Silica Sol Market Synopsis

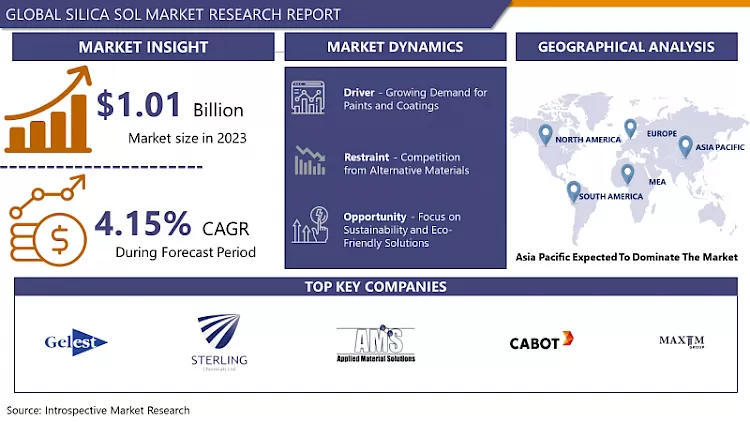

SilicaSol Market Size Was Valued at USD 1.01 Billion in 2023 and is Projected to Reach USD 1.46 Billion by 2032, Growing at a CAGR of 4.15 % From 2024-2032.

Silica sol, a water-based colloidal solution containing nanoparticles of silicon dioxide, exhibits versatility and finds extensive application in diverse industrial sectors like coatings, catalysts, and investment casting. Its distinctive characteristics, such as a substantial surface area and robust stability, render it invaluable for the production of resilient and premium-quality items in various industries.

- Silica Sol, a colloidal variant of silica, boasts diverse applications across multiple industries owing to its distinct properties. A pivotal use of Silica Sol lies in the realm of investment casting, where it plays a vital role as a binder in crafting ceramic molds. The sol's expansive surface area and well-distributed particle sizes contribute to the creation of intricate and finely detailed castings, elevating the precision of the end product. This application is particularly widespread in industries like aerospace, automotive, and jewelry, where intricate and highly precise components are in demand.

- Furthermore, Silica Sol serves in coatings and adhesives, offering advantages such as enhanced adhesion, durability, and corrosion resistance. Its colloidal nature enables uniform distribution and a sleek finish, making it a preferred component in formulations for paints, coatings, and adhesives. Additionally, Silica Sol finds utility in catalyst production, textiles, and as a polishing agent in the electronics sector. Its adaptable characteristics, stability, and compatibility with diverse materials establish Silica Sol as a vital ingredient in processes that necessitate precision, durability, and high-performance attributes.

Silica Sol Market Trend Analysis:

Growing Demand for Paints and Coatings

- Growing Demand for Paints and Coatings the Silica Sol market is experiencing significant growth driven by the burgeoning demand for paints and coatings across diverse industries. The paints and coatings sector are a major consumer of Silica Sol due to its unique properties that enhance the performance and quality of these products. Silica Sol is widely utilized as a thickening and gelling agent in paint formulations, contributing to improved rheological properties and stability. Its colloidal nature allows for the creation of smoother and more durable coatings, ensuring better adhesion to surfaces and a uniform finish.

- One of the primary factors propelling the demand for Silica Sol in the paints and coatings industry is the increasing construction activities globally. The booming construction sector, coupled with rising infrastructure development projects, has led to a surge in the need for high-performance paints and coatings. Silica Sol's role in enhancing the durability, weather resistance, and overall quality of these coatings makes it a preferred choice for manufacturers looking to meet the growing demand for long-lasting and aesthetically pleasing finishes.

- Moreover, the automotive industry, another major consumer of paints and coatings, is experiencing robust growth, further fueling the demand for Silica Sol. As automotive manufacturers focus on producing vehicles with advanced coatings for improved appearance and protection, the Silica Sol market is poised to benefit significantly from this trend.

Focus on Sustainability and Eco-Friendly Solutions

- The Silica Sol market is witnessing substantial growth opportunities, due to the increasing prioritization of sustainability and eco-friendly solutions by various industries. As global awareness of environmental concerns grows, Silica Sol emerges as a favorable option in diverse applications due to its eco-friendly properties. Notably non-toxic, Silica Sol does not release harmful pollutants, aligning seamlessly with the sustainability objectives of industries seeking greener alternatives.

- In the realm of paints and coatings, a significant market for Silica Sol, the demand for environmentally friendly formulations is experiencing a surge. Silica Sol addresses this demand by contributing to the development of low-VOC (volatile organic compound) and water-based coatings. These formulations not only mitigate the environmental impact associated with traditional solvent-based coatings but also comply with strict regulations and consumer preferences for eco-friendly products. As industries increasingly adopt eco-friendly practices and adhere to stringent environmental standards, the utilization of Silica Sol becomes crucial in fostering sustainable manufacturing processes.

- Moreover, the eco-friendly attributes of Silica Sol expand its relevance beyond the paints and coatings sector. Industries such as pharmaceuticals, textiles, and electronics are exploring Silica Sol for its green and sustainable characteristics, leading to its broader market adoption. With the global emphasis on sustainability gaining momentum, the Silica Sol market is well-positioned to capitalize on the escalating demand for environmentally conscious solutions across diverse industries.

Silica Sol Market Segment Analysis:

Silica Sol Market Segmented on the basis of Type, Purity, Particle Size, Application and End-User

By Purity, High Purity segment is expected to dominate the market during the forecast period

- High purity Silica Sol stands out for its low impurity levels and precise particle size distribution, making it especially well-suited for critical applications in industries such as electronics, pharmaceuticals, and specialty coatings. The dominance of this segment is a result of the growing need for high-performance materials in these sectors, where stringent quality standards and exact formulations are paramount.

- Industries that demand advanced technology and precision, such as electronics manufacturing, rely heavily on high-purity Silica Sol for critical applications like semiconductor fabrication. The high-purity segment is projected to sustain its prominence, given the ongoing prioritization of quality and performance in these industries, consequently fueling the demand for Silica Sol with minimal impurities and superior characteristics.

By Application, Coatings segment held the largest share of 30.28% in 2022

- The coatings segment has emerged as the predominant force, claiming the largest share in the Silica Sol market. This dominance is attributed to the extensive utilization of Silica Sol in the coatings industry, where it plays a crucial role in enhancing the performance and attributes of various coatings formulations. Silica Sol finds widespread application as a thickening and gelling agent in coatings, contributing to the improved stability, adhesion, and durability of the final products. Its colloidal nature facilitates the creation of smoother and more uniform coatings, meeting the stringent quality standards required by diverse industries.

- The coatings sector encompasses a broad spectrum of applications, ranging from architectural paints and automotive coatings to industrial coatings and specialty coatings. The adaptability of Silica Sol in addressing the specific requirements of these applications has propelled the coatings segment to maintain its leadership position in the Silica Sol market. The sustained demand is driven by the continuous global growth of the coatings industry.

Silica Sol Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is poised to establish its dominance in the Silica Sol market, emerging as a central hub for both production and consumption. This dominance is propelled by various factors, including robust industrial expansion, rapid urbanization, and growing demand across diverse end-use sectors. Countries such as China, India, and Japan are witnessing substantial growth in industries like construction, automotive, and electronics, where Silica Sol is extensively applied, particularly in coatings and specialty materials.

- Furthermore, the region's emphasis on technological advancements and the adoption of environmentally sustainable practices in manufacturing processes contribute significantly to its prominence in the Silica Sol market. With an increasing demand for high-performance materials and a thriving manufacturing landscape, Asia Pacific is well-positioned to sustain its leading role in shaping the growth trajectory of the Silica Sol market in the foreseeable future.

Silica Sol Market Top Key Players:

- Gelest, Inc. (U.S)

- Sterling Chemicals (U.S)

- W. R. Grace & Co.-Conn (U.S)

- Bedoukian Research (U.S)

- AMS Applied Material Solutions (U.S)

- Ecolab Inc. (U.S)

- Cabot Corporation (U.S)

- Maxim Group (U.S)

- Boc Sciences (U.S)

- Evonik Industries AG (Germany)

- Merck KGaA (Germany)

- Nanoco Technologies (United Kingdom)

- EM Industries (Switzerland)

- ADEKA CORPORATION (Japan)

- Nissan Chemical Corporation (Japan)

- Zeon Corp (Japan)

- Nippon Zeon (Japan)

- Finetech Industry Limited (China)

- Angene International Limited (China)

- HangZhou Peak Chemical (China)

- Zhangjiagang Xinyi Chemical (China)

- Struchem (China)

- Jinan Haohua Industry (China)

- Atomax Chemicals (China)

- Wacker Silicones Korea Co., Ltd. (South Korea), and Other Major Players

Key Industry Developments in the Silica Sol Market:

In March 2023, Alfa Chemistry, a well-known provider of specialty chemicals and materials, has introduced an innovative series of colloidal materials tailored for scientists. This latest product offering encompasses colloidal silica, colloidal nanoparticles, colloidal catalysts, and more.

In December 2022, Nissan Chemical Industries, based in Japan, has strengthened its position in the Asian Silica Sol market through the acquisition of Fuji Silicon Co., Ltd., also based in Japan. This strategic move not only grants Nissan Chemical increased production capacity but also diversifies its product portfolio by incorporating specialized fumed silica offerings.

|

Global Silica Sol Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.01 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.15 % |

Market Size in 2032: |

USD 1.46 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Particle Size |

|

||

|

By Purity |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Silica Sol Market by By Type (2018-2032)

4.1 Silica Sol Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Alkaline Silica

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Acidic Silica

4.5 Ordinary Silica

Chapter 5: Silica Sol Market by By Particle Size (2018-2032)

5.1 Silica Sol Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Up to 50 nm

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 51 to 100 nm

5.5 Above 100 nm

Chapter 6: Silica Sol Market by By Purity (2018-2032)

6.1 Silica Sol Market Snapshot and Growth Engine

6.2 Market Overview

6.3 High Purity

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Standard Purity

Chapter 7: Silica Sol Market by By Application (2018-2032)

7.1 Silica Sol Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Adhesives and Sealants

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Coatings

7.5 Investment Casting Catalysis

7.6 Textile

7.7 Refractories

Chapter 8: Silica Sol Market by By End-User (2018-2032)

8.1 Silica Sol Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Automotive

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Electronics

8.5 Construction

8.6 Healthcare

8.7 Chemicals

8.8 Aerospace

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Silica Sol Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 ADENIUMROSE CO. LLC (US)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 ALTMAN SPECIALTY PLANTS LLC (U.S)

9.4 ANNIES GARDEN AND PATIO (U.S)

9.5 COSTA FARMS LLC (U.S)

9.6 FAIRYBLOOMS LLC (U.S)

9.7 MOUNTAIN CREST GARDENS (U.S)

9.8 NORCAL SUCCULENT SHOP (U.S)

9.9 SUCCULENT MARKET (U.S)

9.10 SUCCULENTS BOX LLC (U.S)

9.11 TENTH AVENUE HOLDINGS LLC (U.S)

9.12 THE BOUQS CO. (U.S)

9.13 THE LEAF AND CLAY (U.S)

9.14 DUMMEN ORANGE (NETHERLANDS)

9.15 QUEEN KNUD JEPSEN A/S (DENMARK)

9.16 MYBAGEECHA (INDIA)

9.17 NURSERYLIVE (INDIA)

9.18 NURTURING GREEN PLANTATION PVT. LTD. (INDIA)

9.19 ROOTLY PLANT DECOR PVT. LTD. (INDIA)

9.20 UGAOO AGRITECH PVT. LTD. (INDIA)

9.21 QINGDAO FLOWERY CRAFTS CO. LTD. (CHINA)

9.22 YIWU LISHI IMP. AND EXP. COLTD (CHINA)

Chapter 10: Global Silica Sol Market By Region

10.1 Overview

10.2. North America Silica Sol Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By By Type

10.2.4.1 Alkaline Silica

10.2.4.2 Acidic Silica

10.2.4.3 Ordinary Silica

10.2.5 Historic and Forecasted Market Size By By Particle Size

10.2.5.1 Up to 50 nm

10.2.5.2 51 to 100 nm

10.2.5.3 Above 100 nm

10.2.6 Historic and Forecasted Market Size By By Purity

10.2.6.1 High Purity

10.2.6.2 Standard Purity

10.2.7 Historic and Forecasted Market Size By By Application

10.2.7.1 Adhesives and Sealants

10.2.7.2 Coatings

10.2.7.3 Investment Casting Catalysis

10.2.7.4 Textile

10.2.7.5 Refractories

10.2.8 Historic and Forecasted Market Size By By End-User

10.2.8.1 Automotive

10.2.8.2 Electronics

10.2.8.3 Construction

10.2.8.4 Healthcare

10.2.8.5 Chemicals

10.2.8.6 Aerospace

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Silica Sol Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By By Type

10.3.4.1 Alkaline Silica

10.3.4.2 Acidic Silica

10.3.4.3 Ordinary Silica

10.3.5 Historic and Forecasted Market Size By By Particle Size

10.3.5.1 Up to 50 nm

10.3.5.2 51 to 100 nm

10.3.5.3 Above 100 nm

10.3.6 Historic and Forecasted Market Size By By Purity

10.3.6.1 High Purity

10.3.6.2 Standard Purity

10.3.7 Historic and Forecasted Market Size By By Application

10.3.7.1 Adhesives and Sealants

10.3.7.2 Coatings

10.3.7.3 Investment Casting Catalysis

10.3.7.4 Textile

10.3.7.5 Refractories

10.3.8 Historic and Forecasted Market Size By By End-User

10.3.8.1 Automotive

10.3.8.2 Electronics

10.3.8.3 Construction

10.3.8.4 Healthcare

10.3.8.5 Chemicals

10.3.8.6 Aerospace

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Silica Sol Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By By Type

10.4.4.1 Alkaline Silica

10.4.4.2 Acidic Silica

10.4.4.3 Ordinary Silica

10.4.5 Historic and Forecasted Market Size By By Particle Size

10.4.5.1 Up to 50 nm

10.4.5.2 51 to 100 nm

10.4.5.3 Above 100 nm

10.4.6 Historic and Forecasted Market Size By By Purity

10.4.6.1 High Purity

10.4.6.2 Standard Purity

10.4.7 Historic and Forecasted Market Size By By Application

10.4.7.1 Adhesives and Sealants

10.4.7.2 Coatings

10.4.7.3 Investment Casting Catalysis

10.4.7.4 Textile

10.4.7.5 Refractories

10.4.8 Historic and Forecasted Market Size By By End-User

10.4.8.1 Automotive

10.4.8.2 Electronics

10.4.8.3 Construction

10.4.8.4 Healthcare

10.4.8.5 Chemicals

10.4.8.6 Aerospace

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Silica Sol Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By By Type

10.5.4.1 Alkaline Silica

10.5.4.2 Acidic Silica

10.5.4.3 Ordinary Silica

10.5.5 Historic and Forecasted Market Size By By Particle Size

10.5.5.1 Up to 50 nm

10.5.5.2 51 to 100 nm

10.5.5.3 Above 100 nm

10.5.6 Historic and Forecasted Market Size By By Purity

10.5.6.1 High Purity

10.5.6.2 Standard Purity

10.5.7 Historic and Forecasted Market Size By By Application

10.5.7.1 Adhesives and Sealants

10.5.7.2 Coatings

10.5.7.3 Investment Casting Catalysis

10.5.7.4 Textile

10.5.7.5 Refractories

10.5.8 Historic and Forecasted Market Size By By End-User

10.5.8.1 Automotive

10.5.8.2 Electronics

10.5.8.3 Construction

10.5.8.4 Healthcare

10.5.8.5 Chemicals

10.5.8.6 Aerospace

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Silica Sol Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By By Type

10.6.4.1 Alkaline Silica

10.6.4.2 Acidic Silica

10.6.4.3 Ordinary Silica

10.6.5 Historic and Forecasted Market Size By By Particle Size

10.6.5.1 Up to 50 nm

10.6.5.2 51 to 100 nm

10.6.5.3 Above 100 nm

10.6.6 Historic and Forecasted Market Size By By Purity

10.6.6.1 High Purity

10.6.6.2 Standard Purity

10.6.7 Historic and Forecasted Market Size By By Application

10.6.7.1 Adhesives and Sealants

10.6.7.2 Coatings

10.6.7.3 Investment Casting Catalysis

10.6.7.4 Textile

10.6.7.5 Refractories

10.6.8 Historic and Forecasted Market Size By By End-User

10.6.8.1 Automotive

10.6.8.2 Electronics

10.6.8.3 Construction

10.6.8.4 Healthcare

10.6.8.5 Chemicals

10.6.8.6 Aerospace

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Silica Sol Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By By Type

10.7.4.1 Alkaline Silica

10.7.4.2 Acidic Silica

10.7.4.3 Ordinary Silica

10.7.5 Historic and Forecasted Market Size By By Particle Size

10.7.5.1 Up to 50 nm

10.7.5.2 51 to 100 nm

10.7.5.3 Above 100 nm

10.7.6 Historic and Forecasted Market Size By By Purity

10.7.6.1 High Purity

10.7.6.2 Standard Purity

10.7.7 Historic and Forecasted Market Size By By Application

10.7.7.1 Adhesives and Sealants

10.7.7.2 Coatings

10.7.7.3 Investment Casting Catalysis

10.7.7.4 Textile

10.7.7.5 Refractories

10.7.8 Historic and Forecasted Market Size By By End-User

10.7.8.1 Automotive

10.7.8.2 Electronics

10.7.8.3 Construction

10.7.8.4 Healthcare

10.7.8.5 Chemicals

10.7.8.6 Aerospace

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Silica Sol Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.01 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.15 % |

Market Size in 2032: |

USD 1.46 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Particle Size |

|

||

|

By Purity |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Silica Sol Market research report is 2024-2032.

Gelest, Inc. (U.S), Sterling Chemicals (U.S), W. R. Grace & Co.-Conn (U.S), Bedoukian Research (U.S), AMS Applied Material Solutions (U.S), Ecolab Inc. (U.S), Cabot Corporation (U.S), Maxim Group (U.S), Boc Sciences (U.S),Evonik Industries AG (Germany), Merck KGaA (Germany),Nanoco Technologies (United Kingdom), EM Industries (Switzerland), ADEKA CORPORATION (Japan),Nissan Chemical Corporation (Japan), Zeon Corp (Japan), Nippon Zeon (Japan), Finetech Industry Limited (China), Angene International Limited (China), HangZhou Peak Chemical (China), Zhangjiagang Xinyi Chemical (China), Struchem (China), Jinan Haohua Industry (China), Atomax Chemicals (China), Wacker Silicones Korea Co., Ltd. (South Korea) and Other Major Players.

The Silica Sol Market is segmented into Type, Nature, Application, and region. By Type, the market is categorized into Alkaline Silica, Acidic Silica and Ordinary Silica. By Particle Size, the market is categorized into Up to 50 nm, 51 to 100 nm and Above 100 nm. By Purity, the market is categorized into High Purity and Standard Purity. By Application, the market is categorized into Adhesives and Sealants, Coatings, Investment Casting, Catalysis, Textile and Refractories. By Application, the market is categorized into Automotive, Electronics, Construction, Healthcare, Chemicals and Aerospace. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Silica sol, a water-based colloidal solution containing nanoparticles of silicon dioxide, exhibits versatility and finds extensive application in diverse industrial sectors like coatings, catalysts, and investment casting. Its distinctive characteristics, such as a substantial surface area and robust stability, render it invaluable for the production of resilient and premium-quality items in various industries.

Silica Sol Market Size Was Valued at USD 1.01 Billion in 2023 and is Projected to Reach USD 1.46 Billion by 2032, Growing at a CAGR of 4.15 % From 2024-2032.