.4.5.7 Others

8.4.6 Historic and Forecasted Market Size By By End User

8.4.6.1 Enterprises

8.4.6.2 Data Centers

8.4.6.3 Cloud Service Providers

8.4.6.4 Government and Defense Organizations

8.4.6.5 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Server Software Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Type

8.5.4.1 Server Operating System

8.5.4.2 Database Management Software

8.5.4.3 Virtualization Software

8.5.4.4 Cloud Management Software

8.5.4.5 Server Management Software

8.5.5 Historic and Forecasted Market Size By By Industry Vertical

8.5.5.1 IT and Telecom

8.5.5.2 Healthcare

8.5.5.3 Manufacturing

8.5.5.4 Retail and E-Commerce

8.5.5.5 BFSI

8.5.5.6 Government and Public Sector

8.5.5.7 Others

8.5.6 Historic and Forecasted Market Size By By End User

8.5.6.1 Enterprises

8.5.6.2 Data Centers

8.5.6.3 Cloud Service Providers

8.5.6.4 Government and Defense Organizations

8.5.6.5 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Server Software Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Type

8.6.4.1 Server Operating System

8.6.4.2 Database Management Software

8.6.4.3 Virtualization Software

8.6.4.4 Cloud Management Software

8.6.4.5 Server Management Software

8.6.5 Historic and Forecasted Market Size By By Industry Vertical

8.6.5.1 IT and Telecom

8.6.5.2 Healthcare

8.6.5.3 Manufacturing

8.6.5.4 Retail and E-Commerce

8.6.5.5 BFSI

8.6.5.6 Government and Public Sector

8.6.5.7 Others

8.6.6 Historic and Forecasted Market Size By By End User

8.6.6.1 Enterprises

8.6.6.2 Data Centers

8.6.6.3 Cloud Service Providers

8.6.6.4 Government and Defense Organizations

8.6.6.5 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Server Software Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Type

8.7.4.1 Server Operating System

8.7.4.2 Database Management Software

8.7.4.3 Virtualization Software

8.7.4.4 Cloud Management Software

8.7.4.5 Server Management Software

8.7.5 Historic and Forecasted Market Size By By Industry Vertical

8.7.5.1 IT and Telecom

8.7.5.2 Healthcare

8.7.5.3 Manufacturing

8.7.5.4 Retail and E-Commerce

8.7.5.5 BFSI

8.7.5.6 Government and Public Sector

8.7.5.7 Others

8.7.6 Historic and Forecasted Market Size By By End User

8.7.6.1 Enterprises

8.7.6.2 Data Centers

8.7.6.3 Cloud Service Providers

8.7.6.4 Government and Defense Organizations

8.7.6.5 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Server Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.2 Billion |

|

Forecast Period 2024-32 CAGR: |

8.5% |

Market Size in 2032: |

USD 21.3 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Industry Vertical |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Server Software Market research report is 2024-2032.

Amazon Web Services (AWS) (USA), Cisco Systems (USA), Citrix Systems (USA), Dell Technologies (USA), Ericsson (Sweden), Fujitsu (Japan), Google LLC (USA), Hewlett Packard Enterprise (HPE) (USA), IBM (USA), Intel Corporation (USA), Microsoft Corporation (USA), Oracle Corporation (USA), Rackspace Technology (USA), Red Hat (USA), VMware Inc. (USA), Other Active Players.

The Server Software Market is segmented into Type, By Industry Vertical, End User and region. By Type, the market is categorized into Server Operating System, Database Management Software, Virtualization Software, Cloud Management Software, Server Management Software), By Industry Vertical, the market is categorized into (IT and Telecom, Healthcare, Manufacturing, Retail and E-Commerce, BFSI, Government and Public Sector, Others), End User, the market is categorized into (Enterprises, Data Centers, Cloud Service Providers, Government and Defense Organizations, Others. By region, it is analyzed across North America (U.S., Canada, Mexico),Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

The range of software designed to perform command, coordination and control of the server, working in different computing systems. This involves software that is employed in the development as well as management of server platforms for example operating systems and databases, virtualization tooling as well as server management programs. These tools are critically valuable for the fine-tuning of server performance, protection against potential threats, and enhancing data functionality, storage, and transfer for companies, organizations, and data fatalities.

Server Software Market Size Was Valued at USD 10.2 Billion in 2023, and is Projected to Reach USD 21.3 Billion by 2032, Growing at a CAGR of 8.5% From 2024-2032.